Register today for OSC Dialogue 2024: Inviting, thriving and secure capital markets

Notice of Initial Operations Report and Request for Comment – Lynx ATS

Omega Securities Inc (OSI) intends to begin operating a second trading platform Lynx ATS. This Notice of Initial Operations is being published in accordance with the process established in OSC Staff Notice 21-706 Marketplaces' Initial Operations and Material System Changes. In accordance with OSC Staff Notice 21-706, the Ontario Securities Commission and OSI request participants to provide comment on the information provided in this Notice. Comments on the proposed changes should be in writing and submitted by Tuesday, May 21, 2013 to:

Market Regulation Branch

Ontario Securities Commission

Suite 1903, Box 55

20 Queen Street West

Toronto, ON M5H 3S8

Fax 416 595 8940

[email protected]

And

Richard J. Millar

Chief Compliance Officer

Omega Securities Inc.

100 Lombard St. Suite 101

Toronto, ON M5C 1M3

[email protected]

Comments received will be made public on the OSC website. Upon completion of the review by OSC staff, and in the absence of any regulatory concerns, notice will be published to confirm the completion of Commission staff's review and to outline the intended date for the commencement of operations.

If you have any questions concerning the information below please contact Richard J Millar, CCO for Omega ATS, at 416 646 2764 or [email protected]

Overview

Omega Securities Inc (OSI) the parent company of Omega ATS intends to introduce a second trading marketplace, Lynx ATS, in Q4 of 2013. With the consolidation of Maple and the recent approval of CX2, OSI believes it is necessary for its competitiveness to operate a second marketplace. With the Maple driven market consolidation, the emergence of new marketplaces is the only way to ensure the competitive pricing and innovative solutions our industry requires. OSI will have no additional charges for Lynx ATS market data, connection fees, and subscription fees. With respect to trading fees, OSI is proposing to introduce a maker/taker model for Lynx ATS.

Lynx ATS will initially have all the same order types and functionality of Omega ATS, having two marketplaces will allow OSI to tailor our innovative pricing, services and order types to the various segments of the trading community.

Subscription

All subscribers currently subscribed to Omega ATS will be eligible to subscribe to Lynx ATS. Subscribers may opt to subscribe to either Omega ATS, Lynx ATS or both. Lynx ATS will have no additional connectivity, data fee, or membership fee. Each subscriber must be:

• A member in good standing of IIROC, registered as a dealer with at least one Canadian provincial securities regulatory authority,

• be a Clearing and Depository Services Inc (CDS) participant or have a clearing arrangement with a carrying broker, custodian, or other institution that is a CDS participant.

• A subscriber that has executed a Subscriber Agreement and has a Subscriber Information Form on file with OSI, the parent company of Omega ATS and Lynx ATS.

Access To Lynx ATS

Subscribers will access Lynx ATS by way of existing IP-based infrastructures, such as secure VPN Internet portals or existing commercial vertical networks. Lynx ATS will be accessible to any secure IP network, including private Broker-to-Broker networks.

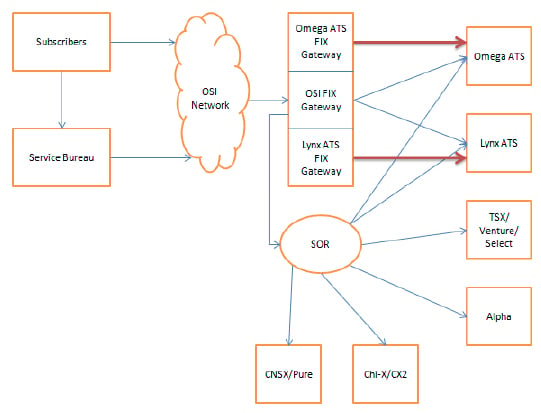

As illustrated above Omega ATS and Lynx ATS operate separately, there is no requirement to subscribe to both marketplaces. Subscribers, have the option of connecting to Lynx ATS through their existing Omega ATS FIX connection, through our SOR, or to connect directly to Lynx ATS only. FIX connections that are directly connected to Lynx ATS only will not be able to access Omega ATS.

Subscribers may interface their OMS software with Lynx ATS by writing to Lynx's standards based FIX 4.2 API for order entry. All displayed orders (i.e., full depth of book) are provided to our subscribers and to any valid market data vendor.

Order Matching and Execution

Lynx ATS is a fully automated system. Order-entry, order matching, and trade executions are fully automated. Orders are entered electronically by subscribers and match according to the established, non-discretionary methods embedded in the Lynx ATS matching engine (Thymex).

Full Depth-of-Book Visibility

Lynx ATS will publicly disseminate pre-trade order data in real-time and electronically through one or more information vendors. Lynx ATS order and trade information is to be disseminated as part of the Information Processors Consolidated Data Feed (CDF) and the Canadian Best Bid/Best Offer (CBBO), from where it will be redistributed by data vendors. The principal order-entry systems will also disseminate order and trade information real-time to their users.

Price/Time Priority

All eligible orders will match within Lynx ATS according to a strict price/time priority (with the exception of intentional crosses, which will be granted time priority over other orders on the book at the same price level).

Price Increments

Price increments comply with the minimum permitted under UMIR: currently, full penny increments, except for stocks trading at less than $0.50, which may be traded at half-penny increments. Mid-market pegged orders may execute at sub-UMIR increments. Government of Canada debt issues and corporate debt securities will trade in 1/10,000th of a cent increment.

Board Lot Sizes

Board lot sizes will be set to equal Standard Trading Units (as defined under the UMIR) based on the previous-day closing price on the listing exchange on which the stock is listed.

Trading Hours

OSI will operate Lynx ATS as a continuous auction market operating from 8:30 a.m. to 5:00 p.m. Eastern Time.

Securities Traded

Lynx ATS will support the trading of TSX-listed and TSX Venture-listed securities, CNSX-listed, NYSE-listed (in Canada in Canadian Dollars), NASDAQ-listed (in Canada in Canadian dollars), AMEX-listed securities (in Canada in Canadian dollars), listed and unlisted Government of Canada Fixed Income securities and Canadian corporate (public corporations) Fixed Income securities.

Market Data and Trade Reporting

Lynx ATS will report accurate and timely information regarding its trade executions for Canadian listed stocks to all information vendors carrying the Lynx ATS market data feed including the information processor TMX Datalinx. The Lynx ATS market data feed is a separate feed from Omega ATS, but utilizes the same ITCH 3.0 and SOUP 2.0 protocol for unicast, or OSI's proprietary lightway protocol for multicast. In addition, all principal order-entry applications used by dealers in Canada (IRESS, Fidessa, Frontline, Exegy, ORC Software and ITS) will display real-time Lynx ATS order and trade data.

Electronic confirmations of the principal trade details (execution price, volume and time of execution) will be sent to subscribers upon execution. This will include the attributes for the order including, time order was submitted into the Lynx ATS system, broker and trader ID, account type, regulation ID, symbol, price, side, size, executed portion, order changes and price if applicable. The drop copy will be generated near real time and sent to the recipient when the order is accepted into our system, or the trade is executed.

Quotations and executions for unlisted securities will be reflected near real-time on the Omega/Lynx ATS website.

As orders flow from the subscriber FIX gateways into the databases, and as executions occur, they generate the ITCH market data feed which is to be transported to subscribers via the SoupTCP unicast protocol or via a proprietary lightweight multicast protocol. This multicast feed is intended to broadcast two simultaneous ITCH market data feeds externally to multiple Lynx subscribers as an alternative to the unicast feed. This market data feed carries the full depth of book. Lynx ATS will offer a unicast only Level 1 feed which carries the top of book data as well as execution messages. Lynx ATS provides a FIX protocol-based feed to be used as the IIROC Market Regulation Feed.

Order Types and Features

Lynx ATS will support only limit orders and not market orders. All orders placed on Lynx ATS are "day" orders.

Subscribers have the option of attributing an order to their related PO or Subscriber number or entering the order anonymously. By default, all orders entered on Lynx ATS are attributed, and if a subscriber wishes to attribute, they can submit the appropriate value in the anonymous FIX tag on order entry.

The initial constraints that may be imposed on an order by Lynx ATS subscribers (in addition to the limit price) are the following:

• Limit Order -- Lynx ATS will only execute a limit order at or better than the specified limit price in the order. Any unexecuted portion of a limit order that does not cancel will be posted to Lynx ATS at the limit price or better for price protected orders.

• Immediate or Cancel (IOC) -- Lynx ATS will attempt to match as many shares as possible for an IOC order. The unfilled portion of the IOC order will be immediately cancelled.

• All or None (AON) -- Lynx ATS will only fill an AON order with a matching order that has an equal or greater number of shares. The AON order will be immediately rejected if there are not enough shares to fill the order.

• Fill or Kill (FOK) -- A Lynx ATS FOK order will be treated as identical to an AON.

• Post Only -- A subscriber will be able to specify that an order be "Post Only" (i.e., it does not immediately remove liquidity from the order book). However, if an order marked "Post Only" is priced beyond the best price on the other side of the Lynx ATS market, then the order is rejected to prevent a crossed market. In order to prevent a locked market, if a second incoming post only order is priced at the other side of the Lynx ATS market, this order will be rejected.

Crosses

The UMIR by-pass marker will be fully supported for IOC and crosses only. Any other order type submitted to Lynx ATS with the by-pass marker will be rejected (in particular, day orders marked by-pass will be rejected).

• Intentional By-Pass Cross -- A trade that occurs when two accounts of the same subscriber buy and sell the same security at an agreed price and volume. Crosses on Lynx ATS will receive time priority. All intentional crosses on Lynx are by-pass crosses. They will not interact with hidden liquidity. All crosses must be flagged by the user with the Intentional By-Pass Cross and DAO markers. Intentional By-Pass Crosses not so marked by the user will be rejected by Lynx ATS. Since it is a subscriber's responsibility to displace better priced liquidity in the context of the CBBO prior to putting up a by-pass cross outside the context of the current market, an Intentional By-Pass Cross outside the bid ask spread is not interfered with by same-priced liquidity or better priced hidden liquidity.

• Internal By-Pass Cross -- A trade identical to the Intentional By-Pass Cross except the originating orders from the subscriber is between managed accounts that have the same beneficial owner. An Internal By-Pass cross marker will be automatically attached to the trade-print by Lynx ATS to be disseminated publicly over the Lynx ATS market data feed.

• Basis Cross -- A trade whereby a basket of securities or an index participation unit is transacted at prices achieved through the execution of related exchange-traded derivative instruments which may include index futures, index options and index participation units in an amount that will correspond to an equivalent market exposure. A Basis Cross will not be subject to any interference. In accordance with UMIR, prior to execution, the subscriber shall report details of the transaction to IIROC.

• VWAP Cross -- A transaction for the purpose of executing a trade at a volume-weighted average price of a security traded for a continuous period on or during a trading day on Canadian exchanges or alternative trading systems. The volume weighted average price is the ratio of value traded to total volume. In accordance with UMIR, where applicable, prior to execution, the subscriber shall report details of the transaction to IIROC.

Other Order Types

• Pegged Order -- The order will allow subscribers to peg orders to the near, mid or far-side of the market as determined by the CBBO, with a limit price which is the maximum match price for a buy or the minimum match price of a sell order. Pegged order matching logic is based strictly on price-time priority and will match as if they were limit orders at that price. A pegged order loses time priority every time it is re-priced. Subscribers will have the option of specifying an offset on the order that will increment or decrement the price of the order from the appropriate peg level: near, mid or far.

• Primary Peg orders are visible orders which will peg to the CBBO on the same side of the pegged order. A Primary Peg buy order will peg to the best bid and a Primary Peg sell order will peg to the best offer. Only a "0" offset is supported for the Primary Peg order type.

• Market Peg orders are visible orders which will peg to the CBBO on the opposite side of the pegged order. A Market Peg buy order will peg to the best offer and a Market Peg sell order will peg to the best bid. Market Peg orders must have an offset value greater than "0" to prevent locked or crossed markets.

• Peg Offsets are used to adjust the peg price by a specified increment either closer to or further away from the pegged orders reference price.

• Mid Point Peg orders are hidden orders that are always priced at the mid point between the CBBO. These orders can execute at the half penny for stocks with one penny tick increments and at the quarter penny for stocks with half penny increments dependent on the mid point calculation at the time of execution. As with all of Lynx ATS' pegged orders, subscribers can specify a limit price.

• Iceberg Order -- Iceberg orders are limit orders that allow our subscribers to enter the full quantity of their limit order, but exposes to the market book only a fraction of the full order (minimum one board lot). The iceberg order will refresh the fractional quantity selected automatically until the full quantity of the order is completed. The undisclosed volume will have no priority over disclosed volumes at a given price. The "refreshed volume" created after the fulfilling of a disclosed fraction of the complete order will take its natural place in time sequence at a given price as any new order.

• Odd Lot/ Mixed Lot facility (to be available Q1 2014 after launch) - The Odd Lot/ Mixed Lot facility for Lynx ATS (provided by OSI), provides additional competition in this limited market segment. OSI's odd lot facility (also found on Omega ATS) will be the only such facility to offer single share odd lot trading, (all other marketplaces only have All or Nothing orders). Any odd lot order placed on the Lynx ATS will be able to trade in increments as little as a single share. The Lynx ATS odd lot book will rely on natural price discovery and allow the auction of odd lot portions down to as little as one share without the intervention of market makers.

Odd lots are quantities that do not conform to the regular board lots which are determined by the prior days' closing price. A board lot is 100 shares for a security with a previous day closingprice at or greater than $1.00, 500 shares for a security with a previous day closing price at or greater than $0.10 but less than $1.00, and 1000 shares for a security with a previous day closing price less than $0.10.

• Opening Limit Bid/Offer (SOR/OPR) -- (OLBO) (to be available Q1 2014 after launch) This order type is intended to encourage immediate post-open participation on Lynx ATS by placing the orders to the top of book at the open.

OLBO orders will only be able to be submitted prior to the TSX market open of 9:30am. When the order is accepted by Lynx ATS, the order will be held in an inactive state during the pre-market phase, between the Lynx ATS open at 8:30am until the TSX COP dissemination at approximately 9:30am. The OLBO will not interact with any liquidity during this time. When the TSX COP is disseminated, all OLBO orders will become active, taking on an aggressive or passive nature dependent on the COP price relative to the CBBO at the open. Passive orders will automatically be posted at the best bid or offer and aggressive orders can be flagged to route or be re-priced by the OPR marker.

Other System Capabilities of the Lynx ATS trading engine:

Order Protection

Lynx ATS will offer subscribers order protection functions which would include, the ability to re-price, cancel, route the order away, or submit the order as a DAO with no protection. By default, the order protection feature is active and has been set to automatically re-price the order prior to being booked to Lynx ATS. A re-priced order will fall into conventional time price priority after re-pricing, the order loses time priority every time it is re-priced. Subscribers have the ability to specify their own defaults by order entry session with individual order over-rides.

Self-trade prevention

Lynx ATS will offer a self-trade prevention option for our subscribers, in order to prevent orders from the same trader ID or within the same firm from trading against each other. Upon request, Lynx ATS will provide a subscriber with a value to include in the self trade prevention FIX tag. When two orders with the same self-trade prevention value would interact, one of the orders would be cancelled. The side that is cancelled, active or passive is configurable at the firm level. All orders belonging to this firm will follow this setting. Lynx ATS will provide multiple self-trade prevention values to a broker so a group of trader IDs may be set prevent self-trading, but still interact with other internal liquidity.

Risk Controls

Lynx ATS will provide our subscribers with features to limit their risk when trading on Lynx ATS. In conjunction with the self-trade prevention, Lynx ATS will offer additional controls giving subscribers the ability to set limits on the size, and or the value of the order, per order, per trader, or aggregate of traders. When a subscriber submits an order which would exceed the limit of their exposure, the order will be rejected by indicating the order exceeds limit parameters. When orders are cancelled and the outstanding volume or value moves below the preset threshold, additional orders will be accepted again. Volume and value limits will be set in advance and cannot be modified intraday.

Clearly Erroneous Trade Policy

IIROC has the authority to amend orders and/or cancel trades. Lynx ATS will have the ability to amend and cancel trades. In the event of a voluntary bust (where both counter parties agree to the cancellation), Lynx ATS will inform IIROC of the impending action. Trades cancelled on trade date will not be included in the CDS trade file and will be removed from the trading record. In such cases, modified trade information will be included in Lynx ATS' CDS file and trading tape. In the event one party does not agree to a voluntary cancellation, the contra can contact IIROC to request a review.

In the event of a system based erroneous trade or trades, OSI would follow the following procedure:

• Upon detection by either the Subscriber or OSI the function would be halted.

• Inform all impacted parties Subscribers, Vendors, and Regulators.

• OSI would assess the condition and determine the severity and scope of the impact

• OSI would resolve the condition and report to the impacted parties (Subscribers, Vendors, Regulators).

Procedures for clearance and settlement of transactions

Lynx ATS will upload an end-of-day batch report of daily trade activity to CDS, which will clear and settle all trades under its net settlement facility. Subscribers or their Clearing Parties will thereby rely on their existing arrangements with CDS to clear and settle trades executed on Lynx ATS. Lynx ATS will not accommodate trading in any issue that is not eligible for clearing and settlement on CDS. Concerning debt securities, settlements will be conducted through CDS on a trade for trade basis on all additional securities being added to Lynx except where the security traded is eligible for CNS. Prices of executed trades for debt securities will have the accrued interest added therefore one net figure will be reported to CDS for matching and settlement purposes.