Register today for OSC Dialogue 2024: Inviting, thriving and secure capital markets

Trading Notice – Request for Comments on Proposed Significant Change to the Treatment of Weighted Closing Price Eligible Securities – Neo Exchange Inc.

Notice #: 2020-004

Currently, for NEO-listed Exchange Traded Funds ("ETFs"), the Weighted Closing Price is determined by the market activity during the last 15 minutes of trading. If there is no trade in the last 15 minutes of trading, the Closing Price will be set to the Time-Weighted Average Price NBBO Midpoint calculated over that period. If the ETF has traded during the 15 minutes period then the Closing Price will be set to the NLSP nearest to 4:00 p.m. For a detailed example of how the Weighted Closing Price is calculated, please see Section 9.1 of the NEO Exchange Trading Functionality Guide.

For all NEO-listed ETFs NEO is proposing to publish a print immediately following the time at which the Weighted Closing Price is available (approximately 4:30 p.m. EST each business day). Such a print would be published as a zero-volume trade at the Closing Price. The print would be done using a new cross trade type ("Closing Price Publication") attributed to the NEO Exchange (broker code 301). Proposed changes to the market data specifications can be found in Appendix A.

Expected Date of Implementation

We are seeking to implement the Significant Change in Q1 of 2021 following the required availability in our testing environment for at least 60 days prior to the implementation date.

Rationale for the Proposed Significant Change and Relevant Supporting Analysis

We introduced the concept of the Weighted Closing Price in 2018 to provide more accurate pricing for ETFs, especially those that trade infrequently. Although it has proven a great success, as demonstrated by the data below, the fact that the closing price is a derived value that does not have an associated trade causes some downstream implications where users are not always able to leverage the Weighted Closing Price in the way it was intended.

In particular, certain global fund managers with centralized operations covering multiple countries rely on a common implementation and common procedures across their fund accounting teams when tracking ETF performance. As a result, to properly leverage the availability of the Weighted Closing Price, a trade at the Weighted Closing Price needs to occur and be published in order for the various market data terminals and feeds to make the Weighted Closing Price available for use by asset management fund operations teams. For example, for funds that hold ETFs in the portfolio, if those ETFs holdings are not marked-to-market at a price close to the NAV, a tracking error is introduced for the fund.

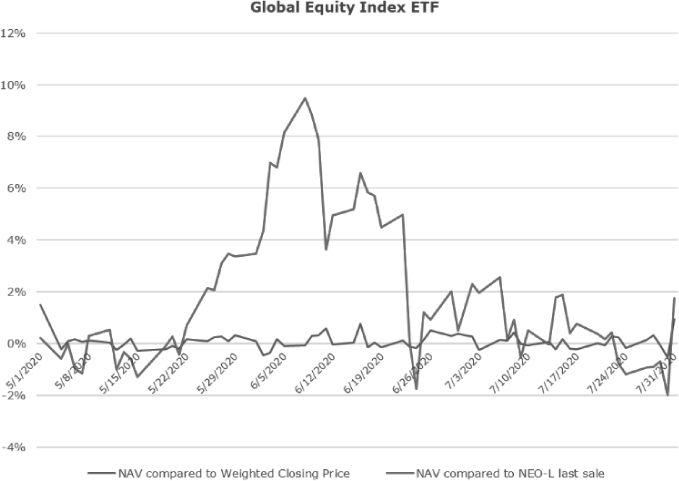

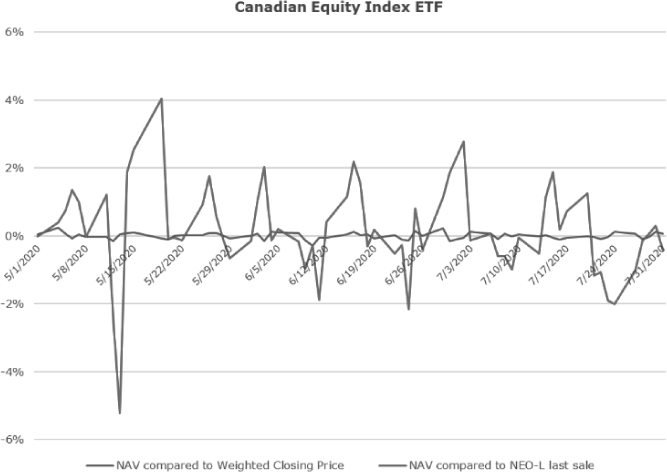

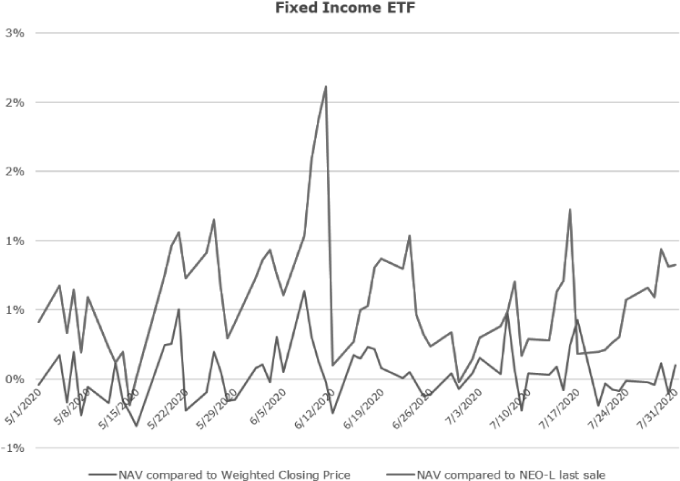

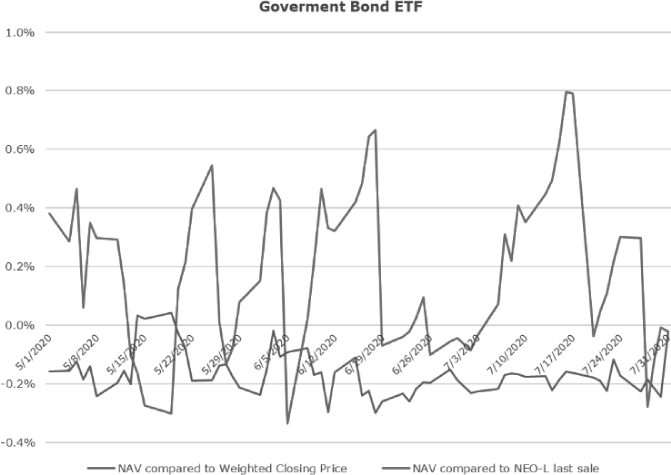

The following charts show the deviation from the daily NAV for four different NEO-listed ETFs over the period May 1, 2020 to July 31, 2020, compared to the Weighted Closing Price (blue line) with the previous methodology (red line) where the closing price would have been the last sale price in NEO-L. The data clearly demonstrates that the Weighted Closing Price is a significantly better representation of the value of the fund.

An additional benefit of publishing a print at the Weighted Closing Price is that it also addresses a number of market structure challenges that, on a routine and daily basis, result in stale ETF pricing for retail investors, financial advisors, investment funds and other stakeholders:

• by ensuring that a meaningful and representative closing price is visible to investors across all electronic data platforms (websites, discount platforms, etc.); and

• by providing, in an environment where fragmentation of securities trading continues to increase, a consolidated end of day closing price leveraging the NEO Closing Price methodology (approved and implemented in December 2018), which considers trading activity across all marketplaces to calculate the Weighted Closing Price.

Introducing a separate cross type tag, and the fact that the print will be attributed to NEO and not to a regular trading member, will make it easy for market participants to distinguish this print from a trade. Also, since the print will be for zero volume there is no risk of creating the perception of actual trading activity.

Expected Impact of Proposed Significant Change on Market Structure, Members, Investors, Issuers and Capital markets

We expect the proposed change to have a positive impact on NEO-listed ETF issuers and investors and, as a result on capital markets due to increased closing price visibility as explained above. We do not expect any impact on market structure.

Impact on Exchange's Compliance with Ontario Securities Law and on Requirements for Fair Access and Maintenance of Fair and Orderly Markets

There would be no foreseeable impact on compliance with securities law, fair access or maintenance of fair and orderly markets.

As the print will never set a new price (the official closing price is always established and published prior to the print) and there's no appearance of trading activity (the volume is always zero, and clearly marked as a closing price publication trade type attributed to the exchange), we believe the proposal does not create the "misleading appearance of trading activity" and therefore does not raise concerns with respect to section 126.1 of the Securities Act (Ontario).

Consultation

We consulted with several ETF issuers as well as market makers familiar with pricing challenges encountered by investors. All have been overwhelmingly positive about the proposed solution to a painful problem for the industry.

Impact on the Systems of Members or Service Vendors

This change will have limited to no impact on members or service vendors. As the technical change is simply the introduction of a new cross type in an existing field most vendors would process it automatically without any system changes. Those that do not wish to process this print message can easily filter it out based on the cross-type tag and/or the "zero" quantity.

New Feature or Rule

NYSE Arca has a similar closing price methodology for ETFs, but in the United States this problem has been solved at the level of the Security Information Processor (SIP). The CTA/UTP specifications dictate that the official market center closing price should update the consolidated last sale price.

While implementing an official Canadian closing price across all listed securities from a single centralized source would be ideal and preferred, critical technologies involved in various aspects of the industry from fund accounting, trading, through to advisor and retail investor platforms/websites do not leverage the existing Information Processor and instead consolidate (or fragment) the data further themselves, creating deviations in official closing values and perceived benchmarks. Our proposed solution would have an immediate impact for NEO-listed issuers while we work towards a more holistic industry solution.

Comments

Comments should be provided, in writing, no later than October 24, 2020 to:

Valerie Lockerbie

Head of Legal and Regulatory

Neo Exchange Inc.

155 University Avenue, Suite 400

Toronto, ON M5H 3B7

e-mail: [email protected]

with a copy to:

Market Regulation Branch

Ontario Securities Commission

20 Queen Street West, 22nd Floor

Toronto, ON M5H 3S8

e-mail: [email protected]

Please note that, unless confidentiality is requested, all comments will be made publicly available.

Appendix A -- Revised NITCH Market Data Specification

The following highlighted change will be made to the trade message in the NITCH Market Data Specifications, adding the new cross type. A clarifying note will be added to our documentation explaining how this new cross trade type will be used in conjunction with the other fields in the trade message.

8.6.11 Trade

|

Field |

Offset |

Length |

Type |

Description |

|

|

|

|||||

|

... |

|

|

|

|

|

|

|

|||||

|

Cross Type |

60 |

1 |

UInt8 |

The type of the Cross/BTF Order |

|

|

|

|||||

|

|

|

|

|

Value |

Meaning |

|

|

|||||

|

|

|

|

|

5 |

Internal Cross |

|

|

|||||

|

|

|

|

|

11 |

Basis Cross |

|

|

|||||

|

|

|

|

|

12 |

Contingent Cross |

|

|

|||||

|

|

|

|

|

14 |

VWAP Cross |

|

|

|||||

|

|

|

|

|

15 |

National Cross |

|

|

|||||

|

|

|

|

|

16 |

Bypass Cross |

|

|

|||||

|

|

|

|

|

18 |

Derivative Cross |

|

|

|||||

|

|

|

|

|

19 |

Closing Price Publication |

|

|

|||||

|

... |

|

|

|

|

|

Note: When the Cross Type is set to 19 (Closing Price Publication), Executed Size will be set to 0 (zero) and both Buy Attribution and Sell Attribution will be set to 301 (NEO Exchange's Broker ID)