Register today for OSC Dialogue 2024: Inviting, thriving and secure capital markets

Joint CSA/IIROC Staff Notice 23-327 – Update on Internalization within the Canadian Equity Market

Joint CSA/IIROC Staff Notice 23-327 – Update on Internalization within the Canadian Equity Market

I. INTRODUCTION

This Staff Notice is a follow-up to Joint CSA/IIROC Consultation Paper 23-406 Internalization within the Canadian Equity Market (the Consultation Paper) that was published for a 60-day comment period on March 12, 2019, by staff of the Canadian Securities Administrators (CSA) and the Investment Industry Regulatory Organization of Canada (IIROC) (together, Staff or we).{1} The Consultation Paper was published in response to concerns raised about the internalization of equity trades on Canadian marketplaces. 21 comment letters were received.

This Staff Notice summarizes the feedback received, refreshes certain data published as part of the Consultation Paper and provides an update on next steps.

II. BACKGROUND

Beginning in 2017, Staff became aware of growing concerns about a perceived increase in the magnitude of internalization of retail/small orders within the Canadian equity market.

Internalization generally refers to trades that are executed with the same dealer as both the buyer and the seller, with the dealer either acting as an agent for its clients on both sides of the trade, or trading as principal and taking the other side of a client order. Internalized trades occur on Canadian marketplaces as either "intentional" or "unintentional" crosses.{2}

The Consultation Paper provided background information that described certain relevant aspects of the Canadian rule framework, identified specific issues and concerns, and provided data illustrating recent levels of internalization in Canada.

A. Issues and Concerns

Below, we discuss the primary issues presented and the feedback received in response to the Consultation Paper. A complete summary of comments received and Staff responses is at Appendix B.

i. Broker Preferencing

As described in the Consultation Paper, broker preferencing is an important element of the concerns raised in relation to internalization. Broker preferencing is a common order matching feature of many Canadian equity marketplaces. It allows an incoming order sent to a marketplace to match and trade first with other orders from the same dealer, ahead of orders from other dealers that are at the same price and which have time priority. Broker preferencing is relevant to issues associated with internalization as it can facilitate internalization through the execution of unintentional crosses. It has been a divisive issue for many years in Canada, and the responses that Staff received to specific questions in the Consultation Paper related to broker preferencing reflects the continuing divergence in the views of stakeholders.

Some respondents articulated their belief that broker preferencing is a benefit to clients of dealers and a preferable alternative to equity market structure models in other jurisdictions. Some supporters expressed the view that retail clients were specific beneficiaries of better execution quality as a result of broker preferencing, and that the ability for dealers to efficiently interact with their own orders on a marketplace encourages the transparent display of liquidity on Canadian marketplaces.

Other commenters however, described negative impacts of broker preferencing, notably in the context of fairness through the creation of an unlevel playing field, where not all market participants, including investors, have equal access to interact with orders. Despite the views that broker preferencing benefits the Canadian market by encouraging displayed liquidity, some respondents argued that the impact is less beneficial and felt that the ability to override the time priority of other displayed orders in an order book results in a negative impact on immediacy and a perception of a lack of fairness where a displayed order might not receive an execution despite it having been at the top of the order book queue.

The Consultation Paper specifically requested views on whether broker preferencing conveys greater benefits to larger dealers. Most commenters agreed that larger dealers and their clients may receive greater benefits. The Consultation Paper also specifically requested any data that illustrated either the positive or negative impacts of broker preferencing (and internalization, more generally). Very limited data was received that could quantitatively evidence the impacts.

ii. The Individual Versus the Common Good

The Consultation Paper described the issue of the individual good versus the common good. It was noted that, while it may be reasonable to conclude that the internalization of client orders may benefit individual dealers and their respective clients, it may also be true that a market in which participants collectively act to maximize their own benefits may not result in a market which functions in the best interests of all those participating. Staff noted the importance of a balance between a market that adheres to the principles of fairness and integrity and one that operates to the benefit of the individual participants who interact within it.

The comments received regarding the common versus the individual good were mixed. Many characterized internalization as being contrary to the common good, while others suggested that Canadian market structure should seek to find an appropriate balance through the use of internalization.

iii. Segmentation of Retail Orders

Segmentation of orders typically means the separation of orders from one class or type of market participant from those of other classes of participants. In describing this issue in the Consultation Paper, Staff noted that, in the Canadian context, this is typically focused on the orders of retail investors. The Consultation Paper discussed the value proposition inherent in interacting with retail orders, and we offered commentary on how Canadian market structure has evolved with various methods that seek to either implicitly or explicitly segment retail orders.

Most commenters believed that the segmentation of orders is a concern for a variety of reasons, including that the removal of access to retail orders (or orders of any participant) is contrary to principles of fairness and may result in a lower quality, less liquid and less competitive market. Some felt that a distinction was warranted between the segmentation resulting from participants choosing between various commercial models that are available to all market participants, and the segmentation schemes that serve to isolate retail orders through restricting access.

It was not evident from responses to the Consultation Paper that the Canadian market has reached a point where the level of segmentation requires an immediate policy response. Most respondents believed that the structure of the Canadian market provides for favourable outcomes for retail investors, although continued caution was recommended to avoid unbalanced results.

iv. Automated Matching Against Client Orders on a Marketplace

The Consultation Paper highlighted that, as part of the ongoing technological evolution of the Canadian market, systems may be used by dealers to automate the internalization of orders through broker preferencing. It was noted by Staff, that such systems may appear to exhibit the characteristics of a marketplace as defined within the Canadian rule framework.{3}

Most commenters were of the view that systems that automate the internalization of orders should be considered a marketplace, and that relevant provisions of the rules should apply. Concerns were raised about the creation of discrete silos of liquidity within dealers that become inaccessible to the broader market. Some, however, suggested that dealers may simply be automating what has historically been a manual process, one that has never been considered a marketplace, and that the application of technology alone should not change the regulatory classification of dealer workflows.

III. Revised Internalization Data

In addition to describing various issues and seeking feedback, the Consultation Paper also included data that explored the magnitude of:

• intentional crosses;

• unintentional crosses;

• crosses where the dealer acted as principal; and

• the use of broker preferencing on certain Canadian marketplaces.

With respect to intentional and unintentional crosses, the data in the Consultation Paper relied on information received by IIROC through the Market Regulation Feed and submitted by each Canadian marketplace for the period of January 2016 through June 2018.

Data examining the magnitude of broker preferencing was provided directly to Staff by the marketplaces themselves. However, not all Canadian marketplaces were able to accurately distinguish between unintentional crosses resulting from broker preferencing itself (and where time priority was not followed), and unintentional crosses where a resting order was already in a position of time priority and would have been executed despite the availability of broker preferencing. This incomplete broker preferencing data requested from marketplaces covered the period of January 2017 through July 2018.

Some time has passed since the publication of the Consultation Paper and Staff's review of the feedback received and associated data collected, and we are of the view that it is important to update certain data to more accurately reflect current market statistics. Therefore, we are republishing certain data at Appendix A that updates the period of coverage from January 2016 through October 2019. We have also added charts that represent information that the Consultation Paper included in graphs to make the information easier to read.

The data at Appendix A however, does not update the specific broker preferencing information initially provided by marketplaces for purposes of the Consultation Paper. While this data was informative, it did not include all Canadian marketplaces and as such, is incomplete for the purposes of regulatory policy decisions. IIROC has been working with Canadian marketplaces to receive broker preferencing data as part of the Market Regulation Feed, but IIROC has not received this for a sufficient length of time to provide updated information at Appendix A. Future analysis will consider this information and may also consider other market structure developments such as changes implemented by marketplaces that may impact levels of internalization.

IV. NEXT STEPS

The Consultation Paper purposely did not offer Staff's views on the issues presented, but rather, focused specifically on seeking feedback in order to help inform future policy decisions. The background information and related narrative in the Consultation Paper recognized the competing interests associated with internalization and attempted to provide a balanced presentation of what Staff considers to be the primary issues.

The feedback received was varied and, consistent with the way the issues were framed in the Consultation Paper, balance was a common theme presented in the responses. Specifically regarding broker preferencing, while the practice is at odds with price/time priority in order execution, broker preferencing is a longstanding part of Canadian market structure. As currently functioning, broker preferencing may allow dealers to benefit from interaction with their own orders, and may also benefit individual clients with improved execution quality. There may be nuanced outcomes of broker preferencing, and some market participants may not be impacted in the same way as others. Based on the feedback received and the data reviewed, we do not believe that the Canadian market is presently functioning in a way that warrants near-term policy work or changes to the current rule framework.

As noted, the Consultation Paper highlighted that systems may be used by dealers to automate the internalization of orders, and that these systems may appear to exhibit characteristics of a marketplace as defined within the Canadian regulatory framework. This is further described in the guidance included in the Companion Policy to National Instrument 21-101 Marketplace Operation (NI 21-101CP) regarding when dealers may be operating a marketplace.{4} The CSA will consider whether additional clarification should be provided in relation to when a system is a "marketplace".

With respect to the updated data published at Appendix A, Staff note that the level of unintentional crosses has increased since the six-month period of January through June 2018, which was the final period of data initially published alongside the Consultation Paper. While the most recent data illustrates an increase, Staff have looked at the underlying non-public data and are comfortable that the increase is not an indication of broad changes in the way in which dealers are managing their orders or of a specific concern that necessitates an immediate regulatory policy response.

We will however, continue to monitor the data on an ongoing basis and if there are any indications that changes to internalization practices, including internalization that is enabled through the use of dealer systems, are possibly impacting Canadian market quality in a negative way, we will consider appropriate responses at that time.

V. QUESTIONS

Please refer your questions to any of the following:

Kent Bailey

Kortney Shapiro

Senior Advisor, Trading, Market Regulation

Legal Counsel, Market Regulation

Ontario Securities Commission

Ontario Securities Commission

Ruxandra Smith

Roland Geiling

Senior Accountant, Market Regulation

Analyste en produits dérivés

Ontario Securities Commission

Direction de l'encadrement des bourses et des OAR

Autorité des marchés financiers

Serge Boisvert

Lucie Prince

Analyste en réglementation

Analyste

Direction de l'encadrement des bourses et des OAR

Direction de l'encadrement des bourses et des OAR

Autorité des marchés financiers

Autorité des marchés financiers

Jesse Ahlan

Meg Tassie

Regulatory Analyst, Market Structure

Senior Advisor

Alberta Securities Commission

British Columbia Securities Commission

Kevin McCoy

Vice-President, Market Policy & Trading Conduct Compliance

IIROC

{1} Published at: https://www.osc.gov.on.ca/documents/en/Securities-Category2/csa_20190312_internalization-within-the-canadian-equity-market.pdf

{2} An "intentional" cross is considered to mean a trade that results from the simultaneous entry by a dealer of both the buy and the sell sides of a transaction in the same security at the same price. An "unintentional" cross is considered to mean the execution of a trade where the two orders are from the same dealer, but not simultaneously entered.

{3} The definition of a "marketplace" is included in National Instrument 21-101 Marketplace Operation and, in Ontario, also in the Securities Act (Ontario).

{4} Specifically, subsection 2.1(8) of NI 21-101CP clarifies that, if a dealer uses a system to match buy and sell orders or pair orders with contra-side orders outside of a marketplace and routes the matched or paired orders to a marketplace as a cross, it may be considered to be operating a marketplace under subparagraph (a)(iii) of the definition of "marketplace".

Appendix A

Quantitative Analysis of Internalization on Canadian Marketplaces

Appendix A looks quantitatively at trading activity and features associated with the internalization of orders and updates the data that was initially published as Part 1 of Appendix A to the Consultation Report.

This appendix provides data with respect to the occurrences of intentional and unintentional crosses on all Canadian marketplaces for the period of January 2016 to October 2019, and relies on data received by IIROC through the Market Regulation Feed submitted by each marketplace.

Fig. 1 -- Percentage of Total Trades Executed as Intentional (IC) or Unintentional Crosses (UIC)

- - - - - - - - - - - - - - - - - - - -

This figure shows overall crosses as a percentage of total number of trades. The upper chart shows unintentional crosses and the lower chart shows intentional crosses. Table 1 provides a summary of the averages and the percentage change over the period.

- - - - - - - - - - - - - - - - - - - -

Fig 2 -- Percentage of Total Volume Executed as Intentional or Unintentional Crosses

- - - - - - - - - - - - - - - - - - - -

This figure shows overall crosses as a percentage of total volume traded. The upper chart shows unintentional crosses and the lower chart shows intentional crosses. Table 1 provides a summary of the averages and the percentage change over the period.

- - - - - - - - - - - - - - - - - - - -

Fig 3 -- Percentage of Total Value Executed as Intentional or Unintentional Crosses

- - - - - - - - - - - - - - - - - - - -

This figure shows overall crosses as a percentage of total value traded. The upper chart shows unintentional crosses and the lower chart shows intentional crosses. Table 1 provides a summary of the averages and the percentage change over the period.

- - - - - - - - - - - - - - - - - - - -

Table 1 -- Six-month Averages of Intentional and Unintentional Crosses

|

|

2016 Period 1 |

2016 Period 2 |

2017 Period 3 |

2017 Period 4 |

2018 Period 5 |

2018 Period 6 |

2019 Period 7 |

Change between Period 1 and 7 |

Change between Jan 2016-Jun 2018 & Jul 2018 -- Oct 2019 |

||

|

|

|||||||||||

|

|

Jan-June |

July-Dec |

Jan-June |

July-Dec |

Jan-June |

July-Dec |

Jan-June |

Net Change |

% Change |

Net Change |

% Change |

|

|

|||||||||||

|

Unintentional by Trade |

12.27% |

11.64% |

12.07% |

13.12% |

13.91% |

15.38% |

16.32% |

4.05% |

33.04% |

3.44% |

27.26% |

|

|

|||||||||||

|

Unintentional by Volume |

11.85% |

11.70% |

11.58% |

12.62% |

12.75% |

13.23% |

13.90% |

2.05% |

17.34% |

1.49% |

12.28% |

|

|

|||||||||||

|

Unintentional by Value |

11.44% |

11.39% |

11.48% |

12.65% |

13.40% |

14.21% |

15.12% |

3.68% |

32.16% |

2.99% |

24.74% |

|

|

|||||||||||

|

Intentional by Trade |

0.06% |

0.07% |

0.07% |

0.10% |

0.11% |

0.11% |

0.10% |

0.04% |

63.72% |

0.02% |

18.76% |

|

|

|||||||||||

|

Intentional by Volume |

11.53% |

10.03% |

10.46% |

9.41% |

8.87% |

9.46% |

9.09% |

-2.45% |

-21.21% |

-0.82% |

-8.19% |

|

|

|||||||||||

|

Intentional by Value |

13.18% |

12.13% |

13.82% |

12.09% |

11.67% |

10.88% |

10.43% |

-2.75% |

-20.84% |

-1.94% |

-15.40% |

- - - - - - - - - - - - - - - - - - - -

Table 1 shows the average percentages of total trade executions executed as intentional and unintentional crosses by number of trade, total volume and value averaged over six-month periods. Net change between period 1 and 7 is calculated by comparing period 7 (Jan-June 2019) to period 1 (Jan-June 2016). % Change between period 1 and 7 is the net change as a percentage of the period 1 percentage.

- - - - - - - - - - - - - - - - - - - -

Fig 4 -- Average Cross Trades by Account Type -- Compared Against Average Non-cross (NC) Trades

- - - - - - - - - - - - - - - - - - - -

Fig 4 shows the percentage of intentional and unintentional crosses by number of trades and client types. Client types of non-cross trades are provided for comparison purposes. "OTHER" refers to any trade involving an account type market that is not CL-CL (Client to Client) or CL-IN (Client to Inventory).

- - - - - - - - - - - - - - - - - - - -

Fig 5 -- Average Cross Volume by Account Type -- Compared Against Average Non-cross Volume

- - - - - - - - - - - - - - - - - - - -

Fig 5 shows the percentage of intentional and unintentional crosses by volume and client types. Client types of non-cross trades are provided for comparison purposes.

- - - - - - - - - - - - - - - - - - - -

Fig 6 -- Average Cross Value by Account Type -- Compared Against Average Non-cross Value

- - - - - - - - - - - - - - - - - - - -

Fig 6 shows the percentage of intentional and unintentional crosses by value traded and client types. Client types of non-cross trades are provided for comparison purposes.

- - - - - - - - - - - - - - - - - - - -

Fig 7 -- Crosses by Account Type

- - - - - - - - - - - - - - - - - - - -

Fig 7 shows the change over the period by number of trades, total volume traded and total value traded by client type. The percentages are measured against the total trading that occurred on all marketplaces.

- - - - - - - - - - - - - - - - - - - -

Table 2 -- Cross by Account Types -- 6-month Averages

|

|

|

2016 Period 1 |

2016 Period 2 |

2017 Period 3 |

2017 Period 4 |

2018 Period 5 |

2018 Period 6 |

2019 Period 7 |

Change between Period 1 and 7 |

Change between Jan 2016 -- Jun 2018 & Jul 2018 -- Oct 2019 |

||

|

|

||||||||||||

|

Cross |

Account Type |

Jan-June |

July-Dec |

Jan-June |

July-Dec |

Jan-June |

Jul-Dec |

Jan-June |

Net Change |

% Change |

Net Change |

% Change |

|

|

||||||||||||

|

Unintentional by Trade |

CL-CL |

10.25% |

9.47% |

9.89% |

10.13% |

10.72% |

12.35% |

13.02% |

2.77% |

27.00% |

2.73% |

27.00% |

|

|

||||||||||||

|

|

CL-IN |

1.73% |

1.95% |

1.95% |

2.74% |

2.81% |

2.58% |

2.79% |

1.07% |

61.73% |

0.50% |

22.35% |

|

|

||||||||||||

|

|

OTHER |

0.29% |

0.23% |

0.24% |

0.25% |

0.39% |

0.45% |

0.51% |

0.22% |

75.44% |

0.21% |

76.05% |

|

|

||||||||||||

|

Unintentional by Value |

CL-CL |

8.80% |

8.46% |

8.22% |

8.79% |

9.95% |

10.95% |

11.46% |

2.66% |

30.19% |

2.72% |

30.73% |

|

|

||||||||||||

|

|

CL-IN |

2.25% |

2.53% |

2.91% |

3.51% |

3.00% |

2.78% |

2.93% |

0.68% |

30.20% |

0.03% |

1.20% |

|

|

||||||||||||

|

|

OTHER |

0.39% |

0.40% |

0.36% |

0.35% |

0.45% |

0.48% |

0.73% |

0.34% |

88.34% |

0.23% |

60.36% |

|

|

||||||||||||

|

Unintentional by Volume |

CL-CL |

9.37% |

9.31% |

8.97% |

9.83% |

10.12% |

10.69% |

11.32% |

1.96% |

20.92% |

1.49% |

15.61% |

|

|

||||||||||||

|

|

CL-IN |

2.18% |

2.14% |

2.38% |

2.58% |

2.40% |

2.19% |

1.97% |

-0.21% |

-9.44% |

-0.26% |

-11.20% |

|

|

||||||||||||

|

|

OTHER |

0.30% |

0.25% |

0.23% |

0.21% |

0.23% |

0.35% |

0.60% |

0.30% |

98.79% |

0.26% |

106.71% |

|

|

||||||||||||

|

Intentional by Trade |

CL-CL |

0.018% |

0.020% |

0.019% |

0.023% |

0.019% |

0.017% |

0.019% |

0.0005% |

2.52% |

-0.002% |

-9.04% |

|

|

||||||||||||

|

|

CL-IN |

0.04% |

0.05% |

0.05% |

0.08% |

0.09% |

0.09% |

0.08% |

0.04% |

87.98% |

0.02% |

26.13% |

|

|

||||||||||||

|

|

OTHER |

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

NA * |

0.001% |

NA * |

|

|

||||||||||||

|

Intentional by Value |

CL-CL |

4.13% |

3.75% |

3.56% |

3.23% |

2.56% |

2.26% |

2.03% |

-2.10% |

-50.92% |

-1.33% |

-38.50% |

|

|

||||||||||||

|

|

CL-IN |

9.04% |

8.38% |

10.26% |

8.65% |

8.64% |

8.11% |

7.92% |

-1.12% |

-12.44% |

-0.96% |

-10.69% |

|

|

||||||||||||

|

|

OTHER |

0.00% |

0.00% |

0.00% |

0.20% |

0.47% |

0.51% |

0.49% |

0.48% |

NA * |

0.35% |

NA * |

|

|

||||||||||||

|

Intentional by Volume |

CL-CL |

3.54% |

3.16% |

2.96% |

2.94% |

2.24% |

2.44% |

2.09% |

-1.45% |

-40.87% |

-0.69% |

-23.37% |

|

|

||||||||||||

|

|

CL-IN |

7.99% |

6.86% |

7.50% |

6.24% |

6.16% |

6.44% |

6.46% |

-1.53% |

-19.19% |

-0.53% |

-7.69% |

|

|

||||||||||||

|

|

OTHER |

0.00% |

0.00% |

0.00% |

0.23% |

0.48% |

0.58% |

0.54% |

0.54% |

NA * |

0.40% |

NA * |

- - - - - - - - - - - - - - - - - - - -

Table 2 shows the average percentages of intentional and unintentional crosses by client type and number of trades, total volume and value averaged over six-month periods. Net change is calculated by comparing period 7 (Jan-June 2019) to period 1 (Jan-June 2016). % Change between period 1 and 7 is the net change as a percentage of the period 1 percentage.

* Due to the negligible values in the denominator, the % changes are not informative. Thus, they are marked as NA.

- - - - - - - - - - - - - - - - - - - -

Table 2.1 -- Marketplace Reference Data

|

Market Name |

Market Alias |

Dark Market |

Market Full Name |

|

|

|||

|

ALF |

ALF |

No |

Alpha |

|

|

|||

|

AQD |

AQD |

Yes |

NEO-D |

|

|

|||

|

AQL |

AQL |

No |

NEO-L |

|

|

|||

|

AQN |

AQN |

No |

NEO-N |

|

|

|||

|

CDX |

TSXV |

No |

TSX Venture |

|

|

|||

|

CHX |

CHX |

No |

Nasdaq CXC |

|

|

|||

|

CNQ |

CSE |

No |

Canadian Securities Exchange |

|

|

|||

|

CX2 |

CX2 |

No |

Nasdaq CX2 |

|

|

|||

|

CXD |

CXD |

Yes |

Nasdaq CXD |

|

|

|||

|

ICX |

ICX |

Yes |

Instinet ICX |

|

|

|||

|

LIQ |

LIQ |

Yes |

Liquidnet |

|

|

|||

|

LYX |

LYX |

No |

Lynx |

|

|

|||

|

OMG |

OMG |

No |

Omega |

|

|

|||

|

PTX |

PTX |

No |

Pure |

|

|

|||

|

TCM |

TCM |

Yes |

MATCHNow |

|

|

|||

|

TSE |

TSX |

No |

TSX |

Fig 8 -- Average Cross Percentage by Marketplace -- Relative to Own Trading

- - - - - - - - - - - - - - - - - - - -

Fig 8 shows the percentage of intentional and unintentional crosses by total trades, total volume and total value measured against each marketplace's own trading. Percentages displayed above the bars correspond to volume.

- - - - - - - - - - - - - - - - - - - -

Fig 9 -- Average Contribution by Marketplace

- - - - - - - - - - - - - - - - - - - -

Fig 9 shows the percentage contribution by each marketplace against the total traded by all marketplaces. For comparison purposes, total (including cross and non-cross activity) number of trades, volume and value has been included. This chart is generated based on the exact data in Table 2.2.

- - - - - - - - - - - - - - - - - - - -

Table 2.2 -- Average contribution by each marketplace in terms of intentional / unintentional cross trades and overall trades

|

Market |

Trade |

Volume |

Value |

Trade UIC |

Volume UIC |

Value UIC |

Trade IC |

Volume IC |

Value IC |

|

|

|||||||||

|

TSE |

48.6% |

36.3% |

54.8% |

55.1% |

47.0% |

66.4% |

29.7% |

29.8% |

27.5% |

|

|

|||||||||

|

CDX |

2.1% |

18.2% |

0.8% |

2.1% |

20.6% |

0.9% |

1.4% |

4.0% |

0.3% |

|

|

|||||||||

|

CHX |

16.4% |

10.4% |

14.8% |

12.8% |

6.2% |

9.2% |

24.5% |

28.1% |

31.6% |

|

|

|||||||||

|

CNQ |

3.2% |

8.9% |

2.2% |

1.7% |

9.3% |

0.8% |

3.3% |

4.3% |

3.8% |

|

|

|||||||||

|

TCM |

6.2% |

6.1% |

5.7% |

9.1% |

4.0% |

6.5% |

0 |

0 |

0 |

|

|

|||||||||

|

AQN |

2.5% |

5.1% |

5.5% |

2.4% |

1.7% |

1.5% |

40.1% |

31.8% |

33.2% |

|

|

|||||||||

|

ALF |

5.5% |

4.5% |

5.8% |

3.6% |

2.6% |

4.2% |

0.1% |

0.1% |

0.1% |

|

|

|||||||||

|

OMG |

6.9% |

3.7% |

4.2% |

5.6% |

2.3% |

3.0% |

0.1% |

1.2% |

2.9% |

|

|

|||||||||

|

CX2 |

5.8% |

3.5% |

3.8% |

5.1% |

2.2% |

3.4% |

0.8% |

0.8% |

0.7% |

|

|

|||||||||

|

AQL |

2.1% |

2.3% |

1.5% |

2.0% |

2.6% |

1.5% |

0 |

0 |

0 |

|

|

|||||||||

|

CXD |

0.6% |

0.6% |

0.5% |

0.4% |

0.4% |

0.4% |

0 |

0 |

0 |

|

|

|||||||||

|

LYX |

0.2% |

0.3% |

0.1% |

0.1% |

0.1% |

0.1% |

0.001% |

0.000% |

0.000% |

|

|

|||||||||

|

LIQ |

0.001% |

0.1% |

0.2% |

0.0% |

1.0% |

1.8% |

0 |

0 |

0 |

|

|

|||||||||

|

ICX |

0.017% |

0.020% |

0.045% |

0.1% |

0.1% |

0.2% |

0 |

0 |

0 |

|

|

|||||||||

|

AQD |

0.004% |

0.004% |

0.007% |

0.003% |

0.002% |

0.004% |

0 |

0 |

0 |

|

|

|||||||||

|

Total |

100% |

100% |

100% |

100% |

100% |

100% |

100% |

100% |

100% |

Fig 10 -- CL-CL Crosses by Security Price

- - - - - - - - - - - - - - - - - - - -

Fig 10 shows a breakdown of intentional and unintentional client-client crosses as a percentage of total trading activity over the period by security price. 5 buckets are used: =<.10,>.10 -- $1, >$1 -- $5, >$5 -- $10, >$10.

- - - - - - - - - - - - - - - - - - - -

Fig 11 -- CL-IN Crosses by Security Price

- - - - - - - - - - - - - - - - - - - -

Fig 11 shows a breakdown of intentional and unintentional client-inventory crosses as a percentage of total trading activity over the period by security price. 5 buckets are used: =<.10,>.10 -- $1, >$1 -- $5, >$5 -- $10, >$10.

- - - - - - - - - - - - - - - - - - - -

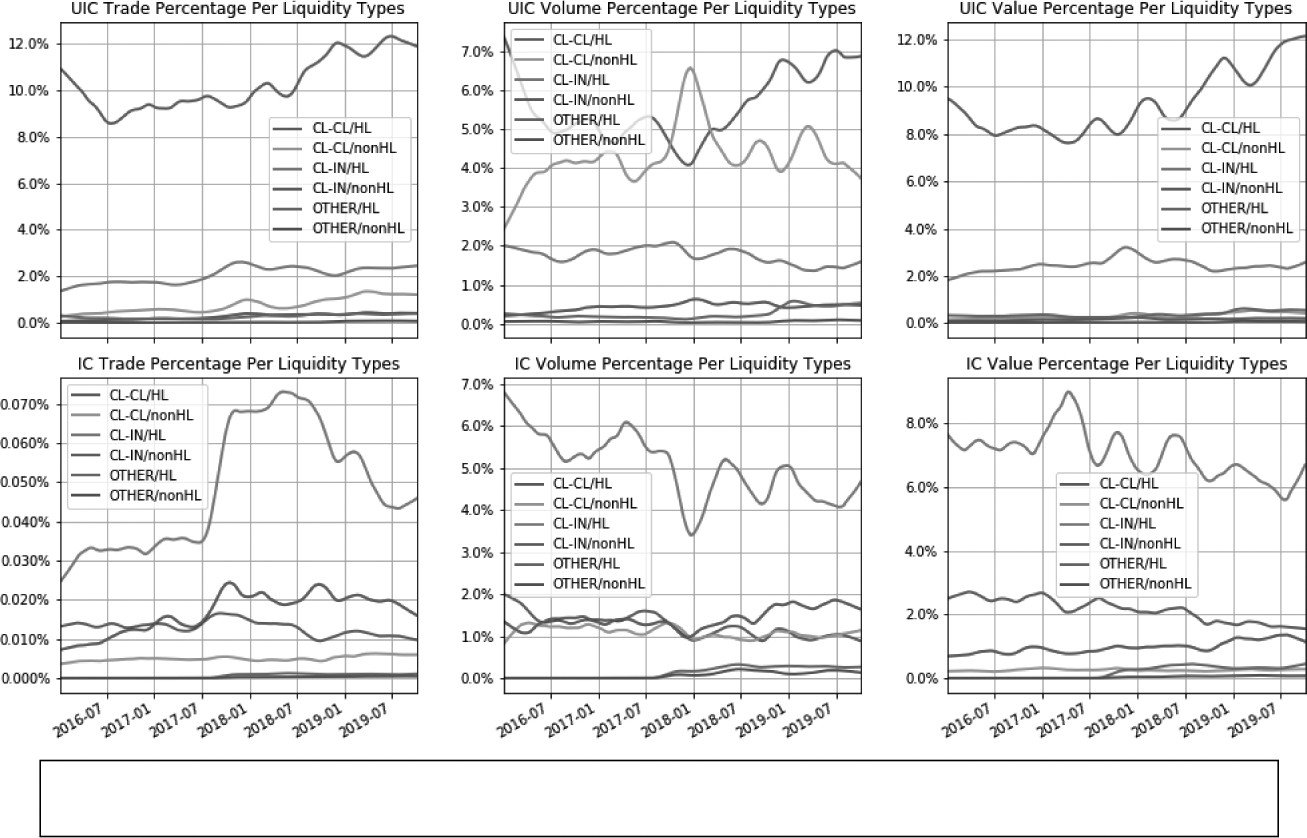

Fig 12 --Crosses by Liquidity

- - - - - - - - - - - - - - - - - - - -

Fig 12 shows a breakdown of intentional and unintentional crosses as a percentage of total trading activity by client type over the period by liquidity. For the calculation of liquidity, the IIROC highly-liquid security list was used.

- - - - - - - - - - - - - - - - - - - -

Table 3 -- Average Contribution by Top 15 Dealers

|

Total Value |

88.04% |

|

|

|

|

Total Volume |

81.87% |

|

|

|

|

Total Trades |

87.77% |

|

|

|

|

Intentional Crosses -- Value |

85.97% |

|

|

|

|

Intentional Crosses -- Volume |

77.11% |

|

|

|

|

Intentional Crosses -- Trades |

81.16% |

|

|

|

|

Unintentional Crosses -- Value |

94.75% |

|

|

|

|

Unintentional Crosses -- Volume |

94.68% |

|

|

|

|

Unintentional Crosses -- Trades |

98.59% |

- - - - - - - - - - - - - - - - - - - -

Table 3 aggregates the activity of the top 15 dealers as measured by trading activity. Percentages reflect the aggregate contribution over the period. For comparison purposes, total (including cross and non-cross trades) number of trades, volume and value have been included.

- - - - - - - - - - - - - - - - - - - -

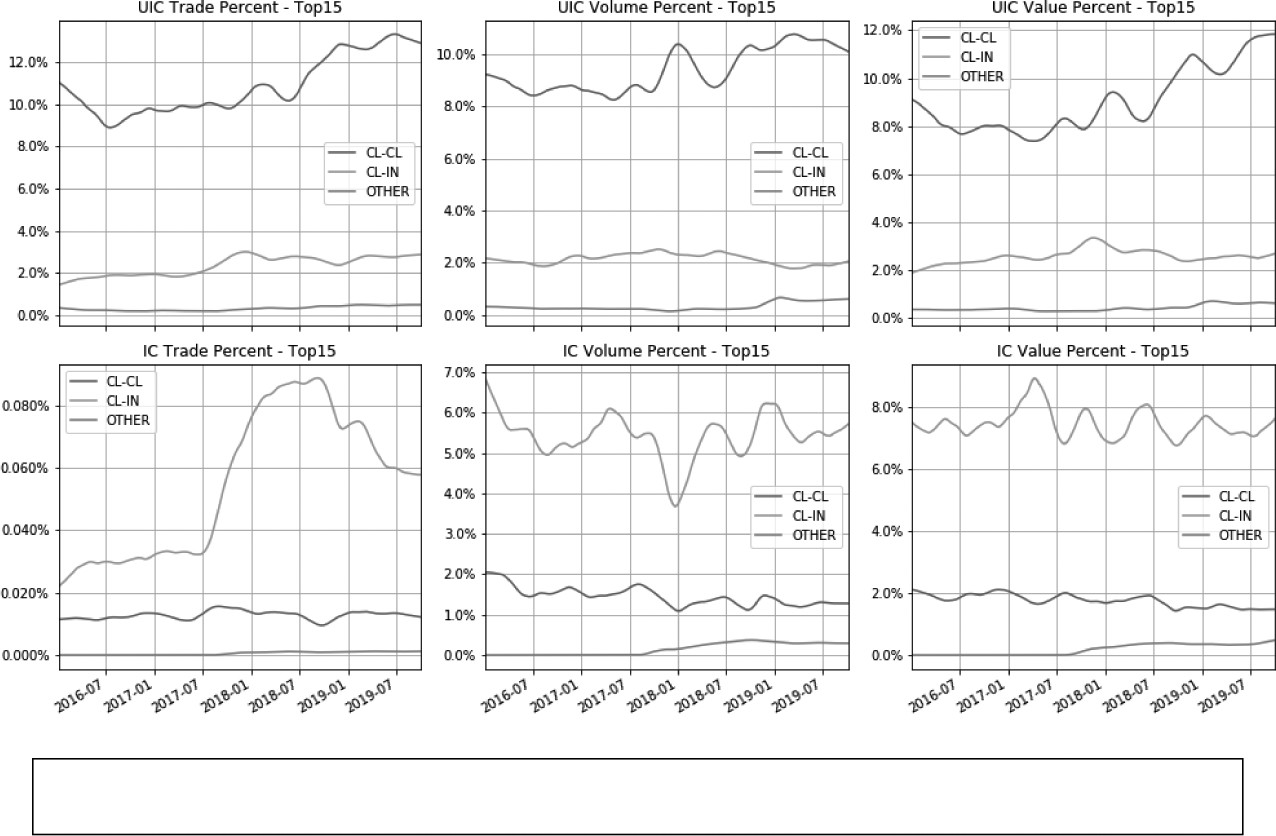

Fig 13 -- Top 15 Dealers -- Crosses -- Percentage of Own Trading

- - - - - - - - - - - - - - - - - - - -

Fig 13 shows the percentage of intentional and unintentional crosses by client type of the top 15 dealers as compared against the total trading activity of the same top 15 dealers on all marketplaces.

- - - - - - - - - - - - - - - - - - - -

Fig 14 -- Top 15 Dealers -- Crosses -- Percentage of Total Trading

- - - - - - - - - - - - - - - - - - - -

Fig 14 shows the percentage of intentional and unintentional crosses by client type of the top 15 dealers as compared against the total trading activity of all dealers on all marketplaces.

- - - - - - - - - - - - - - - - - - - -

APPENDIX B

Summary of comments received and responses

LIST OF COMMENTERS

1. The Canadian Advocacy Council for Canadian CFA Institute Societies

2. Leede Jones Gable Inc. -- Jason Jardine

3. Buy Side Investment Management Association -- Brent Robertson

4. Select Vantage Canada Inc. -- Daniel Schlaepfer, Hugo Kruyne and Mario Josipovic

5. Canadian Foundation for Advancement of Investor Rights

6. NEO Exchange Inc. -- Cindy Petlock

7. TD Direct Investing -- Paul Clark

8. TD Securities Inc. -- David Panko

9. Desjardins Securities

10. Acumen Capital Finance Partners Limited -- Myja Miller

11. Ian Bandeen

12. Independent Trading Group

13. TMX Group Limited -- Kevin Sampson

14. BMO Capital Markets -- Dave Moore

15. Investment Industry Association of Canada -- Susan Copland

16. RBC Dominion Securities Inc. Capital Markets and Wealth Management -- Thomas Gajer

17. Scotiabank -- Alex Perel

18. National Bank Financial Inc. -- Nicolas Comtois, Alain Katchouni and Patrick McEntyre

19. Canadian Security Traders Association Inc.

20. Nasdaq Canada

21. CIBC World Markets Inc.

|

Topic |

Summary of Comments |

CSA/IIROC Response |

|||

|

|

|||||

|

General Comments |

One commenter suggested that the consultation process is biased towards large market participants and suggested that regulators hold both formal and informal roundtables in order to solicit views from all industry participants. Conversely, one commenter was supportive of what they believed was a collaborative consultation process. |

The public comment process specifically solicited views from all interested stakeholders and we received comments from both large and small participants. |

|||

|

|

|||||

|

|

One respondent expressed the view that regulatory concern in Canada stems from related concerns with the securities industry in the United States, and noted differences in market structure between both countries, particularly with respect to retail internalization/wholesaling. |

While we agree with the view that notable differences in market structure exist between Canada and the United States, we do not agree with the belief that the regulatory concern with respect to internalization in Canada stems from similar concerns that are present in the United States. We note, as an example, that broker preferencing is an important element of the concerns expressed and is an aspect of market structure that is generally unique to Canada. |

|||

|

|

|||||

|

Question 1 -- How do you define internalization? |

The Consultation Paper defined internalization as being generally "a trade that is executed with the same dealer as both the buyer and the seller." Most commenters agreed with the Consultation Paper's definition of the term. |

|

|

||

|

|

One respondent believed, however, that for the purposes of the Consultation Paper, the definition should focus on methods of internalization that are intentional and have a high degree of certainty of the outcome, whether facilitated by technology or performed manually. |

The definition set out in the Consultation Paper was not intended to focus on methods of internalization, but rather to provide a broad definition from which we could solicit feedback on several related issues. |

|||

|

|

|||||

|

Question 2 -- (Key attributes of a market) -- Are all of these attributes relevant considerations from a regulatory policy perspective? If not, please identify those which are not relevant, and why. |

Most commenters agreed that the attributes set out in the Consultation Paper are relevant considerations from a regulatory policy perspective. |

We agree that the key market attributes that were described as early as 1997, and which have guided the consideration of market structure policy changes should be applied broadly to the entire market. We note that these attributes have influenced policy decisions over the years that are related not only to marketplaces, but to issues that impact all stakeholders. |

|||

|

|

One commenter believed that rather than applying the attributes strictly, they should be applied to the entire market ecosystem to recognize the role that dealers play in contributing to market quality. |

|

|

||

|

|

|||||

|

Question 3 -- (Key attributes of a market) -- How does internalization relate to each of these attributes? If other attributes should be considered in the context of internalization, please identify these attributes and provide rationale. |

Most respondents articulated that internalization can impact the stated attributes, either positively or negatively. One commenter stated that internalization harms all the attributes. Another commenter stated that internalization increases segmentation, which in turn affects various attributes. |

We highlight the differing views presented by respondents. We believe that the diversity of comments supports the position that while some attributes may be impacted through internalization, the magnitude of the impact cannot be easily quantified. |

|||

|

|

Specifically, some argued that increased levels of internalization will impact liquidity through wider spreads and more unstable quotes, while others believed that internalization enhances both liquidity and immediacy of order execution. |

|

|

||

|

|

Some commenters believed that changes to the rules related to internalization, particularly broker preferencing, may cause dealers to seek to replicate the benefits that they receive in other ways, which may negatively impact key market attributes. |

We note this response as an example that recognizes the need to be cautious that regulatory policy changes are balanced and do not result in unintended outcomes. |

|||

|

|

|||||

|

Question 4 -- Please provide your thoughts on the question of the common versus the individual good in the context of internalization and best execution. |

Most commenters characterized internalization as being detrimental to the common good, however many also expressed a desire to find a balance between the individual good (e.g. internalization, broker preferencing) and the common good (e.g. fair access, price discovery). However, a few commenters supported internalization over the common good. |

We highlight the reference to balance as a common theme throughout many of the responses received. We are of the view that balance is an important consideration in evaluating any policy work in relation to the concerns raised. |

|||

|

|

Several commenters prioritized the common good over the individual good, while others expressed concern about the outcomes of increased internalization, including its impacts on liquidity and overall market toxicity. |

We recognize the underlying concerns with respect to increased levels of internalization. While we do not believe that the current data regarding internalization indicates concerns that warrant an immediate policy response, we intend to monitor data on an ongoing basis, both specific to the magnitude of internalization as well as general market quality measures. Where we see evidence of negative impacts, we will consider appropriate policy responses at that time. |

|||

|

|

One respondent believed that market participants who benefit from internalization may have little incentive to promote the common good. |

|

|

||

|

|

One commenter, however, expressed concern over focusing primarily on the common good because in doing so, it may ultimately sacrifice execution quality and pose a risk of losing global order flows into the Canadian market. |

As previously noted, we recognize the need to continue to ensure a competitive Canadian market while also being cautious that regulatory policy changes do not result in unintended outcomes. |

|||

|

|

|||||

|

Question 5 -- Please provide any data regarding market quality measures that have been impacted by internalization. Please include if there are quantifiable differences between liquid and illiquid equities. |

The sole direct respondent to this question asserted that it is difficult to measure the impact of internalization on market quality without conducting a formal study. Furthermore, they believe that the U.S. market has a higher execution quality than in Canada, and believes this may be a result of greater liquidity available through internalization. |

We highlight the lack of available data from respondents and reiterate that we have not seen specific negative impacts that warrant an immediate policy response. |

|||

|

|

|||||

|

Question 6 -- Market participants: please provide any data that illustrates the impacts to you or your clients resulting from your own efforts (or those of dealers that execute your orders) to internalize client orders (e.g. cost savings, improved execution quality) or the impacts to you or your clients resulting from internalization by other market participants (e.g. inferior execution quality/reduced fill rates). |

The sole respondent to this question asserted their clients benefit from internalization through higher fill rates on passive orders, reduced market impact of marketable orders, lower indirect cost of execution and a reduction in adverse selection. |

See above re: Question 5. |

|||

|

|

|||||

|

Question 7 -- Please provide your views on the benefits and/or drawbacks of broker preferencing? |

Commenters highlighted many benefits and drawbacks to broker preferencing. Generally, respondents were divided in their support or opposition. |

As referenced above, we believe that the diversity of views expressed in the comments we received is supportive of the position that the magnitude of the impact of broker preferencing cannot be easily quantified, and we again highlight the theme of balance. We are of the view that a policy response at this time, absent clear evidence of a market structure that is negatively impacting the common good, may affect the balance of Canadian market structure and result in other outcomes. As part of our ongoing monitoring, we are committed to continuing to evaluate the extent to which order execution results from broker preferencing, and any corresponding impacts. |

|||

|

|

<<Specific benefits that were noted included:>> |

|

|

||

|

|

• |

immediacy of trade execution and reduced execution costs; |

|

|

|

|

|

• |

improves the ability of retail and institutional clients to capture the spread; |

|

|

|

|

|

• |

reduction in the market impact of larger orders; |

|

|

|

|

|

• |

broker preferencing is preferable to other alternatives, including an expansion in the number of dark pools and/or dealers setting up their own trading venues; and |

|

|

|

|

|

• |

as compared to U.S. market structure, it is preferable because: |

|

|

|

|

|

|

• |

it is more fair; |

|

|

|

|

|

• |

the primary beneficiaries are retail clients; and |

|

|

|

|

|

• |

it encourages the posting of liquidity on public marketplaces and client-to-client order matching. |

|

|

|

|

<<Drawbacks that were noted included:>> |

|

|

||

|

|

• |

a negative impact on fairness and/or the principles of a fair and open market by creating an unlevel playing field, as not all participants have the chance to interact with a given order; and |

|

|

|

|

|

• |

a negative impact on immediacy for displayed orders and a resulting negative perception of fairness if orders are not executed or if immediacy is reduced. |

|

|

|

|

|

Several commenters noted that the concerns raised may be especially impactful where broker preferencing is leveraged on a systematic basis. |

|

|

||

|

|

Many respondents offered comments in relation to potential changes to the application of broker preferencing. Commenters were divided in this regard. |

|

|

||

|

|

Several commenters supported either a full prohibition of broker preferencing, or a limitation of its application to smaller orders (typically less than 50 standard trading units). |

|

|

||

|

|

Respondents who were not in favour of changes or restrictions, were of the view that this would result in increased costs and complexity and that alternatives could lead to greater market fragmentation and an increased advantage to market participants who utilize low latency trading strategies. |

|

|

||

|

|

It was also noted that restrictions are unnecessary as Rule 6.3 Order Exposure of the Universal Market Integrity Rules (UMIR)already facilitates price discovery, immediacy and liquidity. |

|

|

||

|

|

One commenter also believed that restrictions on broker preferencing could impact the competitiveness of the Canadian market by increasing costs. |

|

|

||

|

|

|

|

|

|

We will continue to monitor our trading rules and that the policy objectives continue to be met. We may propose amendments where appropriate if we identify rules that are not meeting the intended policy objectives. |

|

|

|

|

|

|

We refer to previous responses related to potential unintended outcomes that may result from immediate policy responses that are not supported by measurable evidence of an existing issue. |

|

|

|||||

|

Question 8 -- Market participants: where available, please provide any data that illustrates the impact of broker preferencing on order execution for you or your clients (either positive or negative). |

One commenter observed that, based on its internal statistics, no one client segment benefits disproportionately from broker preferencing. |

We highlight the lack of available data illustrating specific negative impacts that warrant an immediate policy response. |

|||

|

|

|||||

|

Question 9 -- Please provide your thoughts regarding the view that broker preferencing conveys greater benefits to larger dealers. |

Most commenters supported the view that larger firms gain greater benefits relative to smaller dealers. One commenter noted that broker preferencing creates an incentive for liquidity providers to become clients of larger dealers. |

We recognize the concerns that, in relation to broker preferencing, smaller dealers may be at a disadvantage as compared to larger dealers that have significantly higher volume of orders. We note that benefits of broker preferencing are not exclusive to larger dealers and that small dealers can also benefit both in circumstances where they have existing orders in an order book, and potentially by access to greater liquidity provided through the trading activity of other dealers. Absent clear evidence of an unbalanced market structure that is causing measurable negative impacts, we are cautious of proposing changes at this time, but will continue to monitor for impacts going forward. |

|||

|

|

|||||

|

|

Others were less supportive of this view and offered a number of qualifying comments. Respondents expressed the view that broker preferencing does not only benefit larger dealers, but any dealer with two-sided volume of client orders, with diversified business lines or with a large amount of active (i.e. marketable) order flow. |

|

|

||

|

|

|||||

|

|

One commenter believed that broker preferencing benefits smaller dealers as it provides greater liquidity, price discovery and access to order flow as compared to alternative market structures that exclude small dealers entirely. |

|

|

||

|

|

|||||

|

Question 10 -- Does broker preferencing impact (either positively or negatively) illiquid or thinly-traded equities differently than liquid equities? |

A couple of commenters noted that they were not aware of any studies covering the impact of broker preferencing on either liquid or illiquid securities. |

|

|

||

|

|

Those that responded to the question had mixed views. A couple of commenters noted that there is a higher trading volume in liquid securities which ultimately leads to a higher frequency of broker preferencing. |

We believe that the divergent views support the position that the magnitude of any impacts of broker preferencing between liquid and less-liquid securities cannot be easily determined. We will continue to monitor market quality measures and the magnitude of broker preferencing and will consider the liquidity profile of a security. |

|||

|

|

Most of those who responded to this question thought that the impact of broker preferencing is more pronounced on illiquid securities, for reasons including: |

|

|

||

|

|

• |

the value of time priority is large for thinly traded securities or for those where trading is concentrated on one marketplace; |

|

|

|

|

|

• |

queue-jumping resulting from broker preferencing may have a greater impact on the perception of fairness with respect to illiquid securities; |

|

|

|

|

|

• |

concerns about the liquidity of these securities are already high; and |

|

|

|

|

|

• |

broker preferencing may incentivize dealers to make markets, thus contributing to liquidity when it is most needed. |

|

|

|

|

|

A couple of commenters thought the impact of broker preferencing is higher on liquid securities. One commenter noted that more liquid securities trade in multiple order books with deep queues, especially at lower price points. It is difficult for resting orders to be filled on time priority alone, thus they benefit from broker preferencing. |

|

|

||

|

|

|||||

|

|

Another respondent thought that broker preferencing is not a key factor in the liquidity of thinly-traded securities, as liquidity is primarily a function of institutional ownership, retail interest, research coverage and not of market microstructure. |

|

|

||

|

|

Finally, one commenter noted that the impact is likely the same for liquid and illiquid securities. |

|

|

||

|

|

|||||

|

Question 11 -- Do you believe that a dealer that internalizes orders on an automated and systematic basis should be captured under the definition of a marketplace in the Marketplace Rules? Why, or why not? |

Two commenters, representing sell-side participants, were of the view that if dealers are automating what could be done manually, or what was done manually in the past, they should not be considered a marketplace as defined in the Marketplace Rules. The application of technology should not change how an activity is classified from a regulatory perspective. One of the commenters noted, however, that mechanisms for holding large numbers of client orders away from the open market while systematically seeking to find matches within those orders would be outside what can be done manually by dealers and such systems would be a marketplace. |

We are of the view that, if a dealer's activities are similar to those undertaken by a marketplace, in that the dealer systematically matches buy and sell orders of securities with limited discretion by the dealer in the execution process, it may meet the definition of a marketplace. The CSA will consider whether additional clarification should be provided in relation to when a system is a "marketplace". |

|||

|

|

|||||

|

|

Most commenters, however, thought that a dealer or any system that automates the internalization of orders should be considered a marketplace. These commenters noted that the Canadian market is relatively small and has large intermediaries and significant retail participation. Creating silos of liquidity would not only reduce efficiency but so too negatively impact fairness. If considered marketplaces, the fair access requirements in the Marketplace Rules would therefore apply. |

We share the concerns of respondents in relation to silos of liquidity and potential negative impacts on the Canadian market, but do not believe that the current available data illustrates concerns that require an immediate policy response. As highlighted in previous responses, we intend to continue monitoring for such negative impacts and will consider appropriate policy measures where, and if necessary. |

|||

|

|

|||||

|

Question 12 -- Do you believe segmentation of orders is a concern? Why, or why not? Do your views differ between order segmentation that is achieved by a dealer internalizing its own orders and order segmentation that is facilitated by marketplaces? |

The majority of commenters thought segmentation of orders is a concern, for reasons including: |

We note that we share some of the concerns highlighted, especially as they relate to overall quality of the Canadian market. |

|||

|

|

• |

it runs contrary to the principle of fair access; |

|

||

|

|

• |

it siloes liquidity and reduces opportunities for the broadest degree of order interaction; |

|

||

|

|

• |

undermining the diversity of orders in the market would make it less liquid and less competitive; |

|

|

|

|

|

• |

segmentation of retail orders in particular, is an unhealthy trend, particularly in a smaller market like Canada where there are liquidity challenges; |

|

|

|

|

|

• |

removal of one category of orders would negatively impact price discovery; it was noted that the removal of retail order flow would negatively impact price discovery as it is a significant contributor to price discovery; |

|

|

|

|

|

• |

removal of retail order flow would increase toxicity among the remaining non-retail market, driving the non-retail market away from transparent markets; |

|

|

|

|

|

• |

segmentation is often associated with information leakage; and |

|

|

|

|

|

• |

it may erode market quality in Canada. |

|

|

|

|

|

|

|

|

As noted in the Consultation Paper, segmentation of orders may result from different mechanisms including: |

|

|

|

|

|

|

• |

marketplace fee models (i.e. fee and rebate structures); |

|

|

|

|

|

• |

other marketplace functionality (e.g. order processing delays, market maker programs); and |

|

|

|

|

|

• |

dealer trading practices or processes that seek to internalize retail, or potentially other order flow. |

|

|

Some commenters noted the proliferation of order types and incentives offered by marketplaces. One also noted that these marketplace offerings drive unnecessary intermediation. |

|

|

||

|

|

|||||

|

|

One commenter indicated that there should be a distinction between implicit and explicit segmentation. The commenter noted that there is a difference between competing commercial models that incentivize participants to seek out the services that best meet their objectives, but marketplace features should be accessible to all and users can choose how to use them. However, there should not be features that explicitly segment orders and restrict access. |

In the review of various marketplace proposals, we consider issues related to segmentation, particularly in the context of fair access and leakage of information, and the impacts of marketplace proposals on Canadian market quality. We have not currently identified concerns from segmentation of orders that we believe necessitates an immediate policy response. |

|||

|

|

Some commenters noted that the concerns with respect to segmentation are the same regardless of whether it occurs at the dealer level, through internalization, or through marketplace features. It was noted that marketplaces and dealers enabling segmentation have been treated differently from a regulatory perspective, which is a concern. |

|

|

||

|

|

One commenter was of the view that some level of segmentation is necessary in order to improve execution quality for certain classes of orders, however, if it were excessive, it would impact market quality. The commenter noted that the segmentation of retail orders in the U.S., through wholesaling, has been successful in improving immediacy, execution quality and market impact for retail clients. The same commenter was of the view that the erosion of the Canadian market share is directly related to the inability to segment retail order flow in the existing regulatory framework. |

|

|

||

|

|

|||||

|

Question 13 -- Do you believe that Canadian market structure and the existing rule framework provides for optimal execution outcomes for retail orders? Why or why not? |

While not necessarily agreeing in all cases with the term "optimal", commenters were generally supportive of Canadian market structure relative to other jurisdictions and were of the view that the Canadian market structure and the existing rule framework provide for favourable execution outcomes for retail orders. Some highlighted certain rules and requirements supporting retail order execution, while another noted that retail orders are the beneficiaries of low trading fees charged by retail dealers. |

While we are of the view that a "perfect" market structure likely does not exist, we believe that the current Canadian market ecosystem represents a reasonable equilibrium between the needs of various market participants, including retail investors. |

|||

|

|

One commenter noted the inherent challenge in the obligation for dealers to improve retail order execution outcomes, and the potential impact on the wider market. This sentiment was echoed by another commenter who suggested that any additional decisions taken to benefit retail should be undertaken with caution to avoid tradeoffs between the common and individual good. |

|

|

||

|

|

One commenter disagreed with the notion that retail orders receive optimal execution outcomes and suggested that retail orders receive better execution in the U.S. This commenter highlighted the importance of ensuring that Canadian markets are competitive with the U.S. to protect our market share while attracting additional orders. |

We agree with the importance of ensuring the Canadian market continues to be competitive, especially where trading in securities listed in Canada can easily be effected in Canada and/or in other jurisdictions. |

|||

|

|

|||||

|

Question 14 -- Should the CSA and IIROC consider changes to the rule framework to address considerations related to orders from retail investors? If yes, please provide your views on the specific considerations that could be addressed and proposed solutions. |

Many respondents provided views on potential changes to the rule framework to address concerns related to retail orders. One commenter highlighted existing rules and noted that IIROC and the CSA should continue ensuring that dealers comply, including with respect to order exposure, best execution, and client-principal trading. |

|

|

||

|

|

Several commenters specifically highlighted UMIR Rule 6.3 Order Exposure and expressed the view that the order size thresholds associated with its application should be reviewed with the possibility of amending them in a way that strengthens the rule and the corresponding benefits for retail orders. It was noted that this may similarly strengthen other UMIR Rules to which the thresholds are applicable. |

As part of the on-going work associated with this project, IIROC will review many of the provisions within UMIR to ensure the intended policy objectives continue to be met. IIROC will consider rules amendments as appropriate. |

|||

|

|

Several respondents identified the "guaranteed fill" facilities or functionality in place at various Canadian marketplaces and which typically apply to the execution of retail orders. Some were of the view that these facilities should be revisited in a way that either limits or reconsiders their use entirely, although one commenter noted that such facilities have allowed retail dealers to find better liquidity for retail order execution. One commenter also suggested that such facilities only be permitted to be offered by a listing exchange in the context of a formal market making program. |

The CSA has considered the various 'guaranteed fill' facilities in the context of balancing the obligations of exchange market makers relative to the benefits afforded. The CSA believes that they are currently balanced appropriately and note that while some may view such facilities as a benefit rather than an obligation, the programs are typically designed to supplement liquidity in an exchange's order book and further note that existing displayed orders receive execution priority. |

|||

|

|

A number of commenters recommended that the CSA and IIROC introduce order routing and execution reporting requirements both in the context of retail and institutional orders. |

The CSA has proposed such reporting requirements in the past, but did not move forward with finalizing proposals. If warranted, the CSA would again consider whether reporting would provide meaningful benefits. |

|||

|

|

Two commenters suggested a dedicated facility for the execution of retail orders that would have open access for anyone seeking to provide liquidity to retail orders on a multilateral basis. One of these commenters believed that this would provide some of the advantages of the wholesale model in the U.S., but ensure multilateral interactions. |

The CSA and IIROC are supportive of innovation that might help to improve Canadian market structure and would review any marketplace proposals in this regard in accordance with the normal processes. |

|||

|

|

One commenter recommended that the CSA and IIROC require the provision of access to real-time data for retail investors and investment advisors to provide a better view of available liquidity and how orders are executed, while supporting more informed investment decisions. |

Like many jurisdictions globally, we are considering a variety of issues associated with market data. Any proposals in relation to market data would be made under a separate policy initiative. |

|||

|

|

|||||

|

Question 15 -- Are there other relevant areas that should be considered in the scope of our review? |

Some respondents offered additional areas that they believed would be relevant for consideration. |

|

|

||

|

|

One commenter highlighted the mandated trading increments defined in UMIR as being at the core of internalization activities and the practice of spread capture. This commenter suggested that reducing or eliminating the minimum trading increment would benefit investors and the potential for spread reductions could result in greater volume and improved liquidity. |

We acknowledge the comment but note that removing the minimum trading increment would result in trades quoted at sub-penny increments. We are cautious of any potential unintended consequences and impacts to the industry. |

|||

|

|

Another respondent suggested that the CSA reconsider fee structures that discriminate between different types of participants with the goal of providing a better balance between the individual and the common good. |

|

|

||

|

|

Further related to fee structures, one commenter expressed support for the proposed CSA trading fee rebate pilot, noting that trading fees and trading fee models are some of the biggest contributors to segmentation. While not expressing support for the pilot, another respondent suggested capping rebates for liquidity-removal paid by marketplaces with inverted "taker-maker" fee schedules. |

|

|

||

|

|

One commenter suggested that orders that are created solely to take advantage of existing orders are not appropriate. |

|

|

||