OSC Staff Notice: 33-746 - 2015 Annual Summary Report for Dealers, Advisers and Investment Fund Managers

OSC Staff Notice: 33-746 - 2015 Annual Summary Report for Dealers, Advisers and Investment Fund Managers

Annual Summary Report for Dealers, Advisers and Investment Fund Managers Compliance and Registrant Regulation

OSC Staff Notice 33-746

September 21, 2015

Table of Contents

|

Introduction |

|||

|

|

|||

|

1. |

Key policy initiatives impacting registrants |

||

|

|

1.1 |

Cost disclosure, performance reporting and client statements |

|

|

|

1.2 |

Expanded exempt market review |

|

|

|

1.3 |

Best interest standard |

|

|

|

1.4 |

EMD scope of activities |

|

|

|

1.5 |

Outbound advising and dealing |

|

|

|

1.6 |

Derivatives regulation |

|

|

|

1.7 |

Registrant custody practices |

|

|

|

1.8 |

Independent dispute resolution services for registrants |

|

|

|

1.9 |

Ongoing amendments to registration requirements, exemptions and ongoing registrant obligations |

|

|

|

|||

|

2. |

Outreach to registrants |

||

|

|

2.1 |

Registrant Outreach program |

|

|

|

2.2 |

Registrant Advisory Committee |

|

|

|

2.3 |

Communication tools for registrants |

|

|

|

2.4 |

Topical Guide for registrants |

|

|

|

|||

|

3. |

Registration of firms and individuals |

||

|

|

3.1 |

Update on registration initiatives |

|

|

|

3.2 |

Current trends in deficiencies and acceptable practices |

|

|

|

|||

|

4. |

Information for dealers, advisers and investment fund managers |

||

|

|

4.1 |

All registrants |

|

|

|

4.2 |

Dealers (EMDs and SPDs) |

|

|

|

4.3 |

Advisers (PMs) |

|

|

|

4.4 |

Investment fund managers |

|

|

|

|||

|

5. |

Acting on registrant misconduct |

||

|

|

|||

|

6. |

Additional resources |

||

|

|

|||

|

Appendix A -- Compliance and Registrant Regulation Branch and contact information for registrants |

|||

DIRECTOR'S MESSAGE

Ontario's capital markets are continuously evolving as is the regulatory landscape. The emergence of complex business models and products requires registrants and regulators alike to work together, protecting investors and fostering fair and efficient capital markets.

Registrants have an obligation to deal fairly, honestly and in good faith with clients, which is essential to promoting confidence in Ontario's capital markets. The Ontario Securities Commission's Compliance and Registrant Regulation Branch (CRR) supports registrants in meeting their obligation by focusing on improving how we work together. We continue to develop our oversight and guidance, whether through compliance reviews, the publication of staff notices or the provision of outreach sessions. Our open communication with registrants allows us to enhance existing tools and develop and apply new ones to help registrants achieve effective compliance systems.

We continue to focus on the Registrant Outreach program, by providing sessions on timely topics. In June, we held a session on the elements of an effective compliance system and prior to that we held a session on Phase 2 of the Client Relationship Model (CRM2), given the imminent deadlines that registrants have to meet. We are always looking for new presentation topics and encourage registrants to inform us of any issues that we could address and provide additional guidance on.

As a gatekeeper to Ontario's capital markets, CRR's registration process is essential to assessing the suitability of potential market participants and their interaction with investors in our markets. As part of our review of initial firm registration applications, we established a pre-registration review process that we refer to as "Registration as the First Compliance Review". We are happy to say that this process has been launched and is fully operational. Our objective is to provide guidance to new registrants, answer their questions and assist them in establishing an effective compliance system. The end goal is to help registrants be compliant and meet their regulatory obligations from the start of their operations. We are delighted with the positive feedback we have received regarding the pre-registration interviews completed to date.

We also recently launched the Topical Guide for registrants which organizes relevant information, including rules and guidance, to allow registrants to easily search for guidance. Similarly, work has been done to improve access to CRR's Director's decisions. These tools are located on the Registrant Outreach program web page.

CRR is committed to maintaining open communication with our registrants and to assist them with managing these challenges. We are encouraged by the positive feedback received from our registrant community regarding our efforts to maintain ongoing and open interaction. We look forward to maintaining this important productive relationship.

INTRODUCTION

Introduction

This annual summary report prepared by the CRR Branch (the annual report) provides information for registered firms and individuals (collectively, registrants) that are directly regulated by the Ontario Securities Commission (OSC). These registrants primarily include:

• exempt market dealers (EMDs),

• scholarship plan dealers (SPDs),

• advisers (portfolio managers or PMs), and

• investment fund managers (IFMs).

The OSC's CRR Branch registers and oversees firms and individuals in Ontario that trade or advise in securities or act as IFMs.

|

Individuals |

Firms |

|

|

|

|

|

||||

|

66,836 |

1,071{1} |

|

|

|

|

|

||||

|

|

PMs |

EMDs |

SPDs |

IFMs |

|

|

||||

|

|

311{2} |

262{3} |

2{4} |

496{5} |

{1} This number excludes firms registered solely in the category of investment dealer, mutual fund dealer, commodity trading manager, futures commission merchant, restricted PM, and restricted dealer.

{2} This number includes firms registered as sole PMs and PMs also registered as EMDs.

{3} This number includes firms solely registered as EMDs.

{4} This number includes firms solely registered as SPDs.

{5} This number includes sole IFMs and IFMs registered in multiple categories.

a) Registrants overseen by the OSC

Although the OSC registers firms and individuals in the category of mutual fund dealer and firms in the category of investment dealer, these firms and individuals are directly overseen by their self-regulatory organizations (SROs), the Mutual Fund Dealers Association of Canada (MFDA), and the Investment Industry Regulatory Organization of Canada (IIROC), respectively. This report focuses primarily on registered firms and individuals directly overseen by the OSC.

In this annual report, we summarize new and proposed rules and initiatives impacting registrants, current trends in deficiencies from compliance reviews of registrants (including acceptable practices to address them and unacceptable practices to prevent them), and current trends in registration. We provide an update on our Registrant Outreach program that helps strengthen our communication with registrants on compliance practices. We also provide a summary of some key registrant misconduct cases, explain where registrants can get more information about their regulatory obligations, and provide CRR Branch contact information.

This report is a key component of our outreach to registrants. We strongly encourage registrants to thoroughly read and use this report to enhance their understanding of:

• initial and ongoing registration and compliance requirements,

• our expectations of registrants and our interpretation of regulatory requirements, and

• new and proposed rules and other regulatory initiatives.

As a means of promoting pro-active compliance, we recommend registrants use this report as a self-assessment tool to strengthen their compliance with Ontario securities law, and as appropriate, to make changes to enhance their systems of compliance, internal controls and supervision.{6}

KEY POLICY INITIATIVES IMPACTING REGISTRANTS

|

1.1 |

Cost disclosure, performance reporting and client statements |

|

|

|

|

1.2 |

Expanded exempt market review |

|

|

|

|

1.3 |

Best interest standard |

|

|

|

|

1.4 |

EMD scope of activities |

|

|

|

|

1.5 |

Outbound advising and dealing |

|

|

|

|

1.6 |

Derivatives regulation |

|

|

|

|

1.7 |

Registrant custody practices |

|

|

|

|

1.8 |

Independent dispute resolution services for registrants |

|

|

|

|

1.9 |

Ongoing amendments to registration requirements, exemptions and ongoing registrant obligations |

1 Key policy initiatives impacting registrants

1.1 Cost disclosure, performance reporting and client statements

On July 15, 2013, the CRM2 amendments to National Instrument 31-103 Registration Requirements, Exemptions and Ogoing Registrant Obligations (NI 31-103) came into effect. They are being phased-in over a three-year period, ending in 2016. The amendments introduce new requirements for reporting to clients about the costs and performance of their investments, and the content of the investments in their accounts. The requirements apply to dealers and PMs in all categories of registration, with some application to IFMs as well. For more information about these amendments, see CSA Notice of Amendments to NI 31-103 and to Companion Policy 31-103CP Registration Requirements, Exemptions and Ongoing Registrant Obligations (Cost Disclosure, Performance Reporting and Client Statements).

IIROC and MFDA member rules have been harmonized with the Canadian Securities Administrators (CSA) CRM2 requirements and will be implemented on the same schedule. SRO members who comply with equivalent member rules have been exempted from the CRM2 requirements in NI 31-103.

In May, the OSC issued orders in parallel with other CSA members providing interim relief from the new requirements relating to enhanced account statements that came into effect as of July 15, 2015. The orders provide that these requirements may be met starting with statements delivered for the period ending December 31, 2015, instead of the period that includes July 15, 2015. The orders also addressed certain technical issues that had been identified relating to the delivery of information prescribed in the CRM2 requirements. The SROs have made housekeeping amendments to their member rules that have the same effect as the CSA orders. For more information about the orders, see CSA Staff Notice 31-341 -- Omnibus/Blanket Orders Exempting Registrants from Certain CRM2 Provisions of National Instrument 31-103 Registration Requirements, Exemptions and Ongoing Registrant Obligations.

The last phase of the implementation of CRM2 will begin with the 12-month period that includes July 15, 2016, when requirements for the delivery of annual reports on charges and on investment performance will come into effect. It is our expectation that most firms will plan to report on a calendar year basis, which will mean their first reports will cover the year beginning January 2016 and will be delivered to clients in January 2017.

For additional information, see

1.2 Expanded exempt market review

|

EXEMPT MARKET REVIEW{7} |

|||||

|

|

|||||

|

$45 BILLION |

90% |

27,000 |

|||

|

|

|||||

|

• |

ontario capital exemption distributions |

• |

capital raised through accredited investor exemption |

• |

purchases made by Ontario residents in exempt distributions |

{7} Source: February 19, 2015 Exempt Market Review Backgrounder

On March 20, 2014, we published for comment four new capital raising prospectus exemptions. The proposed exemptions include the offering memorandum prospectus exemption, a family, friends and business associates prospectus exemption, an existing security holder prospectus exemption, and a crowdfunding prospectus exemption (crowdfunding) along with a registration framework applicable to online crowdfunding portals. These exemptions are intended to facilitate capital raising by businesses at different stages of development, including start-ups and small and medium-sized enterprises (SMEs), while maintaining an appropriate level of investor protection.

Registrants that will be relying on these prospectus exemptions must comply with the terms of each prospectus exemption. If a registrant plans to distribute securities under any of the new prospectus exemptions, the registrant must establish, maintain and apply internal controls and procedures to monitor compliance with the new prospectus exemptions and to manage the risks associated with its business in accordance with prudent business practices.

In anticipation of the adoption of the new exemptions, the CRR Branch, along with other OSC branches, are developing compliance programs to oversee the use of the new exemptions. CRR is reviewing current compliance measures with respect to registrants involved in the exempt market to consider how existing compliance oversight may need to be adapted once the new exemptions are in force. This includes a review of resources and consideration of how the new exemptions will impact our risk-based approach to compliance reviews of registered firms.

The existing security holder prospectus exemption along with the corresponding changes to the companion policy came into force on February 11, 2015. The family, friends and business associates prospectus exemption along with the corresponding changes to the companion policy came into force on May 5, 2015.

On February 19, 2015, we also published amendments to National Instrument 45-106 Prospectus Exemptions (NI 45-106) relating to the accredited investor and minimum amount investment prospectus exemptions. Effective May 5, 2015, the following changes came into force:

• the minimum amount exemption is only available for distributions to non-individuals, and

• the accredited investor exemption (the AI exemption) is amended to:

• require individual accredited investors, other than those who qualify as permitted clients, to complete and sign a new risk acknowledgment form that describes, in plain language, the categories of individual accredited investor and identifies the key risks associated with purchasing securities in the exempt market,

• include family trusts established by an accredited investor for his or her family in the definition of accredited investor, and

• in Ontario, allow fully managed accounts to purchase investment fund securities under the managed account category of the AI exemption, harmonizing with the rest of the CSA.

There are two other initiatives intended to facilitate capital raising by businesses from a broad investor base, the offering memorandum prospectus exemption (OM exemption) and crowdfunding regime. In March 2014, the OSC published for comment an OM exemption, which would allow businesses to raise capital based on a comprehensive disclosure document being made available to investors. The exemption would be available for a wide range of businesses at different stages of development and would provide businesses with access to a broad investor base. At the same time, the OSC published for comment a crowdfunding regime that would enable early stage businesses to raise capital from a large number of investors through a registered online funding portal. The proposed regime included both a crowdfunding prospectus exemption and a registration framework applicable to online crowdfunding portals. The comment period ended in June 2014 and the participating CSA jurisdictions have been working closely in formulating the OM exemption and the crowdfunding regime. The OSC intends to publish the OM exemption and crowdfunding regime in final form and deliver them to the Minister of Finance for decision in the fall of 2015. After taking into account the feedback from stakeholders, our intention is that the final form of these capital raising tools in Ontario will include the following key elements:

OM exemption

• comprehensive disclosure document at point of sale,

• no limit on the amount of capital an issuer can raise,

• investment limits for investors, other than those who would qualify as accredited investors or investors who would qualify to invest under the family, friends and business associates exemption, substantially along the following:

• in the case of a purchaser that is not an eligible investor, $10,000 in a 12-month period,

• in the case of a purchase that is an eligible investor, $30,000 in a 12-month period, and

• in the case of a purchaser that is an eligible investor and that receives advice from a portfolio manager, investment dealer or EMD that an investment above $30,000 is suitable, up to $100,000 in a 12-month period,

• risk acknowledgement form signed by investors, and

• ongoing disclosure made available to investors, including audited annual financial statements, annual notice regarding the use of the money raised and notice of a limited list of significant events.

Crowdfunding regime

• streamlined offering document at point of sale,

• limit of $1.5 million on amount an issuer group can raise in a 12-month period,

• all investments be made through a funding portal that is registered with securities regulators,

• low investment limits for investors who do not qualify as accredited investors, ($2,500 in a single investment and $10,000 under the exemption in a calendar year) with higher investment limits for accredited investors and no investment limits for permitted clients,

• risk acknowledgement form signed by investors, and

• ongoing disclosure made available to investors, including annual financial statements, annual notice regarding the use of the money raised and notice of a limited list of significant events.

In order to support the OSC's goal this year of championing investor protection issues by advancing regulatory reforms that put the interests of investors first, we are analyzing various approaches for creating a statutory best interest standard with a view to developing one or more proposals for consideration.

In addition to our work on a statutory best interest standard, we are also:

• finalizing our analysis of adviser compensation practices with a view to publishing our review findings, including expectations for compliance and best practices, and

• developing and evaluating other targeted regulatory reforms and/or guidance under NI 31-103 to improve the adviser/client relationship.

The work streams discussed above aim to improve the alignment of the expectations of investors and the actions of their advisers and to assist investors to more effectively meet the challenging environment they face. This is a regulatory area that requires careful consideration to determine the right solution for Ontario's investors and capital markets while at the same time avoiding unintended consequences.

In the recent amendments to NI 31-103, the CSA closely considered the activities that EMDs should and should not conduct.

Subsection 7.1(5) of NI 31-103 came into effect on July 11, 2015 and prohibits EMDs from conducting brokerage activities (trading securities listed on an exchange in foreign or Canadian markets). As a general matter, the CSA believes that the appropriate registration category for participating in prospectus offerings is the investment dealer category. IIROC has rules and an oversight infrastructure to supervise these brokerage activities and, as such, only investment dealers who are IIROC members can conduct these activities.

We continue to work with the U.S. broker dealers affected by this prohibition to ensure compliance with this provision.

1.5 Outbound advising and dealing

On June 5, 2015, OSC Rule 32-505 Conditional Exemption from Registration for United States Broker-Dealers and Advisers Servicing U.S. Clients from Ontario (OSC Rule 32-505) came into force. Its Companion Policy became effective on the same date.

OSC Rule 32-505 provides exemptions from the relevant dealer and adviser registration requirements under the Securities Act (Ontario) (the Act), subject to certain conditions, for broker-dealers (U.S. broker-dealers) and advisers (U.S. advisers) that are trading to, with, or on behalf of, clients that are resident in the USA (U.S. clients), or acting as advisers to U.S. clients, but that trigger the requirement to register as a dealer or adviser in Ontario because they have offices or employees in Ontario. The exemptions in OSC Rule 32-505 are not available to U.S. broker-dealers that trade to, with, or on behalf of, persons or companies that are resident in Ontario (Ontario residents), or U.S. advisers that act as advisers to Ontario residents.

OSC Rule 32-505 was made on the basis that, over the last decade, the OSC (and other Canadian regulators) had, subject to certain conditions that are similar to those in OSC Rule 32-505, exempted U.S. broker-dealers and U.S. advisers with offices in Ontario from the requirement to register. On March 26, 2015, members of the CSA, except Ontario, issued parallel orders of general application (the Blanket Orders) granting exemptions from the requirement to register as a dealer or an adviser on conditions that are substantially similar to those in the Rule. As orders of general application are not authorized under Ontario securities law, the OSC made OSC Rule 32-505 in order to coordinate with the action taken by the CSA.

For more information see OSC Rule 32-505, its Companion Policy and the related notice.

In April 2013, the CSA Derivatives Committee published for comment CSA Consultation Paper 91-407 -- Derivatives: Registration. Comments have been received and are being reviewed. We continue to work with our colleagues in the OSC Derivatives Branch and the CSA Derivatives Committee to develop a rule that will set out the principal registration requirements and exemptions for derivatives market participants, including derivatives dealers, derivatives advisers, and large derivatives market participants.

On October 31, 2014, the reporting obligation for reporting counterparties pursuant to Part 3 of OSC Rule 91-507 -- Trade Repositories and Derivatives Data Reporting (the TR Rule) came into effect. The purpose of the TR Rule is to improve transparency in the derivatives market. Derivatives data is essential for effective regulatory oversight of the derivatives market, including the ability to identify and address systemic risk and the risk of market abuse. OSC Staff Notice 91-704 -- Compliance Review Plan for OSC Rule 91-507 Trade Repositories and Derivatives Data Reporting (OSC Staff Notice 91-704) was published on June 29, 2015 which provides guidance on how we intend to review compliance with the reporting requirements set out in the TR Rule. We expect to commence on-site TR Rule compliance reviews in the fiscal year 2015-2016. Initial reviews are expected to focus on derivatives dealers that are most active in the market.

1.7 Registrant custody practices

We continue our work with the CSA in reviewing the existing custody requirements in NI 31-103 for non-SRO registrants to assess whether these requirements still adequately protect client assets. As discussed in OSC Staff Notice 33-742 -- 2013 OSC Annual Summary Report for Dealers, Advisers and Investment Fund Managers (OSC Staff Notice 33-742), the existing custody requirements for EMDs, PMs and IFMs in sections 14.6 to 14.9 of NI 31-103 focus primarily on maintaining clients' assets separate and apart from the registrants' assets and do not have specific requirements regarding who can act as a custodian for clients' securities. We have found that most of the non-SRO registrants do not hold clients' assets. However, we are aware of a small number of firms that have custody of their clients' assets, and currently there is no requirement for these firms to hold those assets in each client's name. As a result of the review of custody requirements for non-SRO registrants, the CSA may propose further guidance or enhancements to existing requirements to strengthen investor protection. We will also continue to review custody practices of registered firms as part of our compliance field reviews.

1.8 Independent dispute resolution services for registrants

As we mentioned in last year's report, all registered dealers and advisers operating outside of Quebec are required to join the Ombudsman for Banking Services and Investments (OBSI) as the common service provider for dispute resolution services after August 1, 2014, unless an exemption is available. This requirement is set out in amendments to section 13.16 of NI 31-103, see CSA Notice of Amendments to NI 31-103 and to 31-103CP (Dispute Resolution Services). As well, all dealers and PMs must establish complaint handling policies to ensure that all client complaints are addressed appropriately as required in section 13.15 of NI 31-103.

As part of our follow up procedures on confirming OBSI membership, we sent out two surveys in October 2014 and February 2015 to our registrants.

Publication of OBSI Joint Regulators Committee (JRC) Annual Report

On March 19, 2015, the CSA (other than Quebec), IIROC and the MFDA jointly published the first annual report of the OBSI JRC, see CSA Staff Notice 31-340 OBSI Joint Regulators Committee Annual Report for 2014. The report provides an overview of the JRC and also highlights the major activities conducted by the JRC in 2014. The JRC comprises of representatives from the participating CSA jurisdictions and the SROs.

The mandate of the JRC is to:

• facilitate a holistic approach to information sharing and monitor the dispute resolution process with an overall view to promoting investor protection and confidence in the external dispute resolution system,

• support fairness, accessibility and effectiveness of the dispute resolution process, and

• facilitate regular communication and consultation among JRC members and OBSI.

The JRC meets regularly with OBSI to discuss governance and operational matters and other significant issues that could influence the effectiveness of the dispute resolution system. For more information on the terms of reference for the JRC, see Memorandum of Understanding concerning oversight of the Ombudsman for Banking Services and Investments (OBSI) among the participating members of the Canadian Securities Administrators and OBSI.

1.9 Ongoing amendments to registration requirements, exemptions and ongoing registrant obligations

We have continued to monitor NI 31-103 since its implementation in September 2009, and the amendments which came into force in July 2011. Further amendments to NI 31-103 became effective on January 11, 2015. For additional information, refer to amendments to NI 31-103.

OUTREACH TO REGISTRANTS

|

2.1 |

Registrant Outreach program |

|

|

|

||

|

|

a) |

Registrant Outreach web page |

|

|

||

|

|

b) |

Educational seminars |

|

|

||

|

|

c) |

Registrant Outreach Community |

|

|

||

|

|

d) |

Registrant resources |

|

|

||

|

2.2 |

Registrant Advisory Committee |

|

|

|

||

|

2.3 |

Communication tools for registrants |

|

|

|

||

|

2.4 |

Topical Guide for registrants |

|

2 Outreach to registrants

We continue to interact with our stakeholders through our Registrant Outreach program which was launched in 2013. The objectives of our Registrant Outreach program are to strengthen our communication with Ontario registrants that we directly regulate and other industry participants (such as lawyers and compliance consultants), promote stronger compliance practices and enhance investor protection.

2.1 Registrant Outreach program

|

REGISTRANT OUTREACH STATISTICS (since inception) |

|||||

|

|

|||||

|

26 |

4100 |

Key features |

|||

|

|

|||||

|

• |

in-person & webinar seminars provided to June 30, 2015 |

• |

individuals that attended outreach sessions to June 30, 2015 |

• |

dedicated web page |

|

|

|||||

|

|

|

|

|

• |

educational seminars |

|

|

|||||

|

|

|

|

|

• |

registrant outreach community |

|

|

|||||

|

|

|

|

|

• |

registrant resources |

The Registrant Outreach program continues to provide Ontario registrants with practical knowledge on compliance-related matters and gives them the opportunity to hear first-hand from us about the latest issues impacting our registrants. Since the launch of the program in July 2013, approximately 4,100 individuals have attended registrant outreach sessions, either in-person or via a webinar. The feedback from these participants has been very positive.

The Registrant Outreach program is interactive and has the following features to enhance the dialogue with registrants:

a) Registrant Outreach web page

We set up a Registrant Outreach web page on the OSC's website at www.osc.gov.on.ca, which was designed to enhance awareness of topical compliance issues and policy initiatives. Registrants are encouraged to check the web page on a regular basis for updates on regulatory issues impacting them.

b) Educational seminars

Anyone interested in attending an event can go to the Calendar of Events section of the Registrant Outreach page of the OSC website, for seminar descriptions and registration.

c) Registrant Outreach Community

Registrants are also encouraged to join our Registrant Outreach Community to receive regular e-mail updates on OSC policies and initiatives impacting registrants, as well as the latest publications and guidance on our expectations regarding compliance issues and topics.

d) Registrant resources

The registrant resources section of the web page provides registrants and other industry participants with easy, centralized access to recent compliance materials. If you have questions related directly to the Registrant Outreach program or have suggestions for seminar topics, please send an e-mail to [email protected].

2.2 Registrant Advisory Committee

The OSC's Registration Advisory Committee (RAC) was established in January 2013. The RAC, which is currently comprised of 12 external members, advises us on issues and challenges faced by registrants in interpreting and complying with Ontario securities law, including registration and compliance related matters. The RAC also acts as a source of feedback on the development and implementation of policy and rule making initiatives that promote investor protection and fair and efficient capital markets. The RAC meets quarterly and members serve a minimum two year term. The initial two year term for the first RAC members expired in December 2014 and a call for new members was made in the fall of 2014. The new RAC members were officially appointed in January of 2015. You can find a list of current RAC members on the OSC website.

Topics of discussion with the new RAC members have included:

• outside business activities,

• next steps relating to CRM2,

• the OSC's proposed whistleblower program introduced by OSC Staff Consultation Paper 15-401: Proposed Framework for an OSC Whistleblower Program, and

• information relating to OSC Staff Notice 21-708 -- OSC Staff Report on the Canadian Fixed Income Market and Next Steps to Enhance Regulation and Transparency of Fixed Income Markets.

2.3 Communication tools for registrants

We use a number of tools to communicate initiatives that we work on and the findings of those initiatives to our registrants, including CRR annual reports, Staff Notices (OSC and CSA) and e-mail blasts. The information provided to registrants via e-mail blasts is discussed in various sections of this report. The table below provides a listing of recent e-mail blasts sent to registrants.

|

Date of e-mail blast |

E-mail blast topic and additional information |

|

|

|

|

July 27, 2015 |

Monthly Suppression of Terrorism and UN Sanctions Report |

|

|

|

|

July 16, 2015 |

OSC Staff Notice 11-329 -- Withdrawal of Notices and Revocation of Omnibus/Blanket Orders |

|

|

See section 4.1 b) of this report for additional information. |

|

|

|

|

January 14, 2015 |

OSC Staff Notice 13-705 -- Reduced Late Fee for Certain Outside Business Activities Filings |

|

|

See section 4.1 b) of this report for additional information. |

|

|

|

|

October 30, 2014 |

OSC Capital Markets Participation Fees Calculation |

|

|

|

|

July 17, 2014 |

Requirement to make OBSI available to clients |

|

|

See section 1.8 of this report for additional information. |

For more information, see OSC E-mail blasts.

2.4 Topical Guide for registrants

In October 2014, we published a Topical Guide for registrants that is designed to assist registrants and other stakeholders to locate topical guidance regarding compliance and registrant regulation matters.

REGISTRATION OF FIRMS AND INDIVIDUALS

|

3.1 |

Update on registration initiatives |

|

|

|

||

|

|

a) |

Update on pre-registration reviews |

|

|

||

|

|

b) |

Registration service commitment |

|

|

||

|

|

c) |

Voluntary surrenders of registration |

|

|

||

|

|

d) |

Peer-to-peer lending |

|

|

||

|

3.2 |

Current trends in deficiencies and acceptable practices |

|

|

|

||

|

|

a) |

Common deficiencies in firm registration filings |

|

|

||

|

|

b) |

Common deficiencies in individual registration filings |

3 Registration of firms and individuals

The registration requirements under securities law help to protect investors from unfair, improper or fraudulent practices by market participants. The information required to support a registration application allows us to assess a firm's and an individual's fitness for registration. When assessing a firm's fitness for registration we consider whether it is able to carry out its obligations under securities law. We use three fundamental criteria to assess an individual's fitness: proficiency, integrity and solvency. These fitness requirements are the cornerstones of the registration regime.

In this section, we provide an update on current registration initiatives, discuss common deficiencies noted in firm and individual registration filings, highlight the voluntary surrender process, and highlight the potential need for registration related to peer-to-peer lending arrangements.

3.1 Update on registration initiatives

a) Update on pre-registration reviews

As part of our review of initial firm registration applications and applications where firms are adding categories of registration, we perform pre-registration interviews of key personnel of the firms. This process, which we refer to as "Registration as the First Compliance Review" was described in section 3.1 a) of OSC Staff Notice 33-745 -- 2014 Annual Summary Report for Dealers, Advisers and Investment Fund Managers (OSC Staff Notice 33-745).

As of March 31, 2015, we completed twenty-one pre-registration interviews. In most cases, these have been face-to-face interviews with the proposed Ultimate Designated Person (UDP) and the Chief Compliance Officer (CCO) as well as other key personnel (such as the primary dealing or advising representative or the Chief Financial Officer of the applicant firm).

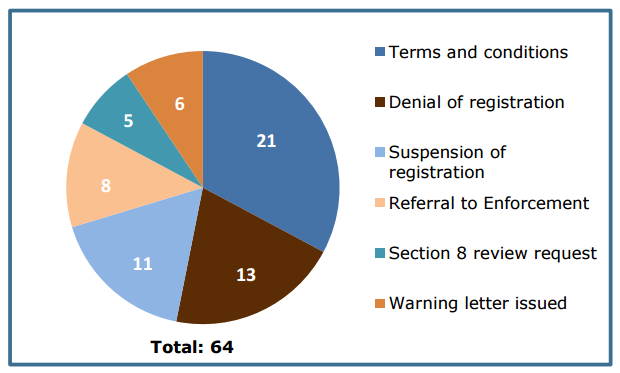

These interviews have helped us to obtain a good understanding of the proposed business activities, compliance system, and proficiency of key individuals of the firms involved. These interviews have also enabled the firms to take action to address potential deficiencies before commencing operations. As part of the pre-registration reviews, we highlight key registration resources such as the Registrant Outreach program, the annual summary report, the Topical Guide for registrants and the guidance provided in CSA Staff Notice 31-336 -- Guidance for Portfolio Managers, Exempt Market Dealers and Other Registrants on the Know-Your-Client, Know-Your-Product and Suitability Obligations (CSA Staff Notice 31-336). There have been some registration applications where we have recommended denial of registration or taken other regulatory action including registering the firm subject to terms and conditions and referral of the firm to the OSC's Enforcement Branch.

In addition to the guidance provided in OSC Staff Notice 33-745, based on our experience to date we suggest the additional practices set out below.

Acceptable practices to prepare for an OSC pre-registration review:

• We expect the proposed CCO to demonstrate a good understanding of the regulatory requirements applicable to the firm and individuals acting on its behalf and of the firm's policies and procedures.

• We expect the firm's business plan to be sufficiently developed so that key personnel can describe with some specificity the business in which the firm intends to engage.

• We expect the description of the business to be consistent with the business plan provided.

Unacceptable practices

Firms and key individuals are discouraged from the following practices:

• Expecting their advisors to respond to questions that should be within the expertise of the key personnel. This may lead to concerns that key firm individuals are not fully proficient.

• Indicate that they will only become familiar with regulatory requirements applicable to the firm and its individuals and will only familiarize themselves with the firm's policies and procedures after registration.

b) Registration service commitment

We continue to follow the OSC service commitment published in May 2014 that sets out a framework for standards, conditions and timelines pertaining to registrants and registration-related filings for which the OSC is the principal regulator. Details of the framework can also be found in section 3.1 c) of OSC Staff Notice 33-745. In relation to registration filings, we also continue to consider a file to be dormant and will take steps to close it if we do not receive a response within three weeks of making a request for additional information. Prior to closing the file, we will send another notification informing the filer of the imminent closure unless a response is received within two weeks of the date of the notification. In cases where a re-activation of the file is requested, an additional fee may be required.

c) Voluntary surrenders of registration

We expect a registrant firm to file an application to surrender its registration when it ceases (or intends to cease) conducting registerable activities. When considering a firm's application, we seek to ensure that satisfactory evidence exists that all financial obligations to clients have been discharged and that surrender of the registration is not prejudicial to the public interest. The evidence that we will require a firm to file will depend on the circumstances. However, in most cases we will require the following:

• an officer's certificate,

• a firm's unaudited financial statements, as at a date after the firm ceased registerable activity, and

• an auditor's comfort letter or specified procedures report.

We encourage surrendering firms to contact us at the time of their applications so that we can tailor information requirements to their businesses.

We will not recommend that the Director approve an application to surrender registration if the information that we require is not provided to us. Further, where a firm refuses to provide the required information, this non-compliance may be considered when assessing future registration applications.

d) Peer-to-peer lending

We have identified a number of "peer-to-peer" lending websites (P2P Websites) that are conducting business in Ontario. P2P Websites generally facilitate the matching of borrowers and lenders. The loan agreements entered into on P2P Websites may constitute a "security" as defined in the Act. If you are approaching Ontario investors to fund peer-to-peer loans or loan portfolios, you must consider whether registration and/or prospectus requirements apply. Additional information on our expectations is available in a news release issued on June 19, 2015.

3.2 Current trends in deficiencies and acceptable practices

a) Common deficiencies in firm registration filings

(i) New firm registration filings -- Form 33-109F6 Firm Registration (Form_33-109f6)

We have received a number of new applications for firm registration that are often submitted without key documents or information necessary for us to assess whether there are issues that impact the suitability of the firm for registration. For example, some firms are submitting applications for the firm's registered and permitted individuals weeks or months after the filing of Form 33-109F6, which can delay a firm's registration if the individuals have any proficiency or suitability issues. We pre-screen new firm applications to ensure that they are substantially complete before assigning these applications for a full review.

Acceptable practices to apply for initial registration in Ontario

Applicants must:

• Include all required attachments to the Form 33-109F6 at the time of the application for registration.

• Be prepared to file registration applications on a timely basis for all of the firm's individuals seeking registration or approval as a permitted individual.

• Provide a business plan covering the firms anticipated plans for the next upcoming three years.

• Provide the index of the firm's policy and procedures manual (and be prepared to provide the entire document upon request).

• If requested, be prepared to provide:

• know your client (KYC) forms (for individuals and permitted clients), and

• relationship disclosure information.

Unacceptable practices

Applicants must not:

• Filie a completed Form 33-109F6 with incomplete documentation and request the application to be assigned for review.

(ii) Change to firm registration filings -- Form 33-109F5 Change of Registration Information (Form 33-109F5)

All registered firms with a head office in Ontario, including IIROC and MFDA members, must notify the OSC of changes to their firm registration information by submitting a completed Form 33-109F5 to update any changes to information previously reported on Form 33-109F6, including changes to a firm's business model.

The required changes and deadlines are outlined in Part 3 of National Instrument 33-109 Registration Information (NI 33-109). Form 33-109F5 must be filed through the OSC's electronic filing portal. Late filings of Form 33-109F5 are subject to the late fees outlined in Appendix D of OSC Rule 13-502 Fees (OSC Rule 13-502 or the Fee Rule).

Acceptable practices to report changes to firm information

Registrants must:

• Ensure that all changes to Form 33-109F6 are filed by submitting a completed Form 33-109F5 within the time frames set out in Part 3 of NI 33-109.

• Ensure that Form 33-109F5 is filed for updates to both firm information (Form 33-109F5) and individual information (Form 33-109F4) with respect to changes (For example: registration of a new CCO or addition of a new shareholder).

Unacceptable practices

Registrants must not:

• Rely on information provided in notices to the OSC under sections 11.9 or 11.10 of NI 31-103 as a substitute for reporting changes on Form 33-109F5 (For example: transactions that result in a change to a firm's business model, business or ownership structure).

• Rely on filings made to IIROC or the MFDA as a substitute for reporting changes on Form 33-109F5.

b) Common deficiencies in individual registration filings

(i) Suitability issues that require additional review

Three criteria are considered when assessing an individual's suitability for registration: integrity, proficiency and solvency. When we identify integrity or proficiency concerns in a registration filing, a further review and analysis must be completed before a recommendation for a registration decision can be made.

We remind registrants that integrity concerns may arise from activities conducted both inside and outside of the securities industry. Violating statutes, regulations, rules or standards of conduct for example in the banking, insurance or mortgage fields may impact a registration decision. Possible non-securities violations that would impact a registration decision include:

• the falsification of credit card applications,

• misconduct, such as churning or rebating, related to the sale of insurance, and

• promoting mortgage investments to an ineligible client.

Concerns identified with respect to an individual's suitability for registration may result in a recommendation to the Director that the individual be subject to terms and conditions on his or her registration or, in situations involving more serious misconduct, a recommendation that the individual's registration be denied.

Acceptable practices to identify suitability issues with individuals

Registrants are expected to:

• Perform a background check on the individual applicant during the hiring process and prior to submitting a Form 33-109F4, in order to identify any potential issues, such as securities and non-securities related violations.

Unacceptable practices

Registrant firms must not:

• Expect that violations of the law by an individual outside of the securities industry will be excluded as relevant information to the assessment of the individual applicant's suitability for registration.

(ii) Improper use of reinstatement notices -- Form 33-109F7 Reinstatement of Registered Individuals and Permitted Individuals (Form 33-109F7)

When an individual leaves a sponsoring firm and joins a new registrant firm, they may submit a form 33-109F7 to have their registration or permitted individual status automatically reinstated in one or more of the same categories and jurisdictions as before, subject to all of the conditions set out in subsection 2.3(2) or 2.5(2) of NI 33-109. Only individuals who meet these conditions are permitted to file Form 33-109F7.

Acceptable practices when reinstating an individual's registration status

Registrants must:

• Review the individual's Form 33-109F1 -- Notice of Termination of Registered Individuals and Permitted Individuals (Form 33-109F1) carefully and conduct additional due diligence to determine if a reinstatement is appropriate.

Unacceptable practices

Registrants must not:

• File Form 33-109F7 for an individual before the individual is eligible to start performing registrable activities with the new registrant firm (i.e. if the individual is still registered with another registrant).

• Submit a reinstatement notice if, for instance, an individual's Form 33-109F1 describes alleged or acknowledged misconduct in the previous twelve month period. Examples of misconduct include breaches of securities laws, SRO rules, or an employer's code of conduct.

(iii) Reactivation of registrant application -- Form 33-109F4 Registration of Individuals and Review of Permitted Individuals (Form 33-109F4)

An individual that is applying to reactivate his or her registration with a new sponsoring firm must file Form 33-109F4 (if the individual does not meet the conditions for reinstatement using Form 33-109F7).

We have found that some individuals have not been disclosing all of the details surrounding the individual's resignation, termination or dismissal for cause by the individual's previous employer(s).

Acceptable practices when applying for individual registration reactivation

Registrants must:

• Provide accurate and complete details under item 12 -- Resignations and Terminations in Form 33-109F4 for an individual applying for registration with a new sponsoring firm.

• If applicable, list and explain in item 12 of Form 33-109F4 the specific issues noted in the notice of termination (Form 33-109F1) filed by the individual's former sponsoring firm. For example, include details with regards to any resignations, terminations or dismissals for cause by an employer following allegations of:

• violations from any statutes, regulations, rules or standards of conduct,

• failure to appropriately supervise compliance with any statutes, regulations, rules or standards of conducts, or

• committing fraud or the wrongful taking of property, including theft.

(iv) Non-disclosure or late disclosure in Form 33-109F4

A registered individual or permitted individual must notify the OSC of a change to any information previously submitted in respect of the individual's Form 33-109F4.

The required changes and deadlines are outlined in Part 4 of NI 33-109. Updates to Form 33-109F4 are made by completing Form 33-109F5 through the National Registration Database (NRD). Late filings of Form 33-109F5 (to amend Form 33-109F4) are subject to the late fees outlined in Appendix D of OSC Rule 13-502.

We have found that individuals often do not make accurate and timely disclosures of changes to information on Form 33-109F4, particularly with respect to the criminal, civil or financial items. These deficiencies often raise suitability issues, which may lead to a recommendation that regulatory action be imposed, such as supervisory terms and conditions, or denial or suspension of registration.

Acceptable practices to submit changes to an individual's registration information

Registrants must:

• File an update to Form 33-109F4 for each new event occurrence (e.g. next court date involving a criminal or civil case or a copy of the Statement of Defense involving a criminal or civil case).

• Consider whether updates to information are required in multiple sections of Form 33-109F4. Examples include the following disclosures:

• individuals who obtain an insurance license (required to be disclosed in item 13.3(a) of Form 33-109F4) must also disclose if they start working for or open their own insurance business under Item 10 of Form 33-109F4, and

• a UDP who holds securities of the registered firm through a personal holding company (required to be disclosed in item 17 of Form 33-109F4) must also disclose that holding company under Item 10 of Form 33-109F4.

Unacceptable practices

Registrants should not:

• Wait and combine multiple changes into one NRD submission. Registrants must notify the regulator of each change by the deadlines outlined in Part 4 of NI 33-109. A separate late fee applies to each change reported on the basis that a separate form was required to be filed in respect of each change.

INFORMATION FOR DEALERS, ADVISERS AND INVESTMENT FUND MANAGERS

|

4.1 |

All registrants |

|

|

|

a) |

Compliance review process |

|

|

b) |

Current trends in deficiencies and acceptable practices |

|

|

c) |

Update on initiatives impacting all registrants |

|

|

||

|

4.2 |

Dealers(EMDs and SPDs) |

|

|

|

a) |

Current trends in deficiencies and acceptable practices |

|

|

b) |

Update on initiatives impacting EMDs |

|

|

||

|

4.3 |

Advisers (PMs) |

|

|

|

a) |

Current trends in deficiencies and acceptable practices |

|

|

b) |

Update on initiatives impacting PMs |

|

|

||

|

4.4 |

Investment fund managers |

|

|

|

a) |

Current trends in deficiencies and acceptable practices |

|

|

b) |

Update on initiatives impacting IFMs |

4 Information for dealers, advisers and investment fund managers

The information in this section includes the key findings and outcomes from our ongoing compliance reviews of the registrants we directly regulate. We highlight current trends in deficiencies from our reviews and provide acceptable practices to address the deficiencies. We also discuss new or proposed rules and initiatives impacting registrants.

This part of the report is divided into four main sections. The first section contains general information that is relevant for all registrants. The other sections contain information specific to dealers (EMDs and SPDs), advisers (PMs) and IFMs, respectively. This report is organized to allow a registrant to focus on reading the section for all registrants and the sections that apply to their registration categories. However, we recommend that registrants review all sections in this part, as some of the information presented for one type of registrant may be relevant to other types of registrants.

This section discusses our compliance review process, current trends in deficiencies resulting from compliance reviews applicable to all registrants (and acceptable practices to address them) and an update on initiatives impacting all registrants.

a) Compliance review process

We conduct compliance reviews of registered firms on a continuous basis. The purpose of compliance reviews is primarily to assess compliance with Ontario securities law; but they also help registrants to improve their understanding of regulatory requirements and our expectations, and help us focus on a specific industry topic or practice we may have concerns with. We conduct compliance reviews on-site at a registrant's premises, but we also perform desk reviews from our offices. For information on "What to expect from, and how to prepare for an OSC compliance review" see the slides from the Registrant Outreach session provided on October 22, 2013 on "Start to finish: Getting through an OSC compliance review".

(i) Risk-based approach

Firms are generally selected for review using a risk-based approach. This approach is intended to identify:

• firms that are most likely to have material compliance issues or practices requiring review (including risk of harm to investors) and therefore considered to be higher risk, and

• firms that could have a significant impact to the capital markets if there are compliance breaches.

To determine which firms should be reviewed, we consider a number of factors, including firms' responses to the most recent risk assessment questionnaire, their compliance history, complaints or tips from external parties, and intelligence information from another OSC branch, an SRO or another regulator.

(ii) Risk Assessment Questionnaire

In June 2014, firms registered with the OSC in the categories of PM, restricted PM, IFM, EMD and/or restricted dealer were asked to complete a comprehensive risk assessment questionnaire (the 2014 RAQ) consisting of questions covering various business operations related to the different registration categories. The RAQ supports our risk based approach to select firms for on-site compliance reviews or targeted reviews.

The data collected from the 2014 RAQ was analyzed using a risk assessment model. Every registrant response was risk ranked and a risk score was generated. Those firms that were risk ranked as high were recommended for a compliance review. A more detailed discussion of these reviews is included in section 4.1 b), 4.2 a), 4.3 a) and 4.4 a) of this report.

(iii) Sweep reviews

In addition to reviewing firms based on risk ranking, we also conduct sweeps which are compliance reviews on a specific topic. Sweeps allow us to respond on a timely basis to industry-wide concerns or issues. We regularly perform sweeps of newly registered firms to assess if they are off to a "good start" and to help them to understand their requirements and our expectations. We also review large or "impact" firms as discussed in (i) above.

We focused the majority of our resources this year on compliance reviews of firms categorized as high risk based on our analysis of the results to the 2014 RAQ. Additional details on the results of these compliance reviews can be found in sections 4.1 b), 4.2 a), 4.3 a) and 4.4 a) of this report.

(iv) Outcomes of compliance reviews

In most cases, the deficiencies found in a compliance review are set out in a written report to the firm so that they can take appropriate corrective action. After a firm addresses its deficiencies, the expected outcome is that they have enhanced their compliance. If a firm had many significant deficiencies, once it addresses these, the expected outcome is that they have significantly enhanced their compliance.

In addition to issuing compliance deficiency reports, we take additional regulatory action when we identify more serious registrant misconduct.

The outcomes of our compliance reviews in fiscal 2015, with comparables for 2014, are presented in the following table and are listed in their increasing order of seriousness. Firms are shown under the most serious outcome for a particular review. The percentages in the table are based on the registered firms we reviewed during the year and not the population of all registered firms.

|

Outcomes of compliance reviews |

Fiscal 2015 |

Fiscal 2014 |

|

(all registration categories) |

|

|

|

|

||

|

Enhanced compliance |

40% |

53% |

|

|

||

|

Significantly enhanced compliance |

47% |

28% |

|

|

||

|

Terms and conditions on registration{8} |

9% |

10% |

|

|

||

|

Surrender of registration |

0% |

3% |

|

|

||

|

Referral to the Enforcement Branch{9} |

3% |

5% |

|

|

||

|

Suspension of registration{10} |

1% |

9% |

{8} This percentage includes some registrants reviewed in the prior period.

{9} This percentage includes some registrants reviewed in the prior period.

{10} This perentage includes some registrants reviewed in the prior period.

For an explanation of each outcome, see Appendix A in OSC Staff Notice 33-738 -- 2012 OSC Annual Summary Report for Dealers, Advisers and Investment Fund Managers (OSC Staff Notice 33-738).

b) Current trends in deficiencies and acceptable practices

In this section, we summarize key trends in deficiencies from recent compliance reviews of EMDs, PMs, and IFMs categorized as higher risk based on the response to the 2014 RAQ. These deficiencies were noted as common deficiencies across all three registration categories.

For each deficiency, we summarize the applicable requirements under Ontario securities law which must be followed. In addition, where applicable, we provide acceptable and unacceptable practices relating to the deficiency discussed. The acceptable and unacceptable practices throughout this report are intended to give guidance to help registrants address the deficiencies, and provide our expectations of registrants. While the best practices set out in this report are intended to present acceptable methods registrants can use to prevent or rectify a deficiency, they are not the only acceptable methods. Registrants may use alternative methods, provided those methods adequately demonstrate that registrants have met their responsibility under the spirit and letter of securities law.

We strongly recommend registrants review the deficiencies and acceptable practices in this report that apply to their registration categories and operations to assess and, as needed, implement enhancements to their compliance systems and internal controls.

(i) Inadequate referral arrangements

We continue to be concerned about the practice of some registrants delegating their KYC and suitability obligations to referral agents such as financial planners and mutual fund dealing representatives. We have detailed our concerns with these types of arrangements in previous annual reports (see section 5.2A of OSC Staff Notice 33-736 -- 2011 Annual Summary Report for Dealers, Advisers and Investment Fund Managers (OSC Staff Notice 33-736), section 4.3.1 of OSC Staff Notice 33-742 and section 4.3 a) of OSC Staff Notice 33-745. Despite this, some registrants continued to delegate their KYC and suitability obligations to referral agents. As a result, we focused on the number of referral arrangements and the amount of fees paid to the referring agents, when analyzing the 2014 RAQ responses in order to select the sample of registrants included in the high risk compliance reviews.

We noted the following issues in relation to these types of referral arrangements where deficiencies were identified:

• registrants had a high number of referral arrangements in place with referral agents,

• registrants established a business model that is primarily reliant on third parties, most of whom are not registered under the Act, to refer clients to the registrant,

• the majority of registrant clients were obtained through these referral arrangements,

• registrants were relying on the referral agents to communicate directly with the referred clients for the purpose of completing the KYC process, executing the suitability analysis, and obtaining regular updates to KYC information and therefore improperly delegating their KYC and suitability obligations under NI 31-103,

• clients confirmed that their ongoing relationship was with the referral agent and not the registrant, even after the client money had been invested by the registrant, including calling the referral agent if they had questions about the client statements received from the registrant,

• the referral agreement did not adequately:

• identify the roles and responsibilities of each of the registrant and the referral agent,

• provide that the registrant may terminate the referral agreement if the referral agent engaged in activities that require registration in relation to the registrant's clients,

• identify a non-exhaustive list of activities that the referral agent could engage in,

• did not identify how the registrant would monitor and enforce the referral agent's compliance with the terms of the referral agreement,

• the referral agents name and contact information appeared on the client statement instead of the registrant's contact information,

• registrants did not have enough registered individuals to be able to adequately service the number of referred clients, thus relying on the referral agent to execute registerable activities on their behalf,

• registrants had not created adequate investment management agreements with the referred clients, and

• in some instances, the referral agent received the majority of the management fee as a referral fee charged by the registrant to the referred client based on the client's assets under management.

In the instances where these issues were identified, we responded by taking further regulatory action, including the imposition of terms and conditions on registration. We also are considering additional regulatory action, including recommending a suspension of registration.

Registrants must comply with the referral arrangement requirements in sections 13.8 to 13.10 of NI 31-103 (also, see the guidance in Part 13 of 31-103CP). A client who is referred to a registrant becomes the client of that registrant for the purposes of the services provided under the referral arrangement. The registrant receiving a referral must meet all of its obligations as a registrant towards its referred clients, including KYC and suitability determinations. Registrants may not use a referral arrangement to assign, contract out of or otherwise avoid their regulatory obligations. Registrants that use referral agents should carefully review their practices to ensure that only appropriately registered individuals are performing registerable activities. Registerable activities include meeting with investors to ascertain their investment needs and objectives, risk tolerance and financial circumstances, discussing and recommending investment opportunities, and performing ongoing portfolio reviews. We also encourage registrants to review the guidance provided in previous annual reports, as referenced above.

(ii) Incomplete and/or inadequate books and records

During our high risk compliance reviews, we noted a number of instances where some firms did not maintain adequate books and records that led to deficiencies in the following areas:

• a lack of or inadequate records to accurately record all business activities, financial affairs and client transactions and to demonstrate compliance with applicable requirements of securities law, and

• firms could not provide OSC Staff with requested books and records, that should have been readily available, supporting a firm's compliance with securities law in a timely manner.

The requirement to maintain adequate books and records is found in section 11.5 of NI 31-103 and in section 19(1) of the Act. Maintaining adequate books and records that can be accessed in a timely manner is a key component of a firm establishing and maintaining an adequate compliance system under section 11.1 of NI 31-103. Additional guidance related to this issue is also found in section 11.1 and 11.5 of 31-103CP and subsection 19(3) of the Act.

Acceptable practices to maintain adequate and complete books and records:

Registrants must:

• Develop and enforce policies and procedures that require adequate books and records to be maintained in relation to all aspects of a registrant's operations.

• Maintain books and records in a manner that is readily available and accessible.

• Have a process in place to review books and records on a regular basis to ensure that adequate and complete books and records are being maintained and that the books and records are up to date (e.g. missing or outdated investment management agreements, outdated insurance riders, incorrect client statements and trade confirmations, missing referral agreements, missing agreements between affiliated entities, incorrect details related to client accounts, etc.).

Unacceptable practices

Registrants must not:

• Engage in registerable activities with missing, incorrect or outdated books and records.

(iii) Repeat common deficiencies

The following includes the deficiencies that we continued to find during the high risk compliance reviews that have been reported on in previous annual reports. The chart highlights the common deficiency and provides information on where guidance related to this deficiency can be found. We encourage you to review the information sources provided as the previously published guidance is still applicable to these issues.

|

Repeat common deficiency |

Information source |

|

|

|

||

|

1) Inadequate written policies and procedures |

• |

Section 4.1 c)(ii) of OSC Staff Notice 33-745 |

|

|

||

|

2) Inadequate or no annual compliance report |

• |

Section 4.1 c)(iv) in OSC Staff Notice 33-745 |

|

|

• |

Section 4.1.2 in OSC Staff Notice 33-742 under the heading Inadequate or no annual compliance report |

|

|

• |

Section 5.1.2 in OSC Staff Notice 33-738 under the heading Failure by CCO to submit an annual compliance report |

|

|

||

|

3) Inaccurate calculation of excess working capital |

• |

Section 4.1 c)(iv) in OSC Staff Notice 33-745 |

|

|

||

|

4) Inadequate relationship disclosure information |

• |

Section 4.1 c)(iv) in OSC Staff Notice 33-745 |

|

|

• |

CSA Staff Notice 31-334 -- CSA Review of Relationship Disclosure Practices (CSA Staff Notice 31-334) |

|

|

• |

Section 5.1.2 in OSC Staff Notice 33-738 under the heading Inadequate relationship disclosure information |

|

|

||

|

5) Incomplete client account statements |

• |

Section 5.2C in OSC Staff Notice 33-736 |

|

|

• |

Section 4.3.3 in OSC Staff Notice 33-742 under the heading PM client account statement practices |

|

|

||

|

6) No notice of or inadequate filing of outside business activities |

• |

Section 3.2 in OSC Staff Notice 33-742 under the heading Outside business activities |

|

|

• |

Section 5.2.1 of OSC Staff Notice 33-738 under the heading Not disclosing outside business activities |

|

|

||

|

7) Financial statements not in accordance with International Financial Reporting Standards (IFRS) |

• |

Section 4.1.2 in OSC Staff Notice 33-742 under the heading Financial statements not prepared in accordance with NI 52-107 |

|

|

||

|

8) Inadequate marketing material |

• |

Section 5.2B of OSC Staff Notice 33-736 |

|

|

• |

CSA Staff Notice 31-325 -- Marketing Practices of Portfolio Managers (CSA Staff Notice 31-325) |

|

|

||

|

9) Inadequate marketing practices |

• |

|

c) Update on initiatives impacting all registrants

(i) Failure to provide notice of ownership changes or asset acquisitions

As reported in section 4.1 b) of OSC Staff Notice 33-745, we continue to have significant concerns with some registrants not filing the required notice under sections 11.9 or 11.10 of NI 31-103 of proposed ownership changes in, or asset acquisitions of, registered firms. For example, we continue to find a number of cases where:

• registrants (including the UDP, CCO, advising representative or dealing representative of the firm) acquired 10% or more of the securities of another registered firm, or their sponsoring firm, without first providing us with the required notice,

• registrants knew, or had reason to believe, that 10% or more of their voting securities were going to be acquired by a non-registrant, including an officer, director, permitted individual or employee of the firm (barring exceptional circumstances, we expect to receive notice of these transactions at least 30 days prior to the transaction taking place) but did not provide us with the required notice as soon as the registered firm knew, or had reason to believe, that this scenario existed, and

• registrants acquired all or a substantial part of the assets of another registered firm without first providing us with the required notice, examples of scenarios where we would expect to receive a section 11.9 or 11.10 notice include:

• the acquisition of another registered firm's book of business, including where the other registered firm is a one-person firm,

• the acquisition of a business line or division of another, large registered firm, and

• the acquisition of all of the investment fund management contracts of another registered firm that is an IFM.

We also found that some IIROC or MFDA member firms did not file the required notices under sections 11.9 or 11.10 based on the view that their SRO notice process was sufficient. This is not the case. The notice obligations apply to all registrants, including member firms of IIROC and the MFDA, and arise from the OSC's responsibility to register dealer firms.

In the cases where registrants did not provide us with the required notice for their completed acquisitions, we required them to file the notice materials for review and pay the applicable filing fees. We typically issue a warning letter to a firm regarding the seriousness of their failure to provide notice, however we may in appropriate circumstances object to the transactions and also take other regulatory action. We may also object to the notice of acquisition even though the transaction has been completed. As mentioned in last year's report, registrants that do not give us the required notice (or provide the notice after the specified deadline) will most likely also be charged late fees for the late notice, as well as applicable late fees for each related securities regulatory filing that is also filed late. For a further discussion regarding late fees generally, see section 3.2(a) of this report.

In addition to filing notices under sections 11.9 or 11.10 of NI 31-103, a change in share ownership of a registered firm, or an acquisition of its assets, typically triggers additional securities regulatory filings. In addition to any SRO filings (discussed above), these additional filings could include:

• filings under NI 33-109 (including, in particular, filings of Form 33-109F5), and

• change of manager approval requests under section 5.5 of National Instrument 81-102 Investment Funds (NI 81-102).

Registrants must ensure that all applicable securities regulatory filings are filed in accordance with their specified timelines in the event of a change in share ownership of a registered firm, or an acquisition of its assets.

(ii) Incomplete applications for exemptive relief

We have noted that applicants and/or their filing counsel (collectively, the filers) do not always follow the required procedures when filing exemptive relief applications. As a consequence, we may be required to spend significant time ensuring that all relevant information has been provided and the application is complete. This additional time can prevent us from processing the application according to the OSC's service standards, or within an expedited time frame, where requested.

We have listed below some of the issues that we encounter when processing exemptive relief applications.

General issues

Some of the general issues noted include:

• applications may not be filed in a timely manner (for example, a filer may request exemptive relief on an expedited basis within a timeframe that is not reasonable to allow for proper review and processing),

• a request to process an application on an expedited basis is made without providing a satisfactory reason to support the request,

• some applications are either not signed by each applicant or do not include a verification statement from each applicant,

• some applications do not follow the required form as set out in the relevant guidance,

• some filers do not make proper use of precedents (for example, some applications are not prepared based on the most up-to-date, relevant precedents or do not cite the relevant precedents), and

• some filers have not completed the applicable legal analysis prior to submission for our review and consideration.

In instances where the applications are deficient, the materials will be returned to the registrant for further review.

Incorrect application filing fees

Some issues relating to filing fees include:

• the filer has not paid the appropriate filing fee for the application, for example:

• the required additional filing fees have not been paid where the application requests relief from two or more sections of the Act, a Regulation or a Rule, and

• the required additional filing fees have not been paid where the application requests relief for more than one filer,

• the filers have not paid the additional $2,000 filing fee to which each of the applicants is subject if an applicant (or its parent company or, if it is a fund, its IFM) is not subject to a participation fee under the Fee Rule or OSC Rule 13-503 (Commodity Futures Act) Fees (the CFA Fee Rule), and

• where the filers may qualify for a fee waiver, the filers have not specified that they are requesting a fee waiver or have not provided reasons for a fee waiver request.

Acceptable practices to ensure exemptive relief applications are ready for submission to the OSC

Filers should ensure that:

• For novel or complex applications, prior to making a formal application for exemptive relief, the filer has considered the submission of a pre-filing to consult with us on a specific issue and how Ontario securities law will be interpreted.

• For local, Ontario-only applications, the filer has consulted OSC Policy 2.1 Applications to the Ontario Securities Commission.

• For applications involving multiple Canadian jurisdictions, the filer has consulted National Policy 11-203 Process for Exemptive Relief Applications in Multiple Jurisdictions (NP 11-203).

• The application is signed by each applicant or includes a signed verification statement from each applicant that authorizes the filing of the application and confirms the truth of the facts in the application.

• Inclusion of all applicable ancillary documents, including the precedents that are cited in the application.