Investor research and reports

Investor research is key to improving our knowledge and understanding of important investor needs and issues. We employ a variety of methodologies in carrying out this research, from broad-based surveys to in-depth qualitative interviews and randomized control trials. Different methodologies allow us to gain different and complementary perspectives on trends and challenges facing retail investors.

Social Media and Retail Investing: The Rise of Finfluencers

This research explores the relationship between Canadian retail investors and the financial advice they encounter on social media. Through a literature review, environmental scan, and survey, we examine the attitudes and behaviours of Canadian retail investors towards financial influencers (finfluencers) and social media. Additionally, an experiment was conducted using an online trading simulation to assess the impact of finfluencers and explore strategies to combat misinformation from finfluencers on investing behaviours. Results demonstrate that finfluencers can significantly influence retail investor trading behaviours, and several effective techniques were identified to reduce their influence.

A Behavioural Insights Analysis of the Effects of Environmental, Social, and Governance Factor (ESG) Disclosure and Advertising by Investment Funds on Retail Investors

This research explores the impact of environment, social, and governance (ESG) factors on retail investor decision-making and behaviour within investment funds. Our literature review and environmental scan underscore the challenges facing retail investors in evaluating the ESG components of investment funds. Furthermore, we conducted an experiment to examine retail investors’ attitudes, values, and preferences towards various attributes of ESG funds. Our findings indicate that ESG ratings significantly sway investor preferences, coming in second only to a fund's past performance. Notably, the strength and format of the ESG ratings substantially steered the choices of retail investors.

Gamification Revisited: New Experimental Findings in Retail Investing

This research builds on the OSC’s 2022 publication of Digital Engagement Practices in Retail Investing: Gamification and Other Behavioural Techniques, uncovering additional areas of concern for regulators and stakeholders related to the use of digital engagement practices by digital trading platforms. The report consists of a behavioural science experiment on a simulated trading platform testing the impact of four digital engagement practices: social interactions, social norms, copy trading, and leaderboards. Results indicate that these techniques have a material impact on investor behaviour, highlighting potential investor protection concerns associated with these techniques.

Artificial Intelligence and Retail Investing: Scams and Effective Countermeasures

This study explores how AI technologies might heighten investors’ vulnerability to scams and evaluates strategies to protect retail investors. AI is being used to make scams more effective and harder to detect, with new scams like deepfakes and voice cloning emerging. We identified both system- and individual-level mitigations to address these risks. Our experiment showed that generative AI tools can increase the appeal of fraudulent investment opportunities and that certain techniques can mitigate the effectiveness of these scams. We conclude that both system-level and individual-level mitigations are important for protecting retail investors from AI scams.

Artificial Intelligence and Retail Investing: Use Cases and Experimental Research

This study investigates the applications of artificial intelligence (AI) in retail investing, including a behavioural science experiment to understand the impact of AI on investor behaviour. The research highlights three investor-facing use cases of AI: decision support, automation, and scams and fraud. The experiment explores how Canadians adhere to an investment suggestion provided by one of three sources: a human provider, an AI tool, or a human provider using an AI tool (i.e., ‘blended’ source). While adherence to suggestions from the ‘blended’ source was highest, there were no significant differences across sources, indicating that Canadians are receptive to advice from AI systems. These findings underscore the importance of using unbiased, high-quality data in AI systems offering investment advice.

Digital Engagement Practices: Dark Patterns in Retail Investing

This study examined the use of dark patterns and other digital engagement practices and how those techniques are being used in some investment contexts. Dark patterns are digital engagement practices that use online interfaces to coerce, steer, and/or deceive users into making decisions that benefit a business but may not align with an investor’s best interests. The study found the prevalent use of dark patterns on digital investing platforms, including concerning techniques that: disguise the cost of investing; obtain personal information without informed consent; and make it harder to withdraw funds or close an account. The OSC is studying the impact of digital engagement practices in the investment industry and the influence these techniques may have on investors.

Profiles of Retirement

This study examined the financial lives of retired Canadians and those approaching retirement. While most retired Canadians said they are in a strong financial position, a concerning 15% of retirees rated their financial situation as poor. Almost one third of retirees reported their monthly expenses in retirement are higher than they expected. The study also found that those who are not yet retired may not retire as comfortably as those who are already retired. Compared to retirees, those who are not yet retired have less savings and more debt. They are more likely to expect to rely on their own savings and less likely to have a work-related pension plan. The study also found both retiree and pre-retirees may not be prepared for financial emergencies. Overall, the study paints a picture of many Canadians over the age of 50 being in a strong financial position, but a significant proportion are financially vulnerable. Identifying and addressing the needs of seniors is an important priority for the OSC. The research results will help inform the OSC’s regulatory and operational work in support of older investors.

Crypto Asset Survey 2023

This study examines Canadians’ crypto-related opinions and behaviours, and compares the findings to the 2022 Crypto Assets Survey to understand how Canadians’ views of crypto changed over an eventful year. Canadians’ crypto ownership has declined by 23% and more Canadians regret investing in crypto. The study provides a profile of crypto owners, their reasons for purchasing crypto assets or funds, the role of financial advice, and importantly, allows us to understand how these factors have changed in the past year as the crypto landscape shifts.

Digital Engagement Practices in Retail Investing: Gamification & Other Behavioural Techniques

This study of retail investors explores the influence of gamification and other behavioural techniques on investing behaviours. Using a randomized controlled trial experiment on an online simulated trading platform, we found that participants who were rewarded with points for buying and selling stocks made 39% more trades than the control group. Those participants who saw a list of top trades were 14% more likely than the control group to buy and sell those top listed stocks. The report provides a taxonomy of gamification and other behavioural techniques found on self-directed online brokerages now and techniques that may be used in the future, and explores the positive and negative impact these techniques have on retail investor behaviour.

Research Study: Crypto Assets 2022

This study examines Canadians’ crypto ownership and knowledge. It found 13% of Canadians currently own crypto assets or crypto funds. The study also found most Canadians did not have a working knowledge of the practical, legal and regulatory dimensions of crypto assets. Crypto assets were believed to play a key role in the financial system by 38% of those surveyed. The study provides a profile of crypto owners, their reasons for purchasing crypto assets or crypto funds, the role of financial advice, impact of advertising, and the experience of crypto owners with crypto trading platforms.

Investors vs. Savers: Attitudes Towards Investing

This study compares the attitudes and beliefs of investors versus savers about our capital markets. It was conducted from January 17 to February 9, 2021 — an interesting time as the GameStop saga began midway through our data collection. The study found significant differences between investors and savers in four thematic areas: wealth creation, fairness of capital markets, effectiveness of regulation, and the economic importance of capital markets.

Investor Knowledge Study

This study assesses the financial knowledge of retail investors across five areas that are of importance when making investment decisions. The survey includes the widely-used financial knowledge questions currently used across Organization for Economic Co-operation and Development (OECD) jurisdictions. On average, investors answered 53% of the questions correctly. The study found that investors have the least knowledge when it comes to investment costs and investor protections. 29% of Canadian investors are overconfident in their financial knowledge, however, completing the survey questions was an effective way to reduce overconfidence in some investors through debiasing.

Research Study: Self-Directed Investors: Insights and Experiences

This study presents a survey of Self-Directed (do-it-yourself or DIY) retail investors that explores several topics to develop a profile of this increasingly important segment of retail investors. Topics include account openings, trading behaviour, experiences during the pandemic, information used to make investing decisions, investing apps and tools, and knowledge of market structure. Key findings include: 10 per cent of Self-Directed investors opened their account during the pandemic; 26 per cent are Self-Directed for their secondary account; the most important information sources used to make investment decisions include their own personal views based on their experiences with a company’s products and services; and 13 per cent consider posts on social media and online message boards such as Reddit, Twitter and Facebook to be important sources of information.

Investing and the COVID-19 Pandemic Study

The Investor Office conducted this study to further our understanding of the experiences and behaviours of retail investors during the COVID-19 Pandemic. The study explored several topics including the financial preparedness, savings behaviour, financial situations, changing preference, and trading activity of retail investors. Key findings include that 32 per cent of investors have experienced a decline in their financial situation during the pandemic while 16 per cent have experienced an improvement. Half of investors have not done any trading during the pandemic, but of those who have been trading, 63 per cent have increased their holdings.

Research Study: Protecting Aging Investors through Behavioural Insights

Protecting Aging Investors through Behavioural Insights identifies behaviourally informed techniques dealers and advisers can use to encourage their older clients to provide the necessary information for enhanced investor protection measures. The report also) identifies ways in which our decisions become more biased as we get older and includes the results of a randomized experiment that demonstrates how to reduce the effect of these biases.

Investor Experience Research Study

This study contains the results of a survey completed between March 30 and April 11 that explored several topics relevant to the retail investing experience in Canada including working with an advisor, understanding investments, avoiding investment fraud and the impact of the COVID-19 pandemic. Key findings include that nearly half of investors are experiencing increased levels of stress, most have had communications with their advisors, and few have sold more than 20% of their portfolios during the pandemic.

Financial Literacy: A Foundation of the Investor Experience

This research about financial literacy tested investor knowledge of key topics including diversification, inflation, and interest. Preliminary results from this study reveal that 34 per cent of Canadians have high financial literacy and 24 per cent of investors may be overconfident in their knowledge.

Improving Fee Disclosure through Behavioural Insights

Improving Fee Disclosure through Behavioural Insights identifies ways to improve how investment fees are communicated to investors by their registered dealers, advisers, and registered representatives (registrants). The report also includes the results of a randomized experiment that demonstrates how these tactics can make disclosures easier for investors to understand.

2018 National Investor Research Study

Key findings from this 2018 National Investor Research Study included:

- Canadians aged 18-34 are the most likely to believe their standard of living will increase in retirement, despite being the least likely to have started saving for retirement of any age group

- seven per cent of Canadian adults currently own cannabis investments, with 1 in 4 cannabis investors spending $10,000 or more on their investments

- most Canadian adults with parents aged 45 or older say their parents have not talked to them about how they would like their finances managed if they were no longer able to do so

Read the full report or read the research summaries.

Encouraging Retirement Planning through Behavioural Insights

Encouraging Retirement Planning through Behavioural Insights identifies ways in which government, regulators, employers, and financial institutions can apply behavioural insights to promote retirement planning. The report includes the results of a randomized experiment that found, among other things, that prompting individuals to think about the friends and family they will be able to spend more time with in retirement can be highly effective in motivating individuals to start the retirement planning process.

Getting Started: Human-Centred Solutions to Engage Ontario Millennials in Investing

This research study to engage Ontario millennials in investing outlined the barriers millennials face when attempting to learn more about or start investing, as well as tactics public and private organizations can employ to address these barriers. The study, prepared by Upside Consulting Group in collaboration with OSC staff, draws from nearly 30 hours of in-depth interviews with Ontarians in the millennial cohort, as well as a review of behavioural sciences literature and existing investing channels available to millennials.

Taking Caution: Financial Consumers and the Cryptoasset Sector

Taking Caution: Financial Consumers and the Cryptoasset Sector revealed that half of cryptoasset owners either didn’t know who regulates offerings of digital coins or tokens or believed that these offerings are unregulated. In addition, one-third said they wouldn’t know where to go if they had a complaint about a cryptoasset service provider. This report also explains how the OSC regulates any coin offerings that are securities offerings.

OSC Staff Notice 11-779 Seniors Strategy

The OSC’s vision is a stronger and more secure financial future for all Ontario seniors. Our Seniors Strategy includes a comprehensive action plan of targeted policy, operational, research, educational, and outreach initiatives to ensure that older Ontarians’ needs are appropriately met by the OSC and the investment industry.

Bitcoin and Other Cryptocurrencies

As a first step towards learning more about who is purchasing cryptocurrencies and why, the Investor Office commissioned a small online survey of Ontarians aged 18 and over. Among the findings, 7 per cent of Ontarians reported owning a cryptocurrency, including 29 per cent of men aged 18 to 34.

Missing Out: Millennials and the Markets

According to Missing Out: Millennials and the Markets, four of out five Ontario millennials (aged 18–36) are saving, but only one in two are investing. Top reasons non-investor millennials gave for avoiding investing included:

- having other financial priorities

- not having enough income or savings

- not knowing enough about investing

- concerns about losing money in the markets

Investing As We Age

According to a the Investor Office survey Investing As We Age, the top financial concerns for 25 per cent of Ontarians age 45 and over are retirement-related, and almost half (45 per cent) of the homeowners in this group rely on the value of their home increasing to fund their retirement. The survey also found gender differences in reported knowledge, behaviour, and stress relating to financial planning among Ontarians 45 years and older, with half as many women (27 per cent) as men (51 per cent) reporting having “good” or “excellent” knowledge of investing.

Behavioural Insights: Key Concepts, Applications, and Regulatory Considerations

Behavioural insights use psychological, economic, and other research to examine how consumers behave, and sometimes reveal that consumers are neither deliberate nor rational in their decisions in the way that traditional models, strategies, and policies assume. The Behavioural Insights report looks at how leading practitioners and regulators are using behavioural insights to address issues in capital markets and improve outcomes for investors and market participants.

Investor Office Activity Report 2015-16

The OSC launched its Investor Office in 2015 with an ambitious agenda. The Investor Office aimed to achieve better investor outcomes by expanding and modernizing the OSC’s efforts in investor engagement, research, education and outreach, and by bringing new perspectives to the organization’s policy-making and operations. Read all about our activities and results for the first year in Investor Office Activity Report for 2015-16.

Retirement Readiness: Canadians 50+

Seniors are an extremely important and growing segment of investors whose needs and issues demand attention. Findings from Retirement Readiness: Canadian 50+, commissioned by the Investor Office of the OSC, revealed that over half of Canadians do not have a plan for retirement savings.

The Investor Perspective (OSC Staff Notice 11-773)

In everything we do, we look at things from the investor perspective. In these pages you will read more about who we are, what we do, and how we think.

Financial Life Stages of Older Canadians

If older Canadians could take what they know now about the financial realities of retirement and apply that knowledge earlier in life, what would they do? This study provided some of those insights and more. Financial Life Stages of Older Canadians identified the main financial risks of Canadians aged 50 and up at each life stage and how they are being managed.

Investor Risk, Behaviour, and Beliefs

The Canadian Money State of Mind Risk Survey 2014: Investor Risk, Behaviour & Beliefs, a national study conducted for the Investor Education Fund (now part of the Ontario Securities Commission’s Investor Office) by The Brondesbury Group, provides a compelling look at how Canadians handle – or don’t handle – risk, emotion, financial loss and decision-making when it comes to their investments.

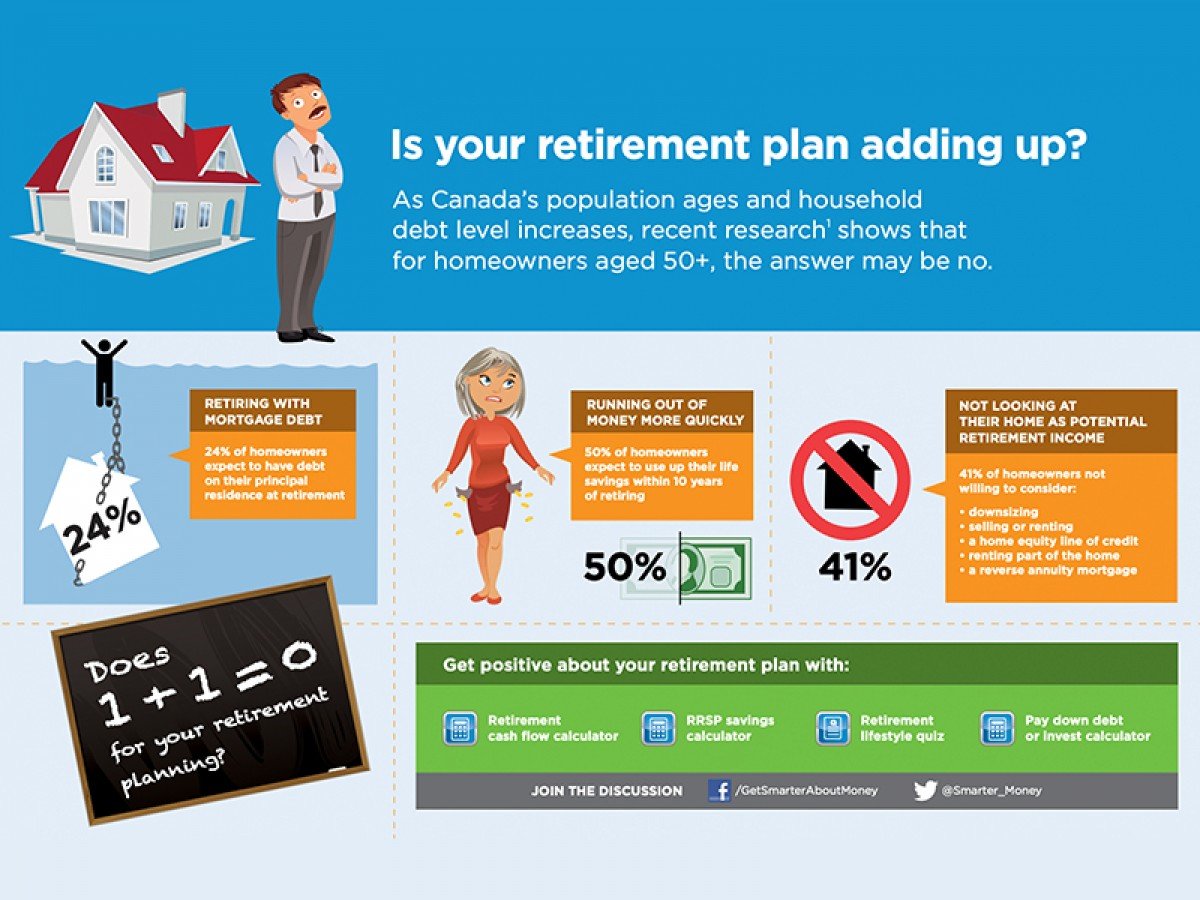

Home Equity as a Source of Retirement Income

According to a new survey conducted for the Investor Education Fund (now part of the Ontario Securities Commission’s Investor Office) by The Brondesbury Group, Canadians are not saving enough for retirement, and half believe they will run out of their retirement savings in the first 10 years of retirement. Despite the lack of retirement savings, the survey revealed that four out of 10 respondents were not willing to consider capitalizing on home equity as an option for retirement income.