OSC Notice 11-785 - Statement of Priorities - Request for Comments Regarding Statement of Priorities for Financial Year to End March 31, 2020

OSC Notice 11-785 - Statement of Priorities - Request for Comments Regarding Statement of Priorities for Financial Year to End March 31, 2020

The Securities Act requires the Commission to deliver to the Minister and publish in its Bulletin each year a statement of the Chair setting out the proposed priorities of the Commission for its current fiscal year in connection with the administration of the Act, the regulations and rules, together with a summary of the reasons for the adoption of the priorities.

This Statement of Priorities is a subset of our overall OSC Business Plan which is aligned with our OSC Strategic Plan. The document sets out the priority actions that the OSC will take in 2019-2020 to address each of the goals and its related priorities. While the proposed priorities will potentially impact more than one organizational goal, each priority is identified only under the specific goal where the greatest impact is expected. In certain cases, the process required to properly assess the issues, including consultations with market participants, and to develop and implement appropriate regulatory solutions, may take more than one year to complete.

In an effort to obtain feedback and specific advice on our proposed priorities, the Commission is publishing a draft Statement of Priorities which follows this Request for Comments. The Commission will consider the feedback and make any necessary revisions prior to finalizing and publishing its 2019-2020 Statement of Priorities. Shortly after the conclusion of our 2018-2019 fiscal year the OSC will publish a report on its progress against its 2018-2019 priorities on our website.

Comments

Interested parties are invited to make written submissions by May 27, 2019 to:

20 Queen Street West

22nd Floor

Toronto, Ontario M5H 3S8

[Editor's Note: The Statement of Priorities follows on separately numbered pages. Bulletin pagination resumes at the end of the Statement of Priorities.]

2019-2020 OSC Statement of Priorities

REQUEST FOR COMMENT

INTRODUCTION

OSC Statement of Priorities

We are pleased to present the OSC Chair's Statement of Priorities for the Ontario Securities Commission for the year commencing April 1, 2019. The Securities Act (Ontario) requires the OSC to publish the Statement of Priorities in its Bulletin and to deliver it to the Minister by June 30 of each year. This Statement of Priorities also supports the OSC's commitment to be both effective and accountable in delivering its regulatory services.

The OSC regulates the largest capital market in Canada and our actions have impacts for Ontario and the rest of Canada. The OSC remains committed to promoting safe, fair and efficient markets in Ontario and has identified a broad range of initiatives to improve the existing regulatory framework. We strive to anticipate problems in the market and act decisively to promote public confidence in our capital markets, protect investors, and support market integrity. We will continue to proactively identify emerging issues, trends, and risks in our capital markets.

Confidence in fair and efficient markets is a prerequisite for economic growth. Investor protection is always a top priority for the OSC. The OSC engages with investor advocacy groups for insights to help the OSC better understand investor needs and interests.

The OSC continues to move the regulatory agenda forward, improving the way we approach our work and engage with industry participants and other regulators to understand the issues and their concerns. The OSC interacts broadly with all stakeholders through various advisory committees to inform operational approaches and policy development.

Our significant work in the international regulatory environment will continue as another key means to gain insights into emerging issues and standards that can be integrated into our policy development and oversight activities. These actions are essential to reach solutions that balance the inclusion of innovation and competition in the marketplace while maintaining appropriate investor safeguards.

The OSC works as part of the Canadian Securities Administrators (CSA) to harmonize rules and their application across the country. The OSC is working with the Ontario government and the OSC's counterparts in other participating jurisdictions to develop a harmonized regulatory approach and seamless transition to the proposed CMRA.

INTRODUCTION

INTRODUCTION

Key Priorities

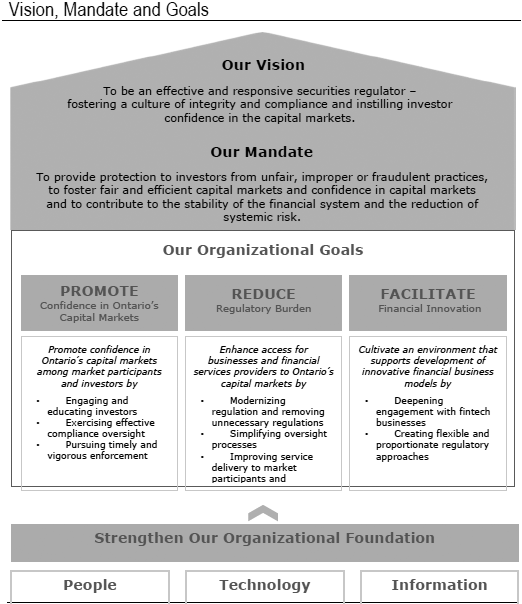

Our 2019-2020 Statement of Priorities (SoP) sets out the priority areas on which the OSC intends to focus its resources and actions in 2019-2020. The OSC has identified four regulatory goals. This SoP sets out the priority initiatives that the OSC will pursue in support of each of these strategic goals. The SoP also describes the environmental factors that the OSC has considered in setting these goals. It is important to note that the majority of OSC resources are focused on delivering the core regulatory work (authorizations, reviews, compliance, enforcement and the systems and infrastructure to support that work) undertaken by the OSC to maintain high standards of regulation in Ontario's capital markets.

Promote Confidence in Ontario's Capital Markets

• Continue Developing and Consulting on Client Focused Reforms

• Continue CSA Policy Work on Mutual Funds Embedded Commissions

• Improve Experience for Retail Investors

• Expand Systemic Risk Oversight of Derivatives

• Timely and Impactful Enforcement Actions

• Support Transition to the CMRA

Reduce Regulatory Burden

• Engage with Stakeholders on Burden Reduction Opportunities

• Initiate OSC Website Redevelopment

Facilitate Financial Innovation

• Engage with the Fintech/Start-Up Sector

• Implement Alternative Funds Regime

Strengthen Our Organizational Foundation

• Implement Strategic Workforce Planning (SWP)

• Continue Redevelopment of National Systems Renewal Program (NSRP)

• Implement First Phase of Market Analysis Platform (MAP)

• Modernize OSC Technology Platform

• Build a Data Driven, Evidence Based and Risk Focused Organization

THE ENVIRONMENT

Scan and Impact

Environmental factors influence securities regulators in their operations and regulatory oversight. Key challenges and issues that may influence the OSC's policy agenda, its operations, and the way it uses its resources, are as follows.

Globalization

The potential impact of continuing geopolitical events, such as Brexit implementation, decisions by the US government and changing trade relationships could have profound impacts on financial regulation globally. The global interconnectedness of markets and mobility of capital create a strong need for harmonization and coordination of regulation. However, the potential for increased protectionism and de-regulation could inhibit global harmonization and create opportunities for regulatory arbitrage.

The markets, products, and participants that the OSC regulates and oversees continue to grow in size and complexity. Globalization of financial markets, products and services adds another layer to these challenges. The sustained growth of cross-border activities raises challenges to regulatory supervision, magnifies the value of cooperation between regulators and increases the benefit of achieving consistent standards and requirements both domestically and internationally.

The OSC works as part of the CSA to harmonize rules and their application across the country to facilitate business needs. Through these efforts, the OSC strives to achieve effective cross-jurisdiction enforcement and gain timely insight, understanding and input into emerging regulatory issues to achieve better regulatory outcomes.

Our international involvement informs how we regulate Ontario's capital markets. The OSC continues to play an active role in international organizations such as the International Organization of Securities Commissions (IOSCO) to influence and promote changes to international standards for securities regulation and share new ideas and learnings that will benefit Ontario markets and participants.

Regulatory Burden

A more competitive environment demands that securities regulators must balance pressures to respond to market issues while avoiding over-regulation. Regulatory costs should be proportionate to the regulatory objectives sought. Regulatory burden, along with the associated costs, is a key focus for many market participants and the Ontario government. The thrust to reduce the regulatory burden on business may require the need to simplify, remove and/or re-engineer our processes and systems. The need for a cost-effective regulatory framework, with proportionate regulation that supports innovation and competition -- while maintaining appropriate investor protections -- is critical. Both over-regulation and under-regulation can dampen innovation and undermine the competitiveness of our capital markets. By re-examining our rules and processes to identify opportunities to reduce undue burdens and streamline regulation the OSC can confirm they are appropriate and necessary while maintaining appropriate safeguards for investors.

Technology and Innovation

The pace of technological evolution and innovation creates challenges to develop and maintain a responsive and aligned regulatory framework. Market participants continue to expand their product and service offerings. Fintech (technology facilitated financial services) and Regtech (technology facilitated regulatory compliance services) innovation continues to advance and is a key disruptive force in the financial services industry. Complexity driven by financial innovation offers many potential benefits and risks to the market. Fintech is leveraging new technology and creating new business models in the financial services industry such as providing new product offerings (e.g. blockchain-based crypto assets) and disrupting service channels (e.g. online advisors). Financial services firms are using technological innovation, digitalization and growth in the use of the distributed ledger technology to reduce operational costs and improve efficiency.

The breadth and pace of innovation in the financial sector could result in gaps in regulation or become a source of non-compliance. For example, the potential applications and impacts of Artificial Intelligence (AI) are significant but are not well understood.

Modernize Financial Regulation

The Government of Ontario has identified initiatives to modernize the financial services regulatory framework. These policy priorities and changes in regulatory authority will impact the OSC and its operations including:

• Changes to the regulatory oversight of syndicated mortgage investments by the Financial Services Commission of Ontario and the OSC

• Title protection for financial planners and financial advisors

• Working with CMRA partners on the transition of the OSC to the proposed CMRA.

Growing Importance of Investor Education

As the responsibility for investing shifts to individuals, they are challenged to achieve the returns needed to finance future needs. There are wide gaps in the levels of investment experience and financial literacy among investors. Investor education has the potential to contribute to improved financial outcomes for investors and is an important component of investor protection.

The OSC is actively involved in providing investor education tools and resources to help investors achieve improved financial outcomes. The ability to achieve meaningful progress in financial literacy levels will be a key to strengthening investor protection. Investors with a greater level of understanding of financial concepts are better able to make informed investment decisions and avoid fraud. The OSC will seek new and innovative ways to deliver investor education and support retail investors in today's complex investing environment.

Changing Demographics and Investor Needs

Demographics are critical to understanding investor needs and are a key driver of most investor-focused issues. Different investor segments (e.g. seniors versus millennials) have unique characteristics and present different challenges in terms of investment objectives and horizons. Their preferences can vary in terms of products (ETFs versus mutual funds) and service channels. Automated financial advice is redefining the delivery of client wealth management services and the fees charged for advice.

Investor Redress

Investors can be at risk for potential losses from improper or fraudulent interactions. Regulators are seeking ways to improve investor access to redress in these types of situations. Avenues to obtain investor redress, including an effective and fair dispute resolution system, are increasingly being included as part of investor protection frameworks. To achieve better results for investors, the OSC will continue its support for OBSI in its role as the independent dispute resolution service made available to investors.

Enforcement and Compliance Tools

Strong compliance oversight and enforcement are essential to maintaining the integrity and attractiveness of our capital markets. Disruption of illegal activity and deterrence are key strategies to prevent or limit harm to investors. Our actions against firms and individuals who do not comply with the rules need to be strong and visible to achieve the desired deterrent effect and enhance public confidence in our markets.

As securities fraud and misconduct become increasingly complex, regulators must evolve their compliance and enforcement approaches and expand their tools. Regulators will need greater access to data and more sophisticated surveillance and analysis tools to more effectively evaluate compliance with regulatory requirements and identify misconduct. Technology is enabling growth in cross-border activities that are detrimental to investors and very difficult to address. This creates challenges in supervision, surveillance and enforcement. If regulatory approaches are not aligned, cross-border supervision and enforcement efforts can be impeded.

Systemic Risk and Financial Stability

The OSC works with many domestic and international regulators to monitor financial stability risks and trends, improve market resilience, and reduce the potential risk of global systemic events. The OSC is continuing to build out a domestic derivatives framework and to operationalize the necessary compliance and investigation tools required to achieve a practical and effective regime.

As part of their review of market stability issues, financial system regulators are examining the need for companies to disclose exposure to economic, environmental and social sustainability risks, including climate change. The Financial Stability Board (FSB) has established a Task Force on Climate-related Financial Disclosures to develop a set of recommendations for consistent, comparable, reliable, clear and efficient climate-related disclosures by companies. The OSC will continue to monitor these developments to determine the need for a regulatory response.

Cybersecurity Resilience

Cyber-attacks that have the potential to disrupt our markets and market participants are likely to occur. Growing dependence on digital connectivity is raising the potential for digital disruption in our financial services and markets and creating a strong imperative to raise awareness about cyber-attacks and strengthen cybersecurity resilience. This is a growing challenge as more businesses, services and transactions span national and international borders. The OSC, working with other regulatory partners, has an important role to play in assessing and promoting readiness and supporting cybersecurity coordination and resilience within the financial services industry and raising awareness of cybersecurity risks.

Data Management

Ever increasing market complexity is generating greater availability and reliance on data. The OSC is adding new tools and processes to support staff in delivering their responsibilities. A key element will be addressing challenges in managing growing volumes of data, including information security. The OSC is investing in information technology and infrastructure to support an integrated data management program that will improve access to information to identify trends and risks and support analysis and decision-making. This will also allow easier filings and access for market participants.

Workforce Strategy

The ability to meet the identified goals and strategic objectives is dependent upon obtaining sufficient and appropriate resources. To meet evolving needs, the OSC will strengthen its capabilities through its people. While attracting, motivating and retaining top talent in a competitive market environment continues to be challenging, the OSC is building its capabilities and skills by recruiting staff across a range of disciplines, and by developing the skills and experience of our internal talent.

THE ENVIRONMENT

Major Planning Themes

The OSC is committed to fostering confidence in Ontario's capital markets, supporting an environment where capital is available on competitive terms, streamlining regulation with a strengthened focus on reducing regulatory burden and maintaining Ontario's financial services sector as a world leader and significant contributor to the province's economy. The main themes of our 2019-2020 OSC Statement of Priorities support the Ontario Government's priorities to make Ontario "Open for Business" and to "Build more Efficient Regulators".

Reduce Regulatory Burden

Delivering responsive regulatory oversight includes being mindful of the impact of regulatory burden on market participants. Reducing red tape will boost productivity, competitiveness and investment. The OSC is re-examining its rules and processes to ensure they are appropriate, necessary and with its CSA partners has identified and is pursuing opportunities to reduce undue burdens and streamline regulation without impeding the ability of the OSC to fulfill its responsibility to protect investors. Together with reducing red tape, the OSC is looking at ways to improve the investor experience, by seeking to modernize the information provided to investors or other interactions that investors have with issuers and registrants. The OSC continues to seek opportunities to make its interface with market participants easier and less costly, including the implementation of electronic solutions to make submission of data easier for market participants.

Support Innovation to Attract Investment in Ontario

The OSC is committed to enhancing confidence and competitiveness in capital markets and making Ontario the most attractive place in North America in which to invest, grow businesses and create jobs. The OSC will continue to actively support business innovation through initiatives such as OSC LaunchPad, the CSA Regulatory Sandbox and globally through the Global Financial Innovation Network (GFIN), to support fintech businesses seeking to offer innovative products, services and applications in Canada. These initiatives are critical to creating a globally competitive, efficient and strong capital markets regulatory system that attracts investments from around the world, streamlines capital raising for businesses and protects investors from financial system risk and misconduct.

Invest in Technology to Support a More Data Driven OSC

The OSC supports the government's broader efforts to ensure services are delivered in the most efficient and effective ways possible. The OSC needs to invest in technology, systems infrastructure and expertise to expand and modernize its technology platform. These investments will be used to replace outdated systems and build the foundation to allow the OSC to become a data driven, evidence based, risk focused organization. Agile organizations make data-driven rather than subjective decisions. The OSC will strive to simplify, modernize and enhance the data that it collects. Development of a robust data and analytics framework for decisions will allow the OSC to deliver service outcomes that clearly demonstrate value for money to all stakeholders.

Support Transition to the CMRA

Ontario's Minister of Finance is playing a leadership role in the implementation of the Cooperative Capital Markets Regulatory System (CCMR). The CCMR would help Ontario's businesses raise capital more efficiently and better protect investors. The OSC will be committing resources to support implementation of the CCMR as a streamlined capital markets regulatory system will make our capital markets more efficient and competitive relative to other countries, facilitate more effective monitoring and responses to systemic risk on a national basis and provide investors timely and uniform protections across jurisdictions.

OUR GOALS

Promote Confidence in Ontario's Capital Markets

We will promote confidence in Ontario's capital markets among market participants and investors by engaging and educating investors; exercising effective compliance oversight; and pursuing timely and vigorous enforcement.

OUR KEY PRIORITIES

Continue Developing and Consulting on Client Focused Reforms

Propose amendments to registrant conduct requirements to better align the interests of securities advisers, dealers and representatives (registrants) with the interests of clients and improve outcomes for clients.

Actions will include:

• Implement recommendations based on the review of comment letters

• Determine next steps in consultation with the CSA and other stakeholders

• Draft second publication of proposed rule amendments and Companion Policy Guidance.

Planned Outcomes

• Better disclosure on product and service offerings reduces information asymmetry for investors

• Client outcomes enhanced when conflicts of interest are addressed in the client's best interest.

• Improved suitability determinations for clients when client's interests are put first.

Continue CSA Policy Work on Mutual Funds Embedded Commissions

With the CSA, develop responses to the proposals published for comment in September 2018.

Planned Outcomes

• Revised proposals developed and published for comment.

Improve Experience for Retail Investors

Improve the investor experience and enhance investor engagement and education.

Actions will include:

• Advance investor protection through investor education resources, themed months (e.g. Seniors Month, Financial Literacy Month) and outreach

• Increase partnerships with stakeholders and community groups interested in investor education initiatives

• Improve effectiveness of OSC policies and outcomes for retail investors through integration of behavioural insights

• Seek ways to improve the investor experience through disclosure innovations, plain language initiatives, improving investor tools and resources, and adopting customer-centric principles in a variety of work areas.

Work toward our vision of a stronger and more secure financial future for all Ontario Seniors.

Actions will include:

• Continue to develop and implement the OSC Seniors Strategy, which includes addressing issues of financial exploitation and cognitive decline

• Continue to evolve strategy to address emerging challenges facing older and vulnerable investors

• Provide education and regulatory tools to registrants to help them meet the needs and priorities of older and vulnerable investors.

Planned Outcomes

• Increased use of educational resources by investors

• Expanded outreach sessions and resources for seniors and new Canadian community groups

• Existing partnerships strengthened and new external relationships created to inform and advance investor focused issues

• Publish a staff notice and rule amendments for comment to address financial exploitation of seniors and vulnerable investors.

Expand Systemic Risk Oversight of Derivatives

The OSC will continue to build out its regulatory framework through various policy and operational initiatives.

Actions will include:

• Publish a proposed business conduct rule and develop a registrant regulation framework

• Develop a compliance review program for derivatives market participants

• Establish a monitoring regime for data relevant to the applicability of a proposed margin rule for uncleared derivatives to Ontario entities

• Improve quality and completion of trade reports to improve systemic risk monitoring and enforcement

• Propose amendments to Trade Reporting rule to accommodate internationally adopted data standards

• Publish final amendments to Clearing rules regarding applicability to affiliates.

Planned Outcomes

• Framework for analyzing OTC derivatives data for systemic risk oversight and market conduct purposes is in place and provides improved awareness of potential systemic vulnerabilities that can impact or be impacted by Ontario's capital markets

• Higher quality trade reports and measurable improvement in trade reporting completion statistics improves our ability to meet policy setting, systemic risk monitoring and enforcement assistance objectives

• Canadian regulatory framework keeps pace with global regulatory developments. Harmonized regulatory approaches (internationally and within the CSA) reduce regulatory burden on our market participants

• Monitoring regime for data relevant to the applicability of proposed margin rule for uncleared derivatives to Ontario entities established.

Timely and Impactful Enforcement Actions

The OSC will promote confidence in Ontario's capital markets by increasing the deterrent impact of OSC enforcement actions and sanctions by actively pursuing timely and consequential enforcement cases to address serious securities laws violations.

Actions will include:

• Ensuring investigative and litigation resources are focused on cases expected to have a strong regulatory impact and are aligned with our strategic priorities

• The Joint Serious Offences Team (JSOT), that works in cooperation with policing partners, will continue to focus on fraudulent behaviour and recidivism

• Identifying ongoing harmful misconduct and take timely, proactive disruptive action to stop the misconduct at the earliest stage and minimize investor harm

• The Whistleblower group will triage tips to focus action on impactful enforcement proceedings with effective regulatory messages.

Our aim is to achieve fair and just outcomes in response to misconduct and ensure compliance with securities laws.

Planned Outcomes

• Implementation of new tools supports increased use of data to support case selection and investigation decisions

• Enhanced profile for the OSC Whistleblower Program increases the number of credible tips

• Increased number of visible, effective disruption actions completed

• Increased visibility of priority case outcomes with strong regulatory messages aligned with OSC strategic priorities.

• Improved use of data analytics in market conduct cases to strengthen the detection of harmful conduct.

Support Transition to the CMRA

The proposed transition to CMRA will require the OSC to re-prioritize, mobilize resources and adopt change management activities once workstreams are activated to prepare for the CMRA launch. The OSC will need to participate with other CMRA partners to complete work to develop effective legislation, regulations and efficient regulatory oversight processes.

Planned Outcomes

• OSC is ready and able to seamlessly transition to the proposed CMRA.

OUR GOALS

Reduce Regulatory Burden

The Ontario Government is fostering a stronger environment for Ontario business and investors by cutting red tape and reducing regulatory burden. The government plans to systematically review Ontario's stock of regulations, then streamline, modernize and, in some cases, eliminate unnecessarily complicated, outdated or duplicative regulations. The OSC will support this goal by assessing policies and processes to streamline regulatory requirements and processes to make it easier to participate in Ontario's capital markets.

OUR KEY PRIORITIES

Engage with Stakeholders on Burden Reduction Opportunities

Regulatory Burden Task Force

On January 14, 2019, the OSC published OSC Staff Notice 11-784: Burden Reduction, which outlines plans to broadly consult Ontario market participants on ways to further reduce regulatory burden and improve the investor experience. The OSC Task Force will develop a strategy to implement regulatory reduction in policy development and operational activities, identify areas that would benefit from a reduction of any undue regulatory burden and develop proposals to streamline those requirements without reducing investor protection or efficiency of the markets.

Stakeholder engagement, particularly with those most impacted by regulatory burden, is essential to the success of this initiative. Since launching the Task Force, the OSC has encouraged input from investors, market participants, SROs, government and staff, resulting in more than 70 comments and suggestions, as well as the participation of approximately 350 people at the first of three public roundtables on the subject. This input will inform the Task Force's priorities and activities.

Actions will include:

• Continue to gather and assess feedback from all stakeholders through online comment forms, public roundtables, internal engagement efforts, stakeholder outreach and consultation papers

• Determine short--, medium-- and long-term regulatory burden goals, establish measurement criteria and prioritize initiatives of greatest impact

• Implement the plan set out in the CSA Staff Notice 81-329 Reducing Regulatory Burden for Investment Fund Issuers

• Revise and modernize NI 33-109 Registration Information

• Publish a Task Force Report that outlines an action plan and analysis of the expected impacts

Regulatory Burden Initiatives

The following initiatives are planned or underway by the OSC with the CSA:

• Develop a CSA agreed interpretation of what would trigger primary business financial statement requirements in an IPO

• Propose amendments to streamline, eliminate duplication among, and potentially consolidate into one report (both annual and interim), the financial statements, MD&A and AIF

• Consider modifications to the BAR requirements

• Codify exemptive relief routinely granted to facilitate at-the-market offerings and consider whether other changes to liberalize the current approach are appropriate

• Identify opportunities to enhance electronic delivery of documents

• Research and identify an alternative and streamlined offering regime for reporting issuers.

We will continue to enhance the impact analyses we conduct for policy initiatives. Proposed initiatives will be aligned with the OSC's mandate and supported by impact analyses that confirm that the value of the regulatory objectives being sought is proportionate to the expected burden on market participants. The OSC will also conduct more post implementation reviews to confirm achievement of identified expected benefits and that no major impacts were missed from the initial analysis.

Planned Outcomes

• Streamlined regulatory requirements and processes make it easier to participate in Ontario's capital markets

• Timely alignment with international regulatory changes results in reduced reporting burden for market participants

• Investor protection is maintained or strengthened

• Proposed policy proposals are informed by impact analysis

• Improved efficiency and effectiveness of operations results in cost savings and improved resource usage.

Initiate OSC Website Redevelopment

The Commission is faced with an aging communications systems infrastructure. Updates to systems and processes are needed to realize efficiencies, comply with accessibility standards, and adapt to increasing volumes. The OSC will undertake a redevelopment of the OSC website to overhaul service delivery to market participants. The redevelopment will improve stakeholder communications by streamlining content, dramatically enhancing search capability, improving usability and efficiency, and meeting accessibility standards in line with the Accessibility for Ontarians with Disabilities Act web content accessibility guidelines.

Actions will include:

• Complete discovery for content revision and website redevelopment, including a user engagement survey

• Develop and begin implementation of a content revision plan

• Develop a technical strategic plan for design and build of the new website

Planned Outcomes

• Identify content to be revised and removed, with an aim to decrease the size of the OSC website by 50%

• Engage vendors in content revision and website redevelopment.

OUR GOALS

Facilitate Financial Innovation

Rapid changes in financial technology have impacted regulators and the sale/distribution of financial products. Regulators are expected to create an environment that supports emerging financial technology, ensuring investor protection, while creating flexible and proportionate regulatory approaches.

The OSC will continue to develop flexible regulatory approaches to help support fintech innovation in Ontario. This includes creating flexible regulatory frameworks for crypto-asset business models, including initial coin and token offerings; crypto-asset investment funds; corporate finance issuers investing in crypto-assets, digital tokens and/or distributed ledger technology-related businesses; and crypto-asset trading platforms.

Engage with the Fintech/Start-Up Sector

Assist Fintech businesses to understand and meet regulatory requirements to accelerate time-to-market and improve attractiveness of Ontario capital markets.

Actions will include:

• Identify issues and opportunities and integrate learnings gained by working with innovative businesses to modernize regulation, reduce burden, improve regulatory alignment and better support emerging businesses

• Publish a CSA/IIROC consultation paper on the regulatory framework for crypto-asset trading platforms

• Examine the current unit creation process for the ETF market, and specifically the less transparent "actively managed" ETF sector. Incorporate regulatory developments in global ETF markets as input in developing a tailored oversight framework for actively managed ETF in Canada.

Planned Outcomes

• OSC LaunchPad and the CSA Regulatory Sandbox supports development of novel business models, facilitates more timely registration and exemptive relief processes for emerging firms and supports fintech businesses to operate in Ontario and other Canadian jurisdictions

• Greater use of creative regulatory approaches (e.g. limited registration and other exemptive relief) provides an environment for innovators to test their products, services and applications

• Time-to-market of novel fintech businesses is reduced while maintaining appropriate investor safeguards

• Capital formation and innovation supported through OSC LaunchPad as Ontario is viewed as a fintech innovation hub with a positive and supportive environment for investment

• Timely updates on the OSC LaunchPad website reflect any fintech-related notices, news releases or guidance

• Oversight framework for actively managed ETFs responds to identified issues and challenges.

Implement Alternative Funds Regime

Expand investment choices for Ontario investors by supporting and facilitating industry stakeholders to develop and launch innovative structured investment products (e.g. foreign structured notes, ADR-type products) and enable portfolio managers to manage fund assets with more flexibility and efficiency.

Planned Outcomes

• Reduction in alternative fund related exemptive relief requests

• Increased numbers of new alternative funds improve investor choice

• Increase in fund managers offering public funds and funds with asset allocation strategies providing balanced exposure to Alternative Funds.

OUR GOALS

Strengthen Our Organizational Foundation

The OSC regulates and supports an ever-changing and highly competitive financial sector. The OSC faces challenges to regulate behaviour in a rapidly changing and technology-driven environment. To meet these challenges and regulate in a manner that is both sound and efficient requires a strong organizational foundation of people, systems and data management and analytics.

The OSC needs to enhance its workforce by seeking staff with strong data-gathering, intelligence, and analytic capabilities who can proactively identify emerging problems, especially when those problems do not fit established patterns. The OSC faces significant challenges to attract and retain staff with these skills as it operates in a competitive market where demand for people is high.

The OSC needs robust systems to manage high volumes of data and support advanced data analytical techniques to uncover patterns and detect non-compliance. Well organized data combined with the right regulatory approach, can help the OSC prevent and detect non-compliance, define where future resources should be focused and ultimately shape future regulatory strategy. Successfully addressing these challenges will position the OSC to provide efficient and effective regulation that delivers better outcomes.

Implement Strategic Workforce Planning

The OSC will conclude the Strategic Workforce Planning (SWP) Project Pilots.

Actions will include:

• Measure the outcomes against success criteria

• Make recommendations to be incorporated into a broader SWP Framework

• In the framework, integrate multiple sources of workforce, employee, position and financial information to enable improved planning and decision making to support OSC operations.

Planned Outcomes

• Strategic workforce planning is integrated into OSC business operations

• Employment relationships are aligned with organizational and employee needs

• Lower turnover of staff with sought-after skill-sets, time to staff critical roles is reduced

• Staffing tactics and work structures reflect evolving approaches to policy and file work that draws upon multiple skills and expertise.

Continue Redevelopment of National Systems Renewal Program (NSRP)

Redevelopment of the CSA national systems is a critical foundation for the OSC to become a more data analytic focused and evidence-based regulator.

Actions will include:

• Support the CSA initiative to replace the CSA national systems with a modern, accessible, integrated, searchable, secure, robust database and system to deliver capabilities that support existing regulatory requirements and can be easily modified to support the future needs of market participants and regulators

• Amend the systems rule, plus a new CSA Systems Fee Rule

• Complete work on OSC local systems and related processes, workflows and policies to ensure they are aligned with the NSRP national systems when they are launched.

Planned Outcomes

• Successful launch of the NSRP system that meets the needs of the users and is aligned with the OSC local systems

• Improved operational functions and more efficient service delivery to market participants.

Implement First Phase of Market Analysis Platform (MAP)

MAP implementation creates enhanced internal analytical capacity to better conduct insider trading and market manipulation investigations and focused policy research. Access to improved analytical resources reduces investigation timelines and creates capacity to complete more cases.

Actions will include:

• Complete Phase I implementation of MAP.

Planned Outcomes

• Automation of multiple data management processes, thereby increasing data quality accuracy and reliability

• Increased ability to detect market misconduct

• Increased efficiency in terms of quality, reliance and usage of automated reports and queries

• Ability to store a wider breadth and depth of trade related data on a timelier and more standardized basis.

Modernize OSC Technology Platform

The OSC has planned several strategic initiatives to modernize its technology platforms and safeguard information to support new approaches to its regulatory work and improve efficiency in delivering regulatory outcomes.

Data Management Program

The OSC will continue to pursue its Data Management Program (DMP) with integrated NSRP local system requirements. As part of the program, new business systems will be developed that support new approaches to regulatory work and improve efficiency in delivering regulatory outcomes.

Actions will include:

• A new centralized review and case management system for improved regulatory business work-flow management

• A right-sized framework for on-going data governance

• A data management technology stack that includes tools for improved data management and analytics.

Systems Modernization & IT Resilience

Significant IT modernization investments on infrastructure services and enterprise software are planned.

Actions will include:

• New OSC Compliance System

• Enforcement E-Discovery System Replacement

• Additional Data Management & Analytics Tools

• On-going platform currency upgrades and improvements to various internal operational systems

Information Security Program

The OSC will continue to implement an Information Security Program that is aligned with the national Institute of Standards and Technology cybersecurity framework.

Actions will include:

• Improve information security governance

• Improve on-going information security operations and remediation of information security risks

• Implement additional information security tools and technology

• Develop additional policy, procedures and controls

• Continue on-going information security awareness training for all staff.

Planned Outcomes

• Successful implementation of the OSC Data Management Program enables improved management, usage and quality of OSC data

• Implementation of additional tools and technologies facilitates improved data management and analytics

• On-going platform currency and upgrade activities completed as required

• Successful implementation of the Information Security Program results in secure operations of OSC systems and more reliable OSC system up-time.

Build a Data Driven, Evidence Based, Risk Focused Organization

Implementation of a data-driven, evidence-based, risk focused organization will require a clearly defined data strategy, policies and procedures, standards, skilled resources and a shift in culture; as well as visible and active senior management support. The OSC will build its capability to be a data driven, evidence based, risk focused organization.

Actions will include:

• Establish and launch an Enterprise Data Management Office to support a data-driven, evidence-based and risk-focused organization

• Develop and implement a fit-for-purpose data governance framework and approach to data management to enhance the collection, management and analysis of data

• Promote use of enhanced data management and analytics at the OSC to support and inform OSC policy and operations

• Further develop staff expertise to assemble and analyze relevant, reliable, comparable and timely data in a systematic manner.

Planned Outcomes

• Integrated vision, strategy and governance of OSC data management initiatives

• Consistent cross-Commission compliance with data policies, standards and procedures

• Improved data management processes and more focused data collection

• Improved staff efficiency through timely access to accurate, complete and quality data that supports business needs

• Demonstrated use of data in support of priority setting and policy and operational decision-making

• Better service and trend analysis.

BUDGET

Financial Outlook

The OSC is proposing a balanced budget net of recoveries and exclusion of $1.7 million interest charge under IFRS16. The total budgeted revenue of $126.8 million remains unchanged from forecast but is an increase of $6.8 million over the prior year's budget. Forecasted revenue was adjusted for actual experience in 2018-2019. Chargeable filing volumes are expected to decline as a result of the regulatory burden initiative. As plans crystalize, the impact to revenues will be determined. As a result, a reduction in revenues has not been budgeted at this time. Overall operating expenses are expected to increase $5.1 million from forecast primarily driven by incremental salaries and benefits costing $2.9 million and IT maintenance of $2.0 million.

Capital spending on projects is expected to increase $1.7 million from the forecast for new and on-going projects. A non-cash right of use asset for $56.7 million is to be recorded for financing lease arrangements under IFRS16.

|

$000's |

2018-2019 Budget |

2018-2019 Forecast |

2019-2020 Proposed Budget |

Proposed Budget to 2018-19 Budget |

Proposed Budget to 2018-19 Forecast |

||

|

|

|||||||

|

|

|

|

|

$ |

% |

$ |

% |

|

|

|||||||

|

|

|

|

|

Favourable / (Unfavourable) |

|||

|

|

|||||||

|

Revenues |

119,990 |

126,773 |

126,839 |

6,849 |

6% |

66 |

0% |

|

|

|||||||

|

Operating Expenses |

129,446 |

124,328 |

129,443 |

3 |

0% |

(5,115) |

(4%) |

|

|

|||||||

|

Finance Costs (IFRS 16) |

-- |

-- |

1,729 |

(1,729) |

(100%) |

(1,729) |

(100%) |

|

|

|||||||

|

Recovery of Enforcement Costs |

(1,000) |

(2,658) |

(1,000) |

-- |

0% |

(1,658) |

(62%) |

|

|

|||||||

|

Recovery of Investor Education Costs |

(1,530) |

(1,530) |

(1,587) |

57 |

4% |

57 |

4% |

|

|

|||||||

|

Expenses (Net of Recoveries and Finance Costs) |

126,916 |

120,140 |

128,585 |

(1,669) |

1% |

(8,445) |

(7%) |

|

|

|||||||

|

Operating Surplus/(Deficit) |

(6,926) |

6,633 |

(1,746) |

5,180 |

75% |

(8,379) |

(126%) |

|

|

|||||||

|

Capital Additions |

9,948 |

5,552 |

7,244 |

2,704 |

27% |

(1,692) |

(30%) |