Joint CSA and IIROC Staff Notice 23-329 - Short Selling in Canada

Joint CSA and IIROC Staff Notice 23-329 - Short Selling in Canada

The Canadian Securities Administrators (CSA) and the Investment Industry Regulatory Organization of Canada (IIROC and, together with the CSA, we) are publishing Joint Canadian Securities Administrators and Investment Industry Regulatory Organization of Canada Staff Notice 23-329 Short Selling in Canada (Notice) to provide an overview of the existing regulatory landscape surrounding short selling, give an update on current related initiatives and request public feedback on areas for regulatory consideration.

We believe that it is important and timely to review our regulatory framework to ensure it is current and appropriate given the way markets continue to evolve. This Notice reflects our commitment to do so, especially in light of public feedback we received with respect to short selling and international developments, described later in the Notice.

The CSA are also publishing today a summary of comments and responses to the CSA Consultation Paper 25-403 Activist Short Selling (Activist Short Selling Consultation Paper).{1} The Activist Short Selling Consultation Paper was published on December 3, 2020. Its purpose was to facilitate the discussion of concerns relating to activist short selling and its potential impact on capital markets. Some of the comments received in response to the Activist Short Selling Consultation Paper addressed topics broader than activist short selling activities and related to short selling and short selling regulation in general. Similar issues have also been raised by other stakeholders. These comments are summarized in the summary and responses to the Activist Short Selling Consultation Paper and published today in CSA Staff Notice 25-306 Activist Short Selling Update (Staff Notice 25-306). We discuss the broader comments related to short selling in this Notice.

While this Notice does not directly cover the Canadian trade settlement regime, we also discuss, at a high level, failed trades and related initiatives, to provide additional context to the extent that they may relate to short selling.

The Notice is organized as follows:

• Part 1 provides background on short selling and failed trades and includes an overview of existing regulatory requirements relating to short selling; and

• Part 2 includes a discussion of comments and concerns raised by stakeholders that are relevant to short selling and failed trades and sets out specific questions for public feedback.

Part 1. Background on short selling, failed trades, and the regulatory framework

A. Definition of Short Selling

IIROC's Universal Market Integrity Rules (UMIR) define a "short sale"{2} as a sale of a security, other than a derivative instrument, which the seller does not own either directly or through an agent or trustee.{3} It involves selling securities at the current market price either with the expectation of being able to cover the short position by purchasing later at a lower price, thus making a profit, or to lock in a profit arising from a difference in price between the securities sold short and a related security. Short selling is a legitimate trading practice that helps market participants manage risk, contributes to market liquidity and promotes price discovery.

Short selling carries certain risks. For example, a short seller may incur potentially unlimited costs to close the short position if the price of the particular security rises.

B. Definition of Failed Trades

The term "failed trade" is not defined in securities legislation. However, a failed trade is generally understood to occur when a seller (whether short or long) fails to deliver securities or the buyer fails to pay the funds when delivery/payment is due, currently on the second business day after the trade date, unless a later settlement date is agreed to by all parties at the time of the trade. Failed trades may also occur when there are issues with instructions of the buyer and the seller regarding settlement (for example, when there are different instructions from the buyer and the seller, or one party of the trade has not provided instructions or provided them too late). In the context of this Notice, "failed trades", "settlement fails or failures" and "fail to deliver", all mean failure to deliver securities on the settlement date.

UMIR Rule 1.1 defines "failed trade."{4} It includes a short sale by an account that has failed to make available the securities for settlement or has failed to make arrangements with a Participant or Access Person (as defined in UMIR){5} to borrow the securities in time to deliver on the settlement date.

C. Overview of the current short selling regulatory framework

Short selling is subject to a well-developed framework comprising Canadian securities legislation and IIROC requirements and is mostly overseen by IIROC. This framework includes a detailed reporting regime that provides IIROC with timely information which IIROC uses to monitor and supervise potentially inappropriate short selling practices.

i. Canadian securities legislation requirements

Canadian securities legislation requires a person who places an order for the sale of a security with a registered dealer to declare to the dealer at the time of placing the order if they do not own the security.{6}

Securities legislation{7} and National Instrument 23-101 Trading Rules{8} (NI 23-101) prohibit activities that are manipulative and/or deceptive, which could occur in connection with short selling.

ii. IIROC requirements

IIROC has several requirements relevant to short selling applicable to Participants{9} or Access Persons{10} including:

• a requirement to mark all orders representing a short sale as either "short" or "short-marking exempt";{11}

• a requirement to report "Extended Failed Trades" to IIROC;{12}

• a requirement that, if an Extended Failed Trade report is filed with IIROC, further short sales generally cannot be made by that Participant, acting as principal or agent, or by an Access Person without having made prior arrangements to borrow the securities necessary for settlement; {13}

• ability for IIROC to designate a security as a "Pre-Borrow Security";{14} and

• ability for IIROC to designate a security as a "Short Sale Ineligible Security".{15}

UMIR also requires Participants and Access Persons to calculate and report to IIROC the aggregate short positions of each individual account twice a month.{16} IIROC consolidates and publishes a Consolidated Short Position Report showing the aggregate short positions on all listed securities as of the current reporting date and the net change in short positions from the previous reporting date, on a per security basis, on its website.{17} IIROC also aggregates trades marked "short sale" from all marketplaces it monitors, consolidates that information, and publishes a semi-monthly report showing the total industry short sales for each security over the reporting period.{18}

Like securities legislation, UMIR also prohibits activities that are manipulative and/or deceptive. In the context of short selling, these include entering an order for the sale of a security without, at the time of entering the order, having a reasonable expectation of settling any trade that would result from the execution of the order on the settlement date. As such, short selling without having a reasonable expectation to settle the resulting trades on settlement date, generally two days after trade date, is not permitted under UMIR.{19}

On August 17, 2022, IIROC issued guidance confirming the existing obligation of a Participant to have a reasonable expectation to settle a resulting trade on the settlement date, rather than having the expectation to settle the trade on some future date, such as the date securities owned by the seller that are subject to resale restriction become freely tradeable.{20}

IIROC also monitors for potentially abusive trading activity. In the context of short selling activity, IIROC uses algorithms to monitor for unusual levels of short selling coupled with significant price movements and reviews alerts to determine the cause of the price movement and whether there is an indication of abusive trading activities. IIROC may also review social media or chatrooms as well as Extended Failed Trades reports for indications of settlement issues.

IIROC has additional alerts that detect changes in the historical pattern of short selling for a particular security. These alerts allow IIROC to determine if short selling is becoming concentrated within a particular dealer or client. If unusual levels of short selling are detected, IIROC can:

• intervene to vary or cancel any trade deemed "unreasonable";

• impose a halt on the trading of a particular security across all marketplaces;

• contact the listed issuer regarding unusual market activity;

• investigate activity that may not be compliant with UMIR; and

• refer matters to IIROC enforcement for further review and potential discipline.

If appropriate, IIROC may also refer the matter to the enforcement branch of the appropriate CSA jurisdiction for additional investigation and action.

As noted above, IIROC requires Participants to mark all orders representing a short sale as either "short" or "short-marking exempt". This is part of a broader requirement in UMIR that Participants use the correct identifier or designation on an order sent to a marketplace regulated by IIROC.{21} Where there is a missing or erroneous marker or identifier on the order and that order has been executed at least in part, the Participant is required to file a report to the Regulatory Marker Correction System.{22} IIROC reviews its Participants' use of order markers during compliance reviews.

IIROC recently completed a study of failed trades. The study was based on five years (April 1, 2015 -- March 31, 2020) of settlement data from the CDS Clearing and Depository Services Inc. (CDS) related to continuous net settlement (CNS),{23} outstanding positions, buy-ins and trade-for-trade (TFT){24} settlement transactions. IIROC Notice 22-0190 includes the results of IIROC's study and additional discussion of the CNS and TFT processes. In essence, the study identified several considerations:

• potential issues with settlement were not consistent across all listed securities and a "one size fits all" approach may not be appropriate;

• reasons for fails varied amongst dealers and several dealers with similar business models were identified as having disproportionate fails relative to the amount of their trading;

• correlations between short sales and settlement issues in securities listed on exchanges that list junior securities{25} were more significant than on other exchanges;

• securities listed on exchanges that list junior securities experience more overall settlement issues compared to securities listed on other exchanges, especially in the sectors of mining, healthcare, and energy; and

• higher correlation was observed between outstanding failed trades that were intended to settle through the CNS method of settlement and reported short positions than between failed trades that remained outstanding 10 days from settlement date and short positions for trades that were intended to settle through TFT processes.

At Appendix A, we have included a detailed history of IIROC's short selling requirements, a summary of studies that have been conducted over time to assess their continuing adequacy and the rationale supporting why such requirements continue to be included or have been removed.

Part 2. Discussion

A. Overview of comments regarding short selling

It is widely acknowledged that short selling plays an important role in the financial markets by promoting transparency and contributing to liquidity and price discovery, and thus contributing to market integrity and investor protection. Short selling can also be a legitimate investment management strategy used for mitigating portfolio risk by hedging short positions against long positions, so that losses are mitigated regardless of the direction of the market.

Short sellers, particularly activist short sellers who publicly announce that they have a short position in a security, may provide new information about issuers that can assist in ensuring the price of their securities is more reflective of their underlying value. For example, short sellers identify securities they think could be overvalued. Often, after disclosure by activist short sellers, a correction occurs in the market price of these securities. As we described in the Activist Short Selling Consultation Paper, sometimes issuers pursue certain actions in response to short selling campaigns which may include a change in management or hiring a new auditor or private investigator.

However, short selling is not without controversy and some stakeholders hold negative perceptions about short selling or certain aspects of short selling activities. A common theme of concerns expressed is that issuers perceive the Canadian regulatory regime as lax compared to other jurisdictions, especially the U.S., which makes it easier to conduct an activist campaign that unfairly targets Canadian issuers.

As we indicated in the past, and explain in further detail in Appendix A, we believe that Canada's regulatory regime governing short sales is generally consistent with the four principles for the effective regulation of short selling published by the International Organization of Securities Commissions (IOSCO) in 2009.{26} Further, as we concluded in Staff Notice 25-306, we have not received evidence of specific issues arising from activist short selling campaigns that would justify a regulatory response. That said, we acknowledge the comments surrounding short selling in general, some of which have been raised more recently. We discuss the key themes below and invite further feedback from the public.

i. Tick test{27}

The "tick test" was a restriction on the price at which certain types of trades can occur. In the case of short sales subject to the tick test, the sale could not occur at a lower price than the previous trade, subject to limited exceptions.

As explained in more detail in Appendix A, IIROC amended UMIR in March 2012 to repeal the tick test. This was supported by empirical evidence from short sales and failed trade studies in the Canadian market. These studies did not find a relationship between rapid price declines and unusual short selling activity and did not support adopting an alternative uptick rule similar to Rule 201 of the U.S. Securities and Exchange Commission (SEC).{28}

Concerns have been expressed regarding a perceived negative impact that resulted from the repeal of the tick test. Several commenters that provided responses to the Activist Short Selling Consultation Paper recommended that the CSA review the impact that the removal of the tick test has had on the market.

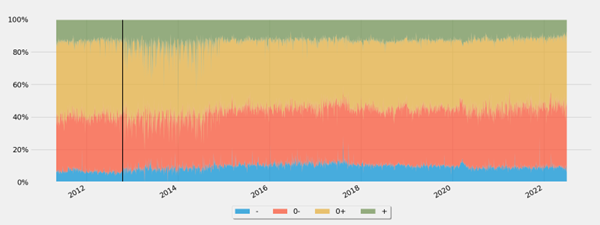

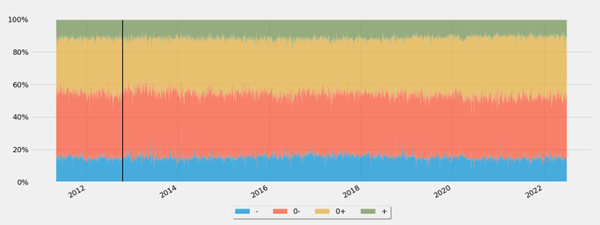

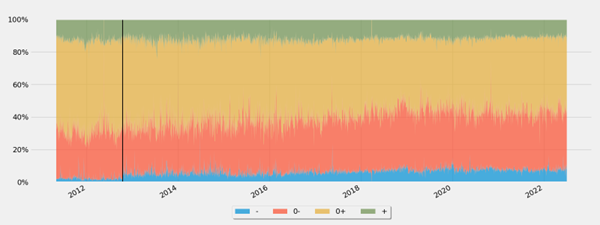

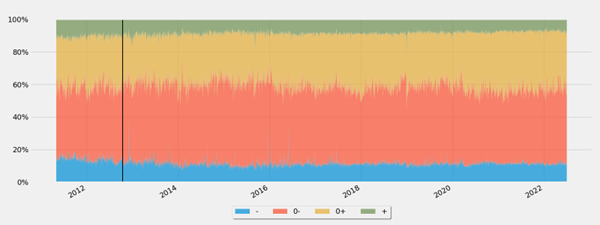

IIROC monitors the proportion of short selling relative to total sales, and the frequency of short sales that are executed on a downtick. Some results of this monitoring are included as Appendix C. These results show that:

• the frequency of short sales executed on downticks when compared to short sales executed on other ticks is relatively low,

• the rates of shorts sales executed on a downtick are lower on exchanges that list junior securities than on other exchanges, and

• on all exchanges, the frequency of trades executed on a downtick is lower on sales from a short position than a long position.

ii. Short selling and pre-borrow requirements

Concerns have been raised that market participants may engage in short selling where they enter short sale orders without an intention to settle the resulting trades on settlement date, purely as a means to drive down the price of an issuer's securities. The short seller fails to deliver the shares on the settlement date and anticipates settling the trade when the securities can be bought at a later date in the open market at a price that is profitable to the seller.

As noted above, there are existing requirements in Canadian securities legislation and UMIR that prohibit manipulative and deceptive activities. UMIR specifies that entering an order to sell a security without having a reasonable expectation of settling the resulting trade on settlement date is considered a false or misleading appearance of trading activity and thus a manipulative and deceptive activity.{29}

As noted earlier, IIROC published guidance on August 17, 2022 clarifying that Participants, before entering a short sale order, must have a reasonable expectation that they have or will have sufficient securities to allow the Participant to settle any resulting trade on the settlement date for that trade.{30} In this notice, IIROC provides examples where a Participant would not be able to demonstrate a reasonable expectation that sufficient shares would be available on settlement date and the entry of the order would be prohibited.

In addition, as described above, IIROC has certain "pre-borrow" requirements that apply, including the restriction on Participants or Access Persons from making further short sales where an Extended Failed Trade report that relates to a sale of a security failing to settle was filed with IIROC. Specifically, further short sales generally cannot be made by that Participant (acting as principal or as agent) or by an Access Person without prior arrangements to borrow the securities necessary for settlement.{31} Participants and Access Persons must also make prior arrangements to borrow any security designated by IIROC as a "Pre-Borrow Security" before entering an order to sell short on a marketplace.{32}

Despite these requirements, views were expressed in response to the Activist Short Selling Consultation Paper that the current requirements in Canada are not stringent enough, especially when compared with those in the U.S. Some stakeholders noted that in the U.S, Regulation SHO requires a broker-dealer to not accept a short sale order in an equity security unless it has (i) borrowed the security or entered into a bona-fide arrangement to borrow the security; or (ii) reasonable grounds to believe that the security can be borrowed so that it can be delivered on the date delivery is due; and (iii) documented compliance with this requirement.{33}

In Ontario, the Ontario Capital Markets Modernization Taskforce (CMM Taskforce) recommended that IIROC revise UMIR to require a Participant to confirm the ability to borrow securities prior to accepting a short sale order from another person or entering an order for its own account.{34}

We ask whether the market has changed to support the introduction of such requirements at this time. In particular, we have the following questions:

Questions:

1. Should the existing regulatory regime around pre-borrowing in certain circumstances be strengthened? What requirements would be appropriate? Specifically, should there be "pre-borrow" requirements similar to those in the U.S., as described above? Please provide supporting rationale and data.

2. What would be the costs and benefits of implementing such requirements?

iii. IIROC's Extended Failed Trades requirements

We have discussed above IIROC's requirements for Participants and Access Persons to report Extended Failed Trades. IIROC also has an anti-avoidance provision to prohibit Participants from entering into a transaction or series of transactions in an attempt to "re-age" the default in order to avoid filing an Extended Failed Trade Report, which would be a violation of the requirement in UMIR 2.1 to trade openly and fairly.{35}

The failed trade is not reportable until ten trading days following the settlement date. This was to allow for administrative delays that may impact settlement and to better identify those transactions of greater concern.

Some concerns have been raised by stakeholders about the ten-trading day threshold. The concern is that this timeline is too long for an unsettled trade to be reported and should be shortened.

Questions:

3. Does the current definition of a "failed trade", as described in Part 1, above, appropriately describe a failed trade?

4. Should a timeline shorter than ten days following the expected settlement date be considered? What would be an appropriate timeline? Please provide rationale and supporting data.

iv. Transparency of short selling positions

We described above how IIROC publicly discloses short positions by publishing the Consolidated Short Position Report twice monthly. In contrast to other jurisdictions (such as the European Union and Australia), there are no regulatory or public reporting requirements or obligations to disclose information on the short position of an individual account. Even so, it is not uncommon for an activist short seller to voluntarily disclose that they are short a particular security when they commence a campaign.

As described in Appendix A, IIROC has conducted extensive consultations on transparency measures that would provide timely information to the market. The Short Sale Trading Statistics Summary Report{36} was introduced in 2013, and in 2016, following additional consultation, IIROC also started publishing the Consolidated Short Position Report{37}, also described in Appendix A. IIROC also publishes the Short Sale Trading Corrections Report{38} twice a month. This report aggregates trade marker corrections affecting short sale traded volume submitted through the Regulatory Marker Correction System.

Comments provided in response to the Activist Short Selling Consultation Paper supporting additional transparency are summarized in Staff Notice 25-306 published today and include recommendations to require the reporting of the identity of short sellers and short positions to the regulator, the public or both. Other comments cautioned that additional transparency could have unintended consequences, such as promoting group behaviour that would drive down a target issuer's stock price.

We are reviewing international initiatives to enhance reporting and disclosure requirements, such as those described in Appendix B of this Notice.

Questions:

5. Should additional public transparency requirements of short selling activities or short positions be considered? Please indicate what such requirements should be and the frequency of any disclosure. Please also provide a rationale and empirical data to support your suggestions or to support why changes are not needed.

6. Should additional reporting requirements regarding short selling activities be considered by the securities regulatory authorities? Please indicate what such requirements should be and the frequency of any disclosure. Please also provide a rationale and empirical data to support your suggestions or to support why changes are not needed.

7. As noted above, IIROC's study of failed trades showed that correlations between short sales and settlement issues in junior securities were more significant, and that junior securities experience more settlement issues compared to other securities. Should specific reporting, transparency or other requirements be considered for junior issuers? Please provide additional relevant details to support your response.

v. Buy-in and close-out requirements

In Canada, eligible debt and equity securities are cleared and deposited through CDSX, the clearing and settlement system of the CDS. CDSX has a Continuous Net Settlement Service (CNS), which is designed to clear and settle primarily equity trades transacted on a Canadian marketplace.

Within CNS, a "buy-in" process enables a buyer in a transaction to accelerate the settlement of outstanding, unsettled CNS positions from its seller(s) which are identified in CDS procedures as "to-receive". Outstanding to-receive CNS positions are those quantities of shares which have failed to settle on the "value date" (the date on which the parties to a trade have agreed that it is to be settled). The buy-in process is initiated when a buyer (i.e. receiver) chooses to enter an "intent to buy-in" outstanding to-receive positions in CDSX against an outstanding quantity of shares owed to them. The participant owing the specified security is provided with a 48-hour notice that they may be held liable to deliver on some or all of their portion of the buy-in security.

The CMM Taskforce, in its Final Report,{39} noted that, in contrast with the U.S.{40} and the European Union{41}, there are no mandatory close-out or buy-in provisions in Canada. The CMM Taskforce recommended that, should a short sale fail to settle, the short seller be subject to a mandatory buy-in. To allow for fails due to administrative issues, the buy-in requirement would be triggered at settlement date +2 days. The CMM Taskforce recommended that the obligation to execute the buy-in rest with the investment dealer and that exemptions be considered for additional activities that may cause a legitimate settlement delay.

Question

8. Would mandatory close-out or buy-in requirements similar to those in the U.S. and the European Union be beneficial for the Canadian capital markets? Please provide rationale and data substantiating the costs and benefits of such requirements on market participants.

Conclusion

As we noted in the past, we are of the view that Canada's regulatory regime governing short sales is generally consistent with the four IOSCO principles for the effective regulation of short selling. However, we are aware of the comments raised by various stakeholders, including the expression of a number of concerns. In this Notice, we seek input on the items discussed above. In addition to answers to the questions set out above, we also seek general comment on other aspects of short selling where stakeholders believe there is room for regulatory initiatives.

Part 3. Comments

Please submit your comments in writing, on or before March 8, 2023. Please send your comments in writing to the following addresses:

Me Philippe Lebel

Secrétaire et directeur général des affaires juridiques

Autorité des marchés financiers

Place de la Cité, tour Cominar

2640, boulevard Laurier, bureau 400

Québec (Québec) G1V 5C1

Télécopieur : 514 864-63811

[email protected]

The Secretary

Ontario Securities Commission

20 Queen Street West, 22nd floor, Toronto, Ontario M5H 3S8

[email protected]

Part 4. Questions

Please refer your questions to any of the following CSA and IIROC staff:

Timothy Baikie Senior Legal Counsel, Market Regulation Ontario Securities Commission [email protected] |

Hanna Cho |

|

Ruxandra Smith |

Serge Boisvert |

|

Roland Geiling |

Jesse Ahlan |

|

Michael Grecoff |

H. Zach Masum |

|

Tyler Ritchie |

Doug Harris |

|

Theodora Lam |

Kevin McCoy |

{1} At https://www.osc.ca/en/securities-law/instruments-rules-policies/2/25-403/csa-consultation-paper-25-403-activist-short-selling.

{2} Section 1.1 of UMIR; see also Policy 1.1 -- Definitions, Part 3 -- Definition of "Short Sale" of UMIR at https://www.iiroc.ca/rules-and-enforcement/umir-rules/11-definitions.

{3} The term "short sale" is used in securities legislation but not defined. See e.g., Securities Act, R.S.O. 1990 as am. S.48, Securities Act (Québec), CQLR, c. V-1.1, section 194 and s. 54 of the Nova Scotia Securities Act, which requires declaration of a short position and describes what is a "short position".

{4} Section 1.1 of UMIR at https://www.iiroc.ca/rules-and-enforcement/umir-rules/11-definitions.

{5} Section 1.1 of UMIR at https://www.iiroc.ca/rules-and-enforcement/umir-rules/11-definitions.

{6} Note for instance section 194 of the Securities Act (Québec), which provides that no person may sell a security short without previously notifying the dealer responsible for carrying out the transaction. See also, Securities Act (Ontario), section 48; NS Act s. 54.

{7} See e.g., Securities Act (Ontario), RSO 1990, c S.5, ss 126.1 and 126.2; Securities Act (Québec), CQLR, V-1.1, ss 195.2, 197, 199.1 and 200; Securities Act (Alberta), RSA 2000, c S-4, ss 93 and 221.1; Securities Act (British Columbia), RSBC 1996, c 418, ss 57 and 168.1; Securities Act (Manitoba), CCSM, c S50, ss 76 and 136(1); The Securities Act (Saskatchewan), 1988 c S-42.2, ss 55.1, 55.11, 55.13(1); NS Act ss. 132A and 132B; and Derivatives Act (Québec), CQLR, I-14.01, ss 150, 151, 152 and 156.

{8} See section 3.1 NI 23-101.

{9} A Participant is defined in the UMIR to include a dealer that is a member of an exchange, a user of a quotation or trade reporting system or a subscriber of an alternative trading system (ATS).

{10} An Access Person is defined in the UMIR as a person other than a Participant that is a subscriber or user of a marketplace.

{11} See UMIR, Part 3 -- Short Selling, Prohibition on the Entry of Orders, at https://www.iiroc.ca/rules-and-enforcement/umir-rules/32-prohibition-entry-orders. A short-marking exempt order includes an order for a security from an arbitrage account, an account of a market maker for that security, or other specified accounts that buy and sell securities and that has at the end of any trading day no more than a nominal long or short position in any security. UMIR, Part 1 -- Definitions and Interpretation, at https://www.iiroc.ca/rules-and-enforcement/umir-rules/11-definitions.

{12} A trade that did not settle and was not rectified within 10 trading days from the original settlement must be reported to IIROC. See: UMIR, Part 7 Trading in a Marketplace -- Extended Failed Trades, https://www.iiroc.ca/rules-and-enforcement/umir-rules/710-extended-failed-trades.

{13} UMIR, Part 6 -- Order Entry and Exposure -- Entry of Orders on Marketplace, at https://www.iiroc.ca/rules-and-enforcement/umir-rules/61-entry-orders-marketplace.

{14} "Pre-Borrow Security" means a security that has been designated by a Market Regulator to be a security in respect of which an order, that on execution would be a short sale, may not be entered on a marketplace unless the Participant or Access Person has made arrangements to borrow the securities that would be necessary to settle the trade prior to the entry of the order. UMIR, Part 1 -- Definitions and Interpretation and UMIR, Policy 1.1, Definition of Pre-Borrow Security at https://www.iiroc.ca/rules-and-enforcement/umir-rules/11-definitions. See also, , UMIR, Part 6 -- Order Entry and Exposure -- Entry of Orders on Marketplace at https://www.iiroc.ca/rules-and-enforcement/umir-rules/61-entry-orders-marketplace.

{15} "Short Sale Ineligible Security" is defined as a security or a class of securities that has been designated by a market regulator to be a security in respect of which an order on execution that would be a short sale may not be entered on a marketplace for a particular trading day or trading days. UMIR, Part 1 -- Definitions and Interpretation, at https://www.iiroc.ca/rules-and-enforcement/umir-rules/11-definitions; see also Rule 3.2 -- Prohibition on the Entry of Orders at https://www.iiroc.ca/rules-and-enforcement/umir-rules/32-prohibition-entry-orders.

{16} UMIR, Part 10 -- Compliance, Report of Short Positions, https://www.iiroc.ca/rules-and-enforcement/umir-rules/1010-report-short-positions.

{17} Consolidated Short Position Report is published twice monthly and based on the short position information submitted to IIROC by Participant and applicable Access Persons.

{18} The Short Sale Trading Statistics Summary Report prepared by IIROC shows the aggregate proportion of short selling in the total trading activity of a particular security, based on data for trades marked "short sale" supplied to IIROC by each marketplace monitored by IIROC. The report is produced twice monthly: (i) for the period from the first to the 15th of each month, and (ii) for the 16th to the end of each month.

{19} See: UMIR, Part 2 -- Abusive Trading, Manipulative and Deceptive Activities, at Part 2 (g) -- (h), at https://www.iiroc.ca/rules-and-enforcement/umir-rules/22-manipulative-and-deceptive-activities.

{20} See: IIROC Notice 22-0130 -- Guidance on Participant Obligations to have Reasonable Expectations to Settle any Trade Resulting from the Entry of a Short Sale Order.

{21} https://www.iiroc.ca/rules-and-enforcement/umir-rules/62-designation-and-identifiers

{22} https://www.iiroc.ca/news-and-publications/notices-and-guidance/marker-corrections-and-use-regulatory-marker-correction-system

{23} Canadian equity marketplaces send a daily report of all transactions directly to CDS. Most of these transactions will be designated to settle through CNS, through a process of novation (where a settlement transaction between two dealers is replaced by two transactions, one between each of the dealers and CDS) and netting.

{24} Some IIROC dealers that are CDS participants can provide settlement instructions directly to CDS. In the TFT mode, settlement occurs directly between two CDS participants.

{25} Exchanges that list junior securities are the TSXV, the Canadian Securities Exchange (CSE) and NEO Exchange (NEO).

{26} See: Regulation of Short Selling -- Final Report, available at https://www.iosco.org/library/pubdocs/pdf/IOSCOPD292.pdf. The first principle: short selling should be subject to appropriate controls to reduce or minimise the potential risks that could affect the orderly and efficient functioning and stability of financial markets; the second principle: short selling should be subject to a reporting regime that provides timely information to the market or to market authorities; the third principle: short selling should be subject to an effective compliance and enforcement regime; and the fourth principle: short selling regulation should allow appropriate exceptions for certain types of transactions for efficient market functioning and development.

{27} The tick test referred to a previous requirement in UMIR that a short sale not be made at a price which is less than the last sale price of the security.

{28} Rule 201 generally requires marketplaces to establish, maintain, and enforce written policies and procedures that are reasonably designed to prevent the execution or display of a short sale at an impermissible price when a stock has triggered a circuit breaker by experiencing a price decline of at least 10 percent in one day (based on the prior day's closing price). Once the circuit breaker in Rule 201 has been triggered, the price test restriction will apply to short sale orders in that security for the remainder of the day and the following day, unless an exception applies.

{29} Part 2 -- False or Misleading Appearance of Trading Activity or Artificial Price of UMIR Policy 2.2 Manipulative and Deceptive Activities.

{30} See: IIROC Notice 22-0130 -- Guidance on Participant Obligations to have Reasonable Expectations to Settle any Trade Resulting from the Entry of a Short Sale Order.

{31} See: UMIR, Part 6 -- Order Entry and Exposure -- Entry of Orders on Marketplace, Rules 6.1(4) and 6.1(6).

{32} "Pre-Borrow Security" means a security that has been designated by a Market Regulator to be a security in respect of which an order, that on execution would be a short sale, may not be entered on a marketplace unless the Participant or Access Person has made arrangements to borrow the securities that would be necessary to settle the trade prior to the entry of the order. UMIR, Policy 1.1, Definition of Pre-Borrow Security, 1.1; See also Part 6 -- Order Entry and Exposure -- Entry of Orders on Marketplace, Rule 6.1(5).

{33} SEC Rule 242.203(b)(1) under Regulation SHO -- Regulation of Short Sales, at Regulations M, SHO, ATS, AC, NMS, and SBSR and Customer Margin Requirements for Security Futures.

{34} At https://files.ontario.ca/books/mof-capital-markets-modernization-taskforce-final-report-en-2021-01-22-v2.pdf.

{35} Subsection 2.1(1)(a) of UMIR 2.1 Specific Unacceptable Activities.

{36} https://www.iiroc.ca/sections/markets/reports-statistics-and-other-information/short-sale-trading-statistics-and-reports

{37} https://www.iiroc.ca/sections/markets/reports-statistics-and-other-information/short-sale-trading-statistics-and-reports

{38} https://www.iiroc.ca/sections/markets/reports-statistics-and-other-information/short-sale-trading-statistics-and-reports

{39} Ibid 34.

{40} In the U.S., Rule 204 Close-out requirement of Regulation SHO, at https://www.ecfr.gov/current/title-17/part-242/subject-group-ECFR1607681c7b4f78d, requires brokers and dealers that are participants of a registered clearing agency to take action to close out fail to deliver positions. The broker-dealer is required to purchase or borrow securities of like kind and quantity by no later than T+3 and, for bona-fide market making activities, by T+5.

{41} This referred to the requirement in Article 15 Buy-in procedures of the EU Short Selling Regulation, at https://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=OJ:L:2012:086:0001:0024:en:PDF, that a central counterparty in a Member State that provides clearing services for shares ensure that, among others, where a natural or legal person who sells shares is not able to deliver the shares for settlement within four business days after the day on which settlement is due, procedures be automatically triggered for the buy-in of the shares to ensure delivery for settlement. It should be noted that this requirement was removed from the regulation in March 2022 until November 2, 2025. See https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32022R1930. On November 10, 2022, the European Parliament published a draft report, at https://www.europarl.europa.eu/doceo/document/ECON-PR-736678_EN.pdf in which it is proposing to dispense with mandatory buy-ins.

APPENDIX A

HISTORY OF SHORT SELLING REGULATION IN CANADA

There has been a steady evolution of short selling regulation in Canada. Beginning in 2002, Market Regulation Services Inc. (RS), a predecessor organization to IIROC, imposed UMIR requirements on Participants{42} to:

• prohibit the short selling of a security on a marketplace unless the price is at or above the last sale price (tick test or tick rule);

• designate orders and trades as short sales on a marketplace; and

• file short position reports.{43}

These requirements reflected short selling rules already in place on exchanges that retained RS to act as regulation services provider.

In the following years, IIROC expanded on these requirements and, among other things{44}, provided specific exemptions{45} from the tick test, consistent with IOSCO's Principles of Short Sale Regulation.{46}

A. Review of Regulatory Regime on Short Selling and Failed Trades in Canada

To ensure the overall effectiveness of regulation of equity trading in Canada, IIROC took the following steps which culminated in the 2008 amendments to UMIR:

i. Strategic Review of the Short Selling Regime in UMIR

IIROC launched a strategic review that included looking at the short selling regime in UMIR{47} by:

• conducting a series of roundtable discussions across Canada{48}, where respondents:

• favoured a prohibition of market manipulation, as opposed to price restrictions on short sales; and

• indicated little support for importing the U.S. pre-borrowing requirements;

• reviewing the academic literature on short selling, which indicated the tick rule was of limited use in arresting market declines and may have a negative impact on price discovery, thus limiting any beneficial impact they may have in preventing market manipulation; and

• reviewing the regulation of short selling and failed trades in other jurisdictions, including the U.S., U.K. and Japan.

ii. Working Group on Short Selling and Failed Trade Issues

RS and the Investment Dealers Association of Canada (IDA), both IIROC's precursors, the CSA and staff from CDS, TSX and the Bourse de Montréal, looked at short selling further and formed a working group on Short Selling and Failed Trade Issues (Working Group).{49} This Working Group monitored regulatory developments in the U.S. including the 2004 SEC SHO Pilot Project{50} which evaluated the effectiveness and necessity of price restrictions (tick test) in short selling. The Working Group also looked at data on failed trades from November 2004 to February 2005 and found the market value of fails in the issues on the "fail list"{51} using the U.S. criteria would account for approximately 12.2% of the market value of all failed trades.{52}

As a result of this work, IIROC questioned whether the benefits of a US-style "fail list" for Canadian markets in 2007 would be commensurate with the costs due to:

• the link between short sales and failed trades in the U.S. was not present in Canada given the presence of uniform short sale restrictions across all Canadian equity marketplaces;

• generally lower rates of trade failure in Canada than the U.S.; and

• the fact that failed trades in securities on the fail list accounted for a limited percentage of the value in failed trades.

iii. 2007 Failed Trade Study{53}

To get data on the prevalence of failed trades, including on the contribution of short sales in the occurrence of failed trades, IIROC conducted a statistical study of failed trades on Canadian marketplaces and published its findings in April 2007 (2007 Failed Trade Study). The 2007 Failed Trade Study results showed that a short sale had a lower probability of failing than trades generally and that the principal reason for trade failures was administrative error. At the time, IIROC concluded that the concepts of short sale regulation and failed trade regulation were distinct and that the measures adopted to address failed trades should be broad enough to encourage timely settlement of trades in all circumstances. As a result, IIROC recommended looking further into:

• eliminating the requirement to file short position reports, or replacing them with summary periodic information on short sales conducted on marketplaces;

• introducing a "failed trade report" that would be filed when an account fails to deliver securities sold by the account within a specified period following settlement date; and

• introducing provisions for a regulation services provider to approve post-trade cancellations and variations.

iv. 2008 Trends Study{54}

As part of IIROC's ongoing commitment to monitor trading activity on equity marketplaces in Canada to ensure that its rules for market integrity are informed by relevant and timely data, IIROC completed a study of trends in trading activity, short selling and failed trades (2008 Trends Study) and published its report in February 2009. The 2008 Trends Study indicated, among other findings, that:

• short sales tended to have a lower volume but higher value than sales from a long position (indicating a concentration of short sale activity in more senior and liquid securities on each of the marketplaces);

• other than the increase in short sales of inter-listed securities, there had been no significant change in the pattern of short selling in comparison with the trading of securities generally; and

• the number of failed trades as a percentage of the overall number of trades had generally declined over the review period.

Findings from the 2008 Trends Study did not support the need in Canada to follow actions on short selling taken at the time by the SEC, including the Regulation SHO proposal.{55}

B. 2008 UMIR Amendments

Results from the body of work described above led to IIROC's decision to amend UMIR with respect to short selling and failed trades in 2008 (2008 UMIR Amendments), which included:

i. Additional restrictions in short selling

IIROC amended UMIR to provide for the ability to prohibit short selling in particular securities or class of securities in real-time (Short Sale Ineligible Security{56}) and respond to developments in trading where rates of failed trades had become excessive.{57}

IIROC also clarified requirements that must be met for a seller to be considered the owner of securities at the time of a sale, including that if a seller has not taken all necessary steps to become legally entitled to the security, the seller would be considered to be making a short sale and the order must be identified accordingly.{58}

ii. Enhanced monitoring of Failed Trades

IIROC required Participants and Access Persons to report "failed trades" where the failure was not resolved within ten trading days following the original settlement date of the trade (EFTR).{59} IIROC also implemented a new web-based reporting system for EFTRs to identify "problem" fails so that IIROC would be able to assess the reasons for the failure and monitor the steps taken to resolve the problem.{60} IIROC also included an anti-avoidance provision to prohibit Participants and Access Persons from entering into a transaction or series of transactions in an attempt to "re-age" the default in order to avoid filing an EFTR, which would be a violation of the requirement to trade openly and fairly in UMIR 2.1.

iii. Enhanced monitoring of Cancelled or Varied Trades

IIROC prohibited the cancellation or variation{61} of a trade unless the variation or cancellation was made by IIROC or with notice to IIROC (TVCR).{62} TVCR reports allowed IIROC to review these changes and ensure that the variation or cancellation is for a bona fide reason and not part of a manipulative or deceptive manner of trading.{63}

IIROC continued to monitor short selling and failed trades and enhanced its surveillance regime to see if further regulatory action would be required. The following measures adopted by IIROC and further studies ultimately led to further amendments in UMIR in 2012:

iv. New Surveillance Alerts

IIROC introduced additional alerts that detected changes in the historic pattern of short selling for a particular security. These alerts allowed IIROC to determine if short selling was becoming concentrated within particular dealers or clients.{64} If unusual levels of short selling were detected, IIROC would also have the ability to:

• intervene to vary or cancel the prices of any trade deemed "unreasonable";

• impose a halt on the trading of a particular security across all marketplaces.{65}

C. Studies Conducted Subsequent to 2008 UMIR Amendments

i. Short Prohibition Study{66}

IIROC continued to monitor against regulatory arbitrage opportunities by undertaking a study (Short Prohibition Study) to evaluate the impact of the CSA orders{67} (Orders), which prohibited short sales of certain financial issuers listed on the TSX that were also listed on an exchange in the U.S. (Restricted Financials). These temporary orders were issued by CSA jurisdictions as a precautionary measure to prevent regulatory arbitrage with respect to short selling of inter-listed financial sector issuers because of initiatives taken by the Securities and Exchange Commission to prohibit short selling of financial sector issuers.

The Short Prohibition Study compared rates of trade failure of Restricted Financials to those of other issuers in the financial sector that were only listed on the TSX (Non-Restricted Financials). The analysis covered the periods before, during, and after the Orders were in effect{68}. IIROC published its findings in February 2009 which indicated the issuance of the Orders:

• did not appear to have had any appreciable effect on the price of securities of either the Restricted Financials or Non-Restricted Financials (both of which performed better than the benchmark index of market performance);

• appeared to have had a significant impact on market quality for the trading of the Restricted Financials by:

• reducing liquidity available in the Restricted Financials; and

• increasing the "spread" for Restricted Financials as measured by the difference between the closing bid and ask prices.

ii. 2011 TSXV Study{69}

To see if short selling activity was the cause or a contributing factor to significant price declines, IIROC conducted and published a multi-year study (2011 TSXV Study) on the relationship between price movement and short sale activity on the TSXV during May 1, 2007 to April 30, 2010, when trading on the TSXV was subject to price restrictions on short sales{70}. IIROC found that the prices and rates of short selling activity tended to move in tandem and that, in periods of most significant price decline, "shorts" were in the market buying securities to cover their positions thereby providing price support.{71} The data from the 2011 TSXV Study also suggested that:{72}

• the steep price decline evidenced between July 2008 and December 2008 was neither caused by nor exacerbated by short selling activity; and

• the tick test was not an effective tool to restrict significant and rapid systemic price declines.

iii. 2011 Trends Study{73}

IIROC also updated its 2008 Trends Study by publishing a multi-year study on trends in trading activity, short sales and failed trades for the period May 1, 2007 to April 30, 2010 (2011 Trends Study). The 2011 Trends Study found that the rates of short sales were relatively constant throughout the period and that rates of trade failure generally declined. Based on the 2011 Trends Study and IIROC's previous empirical studies, IIROC found that the Canadian market did not experience problems with short selling, particularly naked short sales and failed trades that may have been evident in other jurisdictions.

iv. Short Sale Circuit Breaker Study{74}

To determine whether IIROC should consider similar short sale circuit breaker requirements as the SEC at the time, IIROC monitored and reviewed short selling activity on Canadian marketplaces from February 28 to April 29, 2011 in inter-listed securities where a short sale circuit breaker had been triggered in the U.S. Based on IIROC's empirical studies, IIROC did not find a relationship between rapid price declines and unusual short selling activity, and did not find there was evidence of a systemic migration of short selling activity of inter-listed securities to Canadian markets when short sale circuit breakers were in effect in the U.S. IIROC concluded that Canada did not need to adopt the same short sale circuit breaker system and alternative uptick rules similar to the SEC's Rule 201.{75}

D. 2012 UMIR Amendments

Supported by the empirical evidence from the above studies on short sales and failed trades in the Canadian market, IIROC amended UMIR in March 2012 to repeal the tick test (2012 UMIR Amendments).{76} This amendment paralleled the SEC's repeal of price restrictions on short sales that became effective on July 7, 2007, following a multi-year "pilot project" which concluded that price restrictions had no effect on market prices.{77} Before the 2012 UMIR Amendments, IIROC had to provide an exemption from the price restrictions on short sales with respect to securities that were inter-listed on an exchange in the U.S.{78}

Based on IIROC's studies, IIROC believed there were better mechanisms than the tick test to detect and address abusive short selling,{79} and implemented the following new initiatives on short selling and failed trades as part of the 2012 UMIR Amendments:

i. Pre-Borrow Requirements in certain circumstances

While short selling with no reasonable expectation to settle on settlement date was already prohibited as a type of manipulative and deceptive activity under UMIR 2.2{80}, IIROC introduced the following limited pre-borrow requirements in March 2012 that would apply even if there was a reasonable expectation to settle:{81} Participants or Access Persons must make arrangements to borrow the securities necessary for settlement before entering an order for a short sale on a marketplace for a security which has been designated by IIROC as a "Pre-Borrow Security", or where a Participant has filed an EFTR at any time in the past with respect to:

• a client or non-client account:

• the Participant must not sell short any listed securities on a marketplace on behalf of that client or non-client unless:

• the Participant has made arrangements to borrow the securities in order to settle the resulting trade, or

• the Participant is satisfied, after a reasonable inquiry, that the reason for the prior failed trade was not due to any intentional or negligent act of the client or non-client.

• a principal account: the Participant must not sell short that particular security on a marketplace unless:

• the Participant has made arrangements to borrow the securities in order to settle the resulting trade, or

• the Participant obtained IIROC's consent to enter the short sale on a marketplace.

ii. New Short-Marking Exempt Marker

IIROC also took additional steps to enhance its monitoring of short selling by introducing a new short-marking exempt marker{82}, which by identifying trading that is directionally neutral and has a horizon of a day or less, increased IIROC's ability to monitor selling that takes a directional position.

a. Short Sale Transparency Consultations

While the CSA and IIROC believed that the regulatory framework following the 2012 UMIR Amendments governing short selling and failed trades in Canada was generally consistent with IOSCO principles, on March 2, 2012, the CSA and IIROC issued a consultation paper on approaches to transparency of short sales and short positions.{83} The purpose of this consultation paper was to:

• explain the approach taken by a working group of CSA and IIROC staff to issues regarding the regulation of short sales and failed trades;

• provide a background on CSA and IIROC regulation of short sales and failed trades in Canada;

• provide an overview of recent international developments regarding the regulation of short sales and failed trades; and

• solicit feedback on whether further measures are needed or desirable to: (i) enhance the regulatory reporting and transparency of short sales, or (ii) introduce some transparency of failed trades in Canadian markets.

There was no clear consensus among the commenters who responded to the consultation paper that specific improvements were needed; the majority of respondents believed that the current requirements in UMIR, including the 2012 UMIR Amendments, were adequate. The working group concluded that additional measures were not needed or desirable at that time but monitoring of domestic and international developments should continue.{84}

b. Ongoing Review and Surveillance

As part of IIROC's overall strategy on the regulation of short selling and failed trades, IIROC believes in providing greater transparency regarding short selling in a way that would provide timely information to the market. As a result, IIROC began publishing the Short Sale Trading Summary Report in 2013 on its website on a semi-monthly basis.{85} This report sets out the proportion of short sales in the total trading activity of each listed security across all equity marketplaces for each period.{86} While no one data source can provide a "complete" picture of short sale activity or positions, these semi-monthly trading summaries provided timely information in a cost efficient manner and supplemented the information available through the semi-monthly short position reports.{87}

To further understand and explore issues affecting small-cap issuers, IIROC hosted roundtables in 2014{88} and 2016{89}. In order to facilitate discussions at the 2014 roundtable, IIROC reviewed trading data during January 1, 2012 to March 31, 2014 and found that:

• in the period since the repeal of the tick test, the proportion of short sales executed on a downtick increased to 6.58% of short sales, however the vast majority of short sales were still executed on an uptick or zero tick;

• notwithstanding the repeal of the tick test, a short sale is approximately half as likely to execute on a downtick as other sales. Equally interesting was the fact that a short sale is more likely to execute on an uptick than other sales.

As part of the response to the discussions at the 2016 roundtable, IIROC:

• began publishing the Consolidated Short Position Report{90} on its website on a semi-monthly basis to further increase transparency regarding short sales and

• refreshed the 2007 Failed Trade Study and published the 2022 Failed Trading Study to update the information on short selling activity and failed trades in Canada.

{42} Participant is defined in section 1.1 of the UMIR to include a dealer registered in accordance with securities legislation of any jurisdiction and who is: (i) a member of an Exchange; (ii) a user of a QTRS; or (iii) a subscriber of an ATS.

{43} See Appendix B -- Text of the Universal Market Integrity Rules of the Recognition Order of Market Regulation Services Inc., effective February 14, 2002.

{44} For example, IIROC clarified what is considered:

• a short sale and when a person would be considered to own a security (See MIN 2004-020 Sales of Restricted Securities (August 13, 2004), MIN 2004-023 Provisions Respecting Short Sales (August 27, 2004), MIN 2005-028 Sale of Securities Subject to Transfer Restrictions Only in the United States (July 29, 2005), MIN 2006-002 "When Issued" Trading (January 30, 2006), MIN 2006-010 Short Sale Designations and Restrictions (April 7, 2006)

• a short position and reminded Participants and Access Persons how to file short position reports (See MIN 2003-011 Short Position Reports (May 27, 2003) and MIN 2007-022 Short Position Calculation and Reporting (October 29, 2007).

{45} See the exemption for Basis Orders in 2005 (MIN 2005-010 Provisions Respecting a "Basis Order" (April 8, 2005), Closing Price Orders in 2007 (MIN 2007-002 Provisions Respecting Competitive Marketplaces (February 26, 2007), where the sale is undertaken in accordance with the requirement to move the market to execute a trade at a price lower than the prevailing market (MIN 2008-008 Provisions Respecting "Off-Marketplace" Trades (May 16, 2008), for persons with "Marketplace Trading Obligations" (IIROC Notice 11-0251 Provisions Respecting Market Maker, Odd Lot and Other Marketplace Trading Obligations (August 26, 2011)).

{46} In June 2009, IOSCO published a report on the Regulation of Short Selling, which sets out four principles for the effective regulation of short selling. The UMIR exemptions from price restrictions on short sales for market making and arbitrage activities complied with IOSCO's fourth principle which provided that short selling regulation should allow appropriate exceptions for certain types of transactions for efficient market functioning and development. (IIROC Notice 11-0075 Provisions Respecting Regulation of Short Sales and Failed Trades at p17).

{47} See MIN 2004-026 Strategic Review of the Universal Market Integrity Rules (October 4, 2004), MIN 2007-017 Request for Comments -- Provisions Respecting Short Sales and Failed Trades (September 7, 2007) and IIROC Notice 08-0143 Notice of Approval -- Provisions Respecting Short Sales and Failed Trades (October 15, 2008).

{48} RS established a series of roundtable discussions in Montreal, Toronto, Calgary and Vancouver with representatives from buy-side and sell-side firms, marketplaces and law firms (see MIN 2004-026).

{49} MIN 2007-017 -- Request for Comments -- Provisions Respecting Short Sales and Failed Trades (September 7, 2007) at page 11 and IIROC Notice 08-0143 -- Notice of Approval -- Provisions Respecting Short Sales and Failed Trades (October 15, 2008).

{50} See SEC Release No. 34-50104, July 28, 2004 and Economic Analysis of the Short Sale Price Restrictions Under the Regulation SHO Pilot (Securities and Exchange Commission, Office of Economic Analysis, February 6, 2007).

The SHO Study concluded that the removal of price restrictions on the securities included in the Pilot Project had an effect on the mechanics of short selling, order routing decisions, displayed depth and intraday volatility, but on balance has not had a deleterious impact on market quality or liquidity (see also MIN 2007-017 starting on p8).

{51} The Working Group developed a "fail list" using thresholds from Regulation SHO (of average fail positions over a five-day period of 10,000 shares or more that constitute 0.5% or more of the issued and outstanding shares of the issuer). The application of these criteria would have resulted in an average of 30 issuers on the "fails list" in February 2005. (MIN 2007-017 at p12).

{52} MIN 2007-017 -- Request for Comments -- Provisions Respecting Short Sales and Failed Trades (September 7, 2007) and IIROC Notice 08-0143 -- Notice of Approval -- Provisions Respecting Short Sales and Failed Trades (October 15, 2008).

{53} Statistical Study of Failed Trades on Canadian Marketplaces (Market Regulation Services Inc., April 2007).

{54} IIROC Notice 09-0037 Recent Trends in Trading Activity, Short Sales and Failed Trades (February 4, 2009).

{55} See for example, the T+3 close-out requirement introduced by the SEC in 2008 (SEC Release No. 34-58572 (September 17, 2008)).

{56} IIROC Notice 08-0143 Provisions Respecting Short Sales and Failed Trades (October 15, 2008).

{57} For example, IIROC may become aware of systemic failures to settle trades in a particular security or class of securities through its monitoring of failed trade reports, issuances of "buy-in" notices by CDS, increasing proportion of short selling on the marketplace, or unusual price or volume movements, etc. (see IIROC Notice 08-0143 Provisions Respecting Short Sales and Failed Trades (October 15, 2008) at p11).

{58} For example, with respect to the exercise of options, rights or warrants -- all necessary steps include: made any payment required; submitted to the appropriate person any required forms or notices; and submitted, if applicable, to the appropriate person any certificates for securities to be converted, exchanged or exercised. (IIROC Notice 08-0143 at p12-13).

{59} IIROC implemented EFTR requirements for all trades executed on a marketplace and settle through:

• the continuous net settlement facilities (CNS) on June 1, 2011 (IIROC Notice 11-0161 Reminder Regarding the Reporting of Extended Failed Trades (May 19, 2011)) and

• the trade-for-trade ("TFT") facility of CDS on April 15, 2013 (IIROC Notice 13-0014 Implementation Date for Reporting "Trade-for-Trade" Extended Failed Trades (January 14, 2013).

{60} IIROC Notice 11-0075 -- Request for Comments -- Provisions Respecting Regulation of Short Sales and Failed Trades (February 25, 2011) at p7 and IIROC Notice 12-0078 -- Notice of Approval -- Provisions Respecting Regulation of Short Sales and Failed Trades (March 2, 2012).

{61} Variation with respect to price or volume of the trade, or the settlement date for the trade (see UMIR 7.11).

{62} IIROC implemented TVCR requirements on June 1, 2011 (see IIROC Notice 11-0079 Implementation Date for the Reporting of Trade Variations and Cancellations (February 25, 2011).

{63} IIROC Notice 11-0075 -- Request for Comments -- Provisions Respecting Regulation of Short Sales and Failed Trades (February 25, 2011) at p26 and IIROC Notice 12-0078 -- Notice of Approval -- Provisions Respecting Regulation of Short Sales and Failed Trades (March 2, 2012).

{64} IIROC Notice 08-0143 Provisions Respecting Short Sales and Failed Trades (October 15, 2008), IIROC Notice 11-0075 -- Request for Comments -- Provisions Respecting Regulation of Short Sales and Failed Trades (February 25, 2011) and IIROC Notice 12-0078 -- Notice of Approval -- Provisions Respecting Regulation of Short Sales and Failed Trades (March 2, 2012).

{65} IIROC Notice 11-0075- Request for Comments -- Provisions Respecting Regulation of Short Sales and Failed Trades (February 25, 2011) at p7 and IIROC Notice 12-0078 -- Notice of Approval -- Provisions Respecting Regulation of Short Sales and Failed Trades (March 2, 2012).

{66} IIROC Notice 09-0038 -- Impact of the Prohibition on the Short Sale of Inter-listed Financial Sector Issuers (February 4, 2009).

{67} IIROC Notice 08-0098 Reminder Respecting Obligations in the Conduct of Short Sales (September 22, 2008) and IIROC Notice 08-0101 Restated Reminder Respecting Obligations in the Conduct of Short Sales (September 23, 2008). While IIROC Notices 08-0098 and 08-0101 referred to the orders issued by the OSC, other CSA jurisdictions, such as the AMF, ASC and BCSC also issued similar orders on the same terms as the OSC.

{68} The OSC orders were in effect from September 22, 2008 to October 8, 2008.

{69} IIROC, Price Movement and Short Sale Activity -- The Case of the TSX Venture Exchange (February 2011).

{70} During May 1, 2007 and April 30, 2010, no short sale of a particular security could be made at a price less than the last sale price of that security (tick test).

{71} IIROC Notice 12-0078 -- Notice of Approval -- Provisions Respecting Regulation of Short Sales and Failed Trades (March 2, 2012) at p12.

{72} IIROC, Price Movement and Short Sale Activity -- The Case of the TSX Venture Exchange (February 2011).

{73} IIROC Notice 11-0078 Trends in Trading Activity, Short Sales and Failed Trades (February 25, 2011).

{74} IIROC, Review of Trading on Canadian Equity Marketplaces of Inter-listed Securities Subject to the US Short Sale Circuit Breaker (February 2012).

{75} Under Rule 201 of Regulation SHO, if the price of a security declines at least 10% from the closing price on the primary listing market on the previous trading day, a circuit breaker would be triggered and any short sale executed during the balance of that trading day and the next trading day would have to be entered at a price which was at least one trading increment above the current national best bid.

{76} IIROC Notice 12-0078 -- Notice of Approval -- Provisions Respecting Regulation of Short Sales and Failed Trades (March 2, 2012).

{77} IIROC Notice 11-0075-- Request for Comments -- Provisions Respecting Regulation of Short Sales and Failed Trades (February 25, 2011) and IIROC Notice 12-0078 -- Notice of Approval -- Provisions Respecting Regulation of Short Sales and Failed Trades (March 2, 2012).

{78} MIN 2007-014 -- Guidance -- Exemption of Certain Inter-listed Securities from Price Restrictions on Short Sales (July 6, 2007).

{79} IIROC Notice 12-0078 -- Notice of Approval -- Provisions Respecting Regulation of Short Sales and Failed Trades (March 2, 2012) at p5.

{80} Once a Participant or Access Person becomes aware of difficulties in obtaining particular securities to settle a short sale, the Participant would no longer have a "reasonable expectation" of being able to settle a resulting trade and therefore would not be able to enter further short sale orders. Participants or Access Persons who do not have the ability to borrow that security may be precluded from entering short sales. (Ibid. at p10).

{81} Ibid.

{82} Ibid.

{83} Request for Comment -- CSA-IIROC Joint Notice 23-312 Transparency of Short Selling and Failed Trades, March 2, 2012, (2012) 35 OSCB 2099.

{84} CSA/IIROC Joint Notice 23-315 -- Summary of Comments on CSA/IIROC Joint Notice 23-312 -- Request for Comments -- Transparency of Short Selling and Failed Trades, February 28, 2013, (2013) 36 OSCB 1978.

{85} IIROC Notice 13-0020 Issuance of Initial Short Sale Trading Summary (January 21, 2013).

{86} Short Sale Trading Statistics Summary Reports can be found on the IIROC website at https://www.iiroc.ca/sections/markets/reports-statistics-and-other-information/short-sale-trading-statistics-and-reports

{87} IIROC Notice 11-0075 -- Rules Notice -- Request for Comments -- UMIR -- Provisions Respecting Regulation of Short Sales and Failed Trades (February 25, 2011) at p16 and IIROC Notice 12-0078 -- Notice of Approval -- Provisions Respecting Regulation of Short Sales and Failed Trades (March 2, 2012).

{88} IIROC Notice 14-0117 Selected Background Information for the IIROC Venture Market Roundtable (May 6, 2014).

{89} IIROC Notice 16-0240 Summary of Roundtable Discussions on Market Structure Issues Affecting Small-Cap Issuers (October 20, 2016).

{90} IIROC Notice 18-0062 Short Position Calculation and Reporting (March 22, 2018). Consolidated Short Position Reports can be found on the IIROC website at https://www.iiroc.ca/sections/markets/reports-statistics-and-other-information/short-sale-trading-statistics-and-reports

APPENDIX B

INTERNATIONAL REGULATORY INITIATIVES REGARDING DISCLOSURE AND REPORTING OF SHORT SELLING POSITIONS

In Europe, existing disclosure requirements are under review. Specifically, the European Securities and Market Authority (ESMA) published a Consultation Paper -- Review of certain aspects of the Short Selling Regulation{91} in which, among other things, they seek comment on the existing framework for transparency and publication of net short positions. ESMA published its final report to the European Commission on March 22, 2022. This final report proposed amendments to improve ESMA's operation, focused on clarifying the procedures for the issuance of short and long-term bans, ESMA's intervention powers and proposes to enhance its rules against uncovered short sales by introducing record keeping requirements and harmonization of sanctions. It also includes a review of the framework for transparency and the publication of net short position reports.{92}

In the U.S., the Financial Industry Regulatory Authority (FINRA) published a request for comment on potential enhancements to its short selling program, which would include modifications to its short interest reporting requirements.{93} The public comment period, initially set at August 4, 2021, was extended to September 30, 2021. If implemented, such changes would change the frequency and content of information reported to FINRA and the information that would be made publicly available.

Also in the U.S., on November 18, 2021, the SEC published for a 30-day comment period proposed new Exchange Act Rule 10c-1 (proposed Rule 10c-1), which would increase transparency of securities lending transactions. The proposal is to require lenders of securities to provide the material terms of securities lending transactions to a registered national securities association, such as FINRA. FINRA would make some of the information available to the public.{94} On February 25, 2022, the SEC indicated that it reopened the comment period for this proposed Rule 10c-1. The comment period for this proposal ended on April 1, 2022.

On February 25, 2022, the SEC proposed new Exchange Act Rule 13f-2 (proposed Rule 13f-2){95} and amendments to Regulation SHO and to the national market system plan governing the consolidated audit trail to increase market transparency regarding short selling. The proposed Rule 13f-2 and Form SHO would require that institutional money managers file on the SEC's EDGAR system, on a monthly basis, certain short sale related data, some of which would be aggregated and made public. The proposed Form SHO would be filed within 14 calendar days after the end of each calendar month for equity securities that exceed certain thresholds. Such information would include the name of the security, end of month gross short position and daily trading activity that affects a manager's reported gross short position for each settlement date during the calendar month reporting period. The SEC would publish certain information for the securities, including the aggregated gross short position across all reporting institutional money managers. The extended comment period for proposed Rule 13f-2 ended on April 26, 2022.

{91}Available at ESMA Consultation Paper -- Review of certain aspects of the Short Selling Regulation.

{92} See: Review of certain aspects of the Short Selling Regulation -- Final Report, available at https://www.esma.europa.eu/sites/default/files/library/esma70-448-10_final_report_-_short_selling_regulation_review.pdf.

{93} See: Regulatory Notice 21-19 FINRA Requests Comments on Short Interest Position Reporting Enhancements and Other Changes Related to Short Sale Reporting, available at Regulatory Notice 21-19 | FINRA.org.

{94} Fact sheet available at https://www.sec.gov/rules/proposed/2021/34-93613-fact-sheet.pdf.

{95} See: Short Position and Short Activity Reporting by Institutional Investment Managers -- Proposed Rule, available at https://www.sec.gov/rules/proposed/2022/34-94313.pdf.

APPENDIX C

SELECTED RESULTS OF IIROC MONITORING OF SHORT SELLING ON DOWNTICKS

***The vertical line indicates when the tick restrictions were removed***

Fig 1 -- Short Sale Volume Composition by Market Ticks -- TSX, All Securities

Fig 2 -- Long Sale (excluding SME) Volume Composition by Market Ticks -- TSX, All Securities

Fig 3 -- Short Sale Volume Composition by Market Ticks -- TSXV, All Securities

Fig 4 -- Long Sale (excluding SME) Volume Composition by Market Ticks -- TSXV, All Securities

The TSX and TSXV data is provided as a proxy for marketplaces that list junior securities and marketplaces that list senior securities. At the time the tick restriction was moved CSE had limited listings and market activity and NEO had not yet launched. As a result, the data from both CSE and NEO was less informative.