Notice of Multilateral Instrument 32-102 - Registration Exemptions For Non-Resident Investment Fund Managers Companion Policy 32-102CP Registration Exemptions for Non-Resident Investment Fund Managers

Notice of Multilateral Instrument 32-102 - Registration Exemptions For Non-Resident Investment Fund Managers Companion Policy 32-102CP Registration Exemptions for Non-Resident Investment Fund Managers

NOTICE OF MULTILATERAL INSTRUMENT 32-102

REGISTRATION EXEMPTIONS FOR NON-RESIDENT

INVESTMENT FUND MANAGERS

COMPANION POLICY 32-102CP

REGISTRATION EXEMPTIONS FOR NON-RESIDENT

INVESTMENT FUND MANAGERS

July 5, 2012

Introduction

The Ontario Securities Commission, the Autorité des marchés financiers and the Financial Services Regulation Division, Service NL, Government of Newfoundland and Labrador (collectively, we) are implementing Multilateral Instrument 32-102 Registration Exemptions for Non-Resident Investment Fund Managers (the Multilateral Instrument or MI 32-102) and Companion Policy 32-102CP Registration Exemptions for Non-Resident Investment Fund Managers (the Companion Policy or 32-102CP). We refer collectively to the Multilateral Instrument and the Companion Policy as the Instrument.

The purpose of this Notice is to summarize and explain the Instrument as well as the changes made following the publication of the Instrument for comment on February 10, 2012 (the 2012 Proposal). We received and reviewed the 24 comment letters, and thank everyone who provided their input.

MI 32-102 is subject to approvals, including ministerial approvals in Ontario and Québec. Provided all necessary approvals are obtained, MI 32-102 will come into force on September 28, 2012.

Substance and purpose of the Instrument

The Multilateral Instrument and the Companion Policy will apply in Ontario, Québec and Newfoundland and Labrador (collectively, the jurisdictions, and individually, the local jurisdiction) and relate to registration exemptions for persons or companies acting as investment fund managers for one or more investment funds and that

• do not have their head office or their principal place of business in a jurisdiction of Canada (international investment fund managers); and

• do not have a place of business in the local jurisdiction (domestic non-resident investment fund managers).

We refer to international and domestic non-resident investment fund managers, collectively, as non-resident investment fund managers.

The Multilateral Instrument does not require non-resident investment fund managers to register in the local jurisdiction in circumstances where there are no significant connecting factors to the local jurisdiction. Exemptions from the investment fund manager registration requirement are provided, as follows:

• an exemption in circumstances where there are no security holders of any of the investment funds managed by the investment fund manager, or active solicitation, after September 27, 2012, by either the investment fund manager or any of the investment funds it manages, of residents in the local jurisdiction; and

• an exemption, available only to an international investment fund manager without a place of business in Canada, in circumstances where all of the Canadian distribution of the securities of the investment funds managed by the investment fund manager was restricted to permitted clients.

Background

The 2012 Proposal was made following the prior consultation by the Canadian Securities Administrators (the CSA) on October 15, 2010 (the CSA 2010 Proposal). The CSA 2010 Proposal related to amendments to National Instrument 31-103 Registration Requirements, Exemptions and Ongoing Registrant Obligations (NI 31-103) and to Companion Policy 31-103CP Registration Requirements, Exemptions and Ongoing Registrant Obligations on the registration requirement for non-resident investment fund managers.

The CSA 2010 Proposal provided that

• a non-resident international investment fund manager who carries out investment fund management activities from a location outside of Canada would need to register in the relevant province or territory, if the international fund it manages has security holders that are local residents and the international investment fund manager or the fund it manages, has actively solicited local residents to purchase securities of the fund; and

• a domestic investment fund manager who carries out investment fund management activities would also need to register in another province or territory in addition to the province or territory where its head office is located, if the domestic fund has security holders that are local residents and the domestic investment fund manager, or the fund it manages, has actively solicited local residents to purchase securities of the funds.

The CSA 2010 Proposal also provided for certain exemptions from the requirement to register as an investment fund manager.

In Ontario, Québec and Newfoundland and Labrador, we are maintaining the approach initially outlined in the CSA 2010 Proposal, although we give effect to comments received on certain conditions of the then proposed exemptions, such as thresholds.

This continuity reflects our regulatory objective of investor protection. The Instrument is therefore substantially consistent with the CSA 2010 Proposal.

Summary of written comments to the 2012 Proposal

The comment period for the 2012 Proposal ended on April 10, 2012. Copies of the comment letters are posted on the Ontario Securities Commission website at www.osc.gov.on.ca and on the Autorité des marchés financiers website at www.lautorite.qc.ca. A summary of comments on the 2012 Proposal, together with our responses, is contained in Annex A to this Notice.

Summary of changes to the Instrument

We made changes to the Instrument in response to the comments received and to give better effect to our original intent. As these changes are not material, we are not republishing the Instrument for a further comment period. A description of the changes we made to the Instrument is contained in Annex B of this Notice.

Contents of this Notice

This Notice is organized into the following sections:

1. Key issues

(i) Investor protection initiative

(ii) Connecting the non-resident investment fund manager to the local jurisdiction and availability of exemptions

(iii) Notice and information requirements

2. Transition

3. Where to find more information

4. Questions

This Notice also contains the following annexes:

• Annex A Summary of comments and responses on the 2012 Proposal

• Annex B Summary of changes to the Instrument

• Annex C Adoption of the Instrument

• Annex D Multilateral Instrument 32-102 Registration Exemptions for Non-Resident Investment Fund Managers

• Annex E Companion Policy 32-102CP Registration Exemptions for Non-Resident Investment Fund Managers

• Annex F Amendment to Companion Policy 31-103CP Registration Requirements, Exemptions and Ongoing Registrant Obligations

1. Key issues

(i) Investor protection initiative

We believe the registration of non-resident investment fund managers that do not meet the conditions provided in the exemptions in MI 32-102 is an important local investor protection initiative, for the following reasons:

• we think there is no policy rationale for treating investors unequally; in our view, there should be no lessening of investor protection depending on whether the investor has invested in an investment fund managed by a non-resident or a domestic investment fund manager;

• we also think that all investment fund managers participating in our markets should be subject to the same registration regime, as a matter of fairness, when the investment funds which are managed by the investment fund manager have distributed their securities to residents of the local jurisdiction;

• the tests which apply to non-resident investment fund managers as provided in the exemptions in MI 32-102 are objective, bright-line tests with determinative factors, because we believe that non-resident investment fund managers should be in a position to easily determine whether they are required to register or whether they can avail themselves of one of the exemptions in MI 32-102; and

• we have a mandate to register investment fund managers, as prescribed in our legislation, irrespective of the location of the physical place of business of the person or company acting as an investment fund manager and within the parameters of our jurisdictional authority.

(ii) Connecting the non-resident investment fund manager to the local jurisdiction and availability of exemptions

Triggering registration in the case of non-resident investment fund managers will depend on whether the manager acts as an investment fund manager and whether that manager is managing one or more investment funds that have distributed securities to residents of the local jurisdiction. If these two conditions are met, we consider that the registration requirement applies, subject to available exemptions in MI 32-102. 32-102CP provides guidance for determining whether a person or company is acting as an investment fund manager, according to a series of examples of functions and activities that are indicative of investment fund management.

To the extent the person or company is acting as an investment fund manager, the next question is whether the non-resident investment fund manager is managing one or more investment funds that have distributed securities to residents in the local jurisdiction. Whether or not the distribution process is continuous, by way of a prospectus or under a prospectus exemption, is not relevant to this connecting factor, since the investment fund is an issuer over which the regulator in the local jurisdiction has authority.

It is the fact that there has been a distribution to security holders in the local jurisdiction, and not how the distribution was carried out, that connects the non-resident investment fund manager to the jurisdiction. Investors in investment funds managed by non-resident investment fund managers face the same risks as those who invest in local investment funds.

The following are the key questions in order to determine whether registration is required and whether an exemption is available. These questions are in chart form in Appendix A to the Companion Policy.

|

1 |

Is the person or company acting as an investment fund manager? To respond, consider the functions and activities set out in Part 1 Fundamental Concepts of 32-102CP, under the sub-heading Requirement to register as an investment fund manager. If the answer is no, registration as an investment fund manager is not required. |

|

|

|

||

|

2 |

If the person or company is acting as an investment fund manager, have any of the funds managed by the investment fund manager been distributed in the local jurisdiction? If the answer is no, registration as an investment fund manager is not required. |

|

|

|

||

|

3 |

If any of the funds managed by the investment fund manager has been distributed in local the jurisdiction, the registration requirement applies but an exemption may nonetheless be available. |

|

|

|

||

|

4 |

To determine whether an exemption is available, the initial question is whether any of the investment funds managed by the investment fund manager has security holders who are resident of the local jurisdiction. |

|

|

|

||

|

5 |

If there are security holders resident in the local jurisdiction, are these security holders exclusively permitted clients? |

|

|

|

• If so, the exemption in section 4 of MI 32-102 is available provided all conditions are met. |

|

|

|

• If the security holders are not exclusively permitted clients, the exemption in section 3 of MI 32-102 is available only if there has been no any active solicitation since the coming into force of MI 32-102. |

|

Generally, a non-resident investment fund manager will not be required to register if:

• the investment fund no longer has security holders in the local jurisdiction, notwithstanding a distribution of securities in the past;

• the investment fund has security holders in the local jurisdiction but has not actively solicited residents in the local jurisdiction after September 27, 2012;

• the security holders are permitted clients, provided all of the conditions in section 4 are met.

(iii) Notice and information requirements

We are maintaining the notice requirements in MI 32-102 as they were proposed in the 2012 Proposal. The notices are required in connection with the exemption based on permitted clients, as follows:

• notice of reliance on the exemption to the securities regulatory authority, including disclosure of the assets under management attributable to investors in the local jurisdiction;

• notice of regulatory action to the securities regulatory authority regarding disciplinary history, settlement agreements and ongoing investigations of the investment fund manager

• notice to permitted clients indicating that the investment fund manager is not registered in the local jurisdiction together with certain prescribed disclosure; and

In addition, registered international investment fund managers are required to provide notice to investors, starting March 31, 2013, including, in substance, the disclosure required pursuant to section 14.5 of NI 31-103.

2. Transition regime

On July 5, 2012, the CSA members issued parallel orders (the "orders") to extend the transition provisions in the following sections of Part 16 of NI 31-103:

• section 16.5 [Temporary exemption for Canadian investment fund manager registered in its principal jurisdiction]

• section 16.6 [Temporary exemption for foreign investment fund managers]

We have therefore removed the transition provisions which were provided in sections 6 and 7 of MI 32-102. As a result of the orders, domestic non-resident investment fund managers and international non-resident investment fund managers will have a 3 month extension from September 28, 2012 to December 31, 2012 to apply for registration. Please refer to CSA Staff Notice 31-330 Omnibus/Blanket Orders Extending Certain Transition Provisions Relating to the Investment Fund Manager Registration Requirement and the Obligation to Provide Dispute Resolution Services.

3. Where to find more information

The Instrument is available on the following websites:

www.lautorite.qc.ca

www.osc.gov.on.ca

4. Questions

Please refer your questions to any of the following CSA staff:

Mandi EpsteinSenior Legal Counsel, Compliance and Registrant RegulationOntario Securities CommissionTel: 416-593-2397Carlin FungSenior Accountant, Compliance and Registrant RegulationOntario Securities CommissionTel: 416-593-8226Sophie JeanSenior Policy AdviserDirection des pratiques de distribution et des OARAutorité des marchés financiersTel: 514-395-0337, ext. 4786Toll-free: 1-877-525-0337Craig WhalenManager of Licensing, Registration and ComplianceFinancial Services Regulation Division, Service NLGovernment of Newfoundland and LabradorTel: 709-729-5661

ANNEX A

SUMMARY OF COMMENTS AND RESPONSES ON THE 2012 PROPOSAL

This annex summarizes the written public comments received following the publication on February 10, 2012 (the 2012 Proposal) of proposed Multilateral Instrument 32-102 Registration Exemptions for Non-Resident Investment Fund Managers (the Multilateral Instrument or MI 32-102) and proposed Companion Policy 32-102CP Registration Exemptions for Non-Resident Investment Fund Managers (the Companion Policy or 32-102CP).

We have consolidated and summarized the comments and our responses by theme. We do not provide responses to the comments we received that are fact specific. We also do not provide responses to comments relating to topics which are beyond the scope of the 2012 Proposal, including registration fees and exemptions for federally regulated financial institutions outside of Ontario.

In addition, we generally do not respond to the comments previously dealt with in the summary of comments and responses to the amendments proposed by the CSA on October 15, 2010 (the CSA 2010 Proposal) to National Instrument 31-103 Registration Requirements, Exemptions and Ongoing Registrant Obligations (NI 31-103) and Companion Policy 31-103CP Registration Requirements, Exemptions and Ongoing Registrant Obligations related to the registration requirement for non-resident investment fund managers.

Responses to Comments Received

Lack of harmonization

Many commenters expressed disappointment that there is no harmonized instrument for all jurisdictions regarding non-resident investment fund manager registration. A number of the commenters suggested that we should consider adopting the proposed Multilateral Policy 31-202 Registration Requirement for Investment Fund Managers (MP 31-202). We are maintaining the position expressed in the CSA 2010 Proposal and submit that the 2012 Proposal is therefore consistent with investor protection policy objectives contained in the harmonized amendments to NI 31-103 that were published by the CSA.

In addition, we believe that the bright-line tests in MI 32-102, which list exemptions from the investment fund manager registration requirement for non-resident investment fund managers, provide clarity and ease of use for both industry and regulators. We have carefully considered both approaches for the registration of non-resident investment fund managers, and have come to the conclusion that since non-resident investment fund manager registration is an investor protection measure, the presence of investors in the local jurisdiction is clearly a relevant consideration and the 2012 Proposal has the appropriate policy outcome.

Registration Requirement

Registration trigger

Some of the commenters stated that the presence of security holders as a connecting factor to the local jurisdiction is overly expansive and that distribution should not form part of the non-resident investment fund manager registration requirement.

We do not agree. MI 32-102 is an investor protection initiative. Triggering registration in the case of non-resident investment fund managers in the local jurisdictions will depend on whether the manager acts as an investment fund manager and whether that manager is managing one or more investment funds that have distributed securities to residents of the local jurisdiction. If an investment fund has security holders in the local jurisdiction, this gives rise to investment fund management activities in the jurisdiction, including activities reflecting the relationship between the fund, the investment fund manager (who is responsible for directing those activities) and the security holders. Such activities include the delivery of financial statements, calculating net assets values and fulfilling redemption and dividend payment obligations.

There will be significant investor protection concerns if these activities are not properly performed by the investment fund manager and this could, for example, result in incorrect calculation of net asset value, particularly where the investment funds hold hard-to-value investments, and incorrect or untimely preparation of financial statements and reports to security holders. Our view is that where an investment fund manager has an appropriate connection to a jurisdiction, investors should receive protection from these risks regardless of where the investment fund manager is located.

One commenter stated that there should be a clearer distinction between activities that do not trigger the registration requirement (no security holders or no active solicitation) and activities that would otherwise require registration, but are being exempted pursuant to MI 32-102. Please refer to the chart provided in Appendix A to 32-102CP.

Additional investor protection

One of the commenters asked for the rationale for our view that dealer registration requirements and prospectus requirements do not provide the same ongoing protections or address the same risks as MI 32-102.

Our view is that the dealer registration and prospectus requirements do not provide the same ongoing protections or address the same risks of an investment fund manager managing an investment fund for the reasons set out above.

A number of commenters stated that given the investment fund manager registration requirement in NI 31-103 for domestic non-resident investment fund managers, there is no incremental protection in having them register outside of their home province.

Considering the operational risks associated with investment fund manager activities, as outlined above, we disagree that registration of the investment fund manager in the jurisdiction will not increase investor protection. Our view is that the approach taken in MI 32-102 is consistent with the registration of dealers and advisers in each jurisdiction where they trade securities or act as an adviser.

Grandfathering clause

Some commenters have expressed concerns that MI 32-102 will apply retroactively to non-resident investment fund managers that previously solicited investors in the jurisdiction but ceased doing so prior to the coming into force of MI 32-102 and have existing security holders in the jurisdiction.

We have added a grandfathering clause so that a non-resident investment fund manager would not need to register in the jurisdiction if it has not actively solicited clients after September 27, 2012.

Exemptions from the investment fund manager registration requirement

Notice to regulator of reliance on the permitted client exemption

Certain commenters have indicated they are concerned that the notification to the securities regulatory authority of reliance on the permitted client exemption, which requires disclosure of the assets under management attributable to residents of the local jurisdiction, would result in the identification of their clients and that this information could be subject to disclosure under a freedom of information request.

We do not agree. Since the information to be submitted should be based on the total assets under management that are attributable to local residents in the jurisdiction, we do not expect an international investment fund manager to provide us with a breakdown of the total assets under management by individual client. Clients need not be identified in the notice.

Notice to permitted client

Some of the commenters questioned the usefulness of providing a written notice to the permitted client as a condition of the permitted client registration exemption on the basis that the investment fund manager does not have a relationship with security holders of the funds and that the permitted clients are sophisticated and do not require this disclosure.

We believe that the notice to the permitted client is useful, given that investment fund management activities may give rise to investor protection concerns. The notice to permitted clients under MI 32-102 is the same as the notice that is currently required to be provided by international dealers under section 8.18 of NI 31-103 and international advisers under section 8.26 of NI 31-103 and it is our view that for consistency, it should also be provided by non-resident investment fund managers who rely on the permitted client exemption.

Notice of regulatory action

Some of the commenters raised concerns that the notice of regulatory action that is required to be filed by non-resident investment fund managers relying on the permitted client exemption under MI 32-102 is onerous and could result in non-resident investment fund managers prohibiting permitted client investors from investing in their funds. In addition, certain commenters stated that the requirement to file the notice of regulatory action within 10 days will be onerous and may result in incomplete and inaccurate reporting.

We disagree. The required information under the notice of regulatory action is limited to disciplinary history, settlement agreements and ongoing investigations of the investment fund manager and certain related entities with other securities regulators for the past 7 years and does not require any additional information regarding legal actions or other matters.

One of the commenters indicated that there is no definition of the word "parent" in the notice of regulatory action form. The definition of parent has now been added to the form.

Regulatory burden

Limited investment opportunities for investors

Some of the commenters have stated that the increased regulatory burden of an international investment fund manager being required to register in the jurisdiction could deter them from registering and reduce investment choices and opportunities for investors.

The registration requirements for non-resident investment fund managers are similar to those for resident investment fund managers. The investment fund manager category of registration is designed to address risks to investors associated with their investment in an investment fund by imposing regulatory requirements, including capital, insurance, financial reporting and proficiency requirements, which aim to ensure that the investment fund manager has adequate resources to carry out its functions. Where an investment fund manager has an appropriate connection to the jurisdiction, investors should receive protection from these risks. This approach strikes an appropriate balance between providing an efficient system of registration and protecting investors.

In addition, we note that MI 32-102 provides a registration exemption if the securities of the investment fund have been distributed to permitted clients and, as a result, we do not believe that international investment fund managers would be discouraged from making those investors in the jurisdictions aware of their product offerings.

Proficiency and other registration requirements

One of the commenters expressed concerns that the investment fund manager registration requirements related to compliance, proficiency, working capital and insurance could deter non-resident investment fund managers from doing business in the local jurisdiction.

We do not agree, as there are currently many foreign entities registered in other categories of registration that are subject to the registration requirements of NI 31-103, including the proficiency requirements.

Increased complexity and costs

Some commenters suggested that a non-harmonized regulatory landscape in respect of non-resident investment fund manager registration requirements would result in confusion and uncertainty for non-resident investment fund managers and increased compliance costs.

We disagree, as MI 32-102 provides bright-line tests, which make it clear for non-resident investment fund managers whether they must register in the jurisdiction. These bright-line tests have the effect of eliminating any possible confusion about registration requirements in the jurisdiction, since they are well defined and objective. In addition, MI 32-102 provides exemptions from the investment fund manager registration requirement based on clear, determinative conditions.

There are currently many foreign entities registered in other categories of registration that are subject to the registration requirements of NI 31-103, including the proficiency requirement. Our view is that the 2012 Proposal strikes an appropriate balance between providing an efficient system of registration and protecting investors.

Other comments

Fee rule in Ontario

Certain commenters have stated that changes should be made to OSC Rule 13-502 Fees (Rule 13-502), which requires unregistered investment fund managers to pay capital markets participation fees in Ontario. One of those commenters said that Rule 13-502 should only impose capital markets participation fees on non-resident investment fund managers who rely on the permitted client exemption under MI 32-102.

We agree, and OSC Staff will request approval to publish for comment a proposed amendment to the definition of "unregistered investment fund manager", to exclude investment fund managers who have no security holders or no active solicitation in the jurisdiction from the requirement to pay capital markets participation fees in Ontario.

Costs and benefits, alternatives and comment period

Certain commenters stated that the issue of increased costs to investors resulting from MI 32-102 has not been addressed in anticipated costs and benefits in the 2012 Proposal.

We do not agree, as costs and benefits were considered, including in consultation papers, prior to the implementation of the investment fund manager registration category in NI 31-103. The anticipated investor protection benefits of the 2012 Proposal are set out above and would outweigh the costs of the non-resident investment fund manager registration requirement. It is noted that the costs of investment fund manager registration would be reduced through registration exemptions available under MI 32-102.

In addition, some of the commenters indicated that the proposed MP 31-202 should have been considered as an alternative to the 2012 Proposal.

We disagree. While we considered various alternatives within our respective rule-making authority and were aware of the policy position being taken by a number of the other jurisdictions, we were not aware of any appropriate alternatives to deal with non-resident investment fund managers.

Furthermore, one of the commenters questioned the reason for the 60-day comment period for the 2012 Proposal rather than a 90-day comment period.

Since non-resident investment fund manager registration was originally dealt with in the CSA 2010 Proposal with proposed amendments that were the subject of a 90-day comment period, in accordance with statutory requirements, there was no minimum comment period for the 2012 Proposal. A 60-day comment period for a second publication to comment is appropriate and not unusual.

Transition

Some commenters have questioned whether the September 28, 2012 transition period, by which date non-resident investment fund managers would need to apply for registration under MI 32-102, is realistic. We agree. On July 5, 2012, the CSA members issued parallel orders to extend the transition provisions. Non-resident investment fund managers will have until December 31, 2012 to apply for registration under MI 32-102.

List of commenters

• Alternative Investment Management Association

• Blake, Cassels & Graydon LLP

• Borden Ladner Gervais LLP

• Canada Pension Plan Investment Board

• Canadian Bankers Association

• Canadian Imperial Bank of Commerce

• Franklin Templeton Investments Corp.

• GD-1 Management Inc. and Global Digit II Management Inc.

• Greystone Managed Investments Inc.

• IGM Financial Inc.

• Invesco Canada Ltd.

• Investment Advisor Association

• Investment Funds Institute of Canada

• Landry Morin Investment Managers

• Manulife Asset Management Limited

• Nexus Investment Management Inc.

• Orbis Investment Management Limited

• Osler, Hoskin & Harcourt LLP

• Placements Banque Nationale

• Portfolio Management Association of Canada

• RBC Global Asset Management Inc.

• RESP Dealers Association of Canada

• Stikeman Elliot LLP

• Tradex Management Inc.

ANNEX B

SUMMARY OF CHANGES TO THE INSTRUMENT

This annex describes the key changes that we made to proposed Multilateral Instrument 32-102 Registration Exemptions for Non-Resident Investment Fund Managers (the Multilateral Instrument or MI 32-102) and proposed Companion Policy 32-102CP Registration Exemptions for Non-Resident Investment Fund Managers (the Companion Policy or 32-102CP) published for comment on February 10, 2012. Provided all necessary approvals are obtained, the Multilateral Instrument will come into force on September 28, 2012. In this annex, we reference the sections of MI 32-102 except where otherwise indicated.

Exemption from investment fund manager registration in the absence of security holders or active solicitation in the local jurisdiction

We have changed section 3 as follows:

• we have clarified that an investment fund manager may manage one or more investment funds, and that the exemption will only apply if all of the investment funds so managed meet the conditions of the exemption; and

• we have restricted the active solicitation condition in time, thereby "grandfathering" any such solicitation made prior to September 28, 2012.

Exemption from investment fund manager registration in respect of permitted clients

We have clarified in section 4, as in section 3, that an investment fund manager may manage one or more investment funds.

Transition

On July 5, 2012, the CSA members issued parallel orders (the "orders") to extend the transition provisions in the following sections of Part 16 of National Instrument 31-103 Registration Requirements, Exemptions and Ongoing Registrant Obligations:

• section 16.5 [Temporary exemption for Canadian investment fund manager registered in its principal jurisdiction]

• section 16.6 [Temporary exemption for foreign investment fund managers]

We have therefore removed the transition provisions which were provided in sections 6 and 7 of MI 32-102. As a result of the orders, domestic non-resident investment fund managers and international non-resident investment fund managers have until December 31, 2012 to apply for registration. Please refer to CSA Staff Notice 31-330 Omnibus/Blanket Orders Extending Certain Transition Provisions Relating to the Investment Fund Manager Registration Requirement and the Obligation to Provide Dispute Resolution Services.

Changes to 32-102CP

We have clarified the guidance on the registration trigger for non-resident investment fund managers, and have added a chart in a new Appendix A to 32-102CP illustrating the requirement to register as an investment fund manager for those investment fund managers who are non-residents, as well as the availability of the exemptions provided in MI 32-102.

ANNEX C

ADOPTION OF THE INSTRUMENT

The Ontario Securities Commission, the Autorité des marchés financiers and the Financial Services Regulation Division, Service NL, Government of Newfoundland and Labrador (collectively, we) are implementing Multilateral Instrument 32-102 Registration Exemptions for Non-Resident Investment Fund Managers (the Multilateral Instrument or MI 32-102) and Companion Policy 32-102CP Registration Exemptions for Non-Resident Investment Fund Managers (the Companion Policy or 32-102CP).

The Multilateral Instrument will be implemented as a rule in each of Newfoundland and Labrador and Ontario, and as a regulation in Québec. The Companion Policy will be adopted as a policy in each of the jurisdictions of Newfoundland and Labrador, Ontario and Québec.

In Ontario, the Multilateral Instrument and other required materials were delivered to the Minister of Finance on July 3, 2012. The Minister may approve or reject the Rule or return it for further consideration. If the Minister approves the Rule or does not take any further action, the Multilateral Instrument will come into force on September 28, 2012.

In Québec, the Multilateral Instrument is adopted as a regulation made under section 331.1 of the Securities Act (Québec) and must be approved, with or without amendment, by the Minister of Finance. The regulation will come into force on the date of its publication in the Gazette officielle du Québec or on any later date specified in the regulation. It is also published in the Bulletin of the Autorité des marchés financiers.

ANNEX D

MULTILATERAL INSTRUMENT 32-102

REGISTRATION EXEMPTIONS FOR NON-RESIDENT

INVESTMENT FUND MANAGERS

Part 1 Definitions and application

Definitions

1. In this Instrument, "permitted client" has the same meaning as in section 1.1 of National Instrument 31-103 Registration Requirements, Exemptions and Ongoing Registrant Obligations, except that it excludes paragraph (m) and (n) and includes a registered charity under the Income Tax Act (Canada) that obtains advice on the securities to be traded from an eligibility adviser, as defined in section 1.1 of NI 45-106 Prospectus and Registration Exemptions, or an adviser registered under the securities legislation of the jurisdiction of the registered charity.

Application of this Instrument

2. This Instrument applies in Ontario, Québec and Newfoundland and Labrador.

Part 2 Exemptions from investment fund manager registration

No security holders or active solicitation in the local jurisdiction

3. The investment fund manager registration requirement does not apply to a person or company acting as an investment fund manager of one or more investment funds if it does not have a place of business in the local jurisdiction and if one or more of the following apply:

(a) none of the investment funds has security holders resident in the local jurisdiction;

(b) the person or company and those investment funds have not, at any time after September 27, 2012, actively solicited residents in the local jurisdiction to purchase securities of the fund.

Permitted clients

4.

(1) The investment fund manager registration requirement does not apply to a person or company acting as an investment fund manager of one or more investment funds if all securities of the investment funds distributed in the local jurisdiction were distributed under an exemption from the prospectus requirement to a permitted client.

(2) The exemption in subsection (1) is not available unless all of the following apply:

(a) the investment fund manager does not have its head office or its principal place of business in Canada;

(b) the investment fund manager is incorporated, formed or created under the laws of a foreign jurisdiction;

(c) none of the investment funds is a reporting issuer in any jurisdiction of Canada;

(d) the investment fund manager has submitted to the securities regulatory authority in the local jurisdiction a completed Form 32-102F1 Submission to Jurisdiction and Appointment of Agent for Service for International Investment Fund Manager;

(e) the investment fund manager has notified the permitted client in writing of all of the following:

(i) the investment fund manager is not registered in the local jurisdiction to act as an investment fund manager;

(ii) the foreign jurisdiction in which the head office or principal place of business of the investment fund manager is located;

(iii) all or substantially all of the assets of the investment fund manager may be situated outside of Canada;

(iv) there may be difficulty enforcing legal rights against the investment fund manager because of the above;

(v) the name and address of the agent for service of process of the investment fund manager in the local jurisdiction.

(3) A person or company that relied on the exemption in subsection (1) during the 12 month period preceding December 1 of a year must notify the securities regulatory authority in the local jurisdiction, by December 1 of that year, of the following:

(a) the fact that it relied upon the exemption in subsection (1);

(b) for all investment funds for which it acts as an investment fund manager, the total assets under management expressed in Canadian dollars, attributable to securities beneficially owned by residents of the local jurisdiction as at the most recently completed month.

(4) A person or company relying on the exemption in subsection (1) must file with the securities regulatory authority in the local jurisdiction, a completed Form 32-102F2 Notice of Regulatory Action within 10 days of the date on which that person or company began relying on that exemption.

(5) A person or company must notify the securities regulatory authority in the local jurisdiction, of any change to the information previously submitted in Form 32-102F2 Notice of Regulatory Action under subsection (4) within 10 days of the change.

Part 3 Notice to investors by international investment fund managers

Contents of the notice

5. A registered investment fund manager whose head office or principal place of business is not located in Canada must provide or cause to be provided, to security holders with an address of record in the local jurisdiction on the records of each investment fund in respect of which the investment fund manager acts as an investment fund manager, a statement in writing disclosing the following:

(a) the investment fund manager is not resident in the local jurisdiction;

(b) the foreign jurisdiction in which the head office or the principal place of business of the investment fund manager is located;

(c) all or substantially all of the assets of the investment fund manager may be situated outside of Canada;

(d) there may be difficulty enforcing legal rights against the investment fund manager because of the above;

(e) the name and address of the agent for service of process of the investment fund manager in the local jurisdiction.

Part 4 Granting an exemption

Who can grant an exemption

6.

(1) The regulator, except in Québec, or the securities regulatory authority may grant an exemption from this Instrument, in whole or in part, subject to such conditions or restrictions as may be imposed in the exemption.

(2) Despite subsection (1), in Ontario, only the regulator may grant such an exemption.

(3) Except in Ontario, an exemption referred to in subsection (1) is granted under the statute referred to in Appendix B of National Instrument 14-101 Definitions opposite the name of the jurisdiction.

Part 5 When this Instrument comes into force

Effective date

7.

(1) Except as set out in subsection (2), this Instrument comes into force on September 28, 2012.

(2) Section 5 comes into force on March 31, 2013.

FORM 32-102F1 SUBMISSION TO JURISDICTION AND

APPOINTMENT OF AGENT FOR SERVICE FOR INTERNATIONAL INVESTMENT FUND MANAGER

(section 4 [permitted clients])

1. Name of person or company ("International Firm"):

2. If the International Firm was previously assigned an NRD number as a registered investment fund manager or an unregistered exempt international firm, provide the NRD number of the firm.

3. Jurisdiction of incorporation of the International Firm:

4. Address of head office or principal place of business of the International Firm:

5. The name, e-mail address, phone number and fax number of the International Firm's chief compliance officer.

Name:

E-mail address:

Phone:

Fax:

6. Name of agent for service of process (the "Agent for Service"):

7. Address for service of process on the Agent for Service:

8. The International Firm designates and appoints the Agent for Service at the address stated above as its agent upon whom may be served a notice, pleading, subpoena, summons or other process in any action, investigation or administrative, criminal, quasi-criminal or other proceeding (a "Proceeding") arising out of or relating to or concerning the International Firm's activities in the local jurisdiction and irrevocably waives any right to raise as a defence in any such proceeding any alleged lack of jurisdiction to bring such Proceeding.

9. The International Firm irrevocably and unconditionally submits to the non-exclusive jurisdiction of the judicial, quasi-judicial and administrative tribunals of the local jurisdiction in any Proceeding arising out of or related to or concerning the International Firm's activities in the local jurisdiction.

10. Until 6 years after the International Firm ceases to rely on section 4 [permitted clients], the International Firm must submit to the securities regulatory authority

a. a new Submission to Jurisdiction and Appointment of Agent for Service for International Investment Fund Manager in this form no later than the 30th day before the date this Submission to Jurisdiction and Appointment of Agent for Servicefor International Investment Fund Manager is terminated; and

b. an amended Submission to Jurisdiction and Appointment of Agent for Service for International Investment Fund Manager no later than the 30th day before any change in the name or above address of the Agent for Service.

11. This Submission to Jurisdiction and Appointment of Agent for Service for International Investment Fund Manager is governed by and construed in accordance with the laws of the local jurisdiction.

Dated: ____________________________________

__________________________________________

(Signature of the International Firm or authorized signatory)

__________________________________________

(Name and Title of authorized signatory)

Acceptance

The undersigned accepts the appointment as Agent for Service of (Insert name of International Firm) under the terms and conditions of the foregoing Submission to Jurisdiction and Appointment of Agent for Service for International Investment Fund Manager.

Dated: ____________________________________

__________________________________________

(Signature of Agent for Service or authorized signatory)

__________________________________________

(Name and Title of authorized signatory)

FORM 32-102F2 NOTICE OF REGULATORY ACTION

(section 4 [permitted clients])

Definitions

Parent-- a person or company that directly or indirectly has significant control of another person or company.

Significant control -- a person or company has significant control of another person or company if the person or company:

• directly or indirectly holds voting securities representing more than 20 per cent of the outstanding voting rights attached to all outstanding voting securities of the other person or company, or

• directly or indirectly is able to elect or appoint a majority of the directors (or individuals performing similar functions or occupying similar positions) of the other person or company.

Specified affiliate -- a person or company that is a parent of a firm, a specified subsidiary of a firm, or a specified subsidiary of a firm's parent.

Specified subsidiary -- a person or company of which another person or company has significant control.

All of the questions below apply to any jurisdiction and any foreign jurisdiction. The information must be provided in respect of the last 7 years.

1. Has the firm, or any predecessors or specified affiliates of the firm entered into a settlement agreement with any financial services regulator, securities or derivatives exchange, self-regulatory organization (SRO) or similar agreement with any financial services regulator, securities or derivatives exchange, SRO or similar organization?

|

Yes _____ |

No _____ |

If yes, provide the following information for each settlement agreement:

Name of entity

Regulator/organization

Date of settlement (yyyy/mm/dd)

Details of settlement

Jurisdiction

2. Has any financial services regulator, securities or derivatives exchange, SRO or similar organization:

|

|

Yes |

No |

|

|

||

|

(a) Determined that the firm, or any predecessors or specified affiliates of the firm violated any securities regulations or any rules of a securities or derivatives exchange, SRO or similar organization? |

|

|

|

|

||

|

(b) Determined that the firm, or any predecessors or specified affiliates of the firm made a false statement or omission? |

|

|

|

|

||

|

(c) Issued a warning or requested an undertaking by the firm, or any predecessors or specified affiliates of the firm? |

|

|

|

|

||

|

(d) Suspended or terminated any registration, licensing or membership of the firm, or any predecessors or specified affiliates of the firm? |

|

|

|

|

||

|

(e) Imposed terms or conditions on any registration or membership of the firm, or predecessors or specified affiliates of the firm? |

|

|

|

|

||

|

(f) Conducted a proceeding or investigation involving the firm, or any predecessors or specified affiliates of the firm? |

|

|

|

|

||

|

(g) Issued an order (other than en exemption order) or a sanction to the firm, or any predecessors or specified affiliates of the firm for securities or derivatives-related activity (e.g. cease trade order)? |

|

|

If yes, provide the following information for each action:

|

Name of Entity |

|

|

|

|

|

Type of Action |

|

|

|

|

|

Regulator/organization |

|

|

|

|

|

Date of action (yyyy/mm/dd) |

Reason for action |

|

|

|

|

Jurisdiction |

|

3. Is the firm aware of any ongoing investigation of which the firm or any of its specified affiliates is the subject?

|

Yes _____ |

No _____ |

If yes, provide the following information for each investigation:

Name of entity

Reason or purpose of investigation

Regulator/organization

Date investigation commenced (yyyy/mm/dd)

Jurisdiction

Name of firm

Name of firm's authorized signing officer or partner

Title of firm's authorized signing officer or partner

Signature

Date (yyyy/mm/dd)

Witness

The witness must be a lawyer, notary public or commissioner of oaths.

Name of witness

Title of witness

Signature

Date (yyyy/mm/dd)

ANNEX E

COMPANION POLICY 32-102CP

REGISTRATION EXEMPTIONS FOR NON-RESIDENT

INVESTMENT FUND MANAGERS

Part 1 Fundamental concepts

Introduction

Purpose of this Companion Policy

This Companion Policy sets out how the Ontario Securities Commission, the Autorité des marchés financiers and the Financial Services Regulation Division, Service NL, Government of Newfoundland and Labrador (collectively, we) interpret or apply the provisions of Multilateral Instrument 32-102 Registration Exemptions for Non-Resident Investment Managers (MI 32-102) and related securities legislation.

MI 32-102 applies in Ontario, Québec and Newfoundland and Labrador.

Appendix A contains a chart illustrating the requirement to register as an investment fund manager for those investment fund managers who are non-residents, as well as the availability of the exemptions provided in MI 32-102.

Numbering system

Except for Part 1, the numbering of Parts and sections in this Companion Policy correspond to the numbering in MI 32-102. Any general guidance for a Part appears immediately after the name of the Part. Any specific guidance on sections in MI 32-102 follows any general guidance. If there is no guidance for a Part or section, the numbering in this Companion Policy will skip to the next provision that does have guidance.

All references in this Companion Policy to sections and Parts are to MI 32-102, unless otherwise noted.

Definitions

Unless defined in MI 32-102, terms used in MI 32-102 and in this Companion Policy have the meaning given to them in the securities legislation of each jurisdiction or in National Instrument 14-101 Definitions.

In this Companion Policy "regulator" means the regulator or securities regulatory authority in a jurisdiction.

This guidance applies to investment fund managers

• that do not have their head office or their principal place of business in a jurisdiction of Canada (international investment fund managers); and

• that are domestic investment fund managers which do not have a place of business in the local jurisdiction (domestic non-resident investment fund managers).

We refer to international and domestic non-resident investment fund managers, collectively, as non-resident investment fund managers.

Requirement to register as an investment fund manager

An investment fund manager is required to register if it directs or manages the business, operations or affairs of one or more investment funds. Some of the functions and activities that an investment fund manager directs, manages or performs include:

• establishing a distribution channel for the fund

• marketing the fund

• establishing and overseeing the fund's compliance and risk management programs

• overseeing the day-to-day administration of the fund

• retaining and liaising with the portfolio manager, the custodian, the dealers and other service providers of the fund

• overseeing advisers' compliance with investment objectives and overall performance of the fund

• preparing the fund's prospectus or other offering documents

• preparing and delivering security holder reports

• identifying, addressing and disclosing conflicts of interest

• calculating the net asset value (NAV) of the fund and the NAV per share or unit

• calculating, confirming and arranging payment of subscriptions and redemptions, and arranging for the payment of dividends or other distributions, if required

Where to register as an investment fund manager

(a) Investment fund managers with a place of business in the local jurisdiction

An investment fund manager is required to register in the local jurisdiction if it directs or manages the business, operations or affairs of one or more investment funds from a place of business in that jurisdiction.

(b) Non-resident investment fund managers

Triggering registration in the case of non-resident investment fund managers in a local jurisdiction depends on whether

(i) the person or company acts as an investment fund manager; and

(ii) that manager is managing one or more investment funds that distribute or have distributed securities to residents of the local jurisdiction

To the extent the person or company is acting as an investment fund manager, the next question is whether the non-resident investment fund manager is managing one or more investment funds that have distributed securities to residents in the local jurisdiction.

If one or more of the investment funds managed by the investment fund manager have security holders in the local jurisdiction, this gives rise to investment fund management activities in such jurisdiction, including activities reflecting the relationship between the fund, the investment fund manager (who is responsible for directing those activities), and the security holders. Such activities include the delivery of financial statements and other periodic reporting, calculating net asset values and fulfilling redemption and dividend payment obligations.

Whether or not the distribution process is continuous, by way of a prospectus or under a prospectus exemption, is not relevant to this connecting factor, since the investment fund is an issuer over which the regulator in the local jurisdiction has authority. The actual distribution of the investment fund's securities is subject to dealer registration and prospectus requirements.

It is the fact that there has been a distribution to holders in the local jurisdiction, and not how the distribution was carried out, that connects the non-resident investment fund manager to the jurisdiction in the regulatory perspective of investor protection. Investors in investment funds managed by non-resident investment fund managers face the same risks as those who invest in local investment funds.

Part 2 Exemptions from investment fund manager registration

3. No security holders or active solicitation

General

Generally, a non-resident investment fund manager will not be required to register if:

• the investment fund no longer has security holders in the local jurisdiction, notwithstanding a distribution of securities in the past;

• the investment fund has security holders in the local jurisdiction but has not actively solicited residents in the local jurisdiction after the coming into the force of MI 32-102;

• the security holders are permitted clients.

Conditions of the exemption

An investment fund manager that does not have a place of business in the local jurisdiction is exempt from the investment fund manager registration requirement if there are no security holders of any of the investment funds managed by it who are resident in that jurisdiction or there is no active solicitation by the investment fund manager or any of the investment funds in that jurisdiction.

Active solicitation

One of the conditions of this exemption is that the investment fund manager and the investment funds it manages have not, after September 27, 2012, actively solicited the purchase of the funds' securities by residents in the local jurisdiction. Active solicitation refers to intentional actions taken by the investment fund or the investment fund manager to encourage a purchase of the fund's securities, such as pro-active, targeted actions or communications that are initiated by an investment fund manager for the purpose of soliciting an investment.

Actions that are undertaken by an investment fund manager at the request of, or in response to, an existing or prospective investor who initiates contact with the investment fund manager would not constitute active solicitation.

Examples of active solicitation include:

• direct communication with residents of the local jurisdiction to encourage their purchases of the investment fund's securities

• advertising in Canadian or international publications or media (including the Internet), if the advertising is intended to encourage the purchase of the investment fund's securities by residents of the local jurisdiction (either directly from the fund or in the secondary/resale market)

• purchase recommendations being made by a third party to residents of the local jurisdiction, if that party is entitled to be compensated by the investment fund or the investment fund manager, for the recommendation itself, or for a subsequent purchase of fund securities by residents of the local jurisdiction in response to the recommendation.

Active solicitation would not include:

• advertising in Canadian or international publications or media (including the Internet) only to promote the image or general perception of an investment fund

• responding to unsolicited enquiries from prospective investors in the local jurisdiction

• the solicitation of a prospective investor that is only temporarily in the local jurisdiction, such as in the case where a resident from another jurisdiction is vacationing in the local jurisdiction.

4. Permitted clients

An investment fund manager that does not have its head office or its principal place of business in Canada is exempt from the investment fund manager registration requirement if it only distributes the securities of its investment funds in the local jurisdiction to permitted clients and certain other conditions set out in subsection 4(2) are satisfied.

If an investment fund manager is relying on the exemption, it must provide an initial notice by filing a Form 32-102F1 Submission to Jurisdiction and Appointment of Agent for Service for International Investment Fund Manager (Form 32-102F1) with the regulator in the local jurisdiction. If there is any change to the information in the investment fund manager's Form 32-102F1, the investment fund manager must update it by filing a replacement Form 32-102F1 with the regulator in the local jurisdiction. So long as the investment fund manager continues to rely on the exemption, it must file an annual notice with the regulator in the local jurisdiction. Subsection 4(3) does not prescribe a form of annual notice. An e-mail or letter will therefore be acceptable.

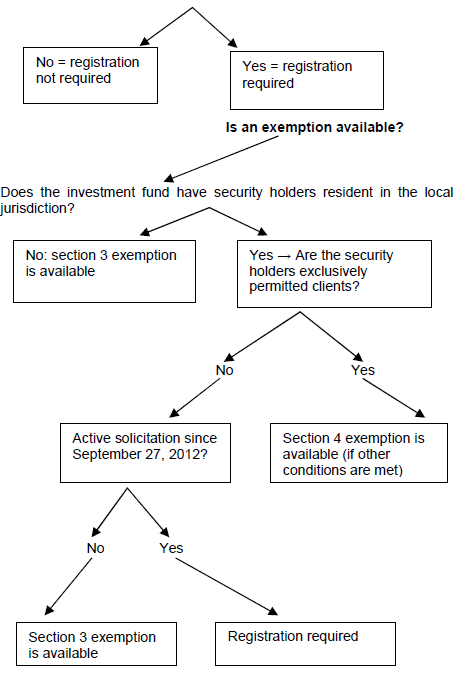

APPENDIX A -- chart illustrating the non-resident investment fund manager registration requirement

and the availability of exemptions

The following chart illustrates the requirement to register as an investment fund manager for those investment fund managers who are non-residents, as well as the availability of the exemptions provided in MI 32-102.

Is the person acting as an investment fund manager?

To respond, consider the following functions and activities

• establishing a distribution channel for the fund

• marketing the fund

• establishing and overseeing the fund's compliance and risk management programs

• overseeing the day-to-day administration of the fund

• retaining and liaising with the portfolio manager, the custodian, the dealers and other service providers of the fund

• overseeing advisers' compliance with investment objectives and overall performance of the fund

• preparing the fund's prospectus or other offering documents

• preparing and delivering security holder reports

• identifying, addressing and disclosing conflicts of interest

• calculating the net asset value (NAV) of the fund and the NAV per share or unit

• calculating, confirming and arranging payment of subscriptions and redemptions, and arranging for the payment of dividends or other distributions, if required

If not an investment fund manager = registration is not required

If an investment fund manager, has the fund distributed securities in the local jurisdiction?

ANNEX F

AMENDMENT TO COMPANION POLICY 31-103CP

REGISTRATION REQUIREMENTS, EXEMPTIONS AND ONGOING REGISTRANT OBLIGATIONS

Section 7.3 [Investment fund manager category] is amended by adding the following new paragraph after the first paragraph under the heading "7.3 Investment fund manager category":

"For additional guidance on the investment fund manager registration requirement in Alberta, British Columbia, Manitoba, Nova Scotia, New Brunswick, Northwest Territories, Nunavut, Prince Edward Island, Saskatchewan and Yukon see Multilateral Policy 31-202 Registration Requirement for Investment Fund Managers and in Newfoundland and Labrador, Ontario and Québec see Multilateral Instrument 32-102 Registration Exemptions for Non-Resident Investment Fund Managers and Companion Policy 32-102CP Registration Exemptions for Non-Resident Investment Fund Managers.