Registration Information Amendments (Commodity Futures Act) - December 16, 2021 - Appendix A – Summary of Notable Changes to the OSC Proposals

Registration Information Amendments (Commodity Futures Act) - December 16, 2021 - Appendix A – Summary of Notable Changes to the OSC Proposals

This appendix summarizes the notable changes to the OSC Proposals. In addition to the changes summarized in this appendix, the OSC Amendments also include technical drafting changes and clarifications.

Reportable activities

The OSC Proposals provided that there would be six categories of Outside Activities that are reportable to regulators:

- Activities with another registered firm

- Activities with an entity that receives compensation from another registered firm for the Registrant’s registrable activity

- Other securities-related activities

- Provision of financial or finance-related services

- Positions of influence

- Specified activities.

Based on comments received, we have made the following revisions:

- We have removed the requirement to report Category 6 [Specified activities] to the Commission on the basis that Categories 1 to 5 allow the Commission to receive the information necessary to carry out its regulatory role. Although activities that fall within Category 6 are no longer reportable to the Commission{1}, firms are responsible for conflicts of interest arising from all Outside Activities (even if they are not reportable to us) and for ensuring their registered individuals have sufficient time to perform the registrable activity and properly service clients, and to maintain their proficiency.

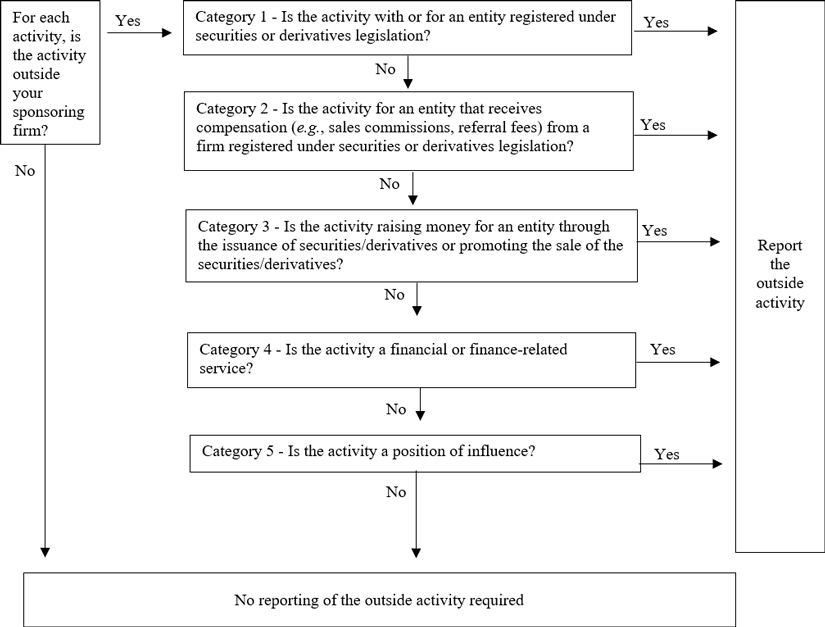

- We have also revised Appendix C of the Companion Policy to OSC Rule 33-506 (Commodity Futures Act) Registration Information, which illustrates the analysis on whether an activity outside of the sponsoring firm is reportable, to reflect the removal of Category 6 and have reproduced it below.

- We have clarified the following:

- Firms are required to identify and address material conflicts of interest arising from the Registrants’ Outside Activities and these Outside Activities may not be limited to those reportable to the securities regulatory authorities.

- An individual’s activity with an affiliated entity is a reportable Outside Activity if it falls within Categories 1 to 5.

- The description of the activities that fall within Category 4 [Provision of financial or finance-related services].

- Volunteer activities are not reportable, unless they fall within Categories 1 to 5.

Reporting deadlines

We published proposals to extend some reporting deadlines such that Registrants would be required to submit registration information generally either within 15 days or 30 days. However, we did not propose changes to the reporting deadlines for changes in an individual’s status, such as becoming a permitted individual or ceasing to be an Individual Registrant, which are reportable within 10 days of the change in status.

Based on the feedback received that three different reporting deadlines would add complexity and increase the likelihood of errors, we changed the deadline to report becoming a permitted individual or ceasing to be an Individual Registrant to 15 days, such that there are generally two reporting deadlines – 15 days or 30 days. A longer reporting period does not raise regulatory risk when an individual ceases to have authority as an Individual Registrant and we are aware through other regulatory filings of when an individual will become a permitted individual.

As a result of this change, we have made a consequential change to extend the deadline for the registered firm to provide an Individual Registrant with a copy of Form 33-506F1 Notice of End of Individual Registration or Permitted Individual Status (Notice of Cessation) from 10 days to 15 days. This change is necessary to align the firm’s filing deadline of the Notice of Cessation with the Commission. Otherwise, in certain circumstances, the registered firm would be required to provide the Individual Registrant with the Notice of Cessation before the registered firm is required to file it with the Commission.

Common errors and updated certificate requirements

The OSC Proposals included changes to address the receipt by the Commission of Registration Forms that are incomplete and/or inaccurate because

- the registration information requirement is unclear,

- despite the certification requirement, the Registrant is not carefully completing the Registration Form,

- the Registrant does not understand the registration information requirements,

- the sponsoring firm, who is required to have discussed the Registration Form with the Individual Registrant, is not providing adequate support, and/or

- the Registrant is not being forthright.

The OSC Proposals also make changes to address areas of the Individual Registration Form that are more likely to be filled out incorrectly.

After considering the comments received and the results of the test conducted, we have made the following revisions:

- As criminal disclosures are reported in a different section of the form, we have decided not to amend Item 12.3 of Form 33-506 Registration of Individuals and Review of Permitted Individuals (33-506 Individual Registration Form).Individual Registrants will continue to be required to report resignations or terminations when at the time of resignation or termination, there was an allegation that the Individual Registrant committed fraud or the wrongful taking of property, including theft.

- We have removed the requirement in Item 12 of the 33-506 Individual Registration Form to report resignations and terminations following allegations that the Individual Registrant violated, or failed to appropriately supervise compliance with, the rules or bylaws or standards of conduct of an industry association.

- We have further revised the language in Item 16 of the 33-506 Individual Registration Form to clarify that Individual Registrants are required to report bankruptcies no matter how long ago the bankruptcy occurred.

- We have amended section 2.3 of OSC Rule 33-506 to clarify when an Individual Registrant’s NRD record is up-to-date so that Form 33-506 Reinstatement of Registered Individuals and Permitted Individuals may be used and have provided guidance in Annex C of the CSA Notice relating to when Individual Registrants should review and respond to items in NRD that read “there is no response to this question”.

- We have added instructions in Item 13.3 of the 33-506 Individual Registration Form to make clear that only registration and licences that involve dealing with the public are to be disclosed.

- Where education and course information are to be reported, we have further clarified that only those required for the registration categories or IIROC approval should be disclosed.

- We have clarified that reporting securities experience applies to certain supervisors and have included instructions for applicants seeking registration as advising representatives limited to client relationship management.

Regulatory burden of certain reporting requirements

In the OSC Proposals, to address concerns that some specific registration information requirements may create a disproportionate reporting burden relative to their original purpose, we proposed changes to:

- Reduce the requirement for reporting changes in percentage ownership on an ownership chart to when the percentage ownership exceeds or falls below 10%, 20% or 50%;

- Provide a mechanism for a registered firm to delegate to another registered firm the requirement to notify the Director of changes in certain registration information;

- Remove the requirement to report a change in the expiry date of a registered firm’s insurance policy where the insurance policy has not lapsed and there have been no other changes to the insurance policy;

- Provide additional guidance on changes in litigation to be reported; and

- Remove the requirement that the Form 33-506F6 Firm Registration be witnessed.

We continue to believe these changes will reduce the burden on Registrants, without impacting the Commission’s ability to oversee Registrants. However, based on the comments received, we have clarified certain aspects of these changes, including:

- In relation to delegating reporting to an authorized affiliate, we have clarified that the certificate of the delegation is only required to be filed once, unless there is a change to the authorized affiliate and in that case, an updated certificate should be filed.

- We have revised the guidance on reporting status updates to litigation to provide more details.

Collecting information on professional titles

The OSC Proposals introduced a new requirement for Individual Registrants to report to the Commission the titles they use.

We acknowledge the comments received suggesting alternative ways for regulators to collect this information, but have maintained the information requirement for Individual Registrants to report their titles. This information implements the CSA’s oversight for the new section 13.18 of NI 31-103 introduced as part of the Client Focused Reforms that prohibits Registrants from holding out their services in any manner that could reasonably be expected to deceive or mislead any person as to:

- their proficiency, experience or qualifications;

- the nature of the person’s relationship or potential relationship with the Registrant; or

- the products or services provided or that might be provided.

However, we have clarified that Individual Registrants are to provide the business titles and professional designations that they use or will use once registered, and to keep this information up-to-date.

1. The Director has the discretion to request more information in these areas on a case-by-case basis. Individual Registrants will continue to be required to report the number of hours they work for their sponsoring firm.