Notice of Proposed Pre-Marketing and Marketing Amendments to Prospectus Rules

Notice of Proposed Pre-Marketing and Marketing Amendments to Prospectus Rules

NOTICE AND REQUEST FOR COMMENT

PROPOSED AMENDMENTS TO

NATIONAL INSTRUMENT 41-101 GENERAL PROSPECTUS REQUIREMENTS AND

COMPANION POLICY 41-101CP TO NATIONAL INSTRUMENT 41-101 GENERAL PROSPECTUS REQUIREMENTS

AND

PROPOSED AMENDMENTS TO

NATIONAL POLICY 41-201 INCOME TRUSTS AND OTHER INDIRECT OFFERINGS

AND

PROPOSED AMENDMENTS TO

NATIONAL INSTRUMENT 44-101 SHORT FORM PROSPECTUS DISTRIBUTIONS AND COMPANION POLICY 44-101CP TO NATIONAL INSTRUMENT 44-101 SHORT FORM PROSPECTUS DISTRIBUTIONS

AND

PROPOSED AMENDMENTS TO

COMPANION POLICY 44-102CP TO NATIONAL INSTRUMENT 44-102 SHELF DISTRIBUTIONS

AND

PROPOSED AMENDMENTS TO

NATIONAL POLICY 47-201 TRADING SECURITIES USING THE INTERNET AND OTHER ELECTRONIC MEANS

Introduction

We, the Canadian Securities Administrators (CSA), are publishing for a 90 day comment period proposed amendments to:

• National Instrument 41-101 General Prospectus Requirements (NI 41-101) and Companion Policy 41-101CP to National Instrument 41-101 General Prospectus Requirements (41-101CP),

• National Policy 41-201 Income Trusts and Other Indirect Offerings (NP 41-201),

• National Instrument 44-101 Short Form Prospectus Distributions (NI 44-101) and Companion Policy 44-101CP to National Instrument 44-101 Short Form Prospectus Distributions (44-101CP),

• Companion Policy 44-102CP to National Instrument 44-102 Shelf Distributions (44-102CP), and

• National Policy 47-201 Trading Securities Using the Internet and Other Electronic Means (NP 47-201).

Objective of the Proposed Amendments

The proposed amendments set out changes to the prospectus pre-marketing and marketing regime in Canada for issuers other than mutual funds. These changes will increase the range of permissible pre-marketing and marketing activities in connection with prospectus offerings. The current regulatory regime limits those activities.

Proposed Text

We invite comment on the following proposed amendments (the proposed amendments):

• Appendix B sets out the proposed amendments to NI 41-101 and 41-101CP,

• Appendix C sets out the proposed amendments to NP 41-201,

• Appendix D sets out the proposed amendments to NI 44-101 and 44-101CP,

• Appendix E sets out the proposed amendments to 44-102CP, and

• Appendix F sets out the proposed amendments to NP 47-201.

Certain jurisdictions may include additional local information in Appendix G.

The proposed amendments have been prepared on the assumption that certain amendments to the prospectus rules that were published for comment on July 15, 2011 will be in effect when the proposed amendments are enacted.

Background

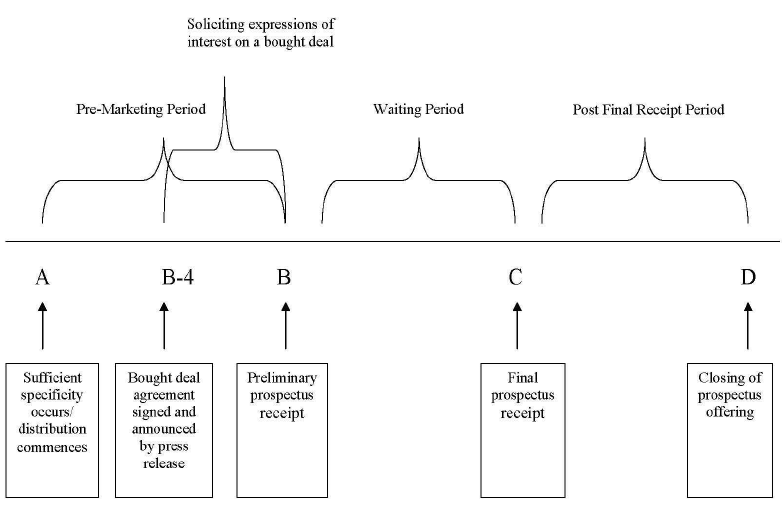

Appendix A provides a summary of the phases of a prospectus offering under the existing regulatory regime.

Pre-marketing

"Pre-marketing" occurs when a dealer communicates with potential investors before a public offering and includes other promotional activity that occurs before a preliminary prospectus is filed. Unless the issuer is relying on the bought deal exemption in Part 7 of NI 44-101, pre-marketing is prohibited in Canada. Specifically,

• securities legislation generally prohibits any form of marketing for a public offering unless a preliminary prospectus has been filed and receipted, and

• investment dealers are not permitted to solicit expressions of interest from investors until a preliminary prospectus is filed and receipted.

The bought deal exemption is a limited accommodation for issuers seeking certainty of financing. Generally, the bought deal exemption allows an investment dealer to solicit expressions of interest before the filing of a preliminary short form prospectus if, among other things, the issuer has entered into an enforceable agreement with an underwriter who has agreed to purchase the full amount of the offering, the issuer issues a news release announcing the agreement, and the issuer files and obtains a receipt for a preliminary prospectus within four business days of the agreement.

Marketing during the waiting period

"Marketing" includes oral or written communications after the filing of a preliminary prospectus. During the "waiting period" between the filing of a preliminary prospectus and a final prospectus, certain limited marketing activities are permitted. For example, it is permissible to:

• distribute a notice containing limited information about the offering,

• distribute the preliminary prospectus, and

• solicit expressions of interest from a prospective investor, if the investor is provided with copy of preliminary prospectus.

Policy rationale for existing rules

The policy rationales for the existing rules include:

• Equal access to information

• Any information given to investors in connection with a public offering should be in the prospectus.

• The prospectus should be available to all investors.

• Deterring conditioning of the market

• Issuers and investment dealers should not condition or prime the market before the preliminary prospectus is filed.

• Deterring insider trading and tippee trading

• The pre-marketing restrictions reinforce the requirement that insiders and "tippees" (as described in section 3.2 of National Policy 51-201 Disclosure Standards) should not trade on the basis of information about a potential offering that has not been generally disclosed.

• Investor protection through adequate disclosure of proposed offering

• A prospectus provides "full, true and plain disclosure" of all material facts.

• The issuer and the underwriters are potentially liable for any misrepresentations in the prospectus.

• The issuer and the underwriters should use the prospectus as the main marketing document.

We believe that these policy rationales are still valid and we have attempted to address them in the proposed amendments.

Substance and Purpose of the Proposed Amendments

The proposed amendments will increase the range of permissible pre-marketing and marketing activities in connection with prospectus offerings. In particular, the amendments will, subject to certain conditions:

• expressly allow non-reporting issuers, through an investment dealer, to determine interest in a potential initial public offering (IPO) by communicating with permitted institutional investors, and

• expressly allow investment dealers to use term sheets and conduct road shows during the "waiting period" and following the receipt of a final prospectus.

The amendments will also clarify when bought deals and bought deal syndicates can be enlarged.

The purposes of the proposed amendments are to:

• ease certain regulatory burdens and restrictions that issuers and investment dealers face in trying to successfully complete a prospectus offering, while at the same time providing protection to investors, and

• clarify certain matters in order to provide clear rules and a "level playing field" for market participants involved in a prospectus offering.

Summary of the Proposed Amendments

The proposed amendments are summarized as follows.

A. Pre-marketing

1. Testing of the waters exemption for IPO issuers

Proposed subsection 13.4(1) of NI 41-101 contains a limited exemption to permit non-reporting issuers, through an investment dealer, to determine interest in a potential IPO through limited confidential communication with permitted institutional investors. The exemption will be subject to certain conditions to ensure confidentiality and prevent abuse (e.g., conditioning of the market). The conditions of the exemption include the following:

• Before providing a permitted institutional investor with information about the proposed offering, the investment dealer must ask the permitted institutional investor to confirm in writing (e.g., by return email) that it will keep the information confidential.

• The issuer relying on the exemption must keep a written record of any investment dealer that it authorized to act on its behalf in making solicitations in reliance on the exemption and a copy of any written authorization.

• An investment dealer that relies on the exemption must keep a written record of any permitted institutional investor that it solicited and a copy of the above-noted correspondence with the investor.

Due to insider and tippee trading concerns, the exemption will not be available to "IPO issuers" that are already public companies in a foreign jurisdiction.

We specifically request comment on the utility of the proposed exemption (see questions 1 to 2 under "Request for Comments" below).

2. Bought deal exemption

As noted above, the bought deal exemption in Part 7 of NI 44-101 is a limited accommodation for issuers seeking certainty of financing. In order to provide clear rules and a "level playing field" for market participants, we propose to amend the rules to clarify certain matters and to specify when a bought deal agreement can be amended or terminated.

Enlarging bought deals

In particular, we propose to amend Part 7 of NI 44-101 so that if an issuer relies on the bought deal exemption and signs a bought deal agreement with an investment dealer, it would be permitted to amend the agreement to provide for a larger offering provided that:

• A news release is issued immediately after the agreement is amended.

• The offering size is increased by not more than a specified percentage of the original size of the offering.

• The preliminary prospectus is filed and receipted within four business days of the original agreement.

• The enlargement of the offering cannot be the culmination of a formal or informal plan to offer a larger amount devised before the execution of the original agreement.

• The enlarged offering is for the same price as the original offering.

The rationale for these conditions is that we expect the original bought deal agreement to be a firm commitment for a substantial number of securities. Otherwise, an investment dealer could circumvent the pre-marketing restrictions and the policy behind the bought deal exemption by entering into the original agreement for a small number of securities in order to solicit investors without a preliminary prospectus and then, after having obtained expressions of interest, entering into an amended agreement for a much larger amount.

We specifically request comment on the specified percentage up to which a bought deal could be enlarged (see question 3 under "Request for Comments" below). We anticipate that the final amendments will include one of the options set out in question 3.

Enlarging bought deal syndicate

The proposed amendments to Part 7 of NI 44-101 also allow for additional underwriters to join the bought deal syndicate if the addition of a particular underwriter was not the culmination of a formal or informal plan to add that underwriter devised before the execution of the original agreement.

Definition of "bought deal agreement"

The proposed amendments to Part 7 of NI 44-101 also provide for:

• All references to "enforceable agreement" to be replaced with "bought deal agreement".

• A definition of "bought deal agreement" to reflect current market practice for bought deals and the policy rationale for the exemption. In particular, the definition will provide that a bought deal agreement cannot have a market-out clause.

Other

We note that the amendments to the prospectus rules that were published for comment on July 15, 2011 propose to amend the bought deal exemption to specify that an investment dealer can continue to solicit expressions of interest after the filing of the preliminary prospectus and before the issuance of a receipt for the preliminary prospectus. This amendment is meant to address an inadvertent gap in permitting solicitations between the time of filing and the time of receipting of the preliminary prospectus. Although this gap would usually only exist for a matter of hours, some investment dealers have indicated that they want to be able to continue to solicit investors during that period. The proposed amendments reflect this change.

3. Additional guidance on "sufficient specificity"

Existing subsection 6.4(4) of 41-101CP provides guidance that a distribution of securities commences when an investment dealer has had discussions with an issuer that are of sufficient specificity that it is reasonable to expect that the investment dealer will propose an underwriting of securities to the issuer. We have concerns that certain market participants have been taking aggressive interpretations of "sufficient specificity". Consequently, we propose to amend subsection 6.4(4) of 41-101CP to provide additional guidance on "sufficient specificity", including permitted activities before the announcement of a bought deal or the filing of a preliminary prospectus. The additional guidance includes examples of situations which would indicate that "sufficient specificity" has occurred and a distribution of securities has commenced. That subsection also sets out our concerns with "non-deal road shows" where issuers and dealers meet with institutional investors to discuss the business and affairs of the issuer.

4. Term sheet provision for bought deals

Under the proposed amendments to section 1.1 of NI 41-101, a "term sheet" is defined as a written communication regarding a distribution of securities under a prospectus that contains information on the issuer or the securities, but does not include:

• a prospectus, or

• a notice, circular, advertisement, letter or other communication referred to in section 13.1 of NI 41-101 that is expressly permitted by securities legislation.

Proposed section 7.5 of NI 44-101 contains a term sheet provision for bought deals so that investment dealers may provide a term sheet to a permitted institutional investor after the bought deal is announced, but before the preliminary prospectus is filed four business days later. This provision would be subject to certain key conditions, which include the following:

• The disclosure in the term sheet must be fair, true and plain (this requirement and the definition of "term sheet" are discussed under "Marketing during the waiting period -- Term sheet provision" below).

• All information concerning securities in the term sheet must be in the bought deal news release or the issuer's continuous disclosure record.

• The term sheet must be approved in writing by the issuer and the underwriters and filed before use (although, as noted in proposed subsection 6.5A(7) of 41-101CP, the term sheet will not be made public on SEDAR until the preliminary prospectus is filed and receipted).

• The term sheet must be included in the preliminary prospectus and final prospectus or incorporated by reference into the preliminary prospectus and final prospectus. This will result in the term sheet being subject to statutory liability for misrepresentations.

• The term sheet must contain a prescribed legend with cautionary language referring investors to the subsequent preliminary prospectus and final prospectus and noting that the term sheet does not contain full disclosure of all material facts.

• Any permitted institutional investor who received a term sheet must receive the subsequent preliminary prospectus.

We specifically request comment on whether the rules should also permit an investment dealer to provide a bought deal term sheet to retail investors before the filing of the preliminary prospectus (see question 4 under "Request for Comments" below). For investor protection reasons, our provisions for term sheets during the waiting period (discussed below) only permit a term sheet to be given to a retail investor if it is accompanied by a copy of the preliminary prospectus (since a term sheet will not provide full, true and plain disclosure of all material facts). However, under the current bought deal exemption, an investment dealer is able to solicit expressions of interest from retail investors before the filing of a preliminary prospectus.

5. News release before filing a preliminary prospectus

Proposed subsection 6.9(3) of 41-101CP contains guidance on how an issuer can comply with its material change reporting obligations without contravening the pre-marketing restrictions. This guidance notes that:

• A material change news release should not be promotional and should be carefully drafted to avoid "conditioning of the market" concerns.

• Even if a material change news release is issued, an investment dealer would not be able to solicit expressions of interest until a bought deal was announced or a preliminary prospectus was filed and receipted.

B. Marketing during the waiting period

1. Term sheet provision

Proposed subsection 13.5(1) of NI 41-101 contains a provision to permit investment dealers to provide a term sheet in conjunction with a preliminary prospectus in order to allow for a greater range of marketing communications during the waiting period. The provision would be subject to certain key conditions, including:

• The disclosure in the term sheet must be fair, true and plain. Since a term sheet is not required to contain the same information as a prospectus, it cannot meet the prospectus requirement of "full, true and plain" disclosure. Proposed subsection 6.5A(2) of 41-101CP provides guidance on when we would consider a term sheet to be fair, true and plain.

• All information concerning the securities in the term sheet, including any comparables (i.e., information that compares the issuer to other issuers), must be contained in the preliminary prospectus.

• The term sheet must be approved in writing by the issuer and the underwriters and filed before use.

• The term sheet must be included in the final prospectus or incorporated by reference into the final prospectus. This will result in the term sheet being subject to statutory liability for misrepresentations.

• The term sheet must be distributed with a copy of the preliminary prospectus.

• The term sheet must contain a prescribed legend with cautionary language referring investors to the preliminary prospectus and noting that the term sheet does not contain full disclosure of all material facts.

Proposed subsection 6.5A(3) of 41-101CP provides guidance on the requirement that all information concerning securities in the term sheet must be contained in the preliminary prospectus (e.g., it is permissible for a term sheet to summarize information from the prospectus or to include graphs or charts based on numbers in the prospectus).

Proposed subsection 6.5A(9) of 41-101CP provides guidance on the remedies available to an investor if a term sheet contains a misrepresentation. For example, an investor who purchases a security distributed under the final prospectus may have remedies under the civil liability provisions of applicable securities legislation. In addition, an investor who purchases a security of the issuer on the secondary market may have remedies under the civil liability for secondary market disclosure provisions of applicable securities legislation if the term sheet contains a misrepresentation since:

• The term sheet is required to be included in the final prospectus or incorporated by reference into the final prospectus (a final prospectus is a "core document" under the secondary market liability provisions), and

• The term sheet is required to be filed and is therefore a "document" under the secondary market liability provisions.

A term sheet filed under the proposed provisions will not be subject to offering memorandum liability as we do not consider such a term sheet to be an offering memorandum under applicable securities legislation since it is not being provided in respect of securities being sold in a distribution under an exemption from the prospectus requirement.

2. Green sheets

Proposed section 6.6 of 41-101CP provides guidance that an investment dealer will continue to be able to provide traditional green sheets to their registered representatives. However, any green sheet that is distributed to the public will be considered a "term sheet" and would contravene the prospectus requirement unless it complied with proposed subsection 13.5(1) of NI 41-101.

3. Road shows

Under the proposed amendments to section 1.1 of NI 41-101, a "road show" is defined as a presentation to potential investors regarding a distribution of securities under a prospectus conducted by an investment dealer on behalf of an issuer in which one or more executive officers of the issuer participate.

Proposed sections 13.8 and 13.9 of NI 41-101 contain provisions for road shows during the waiting period. These provisions will apply to all types of road shows (including in-person, telephone conference calls, over the internet or by other electronic means).

A summary of the proposed road show provisions is set out below.

(a) Express provision for road shows for permitted institutional investors

Proposed section 13.8 of NI 41-101 allows an investment dealer to conduct a road show for permitted institutional investors during the waiting period. This provision will be subject to certain conditions, including:

• Other than comparables (described above), all information in the road show is contained in the preliminary prospectus.

• All information (including any comparables) in the road show must be fair, true and plain.

• Other than comparables, any written materials distributed to investors must comply with the term sheet provision.

(b) Express provision for road shows for retail investors

Proposed section 13.9 of NI 41-101 allows an investment dealer to conduct a road show for retail investors during the waiting period. This provision will be subject to certain conditions, including:

• All information in the road show is contained in the preliminary prospectus.

• All information in the road show must be fair, true and plain.

• Any written materials distributed to investors must comply with the term sheet provision.

Unlike the provision for road shows for permitted institutional investors (discussed above), proposed section 13.9 does not allow road shows for retail investors to contain comparables in the absence of prospectus liability. In the absence of adequate protections for retail investors, we believe that comparables should only be given to permitted institutional investors. We note that:

• Comparables can be "cherry picked" by investment dealers and misunderstood by retail investors.

• In the past, investment dealers have included comparables in road shows for institutional investors. But, given their nature, issuers and investment dealers do not want to include comparables in the prospectus since they would be subject to prospectus liability.

• If an issuer decides to include comparables in a prospectus, they should also include appropriate risk factors and cautionary language.

We specifically request comment on the circumstances in which comparables should be permitted to be given to retail investors (see questions 5 to 9 under "Request for Comments" below).

(c) Restricted access for road shows

The proposed amendments require "restricted access" for road shows. In particular, the investment dealer must establish and follow reasonable procedures to:

• verify the identity and keep a written record of any investor attending the road show in person, by telephone conference call, over the internet or by other electronic means,

• ensure that the investor has received a copy of the preliminary prospectus, and

• restrict copying of any written materials.

These requirements will provide evidence as to who attended a road show in person, by telephone conference call, over the internet or by other electronic means. We think it is important to know what persons attended the road show so that they can be provided with any revised materials and for evidentiary reasons (e.g., complaints, compliance reviews, litigation or enforcement proceedings). We provide guidance on this matter in proposed subsection 6.13(2) of 41-101CP.

(d) Guidance for road shows for cross border IPO offerings

In the past, issuers conducting internet road shows for cross-border IPOs applied for exemptive relief from the "restricted access" requirements in Canadian securities legislation because U.S. securities law required the issuers to either file the internet road show materials with the SEC or make them "available without restriction by means of graphic communication to any person". Issuers felt that if they were to file the materials with the SEC on EDGAR, then they would contravene Canadian waiting period restrictions. Since we are now proposing to require road show materials to be filed on SEDAR, cross-border issuers will be able to file the same materials on EDGAR without applying for exemptive relief. We provide guidance on this matter in proposed subsection 6.13(3) of 41-101CP.

4. Research reports

Proposed section 6.3A of 41-101CP contains guidance that any research reports issued by an investment dealer on an issuer must comply with section 7.7 of IIROC's Universal Market Integrity Rules (UMIR) and any applicable local rule. The guidance also indicates that an investment dealer should have appropriate "ethical wall" policies and procedures in place between the business unit that issues research reports or provides media commentary on an issuer and the business unit that acts as underwriter for prospectus offerings.

C. Marketing after the receipt of a final prospectus

The proposed amendments also contain provisions prescribing when investment dealers can provide term sheets and conduct road shows after the receipt of a final prospectus (provided the disclosure is based on the final prospectus), subject to similar conditions as the conditions described above.

D. Marketing after the receipt of a final base shelf prospectus

The proposed amendments also contain provisions prescribing when investment dealers can provide term sheets and conduct road shows after the receipt of a final base shelf prospectus (provided the disclosure is based on the final base shelf prospectus and any applicable shelf prospectus supplement or preliminary form of shelf prospectus supplement), subject to similar conditions as the conditions described above.

E. Other

The proposed amendments also:

• include new definitions in section 1.1 of NI 41-101 and Part 7 of NI 44-101 to reflect the above proposals (e.g., definition of permitted institutional investor),

• include new guidance in 41-101CP on the proposed sections in NI 41-101 relating to the testing of the waters exemption for IPO issuers, term sheets and road shows,

• include consequential amendments to NI 41-101 (including Form 41-101F1 and Form 41-101F2), 41-101CP, NP 41-201, NI 44-101 (including Form 44-101F1), 44-101CP, 44-102CP and NP 47-201 to reflect the above proposals,

• clarify and update certain language in 41-101CP relating to pre-marketing and marketing activities in connection with prospectus offerings (e.g., proposed section 6.10 of 41-101CP), and

• provide additional guidance on marketing before the filing of a shelf prospectus supplement in proposed section 1.3 of 44-102CP.

Future changes to SEDAR

If the proposed amendments are enacted, we propose to create new "document types" for prospectus filings on the System for Electronic Document Analysis and Retrieval (SEDAR). In particular, we contemplate new document types for term sheets and road show materials. These new document types will allow issuers to accurately file the materials contemplated by the proposed amendments on SEDAR. We invite comment on new document types.

Alternatives Considered

No alternatives to amendments to rules were considered.

Additional Background on Development of Proposals

Prior informal consultations

In developing the proposed amendments, we conducted:

• research on prospectus marketing regimes in the United States and other foreign jurisdictions, and

• informal consultations in 2008 and 2010 with certain issuers, investment dealers, institutional investors, advisory committees in various CSA jurisdictions and other market participants.

Additional proposal that was considered

In addition to the proposed amendments, we considered a proposal for a limited exemption to allow greater "testing of the waters" by existing reporting issuers before the filing of a preliminary prospectus or the announcement of a bought deal. Under the proposal, existing reporting issuers would have been able, through their investment dealers, to determine interest in a potential offering by means of limited confidential communication with permitted institutional investors. The exemption would have been subject to conditions to deter unlawful insider and tippee trading. We decided not to proceed with this proposal for several reasons. Generally, there were concerns expressed during the informal consultations about the proposed exemption, the practicability of the conditions and the potential for unlawful insider and tippee trading.

Impact on Investors

As noted above, the proposed amendments will ease certain regulatory burdens and restrictions that issuers and investment dealers face in trying to successfully complete a prospectus offering, while at the same time addressing investor protection concerns. Investor protection elements include the following:

Testing of the waters exemption for IPO issuers

The proposed testing of the waters exemption for IPO issuers will only be available to solicit permitted institutional investors. Since the issuer will not have prepared a preliminary prospectus, we believe that the exemption should not be available to solicit retail investors. The exemption would also be subject to certain conditions (described above) to ensure confidentiality and reduce the risk of conditioning the market.

Term sheet provisions

The term sheet provisions will permit a greater range of marketing communications for issuers and investment dealers. A term sheet may benefit investors by providing an initial "snap-shot" of certain terms of a prospectus offering. Investor protection will not be compromised since the term sheet will be subject to the conditions described above, including the requirement that the term sheet be included in the final prospectus or incorporated by reference into the final prospectus and therefore subject to liability for misrepresentations.

Road show provisions

The road show provisions permit an investment dealer to conduct a road show for potential investors if the conditions of the applicable provision are met. These conditions (described above) are intended to provide investor protection, including the requirement that:

• comparables can only be given to permitted institutional investors,

• road show materials must be included in the final prospectus or incorporated by reference into the final prospectus and therefore subject to liability for misrepresentations, and

• the investment dealer must establish and follow reasonable procedures for "restricted access" to road shows.

Anticipated Costs and Benefits

While the proposed amendments may impose certain costs on market participants, the proposed changes to the current pre-marketing and marketing regime are generally expected to ease certain regulatory burdens and restrictions that issuers and investment dealers face in trying to successfully complete a prospectus offering and will foster capital raising activities.

General

Market participants will incur costs associated with understanding and complying with the new requirements. These are one-time start-up costs, which may vary among market participants. For example, market participants who presently do not have record keeping systems in place will face greater start-up costs than those who do.

Testing of the waters exemption for IPO issuers

The proposed testing of the waters exemption for IPO issuers involves costs associated with the record keeping requirements set out in the conditions to the exemption. However, these costs are justified by the benefit that the IPO issuer and its investment dealer will be able to determine interest in a potential IPO before incurring additional costs in preparing a preliminary long form prospectus for the IPO.

Term sheet and road show provisions

The proposed term sheet and road show provisions involve costs associated with having to file the term sheet and road show material on SEDAR, comply with disclosure and record-keeping requirements, and comply with restricted access requirements in the case of road shows. However, we believe that these costs are justified by the benefit of being able to distribute a term sheet in connection with a prospectus offering and having clear rules that permit road shows to be held during a prospectus offering.

Bought deal exemption

We do not anticipate any additional material costs with our proposals that specify when a bought deal agreement can be amended or terminated (since an issuer proposing to amend a bought deal agreement would have to prepare an amending agreement in any event). The main benefit is that there will be clear rules on when a bought deal agreement can be amended or terminated and when a bought deal or a bought deal syndicate can be enlarged. By having rules that specify when a bought deal can be enlarged, issuers and investment dealers may be able to save costs associated with filing a separate prospectus for an offering of additional securities.

Unpublished Materials

In proposing the proposed amendments, we have not relied on any significant unpublished study, report, or other written materials.

Local Notices

Where applicable, Appendix G provides additional information required by local securities legislation.

Request for Comments

We welcome your comments on the proposed amendments, and also invite comments on the following specific questions:

Testing of the waters exemption for IPO issuers

1. Would the proposed testing of the waters exemption for IPO issuers be of value to those issuers and their investment dealers? Would it allow them to obtain useful feedback from permitted institutional investors? Why or why not?

2. Do you think the proposed testing of the waters exemption for IPO issuers will be used? If so, who do you think would use the exemption most? Small issuers or large issuers? Or, would it be used equally by both?

Bought deal exemption

3. Our proposals provide for the enlargement of bought deals up to a specified percentage. Should the specified percentage be:

• 15% of the original size of the offering (which corresponds to the existing 15% limit on over-allotment options),

• 25% of the original size of the offering, or

• 50% of the original size of the offering?

Or, do you think another limit is appropriate in order to provide flexibility, yet prevent abuse of the bought deal exemption?

Term sheet provision for bought deals

4. The term sheet provision for bought deals provides that a bought deal term sheet could only be given to permitted institutional investors before the receipt of a preliminary short form prospectus. Should the rules also allow a bought deal term sheet to be given to retail investors before the receipt of a preliminary short form prospectus? Why or why not?

Comparables

5. Our proposals would permit a road show for institutional investors to contain comparables even if the comparables were not contained in the prospectus and therefore not subject to prospectus liability. It has been suggested that institutional investors are better able to understand the nature of comparables and the risks related to comparables (e.g., "cherry picking") than ordinary retail investors and individuals who are accredited investors. Do you agree? Why or why not?

6. Do you agree with our proposal that before attending a road show that may contain comparables, the investment dealer conducting the road show must obtain confirmation in writing from the institutional investor that they will keep the comparables confidential? Why or why not?

7. If comparables are included in a prospectus or a road show, should the prospectus rules prescribe a method for choosing comparables in order to reduce the risk of "cherry picking"? Should the rules contain measures that would foster the preparation of comparables which are fair and balanced or comparables which could assist an investor in determining if an offering was properly priced? What methods would achieve these goals? For example, should the CSA prescribe a template mandating the metrics used in compiling comparables or mandating how to pick a representative sample? If so, do you have suggestions for these templates?

8. If comparables are included in a prospectus or a road show, should the prospectus rules require additional disclosure to alert retail investors about the nature of comparables and how they can be "cherry picked" and misunderstood? What cautionary language and risk factors should be included? What other safeguards could we implement in order to reduce these risks?

How to provide your comments

Please provide your comments in writing by February 23, 2012. If you are not sending your comments by email, an electronic file containing the submissions should also be provided (in Windows format, Microsoft Word).

Please address your submission to the following Canadian securities regulatory authorities:

British Columbia Securities CommissionAlberta Securities CommissionSaskatchewan Financial Services CommissionManitoba Securities CommissionOntario Securities CommissionAutorité des marchés financiersNew Brunswick Securities CommissionSuperintendent of Securities, Prince Edward IslandNova Scotia Securities CommissionSecurities Commission of Newfoundland and LabradorSuperintendent of Securities, Yukon TerritorySuperintendent of Securities, Northwest TerritoriesSuperintendent of Securities, Nunavut

Deliver your comments only to the two addresses that follow. Your comments will be distributed to the other participating CSA member jurisdictions.

John Stevenson, SecretaryOntario Securities Commission20 Queen Street WestSuite 1900, Box 55Toronto, Ontario M5H 3S8Fax: (416) 593-8145E-mail: [email protected]Anne-Marie Beaudoin, SecrétaireAutorité des marchés financiersTour de la Bourse800, square VictoriaC.P. 246, 22e étageMontréal, Québec H4Z 1G3Fax: (514) 864-6381E-mail: [email protected]

Please note that comments received will be made publicly available and posted at www.osc.gov.on.ca and the websites of certain other securities regulatory authorities. We cannot keep submissions confidential because securities legislation in certain provinces requires that a summary of the written comments received during the comment period be published.

Questions

Please refer your questions to any of:

November 25, 2011

Appendix A

Phases of a Prospectus Offering

Appendix B

Proposed Amendments to

National Instrument 41-101 General Prospectus Requirements and Companion Policy

Schedule B-1

Proposed Amendment Instrument for

National Instrument 41-101 General Prospectus Requirements

1. National Instrument 41-101 General Prospectus Requirements is amended by this Instrument.

2. Section 1.1 is amended by adding the following definitions in alphabetical order:

"base shelf prospectus" has the same meaning as in section 1.1 of NI 44-102;

"Canadian financial institution" has the same meaning as in section 1.1 of NI 45-106;

"investment dealer" has the same meaning as in section 1.1 of National Instrument 31-103 Registration Requirements and Exemptions;

"permitted institutional investor" means any of the following:

(a) a Canadian financial institution or a Schedule III bank,

(b) the Business Development Bank of Canada,

(c) a subsidiary of any person or company referred to in paragraph (a) or (b) if the person or company owns all of the voting securities of the subsidiary except the voting securities required by law to be owned by directors of the subsidiary,

(d) a pension fund that is regulated by the federal Office of the Superintendent of Financial Institutions or a pension commission or similar regulatory authority of a jurisdiction of Canada or a foreign jurisdiction and includes a wholly-owned subsidiary of such a pension fund,

(e) an entity organized in a foreign jurisdiction that is analogous to any of the entities referred to in paragraphs (a) to (c),

(f) the Government of Canada or a jurisdiction of Canada, or any Crown corporation, agency or wholly-owned entity of the Government of Canada or a jurisdiction of Canada,

(g) any national, federal, state, provincial, territorial or municipal government of or in any foreign jurisdiction, or any agency of that government,

(h) a municipality, public board or commission in Canada and a metropolitan community or an intermunicipal management board in Québec,

(i) an investment fund if either of the following apply:

(i) the fund is managed by a person or company registered as an investment fund manager under the securities legislation of a jurisdiction of Canada,

(ii) the fund is advised by a person or company authorized to act as an adviser under the securities legislation of a jurisdiction of Canada;

"registered individual" has the same meaning as in section 1.1 of National Instrument 31-103 Registration Requirements and Exemptions;

"road show" means a presentation to potential investors, regarding a distribution of securities under a prospectus, conducted by an investment dealer on behalf of an issuer in which one or more executive officers of the issuer participate;

"Schedule III bank" means a bank named in Schedule III of the Bank Act (Canada);

"shelf prospectus supplement" has the same meaning as in section 1.1 of NI 44-102;

"term sheet" means a written communication regarding a distribution of securities under a prospectus that contains information on the issuer or the securities, but does not include

(a) a prospectus, or

(b) a notice, circular, advertisement, letter or other communication referred to in section 13.1 that is expressly permitted by securities legislation;.

3. Section 9.1 is amended by adding the following after paragraph (a)(vi):

(vii)Term Sheets -- a copy of any term sheet required to be filed under subsection 13.5(1); and.

4. Section 9.2 is amended by adding the following after paragraph (a)(xiii):

(xiv) Term Sheets -- a copy of any term sheet required to be filed under subsection 13.5(1) that has not previously been filed; and.

5. Subsection 13.1(1) is amended by replacing "A" with "Except for a term sheet under subsection 13.5(1), a".

6. Subsection 13.2(1) is amended by replacing "A" with "Except for a term sheet under subsection 13.6(1) or 13.7(1), a".

7. Part 13 is amended by adding the following after section 13.3:

Testing of the waters exemption -- IPO issuers

13.4 (1) Subject to subsections (2) to (4), the prospectus requirement does not apply to a solicitation of an expression of interest in order to ascertain if there would be sufficient interest in an initial public offering of securities of an issuer pursuant to a preliminary long form prospectus, if

(a) the issuer has a reasonable expectation of filing a preliminary long form prospectus in respect of an initial public offering in at least one jurisdiction;

(b) the issuer

(i) is not a reporting issuer in any jurisdiction before the date of the preliminary long form prospectus,

(ii) is not an SEC issuer before the date of the preliminary long form prospectus,

(iii) does not have a class of securities that has been assigned a ticker symbol by the Financial Industry Regulatory Authority in the United States of America for use on any of the over-the-counter markets in the United States of America before the date of the preliminary long form prospectus,

(iv) does not have a class of securities that have been traded on an over-the-counter market where trading data is publicly reported before the date of the preliminary long form prospectus, and

(v) does not have any of its securities listed, quoted or traded on a marketplace outside of Canada or any other facility outside of Canada for bringing together buyers and sellers of securities where trading data is publicly reported before the date of the preliminary long form prospectus;

(c) an investment dealer makes the solicitation on behalf of the issuer;

(d) the issuer provided written authorization to the investment dealer to act on its behalf before the investment dealer made the solicitation;

(e) the solicitation is made to a permitted institutional investor; and

(f) the issuer and the investment dealer keep information about the proposed offering confidential.

(2) An investment dealer must not solicit an expression of interest from a permitted institutional investor under subsection (1) unless

(a) any written material provided to the investor is marked confidential and contains a legend stating that the material is not subject to liability for misrepresentations under applicable securities legislation; and

(b) before providing the investor with information about the proposed offering, the investment dealer obtains confirmation in writing from the investor that the investor will keep the information confidential.

(3) An issuer relying on the exemption in subsection (1) must keep a written record of any investment dealer that it authorized to act on its behalf in making solicitations in reliance on the exemption and a copy of any written authorizations referred to in paragraph (1)(d).

(4) An investment dealer relying on the exemption in subsection (1) must keep

(a) a written record of any permitted institutional investor that it solicited in reliance on the exemption,

(b) a copy of any written material referred to in paragraph (2)(a), and

(c) any written confirmations referred to in paragraph (2)(b).

Term sheets during the waiting period

13.5 (1) An investment dealer that provides a term sheet to a potential investor during the waiting period is exempt from the prospectus requirement if

(a) the term sheet complies with subsections (2) to (6);

(b) the disclosure in the term sheet is fair, true and plain;

(c) other than contact information for the investment dealer, all information in the term sheet concerning the securities is disclosed in the preliminary prospectus and any amendment to the preliminary prospectus;

(d) the term sheet contains the same cautionary language in bold type, other than prescribed legends, as the face page and summary of the preliminary prospectus;

(e) the term sheet is approved in writing by the issuer and the underwriters and filed before it is provided;

(f) the term sheet is provided in the local jurisdiction only if a receipt for the preliminary prospectus was issued in the jurisdiction; and

(g) the investment dealer provides a copy of the preliminary prospectus and any amendment with the term sheet.

(2) A term sheet provided under subsection (1) must be dated and state the following, on the first page, with the bracketed information completed:

A preliminary prospectus containing important information relating to the securities described in this [term sheet] has been filed with the securities regulatory authority(ies) in [each of/certain of the provinces/provinces and territories of Canada]. A copy of the preliminary prospectus, and any amendment to the preliminary prospectus, is required to be delivered with this [term sheet].

The preliminary prospectus is still subject to completion. There will not be any sale or any acceptance of an offer to buy the securities until a receipt for the final prospectus has been issued.

This [term sheet] does not provide full disclosure of all material facts relating to the securities offered. Investors should read the preliminary prospectus, any amendment to the preliminary prospectus, the final prospectus and any amendment to the final prospectus for disclosure of those facts, especially risk factors relating to the securities offered, before making an investment decision.

(3) If a term sheet is provided during the waiting period under subsection (1), the issuer must

(a) include the term sheet in its final prospectus or incorporate by reference the term sheet into its final prospectus in the manner contemplated by subsection 36A.1(1) of Form 41-101F1, subsection 37.3(1) of Form 41-101F2 or subsection 11.6(2) of Form 44-101F1, as applicable, and

(b) indicate that the term sheet is not part of the final prospectus to the extent that the term sheet's contents have been modified or superseded by a statement contained in the final prospectus and, if a statement in the term sheet has been modified or superseded, disclose how the statement in the term sheet has been modified or superseded by the statement in the final prospectus.

(4) If a term sheet is provided during the waiting period under subsection (1) but the issuer does not include the term sheet in its final prospectus or incorporate by reference the term sheet into its final prospectus in the manner contemplated by subsection 36A.1(1) of Form 41-101F1, subsection 37.3(1) of Form 41-101F2 or subsection 11.6(2) of Form 44-101F1, as applicable, the term sheet is deemed for purposes of securities legislation to be incorporated into the issuer's final prospectus as of the date of the final prospectus to the extent not otherwise expressly modified or superseded by a statement contained in the final prospectus.

(5) If the final prospectus, or any amendment to the final prospectus, modifies a statement of a material fact that appeared in a term sheet provided during the waiting period under subsection (1), the issuer must prepare a revised term sheet that highlights the modified statement and the relevant investment dealer must deliver with the final prospectus, or any amendment, a copy of the revised term sheet to each purchaser of securities distributed under the final prospectus, or any amendment, that received the original term sheet.

(6) Any revised term sheet provided with the final prospectus, or any amendment, under subsection (5) must comply with section 13.6.

Term sheets after the receipt of a final prospectus

13.6 (1) An investment dealer must not provide a term sheet to a potential investor after a receipt for a final prospectus, or any amendment to the final prospectus, is issued unless

(a) the term sheet complies with subsections (2) to (5);

(b) the disclosure in the term sheet is fair, true and plain;

(c) other than contact information for the investment dealer, all information in the term sheet concerning the securities is disclosed in the final prospectus and any amendment;

(d) the term sheet contains the same cautionary language in bold type, other than prescribed legends, as the face page and summary of the final prospectus;

(e) the term sheet is approved in writing by the issuer and the underwriters and filed before it is provided;

(f) the term sheet is provided in the local jurisdiction only if a receipt for the final prospectus was issued in the jurisdiction; and

(g) the investment dealer provides a copy of the final prospectus, and any amendment, with the term sheet.

(2) A term sheet provided under subsection (1) must be dated and state the following, on the first page, with the bracketed information completed:

A final prospectus containing important information relating to the securities described in this [term sheet] has been filed with the securities regulatory authority(ies) in [each of/certain of the provinces/provinces and territories of Canada]. A copy of the final prospectus, and any amendment to the final prospectus, is required to be delivered with this [term sheet].

This [term sheet] does not provide full disclosure of all material facts relating to the securities offered. Investors should read the final prospectus, and any amendment, for disclosure of those facts, especially risk factors relating to the securities offered, before making an investment decision.

(3) If a term sheet is provided under subsection (1), the issuer must include the term sheet in its final prospectus and any amendment to the final prospectus or incorporate by reference the term sheet into its final prospectus, and any amendment, in the manner contemplated by subsection 36A.1(2) of Form 41-101F1, subsection 37.3(2) of Form 41-101F2 or subsection 11.6(3) of Form 44-101F1, as applicable.

(4) If a term sheet is provided under subsection (1), the issuer must

(a) state in the final prospectus that any term sheet provided by the issuer to a potential purchaser after the date of the final prospectus is deemed for the purposes of securities legislation to be incorporated into the final prospectus, and

(b) in the case of an amendment to the final prospectus, indicate that the term sheet is not part of the final prospectus to the extent that the term sheet's contents have been modified or superseded by a statement contained in the amendment and, if a statement in the term sheet has been modified or superseded, disclose how the statement in the term sheet has been modified or superseded by the statement in the amendment.

(5) If a term sheet is provided under subsection (1) but the issuer does not include the term sheet in its final prospectus, and any amendment, or incorporate by reference the term sheet into its final prospectus, and any amendment, in the manner contemplated by subsection 36A.1(2) of Form 41-101F1, subsection 37.3(2) of Form 41-101F2 or subsection 11.6(3) of Form 44-101F1, as applicable, the term sheet is deemed for purposes of securities legislation to be incorporated into the issuer's final prospectus as of the date of the final prospectus to the extent not otherwise expressly modified or superseded by a statement contained in the final prospectus.

Term sheets after the receipt of a final base shelf prospectus

13.7 (1) An investment dealer must not provide a term sheet to a potential investor after a receipt for a final base shelf prospectus, or any amendment to the final base shelf prospectus, is issued unless

(a) the term sheet complies with subsections (2) to (8);

(b) the disclosure in the term sheet is fair, true and plain;

(c) other than contact information for the investment dealer, all information in the term sheet concerning the securities is disclosed in the final base shelf prospectus, any amendment to the final base shelf prospectus, or any applicable shelf prospectus supplement or preliminary form of shelf prospectus supplement that has been filed;

(d) the term sheet contains the same cautionary language in bold type, other than prescribed legends, as the face page and summary of the final base shelf prospectus;

(e) the term sheet is approved in writing by the issuer and the underwriters and filed before it is provided;

(f) the term sheet is provided in the local jurisdiction only if a receipt for the final base shelf prospectus was issued in the jurisdiction; and

(g) the investment dealer provides a copy of the final base shelf prospectus, and any amendment to the final base shelf prospectus, and any applicable shelf prospectus supplement or preliminary form of shelf prospectus supplement with the term sheet.

(2) A term sheet provided under subsection (1) must be dated and state the following, on the first page, with the bracketed information completed:

A final base shelf prospectus containing important information relating to the securities described in this [term sheet] has been filed with the securities regulatory authority(ies) in [each of/certain of the provinces/provinces and territories of Canada]. A copy of the final base shelf prospectus, any amendment to the final base shelf prospectus, and any applicable shelf prospectus supplement or preliminary form of shelf prospectus supplement is required to be delivered with this [term sheet].

This [term sheet] does not provide full disclosure of all material facts relating to the securities offered. Investors should read the final base shelf prospectus, any amendment and any applicable supplement for disclosure of those facts, especially risk factors relating to the securities offered, before making an investment decision.

(3) If a term sheet is provided under subsection (1) after a receipt for the final base shelf prospectus is issued but before a shelf prospectus supplement is filed, the issuer must

(a) include the term sheet in the relevant shelf prospectus supplement or incorporate by reference the term sheet into the relevant shelf prospectus supplement in the manner contemplated by paragraph 4 of subsection 6.3(1) of NI 44-102, and

(b) indicate that the term sheet is not part of the shelf prospectus supplement to the extent that the term sheet's contents have been modified or superseded by a statement contained in the shelf prospectus supplement and, if a statement in the term sheet has been modified or superseded, disclose how the statement in the term sheet has been modified or superseded by the statement in the shelf prospectus supplement.

(4) If a term sheet is provided under subsection (1) after a receipt for the final base shelf prospectus is issued and after the relevant shelf prospectus supplement is filed, the issuer must include the term sheet in the relevant shelf prospectus supplement or incorporate by reference the term sheet into the relevant shelf prospectus supplement in the manner contemplated by paragraph 4 of subsection 6.3(1) of NI 44-102.

(5) If a term sheet is provided under subsection (1) after a receipt for the final base shelf prospectus is issued and after the relevant shelf prospectus supplement is filed, the issuer must state in the shelf prospectus supplement that any term sheet provided by the issuer to a potential purchaser after the date of the shelf prospectus supplement and before the termination of the distribution is deemed to be incorporated into the shelf prospectus supplement.

(6) If a term sheet is provided under subsection (1) but the issuer does not include the term sheet in its relevant shelf prospectus supplement or incorporate by reference the term sheet into its relevant shelf prospectus supplement in the manner contemplated by subsection (3) or (4), as applicable, the term sheet is deemed for purposes of securities legislation to be incorporated into the shelf prospectus supplement as of the date of the supplement to the extent not otherwise expressly modified or superseded by a statement contained in the supplement.

(7) If a shelf prospectus supplement modifies a statement of a material fact that appeared in a term sheet provided under subsection (1) with a preliminary form of shelf prospectus supplement, the issuer must prepare a revised term sheet that highlights the modified statement and the relevant investment dealer must deliver with the shelf prospectus supplement a copy of the revised term sheet to each purchaser of securities distributed under the shelf prospectus supplement that received the original term sheet.

(8) Any revised term sheet provided with the shelf prospectus supplement under subsection (7) must comply with this section.

Road shows for permitted institutional investors during the waiting period

13.8 (1) An investment dealer that conducts a road show for permitted institutional investors during the waiting period is exempt from the prospectus requirement if

(a) the road show complies with subsections (2) to (4);

(b) the disclosure in the road show is fair, true and plain;

(c) other than information that compares the issuer to other issuers and contact information for the investment dealer conducting the road show, all information in the road show concerning the securities is disclosed in the preliminary prospectus and any amendment to the preliminary prospectus;

(d) the issuer provides written authorization to the investment dealer to conduct the road show;

(e) the road show is conducted in the local jurisdiction only if a receipt for the preliminary prospectus was issued in the jurisdiction;

(f) only permitted institutional investors, registered individuals and representatives of the issuer attend the road show; and

(g) before the road show commences, the investment dealer obtains confirmation in writing from each permitted institutional investor attending the road show that the permitted institutional investor will keep confidential any information that compares the issuer to other issuers that is disclosed in connection with the road show.

(2) An investment dealer must not provide written material, other than a preliminary prospectus and any amendment to a preliminary prospectus, to a permitted institutional investor attending a road show conducted under subsection (1) unless

(a) other than information that compares the issuer to other issuers, the written material is provided in accordance with section 13.5;

(b) the issuer redacts any information not disclosed in the preliminary prospectus, or any amendment, that compares the issuer to other issuers from the written material before filing it in accordance with paragraph 13.5(1)(e);

(c) the version of the written material that is filed contains a description of any information that was redacted in accordance with paragraph (b) immediately after the redacted information; and

(d) the version of the written material that is provided to the permitted institutional investor attending the road show contains a statement, immediately after any information not disclosed in the preliminary prospectus or any amendment that compares the issuer to other issuers, that the information is not disclosed in the preliminary prospectus, or any amendment, and will not be subject to prospectus liability.

(3) The investment dealer must establish and follow reasonable procedures to

(a) verify the identity and keep a written record of any permitted institutional investor attending the road show in person, by telephone conference call, over the internet or by other electronic means;

(b) ensure that the permitted institutional investor has received a copy of the preliminary prospectus and any amendment to the preliminary prospectus; and

(c) restrict copying of any written materials.

(4) The investment dealer must commence the road show with the oral reading of the following statement, with the bracketed information completed:

A preliminary prospectus containing important information relating to the securities described in this presentation has been filed with the securities regulatory authority(ies) in [each of/certain of the provinces/provinces and territories of Canada]. A copy of the preliminary prospectus, and any amendment to the preliminary prospectus, is required to be delivered to each investor attending this presentation.

The preliminary prospectus is still subject to completion. There will not be any sale or any acceptance of an offer to buy the securities until a receipt for the final prospectus has been issued.

This presentation does not provide full disclosure of all material facts relating to the securities offered. Investors should read the preliminary prospectus, any amendment to the preliminary prospectus and the final prospectus for disclosure of those facts, especially risk factors relating to the securities offered, before making an investment decision.

Road shows for retail investors during the waiting period

13.9 (1) An investment dealer that conducts a road show for potential investors during the waiting period is exempt from the prospectus requirement if

(a) the road show complies with subsections (2) to (4);

(b) the disclosure in the road show is fair, true and plain;

(c) other than contact information for the investment dealer conducting the road show, all information in the road show concerning the securities is disclosed in the preliminary prospectus and any amendment to the preliminary prospectus;

(d) the issuer provides written authorization to the investment dealer to conduct the road show;

(e) the road show is conducted in the local jurisdiction only if a receipt for the preliminary prospectus was issued in the jurisdiction; and

(f) only potential investors, registered individuals and representatives of the issuer attend the road show.

(2) An investment dealer must not provide written material, other than a preliminary prospectus and any amendment to the preliminary prospectus, to an investor attending a road show conducted under subsection (1) unless the written material is provided in accordance with section 13.5.

(3) The investment dealer must establish and follow reasonable procedures to

(a) verify the identity and keep a written record of any investor attending the road show in person, by telephone conference call, over the internet or by other electronic means;

(b) ensure that the investor has received a copy of the preliminary prospectus and any amendment; and

(c) restrict copying of any written materials.

(4) The investment dealer must commence the road show with the oral reading of the following statement, with the bracketed information completed:

A preliminary prospectus containing important information relating to the securities described in this presentation has been filed with the securities regulatory authority(ies) in [each of/certain of the provinces/provinces and territories of Canada]. A copy of the preliminary prospectus, and any amendment to the preliminary prospectus, is required to be delivered to each investor attending this presentation.

The preliminary prospectus is still subject to completion. There will not be any sale or any acceptance of an offer to buy the securities until a receipt for the final prospectus has been issued.

This presentation does not provide full disclosure of all material facts relating to the securities offered. Investors should read the preliminary prospectus, any amendment to the preliminary prospectus and the final prospectus for disclosure of those facts, especially risk factors relating to the securities offered, before making an investment decision.

Road shows for permitted institutional investors after the receipt of a final prospectus

13.10 (1) An investment dealer must not conduct a road show for permitted institutional investors after a receipt for a final prospectus, or any amendment to the final prospectus, is issued unless

(a) the road show complies with subsections (2) to (4);

(b) the disclosure in the road show is fair, true and plain;

(c) other than information that compares the issuer to other issuers and contact information for the investment dealer conducting the road show, all information in the road show concerning the securities is disclosed in the final prospectus and any amendment;

(d) the issuer provides written authorization to the investment dealer to conduct the road show;

(e) the road show is conducted in the local jurisdiction only if a receipt for the final prospectus was issued in the jurisdiction;

(f) only permitted institutional investors, registered individuals and representatives of the issuer attend the road show; and

(g) before the road show commences, the investment dealer obtains confirmation in writing from each permitted institutional investor attending the road show that the permitted institutional investor will keep confidential any information that compares the issuer to other issuers that is disclosed in connection with the road show.

(2) An investment dealer must not provide written material, other than a final prospectus and any amendment, to permitted institutional investors attending a road show conducted under subsection (1) unless

(a) other than information that compares the issuer to other issuers, the written material is provided in accordance with section 13.6;

(b) the issuer redacts any information not disclosed in the final prospectus, or any amendment, that compares the issuer to other issuers from the written material before filing it in accordance with paragraph 13.6(1)(e);

(c) the version of the written material that is filed contains a description of any information that was redacted in accordance with paragraph (b) immediately after the redacted information; and

(d) the version of the written material that is provided to the permitted institutional investors attending the road show contains a statement, immediately after any information not disclosed in the final prospectus or any amendment that compares the issuer to other issuers, that the information is not disclosed in the final prospectus or any amendment and will not be subject to prospectus liability.

(3) The investment dealer must establish and follow reasonable procedures to

(a) verify the identity and keep a written record of any permitted institutional investor attending the road show in person, by telephone conference call, over the internet or by other electronic means;

(b) ensure that the permitted institutional investor has received a copy of the final prospectus and any amendment; and

(c) restrict copying of any written materials.

(4) The investment dealer must commence the road show with the oral reading of the following statement, with the bracketed information completed:

A final prospectus containing important information relating to the securities described in this presentation has been filed with the securities regulatory authority(ies) in [each of/certain of the provinces/provinces and territories of Canada]. A copy of the final prospectus, and any amendment to the final prospectus, is required to be delivered to each investor attending this presentation.

This presentation does not provide full disclosure of all material facts relating to the securities offered. Investors should read the final prospectus and any amendment for disclosure of those facts, especially risk factors relating to the securities offered, before making an investment decision.

Road shows for retail investors after the receipt of a final prospectus

13.11 (1) An investment dealer must not conduct a road show for potential investors after a receipt for a final prospectus, or any amendment to the final prospectus, is issued unless

(a) the road show complies with subsections (2) to (4);

(b) the disclosure in the road show is fair, true and plain;

(c) other than contact information for the investment dealer conducting the road show, all information in the road show concerning the securities is disclosed in the final prospectus and any amendment;

(d) the issuer provides written authorization to the investment dealer to conduct the road show;

(e) the road show is conducted in the local jurisdiction only if a receipt for the final prospectus was issued in the jurisdiction; and

(f) only potential investors, registered individuals and representatives of the issuer attend the road show.

(2) An investment dealer must not provide written material, other than a final prospectus and any amendment, to investors attending a road show conducted under subsection (1) unless the written material is provided in accordance with section 13.6.

(3) The investment dealer must establish and follow reasonable procedures to

(a) verify the identity and keep a written record of any investor attending the road show in person, by telephone conference call, over the internet or by other electronic means;

(b) ensure that the investor has received a copy of the final prospectus and any amendment; and

(c) restrict copying of any written materials.

(4) The investment dealer must commence the road show with the oral reading of the following statement, with the bracketed information completed:

A final prospectus containing important information relating to the securities described in this presentation has been filed with the securities regulatory authority(ies) in [each of/certain of the provinces/provinces and territories of Canada]. A copy of the final prospectus, and any amendment to the final prospectus, is required to be delivered to each investor attending this presentation.

This presentation does not provide full disclosure of all material facts relating to the securities offered. Investors should read the final prospectus and any amendment for disclosure of those facts, especially risk factors relating to the securities offered, before making an investment decision.

Road shows for permitted institutional investors after the receipt of a final base shelf prospectus

13.12 (1) An investment dealer must not conduct a road show for permitted institutional investors after a receipt for a final base shelf prospectus, or any amendment to the final base shelf prospectus, is issued unless

(a) the road show complies with subsections (2) to (4);

(b) the disclosure in the road show is fair, true and plain;

(c) other than information that compares the issuer to other issuers and contact information for the investment dealer conducting the road show, all information in the road show concerning the securities is disclosed in the final base shelf prospectus, any amendment to the final base shelf prospectus and any applicable shelf prospectus supplement or preliminary form of shelf prospectus supplement that has been filed;

(d) the issuer provides written authorization to the investment dealer to conduct the road show;

(e) the road show is conducted in the local jurisdiction only if a receipt for the final base shelf prospectus was issued in the jurisdiction;

(f) only permitted institutional investors, registered individuals and representatives of the issuer attend the road show; and

(g) before the road show commences, the investment dealer obtains confirmation in writing from each permitted institutional investor attending the road show that the permitted institutional investor will keep confidential any information that compares the issuer to other issuers that is disclosed in connection with the road show.

(2) An investment dealer must not provide written material, other than a final base shelf prospectus, any amendment to the final base shelf prospectus and any applicable shelf prospectus supplement or preliminary form of shelf prospectus supplement, to permitted institutional investors attending a road show conducted under subsection (1) unless

(a) other than information that compares the issuer to other issuers, the written material is provided in accordance with section 13.7;

(b) the issuer redacts any information not disclosed in the final base shelf prospectus, any amendment to the final base shelf prospectus or any applicable shelf prospectus supplement or preliminary form of shelf prospectus supplement that compares the issuer to other issuers from the written material before filing it in accordance with paragraph 13.7(1)(e);

(c) the version of the written material that is filed contains a description of any information that was redacted in accordance with paragraph (b) immediately after the redacted information; and

(d) the version of the written material that is provided to the permitted institutional investors attending the road show contains a statement, immediately after any information not disclosed in the final base shelf prospectus, any amendment to the final base shelf prospectus or any applicable shelf prospectus supplement or preliminary form of shelf prospectus supplement that compares the issuer to other issuers, that the information is not disclosed in the final base shelf prospectus, any amendment or any applicable supplement, and will not be subject to prospectus liability.

(3) The investment dealer must establish and follow reasonable procedures to

(a) verify the identity and keep a written record of any permitted institutional investor attending the road show in person, by telephone conference call, over the internet or by other electronic means;

(b) ensure that the permitted institutional investor has received a copy of the final base shelf prospectus, any amendment to the base shelf prospectus and any applicable shelf prospectus supplement or preliminary form of shelf prospectus supplement; and

(c) restrict copying of any written materials.

(4) The investment dealer must commence the road show with the oral reading of the following statement, with the bracketed information completed:

A final base shelf prospectus containing important information relating to the securities described in this presentation has been filed with the securities regulatory authority(ies) in [each of/certain of the provinces/provinces and territories of Canada]. A copy of the final base shelf prospectus, any amendment to the final base shelf prospectus and any applicable shelf prospectus supplement or preliminary form of shelf prospectus supplement is required to be delivered to each investor attending this presentation.

This presentation does not provide full disclosure of all material facts relating to the securities offered. Investors should read the final base shelf prospectus, any amendment and any applicable supplement for disclosure of those facts, especially risk factors relating to the securities offered, before making an investment decision.

Road shows for retail investors after the receipt of a final base shelf prospectus

13.13 (1) An investment dealer must not conduct a road show for potential investors after a receipt is issued for a final base shelf prospectus, or any amendment to the final base shelf prospectus, unless

(a) the road show complies with subsections (2) to (4);

(b) the disclosure in the road show is fair, true and plain;