[withdrawn by CSA Staff Notice 11-346, September 14, 2023] CSA Consultation Paper 51-404 Considerations for Reducing Regulatory Burden for Non-Investment Fund Reporting Issuers

[withdrawn by CSA Staff Notice 11-346, September 14, 2023] CSA Consultation Paper 51-404 Considerations for Reducing Regulatory Burden for Non-Investment Fund Reporting Issuers

CSA Consultation Paper 51-404

Considerations for Reducing Regulatory Burden for

Non-Investment Fund Reporting Issuers

April 6, 2017

CSA CONSULTATION PAPER 51-404 CONSIDERATIONS FOR REDUCING REGULATORY BURDEN FOR NON-INVESTMENT FUND REPORTING ISSUERS

PART 1 -- Introduction

The current Canadian Securities Administrators (CSA or we) Business Plan identifies a review of the regulatory burden on reporting issuers as one of the CSA's key initiatives for 2016-2019.{1} Changes brought on by shifts in market conditions, investor demographics, technological innovation and globalization all have a real impact on reporting issuers. As capital markets evolve, our approach to regulation needs to reflect the realities of business for Canadian reporting issuers to remain competitive. Regulatory requirements and the associated compliance costs should be balanced against the significance of the regulatory objectives sought to be realized and the value provided by such regulatory requirements to investors and other stakeholders.

The purpose of this CSA Consultation Paper (the Consultation Paper) is to identify and consider areas of securities legislation applicable to non-investment fund reporting issuers{2} that could benefit from a reduction of undue regulatory burden, without compromising investor protection or the efficiency of the capital market. Part 2 of this Consultation Paper is focused on considering options to reduce the regulatory burden associated with both capital raising in the public markets (i.e., prospectus related requirements) and the ongoing costs of remaining a reporting issuer (i.e., continuous disclosure requirements).

Appendix A to this Consultation Paper provides a snapshot of the size and types of reporting issuers who operate in the public market. We note that the Consultation Paper focuses only on the various securities legislation requirements applicable to non-investment fund reporting issuers. Separately, the CSA are also considering ways to reduce regulatory burden in other areas of securities legislation, such as reducing the disclosure obligations for investment funds.

Through recent policy initiatives, the CSA have taken steps to support reporting issuers while maintaining investor protection. For example, we have:

• liberalized the prospectus marketing regime by increasing the range of permissible pre-marketing and marketing activities in connection with public offerings,

• introduced new exemptions for use by reporting issuers and amended or modified certain existing prospectus exemptions available to reporting issuers, and

• tailored disclosure and other requirements to alleviate certain requirements for venture issuers in the prospectus and continuous disclosure regimes.

Similarly, the CSA are currently:

• reviewing the current resale regime for prospectus-exempt securities to determine the extent to which the resale provisions continue to be relevant in today's markets and to assess the market impact of alternative regulatory approaches, and

• creating a new national filing system to replace the core CSA national systems.

Appendix B to this Consultation Paper briefly discusses and highlights the details of these regulatory initiatives.

While we have undertaken a number of policy initiatives to decrease regulatory burden for reporting issuers, the CSA recognize that there is more we can do to address other potential sources of regulatory burden for reporting issuers, while being mindful of the impact on investor protection. This Consultation Paper is the first step in this process. We are seeking feedback from market participants and stakeholders to identify specific areas of securities legislation where the regulatory burden on reporting issuers may be out of proportion to the regulatory objectives sought to be achieved. We will consider all comments received in assessing the scope and timing of any further work to reduce regulatory burden. However, while this Consultation Paper sets out a range of potential options and requests comments on these and any other options for consideration that we have not identified, we note that no definitive decisions have been made as to whether to move forward on any particular regulatory initiative.

Comments must be submitted in writing by July 7, 2017. We encourage commenters to provide comments on the full range of options identified in this Consultation Paper.

PART 2 -- Potential options to reduce regulatory burden

We set out below some potential regulatory options which may reduce regulatory burden for reporting issuers:

2.1 Extending the application of streamlined rules to smaller reporting issuers

2.2 Reducing the regulatory burdens associated with the prospectus rules and offering process

(a) Reducing the audited financial statement requirements in an initial public offering (IPO) prospectus

(b) Streamlining other prospectus requirements

(c) Streamlining public offerings for reporting issuers

(d) Other potential areas

2.3 Reducing ongoing disclosure requirements

(a) Removing or modifying the criteria to file a business acquisition report (BAR)

(b) Reducing disclosure requirements in annual and interim filings

(c) Permitting semi-annual reporting

2.4 Eliminating overlap in regulatory requirements

2.5 Enhancing electronic delivery of documents

While this Consultation Paper discusses some initiatives relating to financial information required under securities legislation, we note that accounting standards for use by entities that prepare financial statements in accordance with Canadian generally accepted accounting principles (GAAP) are established by the Accounting Standards Board (AcSB), an independent body, and not by the CSA. The AcSB determines the contents of the CPA Canada Handbook -- Accounting (the Handbook) and has approved the standards set out in Part I of the Handbook (i.e. International Financial Reporting Standards or IFRS) as accounting standards for publicly accountable enterprises.

In this Part, we set out a number of potential options for reducing regulatory burden for reporting issuers, including specific consultation questions to gauge the nature and scope of the issues to be addressed in each of these areas. We are also soliciting general feedback on which of these options should be prioritized (and, if so, the reasons why), whether such issues can be addressed in the short-term or medium-term, what the impact on investors may be, and any other areas of securities legislation which should also be considered.

- - - - - - - - - - - - - - - - - - - -

General consultation questions

1. Of the potential options identified in Part 2:

(a) Which meaningfully reduce the regulatory burden on reporting issuers while preserving investor protection?

(b) Which should be prioritized and why?

2. Which of the issues identified in Part 2 could be addressed in the short-term or medium-term?

3. Are there any other options that are not identified in Part 2 which may offer opportunities to meaningfully reduce the regulatory burden on reporting issuers or others while preserving investor protection? If so, please explain the nature and extent of the issues in detail and whether these options should constitute a short-term or medium-term priority for the CSA.

- - - - - - - - - - - - - - - - - - - -

2.1 Extending the application of streamlined rules to smaller reporting issuers

Under Canadian securities legislation, venture issuers are permitted to comply with continuous disclosure requirements that are generally less onerous than those imposed on other reporting issuers. For example, venture issuers have:{3}

• longer filing deadlines for annual and interim financial statements

• a higher threshold for significant acquisition reporting

• no requirement to file an annual information form (AIF)

• ability to file a quarterly highlights document to meet interim management's discussion and analysis (MD&A) requirements

• different corporate governance requirements

• reduced certification requirements

We currently distinguish venture issuers from non-venture issuers based on their exchange listings. A reporting issuer generally qualifies as a venture issuer as long as it does not have securities listed or quoted on what we consider senior securities exchanges or most foreign exchanges (a Non-Venture Exchange).{4} Some of the reasons for the current delineation between venture and non-venture issuers were stability and transparency.

We are considering ways to reduce reporting requirements for smaller reporting issuers based on a different metric. One option would be to adopt a size-based distinction. Under this option, a reporting issuer's size could be measured, for example, by the size of its assets, revenue, market capitalization or a combination of criteria. A size-based distinction would allow smaller reporting issuers listed on senior securities exchanges to utilize the reduced regulatory requirements currently restricted to venture issuers.

For example, we note that the rules and regulations of the U.S. Securities and Exchange Commission (SEC) provide reduced reporting requirements for "smaller reporting companies". Smaller reporting companies provide less historical financial information, have longer filing deadlines and have reduced executive compensation and MD&A disclosure requirements. Smaller reporting companies are presently defined as registrant companies (which are analogous to Canadian reporting issuers) with less than US$75 million in common equity public float, or less than US$50 million in revenue in the case of companies without publicly traded equity. The SEC has recently proposed amendments that, if adopted, would expand the number of registrants that qualify as smaller reporting companies by increasing the criteria thresholds to less than US$250 million in common equity public float or US$100 million in revenue for registrant companies with zero public float.

Additionally, the U.S. Jumpstart Our Business Startups Act of 2012 introduced a new category of registrant: the emerging growth company (EGC). Most companies with annual revenue under US$1 billion qualify as an EGC and benefit from reduced regulatory and reporting requirements under the U.S. Securities Exchange Act of 1934.{5} The EGC status is time-limited. While the quantitative thresholds adopted by the SEC for the U.S. market would need to be adjusted to reflect the significantly smaller scale of the Canadian capital market and its reporting issuers, the general approach taken by the SEC might suggest options worth considering in the Canadian context.

With a median market capitalization of $112 million for reporting issuers listed on the TSX{6}, a number of TSX-listed reporting issuers could likely benefit from reduced reporting requirements if we were to adopt a size-based distinction similar to the criteria for smaller reporting companies under the SEC rules.

- - - - - - - - - - - - - - - - - - - -

Consultation questions

4. Would a size-based distinction between categories of reporting issuers be preferable to the current distinction based on exchange listing? Why or why not?

5. If we were to adopt a size-based distinction:

(a) What metric or criteria should be used and why? What threshold would be appropriate and why?

(b) What measures could be used to prevent reporting issuers from being required to report under different regimes from year to year?

(c) What measures could be used to ensure that there is sufficient transparency to investors regarding the disclosure regime to which the reporting issuer is subject?

(d) How could we assist investors in understanding the distinction made and the requirements applicable to each category of reporting issuer?

6. If the current distinction for venture issuers is maintained, should we extend certain less onerous venture issuer regulatory requirements to non-venture issuers? Which ones and why?{7}

- - - - - - - - - - - - - - - - - - - -

2.2 Reducing the regulatory burdens associated with the prospectus rules and offering process

(a) Reducing the audited financial statement requirements in an IPO prospectus

The venture issuer regulation amendments introduced in 2015 reduced the number of years of financial information and related analysis required in a venture issuer IPO prospectus from three to two years. In addition, National Instrument 41-101 General Prospectus Requirements contains an exemption based on size from the requirement to audit the second and third most recently completed financial years.

We understand that an issuer may choose to list on a Non-Venture Exchange at the time of its IPO despite having relatively low revenues. We could consider allowing issuers that intend to list on a Non-Venture Exchange to present a reduced number of years of audited financial statements in their IPO prospectus if they have pre-IPO revenues under a certain threshold. Alternatively, we could allow all issuers to do so. These issuers could still be subject to the continuous disclosure requirements of a non-venture issuer post-IPO. However, it is unclear to us whether this would contribute to more efficient capital raising in the public market in isolation.

- - - - - - - - - - - - - - - - - - - -

Consultation questions

7. Is it appropriate to extend the eligibility criteria for the provision of two years of financial statements to issuers that intend to become non-venture issuers? If so:

(a) How would this amendment assist in efficient capital raising in the public market?

(b) How would having less historical financial information on non-venture issuers impact investors?

(c) Should we consider a threshold, such as pre-IPO revenues, in determining whether two years of financial statements are required? Why or why not?

(d) If a threshold is appropriate, what threshold should be applied to determine whether two years of financial statements are required, and why?

8. How important is the ability to perform a three year trend analysis?

- - - - - - - - - - - - - - - - - - - -

(b) Streamlining other prospectus requirements

In addition, there are other prospectus requirements that we can consider removing or modifying to reduce the issuer's preparation costs while still providing potential investors with clear, understandable and comprehensive disclosure necessary to make an informed investment decision. These options include:

• increasing BAR thresholds for non-venture issuers (also discussed in a continuous disclosure context below),

• removing the requirement for interim financial statements to be reviewed by an auditor,

• removing the requirement to include pro forma financial statements for significant acquisitions, and

• tailoring disclosure requirements for non-IPO prospectuses to only focus on the following information: an overview of the issuer's business, key information regarding the issuer's management, disclosure of any conflicts of interest, a description of securities distributed and relevant rights, and the principal risks facing the business.

- - - - - - - - - - - - - - - - - - - -

Consultation questions

9. Should auditor review of interim financial statements continue to be required in a prospectus? Why or why not?

10. Should other prospectus disclosure requirements be removed or modified, and why?

- - - - - - - - - - - - - - - - - - - -

(c) Streamlining public offerings for reporting issuers

The prospectus requirement, including the statutory rights investors receive under this regime, is a fundamental pillar of our current regulatory regime. Historically, the short form prospectus regime was designed to facilitate efficient capital raising for reporting issuers while providing investors with all of the protections of a prospectus, including statutory rights of withdrawal, rescission and damages, and the protections afforded by the statutory liability regime for the contents of the prospectus (i.e., the liability imposed by securities legislation on the reporting issuer, the underwriters, the board of directors, etc.).

(i) Short form prospectus offering system

We have heard from some stakeholders that the time and cost to prepare a short form prospectus may be impediments to capital raising.

We are considering whether to eliminate or modify existing short form prospectus disclosure requirements where such requirements are duplicative, are not providing potential investors with timely, relevant information or may be misaligned with current market practices. For example, risk factor disclosure in short form prospectuses may often seem repetitive or boilerplate and the required disclosure of price ranges and trading volumes is available on the website of the reporting issuer's trading market.

We could also consider whether to extend the short form prospectus offering system to additional reporting issuers not currently qualified to use it (i.e., re-examine the short form eligibility requirements).

- - - - - - - - - - - - - - - - - - - -

Consultation questions

11. Is the current short form prospectus system achieving the appropriate balance (i.e., between facilitating efficient capital raising for reporting issuers and investor protection)? If not, please identify potential short form prospectus disclosure requirements which could be eliminated or modified in order to reduce regulatory burden on reporting issuers, without impacting investor protection, including providing specific reasons why such requirements are not necessary.

12. Should we extend the availability of the short form prospectus offering system to more reporting issuers? If so, please explain for which issuers, and why this would be appropriate.

- - - - - - - - - - - - - - - - - - - -

(ii) Potential alternative prospectus model

We are also considering whether conditions are right to revisit the merits of a prospectus offering model for reporting issuers that is more closely linked to continuous disclosure.

In 2000, the CSA published for comment a concept proposal called Integrated Disclosure System (IDS).{8} This regime was designed to complement the existing prospectus regime. Under the IDS, reporting issuers were required to provide investors with more comprehensive and timely continuous disclosure by using an abbreviated offering document integrating the reporting issuer's disclosure base.

In 2002, the British Columbia Securities Commission also published for comment a proposal on, among other things, a system called Continuous Market Access (CMA).{9} This regime was designed to replace the existing prospectus regime. CMA provided reporting issuers with access to markets by disclosing the offering in a press release. No offering document was required, but reporting issuers were subject to an enhanced continuous disclosure regime and the obligation to disclose all material information about the reporting issuer.

The IDS and CMA proposals were intended to de-emphasize the traditional focus on primary market disclosure and put increased focus on a reporting issuer's continuous disclosure, in recognition of the fact that the majority of trading was taking place in the secondary rather than primary markets. They were also meant to provide reporting issuers with faster and more flexible access to public markets.

Ultimately, these proposals did not go forward and, instead, the CSA subsequently updated the short form prospectus system.

Differences between the securities legislation of the various CSA jurisdictions may have been an obstacle at the time the IDS and CMA were proposed. However, since the early 2000s, the CSA have implemented different rules to further develop the harmonized approach to securities legislation across the country, such as national disclosure rules, the passport regime and registration requirements. Also, all CSA jurisdictions have adopted a statutory secondary market liability regime, which did not exist at the time the IDS and CMA were proposed.

We are now considering if the conditions are right to amend the current prospectus offering regime for reporting issuers. The intention is that the disclosure provided to investors be more concise and focused than under the current short form prospectus regime. For example, in cases other than a significant acquisition or significant changes to the reporting issuer's business, the disclosure in a prospectus could be limited to relevant items concerning the offering and the offered securities, such as:

• a detailed description of the securities offered

• intended use of proceeds

• the plan of distribution

• consolidated capitalization

• earnings coverage

• material risk factors associated with the offering and the offered securities

• conflicts of interest, if any

• investors' statutory rights of withdrawal, damages and rescission

Under an alternative prospectus model, reporting issuers and dealers participating in an offering would assume liability for any misrepresentation in the reporting issuer's disclosure base and all written marketing communications pertaining to the offering or the securities offered.

- - - - - - - - - - - - - - - - - - - -

Consultation questions

13. Are conditions right to propose a type of alternative prospectus model for reporting issuers? If an alternative prospectus model is utilized for reporting issuers:

(a) What should the key features and disclosure requirements of any proposed alternative prospectus model be?

(b) What types of investor protections should be included under such a model (for example, rights of rescission)?

(c) Should an alternative offering model be made available to all reporting issuers? If not, what should the eligibility criteria be?

- - - - - - - - - - - - - - - - - - - -

(iii) Facilitating at-the-market (ATM) offerings

An ATM offering is a continuous distribution by a reporting issuer of equity securities into a public trading market, such as the TSX, at prevailing market prices. ATM offerings are made through a registered securities dealer, typically acting on an agency basis. Distribution agreements governing ATM offerings usually provide reporting issuers with significant flexibility to establish parameters with respect to the timing, price and amount of securities to be sold during a specified period, subject to some limitations.

Part 9 of National Instrument 44-102 Shelf Distributions (NI 44-102) establishes certain rules for ATM offerings under Canadian shelf prospectuses, including an upper limit on the market value of securities which may be distributed under an ATM offering,{10} and a prohibition against market stabilization activities in connection with such an offering. NI 44-102 does not establish a comprehensive framework for ATM offerings as it does not exempt ATM offerings from certain provisions of securities legislation applicable to all prospectus offerings, such as the prospectus delivery requirement and statutory rights of rescission and withdrawal. However, these are impracticable in the context of an ATM offering. Consequently, a reporting issuer wishing to conduct an ATM offering must obtain exemptive relief from these requirements. As a condition of granting the requested relief, exemptive relief granted by CSA members in connection with ATM offerings has typically limited the number of securities that may be sold under the ATM offering on any given trading day (as a percentage of the aggregate daily trading volume) and required monthly reports in respect of sales made through the ATM offering.

ATM offerings are well established in the United States, but much less common in Canada. A number of Canadian issuers have chosen to conduct ATM offerings exclusively in the United States, rather than in Canada. Some industry participants have observed that the limited number of ATM offerings in Canada may be partly attributable to regulatory burden associated with the requirement to obtain prior exemptive relief and the conditions typically imposed in connection with such relief. They have also suggested that some of the current restrictions on ATM offerings could be relaxed or eliminated without compromising necessary investor protection and the integrity of the capital markets. We are seeking feedback from participants in the Canadian capital markets as to whether there are measures we should adopt to facilitate ATM offerings in Canada.

- - - - - - - - - - - - - - - - - - - -

Consultation questions

14. What rule amendments or other measures could we adopt to further streamline the process for ATM offerings by reporting issuers? Are there any current limitations or requirements imposed on ATM offerings which we could modify or eliminate without compromising investor protection or the integrity of the capital markets?

15. Which elements of the exemptive relief granted for ATM offerings should be codified in securities legislation to further facilitate such offerings?

- - - - - - - - - - - - - - - - - - - -

(d) Other potential areas

We are also considering other potential areas for reducing regulatory burden associated with capital raising, including:

• facilitating cross-border offerings

• further liberalizing the pre-marketing and marketing regime

- - - - - - - - - - - - - - - - - - - -

Consultation questions

16. Are there rule amendments and/or processes we could adopt to further streamline the process for cross-border prospectus offerings, without compromising investor protection, by: (i) Canadian issuers and (ii) foreign issuers?

17. As noted in Appendix B, in 2013 a number of amendments were made to liberalize the pre-marketing/marketing regime in Canada. Are there rule amendments and/or processes we could adopt to further liberalize the prospectus pre-marketing and marketing regime in Canada, without compromising investor protection, for: (i) existing reporting issuers and (ii) issuers planning an IPO, and if so in what way?

- - - - - - - - - - - - - - - - - - - -

2.3 Reducing ongoing disclosure requirements

(a) Removing or modifying the criteria to file a BAR

Currently, reporting issuers are required to file a BAR within 75 days after completion of an acquisition that meets the significance tests set out in Part 8 of NI 51-102. This requirement was introduced in 2004 to provide investors in the secondary market, on a relatively timely basis, the type of information currently required for primary market investors in a prospectus offering. Disclosure required in a BAR includes historical financial statements of the business acquired and, in the case of a BAR filed for a non-venture reporting issuer, pro forma financial statements.

In July 2011, the CSA requested comments on proposed National Instrument 51-103 Ongoing Governance and Disclosure Requirements for Venture Issuers (NI 51-103). In NI 51-103, the CSA proposed to increase the significance thresholds for acquisitions made by venture issuers from 40% to 100%. Although the CSA did not implement NI 51-103, it amended NI 51-102 in 2015 to increase the significance thresholds for acquisitions made by venture issuers as proposed in NI-51-103. The increased significance thresholds reduced the instances when venture issuers must file a BAR. No increase of the significance tests for non-venture issuers was proposed at that time, as these changes were made in the context of rule amendments targeting venture issuers only.

Reporting issuers frequently apply for and are granted certain relief from the BAR requirements. We have heard from some stakeholders that the preparation of a BAR entails significant time and cost, and that the information necessary to comply with the BAR requirements may, in some instances, be difficult to obtain. Some of these stakeholders have also questioned the value of the disclosure BARs provide. In the July 2011 consultation on NI 51-103, a number of commenters had also indicated that they did not think pro forma financial statements provide useful information to investors. Other stakeholders have indicated that they continue to believe that there are situations where a BAR provides relevant information to investors seeking to make an investment decision.

We are now considering whether we should conduct a broader review of the BAR requirements. We could consider changes such as:

• removing the requirement to file a BAR entirely in certain circumstances

• removing one or more of the significance tests

• increasing the threshold applied to the three significance tests for non-venture issuers

• providing alternative tests based on specific industry criteria

- - - - - - - - - - - - - - - - - - - -

Consultation questions

18. Does the BAR disclosure, in particular the financial statements of the business acquired and the pro forma financial statements, provide relevant and timely information for an investor to make an investment decision? In what situations does the BAR not provide relevant and timely information?

19. Are there certain BAR requirements that are more onerous or problematic than others?

20. If the BAR provides relevant and timely information to investors:

(a) Are each of the current significance tests required to ensure that significant acquisitions are captured by the BAR requirements?

(b) To what level could the significance thresholds be increased for non-venture issuers while still providing an investor with sufficient information with which to make an investment decision?

(c) What alternative tests would be most relevant for a particular industry and why?

(d) Do you think that the disclosure requirements for a significant acquisition under Item 14.2 of 51-102F5 (information circular) should be modified to align with those required in a BAR, instead of prospectus-level disclosure? Why or why not?

- - - - - - - - - - - - - - - - - - - -

(b) Reducing disclosure requirements in annual and interim filings

We have heard from stakeholders that the volume of information included in annual and interim filings may obscure the focus on the key information needed by a reporting issuer's investors and analysts. We are considering whether there are ways in which we could refocus annual and interim filings on such key information. Possible options include:

• removing the discussion of prior period results from the MD&A

• removing the summary of quarterly results for the eight most recently completed quarters in the MD&A

• allowing all reporting issuers to meet interim MD&A requirements by preparing a "quarterly highlights" document (currently, this option is limited to venture issuers only)

- - - - - - - - - - - - - - - - - - - -

Consultation questions

21. Are there disclosure requirements for annual and interim filing documents that are overly burdensome for reporting issuers to prepare? Would the removal of these requirements deprive investors of any relevant information required to make an investment decision? Why or why not?

22. Are there disclosure requirements for which we could provide more guidance or clarity? For example, we could clarify that discussion of only significant trends and risks is required, or that the filing of immaterial amendments to material contracts is not required under NI 51-102.

- - - - - - - - - - - - - - - - - - - -

(c) Permitting semi-annual reporting

A key element proposed in NI 51-103 was the change from a quarterly financial reporting requirement to a semi-annual reporting requirement.{11} Although the CSA ultimately adopted some of the proposals within NI 51-103 as amendments to the existing regulatory regime for venture issuers, the CSA did not change the quarterly reporting requirement because of concerns expressed by certain commenters. These commenters thought the time period between financial reports would be too long and that the proposals might adversely affect the market perception of venture issuers, their governance, liquidity and comparability to more senior reporting issuers. Some of these commenters did not think that the requirement for interim financial reports was unduly burdensome or costly.

Although the CSA did not implement NI 51-103, it amended NI 51-102 in 2015 to allow venture issuers to replace interim MD&A with quarterly highlights.

There has been considerable discussion over the past several years with respect to perceived short-term focus among publicly-traded entities due to the current emphasis on quarterly financial results, and whether this trend is inconsistent with the creation of value by businesses over the long term. Some academic commentators and business leaders have suggested that quarterly reporting encourages reporting issuers to focus too heavily on short-term financial results, to the detriment of the reporting issuer's business over the longer-term. Others have questioned this analysis, and suggested that the elimination of quarterly reporting would deprive investors of timely financial disclosure, while doing little to push publicly-traded entities into better long-term decision making. We note that a semi-annual reporting model has been a long-established practice in the United Kingdom and Australia.{12} Given this ongoing debate, we are soliciting feedback from participants in the Canadian capital markets as to whether the time is right to revisit this issue.

We could provide the option to report on either a quarterly or semi-annual basis to all reporting issuers, or limit this option to smaller reporting issuers. Reporting issuers would still be required to comply with material change reporting requirements and exchange listing requirements to disclose all material information.

- - - - - - - - - - - - - - - - - - - -

Consultation questions

23. What are the benefits of quarterly reporting for reporting issuers? What are the potential problems, concerns or burdens associated with quarterly reporting?

24. Should semi-annual reporting be an option provided to reporting issuers and if so under what circumstances? Should this option be limited to smaller reporting issuers?

25. Would semi-annual reporting provide sufficiently frequent disclosure to investors and analysts who may prefer to receive more timely information?

26. Similar to venture issuers, should non-venture issuers have the option to replace interim MD&A with quarterly highlights?

- - - - - - - - - - - - - - - - - - - -

2.4 Eliminating overlap in regulatory requirements

There are areas of similarity between the disclosure requirements of IFRS and Form 51-102F1 Management's Discussion & Analysis, such as:

• financial instruments

• critical accounting estimates

• change in accounting policies

• contractual obligations

Additionally, there is potential overlap in the disclosure requirements in the NI 51-102 forms. For instance, both the MD&A and the AIF require a form of discussion of the risks associated with the reporting issuer.

We are considering the removal of some or all of this overlap, or consolidating the requirements of the MD&A, AIF and financial statements into one document.

- - - - - - - - - - - - - - - - - - - -

Consultation questions

27. Would modifying any of the above areas in the MD&A form requirements result in a loss of significant information to an investor? Why or why not?

28. Are there other areas where the MD&A form requirements overlap with existing IFRS requirements?

29. Should we consolidate the MD&A, AIF (if applicable) and financial statements into one document? Why or why not?

30. Are there other areas of overlap in continuous disclosure rules? Please indicate how we could remove overlap while ensuring that disclosure is complete, relevant, clear, and understandable for investors.

- - - - - - - - - - - - - - - - - - - -

2.5 Enhancing electronic delivery of documents

National Policy 11-201 Electronic Delivery of Documents (NP 11-201) provides guidance to securities industry participants that want to use electronic delivery to fulfill delivery requirements in securities legislation. NP 11-201 applies to documents required to be delivered under securities legislation, including prospectuses, financial statements, and proxy-related materials that are delivered by securities industry participants or those acting on their behalf, such as transfer agents.

One area where we have facilitated the use of electronic delivery is in the introduction of "notice-and-access". In 2013, amendments were made to National Instrument 54-101 Communication with Beneficial Owners of Securities of a Reporting Issuer (NI 54-101) to give reporting issuers the option to use the "notice-and-access" method to post proxy-related materials on a website instead of having to mail materials to registered holders (under NI 51-102) and to beneficial owners (under NI 54-101). Under NI 51-102, notice-and-access may also be used to post annual financial statements and MD&A in lieu of sending such documents to all security holders.

Under the "notice-and-access" method, reporting issuers must deliver a printed notice and voting documents to beneficial owners who have not given their prior consent to delivery. Also, beneficial owners may request a paper copy of certain documents, such as information circulars, annual financial statements and MD&A, at no charge. Factors outside of securities legislation, such as the delivery requirements under business corporations legislation, electronic commerce legislation, investor preferences and market practice, may also impact a reporting issuer's obligation to print and deliver certain documents to beneficial owners or a reporting issuer's choice to use notice-and-access.

Despite these developments to facilitate electronic delivery of documents, we have heard from some market participants that reporting issuers continue to incur significant costs associated with printing and delivering various documents required under securities legislation.

Given the widespread use of Internet, social media and technology in communications generally, we are considering whether new methods of electronic delivery should be permitted to further reduce the use of paper to fulfill delivery requirements, thus reducing costs for reporting issuers, and promoting a more environmentally responsible approach to document delivery. At the same time, we acknowledge that not all investors are online or may prefer to receive their documents in paper format for other valid reasons.

- - - - - - - - - - - - - - - - - - - -

Consultation questions

31. Are there any aspects of the guidance provided in NP 11-201 which are unclear or misaligned with market practice?

32. The following consultation questions pertain to the "notice-and-access" model under securities legislation and consideration of potential changes to this model:

(a) Since the adoption of the "notice-and-access" amendments, what aspects of delivering paper copies represent a significant burden for issuers, if any? Are there a significant number of investors that continue to prefer paper delivery of proxy materials, financial statements and MD&A?

(b) Do you think it is appropriate for a reporting issuer to satisfy the delivery requirements under securities legislation by making proxy materials, financial statements and MD&A publicly available electronically without prior notice or consent and only deliver paper copies of these documents if an investor specifically requests paper delivery? If so, for which of the documents required to be delivered to beneficial owners should this option be made available?

(c) Would changes to the "notice-and-access" model as described in question (b) above pose a significant risk of undermining the protection of investors under securities legislation, even though an investor may request to receive paper copies?

(d) Are there other rule amendments that could be made in NI 54-101 or NI 51-102 to improve the current "notice-and-access" options available for reporting issuers?

33. Are there other ways electronic delivery of documents could be further enhanced through securities legislation?

- - - - - - - - - - - - - - - - - - - -

PART 3 -- Providing feedback

We invite interested parties to make written submissions on the consultation questions identified throughout this Consultation Paper. You must submit your comments in writing by July 7, 2017. If you are sending your comments by email, you should also send an electronic file containing the submissions in Microsoft Word.

Address your submission to all of the CSA as follows:

British Columbia Securities CommissionAlberta Securities CommissionFinancial and Consumer Affairs Authority of SaskatchewanManitoba Securities CommissionOntario Securities CommissionAutorité des marchés financiersFinancial and Consumer Services Commission (New Brunswick)Superintendent of Securities, Department of Justice and Public Safety, Prince Edward IslandNova Scotia Securities CommissionSecurities Commission of Newfoundland and LabradorSuperintendent of Securities, Northwest TerritoriesSuperintendent of Securities, YukonSuperintendent of Securities, Nunavut

Deliver your comments only to the addresses below. Your comments will be distributed to the other participating CSA regulators.

Certain CSA regulators require publication of the written comments received during the comment period. We will publish all responses received on the websites of the Autorité des marchés financiers (www.lautorite.qc.ca), the Ontario Securities Commission (www.osc.gov.on.ca), and the Alberta Securities Commission (www.albertasecurities.com). Therefore, you should not include personal information directly in comments to be published. It is important that you state on whose behalf you are making the submission.

PART 4 -- Questions

Please refer your questions to any of the following CSA staff:

{1} http://www.securities-administrators.ca/uploadedFiles/General/pdfs/CSA_Business_Plan_2016-2019.pdf

{2} In the main body of the Consultation Paper, reference to "reporting issuer(s)" means a "reporting issuer" as defined in securities legislation, other than investment funds. In Appendices A and B of this Consultation Paper, reference to "reporting issuer(s)" means a "reporting issuer" as defined in securities legislation.

{3} For additional details, see Appendix B.

{4} For instance, National Instrument 51-102 Continuous Disclosure Obligations (NI 51-102) defines "venture issuer" as a reporting issuer that does not have any of its securities listed or quoted on any of the Toronto Stock Exchange (TSX), Aequitas NEO Exchange Inc., a U.S. marketplace, or a marketplace outside of Canada and the U.S. other than the Alternative Investment Market of the London Stock Exchange or the PLUS markets operated by PLUS Markets Group plc.

{5} The modified requirements available to EGCs include reduced disclosure with respect to financial statements, MD&A, and executive compensation.

{6} http://www.tsx.com/listings/listing-with-us, as of March 31, 2017.

{7} See section 2.2 for a discussion on expanding the eligibility criteria for the provision of two years of financial statements to issuers that intend to become non-venture issuers for IPO prospectuses.

{8} Canadian Securities Administrators Notice and Request for Comment 44-101, 51-401 -- Concept Proposal for an Integrated Disclosure System, Canadian Securities Administrators, January 28, 2000

{9} New Proposals for Securities Regulation -- A new way to regulate, British Columbia Securities Commission, June 5, 2002

{10} The market value of equity securities distributed under an ATM offering may not exceed 10% of the aggregate market value of the reporting issuer's outstanding equity securities of the same class as the class of securities distributed, calculated in accordance with section 9.2 of NI 44-102 as of the last trading day of the month before the month in which the first trade under the ATM offering is made.

{11} A semi-annual reporting requirement was also a key feature of CSA Multilateral Consultation Paper 51-403 Tailoring Venture Issuer Regulation on May 31, 2010 by the securities regulators in Alberta, British Columbia, Manitoba, New Brunswick, Nova Scotia and Saskatchewan.

{12} In the United Kingdom, mandatory quarterly reporting was introduced in 2007. However, this requirement was abandoned in 2014 in favour of a semi-annual reporting requirement. UK reporting companies are still permitted to report on a quarterly basis.

APPENDIX A

SNAPSHOT OF THE PUBLIC MARKET

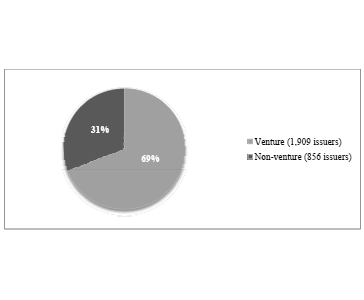

The following charts provide an overview (as of December 31, 2016) of:

• the market capitalization of reporting issuers by industry (both in terms of dollar values and by percentage of total market capitalization), and

• the composition of venture and non-venture issuers (by number of reporting issuers).

Market capitalization and number of reporting issuers, broken down by industry as at December 31, 2016

|

Industry{13} |

Market cap ($ billions) |

Market cap (% of total) |

Number of reporting issuers |

Number of reporting issuers (% of total) |

|

|

||||

|

Financial services |

$809 |

31% |

132 |

5% |

|

Diversified industries |

$556 |

21% |

370 |

13% |

|

Oil & Gas |

$325 |

12% |

247 |

9% |

|

Mining |

$280 |

11% |

1,319 |

48% |

|

Utilities & Pipelines |

$228 |

8% |

25 |

1% |

|

Communications & Media |

$179 |

7% |

37 |

1% |

|

Real estate |

$96 |

4% |

97 |

4% |

|

Technology |

$85 |

3% |

252 |

9% |

|

Clean Technology & Renewable Energy |

$36 |

1% |

108 |

4% |

|

|

||||

|

Life Sciences |

$25 |

1% |

160 |

6% |

|

Forest Products & Paper |

$23 |

1% |

18 |

1% |

|

TOTAL |

$2,642 |

|

2,765 |

|

{13} Source: TMX Market Intelligence Group Report for December 2016 and Canadian Securities Exchange (CSE) data provided by the CSE. Data excludes exchange-traded funds, closed-end funds, capital pool companies and special purpose acquisition corporations.

Status of reporting issuers, as at December 31, 2016

APPENDIX B

SUMMARY OF RECENT CSA POLICY INITIATIVES TO SUPPORT ISSUERS

New or modified prospectus exemptions

Modernization of the exempt market{14} regulatory regime has been a major priority for the CSA. In keeping with this, CSA members have undertaken a series of significant exempt market initiatives related to both introducing new prospectus exemptions and modifying or harmonizing existing ones.{15} The purpose of these policy initiatives was to facilitate greater access to capital through the exempt market for issuers, particularly for start-ups and small and medium-sized enterprises, while maintaining appropriate investor protection.

A number of the prospectus exemptions were specifically designed for use by reporting issuers, including:

• the existing security holder exemption (ESH Exemption),

• the rights offering prospectus exemption (Rights Offering Exemption), and

• the investment dealer exemption (Investment Dealer Exemption).

Other prospectus exemptions are available to both reporting issuers and non-reporting issuers seeking to raise capital:

• the crowdfunding exemption (Crowdfunding Exemption),

• the offering memorandum exemption (OM Exemption), and

• the friends, family and business associates exemption (FFBA Exemption).

ESH Exemption

The ESH Exemption allows reporting issuers listed on specified exchanges to raise funds from existing security holders holding equity securities subject to certain conditions. The ESH Exemption is a cost-effective tool to raise capital because there are no requirements to provide investors with information at the time of distribution except that the reporting issuer is required to issue a news release about the proposed sale of the securities and file any offering materials (other than the subscription agreement) with securities regulators on the same day it provides materials to investors.

Rights Offering Exemption

The CSA have streamlined the rights offering prospectus exemption for non-investment fund reporting issuers in order to reduce the time and cost associated with the use of this exemption. These amendments included:

• removing the current regulatory review process prior to the use of the exemption,

• increasing investor protection through the addition of civil liability for secondary market disclosure,

• introducing a user-friendly form of rights offering circular,

• introducing a new notice that reporting issuers must file on SEDAR and send to security holders informing them about how to access the rights offering circular electronically, and

• increasing the dilution limit from 25% to 100%.

Investment Dealer Exemption{16}

The Investment Dealer Exemption allows reporting issuers listed on a Canadian exchange to raise money by distributing securities to investors who have obtained suitability advice on the investment from an investment dealer. The reporting issuer must have filed all required periodic and timely disclosure documents and issue a news release with key information regarding the distribution, including the use of proceeds and disclosure of any material facts which have not generally been disclosed.

Crowdfunding Exemption{17}

The Crowdfunding Exemption{18} enables start-ups and small and medium enterprises in their early-stages of development to raise capital online from a large number of investors through a single registered funding portal. A limit on the total amount that can be raised is imposed on issuers and investors will be subject to investment limits as a means of limiting their exposure to a highly risky investment. Multilateral Instrument 45-108 -- Crowdfunding (MI 45-108) is available to all issuers that are incorporated or organized in Canada, with their head office in Canada, a majority of their directors resident in Canada, and their principal operating subsidiary (if any) incorporated or organized in Canada or the USA. A crowdfunding offering document must be provided to investors and an issuer may also provide purchasers with a term sheet, video or other materials summarizing the information in the crowdfunding offering document.

OM Exemption

The OM Exemption was designed to facilitate capital-raising by allowing issuers to solicit investments from a wider range of investors than under other prospectus exemptions, provided that investors receive a disclosure document at the point of sale (an offering memorandum), as well as a risk acknowledgement form in respect of their initial investment. The offering memorandum has to be accompanied by audited financial statements; however the offering memorandum requires less disclosure relative to what is required to be included in a prospectus.

FFBA Exemption

The FFBA Exemption permits issuers to distribute securities to the issuer's directors, executive officers, control persons and founders as well as certain family members, close personal friends and close business associates of such persons, subject to a number of conditions. It was designed to allow early-stage issuers greater access to capital from their network of family, close personal friends and close business associates. There are no requirements to provide investors with information at the time of distribution and the exemption can be used without intermediary involvement.

Venture issuer regulation

In 2015, the CSA implemented targeted amendments to the continuous disclosure and prospectus requirements to streamline and tailor disclosure by venture issuers. These amendments were designed to focus disclosure of venture issuers on information that reflects the needs and expectations of venture issuer investors and eliminate disclosure obligations that may be less valuable to those investors, allowing management of venture issuers to focus on the growth of their business. Specifically, the amendments included:

Quarterly highlights

• allow venture issuers to meet the interim MD&A requirement by filing a "quarterly highlights" document

Executive compensation

• allow venture issuers to use a new tailored form of executive compensation disclosure, Form 51-102F6V Statement of Executive Compensation -- Venture Issuers

Business acquisition reporting

• increase the significance threshold of an acquisition from 40% to 100% in determining whether an acquisition is significant for purposes of filing a BAR

IPO prospectus

• reduce the number of years of company history and audited financial statements required in a venture issuer IPO prospectus from three to two years

Corporate governance

• require venture issuers to have an audit committee of at least three members, the majority of whom cannot be executive officers, employees or control persons of the venture issuer or of an affiliate of the venture issuer

Pre-marketing and marketing amendments to prospectus rules

In 2013, the CSA adopted amendments to the prospectus rules and related policies which increased the range of permissible "pre-marketing" and "marketing" activities in connection with prospectus offerings by issuers other than investment funds. By helping to facilitate the prospectus offering process for issuers and investment dealers, these amendments sought to foster capital raising activities.

The purposes of the rule amendments and policy changes were to:

• ease certain regulatory burdens and restrictions that issuers and investment dealers faced in trying to successfully complete a prospectus offering, while at the same time providing protection to investors, and

• clarify certain matters in order to provide clear rules and a "level playing field" for market participants involved in a prospectus offering.

Among other things and subject to certain conditions, the amendments:

• expressly allow non-reporting issuers, through an investment dealer, to determine interest in a potential initial public offering by communicating with accredited investors,

• expressly allow investment dealers to use marketing materials and conduct road shows after the announcement of a bought deal, during the "waiting period", and following the receipt of a final prospectus (subject to appropriate limitations designed to address investor protection concerns),

• specify when bought deals and bought deal syndicates can be enlarged (for reporting issuers relying on the "bought deal" exemption in Part 7 of National Instrument 44-101 Short Form Prospectus Distributions), and

• provide greater clarity regarding certain practices used in connection with bought deals.

Review of the resale regime

Securities that are distributed using prospectus exemptions are generally subject to resale restrictions in accordance with the resale provisions in National Instrument 45 102 -- Resale of Securities (NI 45-102). NI 45-102 requires that an issuer be a reporting issuer for 4 months before securities can be freely traded (the Seasoning Period). Without this requirement, securities issued under a prospectus exemption could be resold in the public market with little or no public disclosure about the issuer. The resale provisions also include a requirement to hold securities for a specified period of time (the Restricted Period). Among other rationales, the Restricted Period is meant to allow sufficient time for the thorough dissemination and absorption in the marketplace of information about the issuer and the securities distributed under a prospectus exemption, and protect those purchasing in the secondary market. With a Restricted Period, securities cannot be sold other than pursuant to a further prospectus exemption until 4 months have elapsed since the distribution date. The Restricted Period may be indefinite if the issuer is not a reporting issuer.

The CSA are undertaking a review of the current resale regime for prospectus-exempt securities to determine the extent to which the resale provisions continue to be relevant in today's markets and to assess the market impact of alternative regulatory approaches.

National Systems Renewal Program (NSRP)

Through various service providers, CSA members operate a number of information technology systems which are widely used across all CSA jurisdictions. These include:

• the System for Electronic Document Analysis and Retrieval,

• the System for Electronic Disclosure by Insiders,

• the National Registration Database,

• the National Registration Search,

• the National Cease Trade Order Database, and

• the Disciplined List.

CSA members have initiated a program to replace these national systems with a single, intuitive and secure filing system for market participants and regulators.

{14} References to the exempt market refer to securities sold in reliance on a prospectus exemption.

{15} See CSA Staff Notice 45-314 -- Updated List of Current CSA Exempt Market Initiatives, published on January 28, 2016.

{16} Alberta, British Columbia, Manitoba, New Brunswick and Saskatchewan have adopted the Investment Dealer Exemption.

{17} MI 45-108 was introduced in Ontario, Quebec, Manitoba, Nova Scotia and New Brunswick in January 2016, and was adopted in Alberta in October 2016 and by Saskatchewan in February 2017.

{18} British Columbia, Saskatchewan, Manitoba, Quebec, New Brunswick and Nova Scotia have introduced a start-up crowdfunding exemption to facilitate capital raising for start-up and early stage businesses. The start-up crowdfunding exemption is not available to reporting issuers.