OSC Staff Notice 51-723 - Report on Staff's Review of Related Party Transaction Disclosure and Guidance on Best Practices

OSC Staff Notice 51-723 - Report on Staff's Review of Related Party Transaction Disclosure and Guidance on Best Practices

OSC Staff Notice 51-723

Report on Staff's Review of Related Party Transaction Disclosure and Guidance on Best Practices

OSC Staff Notice 51-723 -- Report on Staff's Review of Related Party Transaction Disclosure and Guidance on Best Practices is reproduced on the following internally numbered pages. Bulletin pagination resumes at the end of the Staff Notice.

OSC Staff Notice 51-723

Report on Staff's Review of Related Party Transaction Disclosure and Guidance on Best

Publication date: January 29, 2015

Table of Contents

|

1. |

Introduction |

2 |

|

|

||

|

2. |

Scope of Review |

3 |

|

|

||

|

3. |

Overall Results |

4 |

|

|

||

|

4. |

Financial Statement Disclosure |

6 |

|

|

Disclosure Requirement |

6 |

|

|

Staff Commentary |

6 |

|

|

Example -- Entity-specific Disclosure |

7 |

|

|

||

|

5. |

MD&A |

7 |

|

|

Disclosure Requirement |

7 |

|

|

Staff Commentary |

7 |

|

|

Example -- Boilerplate Disclosure |

8 |

|

|

Example -- Entity-specific Disclosure |

8 |

|

|

||

|

6. |

Corporate Governance Practice Disclosure |

8 |

|

|

Disclosure Requirement |

8 |

|

|

Staff Commentary |

9 |

|

|

Example -- Boilerplate Disclosure |

9 |

|

|

Example -- Entity-specific Disclosure |

10 |

|

|

||

|

7. |

Special Transactions |

10 |

|

|

Requirement |

10 |

|

|

Staff Commentary |

11 |

|

|

Example -- Boilerplate Disclosure |

12 |

|

|

Example -- Entity-specific Disclosure |

13 |

|

|

||

|

8. |

Conclusion |

13 |

1. Introduction

Related Party Transactions (RPT) are a regular feature of business and commerce and can be beneficial to a company. Many issuers, particularly smaller issuers, rely extensively on RPTs because RPTs enable issuers to advance their business on a cost-effective basis by leveraging their existing relationships. Under International Accounting Standards, a RPT is a transfer of resources, services or obligations between an issuer and a party related to the issuer or its executive officers or directors.{1} Under Multilateral Instrument 61-101 Protection of Minority Security Holders in Special Transactions (MI 61-101), a RPT is a transaction between the issuer and a related party of the issuer at the time the transaction is agreed to as a consequence of which the issuer directly or indirectly enters into specified transactions, including a purchase or sale of assets, issuing securities or subscribing for securities, borrowing or lending money, and forgiving debts or liabilities.

While RPTs can be beneficial, due to the inherent conflicts of interest, such transactions have the potential in certain circumstances to be unfair or abusive to the issuer or security holders.{2} Controlling shareholders, conflicted directors or others with influence may enter into transactions that are not beneficial to the issuer or may value RPTs in a manner that benefits the related party over the interests of the issuer and its security holders. Accordingly, it is essential, in connection with the disclosure, valuation, review and approval processes followed for RPTs that all security holders be treated in a manner that is fair and perceived to be fair.{3}

Fair treatment of security holders is essential to the protection of the public interest in maintaining capital markets that operate efficiently, fairly and with integrity.{4} In order to assess fairness, it is critical that issuers provide full and adequate disclosure to their shareholders about these transactions, so investors can better understand their business purpose and value. This is the case for ongoing transactions reflected in normal continuous disclosure filings as well as special transactions subject to MI 61-101.

We reviewed 100 issuers to assess RPT disclosure as described below. Our review found that almost all issuers engaged in some form of RPT and provided disclosure with respect to them. There is a general awareness of the need to provide information on RPTs in both the financial statements and the MD&A. However, our review found that in some instances the disclosure lacked an appropriate level of detail. This staff notice provides insight into areas where issuers can focus on improving their disclosure, including examples. In addition, boards can consider this guidance in developing policies for the identification and review of RPTs and ensuring that sufficient detail of the RPT is included in the issuers' public filings.

2. Scope of Review

In Canada, financial statement disclosure requirements under International Financial Reporting Standards (IFRS) and disclosure requirements under Management's Discussion and Analysis (MD&A) in Form 51-102F1 Management's Discussion & Analysis (Form 51-102F1) serve to ensure that investors are provided with sufficient information to make informed investment decisions. In addition, MI 61-101 outlines the requirements for more significant RPTs to ensure fair treatment of security holders. The following table provides a high level overview of the disclosure requirements under these accounting and securities rules.

|

IAS 24 |

Form 51-102F1 |

MI 61-101 |

|||

|

|

|||||

|

• |

Relationship of parents and subsidiaries |

• |

Relationship of related parties |

• |

Description of the RPT |

|

• |

Nature of the related party relationship |

• |

Identity of related parties |

• |

Purpose and business reasons for RPT |

|

• |

Amount of RPT, including commitments |

• |

Business purpose of the RPT |

• |

Effect of RPT on issuer |

|

|

|

• |

Recorded amount and measurement basis used |

• |

Review and approval process followed |

|

|

|

• |

Ongoing commitments |

• |

Description of the interest of every related party and interested party |

|

|

|

|

|

• |

Exemptions from the formal valuation and minority approval requirements relied upon |

Staff of the Ontario Securities Commission (OSC) conducted a review of 100 Ontario reporting issuers with the following two objectives:

• assessing issuer compliance with RPT disclosure requirements under securities and financial statement rules; and

• understanding the range of practice around issuer's corporate governance including their disclosure and approval of RPTs.

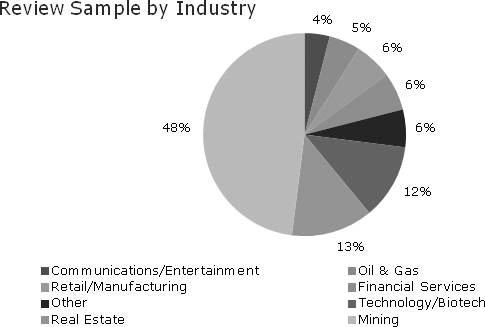

The sample of 100 issuers was selected randomly across all industries.

Forty-seven percent of issuers selected were venture issuers and 53% were non-venture issuers. Those reviewed included issuers of various sizes based on market capitalization. Of the issuers selected, 25% had a market capitalization of less than $5 million and 33% had a market capitalization of greater than $100 million. The remaining 42% had a market capitalization between $5 million and $100 million.

3. Summary of Results

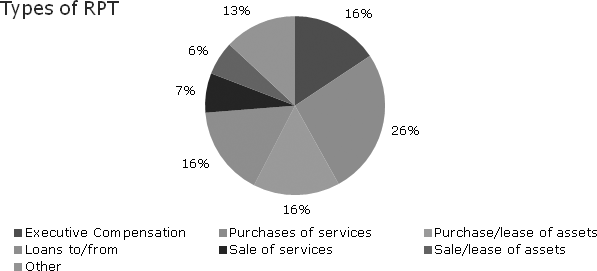

We found that 96% of issuers disclosed RPTs in their financial statements and / or within their MD&A. The most common types of RPTs found in our review were executive compensation, purchase of services or products from a related party, leases of property and loans to or from a related party. Other less common RPTs included sales of products or services to a related party.

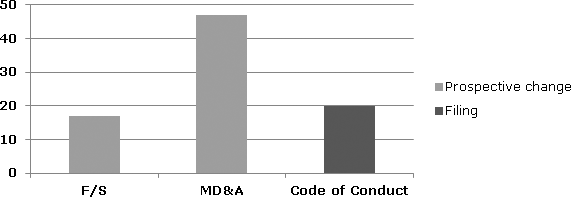

Overall, financial statement and MD&A disclosure met most of the key disclosure requirements and there were no instances where we required restatements. In 17% of the financial statements reviewed, a prospective improvement in disclosure was requested, most frequently relating to disclosure of the relationship between an issuer and its parent or subsidiaries. In 47% percent of MD&A reviewed, the main issue related to disclosure that was overly generic and not specific to the issuer. Prospective changes were requested to improve clarity about RPTs disclosed in the MD&A. Consistent with prior findings by OSC staff in its review of MD&A of mining issuers{5}, the most significant issue found in the MD&A was the lack of details relating to who the RPT was with, often using a generic term such as a "director" as opposed to naming the specific individual.

We found that the need for prospective disclosure improvements was a more significant issue for smaller issuers with a market capitalization of less than $100 million. Fifty-five percent of these issuers committed to making prospective changes to enhance the RPT disclosure in their MD&A. Forty percent were asked to add details to their MD&A by disclosing the specific name of the related party involved and 33% were asked to clarify the nature and purpose of the transaction. For larger issuers, 30% were asked to improve the disclosure in their MD&A.

In addition to annual filings, we also reviewed filings relating to corporate governance matters. If an issuer has a code of conduct, they must file it on SEDAR.{6} We found that many issuers made reference to having a code of conduct that described how the board of directors should address RPTs, while a significant number had not filed the code of conduct on SEDAR. As a result of our review, 20% of the issuers were asked to file their code of conduct on SEDAR.

4. Financial Statement Disclosure

Disclosure Requirement

IFRS contain specific disclosure requirements for related parties. International Accounting Standard 24 Related Party Disclosures (IAS 24) requires entities to disclose relationships between a parent and any subsidiaries it controls, even where there have been no transactions between them.{7} In addition to disclosure of key management compensation, IAS 24 requires an entity to disclose the nature of the related party relationship as well as information about the transactions and outstanding balances, including commitments.{8} This information is necessary for users to understand the potential effect of the related party relationship on the financial statements.{9}

Staff Commentary

We found disclosure of related party information in financial statements generally complied with IFRS requirements. The most common omission related to the disclosure in accordance with paragraph 13 of IAS 24 of relationships between a parent and its subsidiaries. IAS 24 explains that such disclosure enables users of financial statements to form a view about the effects of related party relationships on the entity and should be disclosed irrespective of whether there have been transactions between the parties.{10} Nine issuers agreed to prospectively include this disclosure.

In some circumstances, we found issuers disclosed only the existence of RPTs and outstanding amounts payable to, or receivable from, related parties, without providing further description of the nature and terms of the transactions. More descriptive disclosure provides transparency and clarity, which allows investors to better assess the merits of the transactions, especially when the transactions are material or not in the normal course. As a result of our review, four issuers were asked to prospectively provide more descriptive disclosure in their next set of financial statements.

Example -- Entity-specific Disclosure

Disclosure of relationships between a company and both its parent and / or its subsidiaries is required regardless of whether there have been transactions between them. Some companies omit this disclosure. The following is an example of appropriate disclosure when this requirement is applicable:

The following lists the Company's corporate relationships:

Parent:

AA Parent P.L.C., a company incorporated in the United Kingdom and listed on the London Stock Exchange, is the Company's parent company. There were no transactions, other than dividends paid, between the Company and AA Parent P.L.C. during the financial year.

Subsidiaries:

% equity interest

Name

Country of Incorporation

2013

2012

X Limited

Canada

80.0

--

Y Limited

Canada

95.0

95.0

Z Inc.

United States

100.0

100.0

Joint venture in which the Company is a venturer:

The Company has a 50% interest in V Limited (2012: 50%). Please refer to note 10 for more disclosure related to this joint venture.

5. MD&A

Disclosure Requirement

The MD&A should complement and supplement the financial statements. While many of the MD&A requirements for RPTs in Form 51-102F1 are similar to the requirements under IAS 24, Form 51-102F1 specifically requires an issuer to identify the related person or entity, as well as to discuss the business purpose of the transaction.{11}

Staff Commentary

MD&A disclosure of RPTs is intended to provide both qualitative and quantitative information that is necessary for an understanding of the business purpose and economic substance of a transaction.{12} In order to meet this requirement, the disclosure should be specific and detailed. Overall, we found the disclosure in the MD&A often repeated the disclosure in the financial statements and did not provide the additional disclosure required in the MD&A. Thirty-six percent of issuers reviewed did not provide details about the related party, often using generic terms such as an "officer" or "director" rather than specifically identifying the individual involved in the transaction. In addition, only 38% of the issuers reviewed provided the business purpose for all of their RPTs.

Example -- Boilerplate Disclosure

The disclosure below is an example of boilerplate disclosure for RPTs that does not disclose the identity of the related party and the business purpose of the transaction:

During the year, the Company paid $120,000 to a director as lease payments. As at December 31, 2014, the amount outstanding to the director was $10,000.

Example -- Entity-specific Disclosure

A better example of disclosure for RPTs would be as follows:

During the year, the Company paid $120,000 to Mr. John Smith, a director of the Company, as lease payments for leasing the space used as the Company's warehouse. The current lease expires on December 31, 2015. The terms of the lease were reviewed by disinterested directors of the Board, and were found to be comparable to market terms. The lease is to be reviewed by disinterested directors of the Board every two years and renewed on the condition that the terms are comparable to, or more favourable than, market terms. As at December 31, 2014, the amount outstanding to Mr. Smith was $10,000, which represents the amount for one month's rent.

6. Corporate Governance Practice Disclosure

Disclosure Requirement

While Canadian securities requirements do not mandate corporate governance practices, National Policy 58-201 Corporate Governance Guidelines (NP 58-201) contains recommended guidance on corporate governance practices. For example, section 3.8 of NP 58-201 states that the board should adopt a written code of business conduct and ethics that addresses, among other things, conflicts of interest, including transactions and agreements in respect of which a director or executive officer has a material interest. National Instrument 58-101 Disclosure of Corporate Governance Practices (NI 58-101) contains requirements for disclosure of corporate governance practices for non-venture and venture issuers. A non-venture issuer is required by item 5(b) of Form 58-101F1 Corporate Governance Disclosure (Form 58-101F1) to describe in its management information circular or annual information form any steps the board takes to ensure that directors exercise independent judgment in considering transactions and agreements in respect of which a director or executive officer has a material interest. Further, item 5(a) of Form 58-101F1 requires non-venture issuers to disclose whether or not the board has adopted a written code of business conduct and ethics for directors, officers and employees, and if so, to make certain disclosure related to the code.

While only non-venture issuers are subject to the requirements in Form 58-101F1, item 4 of Form 58-101F2 requires venture issuers to describe what steps, if any, the board takes to encourage and promote a culture of ethical business conduct. Venture issuers are encouraged to disclose whether the board has adopted a written code of business conduct and ethics to help investors to assess their corporate governance practices with respect to RPTs.

If an issuer has adopted a code, the issuer should file a copy of the code on SEDAR in accordance with section 2.3 of NI 58-101. This requirement applies to both venture and non-venture issuers.

Staff Commentary

The board of directors plays a key role in overseeing the identification of RPTs and ensuring all RPTs are disclosed. We encourage the board of a reporting issuer to adopt a written code of business conduct and ethics that establishes written standards reasonably designed to promote integrity and to deter wrongdoing. Effective codes apply to directors, officers and employees of the issuer and address, among other things, conflicts of interest and transactions and agreements where a director or officer has an interest, including RPTs. It is good practice to require directors, officers and employees to certify on an annual basis that they have complied with the code.

We also encourage issuers to consider providing more detailed disclosure about their process for identifying, evaluating and approving RPTs. This could include considering:

• whether the board or a committee of the board reviews and approves RPTs;

• whether a materiality threshold has been adopted to determine which RPTs are subject to independent review by the board or a committee of the board;

• whether the issuer has rules, guidelines or procedures for RPTs conducted in the normal course of business; and

• whether the issuer has rules, guidelines or processes to satisfy itself that a non-material RPT is transacted at fair value.

The review found that most non-venture issuers have generally complied with the requirement in item 5(b) of Form 58-101F1 to describe any steps the board takes to ensure that directors exercise independent judgment in considering conflicted transactions. However, twelve of the non-venture issuers in our sample either did not disclose whether they had a written code of business conduct and ethics in accordance with item 5(a) of Form 58-101F1, or did not file a code on SEDAR in accordance with section 2.3 of NI 58-101 where they indicated that they had one. At staff's request, the 12 issuers agreed to make the appropriate disclosure prospectively and, if applicable, file the code.

In the case where a venture issuer chooses to adopt a code of conduct, they must file it on SEDAR pursuant to section 2.3 of NI 58-101. Eight of the venture issuers in our sample made reference to a code of conduct that had not been filed on SEDAR. At staff's request, the issuers agreed to file their code of conduct.

Example -- Boilerplate Disclosure

The following is a boilerplate example that does not provide details of the process that the audit committee or management undertakes in their review:

The Audit Committee reviews and approves all material related party transactions in which the Company is involved or which the Company proposes to enter into.

Example -- Entity-specific Disclosure

A better example would be as follows:

The Company's management team discusses all related party transactions. In considering related party transactions, management will assess the materiality of related party transactions on a case-by-case basis with respect to both the qualitative and quantitative aspects of the proposed related party transaction. Related party transactions that are in the normal course are subject to the same processes and controls as other transactions, that is, they are subject to standard approval procedures and management oversight, but will also be considered by management for reasonability against fair value. Related party transactions that are found to be material are subject to review and approval by the Company's Audit Committee which is comprised of independent directors.

7. Special Transactions

Requirement

MI 61-101 regulates significant RPTs including those transactions involving directors or senior management of a reporting issuer. When RPTs are undertaken, MI 61-101 requires the board of directors to play an important role in ensuring that all security holders are treated fairly and that the interests of the issuer and minority shareholders are protected. The board is responsible for ensuring that investors are provided with sufficient information to make an informed decision to approve or challenge the approval of a RPT.{13} The board, or an independent special committee appointed by the board, is responsible for overseeing RPTs by, among other things, supervising the preparation of a formal valuation,{14} unless specified exemptions apply,{15} and providing enhanced disclosure in information circulars and material change reports.{16} In addition, RPTs are subject to minority shareholder approval under MI 61-101,{17} unless specified exemptions are available.{18}

If a material change report is required to be filed with respect to a RPT, the material change report must include specific disclosure of the RPT, including:

• a description of the transaction and its material terms;

• the purpose and business reasons for the transaction;

• its effect on the issuer;

• the review and approval process followed by the issuer;

• a description of the interest of every interested party and related party; and

• if applicable, the formal valuation or minority approval exemptions relied upon.{19}

If the issuer files a material change report less than 21 days before the expected date of the closing of the transaction, the issuer must explain in the news release and in the material change report why the shorter period is reasonable or necessary in the circumstances.{20}

MI 61-101 also prescribes information that an issuer must include in an information circular prepared in connection with a meeting of the holders of affected securities if minority approval of the RPT is required.{21} The information required to be disclosed in an information circular is similar to what should be included in the material change report, discussed above. The disclosure must permit holders of affected securities to make an informed decision whether to approve the RPT.

Staff Commentary

When considering a RPT, consideration should also be given to the guidance provided by Companion Policy 61-101CP To Multilateral Instrument 61-101 Protection of Minority Security Holders in Special Transactions (61-101CP) to ensure that all security holders are treated fairly. In our view, providing sufficient information to security holders includes directors disclosing their reasonable beliefs as to the desirability or fairness of the proposed RPT and making useful recommendations regarding the RPT.{22} The disclosure should describe in reasonable detail the material factors on which beliefs regarding the RPT are based. The board should also fully discuss the background of deliberations by the directors and any analysis of expert opinions received.{23}

A statement that the directors are unable to make or are not making a recommendation about the RPT, a statement that the directors have no reasonable belief as to the desirability or fairness of the RPT, or a failure to indicate whether the directors consider the RPT to be fair, without more detailed reasons, would generally be viewed as insufficient disclosure.{24}

In addition, it is important for boards to put in place an appropriate review and approval process to safeguard against the potential that a related party would have an unfair advantage arising as a result of a conflict of interest or informational or other advantage in connection with a proposed RPT. A good practice, as set out in subsection 6.1(6) of 61-101CP, is to appoint a special committee of disinterested directors to carry out, review and report on the negotiation of the RPT. In Staff's view, the mandate of any special committee considering a RPT should generally give the special committee full authority to negotiate the terms of the transaction, consider other alternative transactions, and consider whether the RPT is in the interests of, or fair to, security holders.

In our review, the disclosure requirements in MI 61-101 for material change reports for RPTs were generally complied with. Approximately 9% of the issuers reviewed filed a material change report in relation to RPTs. No issuer reviewed was required to provide a formal valuation or obtain minority approval under MI 61-101 of a RPT. The two most commonly relied upon exemptions from the minority shareholder approval and formal valuation requirements of MI 61-101 were the 25% market capitalization exemption and the financial hardship exemption.{25}

In a few instances, issuers did not disclose in the material change report information about insider participation in a private placement where the private placement was a material change for the issuer. Although the insider participation in itself may not have been material in value, the obligation to provide disclosure about a RPT is triggered when a material change report is required to be filed even if the transaction is exempt from minority approval under MI 61-101. In other words, when filing a material change report where there is any insider participation, the material change report should contain information about the insider participation in a RPT, including a description of the interest of every interested party and the review and approval process followed by the issuer, even if the insider participation may form only a small part of the private placement.

Example -- Boilerplate Disclosure

The example below illustrates the kind of boilerplate disclosure that is occasionally found in a material change report describing RPT:

The Company announced a non-brokered private placement offering of 5,000,000 shares (the Offered Shares) at a price of $0.50 per share for aggregate proceeds of $2,500,000. Insiders of the Company have subscribed for 20% of the Offered Shares.

Example -- Entity-specific Disclosure

The example below illustrates better disclosure included in the material change report when there is a RPT:

On January 21, 2014, the Company announced a non-brokered private placement offering of 5,000,000 shares (the Offered Shares) at a price of $0.50 per share for aggregate proceeds of $2,500,000. The Proposed Private Placement is expected to close on March 1, 2014. The net proceeds of this private placement will be used to advance the Company's exploration in the Company's Ottawa property, as well as for working capital and general administrative purposes.

...

Insiders of the Company have subscribed for an aggregate of 1,000,000 shares at a price of $0.50 per share, for aggregate proceeds of $500,000, comprising 20% of the total amount raised.

John Smith, the CEO and a director of the Company, subscribed for 600,000 shares for $300,000, increasing his holding from 2.0% to 4.0% of the issued and outstanding shares.

Jane Doe, a director of the Company, subscribed for 400,000 shares for $200,000, increasing her holding from 0.5% to 2.0% of the issued and outstanding shares.

The participation of Mr. Smith and Ms. Doe in the private placement constitutes a "related party transaction" as such terms are defined in Multilateral Instrument 61-101 Protection of Minority Security Holders in Special Transactions (MI 61-101). The Company is relying on the exemptions from the formal valuation and minority approval requirements set out in subsection 5.5(a) and paragraph 5.7(1)(a) of MI 61-101 because the fair market value of the consideration for the securities of the Company to be issued to the insiders does not exceed 25% of its market capitalization.

The insider private placements were approved by the disinterested directors of the Company who concluded that the private placements were entered into on market terms and were fair to minority security holders.

8. Conclusion

RPTs are a normal feature of commerce and business and such transactions by their very nature give rise to conflicts of interest and have the potential to be unfair or abusive to issuers and their securities holders. As part of a good governance regime, reporting issuers and their board of directors should consider the guidance and recommendations in this staff notice. Consideration should also be given to a company's policies and procedures for identifying, evaluating and approving RPTs. Once RPTs are identified, the board of directors should ensure that they are properly disclosed in accordance with accounting and securities rules.

This is a notice setting forth Staff's views which are not necessarily those of the Commission.

{1} Section 9 of International Accounting Standard 24 Related Party Disclosures

{2} Section 1.1 of Companion Policy 61-101CP To Multilateral Instrument 61-101 Protection of Minority Security Holders in Special Transactions

{3} Section 1.1 of Companion Policy 61-101CP To Multilateral Instrument 61-101 Protection of Minority Security Holders in Special Transactions

{4} Section 1.1 of Companion Policy 61-101CP To Multilateral Instrument 61-101 Protection of Minority Security Holders in Special Transactions

{5} The report of findings in this review together with guidance for issuers are included in OSC Staff Notice 51-722 Report on a Review of Mining Issuers' Management's Discussion and Analysis and Guidance.

{6} Section 2.3 of National Instrument 58-101 Disclosure of Corporate Governance Practices

{7} Paragraph 13 of IAS 24

{8} Paragraph 18 of IAS 24

{9} Paragraph 14 of IAS 24

{10} Paragraph 14 of IAS 24

{11} Item 1.9 of Form 51-102F1

{12} Item 1.9 of Form 51-102F1

{13} Subsection 6.1(2) of Companion Policy 61-101CP To Multilateral Instrument 61-101 Protection of Minority Security Holders in Special Transactions

{14} Section 5.4 of MI 61-101

{15} Section 5.5 of MI 61-101

{16} Sections 5.2 and 5.3 of MI 61-101

{17} Section 5.6 of MI 61-101

{18} Section 5.7 of MI 61-101

{19} Subsection 5.2(1) of MI 61-101

{20} Subsection 5.2(2) of MI 61-101

{21} Subsection 5.3(3) of MI 61-101

{22} Subsection 6.1(2) of 61-101CP

{23} Subsection 6.1(3) of 61-101CP

{24} Subsections 6.1(2) and 6.1(4) of 61-101CP

{25} In the board's assessment of whether the issuer can avail itself of the financial hardship exemption, the board is encouraged to consider the guidance set out in the notice published by the TSX dated April 27, 2009 (the TSX Staff Notice) on the types of procedural and informational considerations it would expect from issuers seeking to establish financial hardship as a basis for reliance upon the financial hardship exemption in subsection 604(e) of the TSX Company Manual. As the TSX financial hardship considerations are similar to, and are based on, the financial hardship exemption in MI 61-101, the considerations set out in the TSX Staff Notice may be relevant to not only a TSX listed issuer, but also a venture issuer, that proposes to rely upon the financial hardship exemption in MI 61-101.