OSC Staff Notice 51-727 - Corporate Finance Branch - 2015-2016 Annual Report

OSC Staff Notice 51-727 - Corporate Finance Branch - 2015-2016 Annual Report

Corporate Finance Branch

2015-2016 Annual Report

July 28, 2016

Table of Contents

|

|

What is our Branch mandate? |

||

|

|

What are the objectives of the report? |

||

|

|

|||

|

|

Continuous Disclosure Review Program |

||

|

|

|

Overview of the program |

|

|

|

|

Outcomes for fiscal 2016 |

|

|

|

|

Trends and guidance |

|

|

|

|

Issue-oriented review staff notices published in fiscal 2016 |

|

|

|

|

Participation fees |

|

|

|

Offerings -- Public |

||

|

|

|

Statistics |

|

|

|

|

Trends and guidance |

|

|

|

Offerings -- Exempt Market |

||

|

|

|

Assessing compliance |

|

|

|

|

Enhancing awareness |

|

|

|

|

Data gathering |

|

|

|

|

Trends and guidance |

|

|

|

Exemptive Relief Applications |

||

|

|

|

Statistics |

|

|

|

|

Trends and guidance |

|

|

|

Insider Reporting |

||

|

|

|

Insider reporting with respect to rights offerings |

|

|

|

|

Guidance and filing tips |

|

|

|

Designated Rating Organizations |

||

|

|

|||

|

|

Overview |

||

|

|

Exempt Market Regulatory Reform |

||

|

|

|

Regulatory reform initiative |

|

|

|

|

Key capital raising tools |

|

|

|

|

Exempt distribution reporting |

|

|

|

|

Exempt market website |

|

|

|

Distributions of Securities Outside of Ontario |

||

|

|

Passport Expansion and CSA Co-ordination |

||

|

|

|

Cease to be a Reporting Issuer Applications |

|

|

|

|

Failure-to-File Cease Trade Orders and Revocations |

|

|

|

|||

|

Contacts |

|||

Part A: Introduction

Introduction

The Corporate Finance Branch (the Branch or we) of the Ontario Securities Commission (OSC) has a broad regulatory mandate which we execute in pursuing the two purposes of the Securities Act (Ontario) (the Act):

Investor protection

•

To provide protection to investors from unfair, improper or fraudulent practices.

Efficient capital markets

•

To foster fair and efficient capital markets and confidence in capital markets.

A key part of our mandate is issuer regulation. Regulation in this area is broad and takes many forms, including the following:

Issuer regulation

•

Review of public distributions of securities (prospectuses).

•

Review of exempt market activities and related policy development.

•

Continuous disclosure reviews of reporting issuers.

•

Review and consideration of applications for relief from regulatory requirements.

•

Issuer-related policy initiatives.

Other areas covered by our mandate include:

Insider reporting

•

Insider reporting reviews.

Designated rating organizations (DROs)

•

Reviews of credit rating agencies designated as DROs.

Listed issuer regulation

•

Oversight of the listed issuer function for OSC recognized exchanges.

•

Policy initiatives for listed issuer requirements.

In executing our functions, we consult and partner with other OSC branches in many areas, including the exempt market and listed issuer regulation.

What are the objectives of the report?

This report provides an overview of the Branch's operational and policy work during the fiscal year ended March 31, 2016 (fiscal 2016). The report is intended for individuals and entities we regulate, their advisors, as well as investors.

The report aims to:

• encourage compliance with regulatory obligations

• improve disclosure in regulatory filings

• provide insights on trends

• provide guidance on novel issues

• inform on key policy initiatives

Part B: Compliance

Compliance

Continuous Disclosure Review Program

Under Canadian securities laws, reporting issuers must provide timely continuous disclosure (CD) about their business and affairs. Where a reporting issuer has a head office in Ontario, or has a significant connection to Ontario, we have primary responsibility as principal regulator for reviewing that issuer's CD. Disclosure documents include periodic filings such as interim and annual financial statements and management's discussion and analysis (MD&A) as well as certifications of annual and interim filings, management information circulars and annual information forms (AIF).

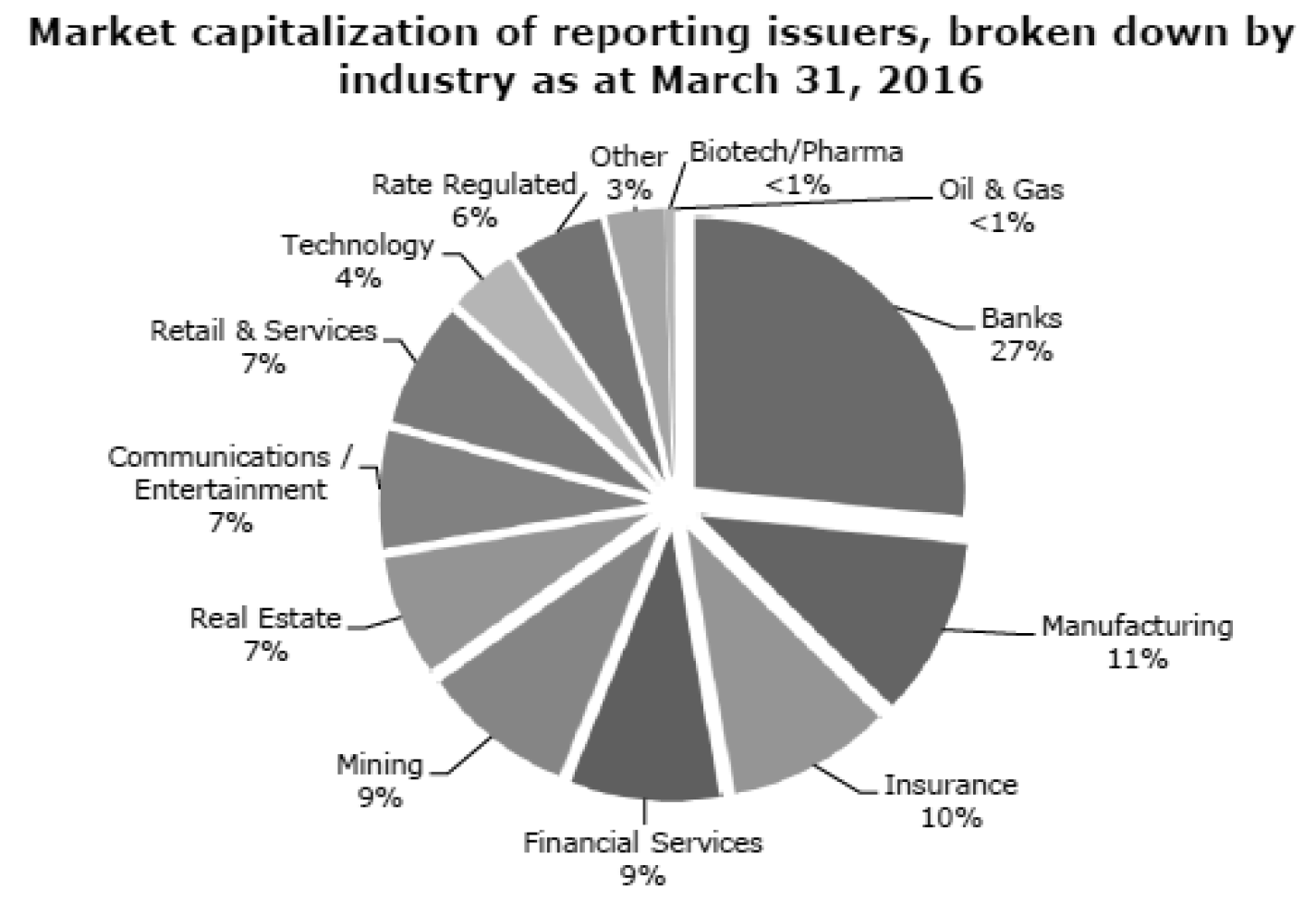

The market capitalization of Ontario reporting issuers is approximately $1,044 billion as at March 31, 2016 ($1,100 billion as at March 31, 2015). The three largest industries by market capitalization are banks, manufacturing and insurance.

Our review program is risk-based and outcome focused. It includes planned reviews based on risk criteria, discussed below, as well as monitoring through news releases, media articles, complaints and other sources. We conduct the program through powers in section 20.1 of the Act and the program is part of a harmonized CD program conducted by the Canadian Securities Administrators (CSA). See CSA Staff Notice (Revised) 51-312 Harmonized Continuous Disclosure Review Program.

The program has two main objectives:

|

Compliance |

• |

To assess whether reporting issuers are complying with their disclosure obligations. |

|

|

||

|

Issuer education and outreach |

• |

To help reporting issuers better understand their disclosure obligations. |

Our CD review program is critical to investor protection as it monitors issuer compliance of CD documents which are available to investors in making investment decisions. This function also supports the raising of new capital, as many issuers raise funds through short form prospectuses which must incorporate CD documents.

Issuer education and outreach from the program happens at both a micro level (through direct communication with an issuer) as well as at a macro level, through broad communications, such as staff notices. We also use the observations and findings in our review program to inform the Branch's outreach program for small and medium enterprises (SMEs) called The OSC SME Institute. Through the institute, we offer SMEs a series of free educational seminars to help them and their advisors understand the securities regulatory requirements for being or becoming a public company in Ontario and participating in the exempt market. For further details see Information for Small and Medium Enterprises on the OSC's website.

In general, we conduct either a "full" review or an "issue-oriented" review of an issuer's CD.

|

Full review |

• |

broad in scope and generally covering an issuer's most recent annual and interim financial statements and MD&A, AIF, annual reports, information circulars, news releases, material change reports and the issuer's website. |

|

|

||

|

Issuer-oriented review |

• |

an in-depth review focusing on a specific accounting, legal or regulatory issue that we believe warrants regulatory scrutiny. |

We use risk-based criteria to identify issuers with a higher risk of disclosure non-compliance and the level of review required. The criteria are designed to identify issuers whose disclosure is likely to be materially improved or brought into compliance with securities laws or accounting standards as a result of our intervention. Our risk-based procedures incorporate both qualitative and quantitative criteria which we review regularly to stay relevant with market changes. We also monitor novel and high growth areas of financing activity when developing our review program. We may also select an issuer for review based on a complaint.

Issue-oriented reviews are conducted to focus on a specific issue of an individual issuer or to focus broadly on an emerging area of risk across issuers (in some cases, industry specific). Conducting issue-oriented reviews broadly allows us to:

• monitor compliance with requirements and provide a basis for communicating interpretations, staff disclosure expectations and areas of concern

• quickly address specific areas where there is heightened risk of investor harm

• provide deficient and industry specific disclosure examples to assist preparers in complying with requirements

• assess compliance with new accounting standards

We measure outcomes of a CD review by tracking the following for each issuer:

• prospective disclosure enhancements

• refilings

• education and awareness

• other, such as enforcement referrals

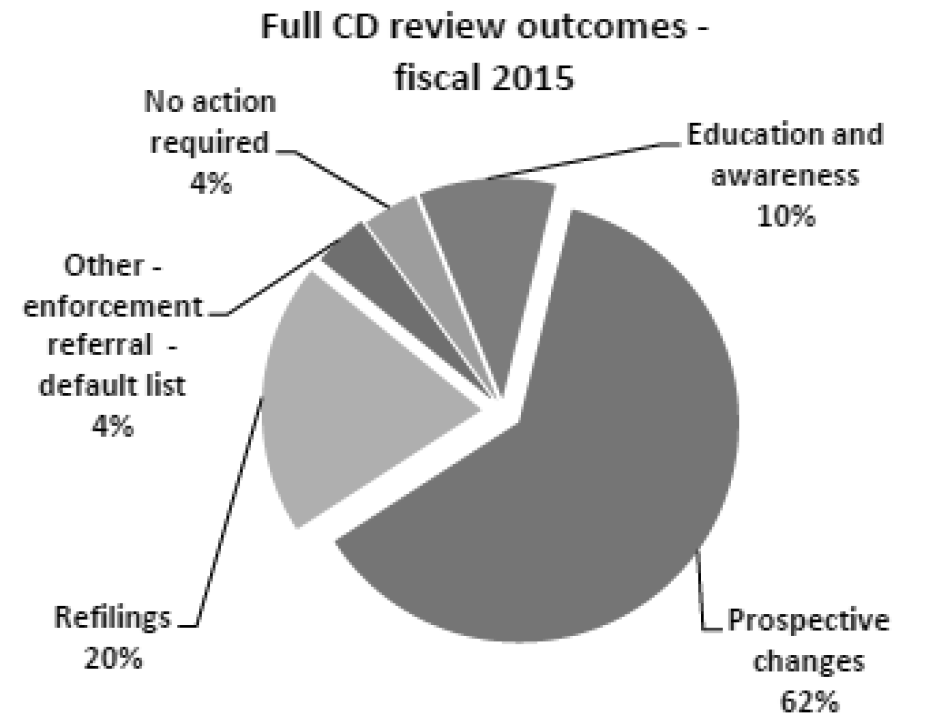

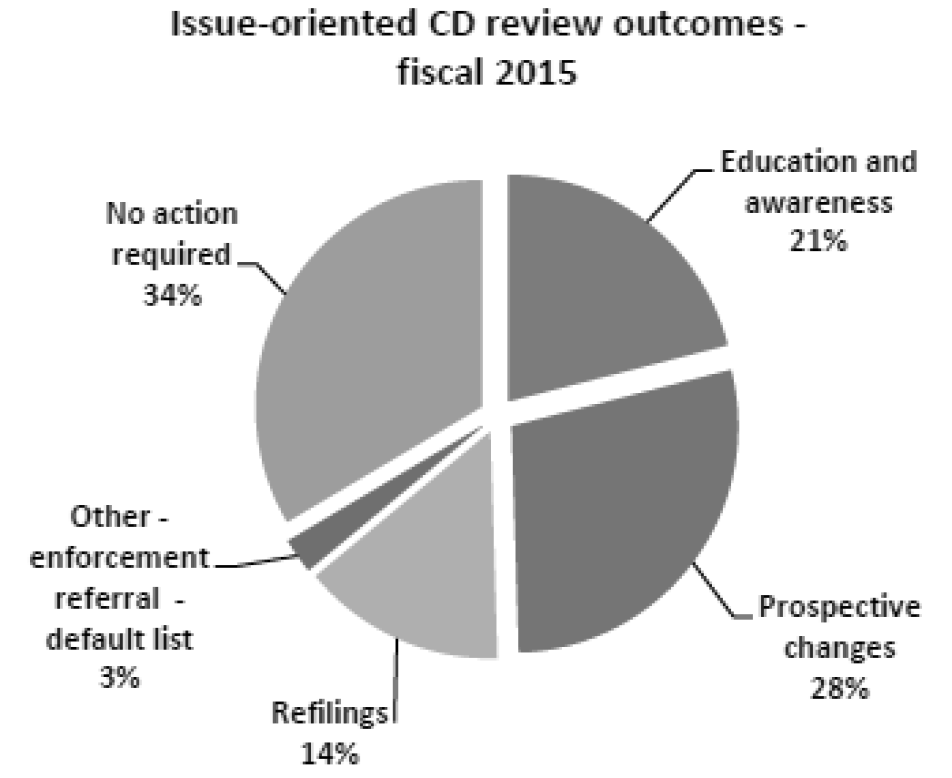

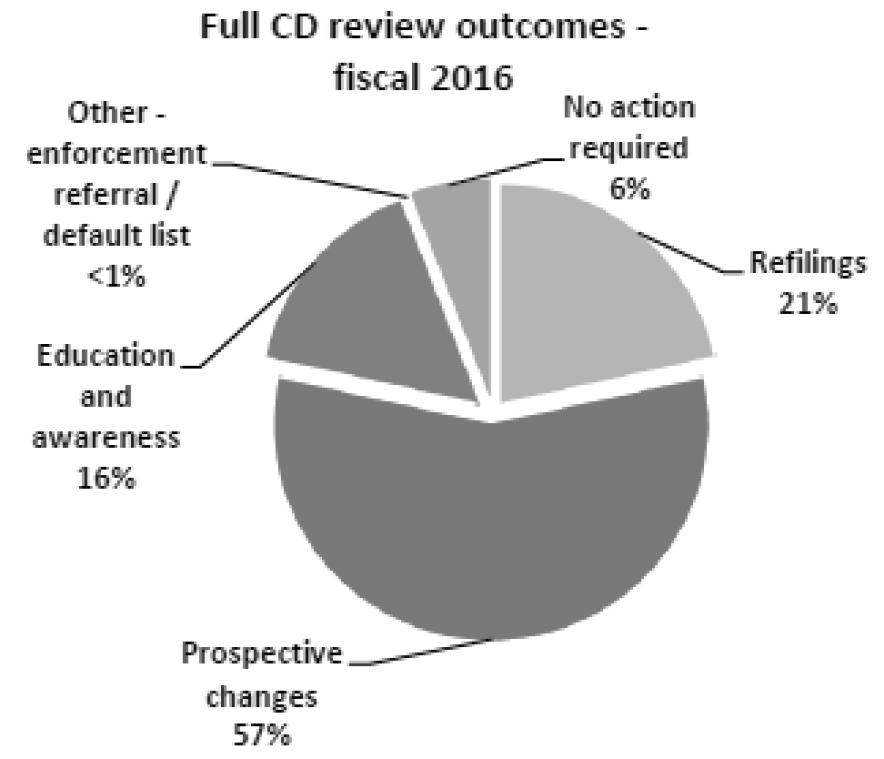

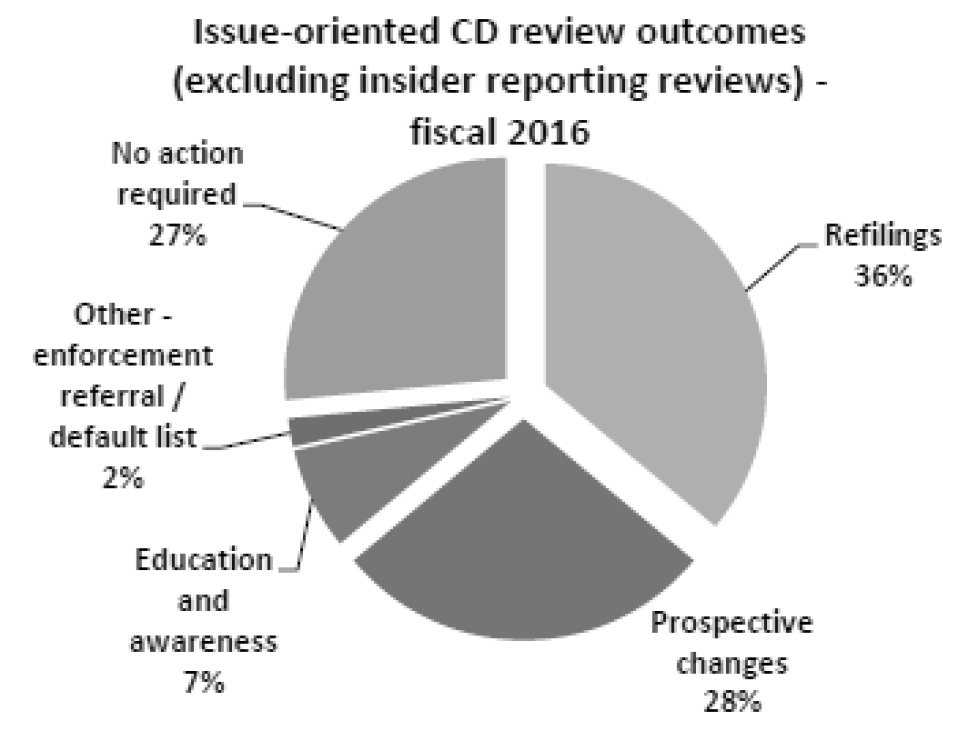

We had at least one outcome in 94% of our full CD reviews and 73% of our issue-oriented reviews (excluding our insider reporting issue-oriented reviews). We found material insider reporting deficiencies in approximately 70% of the issuers we reviewed.

Given our risk-based criteria to identify issuers, the outcomes on a year to year basis should not be interpreted as trends since the issues and issuers reviewed each year might be different.

For reference, the following were the outomes from fiscal 2015:

We encourage issuers to continue to review and improve their disclosure, including in those areas below which we frequently comment on as part of our reviews.

• Management's Discussion and Analysis

MD&A improves an issuer's overall financial disclosure by providing an analytical and balanced discussion of the issuer's results of operations and financial condition. We remind issuers that disclosure must be useful and understandable. MD&A is a narrative explanation, through the eyes of management, about the issuer's performance during the financial period to supplement and complement the financial statements. MD&A must be transparent and clear to be informative. Issuers should avoid boilerplate disclosure where the MD&A merely repeats information from the financial statements. Issuers should avoid disclosing information that users do not need or that does not provide insight into the issuer's past or future performance.

We encourage issuers to review MD&A requirements (Form 51-102F1 Management's Discussion and Analysis). We are disappointed that many issuers continue to struggle in providing meaningful disclosure in their MD&A, especially in the areas noted below.

Results of operations

•

Include a detailed, analytical and quantified discussion of the various factors that affect revenues and expenses, beyond the percentage change or amount.

Issuers with mining exploration projects or research and development projects

•

Do not repeat the history of a project in every subsequent MD&A. While issuers without a current AIF may want to include more historical information to provide background information about their projects, the majority of the discussion should focus on what happened in the current year or interim period.

Reportable segments

•

Include a discussion of your overall performance and your results of operations on a reportable segment basis. This discussion is in addition to the discussion on a consolidated basis.

Liquidity and capital resources

•

Do not provide general statements such as "have adequate working capital to fund operations" or "have adequate cash resources to finance future foreseeable capacity expansions". Rather, provide insight beyond the numbers by discussing material cash requirements, explaining how liquidity obligations have been settled or will be settled and by quantifying working capital needs and how these needs relate to future business plans or milestones. Be specific about the periods in respect of which your discussion applies.

Risks and uncertainties

•

Be specific about the risks and uncertainties the issuer is facing, including the significance and impact those risks have on the issuer's financial position, operations and cash flows. To make the information more meaningful, update your risk disclosures when circumstances change.

Cross-references to other documents

•

Do not simply cross-reference in the MD&A to other documents (e.g. AIF, financial statements). In most instances, doing so does not satisfy the MD&A requirements.

• Non-GAAP financial measures -- Many issuers include non-GAAP financial measures in press releases, MD&A, prospectus filings, websites and marketing materials, as issuers believe this information provides additional insight into their overall performance. We continue to be concerned about the prominence of disclosure given to non-GAAP financial measures in comparison to GAAP financial measures, as well as the larger differences reported between GAAP and non-GAAP measures. When providing non-GAAP financial information, issuers should not mislead investors nor obscure the company's GAAP results. We caution issuers that we may take regulatory action if an issuer discloses information in a manner considered misleading and therefore potentially harmful to the public interest. While we have raised repeated reminders for issuers to meet staff disclosure expectations as outlined in CSA Staff Notice 52-306 Non-GAAP Financial Measures, we continue to see non-compliance and potentially misleading disclosures. We intend to monitor this area closely in the coming fiscal year.

• Forward-looking information (FLI) -- Many issuers disclose FLI in news releases, MD&A, marketing materials, investor presentations or on their website. FLI should provide valuable insight about a reporting issuer's business and how that issuer intends to attain its corporate objectives and targets. We continue to see generic factors and assumptions, being disclosed. Disclosure of specific and relevant material factors or assumptions including material risk factors underlying FLI is necessary for investors to understand how actual results may vary from FLI. Whenever possible, assumptions should be quantified as this provides valuable information for investors. We remind issuers that under section 5.8 of National Instrument 51-102 Continuous Disclosure Obligations (NI 51-102), they need to update previously disclosed FLI when events or circumstances are reasonably likely to cause actual results to differ materially from the previously disclosed FLI (including expected differences). We further note issuers often fail to include a comparison of actual results to previously disclosed financial outlook. Clear, specific and relevant information allows investors to better understand the performance of a reporting issuer, enabling investors to make effective and efficient decisions in the capital markets.

• Website disclosure -- In addition to the required CD filings, issuers often provide stakeholders with information about their business and operations in news releases, investor presentations and on their website. We remind issuers to carefully review any such additional disclosure to ensure the information disclosed through these methods does not contradict information contained in required CD filings. We also remind issuers to consider the disclosure rules summarized in National Policy 51-201 Disclosure Standards before making disclosure through these methods to ensure compliance with the timely disclosure and selective disclosure rules.

• Mining disclosure -- Market participants should be aware of the broad application of National Instrument 43-101 Standards of Disclosure for Mineral Projects (NI 43-101). NI 43-101 generally applies to disclosure that is intended to be, or reasonably likely to be, made available to the public in a jurisdiction in Canada, regardless of whether the issuer making the disclosure is a reporting issuer. Private issuers making disclosure in these circumstances should ensure their disclosure complies with NI 43-101 and should ensure that they file technical reports to support disclosure of mineral resource or reserve estimates, or the results of economic analyses. We have conducted several reviews of private issuers in fiscal 2016, some of which resulted in the issuer filing or refiling a technical report.

• Investment Entities -- We have seen an increase in issuers that have determined they meet the criteria to be an "investment entity" under IFRS 10 Consolidated Financial Statements and measure substantially all of their investments at fair value through profit and loss, including their investments in subsidiaries. The unique attributes of this group of issuers create various disclosure, accounting and potential policy concerns. Our reviews to date have identified several disclosure deficiencies and staff are assessing whether there are any policy gaps that should be addressed for these issuers. We anticipate publishing a staff notice this year on our findings and staff's disclosure expectations for investment entities.

• Debt Covenants -- Issuers that have credit facilities subject to debt covenants are required to discuss in their MD&A defaults or significant risks of default on debt covenants, how they intend to cure the default and how they will address the risks. If an issuer is at risk of breaching its covenants, waiting to disclose this risk until after a covenant has been breached is not useful and may have a material adverse impact on investors. We encourage issuers with debt covenants to include the terms and conditions of those debt covenants in their financial statements' notes and/or in their MD&A. These disclosures are critical to enable investors to assess how an issuer will meet its obligations and whether the issuer is at risk of breaching a covenant, particularly if an issuer's financial condition has deteriorated. We also remind issuers of their obligation to file credit agreements if they are material contracts on which the issuer's business is substantially dependent. As per the guidance in Companion Policy 51-102CP, this would include a financing or credit agreement providing a majority of the reporting issuer's capital requirements for which alternative financing is not readily available on comparable terms.

Additional details on outcomes from fiscal CD reviews across the CSA are published in an annual CSA notice in the summer. See CSA Staff Notice 51-346 Continuous Disclosure Review Program Activities for the fiscal year ended March 31, 2016 for the 2016 annual CSA notice.

Issue-oriented review staff notices published in fiscal 2016

During fiscal 2016, 87% of our reviews were issue-oriented (fiscal 2015: 83%). We published staff notices summarizing the findings from our two issue-oriented reviews covering broad issues.

|

Compliance of reporting insiders and issuers with insider reporting requirements |

• |

For accuracy, completeness and timeliness, reporting insiders need to improve the quality of their insider reporting and reporting issuers need to consistently monitor their System for Electronic Disclosure by Insiders (SEDI) profile supplement. |

|

|

||

|

Disclosure about Women on Boards and in Executive Officer Positions |

• |

Issuers need to have policies explaining how they consider the representation of women on their board and in executive officer positions or explain reasons for not doing so. |

See the following links for the full staff notices:

We will continue to monitor the issues identified in the issue-oriented reviews noted above as well as issues identified in full reviews. This includes reviewing disclosure to ensure issuers have provided prospective disclosure enhancements as requested by staff. Where an issuer fails to make a prospective disclosure enhancement, staff will consider whether an alternative outcome such as a refiling is necessary.

We review the participation fees paid by reporting issuers under OSC Rule 13-502 Fees (the Fee Rule) to ensure that the correct amounts have been paid.

We remind issuers that under the Fee Rule, an issuer must include in its calculation of annual participation fees all capital market debt distributed under a prospectus or prospectus exemption, even if these debt securities are not listed or quoted on a marketplace. An issuer must also include those debt securities that are held by investors who reside outside of Ontario. Capital market debt securities are required to be included because together with equity securities, they give a fuller and more accurate representation of the size of the issuer and its participation in the capital market.

The Fee Rule also requires that all calculations be in Canadian dollars. If the price of a security is not quoted in Canadian dollars or if the fair value of debt securities is not presented in Canadian dollars in the financial statements, the amount must be converted into Canadian dollars using the daily noon{1} exchange rate posted on the Bank of Canada website.

Another key component of our compliance work is the review of offering documents. Securities legislation enumerates specific circumstances under which a receipt for a prospectus shall not be issued. One example is where the aggregate proceeds being raised by the issuer through the prospectus (together with other resources) are insufficient to accomplish the purpose of the offering as stated in the prospectus.

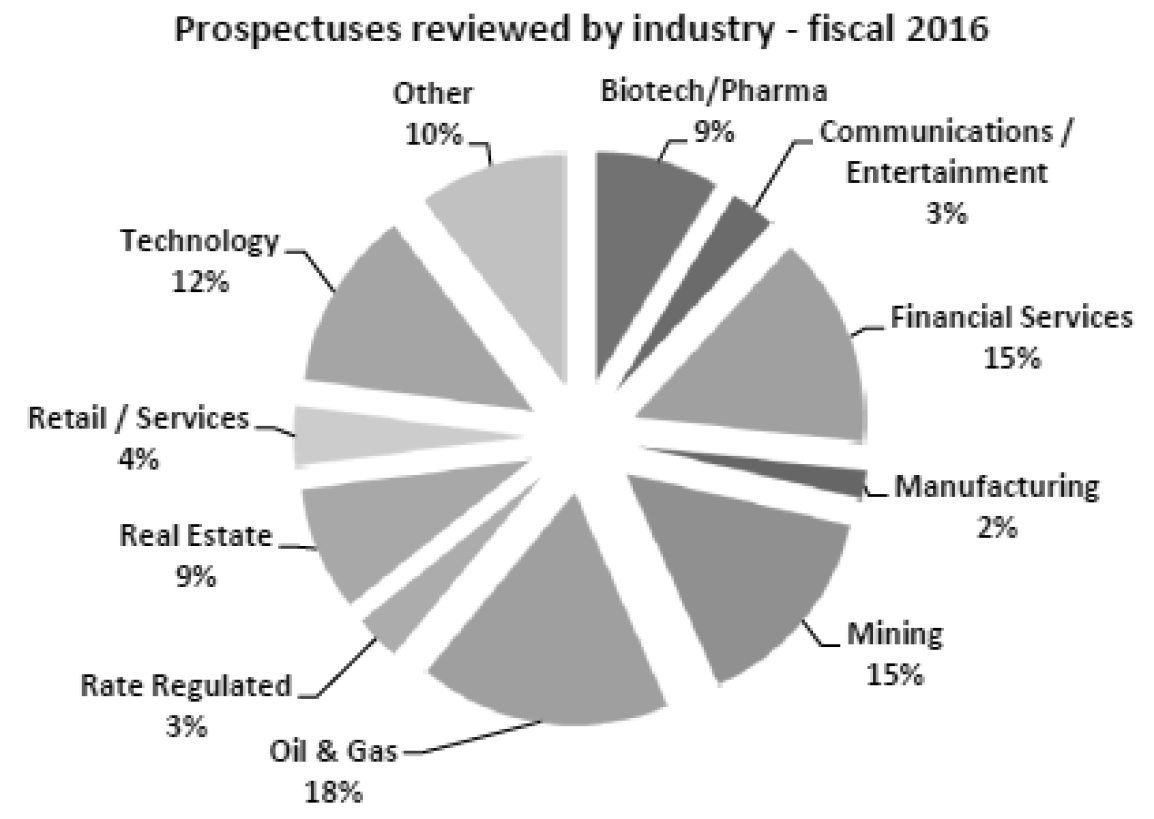

In fiscal 2016, we reviewed over 300 prospectuses and rights offering circulars (fiscal 2015: over 400). These reviews covered a wide range of industries with oil & gas and mining being the most active sectors followed by financial services and technology.

In fiscal 2016, the number of prospectuses we reviewed where Ontario was the principal regulator was lower than the prior fiscal year. Broad market volatility and ongoing downward pressure on commodities continue to impact public markets. The resources, real estate and financial services industries have consistently been active over the years. We continue to see offerings in industries relatively new to the Canadian capital markets such as medical marijuana and gaming. These less mature industries often require enhanced disclosure due to regulation, differences in legal status across jurisdictions and other novel considerations that should be disclosed to investors.

In fiscal 2015, we received the first initial public offering (IPO) prospectus filed by a special purpose acquisition corporation (SPAC) pursuant to Part X Special Purpose Acquisition Corporations of the Toronto Stock Exchange (TSX) Company Manual (SPAC Rules). The SPAC Rules, which were adopted in 2008, provide the framework for the IPO and listing of an issuer that has no operating business. SPACs bear some similarity to capital pool companies (CPCs) in that both involve the creation of publicly-traded shell companies which later acquire an operating business using the initial proceeds raised. However, SPACs are much larger than CPCs and have enhanced investor protections, including the requirement that a minimum of 90% of the gross proceeds of the IPO be placed into escrow. This first SPAC obtained relief from certain of the requirements of the SPAC Rules from the TSX, including relief that required the concurrence of the OSC. The first SPAC also placed 100% of the IPO proceeds into escrow. We have received eight SPAC IPO prospectuses from seven issuers to date, one of which withdrew its prospectus. All of the issuers that obtained a receipt for their final SPAC IPO prospectus obtained the same relief. While generally following the same structure, including placing 100% of the IPO proceeds into escrow, certain SPACs have differed in terms of the deadline for completing a qualifying acquisition, the targeted industry for its qualifying acquisition, the number of warrants issued and the potential for top-up payments payable to the escrow fund. No SPAC has completed a qualifying acquisition at this time.

Key takeaways from our work reviewing offering documents in fiscal 2016 are set out below. Many of the matters highlighted below would benefit from pre-file discussions with staff. This process is outlined in National Policy 11-202 Process for Prospectus Reviews in Multiple Jurisdictions. We remind issuers that an application fee is required for any relief sought in connection with an offering where the relief will be evidenced by the prospectus receipt.

We also remind issuers that the following guidance also applies to the prospectus-level disclosure included in an information circular as a result of Item 14.2 of Form 51-102F5 Information Circular.

• Disclosure improvements -- Disclosure outcomes, where we required material disclosure changes to a prospectus, remained our most consistent outcome.

We encourage issuers to review prospectus requirements, noting the following areas where we frequently find deficiencies.

• Description of business and regulatory environment -- This section needs to be clear and comprehensive as issues may arise in circumstances where an issuer:

• appears to have no business or the offering is a blind pool,

• has a complex corporate structure,

• has a significant change in business/operations,

• is in the medical marijuana industry and lacks disclosure about its specific regulatory environment, or

• has recently completed a significant acquisition or capital restructuring where a regulatory review has not been done.

• Risk factors relating to the business and/or offering -- Be specific. Avoid boiler plate language and tailor the disclosure to the issuer's situation (e.g. assess political/regulatory risk and enhanced controls over finance if operations are in a foreign country).

• MD&A disclosure in a long form prospectus -- Include relevant information and provide sufficient detail.

• Use of proceeds -- Provide sufficient detail and be comprehensive. Phrases such as "for general corporate purposes" may not be sufficient disclosure.

• Financial statement disclosure for certain significant acquisitions -- Where an issuer is raising proceeds to fund an acquisition that makes up a material portion of its business, or is larger than the issuer's existing business, the issuer should consider whether the prescribed disclosure that is normally required for a significant acquisition (as that term is used in securities legislation) is sufficient for the prospectus to contain full, true and plain disclosure. Specifically, issuers should consider if their existing AIF needs to be supplemented with additional disclosure in the prospectus in light of the acquisition and whether inclusion of more audited financial statements is necessary. Notwithstanding the recent amendments that raised the significant acquisition thresholds triggering a business acquisition report filing for venture issuers from 40% to 100% under Part 8 of NI 51-102, even if an acquisition does not meet the 100% asset or investment significant tests, venture issuers should consider whether additional disclosure is necessary for the prospectus to contains full, true and plain disclosure. We encourage issuers and their advisors to consult with staff on a pre-file basis on these issues.

• Primary business in an IPO -- An issuer doing an IPO must include in its prospectus a three-- year financial history (two years for an IPO venture issuer) of the business an investor is investing in, even if this financial history spans multiple legal entities over the three-year period. This includes the financial history for those businesses acquired or that will likely be acquired if those businesses are in the same primary business of the issuer. This provides investors with information on the issuer's entire business, which is the subject of their investment.

As a result, with one exception, there is no significance test for acquisitions that fall within the definition of an issuer under item 32.1 of Form 41-101F1 Information Required in a Prospectus (Form 41-101F1). The only exception to the significance threshold is if the business is over 100% when compared to the primary business of the issuer, in which case, it is important for investors to have the financial history of this business even though it is not the same as that of the primary business of the issuer. In instances where there are multiple acquisitions in the same primary business of the issuer, we encourage issuers and their advisors to consult with staff on a pre-file basis as smaller acquisitions are also likely to form part of the primary business of the issuer.

• Asset vs. business acquisitions -- When an issuer makes an acquisition, there are instances where judgement is involved to determine whether the acquisition is an asset acquisition or a business acquisition. An acquisition could meet the definition of an asset acquisition under International Financial Reporting Standards, while the same acquisition could be considered a business acquisition for securities law purposes. The term "business" should be evaluated in light of the specific facts and circumstances. We generally consider that a separate entity, a subsidiary or a division is a business and that in certain circumstances a smaller component of a company may also be a business, whether or not the business previously prepared financial statements. We generally view the acquisition of licenses, patents, royalties and intellectual property as "business" acquisitions for securities law purposes, as the revenue producing activity or potential revenue producing activity remains the same.

Part 8 of Companion Policy 51-102CP provides guidance in determining whether an acquisition constitutes the acquisition of a business. Specifically, in making that determination, a reporting issuer should consider the continuity of business operations, including the following factors:

(a) whether the nature of the revenue producing activity or potential revenue producing activity will remain generally the same after the acquisition; and

(b) whether any of the physical facilities, employees, marketing systems, sales forces, customers, operating rights, production techniques or trade names are acquired by the reporting issuer instead of remaining with the vendor after the acquisition.

If an existing issuer completes an acquisition of a business that is considered significant, the securities requirements under part 8 of NI 51-102 would apply. We remind issuers that if a company completes a business acquisition through an IPO, the company must include in its prospectus a three-year financial history (two years for an IPO venture issuer) of the business acquired, as this business forms the primary business of the issuer under item 32 of Form 41-101F1. This disclosure will provide investors with information on the entire business, which is the focus of their investment.

We encourage issuers and their advisors to consult with staff on a pre-file basis if there is uncertainty as to whether the acquisition is an asset acquisition or a business acquisition for securities law purposes.

• Sufficiency of proceeds and financial condition of an issuer -- We remind issuers that a critical part of every prospectus review is considering an issuer's financial condition and intended use of proceeds. A prospectus must contain clear disclosure on how the issuer intends to use the proceeds raised in the offering as well as disclosure of the issuer's financial condition, including any liquidity concerns. In some instances, an issuer's representations about its ability to continue as a going concern and the period during which it expects to be able to continue operations may be inconsistent with the issuer's historical statement of cash flows (in particular, its cash flows from operating activities). In these cases, we may request that the issuer provide us with a cash flow forecast or financial outlook-type disclosure to support its assumed period of liquidity (i.e., ability to continue operations). However, disclosure on its own may not be sufficient to satisfy receipt refusal concerns in certain circumstances.

Issuers, including those filing a base shelf or non-offering prospectus, should review CSA Staff Notice 41-307 Corporate Finance Prospectus Guidance -- Concerns regarding an issuer's financial condition and the sufficiency of proceeds from a prospectus offering.

• Material contracts -- We remind issuers to review all contracts entered into in connection with an offering, including financing arrangements, to determine whether the contract is a "material contract" that must be filed with the OSC.

While there is a conditional exemption to the requirement to file and provide particulars of material contracts if such contracts are entered into in the ordinary course of business, issuers should still consider whether the prospectus includes sufficient disclosure about these material contracts in order for the prospectus to contain full, true and plain disclosure. We remind issuers that material contracts on which the issuer's business is substantially dependent are one category of ordinary course of business contracts that must be filed.

We also remind issuers that if a material contract is not executed at the time the final prospectus is filed, the issuer must file an undertaking with the OSC to file the contract no later than seven days after execution of the contract.

• Trust indentures -- We remind issuers that trust indentures and supplemental trust indentures filed in connection with a debt offering should be filed under the document type "Documents affecting rights of securityholders -- Trust indentures re: debt."

Recent changes to increase access to the exempt market have expanded investment opportunities for all investors, including retail investors. The OSC recognizes the need to be vigilant in its oversight of these markets as they evolve under the new regulatory framework. Our program for overseeing distributions in the exempt market, including those under the new prospectus exemptions, has three main elements:

• assessing compliance,

• enhancing awareness, and

• gathering data to support the first two activities.

The Corporate Finance Branch and Compliance and Registrant Regulation Branch of the OSC have primary responsibility for oversight of compliance in the exempt market. Both branches are working very closely together to coordinate and conduct the compliance reviews of issuers and registrants.

As part of the compliance and oversight program, the OSC will oversee issuers and registrants that distribute securities under prospectus exemptions to confirm whether they are complying with their respective obligations.

This program will apply a risk-based approach to select issuers and registered firms for review. We will review and assess their compliance with 1) the prospectus exemptions being relied upon; and 2) their ongoing registrant obligations. The program includes reviewing the offering materials that are distributed to investors, and relied on by the issuer under the new prospectus exemptions, including the offering memorandum exemption, crowdfunding exemption and rights offering exemption. In reviewing the offering materials, we will look to identify misuse of the exemptions and conduct that maybe contrary to the public interest. Where warranted, we will take appropriate compliance and cross-branch referral action, including recommendations regarding enforcement action.

We also plan to engage in education and other outreach activities for issuers, registrants and investors. For example, through programs such as the OSC SME Institute, the OSC offers seminars to the public on securities law requirements, including prospectus exemptions. The Compliance and Registrant Regulation Branch also provides regular webinars and other outreach sessions to the registrant community. In addition, the Office of Investor Policy, Education and Outreach engages in educational outreach activities aimed primarily at retail investors.

Data gathering will support our compliance and outreach activities as well as future policy initiatives. Review of how the prospectus exemptions are being used will allow us to understand whether the conditions of the exemptions are having the intended effect. Working with the CSA, we have developed a new report of exempt distribution, which will facilitate more effective regulatory oversight of the exempt market. Improved data collection through an enhanced report of exempt distribution is essential to support our exempt market initiatives, as it will allow us to gain greater insight into exempt market trends and behavior than is possible with the existing report.

• Rights offerings -- Stand-by commitments are included as part of the rights offering exemption in order to provide greater certainty to security holders of the issuer. We have raised public interest concerns with the structure of an exempt rights offering where a stand-by commitment was proposed that was conditional on the level of security holder participation in the offering and other actions that could not be determined at the time that security holders were required to decide whether to exercise the rights.

Staff review and make recommendations to appropriate decision makers on applications for exemptive relief. The review standard for granting relief varies, but it generally requires a decision maker to determine that granting the requested relief would not be prejudicial to the public interest.

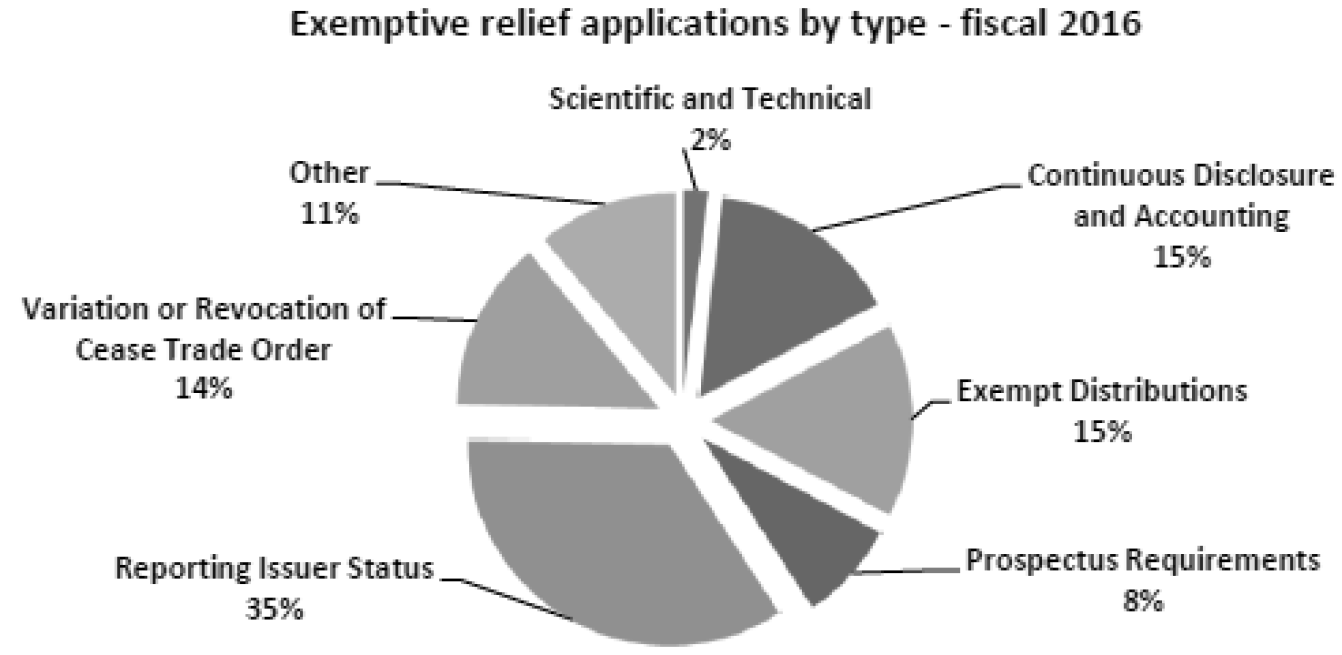

In fiscal 2016, we reviewed over 160 applications for exemptive relief from various securities law requirements (fiscal 2015: over 300).

The number of applications received in fiscal 2016 was substantially lower than the prior fiscal year as a result of a significant number of one-time participation fee relief applications received in fiscal 2015. Excluding those fee applications, the number of applications in fiscal 2016 was only moderately lower than fiscal 2016, although the proportion of the various types of applications was generally consistent. Applications for relief in connection with reporting issuer status remained the predominant type of application, followed by continuous disclosure and exempt distributions as well as applications for partial or full revocations of cease trade orders.

We continue to monitor the types of applications we receive and the exemptive relief granted to determine whether we should consider changes to our rules or policies.

Key takeaways from our exemptive relief work in fiscal 2016 are set out below.

• Revocation of a cease trade order that has been breached -- If an issuer has breached the terms of a cease trade order, it can still seek a revocation. However, it must disclose the circumstances surrounding the breach in the draft decision document and staff will consider the breach (or breaches) in making a recommendation in connection with the issuer's application. In some cases, staff will not recommend granting a revocation order in the face of a breach of the cease trade order or multiple instances of a breach. Staff may also consider whether breaches of a cease trade order warrant enforcement action.

We remind issuers and their advisors that "trade" is defined broadly in the Act and includes acts in furtherance of a trade.

• Revocation of a long standing cease trade order -- Where an issuer with a long standing cease trade order seeks a revocation, the review process may take longer than usual. In these cases, staff view the dormant issuer as "re-entering" the market. In some cases, the issuer has significant gaps in its CD record and staff must review the issuer's updated CD record to consider whether it is sufficient to support trading.

Staff may also require an issuer to provide a written undertaking that it will not execute a reverse takeover of a business outside of Canada unless it files a non-offering prospectus with the OSC.

• Revocation of failure-to-file cease trade orders -- We remind issuers that as a result of amendments to the Act and the Fee Rule, the OSC can treat the filing of the record referred to in a failure-to-file cease trade order that has been in effect for 90 days or less as an application for the revocation of the cease trader order. An application and related fee is not required in this circumstance.

• Applications for a decision that an issuer is not a reporting issuer -- We receive a significant number of these applications each fiscal year and our process for reviewing them is currently set out in National Policy 11-206 Process for Cease to be a Reporting Issuer Applications. See CSA Notice of Publication of Multilateral Instrument 11-102 Passport System and Multilateral Instrument 11-103 Failure-to-File Cease Trade Orders in Multiple Jurisdictions. This process was previously set out in CSA Staff Notice 12-307 Applications for a Decision that an Issuer is not a Reporting Issuer. The process for Ontario-only applications for such a decision is set out in OSC Staff Notice 12-703 Applications for a Decision that an Issuer is not a Reporting Issuer, which was revised on June 16, 2016.

We remind foreign issuers who seek a decision that they are no longer a reporting issuer to review the "modified procedure" to consider details that help support such an application. Staff will ask issuers to describe the due diligence that was conducted to make the representations regarding Canadian ownership of the issuer's securities. We also remind issuers that there should be sufficient time between the required news release announcing the application and the issuance of the order to provide securityholders with the opportunity to object to the order.

• Business acquisition report (BAR) relief -- Relief from the BAR requirements continues to represent a significant number of applications reviewed by the Branch. We remind issuers that the cost or time involved in preparing and auditing the financial statements required to be included in the BAR are not reasons favorably looked upon when considering whether relief is appropriate. These applications should be filed early and not near the filing deadline of the BAR so an issuer can avoid going into default.

We also acknowledge that significance test calculations may, in rare circumstances, result in anomalous results. In these cases, issuers must demonstrate to us that an acquisition is not significant. To that effect, staff may consider on a case-by-case basis alternative metrics in support of a determination that an acquisition is not significant from a practical, commercial or financial perspective. In recommending if relief should be granted, staff will consider the relevance and breadth of alternative metrics presented.

• Applications for prospectus relief -- Many of the novel applications we review relate to exempt market relief such as not filing a prospectus to distribute securities. Issuers and their advisors should carefully consider whether the OSC has granted the requested relief with facts and circumstances similar to those of the applicant. Where relief is novel, staff's review time will take longer and this process often involves consulting with the CSA. Issuers and their advisors may wish to consider whether a pre-file is appropriate for such applications. See National Policy 11-- 203 Process for Exemptive Relief Applications in Multiple Jurisdictions.

We review compliance of reporting insiders and issuers with insider reporting requirements through a risk-based compliance program. We actively and regularly assist filers and their agents by providing guidance on filing matters.

The objective of our insider reporting oversight work is two-fold:

• Compliance

• education and outreach

Insider reporting serves a number of functions, including deterring improper insider trading based on material undisclosed information and increasing market efficiency by providing investors with information concerning the trading activities of insiders, and, by inference, the insiders' views of the respective issuer's future prospects. Non-compliance affects the integrity, reliability and effectiveness of the insider reporting regime, which in turn has a negative impact on market efficiency. Where we identify non-compliance, we reach out to filers and request remedial filings. Filers should make remedial filings as soon as they become aware of an error to accurately inform investors of their activities and to avoid any further late filing fees.

We educate filers through our compliance reviews and we also reach out to new reporting issuers directly to inform them of insider reporting obligations. We encourage issuers to implement insider trading policies and monitor insider trading to meet best practice standards in National Policy 51-201 Disclosure Standards.

Insider reporting with respect to rights offerings

Due to the recent rule changes with respect to rights offerings, we are seeing an increase in their use by reporting issuers. We remind issuers that they must file an issuer event report on SEDI no later than one business day following the commencement of a rights offering. The issuer must also immediately file an amended issuer profile supplement in SEDI format to provide a security designation for the rights (as an issuer derivative) in order to allow the issuer's insiders to file insider reports with respect to the rights.

We remind insiders of a reporting issuer that while Part 8 of National Instrument 55-104 Insider Reporting Requirements and Exemptions (NI 55-104) provides insiders with an exemption from having to initially report receiving the rights issued to them under a rights offering, the insider is required to report the receipt of rights when it reports any subsequent change in its beneficial ownership of, or control or direction over, whether direct or indirect, a security of the reporting issuer. The expiry of the rights would be such a change requiring reporting.

We remind issuers and their insiders that the definition of "reporting insider" can be found in NI 55-104.

Issuers and insiders should also refer to the definition of "significant shareholder" and the interpretation of "control" in NI 55-104 as well as the interpretation of "beneficial ownership" in the Act when determining who is required to file on SEDI. For example, we frequently see circumstances where an individual holds more than 10% of the outstanding shares of an issuer through a holding company but fails to file an insider profile and reports for such holding company, which is also a "significant shareholder" under NI 55-104. Understanding these definitions and interpretations will help filers identify and comply with their obligations.

We encourage issuers and insiders to review the details below, which provide filing tips to assist filers in avoiding some of the common errors we observed during the most recent fiscal year.

Tips for issuers:

• Have you recently checked your issuer profile supplement to ensure your insider affairs contact is up to date?

• Does your issuer profile supplement show all your security designations?

• If you have engaged in a normal course issuer bid recently, have you set up an insider profile on SEDI to report acquisitions?

• The exemption in Part 5 of NI 55-104 does not apply to the acquisition of options or similar securities or related financial instruments (e.g. deferred share units, restricted share awards or stock appreciation rights) granted to a director or an officer. Rather, you must comply with Part 6 of NI 55-104 and file an issuer grant report within 5 days of the grant date if you want insiders to have the benefit of the delayed reporting exemption available for these transactions.

• In filing an issuer grant report, have you disclosed all of the details required by NI 55-104? If you have not, your reporting insiders cannot rely on the exemption in Part 6 of NI 55-104 and may be subject to late filing fees.

• Have you created deferred share units, restricted share awards and other similar securities under the security category of "issuer derivative" on SEDI? Creating these under the category of "equity" is incorrect.

Tips for insiders:

• Have you recently checked your insider profile to ensure the contact information is correct?

• You must file an amended insider profile within 10 days of any change in your name, your relationship to an issuer or if you have ceased to be a reporting insider of an issuer.

• Have you filed insider reports on SEDI that reflect all of your securities holdings and related transactions for an issuer? For example, have you recently received a grant of stock options or other form of compensation under a reporting issuer's compensation plan?

• You must file reports on transactions in securities over which you have control or direction or beneficial ownership of.

• Carefully consider whether you can rely on any of the exemptions in Part 9 of NI 55-104. For example, the "corporate group" reporting exemption in section 9.5 of NI 55-104 is not available where securities representing 10% or more of voting rights in a reporting issuer are held for an individual through a holding corporation which the individual controls. In such cases, both the individual and the corporation must file insider reports.

• Have you reviewed the continuous disclosure filings of the reporting issuer (e.g., management information circulars) that include your securities holdings for accuracy and completeness? Please report any discrepancies to the reporting issuer.

Designated Rating Organizations

In April 2012, the CSA implemented a regulatory oversight regime for credit rating agencies (CRAs) through National Instrument 25-101 Designated Rating Organizations (NI 25-101). The regime recognizes and responds to the role of CRAs in our credit markets, and the role of CRA-issued ratings which are referred to in securities legislation. Under the regime, the OSC has the authority to designate a CRA as a DRO, to impose terms and conditions on a DRO, and to revoke a designation order, or change its terms and conditions, where the OSC considers it in the public interest to do so.

There are currently four CRAs that have been designated as DROs in Canada under NI 25-101: DBRS Limited, Fitch Ratings, Inc., Moody's Canada Inc., and Standard & Poor's Rating Services (Canada). In Canada, the OSC is the principal regulator of these DROs.

We conduct reviews of DROs using a risk-based approach. Our reviews focus on credit rating activities of the CRAs in Canada or in respect of Canadian issuers.

When we identify a concern, or area of material non-compliance, we may take various actions depending on the nature of the observation and the perceived or potential harm to the marketplace. This may include, but is not limited to, recommending changes to the DRO's policies, procedures or information and documents on the DRO's website, or requiring training or specified oversight of DRO staff in areas where we have seen non-compliance with the DRO's policies or procedures.

Part C: Responsive Regulation

Responsive Regulation

The OSC continues to play a leading role in several significant policy initiatives with other securities regulators in the CSA in addition to policy initiatives that are applicable only in Ontario. This section reports on the status of certain of these initiatives:

• exempt market regulatory reform

• distributions of securities outside of Ontario

• passport expansion and CSA co-ordination:

• cease to be a reporting issuer applications

• cease trade orders and revocations

Exempt Market Regulatory Reform

The OSC was engaged in a review of several aspects of the exempt market regulatory regime for a number of years. This review began as a CSA review of the accredited investor and minimum amount investment prospectus exemptions with the publication of a consultation note in November 2011. In June 2012, the OSC announced that it was expanding the scope of its exempt market review to consider whether the OSC should introduce any new prospectus exemptions that would facilitate capital raising for businesses while protecting the interests of investors.

As a result of this review and related exempt market initiatives, key capital raising tools were amended or introduced during fiscals 2014-2015 and 2015-2016:

• In collaboration with the CSA, the OSC made changes to the accredited investor prospectus exemption and minimum amount investment prospectus exemption to address investor protection concerns.

• The OSC introduced the family, friends and business associates prospectus exemption (FFBA exemption) and the existing security holder prospectus exemption (ESH exemption). These tools are available in substantially similar form in other CSA jurisdictions. The FFBA exemption is intended to enable start-ups and early stage businesses to raise capital from investors within the personal networks of the principals of the business. The ESH exemption allows public companies listed on specified Canadian exchanges to raise capital from their existing investors based on their public disclosure record.

• The OSC introduced the offering memorandum prospectus exemption (OM exemption) and the crowdfunding regime, which included both a crowdfunding prospectus exemption and regulatory requirements applicable to an online crowdfunding portal. The OM exemption allows businesses to raise capital from a broad investor base provided that, among other things, a comprehensive disclosure document is made available to investors. The crowdfunding regime allows businesses, particularly start-ups and early stage businesses, to raise capital from a potentially large number of investors through an online portal registered with the securities regulatory authorities. We worked closely with other CSA jurisdictions in formulating the OM exemption and crowdfunding regime. On the OM exemption, we worked with the securities regulatory authorities in Alberta, New Brunswick, Nova Scotia, Québec and Saskatchewan. On the crowdfunding regime, we worked with the securities regulatory authorities in Manitoba, New Brunswick, Nova Scotia, Québec and Saskatchewan.

• In collaboration with the CSA, the rights offering prospectus exemption was streamlined to make it more attractive to public companies while maintaining investor protection. For example, the rights offering prospectus exemption was modified by:

• removing the current regulatory review process prior to the use of the exemption,

• increasing investor protection through the addition of civil liability for secondary market disclosure,

• introducing a user-friendly form of rights offering circular,

• introducing a new notice that reporting issuers must file on SEDAR and send to security holders informing them about how to access the rights offering circular electronically, and

• increasing the dilution limit from 25% to 100%.

For an overview of these key capital raising prospectus exemptions in Ontario, see Summary of Key Capital Raising Prospectus Exemptions in Ontario on the OSC's website.

For additional information, see the specific notices regarding the amendments to the exempt market regulatory regime resulting in the amended and new prospectus exemptions:

• Accredited Investor and Minimum Amount Investment Prospectus Exemptions

• Crowdfunding

CSA Notice of Publication of Multilateral Instrument 45-108 Crowdfunding

• Existing Security Holder Prospectus Exemption

Notice of Amendments to OSC Rule 45-501 Ontario Prospectus and Registration Exemptions

• Family, Friends and Business Associates Exemption

• Offering Memorandum Exemption

• Rights Offerings

As part of the exempt market initiative, the CSA also recently adopted a new, harmonized report of exempt distribution which replaced two existing forms. This harmonized report will:

• reduce the compliance burden for issuers and underwriters by having a harmonized report of exempt distribution, and

• provide securities regulators with the necessary information to facilitate more effective regulatory oversight of the exempt market and improve analysis for policy development purposes.

See CSA Notice of Amendments to National Instrument 45-106 Prospectus Exemptions Relating to Reports of Exempt Distribution for further information on the new report.

For guidance on completing and filing the new report, see CSA Staff Notice 45-308 (Revised) Guidance for Preparing and Filing Reports of Exempt Distribution under National Instrument 45-106 Prospectus Exemptions.

On July 7, 2016, the CSA published a staff notice addressing the granting of an exemption for certain foreign issuers from the requirement in Schedule 1 of the new report to identify whether a purchaser is a registrant or an insider of the issuer. The OSC approved an amendment instrument providing for this exemption in Ontario and delivered it to the Ontario Minister of Finance on July 5, 2016. The Minister approved the amendment instrument on July 14, 2016 and the amendment instrument will come into force on July 29, 2016.

For more information, see:

• Ontario Amending Instrument for National Instrument 45-106 Prospectus Exemptions

The OSC has created a dedicated Exempt Market page on the OSC's website which provides issuers, registrants and investors with a convenient place to obtain information and access resources about the exempt market, including exempt market data.

Distributions of Securities Outside of Ontario

In 1983, the OSC published a note entitled "Interpretation Note 1 Distributions of Securities Outside Ontario" (the Interpretation Note) in which the OSC acknowledged that an overly broad interpretation of the application of Ontario prospectus requirements could seriously interfere with the capital formation process for issuers effecting financings outside Ontario.

Over time, market participants and Commission staff have found the approach described in the Interpretation Note difficult to administer because of its uncertainty. The OSC approach to distributions outside of the jurisdiction has evolved, as has case law on provincial jurisdiction over activities outside the province, such that the Interpretation Note is out of date and no longer accurately represents OSC staff practice.

As a result, on June 30, 2016, the OSC published for a 90-day comment period, a proposal to withdraw the Interpretation Note and adopt proposed Ontario Securities Commission Rule 72-503 Distributions Outside of Canada (the Proposed Rule) and proposed Companion Policy 72-503CP to OSC Rule 72-503 Distributions Outside of Canada (the Proposed Companion Policy). See Notice and Request for Comment on Proposed OSC Rule 72-503 Distributions Outside of Canada and Companion Policy 72-503CP to OSC Rule 72-503 Distributions Outside of Canada.

The substance and purpose of the Proposed Rule and the Proposed Companion Policy is to provide certainty to participants in cross-border transactions by providing explicit exemptions that respond to the challenges that issuers and intermediaries face in determining whether a prospectus must be filed or an exemption from the prospectus requirement must be relied on, and the effect of related dealer registration requirements, in connection with a distribution of securities to investors outside of Canada.

Generally, the Proposed Rule provides exemptions from the prospectus requirement in respect of a distribution of securities to a person or company outside of Canada in the following circumstances:

• if the distribution is under a public offering document in the United States of America or a designated foreign jurisdiction,

• if a concurrent distribution is qualified under a final prospectus in Ontario,

• if the issuer is and has been a reporting issuer in a jurisdiction of Canada for the four months immediately preceding the distribution, and

• all other distributions, but subject to restrictions on resale to a person or company in a jurisdiction of Canada.

The Proposed Rule also provides for a limited exemption from the dealer and underwriter registration requirements, provided certain conditions are met.

Passport Expansion and CSA Co-ordination

The OSC continues to work with the securities regulators in the other CSA jurisdictions to further enhance Canada's securities regulatory system. On June 23, 2016, amendments to Multilateral Instrument 11-102 Passport System (MI 11-102) came into force in CSA jurisdictions other than Ontario expanding the passport system to cover applications to cease to be a reporting issuer and Multilateral Instrument 11-103 Failure-To-File Cease Trade Orders in Multiple Jurisdictions (MI 11-103) was implemented.

Although Ontario has not adopted MI 11-102 and MI 11-103, the OSC and the other members of the CSA developed two new policies to provide an interface between Ontario and the other CSA jurisdictions to make the securities regulatory system as efficient and effective as possible for all reporting issuers in Ontario and the other CSA jurisdictions:

• National Policy 11-206 Process for Cease to be a Reporting Issuer Applications (NP 11-206)

• National Policy 11-207 Failure-to-File Cease Trade Orders and Revocations in Multiple Jurisdictions (NP 11 -- 207)

See CSA Notice of Publication of Multilateral Instrument 11-102 Passport System and Multilateral Instrument 11-103 Failure-to-File Cease Trade Orders in Multiple Jurisdictions for further information.

The amendments and implementation of new rules and policies introduce a more efficient process for the filing and review of cease to be a reporting issuer applications and revocations of failure-to-file cease trade orders. The changes will also coordinate the process for jurisdictions to reciprocate failure-to-file cease trade orders, where applicable.

Cease to be a Reporting Issuer Applications

Prior to the implementation of NP 11-206, cease to be a reporting issuer applications were filed with and reviewed by each provincial or territorial securities regulator in jurisdictions where the issuer was a reporting issuer by following the "coordinated review" process in National Policy 11-203 Process for Exemptive Relief Applications in Multiple Jurisdictions. NP 11-206 implements a new and more efficient process for the filing and review of these applications whereby an issuer will generally be able to deal only with its principal regulator to obtain an order to cease to be a reporting issuer in all Canadian jurisdictions where it has this status. Cease to be a reporting issuer applications have been the predominant type of application received by the OSC in the last several years.

Failure-to-File Cease Trade Orders and Revocations

When a reporting issuer is in default of certain types of CD requirements under securities legislation, a regulator may issue a failure-to-file cease trade order. Previously, there was no formal coordinated process across Canadian jurisdictions to recognize a failure-to-file cease trade order issued by another jurisdiction. Participating CSA jurisdictions have agreed to a coordinated process for when other regulators will reciprocate the order first issued against the securities of the defaulting reporting issuer. Under new MI 11-103 and local statutory provisions recently adopted by certain CSA jurisdictions: (i) a failure-to-file cease trade order will generally result in the same prohibition or restriction in other participating jurisdictions; and (ii) a reporting issuer will generally be able to deal only with the regulator that issued the failure-to-file cease trade order to obtain a revocation or variation of this order that has the same result in multiple jurisdictions. NP 11-207 outlines the interface process for Ontario to opt into decisions to issue and revoke failure-to-file cease trade orders made by other CSA regulators.

In Ontario, the Act was also amended in fiscal 2015 with respect to the making and revocation of cease trade orders. As a result, the OSC can treat the filing of the record referred to in a failure-to-file cease trade order that has been in effect for 90 days or less as an application for the revocation of the cease trader order. This facilitates the revocation process in NP 11-207 and eliminates the previous requirement to file a formal revocation application. In light of and consistent with the Act amendments, we also amended OSC Rule 13-502 to remove the $4,800 application fee for this type of application.

If you have questions or comments about this report, please contact:

{1} On March 1, 2017 the Bank of Canada will no longer publish two sets of exchange rates (noon and closing), but will instead publish a single indicative rate per currency pair each day at 16:30 Eastern Time (ET). See Bank of Canada's website.