CSA Notice and Request for Comment - Proposed National Instrument 52-112 Non-GAAP and Other Financial Measures Disclosure, Proposed Companion Policy and Related Proposed Consequential Amendments and Changes

CSA Notice and Request for Comment - Proposed National Instrument 52-112 Non-GAAP and Other Financial Measures Disclosure, Proposed Companion Policy and Related Proposed Consequential Amendments and Changes

September 6, 2018

Introduction

The Canadian Securities Administrators (the CSA or we) are publishing for a 90-day comment period the following materials:

• Proposed National Instrument 52-112 Non-GAAP and Other Financial Measures Disclosure (the Proposed Instrument);

• Proposed Companion Policy 52-112 Non-GAAP and Other Financial Measures Disclosure (the Proposed Companion Policy);

• Related proposed consequential amendments or changes to:

• Multilateral Instrument 45-108 Crowdfunding (MI 45-108){1};

• Companion Policy 45-108CP Crowdfunding (45-108CP);

• Companion Policy 51-102CP Continuous Disclosure Obligations (51-102CP);

• Companion Policy 51-105CP Issuers Quoted in the U.S. Over-the-Counter Markets (51-105CP){2};

• Companion Policy 52-107CP Acceptable Accounting Principles and Auditing Standards (52-107CP).

(collectively, the Proposed Materials).

The Proposed Instrument sets out disclosure requirements for non-GAAP financial measures and other financial measures (i.e., segment measures, capital management measures, and supplementary financial measures as defined in the Proposed Instrument).

The Proposed Companion Policy provides guidance on how we will interpret and apply the Proposed Instrument.

The Proposed Materials are intended to replace CSA Staff Notice 52-306 (Revised) Non-GAAP Financial Measures (SN 52-306) and complement other CSA financial disclosure requirements.

The text of the Proposed Materials is contained in Annexes A through E of this Notice and will also be available on the websites of CSA jurisdictions, including:

www.lautorite.qc.cawww.albertasecurities.comwww.bcsc.bc.cawww.nssc.novascotia.cawww.fcnb.cawww.osc.gov.on.cawww.fcaa.gov.sk.cawww.msc.gov.mb.ca

Substance and Purpose

The Proposed Instrument aims to address the disclosure surrounding non-GAAP financial measures and other financial measures.

The Proposed Instrument complements the Securities Acts of the various jurisdictions in Canada that make it an offence to provide false or misleading information to investors. The Proposed Instrument establishes disclosure requirements that must be met to disclose non-GAAP financial measures and other financial measures.

In some cases, non-GAAP and other financial measures are helpful to investors to assess an issuer's performance.

The Proposed Instrument does not contain specific limitations or industry-specific requirements; rather, it includes comprehensive disclosure requirements whose overall goal is to improve the quality of information provided to investors.

We acknowledge that some stakeholders may prefer that we:

• limit, in specific circumstances, the disclosure of certain financial measures, and

• develop industry-specific requirements for certain financial measures.

However, due to the numerous types of ever-evolving financial measures disclosed across a range of industries, we believe that comprehensive disclosure requirements are best suited to respond to investor needs for quality information. These requirements allow investors to better analyze different financial measures within an industry or among different industries.

Although the definition of a non-GAAP financial measure has been updated, the Proposed Materials have substantially incorporated the disclosure guidance in SN 52-306 for non-GAAP financial measures.

To ensure investors appreciate the context of other financial measures, the Proposed Instrument introduces disclosure requirements if such financial measures are disclosed outside the financial statements.

Background

Many issuers, in all industries, disclose a range of financial measures that may lack standardized meanings under the financial reporting framework used in the preparation of the issuer's financial statements, lack context when disclosed outside of the issuer's financial statements, lack transparency as to their calculation or vary significantly by issuer and industry.

Common terms used to label non-GAAP financial measures may include "adjusted earnings", "adjusted EBITDA", "free cash flow", "pro forma earnings", "cash earnings", "distributable cash", "cost per ounce", "adjusted funds from operations" and "earnings before non-recurring items".

In Canada, SN 52-306 is intended to help ensure that non-GAAP financial measures do not mislead investors. Although we have updated SN 52-306 several times to respond to changing circumstances and published various staff notices and reports that comment on the topic, we continue to find that disclosure practices surrounding non-GAAP financial measures vary. Our findings are consistent with those of other stakeholders (particularly investors) who share our desire for quality disclosure.

Over the years, we have also found that other financial measures that do not meet the definition of a non-GAAP financial measure in SN 52-306 may be equally problematic if not accompanied by appropriate disclosure. Such financial measures include those disclosed in the notes to the financial statements that lack context when disclosed outside the financial statements.

Replacing SN 52-306 with the Proposed Instrument will provide CSA Staff with a stronger tool to take appropriate regulatory action as needed.

We are aware that some accounting standards boards, such as the International Accounting Standards Board (IASB), are currently examining, among other things, the structure and content of financial statements. This work may potentially lead to certain changes in the types of information to be included in financial statements. If necessary in the future, we may update the Proposed Instrument (or other securities legislative requirements) to respond to these and other marketplace changes (if any).

We are aware that commentary continues to be issued by certain industry groups, professional bodies, and standard setters on the topic of non-GAAP financial measures and other financial measures disclosed outside the financial statements. This has, in some cases, created confusion with stakeholders as to requirements under Canadian securities law versus suggested non-authoritative guidance. When implemented, the Proposed Instrument will provide authoritative Canadian securities legislative requirements for all issuers when they disclose non-GAAP financial measures and other financial measures.

With the issuance of the Proposed Instrument, we join other securities regulators, including the International Organization of Securities Commissions (IOSCO), the European Securities and Markets Authority (ESMA), and the U.S. Securities and Exchange Commission (SEC), that have recently strengthened their efforts to regulate the disclosure of certain financial measures.

Summary of the Proposed Instrument

The Proposed Instrument:

• applies to all issuers (including investment funds), except for SEC foreign issuers, and all documents (e.g., Management's Discussion and Analysis, press releases, the Annual Information Form, prospectuses etc.) including other written communications in websites or social media;

• pertains to the disclosure of financial measures (including ratios) that are non-GAAP financial measures, segment measures, capital management measures, and supplementary financial measures as defined in the Proposed Instrument;

• includes an updated definition of a non-GAAP financial measure which builds upon and incorporates the disclosure guidance in SN 52-306, and

• introduces the concept of segment measures, capital management measures, and supplementary financial measures, together with associated disclosure requirements.

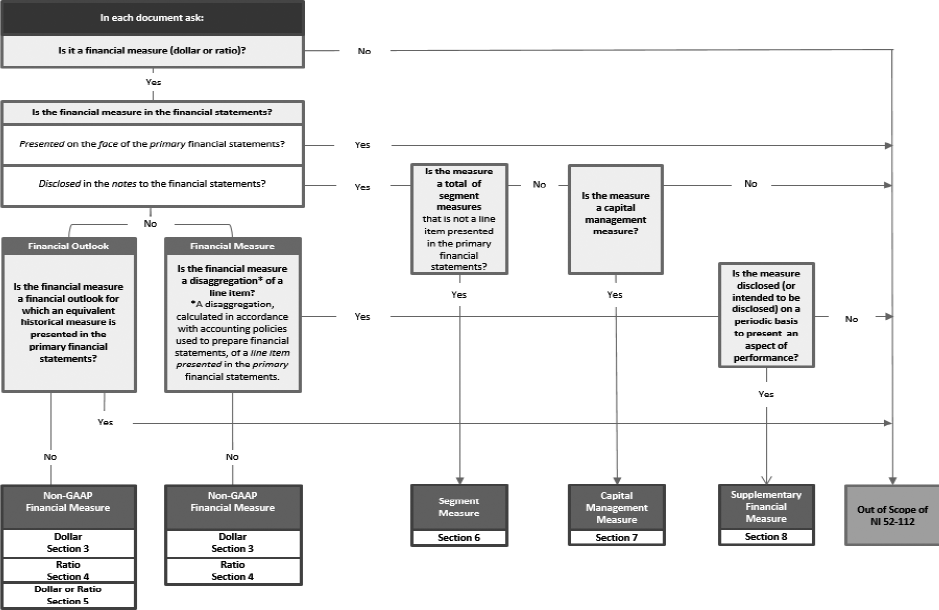

Annex C provides a general overview of the application process for the Proposed Instrument.

Anticipated Costs and Benefits of the Proposed Instrument

Benefits

Issuers

The Proposed Instrument does not limit an issuer's ability to disclose non-GAAP financial measures or other financial measures provided the disclosure is not misleading. If an issuer chooses to disclose these financial measures, the Proposed Instrument contains clear and formalized disclosure requirements that we anticipate will reduce the uncertainty regarding an issuer's disclosure obligations.

Investors

Investors have identified to us several problematic disclosure practices surrounding non-GAAP financial measures and other financial measures, such as a lack of transparency regarding the nature of these financial measures, including calculation, as well as a lack of consistency of disclosures among issuers. The Proposed Instrument addresses these investor concerns by requiring comprehensive disclosures, including disclosure regarding a financial measure's method of calculation and usefulness. Such disclosures are intended to help investors better analyze different financial measures within an industry or among different industries.

Costs

Since the disclosure requirements for non-GAAP financial measures are substantially aligned with the current guidance in SN 52-306, we do not expect issuers to incur increased costs to comply with these disclosure requirements.

We expect issuers will initially incur some immaterial administrative costs to comply with the new disclosure requirements relating to segment measures, capital management measures, and supplementary financial measures in the first reporting period after the Proposed Instrument comes into force, if issuers choose to disclose these financial measures.

Summary of the Proposed Companion Policy

The Proposed Companion Policy provides guidance on how we will interpret and apply the Proposed Instrument and includes, among other things, interpretations of various terms and provisions in the Proposed Instrument as well as selected illustrative examples.

Overall, the goal of the guidance provided in the Proposed Companion Policy is to assist issuers in applying the provisions of the Proposed Instrument so as to help ensure non-GAAP financial measures and other financial measures do not mislead investors. For example, the Proposed Companion Policy contains useful examples and guidance in the following key areas:

• definition of a non-GAAP financial measure, including the terms "disaggregation" and "equivalent financial measure";

• definition of a supplementary financial measure, including the "periodic basis" attribute;

• requirements for a non-GAAP financial measure on labelling, prominence, consistency, location, identification, and usefulness;

• reconciliation requirements for a non-GAAP financial measure, including guidance on the determination of the most directly comparable measure;

• prominence requirement for a non-GAAP financial measure that is a ratio

• reconciliation requirement for a non-GAAP financial measure that is a financial outlook, and

• disclosure requirements for a segment measure and a capital management measure.

The expanded detail set out in the Proposed Companion Policy is intended to clarify the four defined types of financial measure subject to the Proposed Instrument and to explain how we expect the disclosure requirements in the Proposed Instrument to be satisfied.

Consequential Amendments and Changes

We, except the securities regulatory authorities listed in footnote 1 of this Notice, propose consequential amendments or changes to the instructions of Schedule A of Form 45-108F1 Crowdfunding Offering Document of MI 45-108 and section 16 of 45-108CP. We also propose changes to section 4.2 of 51-102CP and section 2.10 of 52-107CP. These proposed amendments and changes replace the references to the guidance provided in SN 52-306 with references to the requirements set out in the Proposed Instrument.

We, except the Ontario Securities Commission, also propose a consequential change to section 5 of 51-105CP to add a reference to the requirements set out in the Proposed Instrument.

Local Matters -- Ontario

Authority for the Instrument

In Ontario, the rule-making authority for the Proposed Instrument is in paragraphs 13, 16, 22, 22.1, 25 and 39 of subsection 143(1) of the Securities Act (Ontario).

Alternatives Considered

To address stakeholder concerns regarding the quality of disclosure surrounding non-GAAP financial measures and other financial measures, we considered updating SN 52-306 or developing a staff bulletin to supplement SN 52-306. After careful consideration, we concluded that the development of the Proposed Materials would be more effective in addressing stakeholder concerns and reducing uncertainty regarding an issuer's disclosure obligations.

Reliance on Unpublished Studies

In developing the Proposed Instrument, we are not relying on any significant unpublished study, report or other written material.

Request for Comments

We welcome your comments on the Proposed Materials.

We particularly appreciate comments that are specific and accompanied by concrete examples.

In addition to any general comments, we also invite comments on the following specific questions:

1. Does the proposed definition of a non-GAAP financial measure capture (or fail to capture) specific financial measures that should not (or should) be captured? Please explain using concrete examples.

2. Are there any specific additional disclosures not considered in the Proposed Instrument, that would significantly improve the overall quality of disclosure and be of benefit to investors? Please explain using concrete examples.

3. Is specific content in the Proposed Companion Policy unclear or inconsistent with the Proposed Instrument?

4. Is the proposed exemption for SEC foreign issuers appropriate? If not, please explain.

5. Is the proposed exclusion of oral statements to the application appropriate? If not, please explain.

6. Is the proposed inclusion of all documents to the application appropriate? If not, for which documents should an exclusion be made available? Please explain.

Please submit your comments in writing on or before December 5, 2018. If you are not sending your comments by email, please send us an electronic file containing submissions provided (in Microsoft Word format).

Address your submission to all of the CSA as follows:

British Columbia Securities CommissionAlberta Securities CommissionFinancial and Consumer Affairs Authority of SaskatchewanManitoba Securities CommissionOntario Securities CommissionAutorité des marchés financiersFinancial and Consumer Services Commission (New Brunswick)Superintendent of Securities, Department of Justice and Public Safety, Prince Edward IslandNova Scotia Securities CommissionSecurities Commission of Newfoundland and LabradorRegistrar of Securities, Northwest TerritoriesRegistrar of Securities, Yukon TerritorySuperintendent of Securities, Nunavut

Deliver your comments only to the addresses below. Your comments will be distributed to the other participating CSA.

Please refer your questions to any of the following:

British Columbia Securities CommissionAnita Cyr, Associate Chief Accountant, British Columbia Securities Commission604-899-6579 | [email protected]Maggie Zhang, Senior Securities Analyst, British Columbia Securities Commission604-899-6823 | [email protected]Alberta Securities CommissionAnne Marie Landry, Senior Securities Analyst, Alberta Securities Commission403-297-7907 | [email protected]Janice Anderson, Senior Accounting Specialist, Alberta Securities Commission403-297-2520 | [email protected]Ontario Securities CommissionAlex Fisher, Senior Accountant, Ontario Securities Commission416-593-3682 | [email protected]Jonathan Blackwell, Senior Accountant, Ontario Securities Commission416-593-8138 | [email protected]Katrina Janke, Senior Legal Counsel, Ontario Securities Commission416-593-8297| [email protected]Mark Pinch, Associate Chief Accountant, Ontario Securities Commission416-593-8057 | [email protected]Autorité des marchés financiersHélène Marcil, Chief Accountant, Autorité des marchés financiers514-395-0337 Ext: 4291| [email protected]Michel Bourque, Senior Regulatory Advisor, Direction de l'information continue, Autorité des marchés financiers514 395-0337 Ext: 4466 | [email protected]Nicole Parent, Analyst, Direction de l'information financière, Autorité des marchés financiers514-395-0337 Ext: 4455 | [email protected]

We cannot keep submissions confidential because securities legislation in certain provinces requires publication of the written comments received during the comment period. All comments received will be posted on the websites of each of the Alberta Securities Commission at www.albertasecurities.com, the Autorité des marchés financiers at www.lautorite.qc.ca and the Ontario Securities Commission at www.osc.gov.on.ca. Therefore, you should not include personal information directly in comments to be published. It is important that you state on whose behalf you are making the submission.

{1} The securities regulatory authorities in British Columbia, Prince Edward Island, Newfoundland and Labrador, Northwest Territories, Yukon Territory and Nunavut are not proposing these consequential amendments or the changes to the related Companion Policy because MI 45-108 does not apply in these jurisdictions.

{2} The Ontario Securities Commission is not proposing this consequential change as Multilateral Instrument 51-105 Issuers Quoted in the U.S. Over-the-Counter Markets and its Companion Policy do not apply in Ontario.

Annex A

PROPOSED NATIONAL INSTRUMENT 52-112 NON-GAAP AND OTHER FINANCIAL MEASURES DISCLOSURE

Table of Contents

|

<<PART>> |

<<TITLE>> |

|

|

|

|

PART 1 DEFINITIONS AND APPLICATION |

|

|

1. |

Definitions |

|

2. |

Application |

|

|

|

|

PART 2 DISCLOSURE REQUIREMENTS |

|

|

3. |

Non-GAAP financial measures |

|

4. |

Non-GAAP financial measures that are ratios |

|

5. |

Non-GAAP financial measures that are financial outlooks |

|

6. |

Segment measures |

|

7. |

Capital management measures |

|

8. |

Supplementary financial measures |

|

|

|

|

PART 3 EXEMPTION |

|

|

9. |

Exemption |

|

|

|

|

PART 4 EFFECTIVE DATE |

|

|

10. |

Effective date |

PROPOSED NATIONAL INSTRUMENT 52-112 NON-GAAP AND OTHER FINANCIAL MEASURES DISCLOSURE

PART 1 DEFINITIONS AND APPLICATION

Definitions

1. In this Instrument

"capital management measure" means a financial measure that is disclosed in the notes to the financial statements to enable users of financial statements to evaluate the issuer's objectives, policies and processes for managing capital;

"financial outlook" has the meaning ascribed to it in National Instrument 51-102 Continuous Disclosure Obligations;

"FOFI" has the meaning ascribed to it in National Instrument 51-102 Continuous Disclosure Obligations;

"non-GAAP financial measure" means

(a) a financial measure of financial performance, financial position or cash flow that is not disclosed or presented in the financial statements and that is not a disaggregation, calculated in accordance with the accounting policies used to prepare the financial statements, of a line item presented in the primary financial statements, or

(b) a financial outlook for which no equivalent financial measure is presented in the primary financial statements;

"primary financial statements" means

(a) the statement of financial position,

(b) the statement of profit or loss and other comprehensive income,

(c) the statement of changes in equity, and

(d) the statement of cash flows;

"segment measure" means a financial measure of segment profit or loss, revenue, expenses, assets, or liabilities that is disclosed in the notes to the financial statements;

"supplementary financial measure" means a financial measure that is not disclosed or presented in the financial statements and that

(a) is a disaggregation, calculated in accordance with the accounting policies used to prepare the financial statements, of a line item presented in the primary financial statements, and

(b) is, or is intended to be, disclosed on a periodic basis to present an aspect of financial performance, financial position or cash flow.

Application

2.

(1) This Instrument applies to an issuer, other than an SEC foreign issuer as defined in National Instrument 71-102 Continuous Disclosure and Other Exemptions Relating to Foreign Issuers.

(2) This Instrument applies to any non-GAAP financial measure, segment measure, capital management measure or supplementary financial measure that an issuer discloses in a document and that is intended to be, or reasonably likely to be, made available to the public in the local jurisdiction, whether or not filed under securities legislation, unless the issuer discloses a specific financial measure in accordance with a requirement of securities legislation or the laws of a jurisdiction of Canada.

(3) This Instrument does not apply to a specified document, a supporting document or a material contract filed by the issuer.

(4) For the purposes of subsection (3), "specified document" means a document referred to in any of paragraphs 12.1(1)(a) to (e) of National Instrument 51-102 Continuous Disclosure Obligations.

(5) For the purposes of subsection (3), "supporting document" means a document referred to in any of clauses 2.3(1)(a)(iv)(A) to (C) of National Instrument 81-101 Mutual Fund Prospectus Disclosure.

(6) For the purposes of subsection (3), "material contract" has the meaning ascribed to it in National Instrument 51-102 Continuous Disclosure Obligations, for an issuer other than an investment fund, and National Instrument 81-106 Investment Fund Continuous Disclosure, for an investment fund.

PART 2 DISCLOSURE REQUIREMENTS

Non-GAAP financial measures

3. An issuer must not disclose a non-GAAP financial measure in a document unless all of the following apply:

(a) the non-GAAP financial measure is labelled appropriately given its composition and in a way that distinguishes it from totals, subtotals and line items presented in the primary financial statements;

(b) subject to subsection 4(1), the non-GAAP financial measure is presented with no more prominence in the document than the most directly comparable financial measure presented in the primary financial statements;

(c) the document presents the same non-GAAP financial measure for the comparative period; and

(d) the first time the non-GAAP financial measure appears in the document, the document

(i) subject to subsection 4(2), identifies the non-GAAP financial measure as such,

(ii) states that the non-GAAP financial measure does not have a standardized meaning under the financial reporting framework used to prepare the financial statements and may not be comparable to similar financial measures presented by other issuers,

(iii) explains how the non-GAAP financial measure provides useful information to a reasonable person and explains the additional purposes, if any, for which management uses the non-GAAP financial measure,

(iv) subject to subsection 4(3) and section 5, provides a quantitative reconciliation, to the most directly comparable financial measure presented in the primary financial statements, which reconciliation

(A) is disaggregated in such a way that it provides a reasonable person an understanding of the reconciling items,

(B) does not describe a reconciling item as non-recurring, infrequent or unusual when a similar loss or gain is reasonably likely to occur within the next two years or has occurred during the prior two years, and

(C) is explained in such a way that it provides a reasonable person an understanding of each reconciling item, and

(v) explains the reason for a change, if any, in the label, composition or calculation of the non-GAAP financial measure.

Non-GAAP financial measures that are ratios

4.

(1) Paragraph 3(b) does not apply if

(a) the non-GAAP financial measure is a ratio, and

(b) the ratio is presented with no more prominence in the document than similar financial measures presented in the primary financial statements.

(2) Subparagraph 3(d)(i) does not apply if

(a) the non-GAAP financial measure is a ratio for which all financial components are disclosed or presented in the financial statements, or

(b) the non-GAAP financial measure is a ratio for which all financial components are disaggregations, calculated in accordance with the accounting policies used to prepare the financial statements, of line items presented in the primary financial statements.

(3) Subparagraph 3(d)(iv) does not apply if

(a) the non-GAAP financial measure is a ratio, and

(b) the first time the ratio appears in the document, the document describes how the ratio is calculated and

(i) identifies each non-GAAP financial measure used to calculate the ratio and complies with section 3 for each non-GAAP financial measure identified, or

(ii) provides a quantitative reconciliation to the ratio as calculated using the most directly comparable financial measures presented in the primary financial statements.

Non-GAAP financial measures that are financial outlooks

5.

(1) For the purposes of subparagraph 3(d)(iv), "primary financial statements" must be read as "FOFI" if

(a) the non-GAAP financial measure is a financial outlook, and

(b) FOFI has been disclosed together with the financial outlook in the document.

(2) Subparagraph 3(d)(iv) does not apply if

(a) the non-GAAP financial measure is a financial outlook,

(b) FOFI has not been disclosed with the financial outlook in the document, and

(c) the first time the financial outlook appears in the document, the document

(i) presents the equivalent historical non-GAAP financial measure, and

(ii) describes

(A) each of the material differences between the financial outlook and the most directly comparable financial outlook for which an equivalent historical financial measure is presented in the primary financial statements, or

(B) each of the significant components of the financial outlook used in its calculation.

Segment measures

6. If an issuer discloses in a document other than the financial statements a total of segment measures that is not a total, subtotal or line item presented in the primary financial statements, the document must,

(a) the first time the total of segment measures appears in the document, provide a quantitative reconciliation of the total of segment measures to the most directly comparable financial measure presented in the primary financial statements,

(b) present the total of segment measures with no more prominence than the most directly comparable financial measure referred to in paragraph (a), and

(c) include the presentation of the total of segment measures for the comparative period, if the total of segment measures has been previously disclosed.

Capital management measures

7.

(1) This section applies to a capital management measure that

(a) is disclosed in a document other than the financial statements, and

(b) is not

(i) a total, subtotal or line item presented in the primary financial statements, or

(ii) a disaggregation, calculated in accordance with the accounting policies used to prepare the financial statements, of a line item presented in the primary financial statements.

(2) If an issuer discloses a capital management measure described in subsection (1) in a document, the document must

(a) present the capital management measure with no more prominence than

(i) the most directly comparable financial measure presented in the primary financial statements, or

(ii) similar financial measures presented in the primary financial statements, if the capital management measure is a ratio,

(b) the first time the capital management measure appears in the document,

(i) describe how the capital management measure is calculated,

(ii) state that the accounting policies used to prepare the financial statements do not specify how the capital management measure is calculated,

(iii) explain how the capital management measure provides useful information to a reasonable person and explains the additional purposes, if any, for which management uses the capital management measure, and

(iv) provide, except where the capital management measure is a ratio, a quantitative reconciliation of the capital management measure to the most directly comparable financial measure presented in the primary financial statements, and

(c) include the presentation of the capital management measure for the comparative period, if the capital management measure has been previously disclosed.

Supplementary financial measures

8. If an issuer discloses a supplementary financial measure in a document, the document must,

(a) the first time the supplementary financial measure appears in the document,

(i) describe how the supplementary financial measure is calculated, and

(ii) explain the reason for a change, if any, in the label, composition or calculation of the supplementary financial measure if it has been previously disclosed, and

(b) include the presentation of the supplementary financial measure for the comparative period, if the supplementary financial measure has been previously disclosed.

PART 3 EXEMPTION

Exemption

9.

(1) The regulator or the securities regulatory authority may grant an exemption from this Instrument, in whole or in part, subject to such conditions or restrictions as may be imposed in the exemption.

(2) Despite subsection (1), in Ontario, only the regulator may grant such an exemption.

(3) Except in Alberta and Ontario, an exemption referred to in subsection (1) is granted under the statute referred to in Appendix B of National Instrument 14-101 Definitions, opposite the name of the local jurisdiction.

PART 4 EFFECTIVE DATE

Effective date

10. This Instrument comes into force on •, 201•.

Annex B

PROPOSED COMPANION POLICY 52-112 NON-GAAP AND OTHER FINANCIAL MEASURES DISCLOSURE

Introduction

National Instrument 52-112 Non-GAAP and Other Financial Measures Disclosure (the "Instrument") sets out specific disclosure requirements for an issuer that discloses non-GAAP financial measures (including non-GAAP financial measures that are ratios or financial outlooks), segment measures, capital management measures and supplementary financial measures.

Compliance with the Instrument does not relieve an issuer from any other obligations under other securities legislation. In particular, an issuer may not present a non-GAAP financial measure or other financial measure in a way that would be misleading.

The Instrument applies to all issuers, including investment funds, with the exception of SEC foreign issuers. The Instrument does apply to an SEC issuer that is not an SEC foreign issuer.

The purpose of this Companion Policy (the "Policy") is to state the view of the securities regulatory authorities on certain provisions of the Instrument. This Policy includes explanations, discussions, and examples of various parts of the Instrument.

The Instrument uses the terms "disclosed" and "presented" in the context of location within the financial statements. A financial measure is disclosed if it is included in the notes to the financial statements. A financial measure is presented if it is included in the "primary financial statements", as that term is defined in the Instrument. The definition of a non-GAAP financial measure excludes all measures presented or disclosed within the financial statements.

Section 1 -- Definition of a non-GAAP financial measure

Common terms used to identify non-GAAP financial measures may include "adjusted earnings", "adjusted EBITDA", "free cash flow", "pro forma earnings", "cash earnings", "distributable cash", "cost per ounce", "adjusted funds from operations" and "earnings before non-recurring items". Many of these terms lack standard meanings and issuers across a spectrum of industries may use the same term to refer to different calculations.

Accounting policies include an issuer's presentation, recognition, and measurement under the financial reporting framework used in the preparation of its financial statements (often referred to as Generally Accepted Accounting Principles ("GAAP")). The accounting policies encompass all principles to be applied by an issuer in preparing and presenting its financial statements, not just those which are disclosed in the notes to the financial statements or those selected when the issuer has to make a choice between alternative accounting policies.

Paragraphs 55 and 85 of IAS 1 Presentation of Financial Statements require the presentation of additional subtotals when such presentation is relevant to an understanding of the issuer's financial position or financial performance. An issuer that presents an additional subtotal in the primary financial statements, such as Earnings Before Interest, Taxes, Depreciation and Amortization ("EBITDA"), would be presenting the subtotal in accordance with the accounting policies used to prepare its financial statements, if it has determined such presentation is relevant to an understanding of its financial performance. That financial statement measure would not meet the definition of a non-GAAP financial measure if it were also disclosed outside the issuer's financial statements.

Measures that are a disaggregation of a line item presented in the primary financial statements, if that measure has been calculated in accordance with the issuer's accounting policies used to prepare the financial statements, would not meet the definition of a non-GAAP financial measure. The disaggregation of a line item includes disclosure of more granular information regarding that line item. This information could be presented through a table illustrating the disaggregation of revenues by certain products or by division, even if the table did not sum to the revenue amount presented in the issuer's primary financial statements, assuming that division or product revenue was calculated in accordance with the issuer's accounting policies under the financial reporting framework used in the preparation of the issuer's financial statements. However, such measure(s) would meet the definition of a non-GAAP financial measure if the revenue amounts were adjusted in any manner.

Disaggregation of subtotals and totals presented in the primary financial statements are captured by the definition of non-GAAP financial measures. For example, if EBITDA is not presented in the primary financial statements, it would be inappropriate to conclude that it is not a non-GAAP financial measure on the basis that it is a disaggregation of profit as presented in the statement of profit or loss. Likewise, a measure calculated by combining numbers disaggregated from different line items would also meet the definition of a non-GAAP financial measure, unless that measure is separately disclosed in the notes to the financial statements, for example, when expenses in the statement of profit and loss are presented by function and then also presented by nature in the notes to the financial statements.

A financial outlook is a non-GAAP financial measure unless an equivalent measure is presented in the primary financial statements. A financial measure is equivalent to a financial outlook if the two were prepared on a consistent basis. For example, if revenue is presented on a forward-looking basis using consistent accounting policies applied by the issuer in its latest set of financial statements (i.e. revenue as presented in the financial statements adjusted only for assumptions about future economic conditions and courses of action) it would not be a non-GAAP financial measure.

For clarity, the definition of a non-GAAP financial measure is not intended to include non-financial information such as:

• number of units;

• number of subscribers;

• volumetric information;

• number of employees or workforce by type of contract or geographical location;

• environmental measures such as greenhouse gas emissions;

• information on major shareholdings;

• acquisition or disposal of own shares; and

• total number of voting rights.

The above list is not exhaustive.

We remind issuers that while non-financial information is not subject to the requirements of the Instrument, non-financial information is subject to various disclosure requirements under applicable securities legislation, including the requirement not to disclose misleading information.

Section 1 -- Definition of primary financial statements

The Instrument uses the terms "statement of financial position", "statement of profit or loss and other comprehensive income", "statement of changes in equity", and "statement of cash flows", to describe the primary financial statements. Issuers may use titles for the statements other than those terms as long as the titles are in compliance with the financial reporting framework used in the preparation of the issuer's financial statements. For example, an issuer may use the title "statement of comprehensive income" instead of "statement of profit or loss and other comprehensive income", or "balance sheet" instead of "statement of financial position".

Section 1 -- Definition of a supplementary financial measure

An attribute of a supplementary financial measure is that it is disclosed, or is intended to be disclosed, on a periodic basis (for example quarterly and/or annually) to present, often in a prominent manner, an aspect of financial performance, financial position or cash flow. Some entities refer to such financial measures as key (financial) performance indicators ("KPIs"). For example, an entity that operates in the retail industry may consider same-store sales a KPI and discloses same-store sales (where same-store sales is a disaggregation calculated in accordance with the accounting policies used to prepare the sales line item presented in the primary financial statements) to periodically report sales performance from period to period. In this case, same-store sales meet the definition of a supplementary financial measure.

For clarity, if an issuer discloses a financial measure that is a disaggregation of a financial statement line item in order to simply explain how the financial statement line item changed from period to period, such a measure would not meet the definition of a supplementary financial measure because the issuer is not presenting an aspect of its financial performance. For example, if an issuer experienced an unexpected increase in administrative expenses, it may analyze the nature of, and reasons for, changes in administrative expenses, by among other things, disclosing disaggregated information about administrative expenses (where the disaggregation was calculated in accordance with the accounting policies used to prepare the administrative expenses line item presented in the primary financial statements).

Section 2 -- Application

The Instrument applies to all documents, including a written communication prepared and transmitted only in electronic form,

• that are required to be filed with the securities regulatory authority, or

• that are not required to be filed with the securities regulatory authority; and

• that are filed with the securities regulatory authority, or

• that are filed or required to be filed with a government or an agency of a government under applicable securities or corporate law or with an exchange or quotation and trade reporting system under its bylaws, rules or regulations, or

• that are any other communication the content of which would reasonably be expected to affect the market price or value of a security of the issuer. We expect that information presented on websites and social media would meet this criteria.

Issuers should not disclose non-GAAP financial measures, segment measures, capital management measures or supplementary financial measures on social media, if character limits would preclude the disclosure of all the required information in accordance with the Instrument (e.g., Twitter).

If an issuer uses social media to provide links to their publications, such publications are in the scope of the Instrument.

The Instrument does not apply to oral statements. However, if a written transcript of an oral statement is provided by the issuer, the issuer must provide the disclosures required by the Instrument. This could be done in an attachment or appendix to the transcript.

Certain "specific financial measures" that are required to be calculated in accordance with prescribed requirements under applicable securities legislation are not subject to the Instrument. Examples of specific financial measures that are not subject to the Instrument include:

• Earnings coverage ratios prescribed by item 9 of Form 41-101F1 Information Required in a Prospectus;

• Summary of Quarterly Results prescribed by section 1.5 of Form 51-102F1 Management's Discussion & Analysis;

• Net Present Value of Future Net Revenue prescribed by section 2.1 of Form 51-101F1 Statement of Reserves Data and Other Oil and Gas Information; and

• Net Asset Value prescribed by part 14 of National Instrument 81-106 Investment Fund Continuous Disclosure.

The above list is not exhaustive. While disclosure of a specific financial measure in accordance with other securities legislation is not subject to the requirements of the Instrument, the disclosure is subject to the provisions of that legislation.

The Instrument also does not apply to a financial measure that is disclosed in accordance with the laws of a jurisdiction of Canada. This exclusion is, however, only applicable in situations where a specific financial measure is required to be disclosed and the law specifically defines the measure and the method to be used in its calculation, for example a government payment calculated and disclosed in accordance with the Extractive Sector Transparency Measures Act (Canada).

For the purposes of paragraph 3(d), paragraph 4(3)(b) and paragraph 5(2)(c) of the Instrument, the requirements must be applied the first time a non-GAAP financial measure is disclosed in a document. Therefore, this disclosure is not required to be repeated throughout a document even though the financial measure may appear more than once in the document.

The "first time" concept is intended to be applied to each discrete document that relates to a specific period or date.

Paragraph 3(a) -- Labelling non-GAAP financial measures

Any label or term used to describe a non-GAAP financial measure or adjustments in a reconciliation must be appropriate given the nature of information.

The following are a few examples which we consider would not be in compliance with the labelling requirement in paragraph 3(a) of the Instrument:

• Labels that cause confusion with amounts prepared in accordance with the financial reporting framework used in the preparation of the issuer's financial statements. Using terms or labels which are the same as, or confusingly similar to, those normally used under the financial reporting framework is misleading. For example, a measure labelled as "cash flows from operations" calculated as cash flows from operating activities before changes in non-cash working capital items, is confusingly similar to the term "cash flows from operating activities" specified in IAS 7 Statement of Cash Flows;

• Labels which are purporting to represent "results from operating activities" or a similar title but which exclude items of an operating nature, such as inventory write-downs, restructuring costs, impairment of assets used for operations and stock-based compensation;

• Labels that are overly optimistic or positive (e.g., guaranteed profit or protected returns); and

• Labels that cause confusion based on the financial measure's composition. For example, in presenting EBITDA as a non-GAAP financial measure, it would be inappropriate to exclude amounts for items other than interest, taxes, depreciation and amortization.

The above list is not exhaustive.

The label used for a non-GAAP financial measure may arise from a written agreement, such as a credit agreement containing a material covenant regarding a non-GAAP financial measure. If the label in the written agreement is inconsistent with the requirements of paragraph 3(a) of the Instrument, the issuer will be expected to clarify that the label is from a written agreement so that a reader does not confuse it with an amount prepared in accordance with the financial reporting framework used in the preparation of the issuer's financial statements.

Paragraph 3(b) -- Prominence of a non-GAAP financial measure

Determining whether a non-GAAP financial measure is presented with no more prominence is a matter of judgment, taking into account the overall disclosure and the facts and circumstances in which the disclosure is made.

We expect that presentation of a non-GAAP financial measure would not in any way confuse or obscure the presentation of financial measures presented in accordance with the financial reporting framework used in the preparation of the issuer's financial statements.

The following are examples that we view as causing a non-GAAP financial measure to be more prominent than the most directly comparable measure presented or disclosed in the financial statements:

• Presenting a full statement of profit or loss and other comprehensive income of non-GAAP financial measures without presenting it in the form of a reconciliation of each non-GAAP financial measure to the most directly comparable measure, sometimes referred to as a single column approach;

• Omitting the most directly comparable measure from a press release headline or caption that includes a non-GAAP financial measure;

• Presenting a non-GAAP financial measure using a style of presentation (for example, bold or larger font) that emphasizes the non-GAAP financial measure over the most directly comparable measure;

• Describing a non-GAAP financial measure as, for example, "record performance" or "exceptional" without at least an equally prominent descriptive characterization of the most directly comparable measure;

• Multiple non-GAAP financial measures being used for the same purpose thereby obscuring disclosure of the most directly comparable measure;

• Providing tabular or graphical disclosure of non-GAAP financial measures without presenting an equally prominent tabular or graphical disclosure of the most directly comparable measures or without including the most directly comparable measures in the same table or graph; and

• Providing a discussion and analysis of a non-GAAP financial measure in a more prominent location than a similar discussion and analysis of the most directly comparable measure. For greater certainty, we take the view that a location is not more prominent if it allows an investor who reads the document, or other material containing the non-GAAP financial measure, to be able to view the discussion and analysis of both the non-GAAP financial measure and the most directly comparable measure contemporaneously. For example, within the previous, same or next page of the document.

The above list is not exhaustive.

The Instrument requires that the non-GAAP financial measure be disclosed with "no more prominence in the document than the most directly comparable financial measure presented in the primary financial statements". If the most directly comparable measure is disclosed with "equal or greater prominence" than the non-GAAP financial measure, the requirement under paragraph 3(b) of the Instrument has been met.

Paragraph 3(c) -- Comparative information

Paragraph 3(c) of the Instrument requires presentation of the same non-GAAP financial measure for the comparative period. For greater clarity, "same" includes the label, composition, and calculation of the non-GAAP financial measure. If there has been a change in label, composition or calculation from what has been disclosed previously, the requirements of subparagraph 3(d)(v) of the Instrument will apply.

We expect that the disclosure required by paragraph 3(c) of the Instrument would not be feasible only in rare circumstances, such as in the first period of operations where no comparative period exists.

Paragraph 3(d) -- First time disclosure requirements

The information required by paragraph 3(d) of the Instrument should be presented in the same document as the non-GAAP financial measure. To satisfy these requirements, an issuer may identify the non-GAAP financial measure as such when it first occurs in the document using a footnote that refers to a separate section within the same document. The requirements in subparagraphs 3(d)(ii), (iii), (iv) and (v) of the Instrument may then be presented in the separate section the footnote referred to.

There may be types of documents where it is not clear when the non-GAAP financial measure first occurs or appears, for example, websites and social media. In these instances, we consider that issuers meet the "first time" objective by, for example, clearly identifying the measure as being a non-GAAP financial measure and providing a link to the other required disclosure.

To prevent duplicate disclosure, an issuer may provide all the required disclosures for all non-GAAP financial measures in one section of the document, and cross-reference to that section each time a non-GAAP financial measure is presented in that same document.

Subparagraph 3(d)(i) -- Identification of a non-GAAP financial measure

Non-GAAP financial measures do not have standardized meanings under the financial reporting framework used in the preparation of the issuer's financial statements. Therefore, it is important that non-GAAP financial measures are identified as such. This also signals to an investor that additional information about the measure should be considered as it may not be comparable to similar measures presented by other issuers.

We are of the view that the subparagraph 3(d)(i) identification requirement of the Instrument would be met by footnoting the non-GAAP financial measure and at the bottom of the page, including the following or similar wording as part of the footnote, "A non-GAAP financial measure which is defined in the Non-GAAP Financial Measures section of this document".

Subparagraph 3(d)(iii) -- Usefulness of non-GAAP financial measure disclosure

The Instrument does not define the term "useful". The term "useful" is intended to reflect how management believes that presentation of the non-GAAP financial measure provides incremental information to investors regarding the issuer's financial position, financial performance or cash flows. The level of detail is a matter of judgment, which takes into account the complexity of the information and how familiar a reasonable person would be with the measure.

The statement satisfying the requirement of subparagraph 3(d)(iii) of the Instrument should:

• not be boilerplate;

• be clear and understandable;

• be specific to the non-GAAP financial measure used, the issuer, the nature of the business and the industry; and

• be specific to the way the non-GAAP financial measure is assessed and applied to decisions made by management.

Issuers should avoid inappropriate or potentially misleading implications about usefulness. The Instrument does not explicitly prohibit certain adjustments. However, if adjustments are not consistent with the usefulness explanation, this may result in a non-GAAP financial measure that is inappropriate or misleading.

A non-GAAP financial measure may be misleading if it includes positive components of the most directly comparable measure but omits negative components. For example, presenting an operating performance measure that excludes normal, recurring, operating expenses necessary to operate an issuer's business could be misleading. Another example is "free cash flow", which is typically calculated as cash flows from operating activities as presented in the statement of cash flows under the financial reporting framework used to prepare the financial statements, less capital expenditures. "Free cash flow" should not be used in a manner that inappropriately implies that the measure represents the residual cash flow available for discretionary expenditures, if issuers have mandatory debt service requirements or other non-discretionary expenditures that are not deducted from the measure.

Subparagraph 3(d)(iv) -- Reconciliation of a non-GAAP financial measure

Subparagraph 3(d)(iv) of the Instrument requires a quantitative reconciliation between the non-GAAP financial measure and the most directly comparable financial measure. An issuer may satisfy this requirement by providing a reconciliation in a clearly understandable way, such as a table. An issuer must ensure that its disclosure is not misleading and will have to consider the level of detail required to provide the necessary context.

The Instrument does not define the "most directly comparable financial measure" and therefore the issuer needs to apply judgment in determining the most directly comparable financial measure. In applying judgment, it is important for an issuer to consider the context of how the non-GAAP financial measure is used. For example, where the non-GAAP financial measure is discussed primarily as a performance measure used in determining cash generated by the issuer or its distribution-paying capacity, its most directly comparable GAAP measure will be from the statement of cash flows. In practice, earnings-based measures and cash flow-based measures are used to disclose operational performance. If it is not clear from the way the non-GAAP financial measure is used what the most directly comparable measure is, consideration should be given to the nature, number and materiality of the reconciling items.

For purposes of presenting the reconciliation, it is permissible to begin with the non-GAAP financial measure or the most directly comparable financial measure presented in the primary financial statements, provided the reconciliation is presented in a comprehensible manner.

The reconciliation should be quantitative, separately itemizing and explaining each significant reconciling item. Disclosure supporting the reconciliation should discuss significant judgments and estimates that management has made in developing the reconciling item.

Where a reconciling item is taken directly from the issuer's primary financial statements, it should be named such that investors are able to identify the item in those statements, and no further explanation of that reconciling item is required.

Where a reconciling item is not extracted directly from the issuer's primary financial statements, but is a component of a line item in the issuer's primary financial statements or originates from outside the primary financial statements, the reconciliation should:

• explain how the figure is calculated;

• include a description of the line item of the primary financial statements where the reconciling item originates, if any; and

• discuss significant judgments and estimates, if any, that management has made in developing the reconciling items used in the reconciliation.

Reconciling items should be calculated using issuer-specific inputs. An issuer may make adjustments that are accepted within an industry; however, the quantum of these adjustments should be calculated using issuer-specific information. For example, an issuer may make an adjustment for operating capital expenditures, which is a standard adjustment in certain industries, however the amount of the adjustment should be calculated based on the issuer's operating capital expenditures, and not by using only an 'industry average' amount as the sole factor.

The level of detail expected in the reconciliation depends on the nature and complexity of the reconciling items. The adjustments made from the most directly comparable financial measure should be consistent with the explanation required by subparagraph 3(d)(iii) of the Instrument regarding why the information is useful to investors and if applicable, how it is used by management. Explanations should be more detailed than merely stating what the reconciling item represents and should also cover the circumstances that give rise to the particular adjustment. For example, an adjustment for impairment of goodwill should be supported by the cause of the impairment.

An "other" or "adjusting items" category to describe numerous insignificant reconciling items should not be used without further explanation as to the nature of items which comprise the category.

Issuers should consider significant reconciling items on an absolute basis. For example, an issuer is expected to separately itemize positive and negative adjustments unless netting is permitted under the financial reporting framework used in the preparation of the issuer's financial statements.

An issuer should disclose any income tax effects of its non-GAAP financial measure depending on the nature of that measures. However, adjustments to arrive at the non-GAAP financial measure should not be presented "net of tax" but should be shown as a separate adjustment and clearly explained.

Where comparative non-GAAP financial measures are presented for a previous period, a reconciliation to the corresponding most directly comparable measure should be provided for that previous period.

An issuer may present adjusted financial information outside the issuer's financial statements using a format that is similar to one or more of the primary financial statements, but that is not in accordance with the issuer's accounting policies under the financial reporting framework used in the preparation of the issuer's most recently completed financial statements. In this case, the adjusted financial information would contain non-GAAP financial measures. Specifically, this would arise if an issuer presents non-GAAP financial measures in a form that is similar to:

• a statement of financial position;

• a statement of profit or loss and other comprehensive income;

• a statement of changes in equity; or

• a statement of cash flows.

Presentation of this information as a single column that excludes the most directly comparable GAAP financial measures in a separate column would be considered misleading. However, this information may be presented in the form of a reconciliation of the non-GAAP financial measure to the most directly comparable financial measure if such presentation shows in separate columns each of the most directly comparable measures, the reconciling items, and the non-GAAP financial measures.

When the adjusted presentation is used as a basis for the qualitative discussions and analysis of an issuer's financial performance, financial position or cash flows with greater prominence than financial measures presented in the primary financial statements, this would be considered not in compliance with the requirement in paragraph 3(b) of the Instrument.

Subparagraph 3(d)(v) -- Changes in a non-GAAP financial measure

If the comparative non-GAAP measure presented in accordance with paragraph 3(c) of the Instrument is not the same as that previously presented, the requirement of subparagraph 3(d)(v) of the Instrument would apply. This would be the case when the label, composition, or calculation of the comparative non-GAAP financial measure is not the same as previously presented.

Including additional reconciling items or excluding previously included reconciling items between the non-GAAP financial measure and the most directly comparable measure constitutes a change in composition or calculation. A clear explanation of the reason for this change is required under subparagraph 3(d)(v) of the Instrument.

A change in magnitude of an individual item would not constitute a change in composition or calculation. For example, an issuer may define adjusted earnings as earnings before impairment losses and transaction costs. Transaction costs may only be incurred every three years, such that there may be no adjustment in year two to reflect transaction costs, but there should be an explanation noting that the issuer expects that it will incur transaction costs in the future. In this example, the issuer should continue to include transaction costs in either the explanation about the usefulness (in periods where no transaction costs have been incurred) or in presenting the reconciliation, to maintain consistency of the non-GAAP financial measure.

Given that the disclosure of non-GAAP financial measures is optional, disclosing a particular non-GAAP financial measure does not generate a requirement to continue disclosing that measure in future periods. If, however, an issuer replaces a non-GAAP financial measure with another measure that achieves the same objectives (that is, the information provided to comply with subparagraph 3(d)(iii) of the Instrument was consistent for both measures), the requirement of subparagraph 3(d)(v) of the Instrument would apply.

Section 4 -- Disclosure of non-GAAP financial measures that are ratios

Financial ratios may be useful in communicating aspects of an issuer's financial performance, financial position or cash flow. Ratios fall under the definition of a non-GAAP financial measure, unless they are disclosed or presented in accordance with the financial reporting framework used in the preparation of the issuer's financial statements. Specifically, earnings per share disclosed in the statement of profit or loss and other comprehensive income is not a non-GAAP financial measure. However, a working capital ratio or sales per square foot are examples of ratios that would meet the definition of a non-GAAP financial measure. For clarity, ratios include those measures expressed as percentages.

The prominence requirement in paragraph 4(1)(b) of the Instrument for ratios differs from that of other non-GAAP financial measures, however the principle that the presentation of ratios should not confuse or obscure the presentation of the most directly comparable financial measure remains the same. For example, we consider that an issuer does not meet the prominence requirement in paragraph 4(1)(b) of the Instrument if the issuer focused its disclosure on an increased gross margin percentage without giving at least equally prominent disclosure to the fact sales have significantly decreased over the same period of time which has resulted in a reduction in total profit period over period.

Many ratios do not have a directly comparable financial measure. As such, issuers should consider the disclosure of the ratio in relation to the overall disclosure of similar performance measures that have been presented in the primary financial statements. For example an issuer may calculate a debt to equity ratio (where the debt component is the total liabilities line item as presented in the statement of financial position and the equity component is the total equity line item as presented in the statement of financial position) and use this in its discussion of liquidity, however this discussion should form part of an overall discussion that should include relevant measures from the issuers primary financial statements.

A ratio may be calculated using one or more of the following:

(a) measures that are presented or disclosed in the issuer's financial statements;

(b) non-GAAP financial measures; and

(c) non-financial information.

It is important for investors to understand the calculation of the ratio. For example, if an issuer has disclosed gross margin percentage calculated using total sales minus cost of goods sold, divided by total sales, this method of calculation should be described.

In addition to describing how the ratio is calculated, paragraph 4(3)(b) of the Instrument requires that a reconciliation be completed in one of two ways. If the ratio is calculated using one or more non-GAAP financial measures, an issuer could meet this reconciliation requirement by identifying each of the non-GAAP financial measures and applying subparagraph 4(3)(b)(i) of the Instrument to those identified components. Alternatively, an issuer could reconcile the entire ratio to a ratio calculated using the most directly comparable measures presented in the primary financial statements.

Some issuers may disclose sales per square foot, where the sales figure is extracted directly from the primary financial statements. The sales figure may directly agree to a line item included in the issuer's statement of profit or loss and other comprehensive income, or it may be a disaggregated sales figure calculated in accordance with the issuer's accounting policies under the financial reporting framework used in the preparation of the issuer's financial statements.

The disaggregated sales figure may reflect same-store sales, calculated in accordance with the accounting policies used to prepare the sales line item presented in the primary statements. However, if the sales figure in "same-store sales" is computed on a constant foreign exchange basis rather than under the requirements in IFRS under IAS 21 The Effects of Changes in Foreign Exchange Rates, the adjusted sales figure would meet the definition of a non-GAAP financial measure and the reconciliation requirement in subparagraph 4(3)(b)(ii) of the Instrument for the ratio could be met by identifying the adjusted sales figure as a non-GAAP financial measure and applying subparagraph 4(3)(b)(i) of the Instrument to the adjusted sales figure. Alternatively, the reconciliation requirement in subparagraph 4(3)(b)(ii) of the Instrument could be met by reconciling the adjusted sales per square foot to sales per square foot, where sales comes directly from the issuer's statement of profit or loss and other comprehensive income.

If each of the components of the ratio is a line item presented in the primary financial statements, an issuer can meet the requirement in subparagraph 3(d)(iv) of the Instrument by disclosing how the ratio is calculated, for example, when gross margin percentage is calculated and disclosed as being total sales minus cost of goods sold, divided by total sales, where each of sales and cost of sales is a line item in the statement of profit and loss and other comprehensive income.

Subsection 5(1) -- Disclosure of non-GAAP financial measure that is a financial outlook and FOFI has been disclosed with the financial outlook

Subsection 5(1) of the Instrument requires that an issuer provide a quantitative reconciliation to the most directly comparable measure presented in the FOFI if the non-GAAP financial measure is a financial outlook and where FOFI has been disclosed with the financial outlook. This quantitative reconciliation must be prepared following the requirements in subparagraph 3(d)(iv) of the Instrument.

In determining whether FOFI has been disclosed with the financial outlook, as outlined in paragraph 5(1)(b) of the Instrument, there may be situations where an issuer presents or prepares FOFI concurrently or as an add-on to the financial outlook. If an extract or summary of FOFI is disseminated or disclosed, an issuer should consider whether this extract or summary was derived from the complete FOFI and whether the condition in paragraph 5(1)(b) of the Instrument has been met such that the reconciliation requirement in subsection 5(1) of the Instrument should apply.

Issuers are reminded that each material line item presented within the FOFI or the quantitative reconciliation under subsection 5(1) of the Instrument is subject to the disclosure requirements in parts 4A and 4B and section 5.8 of NI 51-102 Continuous Disclosure Obligations.

Subsection 5(2) -- Disclosure of non-GAAP financial measure that is a financial outlook for which FOFI has not been disclosed with the financial outlook

Subparagraph 5(2)(c)(i) of the Instrument requires an issuer to present the equivalent historical non-GAAP financial measure the first time that the non-GAAP financial measure that is financial outlook is disclosed. The requirements in section 3 of the Instrument, including the quantitative reconciliation requirements in subparagraph 3(d)(iv) of the Instrument, are applicable to the equivalent historical non-GAAP financial measure.

Determining the relevant historical period to satisfy the quantitative reconciliation requirements in subparagraph 3(d)(iv) of the Instrument is a matter of judgment, taking into account the time period covered by the financial outlook, the nature of the issuer's industry and the extent to which the business of the issuer is cyclical or seasonal. For example, where an issuer presents a financial outlook for the 3 months ending March 31, 20X2, the relevant period for the quantitative reconciliation of the equivalent historical non-GAAP financial measure may be:

• in the case where the business of the issuer is not seasonal, the issuer's most recent interim period ended for which annual financial statements or an interim financial report has been filed (e.g., the 3 months ended December 31, 20X1), or

• in the case where the business of the issuer is seasonal, the comparable historical interim period to that of the financial outlook presented (e.g., the 3 months ended March 31, 20X1).

The reconciliation requirements for a financial outlook non-GAAP financial measure where FOFI has not been disclosed with the financial outlook, are set out in clauses 5(2)(c)(ii)(A) and (B) of the Instrument.

The reconciliation requirement in clause 5(2)(c)(ii)(A) of the Instrument requires that an issuer provide a description detailing the differences between the financial outlook non-GAAP financial measure and the appropriate financial outlook for which an equivalent historical measure is presented in the primary financial statements. An issuer may satisfy this requirement by providing a reconciliation by schedule or other clearly understandable method. To the extent possible, this reconciliation should be quantitative; however, regardless of the format of the presentation, an issuer must ensure that its disclosure is not misleading and will have to consider the level of detail required to provide the necessary context. The disclosure should include the significant judgments and estimates that management has made in developing the reconciling items.

Where a reconciliation for a non-GAAP financial measure that is financial outlook is presented in the format outlined in clause 5(2)(c)(ii)(B) of the Instrument, the reconciliation information provided will be primarily driven by the process followed by the issuer with respect to the preparation, derivation or calculation of the financial outlook, and may include:

(a) a description of each of the significant components of the financial outlook, or

(b) a description of what was used in the calculation of the financial outlook.

For paragraph (a), the description is expected to include the identification and disclosure of each of the significant components of the financial outlook non-GAAP financial measure. For example, if a gross margin financial outlook has been derived by estimating each of its components, revenue and cost of sales, then the description required under clause 5(2)(c)(ii)(B) of the Instrument should include the quantification of each of the revenue and cost of sales components used in the calculation of the gross margin financial outlook.

For paragraph (b), the description is expected to include the process followed in preparing and reviewing the financial outlook. The description should not be boilerplate and should also disclose the material factors or assumptions relevant to the financial outlook.

Non-GAAP financial measures that are financial outlook ratios are subject to both section 4 and section 5 of the Instrument and issuers may choose to apply the reconciliation requirements in either subsection 4(3) or section 5 of the Instrument.

Section 6 -- Disclosure of segment measures

A financial reporting framework used in the preparation of the issuer's financial statements may permit disclosure of a broad category of segment measures, but does not always specify how such measures should be calculated.

Disclosure in the notes to the financial statements of financial measures reported to the chief operating decision maker about an issuer's reportable segments may be determined on a basis that differs from the amounts presented and calculated in the issuer's primary financial statements. When disclosed outside the financial statements, to the extent a total of segment measures is not also disclosed as a line item in the primary financial statements, the accompanying disclosures required by section 6 of the Instrument allow a reader to understand how the measure is calculated and how it relates to the primary financial statements. This would apply in situations where an issuer presents an overall total, or a total for some, but not all, of the segments.

For example, a chief operating decision-maker may review segment-adjusted EBITDA for each of its reportable segments. In preparing financial statements in accordance with the selected financial reporting framework, an issuer is required to reconcile the total of the reportable segment amounts to the corresponding measure for the issuer in total, in this case "entity adjusted EBITDA". Since the "entity adjusted EBITDA" amount is not disclosed in the primary financial statements, an issuer is required to comply with section 6 of the Instrument.

If an issuer discloses financial information about a segment outside the financial statements that is not disclosed in the issuer's financial statements and that is not a disaggregation of a line item presented in accordance with the selected financial reporting framework, then that segment information meets the definition of a non-GAAP financial measure and is subject to the requirements in section 3 of the Instrument.

Section 7 -- Disclosure of capital management measures

Disclosure of information that enables users of the financial statements to evaluate an issuer's objectives, policies and processes for managing capital may be required by the financial reporting framework used in the preparation of the issuer's financial statements.

How an issuer manages its capital is issuer-specific and the financial reporting framework used to prepare the issuer's financial statements might not prescribe a specific calculation. The accompanying disclosure required by section 7 of the Instrument allows a reader to understand how an issuer calculates these measures and how they relate to measures presented in the primary financial statements.

Subparagraph 7(2)(b)(i) of the Instrument requires disclosure of how the capital management measure is calculated. For example, if the capital management measure was calculated in accordance with an agreement, a description of the agreement (e.g. the measure was calculated in accordance with lending agreements) together with details of the calculations would satisfy the requirement.

In situations where the capital management measure is an aggregation of individual line items presented on the primary financial statements, the requirements of subparagraph 7(2)(b)(iv) of the Instrument can be met by detailing how the measure has been calculated, as required by subparagraph 7(2)(b)(i) of the Instrument.

If the capital management measure was calculated using one or more non-GAAP financial measures, the issuer must comply with section 3 of the Instrument, in respect of each non-GAAP financial measure used.

Annex C

General Overview of the Application Process for the Proposed Instrument

Annex D

Consequential Amendments

PROPOSED AMENDMENTS TO MULTILATERAL INSTRUMENT 45-108 CROWDFUNDING

- - - - - - - - - - - - - - - - - - - -

The securities regulatory authorities in British Columbia, Prince Edward Island, Newfoundland and Labrador, Northwest Territories, Yukon Territory and Nunavut are not proposing these consequential amendments because Multilateral Instrument 45-108 Crowdfunding does not apply in these jurisdictions.

- - - - - - - - - - - - - - - - - - - -

1. Multilateral Instrument 45-108 Crowdfunding is amended by this Instrument.

2. Form 45-108F1 is amended by replacing the heading "Non-GAAP financial measures" in the Instructions related to financial statement requirements and the disclosure of other financial information of Schedule A with the following:

Non-GAAP financial measures and other financial measures

3. Form 45-108F1 is amended by replacing the paragraph after the heading "Non-GAAP financial measures" in the Instructions related to financial statement requirements and the disclosure of other financial information of Schedule A with the following:

An issuer that intends to disclose financial measures that are subject to National Instrument 52-112 Non-GAAP and Other Financial Measures Disclosure in its crowdfunding offering document should refer to the requirements set out in that Instrument.

4. This Instrument comes into force on •.

Annex E

Consequential Changes

PROPOSED CHANGE TO COMPANION POLICY 45-108CP CROWDFUNDING

- - - - - - - - - - - - - - - - - - - -

The securities regulatory authorities in British Columbia, Prince Edward Island, Newfoundland and Labrador, Northwest Territories, Yukon Territory and Nunavut are not proposing these consequential changes to Companion Policy 45-108CP Crowdfunding because Multilateral Instrument 45-108 Crowdfunding does not apply in these jurisdictions.

- - - - - - - - - - - - - - - - - - - -