Amendment to Companion Policy 81-101 (Related to Implementation of Stage 1 of Point of Sale Disclosure for Mutual Funds effective January 1, 2011)

Amendment to Companion Policy 81-101 (Related to Implementation of Stage 1 of Point of Sale Disclosure for Mutual Funds effective January 1, 2011)

AMENDMENTS TO

COMPANION POLICY 81-101CP TO

NATIONAL INSTRUMENT 81-101

MUTUAL FUND PROSPECTUS DISCLOSURE

1. Companion Policy 81-101CP To National Instrument 81-101 Mutual Fund Prospectus Disclosure is amended by this Instrument.

2. Section 1.1 is amended by:

a. replacing the first instance of "Canadian securities regulatory authorities" with "Canadian Securities Administrators (CSA or we)";

b. replacing the second instance of "Canadian securities regulatory authorities" with "CSA".

3. Section 2.1 is replaced with the following:

2.1 Purpose of the Instrument

(1) The purpose of the Instrument is to ensure that the offering disclosure regime for mutual funds provides investors with disclosure documents that clearly and concisely state information that investors should consider in connection with an investment decision about the mutual fund, while recognizing that different investors have differing needs in receiving disclosure.

(2) The disclosure regime for mutual funds is built on two main principles:

• providing investors with key information about a mutual fund; and

• providing the information in a simple, accessible and comparable format.

(3) We use the following approaches in the Instrument to achieve the principles referred to in subsection (2):

1. The Instrument has been designed so that fund companies prepare offering disclosure documents that investors would find helpful in making investment decisions.

2. The Instrument contemplates the use of three disclosure documents by a mutual fund:

• a simplified prospectus;

• an annual information form; and

• a summary document called the 'fund facts', which contains key information about a mutual fund.

Together with the financial statements, the management reports of fund performance and other documents incorporated by reference, these documents contain full, true and plain disclosure about the mutual fund.

3. Subsection 4.1(1) of the Instrument requires that the simplified prospectus, annual information form and fund facts document be prepared using plain language and in a format that assists in readability and comprehension. The Instrument and related forms provide detailed requirements on the content and format of these documents.

(4) Mutual funds, managers and participants in the mutual fund industry should prepare disclosure documents and carry out delivery in a manner that is consistent with the spirit and intent of the Instrument..

4. The following is added after section 2.1:

2.1.1 Fund Facts Document

(1) The Instrument requires that the fund facts document be in plain language, be no longer than 4 pages in length, and highlight key information important to investors, including performance, risk and cost. The fund facts document is incorporated by reference into the simplified prospectus.

(2) The Instrument and Form 81-101F3 set out detailed requirements on the content and format of a fund facts document, while allowing some flexibility to accommodate different kinds of mutual funds. The requirements are designed to ensure that the information in a fund facts document of a mutual fund is clear, concise, understandable and easily comparable with information in the fund facts document of other mutual funds.

(3) To help write the fund facts document in plain language, mutual fund companies can use the Flesch-Kincaid methodology to assess the readability of a fund facts document. The Flesch-Kincaid grade level scale is a methodology that rates the readability of a text to a corresponding grade level and can be determined by the use of Flesch-Kincaid tests built into commonly used word processing programs. The CSA will generally consider a grade level of 6.0 or less on the Flesch-Kincaid grade level scale to indicate that a fund facts document is written in plain language. For French-language documents, mutual fund companies may wish to consider using other appropriate readability tools.

(4) Although the Instrument does not require delivery of the fund facts document, the CSA encourages the use and distribution of the fund facts document as a key part of the sales process in helping to inform investors about mutual funds they are considering for investment..

5. Section 2.2 is replaced with the following:

2.2 Simplified Prospectus

(1) The Instrument contemplates that all investors in a mutual fund will receive a simplified prospectus, which is designed to provide an investor with the necessary information to make an informed investment decision. The Instrument requires the delivery only of a simplified prospectus to an investor in connection with a purchase, unless the investor also requests delivery of the annual information form or any of the other documents incorporated by reference into the simplified prospectus, including the fund facts document.

(2) The Instrument and Form 81-101F1 set out detailed requirements on the content and format of a simplified prospectus. The requirements enable the information about a mutual fund to be clear, concise, understandable, well-organized and to easily compare one mutual fund with another..

6. Section 2.3 is replaced with the following:

2.3 Annual Information Form

(1) The Instrument requires that a supplemental disclosure document, the annual information form, be provided to any person on request. The annual information form is incorporated by reference into the simplified prospectus.

(2) Information contained in the related simplified prospectus will generally not be repeated in an annual information form except as necessary to make the annual information form comprehensible as an independent document. In general, an annual information form is intended to provide disclosure about different matters than those discussed in the fund facts document and simplified prospectus, such as information concerning the internal operations of the manager of the mutual fund, which may be of assistance or interest to some investors.

(3) The Instrument and Form 81-101F2 allow for more flexibility in the preparation of an annual information form than is the case with a simplified prospectus and fund facts document. The requirements for the order of disclosing information are less stringent for an annual information form than for a fund facts document or a simplified prospectus. An annual information form may include information not specifically required by Form 81-101F2..

7. Section 2.4 is replaced with the following:

2.4 Financial Statements and Management Reports of Fund Performance -- The Instrument requires that the mutual fund's most recently audited financial statements, any interim statements filed after those audited statements, the mutual fund's most recently filed annual management report of fund performance and any interim management report of fund performance filed after that annual management report be provided upon request to any person or company requesting them. Like the fund facts document and the annual information form, these financial statements and management reports of fund performance are incorporated by reference into the simplified prospectus. The result is that future filings of these documents will be incorporated by reference into the simplified prospectus, while superseding the financial statements and management reports of fund performance previously filed..

8. Section 2.5 is replaced with the following:

2.5 Filing and Delivery of Documents

(1) Section 2.3 of the Instrument distinguishes between documents that are required by securities legislation to be "filed" with the securities regulatory authority or regulator and those that must be "delivered" or "sent" to the securities regulatory authority or regulator. Documents that are "filed" are on the public record. Documents that are "delivered" or "sent" are not necessarily on the public record. All documents required to be filed under the Instrument must be filed in accordance with National Instrument 13-101 System for Electronic Document Analysis and Retrieval (SEDAR).

(2) Section 1.1 of the Instrument defines "business day" as any day other than a Saturday, Sunday or a statutory holiday. In some cases, a statutory holiday may only be a statutory holiday in one jurisdiction. The definition of business day should be applied in each local jurisdiction in which a prospectus is being filed. For example, section 5.1.2 of the Instrument states that the date of the certificate in a simplified prospectus must be within 3 business days before the filing of the simplified prospectus. The certificates in the simplified prospectus are dated Day 1. Day 2 is a statutory holiday in Québec but not in Alberta. If the simplified prospectus is filed in both Alberta and Québec, it must be filed no later than Day 4 in order to comply with the requirement in section 5.1.2 of the Instrument, despite the fact that Day 2 was not a business day in Québec. If the simplified prospectus is filed only in Québec, it could be filed on Day 5..

9. Subsection 2.6(2) is replaced with the following:

(2) Subsection 2.3(6) of the Instrument permits certain material contracts to be filed with certain commercial or financial information deleted in order to keep this information confidential. For example, specific fees and expenses and non-competition clauses could be kept confidential under this provision. In these cases, the benefits of disclosing the information to the public are outweighed by the potentially adverse consequences to mutual fund managers and portfolio advisers. However, the basic terms of these agreements must be included in the contracts that are filed, such as provisions relating to the term and termination of the agreements and the rights and responsibilities of the parties to the agreements..

10. Section 2.7 is replaced with the following:

2.7 Amendments

(1) Paragraph 2.1(1)(d) of the Instrument requires an amendment to an annual information form to be filed whenever an amendment to a simplified prospectus is filed. Similarly, subsection 2.3(5.1) of the Instrument requires an amendment to an annual information form to be filed whenever an amendment to a fund facts document is filed. If the substance of the amendment to the fund facts document or to the simplified prospectus would not require a change to the text of the annual information form, the amendment to the annual information form would consist only of the certificate page referring to the mutual fund to which the amendment to the fund facts document or the simplified prospectus pertains.

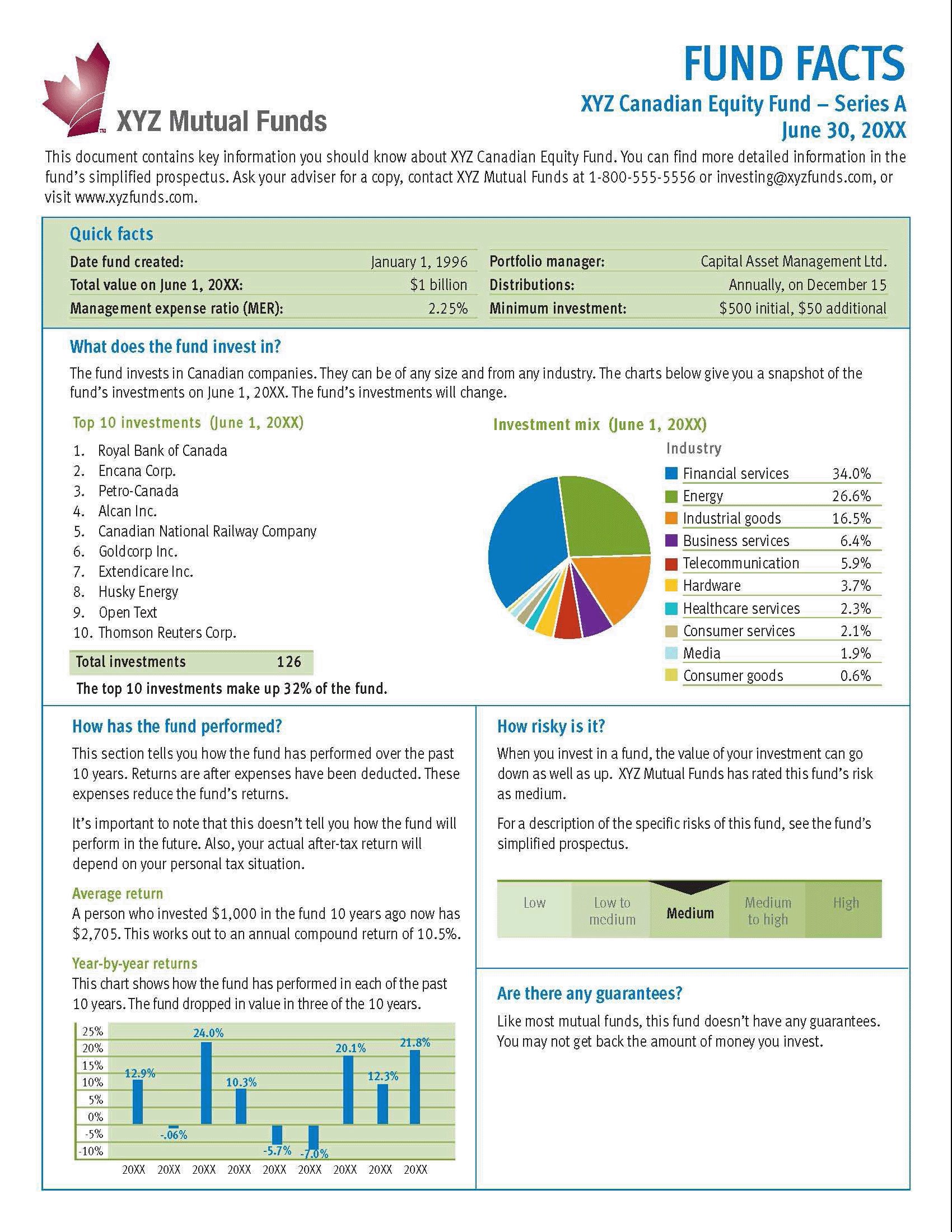

(2) Paragraph 2.1(1)(e) of the Instrument requires a mutual fund to file an amendment to a fund facts document when a material change to the mutual fund occurs that requires a change to the disclosure in the fund facts document. This mirrors the requirement in paragraph 11.2(1)(d) of National Instrument 81-106 Investment Fund Continuous Disclosure. We would not generally consider changes to the top 10 investments, investment mix or year-by-year returns of the mutual fund to be material changes. We would generally consider changes to the mutual fund's investment objective or risk level to be material changes under securities legislation.

(3) A commercial copy of an amended and restated simplified prospectus and annual information form can be created by reprinting the entire document or by putting stickers on an existing document that provide the new text created by the amendment. If stickers are used, one sticker will be required for the substance of the amendments and a separate sticker will be required for the cover page of the document that describes the type and date of the document, as applicable.

(4) Subsection 2.2(4) of the Instrument requires that any amendment to a fund facts document can only take the form of an amended and restated fund facts document. Accordingly, the commercial copy of an amended and restated fund facts document can only be created by reprinting the entire document.

(5) The requirements in section 2.2 of the Instrument apply to an amendment to a full simplified prospectus and to an amendment only to a Part A or Part B section of a simplified prospectus in cases where the Part A and Part B sections are bound separately. Section 2.2 of the Instrument requires amendments to various parts of a multiple SP to be evidenced as follows:

1. Multiple SP with Part A and the Part B sections bound together. An amendment to either or both of the Part A or Part B sections could be in the form of a free standing amending instrument that would be delivered to investors with the rest of the multiple SP. The amending instrument would be identified, in accordance with subsection 2.2(3) of the Instrument, as "Amendment No. [insert number], dated [date of amendment] to the simplified prospectus document for the [name of funds] dated [date of original document]". Or, the amendment could be in the form of a restated and amended multiple SP document, identified as such in accordance with subsection 2.2(3).

2. Multiple SP with Part A and the Part B sections bound separately. If there is an amendment to the Part A section of the document but not to a Part B section, the amendment could be in the form of an amending document or an amended and restated Part A document. An amending document could be identified as "Amendment No. [insert number], dated [date of amendment], to the Part A section of the simplified prospectuses of the [name of funds] dated [original date of multiple SP]", and the amended and restated Part A document could be identified as "Amended and Restated Simplified Prospectuses dated [date of amendment] of the [name of funds], amending and restating the Simplified Prospectuses dated [original date of document].".

3. In the circumstances described in paragraph 2 above, no amendment is required to be made to the Part B sections of the multiple SP. The footer that is required by Item 1 of Part B of Form 81-101F1 to be on the bottom of each page of a Part B section will continue to show the date of the original Part A document. For this reason, the amended Part A document must be identified in a way that shows the date of the amendments and the original date of the document so that investors know that it relates to the corresponding Part B sections.

4. If there is an amendment to a Part B section of a multiple SP with Part A and Part B sections bound separately the amendment must be made by way of an amended and restated Part B document, whether or not an amendment is being made to the Part A section. If no amendment to the Part A section is being made, no amendment is required to the Part A document. The amended and restated Part B document will include a statement in the footer required by Item 1 of Part B of Form 81-101F1 that identifies the document as a document that amends and restates the original Part B document.

(6) Subsection 2.2(4) of the Instrument requires an amendment to a fund facts document to be in the form of an amended and restated fund facts document. An amended fund facts document does not have to be otherwise identified, except for the date of the amendment.

(7) An amendment to a prospectus of a mutual fund, even if it amends and restates the prospectus, does not change the date under Canadian securities legislation by which the mutual fund must renew the prospectus. That date, which is commonly referred to as the "lapse date" for the prospectus, remains that date established under securities legislation. An amendment to a fund facts document will also not change the lapse date for a prospectus.

(8) Securities legislation says that a person or company must not distribute securities, unless a preliminary prospectus and a prospectus have been filed and receipts have been issued by the securities regulatory authority or regulator. This requirement also applies to mutual funds. If a mutual fund adds a new class or series of securities to a simplified prospectus that is referable to a new separate portfolio of assets, a preliminary simplified prospectus must be filed, together with a preliminary annual information form and preliminary fund facts document. However, if the new class or series of securities is referable to an existing portfolio of assets, the new class or series may be added by an amendment to the simplified prospectus. In this case, a preliminary fund facts document for the new class or series must still be filed, as set out in subparagraph 2.1(1)(d)(iii) of the Instrument..

11. The following is added after section 2.7:

2.8 Websites -- Section 2.3.1 of the Instrument requires a mutual fund to post its fund facts document to the website of the mutual fund, the mutual fund's family or the manager of the mutual fund, as applicable. A fund facts document should remain on the website at least until the next fund facts document for the mutual fund is posted. A fund facts document must be displayed in an easily visible and accessible location on the website. It should also be presented in a format that is convenient for both reading online and printing on paper..

12. Section 3.1 is replaced with the following:

3.1 Plain Language -- Subsection 4.1(1) of the Instrument requires that a simplified prospectus, annual information form and fund facts document be written in plain language. The reason for using "plain language" is to communicate in a way that the audience could immediately understand what you tell them. The plain language approach focuses on the needs and abilities of the audience to ensure that the content of a communication is relevant, the organization of the information is logical, the language is appropriate and the presentation is visually appealing.

Mutual funds should consider the following plain language techniques in preparing their documents:

• Organize the document into clear, concise sections, paragraphs and sentences.

• Use:

- common everyday words

- technical, legal and business terms only when unavoidable and provide clear and concise explanations for them

- the active voice

- short sentences and paragraphs

- a conversational and personal tone

- examples and illustrations to explain abstract concepts.

• Avoid:

- superfluous words

- unnecessary technical, legal and business jargon

- vague boilerplate wording

- glossaries and defined terms unless they aid in understanding the disclosure

- abstractions by using more concrete terms or examples

- excessive detail

- multiple negatives..

13. Section 3.2 is replaced with the following:

3.2 Presentation

(1) Subsection 4.1(1) of the Instrument requires that a simplified prospectus, annual information form and fund facts document be presented in a format that assists in readability and comprehension. The Instrument and related forms also set out certain aspects of a simplified prospectus, annual information form and fund facts document that must be presented in a required format, requiring some information to be presented in the form of tables, charts or diagrams. Within these requirements, mutual funds have flexibility in the format used for simplified prospectuses, annual information forms and fund facts documents.

The formatting of documents can contribute substantially to the ease with which the document can be read and understood. Mutual funds should consider using the following formatting ideas when preparing their documents:

• reasonably-sized, easy-to-read typefaces

• headings that are clearly differentiated from the body text

• bulleted or numbered lists

• margins, boxes or shading to highlight information or for supplementary information

• tables, graphs and diagrams for complex information

• "question and answer" format to organize information

• sufficient white space on each page

• images, colour, lines and other graphical elements

• avoiding the use of upper-case, bold, italic or underlining in blocks of text

• avoiding full-justified margins.

(2) We think documents would be easier to read and understand with the use of the design features set out in subsection (1). The use of logos and pictures that accurately depict aspects of the mutual fund industry, the mutual fund or mutual fund family or products and services offered by the mutual fund family may also aid in comprehension and readability. However we think that an excessive use or crowding of design features might make the documents more difficult to read or understand.

(3) On occasion, we have seen amendments to simplified prospectuses prepared in highly legal and technical styles. For example, some amendments merely reference specific lines or sections of a simplified prospectus that are being amended, without providing the reader with a restated section or an explanation for the changes. In addition, some amendments have been presented in the form of photocopies of some other documents, such as meeting materials, with the word "amendment" written on the top of the photocopy. We think that these approaches are inappropriate ways of amending a simplified prospectus or annual information form under the Instrument.

Material changes to mutual funds must be described in a format that assists in readability and comprehension, as required by subsection 4.1(1) of the Instrument. Amendments should be expressed clearly, and in a manner that enables the reader to easily read and understand both the amendment and the revised sections of the relevant document. This manner of expression may require the preparation of either an amended and restated simplified prospectus or annual information form or a clearly worded amendment insert for the existing simplified prospectus or annual information form. Any amendment to a fund facts document must be in the form of an amended and restated fund facts document..

14. Section 4.1 is amended

a. by replacing subsection (1) with the following:

(1) A consolidated "simplified prospectus" pertaining to a number of mutual funds is in law a number of separate simplified prospectuses, one simplified prospectus for each mutual fund. Further, a receipt issued by the securities regulatory authority or regulator in connection with a consolidated "simplified prospectus" in law represents a separate receipt for the simplified prospectus pertaining to each mutual fund. The Instrument and Form 81-101F1 make clear that a simplified prospectus under the Instrument pertains to one mutual fund and use the term "multiple SP" to refer to a document that contains more than one simplified prospectus.;

b. in subsection (3) by

i. replacing "shall" with "must";

ii. replacing "In the view of the Canadian securities regulatory authorities," with "We think";

iii. replacing "between" with "among"; and

iv. replacing "the SP form" with "Form 81-101F1";

c. in subsection (4) by

i. inserting "mutual" before "fund-specific"; and

ii. inserting "mutual" before "funds in which the investor is interested";

d. by replacing subsection (5) with the following:

(5) The Instrument contains no restrictions on how many simplified prospectuses can be consolidated into a multiple SP.;

e. by deleting subsection (6).

15. Section 4.2 is amended

a. in subsection (1) by replacing "It is noted that, as with NP 36, mutual" with "Mutual";

b. by replacing subsection (2) with the following:

(2) A new mutual fund may be added to a multiple SP that contains final simplified prospectuses. In this case, an amended multiple SP and multiple AIF containing disclosure of the new mutual fund, as well as a new fund facts document for each class or series of the new mutual fund would be filed. The preliminary filing would constitute the filing of a preliminary simplified prospectus, annual information form and fund facts document for the new mutual fund, and a draft amended and restated simplified prospectus and annual information form for each existing mutual fund. The final filing of documents would include a simplified prospectus, annual information form and fund facts document for the new mutual fund, and an amended and restated simplified prospectus and annual information form for each previously existing mutual fund. An amendment to an existing fund facts document would generally not be necessary.; and

c. in subsection (3) by replacing "As noted under subsection 2.7(4) of this Policy, an" with "An".

16. The following part is added after Part 4:

PART 4.1 THE FUND FACTS DOCUMENT

4.1.1 General Purposes -- The general purposes of the offering disclosure regime for mutual funds and of the fund facts document are described in section 2.1 of this Policy. This Part provides guidance to preparers of the fund facts document in meeting those purposes.

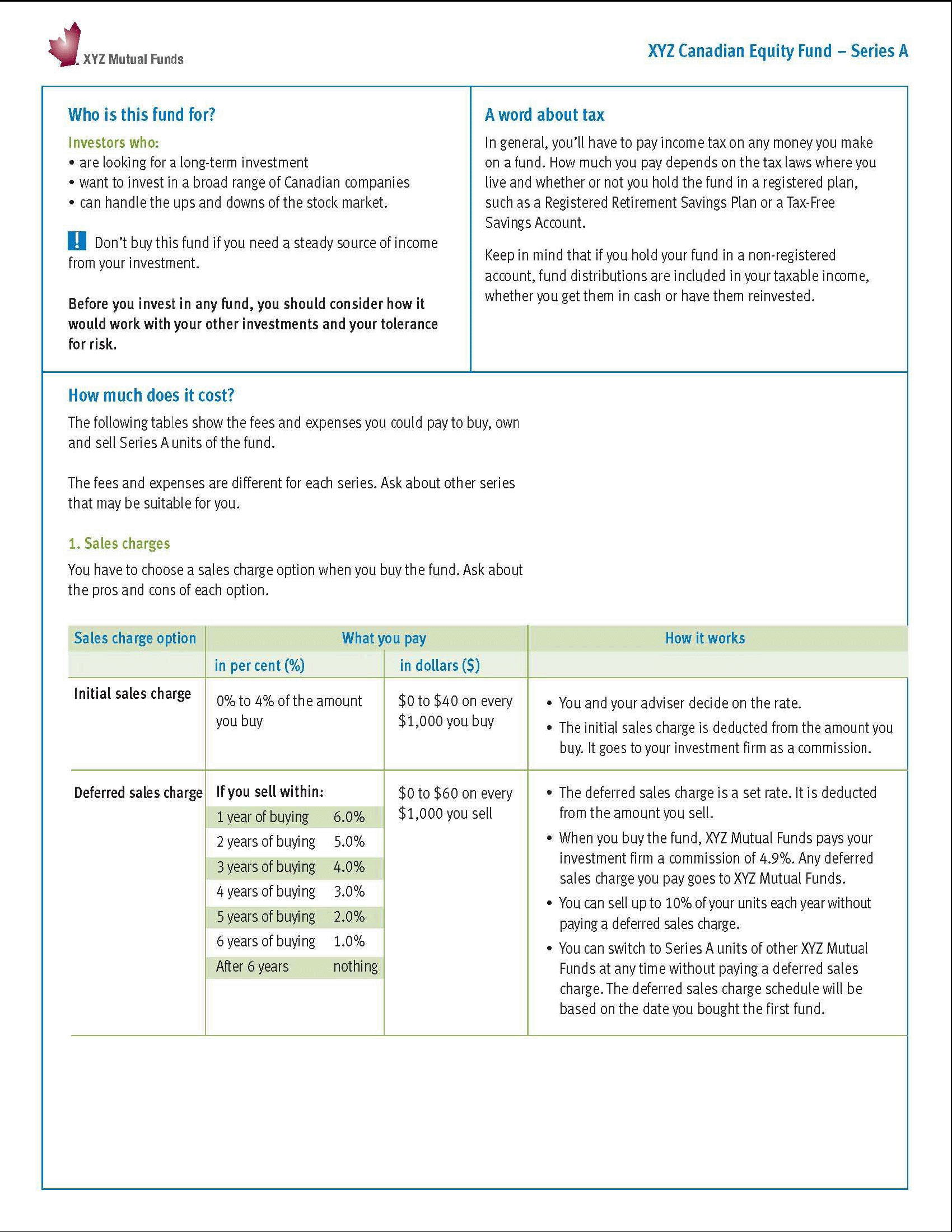

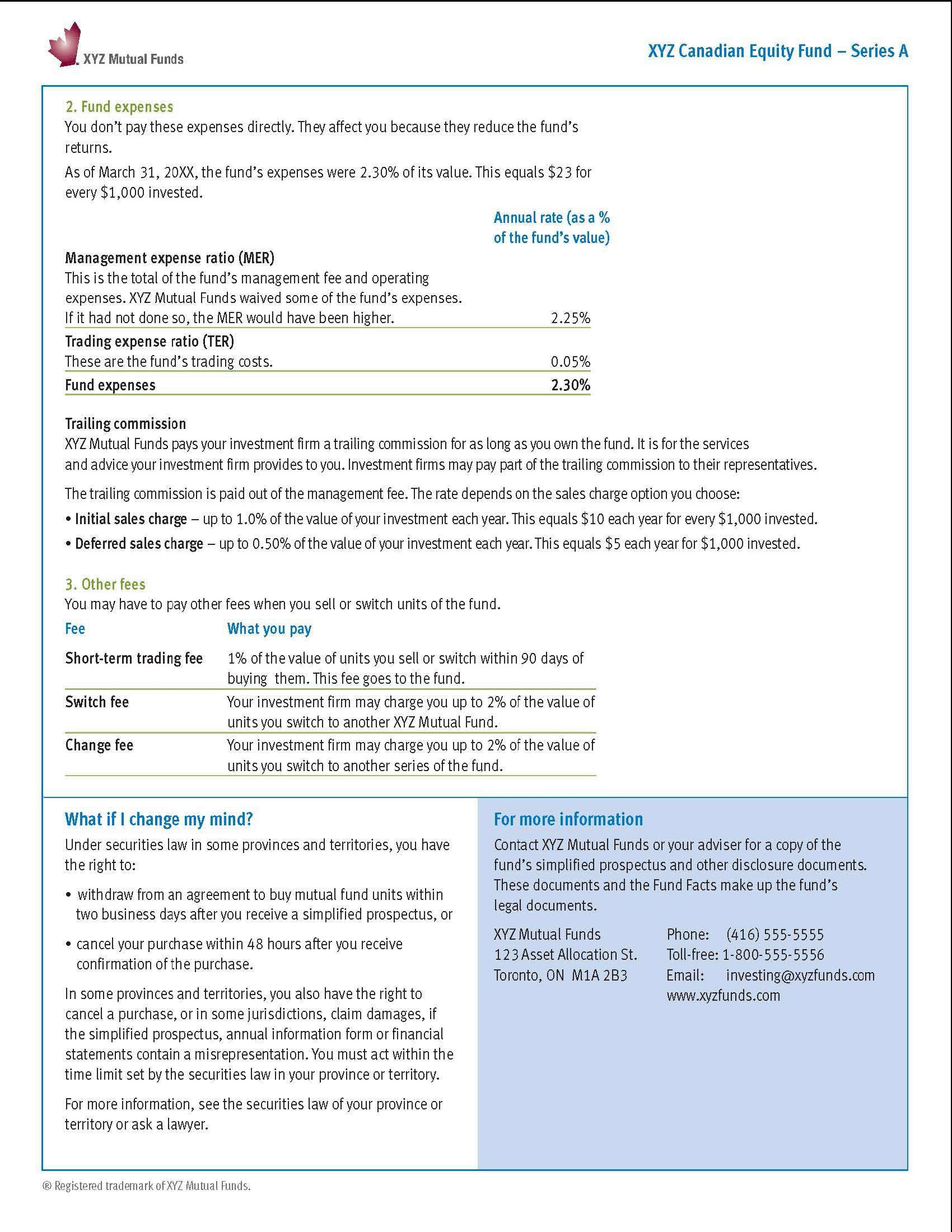

A sample fund facts document is set out in Appendix A to this Policy. The sample is provided for illustrative purposes only.

4.1.2 Multiple Class Mutual Funds -- The purpose for the requirements on the content and format of a fund facts document is to give investors the opportunity to easily compare the key information of one mutual fund to another. For many mutual funds, the class or series may affect not only the management expense ratio and performance, but a number of other considerations as well, such as minimum investment amounts, distributions, suitability, dealer compensation and sales charge options. For this reason, the Instrument requires a fund facts document to be prepared for each class and each series of a mutual fund that is referable to the same portfolio of assets.

4.1.3 Filings

(1) Section 2.1 of the Instrument requires that a fund facts document for each class and series of the securities of a mutual fund be filed concurrently with the mutual fund's simplified prospectus and annual information form.

(2) The most recently filed fund facts document for a mutual fund is incorporated by reference into the simplified prospectus under section 3.1 of the Instrument, with the result that any fund facts document filed under the Instrument after the date of receipt for the simplified prospectus supersedes the fund facts document previously filed.

(3) Section 2.3.2 of the Instrument requires a fund facts document filed under Part 2 of the Instrument to be posted by the mutual fund to the website of the mutual fund, the mutual fund's family or the manager of the mutual fund. Only a final fund facts document filed under the Instrument should be posted to a website. A preliminary or pro forma fund facts document, for example, should not be posted.

4.1.4 Additional Information -- Paragraph 4.1(3)(d) of the Instrument requires a fund facts document to include only information that is specifically mandated or permitted by the required Form 81-101F3.

4.1.5 Format -- The Instrument requires a mutual fund to use the headings and sub-headings stipulated in the Instrument and Form 81-101F3..

17. Section 5.1 is replaced with the following:

5.1 General Purposes -- The general purposes of a simplified prospectus are described in section 2.1 of this Policy. This Part provides guidance to preparers of simplified prospectuses in meeting those purposes..

18. Section 5.2 is replaced with the following:

5.2 Catalogue Approach -- The Instrument requires that a multiple SP must present the fund-specific, or Part B, disclosure about each fund using a catalogue approach. That is, the disclosure about each mutual fund must be presented separately from the disclosure about each other mutual fund..

19. The following section is added after section 5.2:

5.2.1 Accessibility of a Simplified Prospectus -- Mutual funds, managers, and dealers should encourage investors who want more information about a mutual fund to request and read the simplified prospectus and any of the documents incorporated by reference into the simplified prospectus. The Instrument requires that a simplified prospectus or any of the documents incorporated by reference be sent within three business days of a request..

20. Section 5.3 is amended

a. in subsection (1) by

i. replacing "shall" with "must" wherever it occurs; and

ii. replacing "the required form" with "Form 81-101F1";

b. by deleting subsection (2); and

c. by deleting "National" in subsection (3).

21. Section 5.4 is replaced with the following:

5.4 Inclusion of Educational Material

(1) Paragraph 4.1(2)(e) of the Instrument permits educational material to be included in a simplified prospectus. There are no requirements on the location of any educational material. However, the CSA thinks that educational material will be more useful if placed close to mandated disclosure to which it substantively relates.

(2) Educational material contained in a simplified prospectus is subject to the general requirements of the Instrument and should be presented in a manner consistent with the rest of the simplified prospectus. That is, the educational material should be concise, clear and not detract from the clarity or presentation of the information in the simplified prospectus.

(3) The definition of "educational material" contained in section 1.1 of the Instrument excludes material that promotes a particular mutual fund or mutual fund family, or the products or services offered by the mutual fund or mutual fund family. A mutual fund, mutual fund family or those products or services may be referred to in educational material as an example if the reference does not promote those entities, products or services. Mutual funds should ensure that any material included within, attached to or bound with a simplified prospectus is educational material within the meaning of this definition..

22. Section 5.5 is replaced with the following:

5.5 Format -- A simplified prospectus must use the headings and specified sub-headings exactly as they are set out in the Instrument. If no sub-headings are specified, a simplified prospectus may include additional sub-headings under the required headings..

23. Section 6.1 is replaced with the following:

6.1 General Purposes -- The general purposes of an annual information form are described in section 2.1 of this Policy. This Part provides guidance to preparers of annual information forms in meeting those purposes..

24. Section 6.2 is deleted.

25. Subsection 6.4(2) is replaced with the following:

(2) If a mutual fund includes additional information, such as educational material, in an annual information form, that material should not be included primarily for purpose of promotion. An annual information form is designed to be easily understandable to investors and less legalistic in its drafting than traditional prospectuses, but it still constitutes part of a prospectus under securities legislation..

26. Section 7.1 is amended by

a. replacing subsection (1) with the following:

(1) The Instrument contemplates delivery to all investors of a simplified prospectus in accordance with the requirements in securities legislation. It does not require the delivery of the documents incorporated by reference into the simplified prospectus unless requested. However, the CSA encourages mutual funds and dealers to adopt the practice of also routinely providing investors or potential investors with the fund facts document. Mutual funds or dealers may also provide investors with any of the other documents incorporated by reference into the prospectus.;

b. replacing subsection (2) with the following:

(2) The CSA encourage mutual funds, managers, and dealers to make disclosure documents, particularly the fund facts document, available to potential investors as soon as possible in the sales process, in advance of any requirements contained in the Instrument or securities legislation, either directly or through dealers and others involved in selling mutual fund securities to investors.;

c. adding the following subsection after subsection (2):

(2.1) Nothing in the Instrument prevents the simplified prospectus, annual information form or fund facts document from being prepared in other languages, provided that these documents are delivered or sent in addition to any disclosure document filed and required to be delivered in accordance with the Instrument. We would consider such documents to be sales communications.; and

d. replacing subsection (3) with the following:

(3) We do not consider the requirements of section 3.4 of the Instrument to be exclusive. Mutual funds and managers of mutual funds are encouraged to inform investors about using their websites and e-mail addresses to request further information and additional documents..

27. The following section is added after section 7.1:

7.1.1 Electronic Delivery

(1) A simplified prospectus, or any document incorporated by reference into the simplified prospectus, that is required to be delivered or sent under the Instrument may be delivered or sent by means of electronic delivery. Electronic delivery may include sending an electronic copy of the relevant document directly to the investor as an attachment or link, or directing the investor to the specific document on a website.

(2) In addition to the requirements in the Instrument and the guidance in this section, mutual funds, managers and dealers may want to refer to National Policy 11-201 Delivery of Documents by Electronic Means and, in Québec, Notice 11-201 relating to the Delivery of Documents by Electronic Means for additional guidance..

28. Section 7.2 is amended by replacing "Canadian securities regulatory authorities" with "CSA".

29. Section 7.4 is amended by:

a. replacing "or the" with "and"; and

b. replacing "and annual information form" with "or annual information form".

30. Section 8.1 is replaced with the following:

8.1 Investment Disclosure -- Form 81-101F1 requires detailed disclosure concerning a number of aspects of the investment approach taken by a mutual fund, including disclosure concerning fundamental investment objectives, investment strategies, risk and risk management. Form 81-101F3 also contains a summarized form of this disclosure. For many mutual funds, the best persons to prepare and review the disclosure would be the portfolio advisers of the mutual fund and we think mutual funds should generally involve them in preparing and reviewing this disclosure..

31. Section 8.2 is replaced with the following:

8.2 Portfolio Advisers -- Form 81-101F2 requires disclosure concerning the extent to which investment decisions are made by particular individuals employed by a portfolio adviser or by committee. Section 10.3(3)(b) requires certain information about the individuals principally responsible for the investment portfolio of the mutual fund. Part 11 of National Instrument 81-106 Investment Fund Continuous Disclosure requires a simplified prospectus to be amended if a material change occurs in the affairs of the mutual fund that results in a change to the disclosure in the simplified prospectus and fund facts document. Section 7.1 of Companion Policy 81-106CP Investment Fund Continuous Disclosure discusses when a departure of a high-profile individual from a portfolio adviser of a mutual fund may constitute a material change for the mutual fund. If the departure is not a material change for the mutual fund, there is no requirement to amend a simplified prospectus, as long as the simplified prospectus contains full, true and plain disclosure about the mutual fund..

32. Section 9.1 is amended

a. in subsection (1) by

i. replacing "Canadian securities regulatory authorities" with "CSA";

ii. replacing "and" with ",";

iii. inserting "and fund facts document" after "annual information form"; and

iv. inserting "," after "refiling";

b. in subsection (2) by

i. replacing "It should be noted that the" with "The";

ii. replacing "and" with ","; and

iii. inserting "and fund facts document" immediately after "annual information form".

33. The following Part is added after Part 9:

PART 10 EXEMPTIONS

10.1 Applications Involving Novel or Substantive Issues -- Section 6.2 of the Instrument allows exemptive relief from form and content requirements for a simplified prospectus, an annual information or a fund facts document to be evidenced by way of issuance of a receipt. In cases where the CSA thinks that an application for exemptive relief raises novel and substantive issues, or raises a novel policy concern, the CSA may request that such applications follow the process set out in National Policy 11-203 Process for Exemptive Relief Applications in Multiple Jurisdictions. This will likely be the case for applications seeking exemptive relief from the form and content requirements of the fund facts document..

34. The following Appendix is added after Part 10:

Appendix A -- Sample Fund Facts Document

35. This Instrument becomes effective on January 1, 2011