CSA Notice 81-324 and Request for Comment - Proposed CSA Mutual Fund Risk Classification Methodology for Use in Fund Facts

CSA Notice 81-324 and Request for Comment - Proposed CSA Mutual Fund Risk Classification Methodology for Use in Fund Facts

CSA Notice 81-324

and Request for Comment

Proposed CSA Mutual Fund Risk Classification Methodology for Use in Fund Facts

December 12, 2013

Introduction

The Canadian Securities Administrators (the CSA or we) are publishing for a 90 day comment period a CSA risk classification methodology (the Proposed Methodology) for use by mutual fund managers in the Fund Facts document (Fund Facts).

The text of the Proposed Methodology is contained in Annex A of this notice and is available on the websites of members of the CSA.

The CSA developed the Proposed Methodology in response to stakeholder feedback that the CSA has received throughout the implementation of the point of sale disclosure framework for mutual funds (the Framework), notably that a standardized risk classification methodology proposed by the CSA would be more useful to investors as it would provide a consistent and comparable basis for measuring the risk of different mutual funds.

We expect that the Proposed Methodology could be used in documents similar to the Fund Facts as we move forward with summary disclosure documents for other types of publicly offered investment funds, particularly exchange-traded funds (ETFs).

- - - - - - - - - - - - - - - - - - - -

We are seeking feedback on using the Proposed Methodology in the Fund Facts, in particular, whether the CSA should (i) mandate the Proposed Methodology or (ii) adopt it only as guidance for investment fund managers.

- - - - - - - - - - - - - - - - - - - -

Background

Staged Implementation of the Framework

On June 18, 2010, the CSA published CSA Staff Notice 81-319 Status Report on the Implementation of Point of Sale Disclosure for Mutual Funds, which outlined the CSA's decision to implement the Framework in three stages.

The Fund Facts is central to the Framework. It is in plain language, no more than two pages double-sided and highlights key information important to investors, including past performance, risks and the costs of investing in a mutual fund.

The first two stages of the Framework are now completed. Currently, mutual funds subject to National Instrument 81-101 Mutual Fund Prospectus Disclosure (NI 81-101) must produce and file a Fund Facts and make it available on the mutual fund's or the fund manager's website. The Fund Facts must also be delivered or sent to investors free of charge upon request. Beginning on June 13, 2014, the Fund Facts will be required to be delivered instead of the prospectus to satisfy the prospectus delivery requirements under securities legislation.

The CSA is currently working on proposed requirements that would implement delivery of the Fund Facts at the point of sale for mutual funds. We are also proceeding with rule making and seeking legislative amendments, where necessary, to introduce a summary disclosure document for ETFs, similar to the Fund Facts, and the requirement to deliver the summary disclosure document within two days of an investor buying the ETF.

Throughout the development of the Framework, stakeholders commented on the lack of standardization in risk disclosure, and supported the development of a standardized risk classification methodology by the CSA that could to be applied by investment funds managers in assessing the mutual fund's risk on the scale prescribed in the Fund Facts. According to stakeholders, the lack of a standard methodology could result in an inconsistent evaluation of risk and make comparisons between mutual funds difficult. Based on this feedback, the CSA has developed the Proposed Methodology.

For further information on the staged approach to implementation of the Framework, and its progress, please refer to the CSA member websites.

Risk scale in the Fund Facts

Currently, the Fund Facts requires the fund manager of a mutual fund to provide a risk rating for the mutual fund based on a risk classification methodology chosen at the fund manager's discretion. The fund manager must then identify the mutual fund's risk level on the scale prescribed in the Fund Facts which is made up of five categories ranging from Low to High.

In response to stakeholder feedback, and informed by investor document testing of the Fund Facts, the CSA made a number of changes to the presentation of risk in the Fund Facts that will take effect on January 13, 2014. Specifically, recognizing that the majority of fund managers use volatility of past returns (Volatility Risk) in assessing the risk classification of their mutual funds, we have clarified the disclosure in the Fund Facts to state that the risk scale is meant to measure Volatility Risk. Volatility Risk is now explained in concise and understandable language in the Fund Facts and the risk-return linkage has also been highlighted (i.e., funds with higher Volatility Risk may have a greater chance of losing money and may have a greater chance of higher returns). The Fund Facts must also state that low risk mutual funds can still lose money. We also added disclosure in the Fund Facts to clearly indicate that the risk disclosure constitutes the manager's risk rating of the mutual fund.

You can find additional background information on the comments we have received relating to the risk scale in the Fund Facts, and the presentation of risk generally, on the CSA member websites.

Substance and Purpose of the Proposed Methodology

The Proposed Methodology would enable a fund to identify its risk level on the scale prescribed in the Fund Facts.

In addition to consistency, we think that the use of a standard methodology will enhance transparency in the market by enabling third parties to independently verify the risk rating disclosure of a mutual fund in the Fund Facts.

Steps to Constructing the Proposed Methodology

In considering the development of the Proposed Methodology, we reviewed the investment fund risk classification methodology developed by the Investment Funds Institute of Canada (IFIC) (IFIC Methodology) which is the predominant risk classification methodology used today by fund managers to disclose a mutual fund's risk classification for use in the Fund Facts.

We also undertook a review of how other global regulators including the Committee of European Securities Regulators (CESR){1} have approached risk disclosure in their summary disclosure documents. CESR mandates the use of a methodology for measuring and disclosing risk (the CESR Methodology) in its summary disclosure documents. We compared and analyzed essential components of the IFIC and CESR methodologies and kept in our view the most effective components in mind as we developed the Proposed Methodology.

In order to inform our work on the Proposed Methodology, we undertook consultations with industry representatives, academics and investor advocates, among others, in Montreal and Toronto in Fall 2013.

The majority of stakeholders we spoke with supported the development of a standardized, mandatory risk classification methodology, and agreed with the use of standard deviation as the risk indicator. Stakeholders also generally noted that implementation of the Proposed Methodology could result in changes to the risk band classification for some funds. In particular, some queried whether such changes could affect suitability assessments conducted by dealers. These stakeholders remarked that we would need to work closely with the Self-Regulatory-Organizations and dealers when considering the implementation of the Proposed Methodology. Some industry participants pointed out that the fund managers should be allowed some discretion in order to override the quantitative calculation for risk classification purposes.

The consultations brought up some further reflections and led to additional questions in Annex B.

Although standard deviation{2} is used by both IFIC and CESR methodologies and seems to remain the most common risk indicator used by Canadian investment fund managers, we examined other risk indicators currently in use and those that could potentially be used to determine and measure risk. In total, 15 risk indicators were studied. They can typically be grouped into one of five categories: overall volatility risk measures, tail-related risk measures, relative volatility measures, risk adjusted return measures, and relative risk adjusted return measures. Following a thorough analysis of all these risk indicators, we have chosen standard deviation as the most suitable risk indicator for the Proposed Methodology.

Our reasons for choosing standard deviation are as follows:

• The risk scale in the Fund Facts is intended to measure Volatility Risk, and standard deviation is the most widely accepted measure of volatility;

• Its calculation methodology is well known and established;

• The calculation is simple and does not require sophisticated skills or software;

• It provides a consistent risk evaluation for a broad range of investment funds;

• It provides a relatively stable but still meaningful evaluation of risk when coupled with an appropriate historical period;

• It is already broadly used in the industry, and serves as the basis for the IFIC and CESR methodologies;

• It is available from third party data providers, thereby providing a simple and effective source of data for oversight purposes both by regulators and by market participants (including investors); and

• The implementation costs are expected to be minimal.

Overview of the Proposed Methodology

The Proposed Methodology features are:

Risk indicator:

10-year (annualized) standard deviation

Note: Calculated on a 10 year historical basis.

Data used:

Monthly total return calculated in accordance with Part 15 of National Instrument 81-102Mutual Funds.

Note: The monthly total return of a reference index should be used as a proxy to impute missing return data of a fund that does not have a 10 year track record.

Risk categories and corresponding standard deviation bands:

Low

0% -- 2%

Low to medium

2% -- 6%

Medium

6% -- 12%

Medium to high

12% -- 18%

High

18% -- 28%

Very high

> 28%

Frequency of the risk classification assessment:

Monthly

Note: Two tests are needed to assess the risk classification:

(1) Determine if the 10-year standard deviation calculated for the past month falls in a risk band that is at least two risk bands lower or higher than the risk band classification indicated in the most current Fund Facts. If yes, change the risk rating to the indicated band.

(2) Determine if the 12 month average risk classification, calculated from the current and preceding 11 monthly risk classifications (rounded to the nearest integer) falls into a different risk band than its current risk disclosure in the most recent Fund Facts. If yes, change the risk rating to the average risk band.

The Proposed Methodology does not allow for qualitative factors or investment fund managers' discretion to impact the risk ranking process.

Use of a Reference Index

We propose to allow a reference index as a proxy for mutual funds that do not have sufficient performance history.

We have indicated in the Proposed Methodology that the reference index should meet the following criteria:

• have returns highly correlated to the returns of the mutual fund;

• contain a high proportion of the securities represented in the mutual fund's portfolio with similar portfolio allocations; and

• have a historical systemic risk profile highly similar to the mutual fund.

If a reference index is to be used as a proxy in calculating standard deviation, the Proposed Methodology contemplates specific prospectus disclosure and recordkeeping requirements, including written policies and procedures that would provide for a monthly monitoring of the appropriateness of the reference index.

Five to six category scale

The Proposed Methodology also contemplates moving from the five category scale currently prescribed in the Fund Facts to six categories, ranging from Low to Very High. Generally, money market funds as well as short term fixed income funds will be categorized as Low whereas the Very High category will tend to capture precious metal equity funds and commodity focused funds.

Changes to the Risk Scale

We recognize that the use of this Proposed Methodology could result in changes to the risk band categorization for some mutual funds between Fund Facts renewal dates. Consequently, we propose that the investment fund manager monitor the mutual fund's risk classification on a monthly basis, inform investors of risk band changes if they occur within certain prescribed quantitative boundaries and criteria, and update the Fund Facts accordingly.

Alternatives considered

An alternative to the Proposed Methodology is to continue to allow the fund manager to identify the mutual fund's risk level based on the risk classification methodology chosen by the manager. As most mutual fund managers use some type of return volatility measure to determine a mutual fund's risk level, comparability of the presentation of risk in Fund Facts may be achieved, up to a certain extent, without the need to develop the Proposed Methodology. However, we know that not all fund managers use risk classification methodologies based on volatility or variability of returns, and that many of the risk classification methodologies currently in use, including the IFIC Methodology, allow for a considerable degree of judgment and subjectivity, making meaningful risk disclosure comparisons by investors of the mutual fund's risk level difficult.

Anticipated Costs and Benefits

We think that the development of a standard methodology, whether mandated or adopted as guidance, would benefit both investors and the capital markets by providing consistency and transparency of disclosure and improved comparability of investment fund products. We further think that the costs of complying with the Proposed Methodology will be minimal, since most fund managers already use some type of return volatility measure which incorporates either standard deviation, or a close alternative to standard deviation, in order to determine, in whole or in part, a mutual fund's risk level on the scale prescribed in the Fund Facts. We recognize that there may be added costs if the Proposed Methodology causes risk disclosure changes to be made between Fund Facts renewal dates. However, based on our analysis of the Canadian fund universe, we expect these types of changes to occur infrequently and only when there has been a material change in the fund's Volatility Risk.

Overall, we think the potential benefits of improved comparability of the Fund Facts for investors, as well as enhanced transparency to the market, are proportionate to the costs of complying with the Proposed Methodology.

We seek feedback on whether you agree or disagree with our perspective of the cost burden of compliance with the Proposed Methodology.

Request for Comments and Feedback

We would like your input on the Proposed Methodology. Specifically, whether the CSA should (i) mandate the Proposed Methodology or (ii) adopt the Proposed Methodology only as guidance for investment fund managers. We seek suggestions of other means of achieving the same objective other than by mandating the Proposed Methodology, or by adopting it as guidance.

We also seek specific feedback on whether the Proposed Methodology could be used in similar documents to Fund Facts for other types of publicly-offered investment funds, particularly ETFs.

- - - - - - - - - - - - - - - - - - - -

We have raised specific questions for comment in text boxes like this throughout Annex A to this Notice (the Proposed Methodology). You can also find a list of these questions in Annex B. We also welcome your comments on other aspects of the Proposed Methodology, including our general approach and any changes we should consider.

- - - - - - - - - - - - - - - - - - - -

We cannot keep submissions confidential because securities legislation in certain provinces requires publication of a summary of the written comments received during the comment period. All comments will be posted on the AMF website at www.lautorite.qc.ca and on the OSC website at www.osc.gov.ca.

Deadline for Comments

Please submit your comments in writing on or before March 12, 2014. If you are not sending your comments by email, please send a CD containing the submissions (in Microsoft Word format).

Where to Send Your Comments

Address your submission to all of the CSA as follows:

British Columbia Securities Commission

Alberta Securities Commission

Financial and Consumer Affairs Authority of Saskatchewan

Manitoba Securities Commission

Ontario Securities Commission

Autorité des marchés financiers

Financial and Consumer Services Commission (New Brunswick)

Superintendent of Securities, Department of Justice and Public Safety, Prince Edward Island

Nova Scotia Securities Commission

Securities Commission of Newfoundland and Labrador

Superintendent of Securities, Northwest Territories

Superintendent of Securities, Yukon

Superintendent of Securities, Nunavut

Deliver your comments only to the addresses below. Your comments will be distributed to the other participating CSA.

Contents of Annexes

Annex A -- Proposed CSA Risk Classification Methodology

Annex B -- Issues for Comment

Questions

Please refer your questions to any of the following CSA staff:

{1} Now the European Securities and Markets Authority (ESMA).

{2} Standard deviation measures how returns vary over time from the average return. It is a measure of the volatility of investments returns i.e., how spread out the returns are from their average, on average.

ANNEX A

PROPOSED CSA RISK CLASSIFICATION METHODOLOGY

Introduction

This annex sets out the framework and details of the Proposed Methodology. As a starting point, the Proposed Methodology was constructed with the following criteria and objectives in mind:

• be a uniform methodology applicable to all investment funds;

• be easy to understand by all market participants;

• be meaningful and allow for easy comparison across investment funds;

• be difficult to manipulate for someone's benefit, i.e. should minimize subjectivity or any form of discretionary risk assessment;

• be relatively simple and cost-effective for fund managers to implement;

• enable easy and effective regulatory supervision; and

• as much as possible, be a stable indicator of risk while fairly reflecting market cycles and broad market fluctuations.

METHODOLOGY FOR THE CALCULATION OF A FUND'S VOLATILITY RISK

The CSA propose the following risk classification methodology for the purpose of disclosing a fund's Volatility Risk on the Fund Facts' risk scale as required under Form 81-101F3 Contents of Fund Facts Document.

1. Risk indicator -- The risk indicator adopted for the Proposed Methodology is standard deviation, which measures the volatility of past returns of the fund.

- - - - - - - - - - - - - - - - - - - -

Explanatory Note

The volatility of past returns essentially captures the effects of a large number of risk exposures, as many risk exposures would be reflected in the prices of the underlying assets and, ultimately, in the volatility of these prices. While we recognize that risks that have not materialized historically (certain types of liquidity risks and/or counterparty risks for example) would not be captured by standard deviation, or any other backward-looking risk indicator, we emphasize that standard deviation does not attribute more weight to a particular risk factor.

- - - - - - - - - - - - - - - - - - - -

- - - - - - - - - - - - - - - - - - - -

Questions

1. Keeping the criteria outlined in the introduction above in mind, would you recommend other risk indicators? If yes, please explain and supplement your recommendations with data/analysis wherever possible.

2. We believe that standard deviation can be applied to a range of fund types (asset class exposures, fund structures, manager strategies, etc.). Keeping the criteria outlined in the introduction above in mind, would you recommend a different Volatility Risk measure for any specific fund products? Please supplement your recommendations with data/analysis wherever possible.

- - - - - - - - - - - - - - - - - - - -

2. Monthly total returns -- Standard deviation must be calculated using the monthly total returns (i.e. reinvesting all income and capital gains distributions) of the fund.

- - - - - - - - - - - - - - - - - - - -

Question

We understand that it is industry practice (for investment fund managers and third party data providers) to use monthly returns to calculate standard deviation. Keeping the criteria outlined in the introduction above in mind, would you suggest that an alternative frequency be used? Please specifically state how a different frequency would improve fund risk disclosure and be of benefit to investors. Please supplement your recommendations with data/analysis wherever possible.

- - - - - - - - - - - - - - - - - - - -

3. 10 year history -- Fund managers must use monthly total returns over the past 10 years to calculate the standard deviation for the fund.

- - - - - - - - - - - - - - - - - - - -

Explanatory Note

After reviewing fund data for the Canadian fund marketplace, we are of the view that the use of 10-year performance returns is preferable to both shorter (3, 5, 7 years) and longer time periods (15, 20, 25 years) as it strikes a reasonable balance between indicator stability and data availability. Over shorter periods, we found that risk indicators (including standard deviation) tended to fluctuate too much. Over shorter time periods, risk indicators also have a tendency to be misleading -- showing relatively low levels of Volatility Risk just before a market downturn and relatively high levels of volatility just after a market downturn.

- - - - - - - - - - - - - - - - - - - -

- - - - - - - - - - - - - - - - - - - -

Question

Keeping the criteria outlined in the introduction above in mind, should we consider a different time period than the proposed 10 year period as the basis for risk rating disclosure? Please explain your reasoning and supplement your recommendations with data/analysis wherever possible.

- - - - - - - - - - - - - - - - - - - -

4. Fund series/class used -- For each fund, fund managers must use the total returns of the oldest fund series/class of the securities of the fund as the basis for their Volatility Risk calculation across all fund series/ classes, unless an attribute of a particular fund series/class would result in a materially different level of Volatility Risk (e.g. currency hedging) in which case, the total returns of that particular fund series/class must be used.

- - - - - - - - - - - - - - - - - - - -

Explanatory Note

After reviewing fund data for the Canadian fund marketplace, we are of the view that, in most cases, the variance of the standard deviation calculation is small across each fund's series/classes. In addition, data availability across fund series/classes is highly variable -- many fund series/classes do not have the requisite performance history. In light of these two considerations, and keeping in mind our objectives of simplicity and cost-effectiveness, we are not requiring that calculations be made for each fund series/class of securities of a fund.

- - - - - - - - - - - - - - - - - - - -

- - - - - - - - - - - - - - - - - - - -

Question

Keeping the criteria outlined in the introduction above in mind, should we consider an alternative approach to the calculation by series/class? Please supplement your recommendations with data/analysis wherever possible.

- - - - - - - - - - - - - - - - - - - -

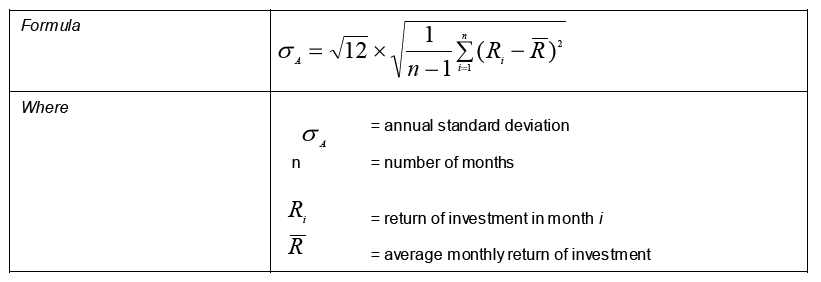

5. Standard deviation -- Volatility Risk (standard deviation) shall be calculated, and then annualized, using the following formula:

Explanatory Note

Standard deviation, calculated and annualized using monthly returns, is one of the most common indicators of volatility and risk used in the industry. We are aware that return distributions may not always be symmetrical, thus standard deviation may either understate or overstate Volatility Risk in some cases. However, we are of the view that given the available alternatives and the known data obstacles, standard deviation is still the best general risk indicator and one that is useful as a first test to measure overall risk. Our analysis of data from the Canadian fund marketplace also revealed that there were relatively few cases where alternative risk indicators signaled a higher risk rating than that indicated by standard deviation. We also note that most risk indicators will tend to underestimate risk where the probability of event risk (i.e. unforeseen event) is high.

- - - - - - - - - - - - - - - - - - - -

6. Use of reference index data -- For new funds or funds that do not have the requisite 10 years of history, the fund manager must use the monthly returns of a reference index to impute missing data. Thus, for a fund without sufficient performance history, the investment fund manager will select a reference index and will add the monthly returns of this reference index to the available monthly returns of the fund, if any, in order to calculate its 10 year standard deviation.

It may be appropriate for a fund that invests in more than one type of security or asset class to build its own blended index as a reference index from a weighted combination of acceptable indices to fill out its return history. For instance, a balanced fund may wish to build its reference index by including data from acceptable bond and equity indices.

We are of the view that certain widely accepted principles and guidelines should be followed by investment fund managers in selecting a reference index for imputed data.

For an index to be acceptable as a reference index, it should:

• exist, be widely recognized and be available during the period the data will be used as proxy;

• for an index that did not exist for all or part of the contemplated period, be a widely recognized reconstruction or calculation of what the index would have been during that period, calculated on a basis consistent with its current basis of calculation;

• be administrated by an organization that is not affiliated with any of the fund, its fund manager, its portfolio manager and its principal distributor;

• have data and a published methodology that are accessible to the fund; and

• be publicly available.

Ideally, the reference index selected or constructed by a fund manager should comply with the following principles:

• whenever possible, have returns highly correlated to the returns of the fund;

• contain a high proportion of the securities represented in the fund's portfolio with similar portfolio allocations;

• have a historical systematic risk profile similar to the fund;

• share the same style characteristics and reflect the market sectors in which the fund is investing;

• have security allocations that represent investable position sizes on a pro rata basis to the fund's total assets;

• be denominated or converted to the same currency as the fund's reported net asset value (or the currency of the fund's oldest share class); and

• have its returns computed on the same basis (e.g., total return, net of withholding taxes, etc.) as the fund's returns.

When using a reference index, we expect a fund manager to:

• monitor on an annual basis, or more frequently should circumstances indicate, the appropriateness of the reference index;

• disclose in the fund's prospectus:

(a) a brief description of the reference index, and

(b) if the reference index is changed, provide details of when and why the change was made;

• maintain adequate books and records, including

(a) internal policies and procedures around monitoring appropriateness of the reference index;

(b) details of the composition, risk and return profile of the reference index relative to the fund; and

(c) any calculations or internal discussions supporting selection of the appropriate reference index.

- - - - - - - - - - - - - - - - - - - -

Questions

Keeping the criteria outlined in the introduction above in mind, do you agree with the principles we have proposed for the use of a reference index for funds that do not have sufficient historical performance data? Are there any other factors we should take into account when selecting a reference index? Please supplement your recommendations with data/analysis wherever possible.

- - - - - - - - - - - - - - - - - - - -

7. Six category scale and risk bands -- We propose to change the Volatility Risk scale from a five band to a six band scale. The six bands will correspond to the following standard deviation ranges:

Risk Category

SD Bands

Low

0 -- 2.0

Low to medium

2.0 -- 6.0

Medium

6.0 -- 12.0

Medium to High

12.0 -- 18.0

High

18.0 -- 28.0

Very High

> 28.0

- - - - - - - - - - - - - - - - - - - -

Explanatory Note

The risk band boundaries were studied in combination with a number of different options for the monitoring procedures. Our objectives were to:

- find the risk band boundaries and monitoring procedure combination that minimized unnecessary band switching (such as when a fund's risk tended to straddle the boundary between bands);

- provide meaningful risk categorization distinctions between fund types;

- provide timely investor notification after consequential fund risk changes;

- minimize the implementation burden for managers, to the extent possible.

To study the placement of the risk band boundaries and the various monitoring procedures, and their impact on the objectives detailed above, we used a survivorship bias-free dataset of 10 year standard deviations rolled monthly from 1965 to 2012 for the Canadian fund universe (about 2,200 fund series were included) from Morningstar Direct.

We found that the proposed risk bands coupled with the requirement to calculate the 12 month average risk band classification best fit the objectives identified above. In particular, the CSA think the inclusion of the sixth band could lead to more meaningful volatility clustering across the fund universe.

Based on our analysis, we expect the "Low" category to capture money market funds and short term fixed income funds, and the "Very High" category to capture precious metal equity funds and commodity focused funds.

The CSA recognize that moving to a 6 band risk scale, along with a change in band boundaries, will likely mean that a number of funds will end up being classified in a risk band that differs from what is currently disclosed in the Fund Facts. In our view, a clear distinction should be drawn between a change in classification that results from the initial application of the Proposed Methodology and a change in classification that results from a material change in the underlying Volatility Risk of a fund. An initial risk band adjustment that results in a fund shifting to a higher risk band should not generally be interpreted as meaning that the fund has a greater degree of risk than was previously the case. The CSA will continue to work with Self-Regulatory Organizations on issues arising from the transition to 6 bands.

- - - - - - - - - - - - - - - - - - - -

- - - - - - - - - - - - - - - - - - - -

Questions

Keeping the criteria outlined in the introduction above in mind:

1. Do you agree with the proposed number of risk bands, the risk band break-points, and nomenclature used for risk band categories?

2. Do the proposed break points allow for sufficient distinction between funds with varying asset class exposures/risk factors?

If not, please propose an alternative, and indicate why your proposal would be more meaningful to investors. Please supplement your recommendations with data/analysis wherever possible.

3. Please comment on any transition issues that you think might arise as a result of risk classification changes that are likely to occur upon the initial application of the Proposed Methodology. How would fund managers and dealers propose to minimize the impact of these issues?

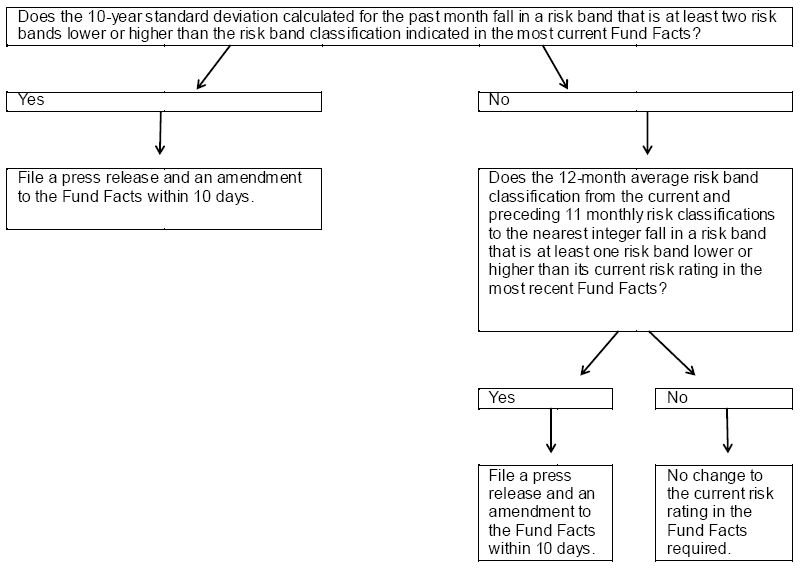

8. Monitoring and changing of risk categorizations -- The following sets out the calculation and process that must be followed by fund managers when monitoring the risk categorizations :

• Monitor the fund's 10-year standard deviation on a monthly basis and categorize the fund in a risk band, using a value of 1 for the lowest risk band, and 6 for the highest risk band;

• If the last monthly calculation of the fund's 10-year standard deviation results in a change of two risk bands (up or down) from the risk band classification indicated in the most current Fund Facts, the fund manager must issue a press release to indicate the change. The fund manager must also file with the securities regulatory authority an amended Fund Facts that reflects the change. Both the press release and the amended Fund Facts must be filed within ten (10) days of their last monthly calculation of the fund's standard deviation;

• If the last monthly calculation of the fund's 10-year standard deviation does not indicate the need to change two risk bands from the most recent risk classification, the fund manager must nevertheless calculate the 12-month average risk classification from the current and preceding 11 monthly risk classifications to the nearest integer. For example, if the last 12 monthly risk band classifications were 3, 2, 3, 2, 2, 2, 2, 3, 3, 3, 3, 3, the average to the nearest integer would be 3;

From the results of this calculation, if a change of at least one (1) risk band up or down from its current risk rating in the most recent Fund Facts is indicated, the fund manager must issue a press release to indicate the change. The fund manager must also file with the securities regulatory authority an amended Fund Facts. Both the press release and the amended Fund Facts must be filed within ten (10) days of their last monthly calculation of the fund's average standard deviation for the last 12 months.

The following chart illustrates the process for the monthly monitoring, and changing of risk categorizations:

Question

- - - - - - - - - - - - - - - - - - - -

Do you agree with the proposed process of risk rating monitoring? Keeping the criteria outlined in the introduction above in mind, would you propose a different set of parameters or different frequency of monitoring risk rating changes? If yes, please explain your reasoning. Please supplement your recommendations with data/analysis wherever possible.

- - - - - - - - - - - - - - - - - - - -

9. Records of standard deviation calculation -- The calculation of standard deviation of a fund must be adequately documented. Fund managers must keep appropriate records of these calculations for at least 10 years.

- - - - - - - - - - - - - - - - - - - -

Question

Is a 10 year record retention period too long? If yes, what period would you suggest instead and why?

- - - - - - - - - - - - - - - - - - - -

ANNEX B

ISSUES FOR COMMENT

Issues for Comment on the Notice and Request for Comment

1. As a threshold question, should the CSA proceed with (i) mandating the Proposed Methodology or (ii) adopting the Proposed Methodology only as guidance for fund managers to identify the mutual fund's risk level on the prescribed scale in the Fund Facts? Are there other means of achieving the same objective than by mandating the Proposed Methodology, or by adopting it only as guidance? We request feedback from investment fund managers and dealers on what a reasonable transition period would be for this.

2. We seek feedback on whether the Proposed Methodology could be used in similar documents to Fund Facts for other types of publicly-offered investment funds, particularly ETFs. For ETFs, what, if any, adjustments would we need to make to the Proposed Methodology? For instance should standard deviation be calculated with returns based on market price or net asset value per unit?

3. We seek feedback on whether you agree or disagree with our perspective of the benefits of having a standard methodology, as well as whether you agree or disagree with our perspective on the cost of implementing the Proposed Methodology.

4. We do not currently propose to allow fund managers discretion to override the quantitative calculation for risk classification purposes. Do you agree with this approach? Should we allow discretion for fund managers to move their risk classification higher only?

Issues for Comment on the Proposed Methodology

5. Keeping the criteria outlined in the introduction above in mind, would you recommend other risk indicators? If yes, please explain and supplement your recommendations with data/analysis wherever possible.

6. We believe that standard deviation can be applied to a range of fund types (asset class exposures, fund structures, manager strategies, etc.). Keeping the criteria outlined in the introduction above in mind, would you recommend a different Volatility Risk measure for any specific fund products? Please supplement your recommendations with data/analysis wherever possible.

7. We understand that it is industry practice (for investment fund managers and third party data providers) to use monthly returns to calculate standard deviation. Keeping the criteria outlined in the introduction above in mind, would you suggest that an alternative frequency be used? Please specifically state how a different frequency would improve fund risk disclosure and be of benefit to investors. Please supplement your recommendations with data/analysis wherever possible.

8. Keeping the criteria outlined in the introduction above in mind, should we consider a different time period than the proposed 10 year period as the basis for risk rating disclosure? Please explain your reasoning and supplement your recommendations with data/analysis wherever possible.

9. Keeping the criteria outlined in the introduction above in mind, should we consider an alternative approach to the calculation by series/class? Please supplement your recommendations with data/analysis wherever possible.

10. Keeping the criteria outlined in the introduction above in mind, do you agree with the criteria we have proposed for the use of a reference index for funds that do not have sufficient historical performance data? Are there any other factors we should take into account when selecting a reference index? Please supplement your recommendations with data/analysis wherever possible.

11. Keeping the criteria outlined in the introduction above in mind,

i. Do you agree with the proposed number of risk bands, the risk band break-points, and nomenclature used for risk band categories?

ii. Do the proposed break points allow for sufficient distinction between funds with varying asset class exposures/risk factors?

If not, please propose an alternative, and indicate why your proposal would be more meaningful to investors. Please supplement your recommendations with data/analysis wherever possible.

12. Do you agree with the proposed process for monitoring risk ratings? Keeping the criteria outlined in the introduction above in mind, would you propose a different set of parameters or different frequency for monitoring risk rating changes? If yes, please explain your reasoning. Please supplement your recommendations with data/analysis wherever possible.

13. Is a 10 year record retention period too long? If yes, what period would you suggest instead and why?

14. Please comment on any transition issues that you think might arise as a result of risk classification changes that are likely to occur upon the initial application of the Proposed Methodology. How would fund managers and dealers propose to minimize the impact of these issues?