Update on the OSC Whistleblower Program 2016 to 2022

Introduction

Introduction

Whistleblowers play a critical role in helping the Ontario Securities Commission (the “OSC”) protect investors and promote confidence in the capital markets. They provide a valued public service by reporting information on securities misconduct which may not otherwise come to light, and which helps the OSC more quickly identify and investigate the misconduct and hold wrongdoers accountable.

The OSC Whistleblower Program (the “Program”), launched in 2016, is Canada’s first and only paid program of its kind run by a securities regulator. Individuals who voluntarily submit original information about violations of Ontario securities law may be eligible for awards of up to $5 million. In addition to a financial incentive, the Program and governing statutes, together, provide robust confidentiality and anti-reprisal protections to encourage individuals to report information about securities misconduct.

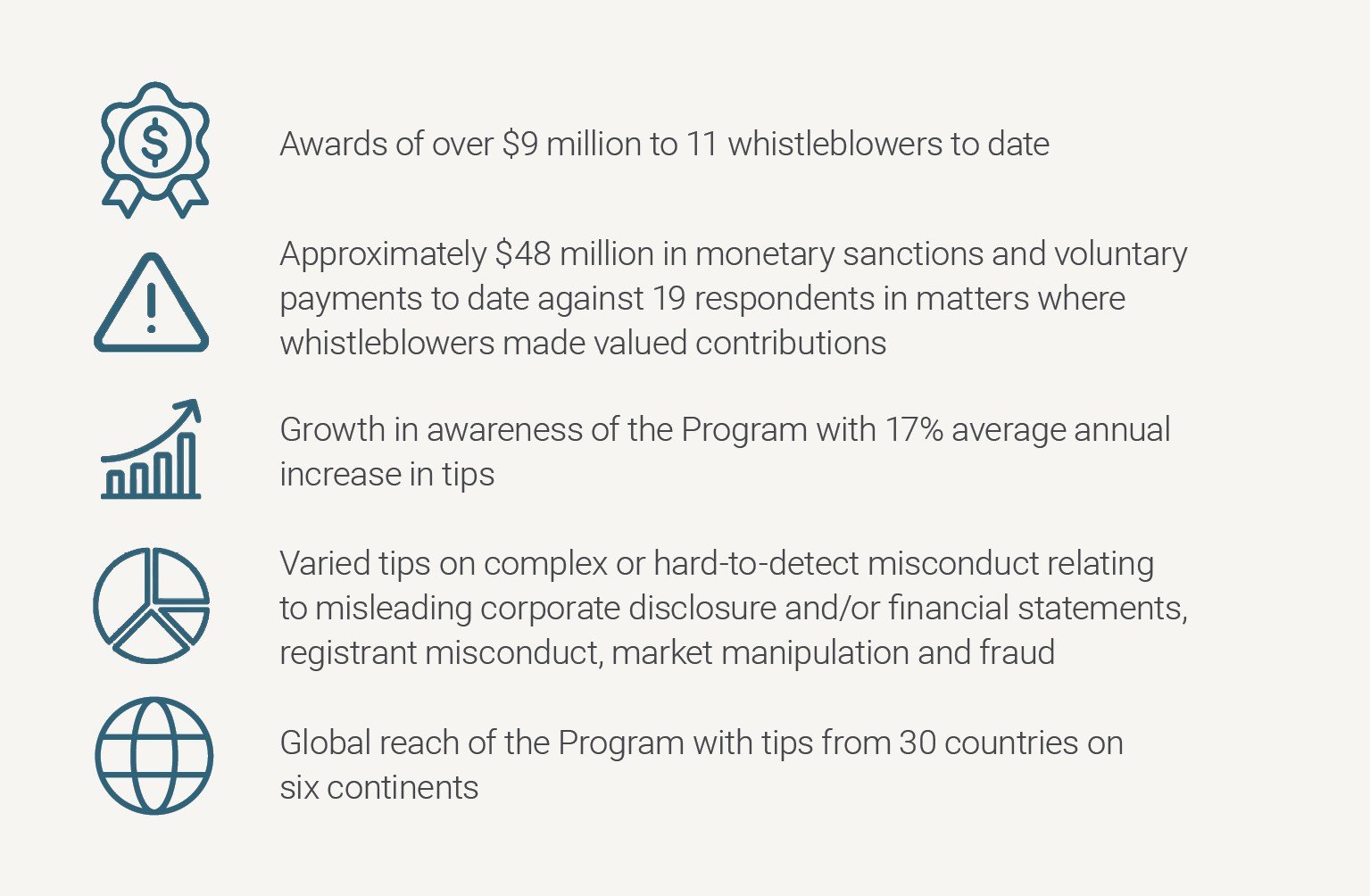

The Program has been a success. Since its launch, it has attracted high quality tips which have resulted in timely and impactful enforcement action, protecting investors from harm, and have led to awards of over $9 million to whistleblowers.

Highlights at a Glance

“The OSC created the Whistleblower Program to identify complex or hard-to-detect securities violations. It has proven to be a resounding success. Our review affirms that the Program is a powerful enforcement tool which incentivizes whistleblowers to come forward and protects them from retaliation. This is clearly evidenced by our numerous investigations involving whistleblower tips. Our work on this update exhibits our commitment to fortifying this essential program and we look forward to collaborating with stakeholders to identify more ways to enhance it.”

Jeff Kehoe, Director of Enforcement

Purpose of the Update

This update shows the critical value that whistleblowers bring to advancing the OSC’s enforcement efforts and how whistleblowers drive the success of the Program. It tells the story of our experiences based on our first five fiscal years of operation. We hope our update will spur further discussion about the importance of whistleblowers.

We also provide potential whistleblowers with helpful suggestions about the information and assistance sought under the Program and encourage market participants to foster a culture of compliance that promotes and welcomes internal reports of misconduct.

The majority of the insights contained in this update is based on analysis of data collected about each tip. Additionally, certain commentary reflects the experiences of members of the Office of the Whistleblower. These insights and experiences also inform improvements that we are considering for the Program.

Confidentiality is a cornerstone of the Program. The OSC cannot disclose any information that could reasonably be expected to identify a whistleblower, including the presence of a whistleblower in a specific matter, with few exceptions. In that vein, we only refer to aggregated data that does not reveal whistleblowers’ identities.

The timeframe covered in this update includes the initial program launch period between July 14, 2016, and March 31, 2017, and five fiscal years between April 1, 2017, and March 31, 2022. Unless otherwise noted, all data is as of March 31, 2022.

The Office of the Whistleblower

The Office of the Whistleblower

The Office of the Whistleblower (the “OWB”) is a dedicated team of professionals within the OSC’s Enforcement Branch. We administer all aspects of the Program. The OWB is the whistleblower’s partner throughout the process – it is our role to see that relevant, timely, specific, and credible information provided by whistleblowers is progressed, their assistance valued, and when applicable, their contributions rewarded.

- We know how much whistleblowers can help: Tips can be submitted online (www.oscwhistleblower.ca) or by mail; we carefully review each and every one. We actively engage with whistleblowers to understand their concerns and to best act on their information. We also work closely with the Enforcement Branch teams who assess and investigate these tips.

- We’re just a phone call away: We maintain a confidential hotline (1-888-672-5553) and are easily accessible to whistleblowers and potential whistleblowers. Although we only accept tips through our online portal or by mail, we are happy to answer questions about the Program and to extend support to whistleblowers on an ongoing basis through our hotline. We have responded to 626 hotline calls.

- We want whistleblowers to benefit too: We know the impact a whistleblower can have on a file. We want to see whistleblowers awarded for the positive results that they help the OSC to achieve. We gather information about whistleblower contributions and give whistleblowers a voice in the award determination process. Paying out awards to whistleblowers is both a sign of the success of the Program and an incentive to encourage future whistleblowers.

- We welcome opportunities to connect: We attribute much of our success to outreach efforts geared toward increasing awareness of the Program and of whistleblowing more generally. For example, thanks to the help of teams across the OSC and to the interest of a diverse range of external organizations, we have reached approximately 7,000 individuals through more than 100 presentations at various industry, professional association and whistleblower advocacy events.

- We always strive to do better: We are increasingly collaborating with other regulators to share learnings and best practices. We are also developing policy tools to promote and encourage whistleblowing. As we move beyond our first five fiscal years, we anticipate taking steps to grow and strengthen our Program.

Awards

Whistleblower Awards

To date, the OSC has paid out $9.33 million in awards to 11 whistleblowers who provided high quality tips resulting in successful, award eligible enforcement actions that, notably:

- Resulted in approximately $48 million in monetary sanctions and voluntary payments ordered against 19 respondents, among other sanctions, holding those responsible accountable

- Included precedent setting cases and cases that enabled the OSC to send clear and timely regulatory messages to specific industries and market players

- Covered the gamut of misconduct, including disclosure violations, registrant misconduct and market abuse – the types of misconduct originally targeted by the Program

- Focused, in nearly every case, on misconduct that would have been difficult to detect without the whistleblowers, which is a key tenet of the Program

- Identified hard-to-detect cases that crossed borders, in which the OSC collaborated with other regulators to achieve successful outcomes

- Involved subjects who primarily consisted of market participants and their directing minds – the core entities and individuals that the OSC regulates.

The Successful Tips

As expected, the tips that resulted in the issuance of an award contained high quality, timely, specific, and credible information. But we can say a bit more.

- Successful tips were more likely to be well developed up front: The submissions that led to awards were typically more comprehensive, detailed and included some form of analysis. OSC Enforcement teams were able to focus investigations and run with the information right from the start. Such well developed tips were submitted by whistleblowers on their own or anonymously with the assistance of counsel who helped whistleblowers analyze their information and clarify their allegations.

- Successful tips didn’t all lead to the opening of a new file: Several tips were incorporated into existing files. Whistleblowers should not feel discouraged from making a submission because they know or think the OSC is already investigating a matter. Whistleblowers’ information can broaden the scope of a file or advance investigations by pointing us to other evidence, by lending their expertise, or by identifying new lines of inquiry.

The Award Recipients

Our analysis of award recipients similarly led to noteworthy insights which we hope will empower more individuals to step forward as whistleblowers.

- Successful whistleblowers came from all corners of the world: While some award recipients were Ontario residents, others were from across Canada, from the U.S. and from overseas. Especially with the increasingly global nature of the capital markets, we know that meaningful tips about potential breaches of Ontario securities law can come from anywhere.

- Successful whistleblowers weren’t always insiders: The majority of award recipients didn’t hold an internal role with the subject entities that they reported about. Rather, they were familiar with the industry or the company, or had skills that enabled them to analyze information to draw out helpful insights.

- Successful whistleblowers provided ongoing support: Investigations are dynamic and can change direction, bringing unexpected challenges. The willingness of a whistleblower to be available to answer questions, to explain nuanced and complex information, to suggest new sources of evidence or to point us to new witnesses, are among the wide-ranging ways that whistleblowers help the OSC to achieve successful enforcement outcomes.

- A number of successful tips were made by joint whistleblowers: Joint whistleblowers often complement each other in terms of access to information or professional knowledge and skills, leading to stronger overall submissions. We believe whistleblowers benefit too, by contributing in ways that play to their strengths and by finding solidarity and support in reporting together.

How Awards Are Determined

Detailed information about the process, the information and whistleblower eligibility requirements, and the factors used to determine the percentage amount of any award can be found in OSC Policy 15-601 Whistleblower Program (the “Policy”). The OWB is involved and available to assist whistleblowers every step of the way. However, it may be helpful for whistleblowers to be aware of the key points below.

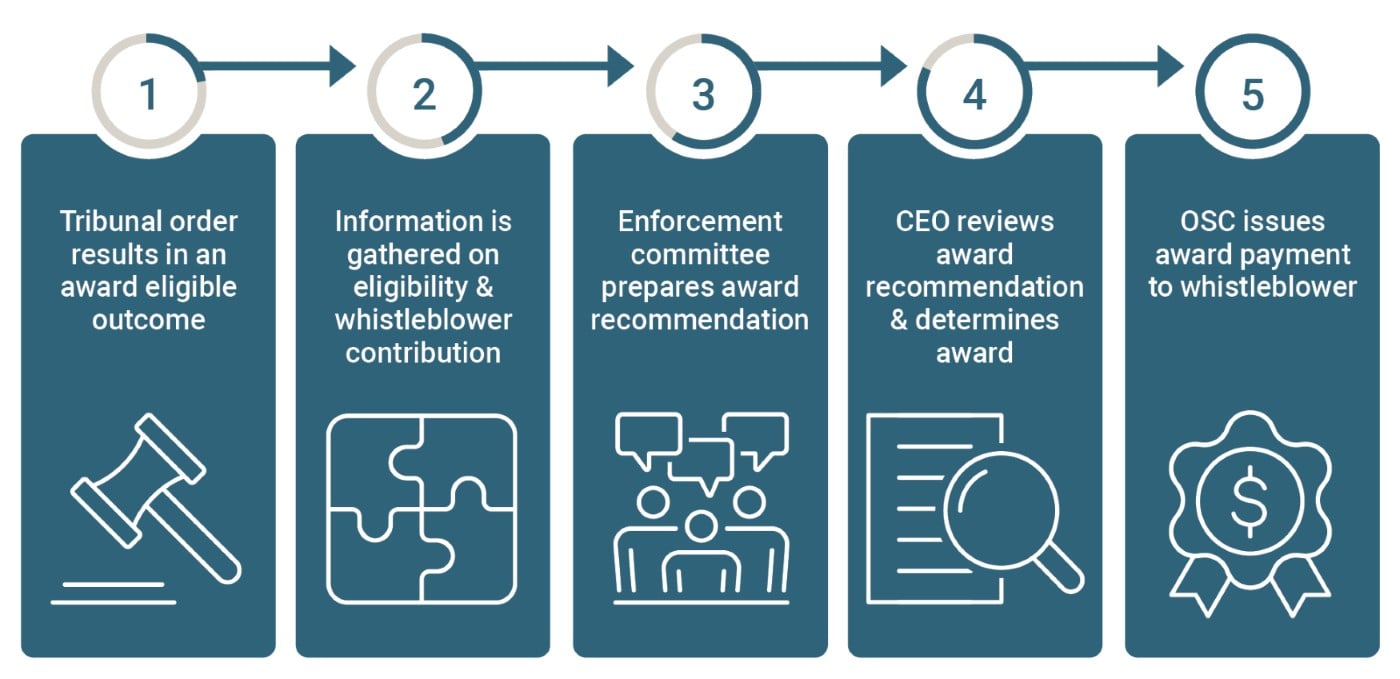

- The award determination process begins once a matter involving whistleblower information results in an order, or multiple orders, by the Capital Markets Tribunal (the “Tribunal”) with total monetary sanctions and/or voluntary payments of $1 million or more.

- Any award issued will range between 5 and 15% of total monetary sanctions and/or voluntary payments, up to a maximum of $5 million.

- Whistleblowers don’t have to monitor Tribunal proceedings. The OWB will contact a whistleblower once a matter involving their tip concludes in an award eligible outcome.

- Whistleblowers will have an opportunity to explain how they contributed to the successful outcome.

- The OWB, the investigation team and an Enforcement committee provide input, but ultimately, our CEO determines whether an award will be issued, the exact percentage used to calculate the amount of the award, and how the award will be allocated among joint whistleblowers.

- The appeal filing period must be expired, or the appeal must be exhausted, before an award payment is made.

A Note About Awards

Whistleblower awards are paid out of funds allocated to the Program, held pursuant to designated settlements and orders. Whistleblowers are never paid using funds that would otherwise be returned to harmed investors.

A distinguishing feature of the Program is that whistleblowers are paid up to $1.5 million of the award amount regardless of whether the OSC collects from the respondents in the matter. Amounts beyond $1.5 million, up to $5 million, are contingent upon collections. To date, all award recipients who were awarded over $1.5 million have received the full amount of their award.

Tips

Tips Submitted by Whistleblowers

As of March 31, 2022, the Program received 797 tips from more than 840 whistleblowers. The vast majority (93%) of tips were received through the OWB’s online portal, a preferred submission method which allows the OSC to process information more quickly.

In addition to the overall number of tips, there are various other metrics the OWB has used to gauge the success of the Program.

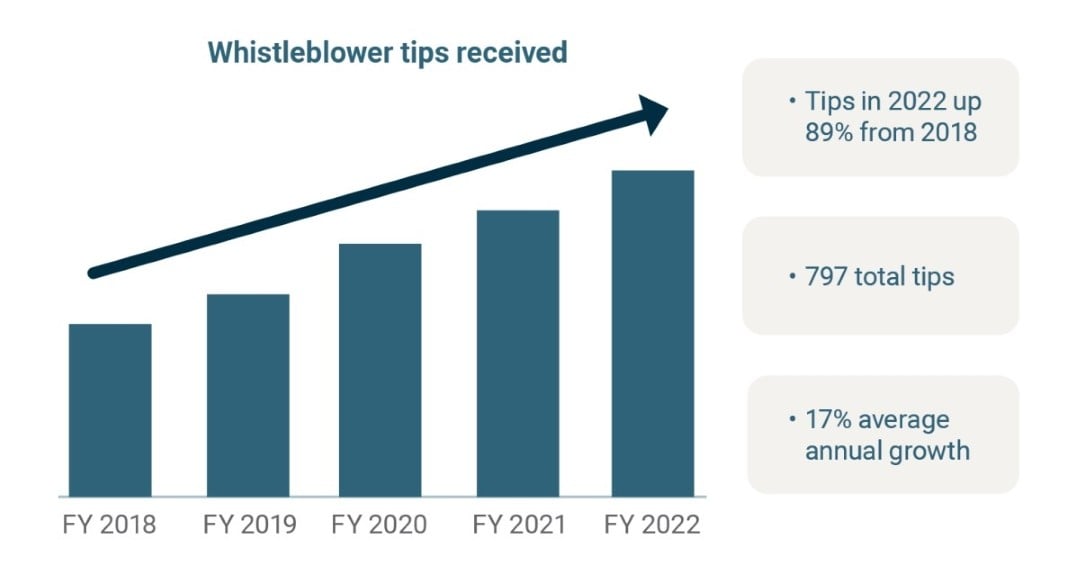

1. The growth in tips

As a new initiative, one of the priorities of the OWB has been to grow the public’s awareness of the existence and the role of the Program and enhance the profile of the Program. The Program experienced an average annual increase in tips of 17%, beginning as of the first completed fiscal year in 2018. Relative to our first fiscal year, the Program generated 89% more tips in 2022. These numbers indicate that promotional and other outreach efforts yielded positive results and demonstrate that there are whistleblowers who are willing to come forward as they become aware of our Program.

We don’t expect whistleblowers to be experts in securities law. We encourage whistleblowers to submit tips on suspected misconduct, which our colleagues in the Enforcement Branch can then assess and investigate for potential breaches.

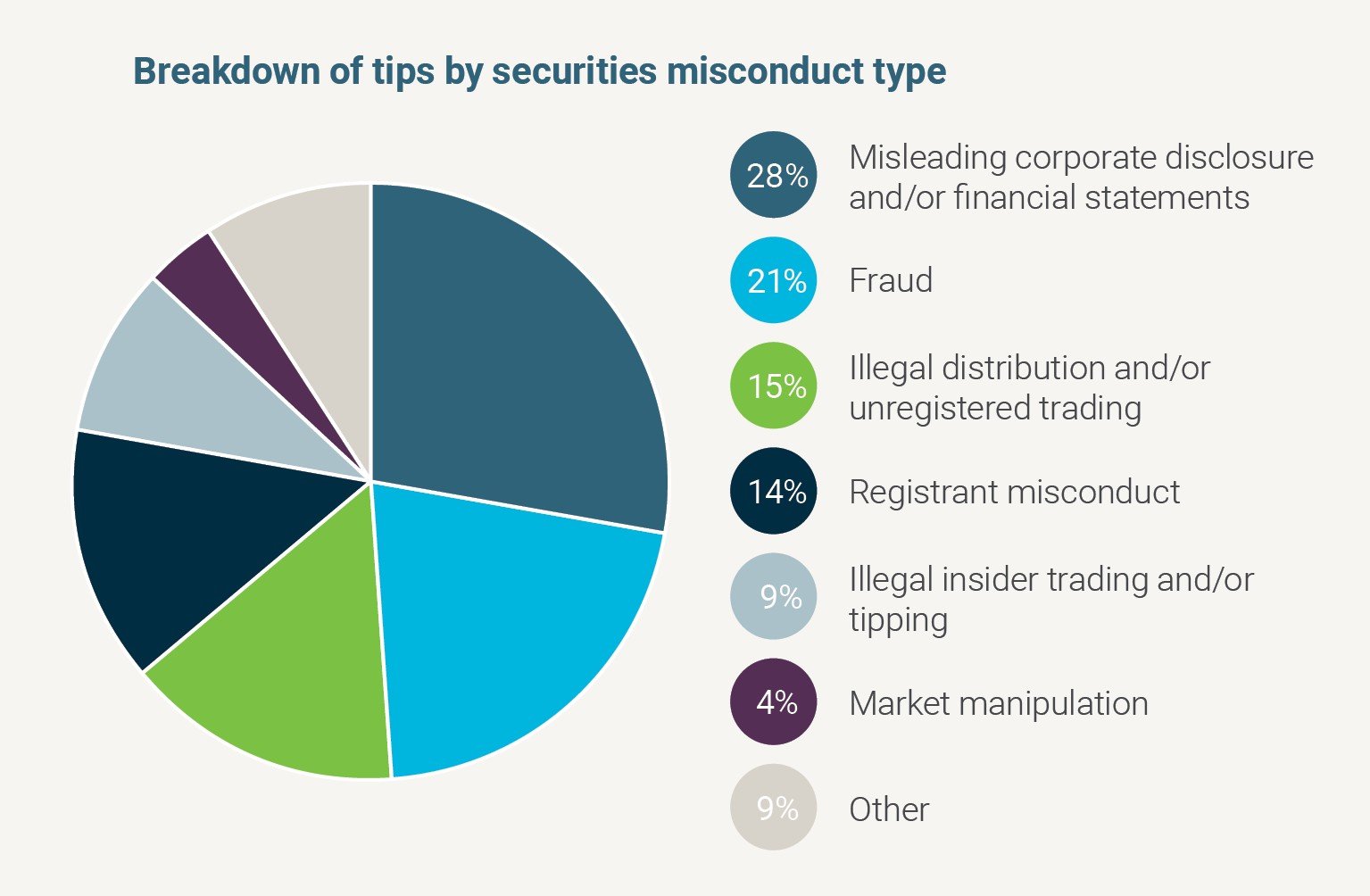

2. Types of alleged securities misconduct

The Program was launched with a view to uncovering complex or hard-to-detect misconduct. In such cases, our Enforcement teams benefit from the involvement of whistleblowers who contribute specialized expertise, knowledge of non-public information, or both. Certain types of misconduct tend to be more complex or hard-to-detect than others. Among these, the numbers show that the Program has successfully attracted tips related to misleading corporate disclosure and/or financial statements and fraud.

But there is also room for growth. In particular, we would like to see more tips related to market manipulation and illegal insider trading. We also observed that, other than tips related to crypto, whistleblower tips generally lagged behind in reporting novel and emerging issues in response to which the OSC may wish to send timely regulatory messages. Current examples of issues of interest include greenwashing, improper tied selling, misuse of algorithms and artificial intelligence, and misconduct by public accounting firms that conduct audits of Ontario reporting issuers.

3. Types of subjects identified by whistleblowers

While the OSC has a broad reach, it is important for us to receive tips about core regulated entities and individuals. Of the securities related tips we received, 50% named public companies and 33% named registrants.

4. The diverse profiles of whistleblowers

Whistleblowers can contribute in many ways, and in that sense, there is no “typical” whistleblower. It is true that whistleblowers often have some role with the subject entity they report about, such as that of an employee or consultant. Their role could afford the whistleblower access to non-public information or a better understanding of that entity’s activities. Indeed, many of our securities related tips were from whistleblowers who indicated having some role and we would welcome even more.

However, whistleblowers need not have any role at all. In fact, such whistleblowers were behind the majority of the securities related tips received. Their submissions can draw upon specialized expertise or experience to provide insights or analysis not apparent on the face of publicly available information. Examples of such whistleblowers include industry analysts, experts such as forensic accountants and geologists, and professional and retail investors.

5. The geographic reach of the Program

Approximately 63% of tips originated from Ontario with another 17% coming from the rest of Canada. The next largest sources of tips (totalling 15%) were the U.S., Australia, the U.K., and China, but tips were received from 30 countries around the world, highlighting the global reach of the Program.

The Program welcomes tips from individuals regardless of where they live. Individuals outside of Ontario, or outside of Canada, may have information related to misconduct linked to Ontario given the global interconnectedness of the capital markets. As a result, the OWB will consider ways to appeal to whistleblowers outside of Ontario, including potentially by better diversifying our outreach efforts across borders. Whistleblowers who report to the OSC may also report their concerns to other regulators.

A Note About Internal Whistleblowers

The Program is designed to complement – not compete with – internal reporting channels. Protections from reprisals extend to those who report internally to their employer, not just to those who report to us, to a recognized self-regulatory organization or to law enforcement. The Policy also aims to eliminate the impact of timing when a whistleblower reports internally first. For award determination purposes, the OSC will consider the timing of the internal report in determining whether a submission was made on a timely basis and, if multiple tips were received from different whistleblowers, which whistleblower reported first. And moreover, awards may be larger when whistleblowers make use of available internal reporting avenues.

Our analysis shows whistleblowers do report internally. Of those whistleblowers who described themselves as current or former employees, or as holding other internal roles, 63% reported their concerns to the entity before reporting under the Program. But 84% of those whistleblowers did not believe, or were not sure, that any steps had been taken to address their concerns. This suggests that market participants and others may benefit from improving how they communicate with whistleblowers to keep them engaged in the internal compliance process.

Protections

Whistleblower Protections

While the issuance of awards can serve as an incentive, in our experience, whistleblowers are also motivated to stop the alleged misconduct. What can make the difference in having whistleblowers come forward is reassuring them that they are protected. With this in mind, the OSC has implemented a number of protections.

Confidentiality

The OSC will make all reasonable efforts to keep a whistleblower’s identity confidential. The OWB provides guidance and training and works closely with Enforcement teams to safeguard identity information. For example, experienced investigators may use indirect or creative avenues to obtain from other sources the same information originally provided by the whistleblower, thus avoiding a direct link of the information back to the whistleblower.

There are exceptions to confidentiality, such as when disclosure is required by law. The most common legally required disclosure is in the context of a contested proceeding when the OSC must disclose relevant information to the respondents.

Protections Against Reprisals

Whistleblowers should be commended and accommodated when coming forward, and yet employees who report potential wrongdoing may shoulder serious and negative consequences intended instead to discourage them, and others like them.

The statutory anti-reprisal provisions make it unlawful to take reprisals against employees for reporting potential breaches of Ontario securities law, whether the report is made to the OSC, a recognized self-regulatory organization or law enforcement, or internally to their employer. Reprisals can include termination, demotion, discipline, and intimidation. Of note, the employee need not be a whistleblower under the Program and the reprisal need only be threatened, not actually carried out, for there to be an offence. Also, under securities legislation, employees who experience workplace reprisals may also be able to bring their own civil case against their employer.

Especially in connection with internal reporting, reprisals undermine the very compliance structures that are intended to prevent and mitigate securities misconduct. The OSC has taken enforcement action in a case where an employee faced reprisal for reporting misconduct to their employer. As stated in the oral reasons for the approval of the settlement in that case: the “Commission will not tolerate … reprisals against whistleblowers.”1 Employers are on notice that the OSC will scrutinize possible reprisals taken against employees.

To further the protections against reprisals, Ontario securities law may void terms of employee agreements, including confidentiality agreements, to the extent they silence employees from sharing information with us, a recognized self-regulatory organization or law enforcement.

1 Coinsquare Ltd. (Re), 2020 ONSEC 19 at para 15.

Looking Ahead

Looking Ahead

The OSC has directly and measurably benefited from whistleblowers who have come in under the Program. Where do we go from here? The OWB is excited to improve on the successes of the Program and to address the challenges we have faced to date. Our current intersecting priority areas are set out below.

- Exploring changes to the Program: With five fiscal years under our belt, and the benefit of analysis conducted in support of this update, we have ideas on how we can grow. We plan to explore amendments to our Policy with the goal of enhancing our recognition of whistleblower contributions, such as by issuing awards in more cases and awarding potentially larger amounts.

- Engaging with experts and stakeholders: While we have some ideas of our own, we’re also on the look out for more. We intend to consult with regulatory partners, market participants, whistleblowing experts and advocates, and others. We are confident that a diversity of perspectives will help us identify additional specific measures that will benefit whistleblowers, attract more tips, and help regulated firms to strengthen their internal compliance.

- Leveraging data analysis on an ongoing basis: As noted, the OWB collected and analyzed data from the tips in an effort to glean insights for this update. We also recently moved to a case management system that will significantly streamline data collection and analysis. With the help of our data scientist colleagues, we will explore ways to capitalize on the available data, to learn more about the incoming tips and the types of whistleblowers who report to us, and to guide substantive changes to the Program and our processes.

- Building on our targeted outreach: We plan to tailor our outreach efforts to address some of the challenges discussed in this update. For example, while we encourage all tips, we also want to better align our efforts to target tips containing non-public or expert information and tips about specific types of misconduct, such as market abuse and novel and emerging issues of interest to the OSC. These issues of interest include greenwashing, improper tied selling, misuse of algorithms and artificial intelligence, and misconduct by public accounting firms that conduct audits of Ontario reporting issuers. Speaking engagements will continue to be part of our outreach toolkit and we invite calls and emails from organizations wishing to discuss potential opportunities.

- Supporting the development of an Ontario whistleblower bar: Many whistleblowers have had questions about obtaining legal help specific to their unique needs. We see key benefits deriving from lawyers who understand the Program and who want to represent whistleblowers. For example, an anonymous submission through counsel provides stronger confidentiality protection, and whistleblowers whose reporting may raise legal issues can obtain tailored advice. We welcome discussions with lawyers who are interested in developing their practice in this area.

Conclusion

Conclusion

Our experiences since the launch of the Program have clearly shown us that there are individuals with actionable information about misconduct in the capital markets. The Program has incentivized these individuals to come forward. This update highlights the significant value that whistleblowers bring in identifying complex or hard-to-detect securities misconduct. The OSC has successfully concluded a number of cases due in large part to the helpful tips submitted by whistleblowers. This has enabled the OSC to hold those who engage in misconduct accountable and to send impactful regulatory messages. As we look to the future, we will leverage our past experiences and successes while we continue to welcome whistleblowers who want to be heard and who should be heard, in our efforts to protect investors.