Proposed Amendments: NI 31-103 - Registration Requirements, Exemptions and Ongoing Registrant Obligations and to Companion Policy 31-103CP Registration Requirements, Exemptions and Ongoing Registrant Obligations

Proposed Amendments: NI 31-103 - Registration Requirements, Exemptions and Ongoing Registrant Obligations and to Companion Policy 31-103CP Registration Requirements, Exemptions and Ongoing Registrant Obligations

NOTICE AND REQUEST FOR COMMENT ON

PROPOSED AMENDMENTS TO

NATIONAL INSTRUMENT 31-103

REGISTRATION REQUIREMENTS, EXEMPTIONS AND ONGOING REGISTRANT OBLIGATIONS

AND TO

COMPANION POLICY 31-103CP

REGISTRATION REQUIREMENTS, EXEMPTIONS AND ONGOING REGISTRANT OBLIGATIONS

June 14, 2012

(2nd Publication)

Cost Disclosure, Performance Reporting and Client Statements

Introduction

The Canadian Securities Administrators (CSA or we) are seeking comment on proposed amendments to National Instrument 31-103 Registration Requirements, Exemptions and Ongoing Registrant Obligations (NI 31-103 or the Rule) as well as Companion Policy 31-103CP Registration Requirements, Exemptions and Ongoing Registrant Obligations (the Companion Policy). We refer to the Rule and Companion Policy as the "Instrument".

The proposed amendments set out requirements for reporting to clients, relating to investment charges, investment performance and client statements. These requirements are relevant to all categories of registered dealer and registered adviser, with some application to investment fund managers.

The proposed amendments would apply in all CSA jurisdictions, and we would expect the requirements for members of the Investment Industry Regulatory Organization of Canada (IIROC) and the Mutual Fund Dealers Association of Canada (MFDA) (together referred to as the self-regulatory organizations or SROs) to be materially harmonized.

The purpose of this Notice is to summarize and explain the significant changes in this proposal (the 2012 Proposal) compared with the proposal published for comment on June 22, 2011 (the 2011 Proposal). We reviewed the 83 comment letters received on the 2011 Proposal, conducted further research on investor behaviour, knowledge and practices, and held additional consultations with industry groups. In formulating the 2012 Proposal, we have taken into account the comments and have undertaken further research on investor issues and consultation with industry. We thank everyone who participated for their input.

Among the key issues to be discussed in this Notice:

• Establishing a common baseline for registrant requirements

• Disclosing trailing commissions and some commissions in fixed-income transactions

• Expanding the account statement into a client statement

• Establishing a method for determining market value

• Mandating the dollar-weighted method of calculating percentage return

• Requiring additional disclosure information for scholarship plans

The comment period ends on September 14, 2012.

Purpose of the proposed amendments and impact on investors

This project, aimed at the disclosure of charges and other compensation and reporting on performance of investments, is an important investor-protection initiative. Research conducted by the CSA shows that investors often don't know the answers to two basic questions about their investments -- (1) What did you pay? and (2) How did your investments perform? We believe that this is a large hole in investor understanding that must be filled. The 2012 Proposal is designed to give investors fundamental information that they can use to assess their investments.

Information about charges related to investments is crucial -- we believe that investors want this information and are entitled to receive it. Charges and other compensation received by a dealer or adviser are often embedded in the cost of a product or buried in the prospectus, or are only briefly referenced when an account is opened. Under the 2011 and 2012 Proposals, this information would be provided at relevant times, such as at account opening, at the time a charge is incurred and on an annual basis.

The same situation exists with reporting on investment performance. If investors receive performance information at all, it is often complex and difficult to understand. We expect that providing investors with clear and meaningful investment performance reporting will assist them in making decisions about meeting their performance goals and objectives, and in evaluating the investment advice they receive from their registrants.

In addition to revising some of the 2011 Proposal, the 2012 Proposal would expand current account statement requirements to provide for a more comprehensive "client statement".

Background

The CSA have been developing requirements in a number of areas related to a client's relationship with a registrant. This initiative is referred to as the Client Relationship Model (CRM) Project. The first phase of the CRM Project included relationship disclosure information delivered to clients at account opening and comprehensive conflicts of interest requirements, and was incorporated into the Instrument when it came into force on September 28, 2009. The 2011 and 2012 Proposals represent the second phase of this project.

Summary of comments to the 2011 Proposals and CSA responses

A summary of comments on the 2011 Proposal, together with our responses, is contained in Appendix A to this Notice.

Contents of this Notice

This Notice is organized into the following sections:

1. Key issues and decisions since the 2011 Proposal

(i) Disclosure of trailing commissions

(ii) Disclosure of fixed-income commissions

(iii) Expanded client statement

(iv) Common baseline requirements for registrants

(v) Percentage return calculation method

(vi) Market valuation methodology

(vii) Issues related to reporting

(viii) Scholarship plans

(ix) Disclosure of new or increased operating charges

2. Investor research and industry consultations

3. Transition

4. Impact on SRO members

5. Authority for the proposed amendments

6. Alternatives considered

7. Anticipated costs and benefits

8. Unpublished materials

9. Request for comments

10. Where to find more information

This Notice also contains the following appendices:

• Appendix A -- summary of comments on the 2011 Proposal, together with our responses

• Appendix B -- draft amending instrument to NI 31-103

• Appendix C -- blackline version of proposed amendments to NI 31-103

• Appendix D -- blackline version of proposed amendments to the Companion Policy

1. Key issues and decisions since the 2011 Proposal

Our review of comments received, combined with further research and industry consultation, has led us to make certain key decisions which are found in the 2012 Proposal.

(i) Disclosure of trailing commissions

We continue to propose that registered firms be required to disclose the dollar amount of trailing commissions they have received. Research shows that most investors are not aware of this type of compensation. When trailing commissions are disclosed, in the Fund Facts document and in a mutual fund prospectus, they are shown as a percentage of fund assets. We believe that this information expressed in dollar terms will provide investors with a better understanding of the fees they pay and the incentives their dealer or adviser receives.

Trailing commissions are typically associated with mutual fund products, but this proposal is not limited to mutual funds. The proposed disclosure would apply to all investment products that pay commissions that are similar in substance to trailing commissions.

This aspect of the 2011 Proposal sparked the largest number of comments, both in letters and our industry consultations. Most industry comments suggested that requiring registrants to disclose the dollar amount of trailing commissions was unnecessary, would be confusing to investors and would result in a sizable cost to industry without providing an overall benefit. We do not agree. We acknowledge the potential costs to industry, but believe that informing the investing public is worth this cost.

Our research suggests that mutual fund investors do not understand trailing commissions, which are a significant component of the ongoing price of a typical mutual fund investment. Research shows that most retail investors

• rely heavily on the advice of their registered dealer when deciding when to buy, sell or hold securities

• do not realize that they are being indirectly charged trailing commissions on an ongoing basis

• do not realize that trailing commissions are paid to their dealer by the investment fund manager of their mutual funds for as long as they stay invested in the fund

Some regulators in other countries are moving to ban compensation models such as those involving trailing commissions altogether. We are not proposing to do so. We believe different dealer compensation models can offer benefits to investors. However, it is essential that there be a significant increase in the transparency to investors of the compensation their dealers or advisers receive. We think this means disclosure that is complete, upfront and understandable to the average investor

A one-time mention in an offering document of trailing commissions expressed as a percentage of the client's investment in a single fund does not meet this test. Adding a compensation report delivered to a client every year that includes the actual dollar amount of all trailing commissions generated by the client's portfolio would go a long way towards the goal of providing real transparency.

The purpose of trailing commissions is to compensate registered dealers (which the mutual fund industry refers to as "advisors") for advice they give their clients. The industry says that there is value in that advice. We agree that advice is valuable. It is our belief that, if implemented, this proposal will help investors understand and assess the costs and benefits of the advice they receive and in so doing, become more informed consumers of that advice. The industry in turn, will benefit from a deepened advisory relationship with its clients.

We acknowledge that investment products sold by financial services firms that are not under CSA or CSA and SRO oversight would not have the same requirement to disclose their compensation. While we are sympathetic, we note that we can only make rules within our jurisdiction. The fact that other segments, including banks and insurance companies, would not be required to comply with corresponding requirements for non-securities investments is not a reason to reduce the level of disclosure that we believe is necessary for securities investors.

Investment fund managers

We understand that currently, dealers and advisers may not have all of the information they would need to comply with the proposed disclosure of the dollar amount of trailing commissions paid to dealers in respect of clients' investments. We therefore propose to require that investment fund managers provide that information to them.

(ii) Disclosure of fixed-income commissions

Investor advocates commented that pricing and compensation in the fixed-income world are difficult to understand and any attempt at providing transparency in this regard would be welcomed. We also heard from those in the mutual fund industry that the proposals related to reporting on embedded compensation were disproportionately related to their products.

We are proposing to require registrants to report the dollar amount of commissions paid to dealing representatives on fixed-income transactions. Industry consultation indicates that these amounts are readily available and are at least a significant part of the incentives for a dealing representative.

- - - - - - - - - - - - - - - - - - - -

Issue for comment

In the interest of making fixed-income transactions more transparent, we invite comments on whether it is feasible and appropriate to mandate the disclosure of all of the compensation and/or income earned by registered firms from fixed-income transactions. This would include disclosure of commissions earned by dealing representatives as well as profits earned by dealers on the desk spread and through any other means.

- - - - - - - - - - - - - - - - - - - -

(iii) Expanded client statement

In the notice of publication of the 2011 Proposal, we indicated our intention to conduct continuing work on what securities should be included in reporting to clients. We discuss the research we undertook in connection with this issue in section 2 of this Notice. It shows that retail investors do not understand the ways in which their investments may be held (i.e. in nominee name or client name), and want regular reporting on all of the securities they own.

The proposed client statement would have three principal sections. The client would see transactions carried out during the reporting period in the first section; reporting on securities held by the registrant in nominee name or certificate form in the second section; and reporting on some securities held in client name in the third section. The third section of the client statement would cover any securities of a client that are held in client name with the issuer of the security where any of the following apply:

• the registrant has trading authority over the security

• the registrant receives continuing payments related to the client's ownership of the security from the issuer of the security, the investment fund manager of the issuer or any other party

• the security is a mutual fund or labour sponsored fund

A client statement only needs to include the sections that are relevant to the client. There is no requirement to include blank sections.

Clients would also receive information about any investor protection fund coverage that applies to the account.

- - - - - - - - - - - - - - - - - - - -

Issue for comment

We understand that all securities transactions are carried out through an account, even when the securities are not held in that account. We have drafted the Rule on this understanding and invite comments on the practicality of this or other approaches to including the securities listed in section 14.14(5.1) in client statements and performance reports.

- - - - - - - - - - - - - - - - - - - -

Exempt-market securities

We recognize that it is not always possible for a registrant to determine reliably whether a client still owns a security that was issued in client name, as is often the case in the exempt market. It is also often the case that a market value for exempt market securities cannot be reliably determined. We do not believe it is in the interests of clients to receive unreliable information. The criteria we have set out for client statements would mean that, in many cases, investors who own exempt market securities would only receive transaction information about those securities in the client statements sent by their dealers.

Investors in the exempt market that we surveyed are generally satisfied with the level of reporting they receive and understand how their investments are held. Our research also suggests that many of these investors do not expect the amount of information about exempt market securities in their client statements to be the same as it is for publicly traded securities if they do not have an ongoing relationship with the registrant that sold them the securities, as is sometimes the case with exempt market dealers.

Book cost information

Under the 2012 Proposal, investors would see the book cost information for each security position included in the client statement, and would be able to assess how well individual securities are performing by comparing their book cost to their current market value. A definition of book cost is included in the Rule. This is a change from the 2011 Proposal, where we had proposed that original cost be provided as the comparator for market value. We made the change because original cost is not adjusted for reinvested earnings, returns of capital or corporate reorganizations. We have found that original cost is not a term that is familiar to most investors and it would be potentially confusing for registrants to have to explain the uses and limits of the original cost measurement to their clients. Book cost is a more widely used measure, familiar already to some investors, that takes the adjustments noted above into consideration

The requirements in section 14.14 [client statements and security holder statements] for investment fund managers in respect of security holders for whom there is no dealer or adviser of record are carried forward with additions to the information to be disclosed that correspond to the requirements for other registered firms.

(iv) Common baseline requirements for registrants

One of the goals of this project is to arrive at a proposal with respect to reporting on charges and other compensation and performance that establishes a common baseline across registration categories. This has not always been the case. In fact, both self-regulatory organizations (IIROC and MFDA) have adopted performance-reporting proposals that were different from each other and different from the CSA proposals. A large number of comment letters addressed this issue, specifically asking that standards be harmonized so that registrants who operate in more than one registration category are not asked to adopt one set of rules, only to have to adopt a different set of rules shortly thereafter. Both SROs have representatives on this project committee, and both have agreed to suspend implementation of their performance-reporting requirements as they await the results of the CSA project.

(v) Percentage return calculation method

We are proposing to mandate that registrants use the dollar-weighted method in calculating the percentage return on a client's account or portfolio, in order to promote consistency and comparability in investor reporting from one registrant to another.

We had previously considered permitting registrants to choose between a time-weighted and dollar-weighted performance calculation method. We have decided to mandate the dollar-weighted method because it most accurately reflects the actual return of the client's investments. This is in keeping with one of the main themes of the project -- allowing investors to measure how their investments have performed.

Time-weighted methods are generally used to evaluate the registrant's performance in managing an account, as the returns are calculated without taking into consideration any external cash flows. These methods isolate the portion of an account's return that is attributable solely to the registrant's actions. The philosophy behind time-weighted methods is that a registrant's performance should be measured independently of external cash flows, because contributions and withdrawals by an investor are out of the registrant's control.

- - - - - - - - - - - - - - - - - - - -

Issue for comment

We invite comments on the benefits and constraints of the proposal to mandate the use of the dollar-weighted method, in particular as they relate to providing meaningful information to investors.

We are not prohibiting the use of the time-weighted method, but if a registered firm uses such a method, it must be in addition to the dollar-weighted calculation.

- - - - - - - - - - - - - - - - - - - -

(vi) Market valuation methodology

The 2012 Proposal sets out a methodology for registrants to use to determine the market value of securities in client reports. This replaces the guidance that was proposed in the 2011 Proposals and would ensure that consistent and reliable standards will apply in client reports.

Proposed section 14.11.1 [determining market value] would apply a hierarchy of methodologies reflecting available information:

• wherever possible, data from a marketplace would be used

• for securities not traded on a marketplace, other market reports such as inter-broker quotes would be used

• where neither of these methods is available, a firm must use observable market data or inputs and failing that, unobservable inputs and assumptions, consistent with International Financial Reporting Standards

• if no price for a security can be reliably determined using these methods, the firm must report that its market value is not determinable and exclude it from calculations of change in value and performance returns

The proposal requires that registrants reasonably believe the market value they are presenting is reliable. This will require the dealer or adviser to exercise some professional judgment.

For illiquid private issuer securities, application of the proposed methodologies may often lead to a good faith determination that market value cannot be reliably determined. We think this is appropriate. In our view, it is better that investors not be misled by an accounting assessment of value when there is in fact no market for a security. Research shows that exempt market investors generally understand that market values may not always be available.

(vii) Issues related to reporting

This section contains information on more changes included in the 2012 Proposal that relate to client reporting.

Client statements

We have amended the Rule with respect to advisers to make it clear that they must deliver client statements and have made it consistent with the requirement for dealers, other than a mutual fund dealer or a scholarship plan dealer, in allowing clients to require monthly statements from advisers.

Investment performance reporting

The 2012 Proposal continues to require firms to provide clients with account performance reporting on an annual basis, as part of, or together with, the client statement.

Performance reports would be account-based, although the 2012 Proposal specifically permits the consolidation of performance reports for more than one account for a client in limited circumstances.

The 2012 Proposal removes net amount invested in performance reports as the starting point for calculating the change in value of a portfolio of securities over time. Instead, we are requiring reporting of the constituent elements of deposits and withdrawals, which we think will be clearer to investors.

Opening market value, deposits and withdrawals

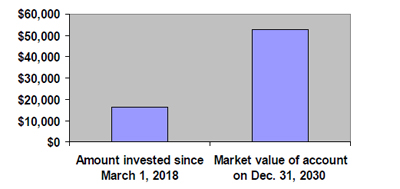

Registered firms would be required under the 2012 Proposal to disclose the opening market value of the account, the market value of deposits and transfers of cash and securities into the account, and the market value of withdrawals and transfers of cash and securities out of the account, for the latest 12-month period and since the inception of the account.

Change in value

The 2012 Proposal provides formulas for calculation of change in value. Essentially, clients would be shown the opening market value of an account, plus deposits into the account, less withdrawals from the account (at market value), which would be compared to the closing market value of the account to determine the change in value of their account over the past 12-month period and also since the inception of the account. This will tell investors how much money they have actually made or lost in dollar terms.

Registered firms can provide more detail about the activity in the client's account that has caused the change in value figure, as described in the Companion Policy.

Sample reports

We are not prescribing the format for the new client reports in the Rule. However, we expect dealers and advisers to present this information in a clear and meaningful manner. They will be required to use a combination of written information with text and tables, and graphical presentation using charts. We encourage registrants that are already providing such information to continue to do so.

We are providing a revised sample investment performance report in the 2012 Proposal that builds on the sample that was published with the 2011 Proposal. We are also including a new sample report on charges and other compensation in the proposed Appendix D of the Companion Policy.

(viii) Scholarship plans

In the notice of publication of the 2011 Proposals and in discussions with industry, we asked whether scholarship plans were sufficiently different that they merited special reporting. We have concluded that they are. In a scholarship plan, the account and the product are essentially the same. They have unique risks and conditions that do not exist for other investment products or portfolios of investments.

In order to highlight the unique risks to investors inherent in these products, we propose to add, at the account opening stage, a requirement for a specific discussion of the consequences to the client of certain circumstances, including the client failing to maintain prescribed plan payments or a beneficiary not participating in or completing a qualifying educational program.

The annual report on charges and other compensation sent to a client who has invested in a scholarship plan would include information about any outstanding front-loaded fees that are a typical feature of scholarship plans.

The investment performance report for a client who has invested in a scholarship plan would provide the relevant information in a scholarship plan:

• how much has been invested

• how much would be returned if the client stopped paying into the plan

• a reasonable projection of the income the client should expect to see if they stay invested to maturity and their designated beneficiary attends a designated educational institution

(ix) Disclosure of new or increased operating charges

We have added a requirement that firms must provide their clients with 60 day written notice of any new or increased operating charge. This is consistent with SRO requirements.

2. Investor research and industry consultations

In addition to the 83 comment letters received in response to the 2011 Proposal, we sought feedback from investors and industry participants to help us to develop the 2012 Proposal. We thank all of those who provided comments and also appreciate the input provided by the SROs during the development of the proposals.

Investor research

From July 2011 through January 2012, The Brondesbury Group conducted research of retail investors and of investors in the exempt market in connection with our continuing work on what securities should be included in client reporting. Some of the findings included:

• retail investors generally do not understand the ways in which their investments are held (i.e., in nominee name or client name) and do not think this should affect the reporting they get

• investors want regular information about all of the securities they own

• expectations may be lower where the investor's relationship with a dealer or adviser is not ongoing

• investors in the exempt market generally are satisfied with the level of reporting they currently receive and have a better understanding

• of how their investments are held (nearly always in client name)

• that a market value for exempt-market securities often cannot be reliably determined

The investor research provided us with useful information on what investors want to receive from their dealers and advisers. The research also identified areas where investors need more guidance or disclosure. The reports on our investor research are or will be available on the websites of CSA jurisdictions (see section 10 of this Notice, Where to find more information).

Industry consultations

Groundwork for the 2011 Proposals included consultations with dealers and advisers to learn about current industry practices and to identify issues and concerns related to providing performance information.

Since the end of the comment period in September 2011, we have held consultation sessions with the Investment Funds Institute of Canada, the Investment Industry Association of Canada, the Portfolio Management Association of Canada and the RESP Dealers Association of Canada (RESPDAC) to explore issues raised in their comment letters.

We thank all of those who participated in these consultations, which helped us to further develop and refine our proposals in many areas.

3. Transition

We originally proposed a transition time of two years for most of the new requirements, taking into account the systems that firms would need to build to accommodate the new processes. Investor advocates suggested that one year was sufficient time to get information on charges and performance into the hands of investors.

However, our consultations with industry have convinced us that the effort required to build systems and train personnel is a substantial undertaking. As a result, we have decided to lengthen the proposed transition period for the implementation of some requirements of the 2012 Proposal to three years. The transition period for some other requirements will be one or two years.

4. Impact on SRO members

The CSA are working with both SROs to materially harmonize the proposed amendments to the Instrument and SRO rules that will be proposed or amended. The SROs currently have performance reporting requirements that differ from each other and those in the proposed amendments. Neither has come into effect yet, and both have been suspended pending finalization of CSA requirements for performance reporting and disclosure of charges and other compensation.

We anticipate exempting the SROs and their members from some or all of the proposed amendments if the SROs adopt materially harmonized requirements.

5. Authority for the proposed amendments

In Ontario, the rule-making authority for the proposed amendments is in the following paragraphs of subsection 143(1) of the Securities Act: 1, 1.1, 2, 3, 5, 7, 8 and 8.1.

6. Alternatives considered

We did not consider alternatives to the use of Rule amendments to achieve the goal of providing more information to investors about charges and other compensation, investment performance and expanded client statements.

7. Anticipated costs and benefits

The anticipated investor protection benefits of the proposed amendments are discussed above. We think the potential benefits to investors would outweigh the costs to registered firms of providing additional disclosure to investors.

8. Unpublished materials

We have not relied on any significant unpublished study, report, or other written materials in preparing the proposed amendments.

9. Request for comments

We welcome your feedback on the proposed amendments. We need to continue our open dialogue with all stakeholders if we are to achieve our regulatory objective of furthering our investor-protection mandate while taking into account the interests of registrants.

All comments will be posted on the Ontario Securities Commission website at www.osc.gov.on.ca and on the Autorité des marchés financiers website at www.lautorite.qc.ca.

All comments will be made publicly available.

- - - - - - - - - - - - - - - - - - - -

We cannot keep submission confidential because securities legislation in certain provinces requires publication of a summary of the written comments received during the comment period. Some of your personal information, such as your e-mail and residential or business address, may appear on the websites. It is important that you state on whose behalf you are making the submission.

- - - - - - - - - - - - - - - - - - - -

Thank you in advance for your comments.

Deadline for comments

Your comments must be submitted in writing by September 14, 2012.

Send your comments electronically in Word, Windows format.

Where to send your comments

Please address your comments to all CSA members, as follows:

Please send your comments only to the addresses below. Your comments will be forwarded to the remaining CSA member jurisdictions.

Questions

Please refer your questions to any of:

10. Where to find more information

The proposed amendments and the research reports are or will be available on websites of CSA members, including:

June 14, 2012

APPENDIX A

SUMMARY OF COMMENTS ON THE 2011 PROPOSAL AND RESPONSES TO COMMENTS

This appendix summarizes the public comments we received on proposed amendments to National Instrument 31-103 Registration Requirements, Exemptions and Ongoing Registrant Obligations (NI 31-103 or the Rule) and Companion Policy 31-103 CP Registration Requirements, Exemptions and Ongoing Registrant Obligations (the Companion Policy) related to cost disclosure and performance reporting as published on June 22, 2011 (the 2011 Proposal). It also summarizes our responses to those comments.

Drafting suggestions

We received a number of drafting comments on the Rule and the Companion Policy. While we incorporated many of the suggestions, this document does not include a summary of the drafting changes we made.

Categories of comments and single response

In this document, we have consolidated and summarized the comments and our responses by the general theme of the comments.

Contents of this summary

This summary is organized into the following sections:

1. Harmonization with self regulatory organizations

2. Cost-benefit analysis

3. Fairness

4. Industry consultation

5. Duplication of disclosure

6. Relationship disclosure information

7. Charges

8. Delivery of reports

9. Client statements

10. Investment performance report

11. Benchmarks

12. Presentation of charges and performance reports

13. Scholarship plan dealers

14. Transition

1. Harmonization with self regulatory organizations

We received comments concerning harmonization with corresponding requirements of the self regulatory organizations (SROs), the Investment Industry Regulatory Organization of Canada (IIROC) and the Mutual Fund Dealers Association of Canada (MFDA), particularly in regard to performance reporting. We believe that all retail clients should have the same information, so harmonization is an important objective.

We are working closely with the SROs to harmonize requirements and to have a single implementation period across registration categories. This will be especially helpful for firms registered in multiple categories, as the same requirements will apply across all categories.

We also received some comments that the regulatory and financial burden on smaller firms required to adopt the new standards will be onerous. We cannot agree to a lower standard for any firms. Retail investors are entitled to the same quality of reporting, regardless of the size of their dealer or adviser (as discussed below, we are prepared to accept that institutional investors may not need or want the same level of reporting).

2. Cost-benefit analysis

Several comment letters predict that it would be expensive for registered firms to implement the 2011 Proposal. We acknowledge that there will be a potentially significant cost to the industry to produce the proposed new documents. However, we believe they represent the addition of fundamental information that investors need in order to make informed investment decisions. We have addressed concerns regarding costs and time by proposing longer transition periods.

There were also suggestions for tiered reporting, with less rigorous reporting to clients with smaller amounts invested. We disagree with this suggestion for several reasons:

• our proposal will provide fundamental information that is beneficial to all retail investors

• if we adopted the commenters' suggestions, it is likely that the majority of retail accounts would fall into the category that would receive less reporting

• investors with smaller amounts invested may be in more need of this information than those in the higher net worth categories

• once systems are in place to meet the proposed requirements, the ongoing cost to produce the new documents should not be significantly different for larger than for smaller accounts

3. Fairness

We received comments suggesting that the mutual funds segment of the securities industry was unfairly singled out under the 2011 Proposal, with their costs unduly emphasized compared with those of competing products. This is not our intention. However, mutual funds have evolved over time into products with complex compensation structures that are potentially difficult to understand. One of our primary goals is to help investors understand all of the costs associated with their investments. If products other than mutual funds are sold with complex compensation structures and dealer incentives, they too will be subject to the requirements to disclose costs for transparency purposes.

There were also some comments to the effect that the 2011 Proposal would result in an uneven playing field, as investment products that do not fall under the jurisdiction of the CSA and SROs will not be subject to similar requirements. These commenters argue that this could cause investors to believe that mutual funds, for example, are more costly than similar products created and sold by financial institutions that are not subject to the securities regulatory regime.

We can only make rules within our jurisdiction. The fact that other segments, including banks and insurance companies, will not be required to comply with corresponding requirements for non-securities investments is not a reason to reduce the level of disclosure that we believe is necessary for those who invest in securities.

4. Industry consultation

Some commenters encouraged us to undertake more industry consultation. As part of our consideration of the comments on the proposals, we held consultation sessions with four industry associations -- the Investment Funds Institute of Canada, the Investment Industry Association of Canada, the Portfolio Management Association of Canada and the RESP Dealers Association of Canada. These sessions were extremely helpful in providing us with a deeper understanding of industry viewpoints, and a more comprehensive look at various issues from the perspective of industry participants. We made several changes following these consultations.

5. Duplication of disclosure

We received a number of comments suggesting that the 2011 Proposal would require disclosures that duplicate information provided in documents that must be delivered to clients under existing requirements, or would use different terminology to describe similar things.

We disagree with the comments that our proposals represent duplication with other disclosure documents, such as point of sale documents. There is in fact little overlap between the reporting requirements in our proposals and existing disclosure requirements. There is a fundamental difference between one-time disclosure to investors about the products they purchase (e.g. in a prospectus or Fund Facts document) and ongoing disclosure about their relationship with the registrant that advises them about their investments in multiple products -- including the costs of the investment portfolio assembled with the registrant's advice and its performance.

Regarding the disclosure of deferred sales charges (DSC) in particular, commenters suggested that this disclosure duplicates information provided in Fund Facts, and is therefore unnecessary. In addition to the considerations set out above, we note that Fund Facts is not currently required to be delivered to investors at the time of the transaction. Our proposals require cost disclosure at the point of sale. The Fund Facts document may be used to comply with the pre-trade disclosure of charges requirement contained in NI 31-103.

We have reviewed the June 2011 Proposals against other disclosure requirements and ensured that the terminology used across the various disclosure documents is as uniform as possible.

6. Relationship disclosure information

Spending sufficient time with clients

There was a request to define how a registrant would spend sufficient time with a client to meet the requirements for disclosure of relationship disclosure information. Whether or not sufficient time has been spent with a client will vary from one situation to the next and depend on a variety of factors requiring the exercise of professional judgement. We believe that evidence in this regard will be the same as for all registrant-client meetings. For example, detailed notes, tapes of telephone calls, email messages and the like may be used as support to demonstrate that sufficient time has been spent with a client. Guidance to this effect has been added to the Companion Policy.

Managed accounts

We agree with a comment that advisers and dealers that charge one all-in fee for the services they provide should not be required to break out the component costs, and have clarified that this is our intention.

Responsibility to report to the client

We agree with the comments that our proposals should make clear which registrant has the responsibility to disclose information to a client in situations where more than one registrant provides services to the client. We have clarified that the registered firm with the client-facing relationship is the entity that has the obligation to provide performance reporting to clients. For example, responsibility for performance reporting rests with an adviser with trading authority over a client's account, and not the dealer who conducts trades at the direction of the adviser and provides custodial services in respect of the account.

Order execution only (discount brokerage) accounts

We received some comments in favour of exempting order execution (discount brokerage) accounts from the proposed new disclosure rules, as well as one comment opposed to doing so. This type of account is provided under an IIROC rule, approved by the CSA, which exempts investment dealers from the usual obligation to assess a trade's suitability for the client. If our proposals come into force, IIROC will amend its rules to materially harmonize. We would consider the applicability of the proposed new disclosure rules to discount brokerage accounts at that time.

Electronic delivery

We confirm that acceptable delivery of disclosure documents includes, with client consent, reports sent by direct email and by enabling clients to access such information on a firm's website, as long as reminders are sent to clients at relevant times. For further guidance on this issue, please refer to NP 11-201 Delivery of Documents by Electronic Means.

Permitted client exemption

Several comment letters noted that the type of reporting desired by, and required for, retail investors is different from that required by institutional clients. Consultations with industry also pointed out that institutions routinely hire consulting firms to analyze their portfolios and the services provided by registered firms. As a result, they are receiving cost and performance information from other sources. We also think institutional investors will generally be in a position to arrange the type and breadth of reporting that they want to receive.

Institutions also often deal with more than one registrant and these relationships are likely to be custodial in nature. Consequently, a given registrant may not have access to all of the information necessary to produce the client reports required in our proposals.

For these reasons, we have revised our proposals to exempt registered firms from the requirement to deliver cost and performance reports where the client is a "permitted client" that is not an individual.

Inappropriate switch transactions

We received a small number of comments from industry arguing that the guidance we propose in regard to inappropriate switch transactions should not be included in the Companion Policy. We disagree. The opportunity to receive a larger trailing commission should not be the reason for a dealer to switch a client's investment from one mutual fund to another. A dealer's incentives should be disclosed to its clients, and the dealer should provide an explanation to the client as to why the switch is appropriate. In contrast, one industry commenter agreed with our position, but argued that guidance would be insufficient to address the problem.

7. Charges

Third party charges

We received comments that third party charges such as custodian fees should not be included in the charges that our proposals would require a registered firm to report to its clients. We agree and have clarified this.

Disclosure of charges at point of sale

We have responded to comments about the difficulty of satisfying the point of sale disclosure of charges requirement in the 2011 Proposal by removing the words "makes a recommendation". Our intention is that clients should receive this disclosure before non-discretionary trades are made. Conversations with clients that involve recommendations but do not end in an instruction to make a trade do not need to include disclosure of potential charges.

It was also suggested that compliance with the proposed requirements for the disclosure of charges could be fulfilled by providing a fee schedule at account opening and/or periodically afterwards. We do not consider this sufficient. It is not realistic to expect clients to retain a fee schedule or to remember the applicable parts of it when considering trading recommendations, and we believe it is appropriate for clients to receive annual reminders about operating charges. The same reasoning applies to our proposed requirement that the annual reports on charges/compensation and performance be provided together. We do not think it is reasonable to expect investors to have all previously disclosed information at their fingertips when making comparisons or assessing performance.

In addition, some of the comments relating to the purported duplication of disclosures discussed above touched on disclosure of charges at point of sale.

Trailing commission disclosure

In their comment letters and in our consultations with industry associations, registered firms made clear their opposition to the disclosure of dollar amounts of trailing commissions. They assert that:

• information about trailing commissions is included in other disclosure documents so providing it in an annual statement would be duplicative

• mutual-fund companies do not currently provide dollar amounts of trailing commissions to registered dealers and advisers that sell their products on a client or account basis, so the selling firm may not be able to make the proposed disclosure

• it will be expensive for mutual-fund companies and the registered firms selling their products to alter their systems to provide the proposed information

• estimated, rather than actual, disclosure of the dollar amounts of trailing commissions associated with clients' investments would be a sufficient and less costly alternative

We have carefully considered this feedback, and we acknowledge that there may be a significant cost imposed on firms. However, we believe that investors need disclosure of the actual dollar amount of trailing commissions paid in respect of their investments to properly evaluate the value of the advice provided by their registered firm. We propose mandating that investment fund managers provide dealers and advisers with the information necessary for them to comply with a requirement to disclose the dollar amount of trailing commissions. Our views on comments about the duplication of disclosure are set out above.

Industry commenters suggested that the proposed disclosure of trailing commissions will be confusing and that investors will think they are being charged twice for the same thing because trailing commissions are paid out of the management fee. We have revised the proposed client disclosure notification in the annual report on charges in order to make clear that trailing commissions do not represent an additional cost to the client.

Deferred sales charges

Some comment letters pointed out that it is not always possible to know how much a DSC will be at the time of a trade. We have revised our proposals to provide that:

• at the time of purchase, the registered firm would have to inform the client that the fund is subject to a DSC, and provide the DSC fee schedule

• at the time of a sale, the registered firm would be allowed to provide an estimate of the DSC, if that is all that is known at the time. The exact amount of the DSC must appear on the trade confirmation.

Yield disclosure

We received one comment letter which stated that some funds include a partial return of capital when calculating yield, which would be misleading. In response, we have included guidance in the Companion Policy clarifying that the return on investment is meant to show returns on capital and not returns of capital.

Disclosure of fixed-income commissions

We received comments that charges embedded in fixed income products should be disclosed in the same way that we propose for other charges. Investor advocates commented that pricing and compensation in the fixed-income world are difficult to understand and any attempt at providing transparency in this regard would be welcomed.

We are now proposing to require registrants to report the compensation paid to dealing representatives on fixed-income transactions. Industry consultation indicates that these amounts are readily available. We realize that this might not be the entirety of fixed-income compensation but this information will nonetheless be helpful to investors. With respect to the disclosure of other compensation embedded in the price of a fixed-income security, we are requiring that a prescribed notification (similar to that in the annual report on charges and other compensation) be included in the trade confirmation.

This requirement would also address comments from some in the mutual-fund industry who suggest that the June 2011 Proposals related to reporting on charges were disproportionately focused on their products.

Sales taxes and withholding taxes

There was a request for clarification of whether sales taxes on charges should themselves be treated as charges. We believe they should and have clarified the proposals in this regard.

We do not consider withholding taxes to be a charge.

Allocation of charges for multiple accounts

It was suggested that the allocation of costs for a client with multiple accounts could be problematic because the client may have set up one account to pay all of the costs, for tax reasons. We have revised our proposals so that a registered firm would have the option of reporting charges on a portfolio basis if the client agrees.

8. Delivery of reports

Integrate report on charges into quarterly client statements

One comment letter suggested that the report on charges be integrated in each quarterly account statement, and not just provided annually. We note that some information on charges is already provided to clients in quarterly statements. We believe that annual disclosure of this information is sufficient. Registrants are always free to provide more than the minimum requirement.

Sending report on charges and performance report with client statement

One comment letter suggested that requiring the proposed annual reports on charges and investment performance with or in the account statement (now "client statement") is overly prescriptive and that the focus should be on ensuring that the information is delivered, rather than on the delivery method. We believe it is important for the information contained in the two annual reports to be included in the same package as the client statement -- either in the same envelope or fully integrated into a single document -- because together, they will allow clients to assess the status of their investments, the costs associated with them, progress toward their investment goals and the value added by their registrant.

Several comment letters requested clarification about the proposed requirement to deliver the annual charges and performance reports every 12 months. We have clarified we are not proposing that the delivery requirement be tied to the anniversary of the opening date of a client's account.

Our revised proposals would permit the first report on charges to be for a period of less than 12 months and would permit the first performance report to be sent more than 12 months, but less then 24 months, after the first trade for a client. These provisions would allow a firm to bring a new client into its regular reporting cycles. A firm also has the option to deliver a performance report for a stub period of less than 12 months during the first year of a client's relationship with the firm, so long as performance is not presented on an annualized basis, which could be misleading to the client.

Report on charges and performance report should be combined

One commenter suggested that annual reports on charges and performance should be combined. For the reasons set out above, we believe they should accompany one another and the client statement. However we do not believe it is necessary that they be combined into a single document. We anticipate they will be combined by some registered firms. But, for others, it may be challenging to change legacy systems to accomplish this. We do not think the benefits of an integrated document would outweigh the extended transition period that would be necessary if we made it a mandatory requirement.

9. Client statements

In the notice of publication of the 2011 Proposal, we indicated our intention to do continuing work on what securities should be included in reporting to clients. We consulted investors, did investor research and reviewed the comments on this subject.

We are proposing to expand the current account statement into a multi-section client statement that will consist of three principal sections:

• the first section would continue to include a list of transactions made for the client during the reporting period

• the second section would include reporting on securities held by a dealer or adviser in a client account in nominee name or certificate form

• the third section would include reporting on any securities of a client that are not held in an account of the dealer or adviser where:

• the registrant has trading authority over the security

• the registrant receives continuing payments related to the client's ownership of the security from the issuer of the security, the investment fund manager of the security or any other party

• the security is a mutual fund or labour sponsored fund

A client statement will only need to include the sections that are relevant to the client. There is no requirement to include blank sections.

The information that is reported to clients would include any investor protection fund coverage that applies to their accounts.

We believe our proposals with respect to client statement reporting will provide clients with more comprehensive information about the securities in their portfolio with a dealer or adviser, regardless whether they are held in an account at the registrant or otherwise. At the same time, we recognize that it is not always possible for a registrant to determine reliably whether a client still owns a security that was issued in client name, as is often the case in the exempt market. It is also often the case that a market value for exempt-market securities cannot be reliably determined. We do not believe it is in the interests of clients to receive unreliable information. The criteria we have set out for client statements would mean that in many cases, investors who own exempt-market securities would only receive transaction information about those securities in the client statements sent by their dealers.

Investors in the exempt market that we surveyed are generally satisfied with the level of reporting they receive and understand how their investments are held. Our research also suggests that many of these investors do not expect the amount of information about exempt-market securities in their client statements to be the same as it is for publicly traded securities if they do not have an ongoing relationship with the registrant that sold them the securities, as is sometimes the case with exempt market dealers.

Valuation

We asked for comments on the guidance proposed for the Companion Policy with respect to determining market value, and whether further guidance was required. In general, comment letters stated the guidance provided now is sufficient.

We are nonetheless concerned that there should be more specific requirements and guidance for determining market value, so that registrants will have greater certainty as to our expectations and investors can expect consistency in reporting.

Our proposals are based on a hierarchy of methodologies reflecting available information. We have included concepts from International Financial Reporting Standards (IFRS) in the valuation of securities for which there is no public market or substitute for a public market such as brokers' quotes. However, the methodology we are prescribing still permits a registered firm to report that a value cannot be determined, if this is the case. In all cases, we expect that a firm will exercise its judgment reasonably, based on measures considered reliable in the industry.

One investor advocate suggested that a registrant should always provide a client with a valuation. Another comment letter suggested that, in situations where a market value cannot be obtained, an estimated market value should be provided as long as it is clearly disclosed as an estimate. This letter stated that such estimates should be subject to independent review by auditors and regulators.

We do not propose requiring a valuation in all circumstances, as we believe it can sometimes be misleading for investors to receive an accounting valuation where no market exists for a security. For illiquid private issuer securities, a registrant may, depending on the facts, arrive at a good faith determination that market value cannot reasonably be determined. Research indicates that exempt market investors are generally sophisticated and understand that information available for exempt market investments may not always be the same as the information available for other investments. Less sophisticated investors may not understand that the accounting estimate may not be an accurate reflection of what they would receive if they sold the security.

Book cost

The 2011 Proposal included a requirement to provide the original cost of securities in the account statement. We asked for specific comments on the issue of permitting the use of tax cost as an alternative to original cost, and invited comments on the benefits and constraints of each approach to cost reporting as they relate to providing meaningful information to investors and their usefulness as a comparator to market value for assessing performance. We received a wide range of comments on this issue.

Some commenters supported original cost with arguments that:

• original cost is more meaningful to investors

• tax cost may not be meaningful or accurate at the account level as taxes are not filed on an account-by-account basis, but rather on a per investment basis

• tax cost may lead to investor confusion

Industry comments in letters and our consultations very strongly supported disclosure of tax cost, arguing that:

• tax cost is the more current and accurate cost number for comparing to market value

• original cost would provide a misleading comparison in situations involving reinvested income, returns of capital and corporate reorganizations

• tax cost is the historical cost figure that is already being provided by many firms and it would be confusing for clients to receive reporting of both amounts

• there would be a significant expense involved in providing original cost

Some commenters suggested that we allow for a flexible approach and permit registered firms to choose whether they disclose original cost or tax cost, and one comment letter suggested that we require the provision of both original and tax cost.

We have considered all the comments and the information gathered from our consultations with industry. We are now proposing a requirement to disclose the "book cost" of securities. Book cost is similar to the concept of tax cost, and will often, but not always, be equivalent to tax cost. We have defined book cost as the total amount paid for a security, including any transaction charges related to its purchase, adjusted for reinvested distributions, returns of capital and corporate reorganizations. We think that the use of book cost as a comparator to market value will provide investors with a meaningful comparison, and give them a more accurate view of the capital appreciation or depreciation of each security position.

We also think that this information will be readily available for most investments in clients' portfolios today, unlike original cost which, for most existing clients, would only have been available in respect of new investments.

10. Investment performance report

Consolidated performance reports

We received several comment letters asking that performance reporting at the portfolio level be permitted where a dealer or adviser constructs a portfolio for a client made up of more than one account, on the basis that it is the performance of the overall portfolio that is most meaningful to the client and reporting on the performance of individual accounts may be misleading.

We also heard from some firms that wish to provide consolidated performance reporting for more than one person (e.g. spouses or family members) as an alternative to performance reporting for each individual. These commenters stated that some clients have integrated investment objectives and strategies whose accounts are managed as a whole and that some clients have asked for consolidated portfolio reporting.

Our revised proposals would allow a registered firm to provide a consolidated portfolio performance report for a client instead of account-by-account reports, if the client consents. However, we do not think it appropriate that a client would only receive performance reporting that is integrated with that of other clients. Under our proposals, if a firm wished to provide consolidated reporting that combines the portfolios of more than one client, it may do so, but only as an additional, supplemental report.

Include other measures, such as comparisons to goals

There was a suggestion that performance reports could include other measures, such as a comparison to the client's investment goals. We do not think it is necessary to prescribe additional information in the performance report but encourage registrants to exceed the minimum requirements and provide additional information to clients, as long as they do so in a way that is understandable to the clients.

Allow more frequent delivery of reports at firms' discretion

Some commenters were under the impression that registrants would not be permitted to provide performance reports to clients more frequently than the proposed requirement for annual reporting. The proposed requirements would set minimum standards, but registered firms are always free to deliver more information than the minimum requirements, including providing more frequent or more detailed reporting.

Content of performance report

We received a number of comments about the content of performance reports that lead us to revisit the subject. We reviewed these comments with reference to the investor research we previously conducted on the content of the sample performance report.

We no longer think the concept of net amount invested will be sufficiently clear to investors. Consequently, our revised proposals do not use net amount invested in performance reports as the starting point for calculating the change in value of a portfolio of securities over time. We now propose to present its constituent elements of deposits and withdrawals.

Under our revised proposals, investment performance reports would include these parts:

(a) Opening market value, deposits and withdrawals

Registered firms would be required to disclose the opening market value of deposits and transfers of cash and securities into the account, and the market value of withdrawals and transfers of cash and securities out of the account, for the latest 12-month period and since the inception of the account.

(b) Change in value

The proposal provides formulas for calculation of change in value. Firms must provide the opening market value of an account, plus deposits into the account, less withdrawals from the account (at market value) to determine the change in the market value of their account over the past 12-month period and since the inception of the account. This will tell investors how much money they have actually made or lost in dollar terms.

Registered firms would be permitted to break out the change in value figure into more detail as described in the Companion Policy.

(c) Percentage returns

Dealers and advisers would be required to provide clients with annualized total percentage returns of their accounts for specified time periods.

Percentage return calculation method

We received comments suggesting that we should prescribe one method of calculating percentage returns for performance reporting purposes in order to promote consistency from one registrant to another. We had previously proposed to permit registrants to choose between a time-weighted or dollar-weighted performance method for calculating annualized total percentage returns. Commenters differed as to which we should require.

We now propose mandating that registrants use the dollar-weighted method in calculating the percentage return on a client's account or portfolio.

The two methods can produce significantly different results, and the differences hinge on whether there are external cash flows. If there are no external cash flows, the two methods will produce identical percentage returns. When there are external cash flows (contributions to, and withdrawals from, an account), there can be a significant difference in the rate of return calculated under the two methodologies.

The dollar-weighted method most accurately reflects the actual return of the client's account, while the time-weighted method shows how much value a registrant has added to the performance of the investor's account. Time-weighted methods are generally used to evaluate the registrant's performance in managing an account. These methods isolate the portion of an account's return that is attributable solely to the registrant's actions. The philosophy behind time-weighted methods is that a registrant's performance should be measured independently of external cash flows, because contributions and withdrawals by an investor are out of the registrant's control.

Given that the two methods are used for different purposes and can produce materially different results, we think there is a compelling reason to choose between the two methods. We have decided to mandate the dollar-weighted method because it most accurately tells an investor how an account has performed. We believe that giving investors information that allows them to measure progress toward their investment goals is essential.

Registrants may provide percentage returns calculated using a time-weighted method in addition to the dollar-weighted calculation. Those who provide both calculations should take care to avoid client confusion over the two calculation methods.

We have expressly invited comment on this issue.

11. Benchmarks

The 2011 Proposal did not include a requirement for registered firms to include benchmark information in the performance reports provided to clients. While the potential usefulness of benchmarks is clear to us, investor research carried out on behalf of the CSA indicated that a significant proportion of investors are likely to misunderstand the use of benchmarks, especially benchmarks that do not directly correspond to their investment portfolio.

In general, industry comments supported this decision.

However, we do not agree with the comment that the use of benchmarks should be discouraged.

The arguments in favour of prescribing benchmarks were best summarized by one comment letter which states that the use of benchmarks will allow retail investors to have a context within which they will be able to assess performance of their account. This letter added that the fact that many investors do not presently understand benchmark information should not suggest that it is not crucial information or that the investor should not be provided with benchmarks. The letter suggested that a discussion about benchmarking between registrants and their clients would provide a good opportunity for investor education.

We continue to propose that the relationship disclosure information provided at account opening should include a general description of benchmarks, the factors that should be considered when using them and whether the firm offers any options for benchmark reporting to clients. We have added guidance in the Companion Policy that encourages firms to include an historical five-year GIC rate in performance reports as an easily understood comparator that shows how a very low-risk investment alternative performed vs securities investments. We propose to keep the Companion Policy guidance on ensuring that any benchmarks a firm chooses to provide are meaningful and relevant to the client and are not misleading.

We have considered comments regarding our proposed requirement that registrants obtain written agreement from clients in order to provide benchmark information, and have decided to remove this proposed requirement. We have concluded that the burdens associated with this requirement would outweigh the benefits.

12. Presentation of charges and performance reports

Prescribe the form of the performance and charge reports

We received a number of comments asking that we prescribe the form of the annual charges and compensation and performance reports. It was argued that a standardized, uniform presentation would be more accessible and meaningful for clients and facilitate comparability year over year and between registered firms.

While we understand this view, we do not believe it is necessary to be that prescriptive. Also, it would be difficult and time consuming to come up with one form of presentation that meets universal approval. We do not think the delay would be warranted. We further understand that individual firms often wish to distinguish themselves with the format and presentation of their reporting.

We are providing sample performance and charge reports, and firms are free to use them as the basis for their reports. As well, third-party service providers may use the sample reports as the basis for offering standardized forms for registrants.

Require that cost and performance reports be in plain language

A couple of comment letters suggested that cost disclosure and performance reporting documents should be written in plain language. We agree and the Companion Policy contains guidance to registrants about their obligation to communicate with clients in a manner that is clear and understandable.

Performance reports should be generated by the firm, not the individual representative

We agree with comments that the firm, not the individual representative, should be responsible for producing performance reports. We have provided clarification in the Companion Policy that it is the firm's responsibility to ensure that its representatives are presenting the reports generated by the firm in an accurate fashion, and not providing misleading information to clients.

13. Scholarship plan dealers

We invited comments on the application of cost and performance reporting requirements for scholarship plan dealers, recognizing that there are unique features to these plans, and asked whether other types of performance reporting would be useful to clients with investments in these plans.

Investor advocates generally support the same cost disclosure and performance reporting requirements for scholarship plans as for all other accounts, reasoning that investors in these accounts require the same amount of information as all other investors. However, we also heard from the RESP Dealers Association of Canada that they believe scholarship plans are significantly different and do merit different performance reporting requirements.

We have concluded that there is no compelling reason to exempt scholarship plan dealers from the proposed requirements for the disclosure of charges. We have also added a specific requirement for the disclosure of unpaid enrolment fees or other instalment fees, as these are a unique feature of scholarship plans.

However, we will require different performance reporting for scholarship plans, which is aimed at providing investors with information we believe matters most for these unique investments:

• how much has been invested

• how much would be returned if the investor stopped paying into the plan

• a reasonable projection of how much the beneficiary might receive if the investor stays in the plan to maturity and if the beneficiary attends a designated educational institution

We are also proposing to add, at account opening, a requirement for a detailed discussion of the risks that are unique to scholarship plan investments, such as loss of earnings if:

• the client fails to maintain prescribed plan payments

• the beneficiary does not participate in or complete a qualifying educational program

14. Transition

The 2011 Proposal provided for an implementation period of two years for most of the proposed new requirements. Most industry comments argue for an implementation period of at least three years, while investor advocates generally stated that one year would be sufficient.

We would like to see the proposed new disclosures in the hands of investors as soon as possible. However, after holding further consultations with industry groups, we are persuaded that the technological challenges posed by the new requirements would be such that it will be very difficult for some of the necessary systems to be developed, tested and implemented in two years. As a result, we are now proposing to mandate a three-year transition period for some of the proposed new reporting requirements.

APPENDIX B

PROPOSED AMENDMENTS TO NATIONAL INSTRUMENT 31-103

REGISTRATION REQUIREMENTS, EXEMPTIONS AND ONGOING REGISTRANT OBLIGATIONS

- - - - - - - - - - - - - - - - - - - -

The proposed amendments in sections 5(l), 13, 16(a), 16(c), 18, and 19 of the amending instrument below are proposed to come into force at dates later than the implementation date for the other proposed amendments. Please refer to section 20. This text box does not form part of the amending instrument.

- - - - - - - - - - - - - - - - - - - -

1. National Instrument 31-103 Registration Requirements, Exemptions and Ongoing Registrant Obligations is amended by this Instrument.

2. Section 1.1 is amended by

(a) adding the following before the definition of "Canadian financial institution":

"book cost" means the total amount paid for a security, including any transaction charge related to purchasing the security, adjusted for reinvested distributions, returns of capital, and corporate reorganizations;

(b) adding the following after the definition of "mutual fund dealer":

"operating charge" means any amount charged to a client by a registered firm in respect of the operation, transfer or termination of an account of the client and includes any sales taxes paid on any of these amounts; and

(c) adding the following after the definition of"subsidiary":

"total percentage return" means the cumulative capital gains and losses and income of an investment over a specified period of time, including realized and unrealized capital gains and losses plus income, expressed as a percentage;

"trailing commission" means any ongoing payment to a registered firm in respect of a security purchased for a client that is paid out of a management fee or other charge to the investment; and

"transaction charge" means any amount charged to a client by a registered firm in respect of a purchase or sale of a security and includes any sales taxes paid on any of these amounts;

3. The title of Division 1 of Part 14 is replaced with "Investment fund managers".

4. Section 14.1 is amended:

(a) by replacing "sections" with "subsection (2), section";

(b) by adding "subsection" before "14.12(5)";

(c) by adding "section" before "14.14";

(d) by replacing "[account statements]" with "[client statements and security holder statements]";

(e) by renumbering it as subsection 14.1(1) and by adding the following after subsection (1):

(2) An investment fund manager for an investment fund, in which a client of a registered dealer or registered adviser has invested, must provide the dealer or adviser with the information concerning charges deducted from the net asset value of securities upon their redemption, and the information concerning trailing commissions paid to the dealer or adviser, that is required by the dealer or adviser in order to comply with paragraphs 14.12(1)(c) and 14.15(1)(h).

5. Subsection 14.2 (2) is amended

(a) by adding "Without limiting subsection (1)," before the word "information";

(b) by deleting the words "required to be";

(c) by adding "that" before the word "subsection";

(d) by replacing "(1) includes all of" with "must include";

(e) in paragraph (b) by replacing "discussion that identifies" with "general description of" and by replacing "a client" with "the client";

(f) in paragraph (c) by adding "general" before "description";

(g) by replacing paragraph (f) with the following: