CSA Mutual Fund Risk Classification Methodology for Use in Fund Facts and ETF Facts - Proposed Amendments to NI 81-102 Investment Funds and Related Consequential Amendments

CSA Mutual Fund Risk Classification Methodology for Use in Fund Facts and ETF Facts - Proposed Amendments to NI 81-102 Investment Funds and Related Consequential Amendments

CSA NOTICE AND REQUEST FOR COMMENT

CSA MUTUAL FUND

RISK CLASSIFICATION METHODOLOGY

FOR USE IN FUND FACTS AND ETF FACTS

PROPOSED AMENDMENTS TO

NATIONAL INSTRUMENT 81-102 INVESTMENT FUNDS

AND

RELATED CONSEQUENTIAL AMENDMENTS

December 10, 2015

Introduction

The Canadian Securities Administrators (CSA or we) is publishing for a 90-day comment period proposed amendments (Proposed Amendments) to:

• National Instrument 81-102 Investment Funds (NI 81-102);

• National Instrument 81-101 Mutual Fund Prospectus Disclosure;

• Companion Policy 81-101CP to National Instrument 81-101 Mutual Fund Prospectus Disclosure;

• National Instrument 41-101 General Prospectus Requirements;{1} and

• Companion Policy 41-101CP to National Instrument 41-101 General Prospectus Requirements.{2}

The Proposed Amendments are part of Stage 3 of the CSA's implementation of the point of sale disclosure project (POS Project).

The Proposed Amendments mandate a CSA risk classification methodology (the Proposed Methodology) for use by the fund manager for the purpose of determining the investment risk level of conventional mutual funds and exchange-traded mutual funds (ETFs) (which are collectively referred to as mutual funds) for disclosure in the Fund Facts document (Fund Facts) as required under Form 81-101F3 Contents of Fund Facts Document and in the ETF Facts document (ETF Facts) as required under proposed Form 41-101F4 Information Required in an ETF Facts Document, respectively.{3}

Currently, the Fund Facts requires a conventional mutual fund to provide its investment risk level based on a risk classification methodology chosen at the fund manager's discretion. We think that a standardized risk classification methodology provides for greater transparency and consistency, which will allow investors to more readily compare the investment risk levels of different mutual funds.

The Proposed Methodology also requires the investment risk level of a conventional mutual fund or an ETF to be determined for each filing of the Fund Facts or ETF Facts, as applicable, and at least annually.

Implementation of this initiative is responsive to comments received throughout the course of the POS Project regarding the need to ensure greater consistency in terms of investment risk level disclosure for mutual funds.

The text of the Proposed Amendments follows this Notice and is available on the websites of members of the CSA.

Background

POS Project

On June 18, 2010, the CSA published CSA Staff Notice 81-319 Status Report on the Implementation of Point of Sale Disclosure for Mutual Funds, which outlined the CSA's decision to implement the POS Project in three stages.

Since July 2011, every conventional mutual fund has been required to prepare a Fund Facts for each class and series. Since June 2014, every dealer has been required to deliver the Fund Facts instead of the prospectus in connection with the purchase of mutual fund securities. Following the publication of final amendments to the POS Project for pre-sale delivery on December 11, 2014, dealers will be required to deliver the Fund Facts at or before the point of sale starting May 30, 2016.

As part of the final stage of the POS Project, two concurrent work streams are under way:

1. ETF summary disclosure document and a new delivery model: proposed amendments published for comment on June 18, 2015 would require the filing of an ETF Facts and delivery of the ETF Facts within two days of an investor purchasing securities of an ETF; and

2. CSA mutual fund risk classification methodology: the Proposed Amendments introduce the Proposed Methodology as a standardized risk classification methodology to be applied in determining the investment risk level of conventional mutual funds and ETFs, which are disclosed in the Fund Facts and the ETF Facts, respectively.

CSA Mutual Fund Risk Classification Methodology

Currently, the Fund Facts requires the fund manager of a conventional mutual fund to provide a risk rating for the mutual fund based on a risk classification methodology chosen at the fund manager's discretion. The fund manager also identifies the mutual fund's investment risk level on the scale prescribed in the Fund Facts which is made up of five categories ranging from Low to High.

An earlier version of the Proposed Methodology was published on December 12, 2013 by the CSA in CSA Notice 81-324 and Request for Comment Proposed CSA Mutual Fund Risk Classification Methodology for Use in Fund Facts (the 2013 Proposal). The 2013 Proposal was developed in response to stakeholder feedback that the CSA has received throughout the implementation of the point of sale disclosure framework for mutual funds, notably that a standardized risk classification methodology proposed by the CSA would be more useful to investors, as it would provide a consistent and comparable basis for measuring the risk of different mutual funds.

A summary of the key themes arising from the 2013 Proposal was published in CSA Staff Notice 81-325 Status Report on Consultation under CSA Notice 81-324 and Request for Comment on Proposed CSA Mutual Fund Risk Classification Methodology for Use in Fund Facts (CSA Staff Notice 81-325).

Substance and Purpose

By mandating the Fund Facts, and eventually the ETF Facts, we intend to provide investors with the opportunity to make more informed investment decisions, by giving investors access to key information about mutual funds, including the investment risk level, in language they can easily understand.

We think that the introduction of a standardized risk classification methodology will help provide investors with meaningful comparisons between conventional mutual funds and/or ETFs.

The 2013 Proposal

In developing the 2013 Proposal, we reviewed the investment fund risk classification methodology developed by the Investment Funds Institute of Canada (IFIC) (IFIC Methodology), which is widely used by fund managers in Canada to disclose a conventional mutual fund's investment risk level in the Fund Facts. We also reviewed how other global regulators approached risk disclosure in their summary disclosure documents. We examined the methodology of the Committee of European Securities Regulators (CESR){4} for measuring and disclosing risk in its summary disclosure document, the Key Investor Information Document.

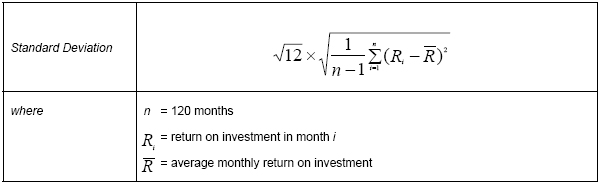

Although standard deviation{5} is used by both IFIC and CESR methodologies, we also examined other risk indicators currently in use and those that could potentially be used to determine and measure risk. We studied 15 indicators, including standard deviation, which can typically be grouped into one of five categories: overall volatility risk measures, tail-related risk measures, relative volatility measures, risk adjusted return measures, and relative risk adjusted return measures.

After a thorough analysis of these 15 indicators, we chose standard deviation as the most suitable risk indicator for the following reasons:

• Its calculation is well known and established;

• The calculation is relatively simple and does not require any sophisticated skills or software;

• It provides a consistent risk evaluation for a broad range of mutual funds;

• It provides a relatively stable but still meaningful evaluation of risk when coupled with an appropriate historical period;

• It is already broadly used in the industry and serves as the basis for the IFIC and CESR methodologies;

• It is available from third party data providers, thereby providing a simple and effective source of data for oversight purposes both by regulators and by market participants (including investors); and

• The implementation costs are expected to be minimal.

We consulted with industry representatives, academics and investor advocates, among others, in Montreal and Toronto in Fall 2013. The majority of stakeholders we spoke with supported the development of a standardized, mandatory risk classification methodology, and agreed with the use of standard deviation as the sole risk indicator to determine a mutual fund's investment risk level on the Fund Facts' scale and proposed ETF Facts' scale. Some industry participants pointed out that the fund managers should be allowed some discretion in order to override the quantitative calculation for risk classification purposes.

Feedback on the 2013 Proposal

We received 56 comment letters on the 2013 Proposal. Copies of the comment letters are posted on the website of Autorité des marchés financiers at www.lautorite.qc.ca and the website of the Ontario Securities Commission at www.osc.gov.on.ca. You can find the names of the commenters and a summary of the comments relating to the 2013 Proposal and our responses to those comments in Annex A to this Notice.

Generally, the majority of commenters supported the development of a standardized, mandatory risk classification methodology, and agreed with the use of standard deviation as the sole risk indicator to determine a mutual fund's investment risk level on the Fund Facts' scale.

Summary of Key Changes to the 2013 Proposal

The following is a summary of the key changes made to the 2013 Proposal.

• Application of Proposed Methodology to ETFs -- s. 15.1.1, NI 81-102

In addition to its application to conventional mutual funds, we extended the application of the Proposed Methodology to ETFs.

• Investment Risk Level -- Item 1 of Appendix F, NI 81-102

Instead of a six-category scale, we kept the CSA five-category scale currently prescribed in the Fund Facts and proposed ETF Facts. We also changed the standard deviation ranges proposed in the 2013 Proposal, which make them consistent with the standard deviation ranges in the IFIC Methodology.

In addition, the investment risk level of a mutual fund may be increased if doing so is reasonable in the circumstances.

• Mutual funds with less than 10 years of history -- Item 4 of Appendix F, NI 81-102

In the 2013 Proposal, we had a list of criteria for an index to be considered acceptable as a reference index and a list of reference index principles. We removed the list of criteria, but we kept the list of reference index principles and amended it.

• Fundamental Changes -- Item 5 of Appendix F, NI 81-102

We added requirements to the Proposed Methodology on how to calculate the standard deviation where there has been a reorganisation or transfer of assets pursuant to paragraphs 5.1(1)(f),(g) or subparagraph 5.1(1)(h)(i) of NI 81-102, or where there has been a change to the fundamental investment objectives of a mutual fund pursuant to paragraph 5.1(1)(c) of NI 81-102.

• Frequency of determining the investment risk level of a mutual fund -- s. 15.1.1, NI 81-102

We changed the frequency of determining the investment risk level of a mutual fund. Rather than monthly, the investment risk level must now be determined upon the filing of a Fund Facts or ETF Facts and, in any case, at least annually.

• Records of standard deviation calculation

We removed the requirement to maintain records for a ten-year period when using the Proposed Methodology to determine the investment risk level of a mutual fund. The requirement in securities legislation to maintain records for a period of 7 years from the date the record was created applies.{6}

Summary of the Proposed Amendments

Application

The Proposed Amendments apply to conventional mutual funds and ETFs.

Overview of the Proposed Methodology

The Proposed Methodology features are:

Risk indicator

10-year (annualized) standard deviation

Note: Calculated on a 10 year historical basis.

Investment risk level and corresponding standard deviation ranges

Low

0 to less than 6

Low to medium

6 to less than 11

Medium

11 to less than 16

Medium to high

16 to less than 20

High

20 or greater

Note: The investment risk level of a mutual fund may be increased if doing so is reasonable in the circumstances. Adequate records should be maintained to document this increase.

Frequency of determining the investment risk level of a mutual fund

(a) for each filing of a Fund Facts or ETF Facts; and

(b) at least annually.

Use of a Reference Index

We propose to allow a reference index as a proxy for conventional mutual funds and ETFs that do not have a sufficient 10-year performance history. We have indicated in the Proposed Methodology that the appropriate reference index should meet, among other things, the following principles:

(a) is made up of one or a composite of several market indices that best reflect the returns and volatility of the mutual fund and the portfolio of the mutual fund;

(b) has returns highly correlated to the returns of the mutual fund;

(c) contains a high proportion of the securities represented in the mutual fund's portfolio with similar portfolio allocations;

(d) has a historical systemic risk profile highly similar to the mutual fund;

(e) reflects the market sectors in which the mutual fund is investing;

(f) has security allocations that represent invested position sizes on a similar pro rata basis to the mutual fund's total assets;

(g) is denominated, in or converted into, the same currency as the mutual fund's reported net asset value;

(h) has its returns computed on the same basis (e.g., total return, net of withholding taxes, etc.) as the mutual fund's returns;

(i) is based on an index or indices that are each administered by an organization that is not affiliated with the mutual fund, its manager, portfolio manager or principal distributor, unless the index is widely recognized and used; and

(j) is based on an index or indices that have each been adjusted by its index provider to include the reinvestment of all income and capital gains distributions in additional securities of the mutual fund.

If a reference index is to be used as a proxy, a mutual fund must disclose in the prospectus a brief description of the reference index, and if the reference index is changed, details of when and why the change was made.

The index or indices used in the management report of fund performance (MRFP) in Form 81-106F1 Contents of Annual and Interim Management Report of Fund Performance can also be used as a proxy to determine the investment risk level of the mutual fund, if the index or indices meet the principles set out in the Proposed Methodology.

Five-category scale

The Proposed Methodology contemplates keeping the CSA's five-category scale, ranging from Low to High, currently prescribed in the Fund Facts and proposed in the ETF Facts.{7} We note that the standard deviation ranges for the corresponding investment risk levels set out in the Proposed Methodology are consistent with the IFIC Methodology. This approach should minimize the changes in investment risk levels for mutual funds resulting from the implementation of the Proposed Methodology, which was a concern expressed by stakeholders.

Anticipated Costs and Benefits

The Proposed Methodology is responsive to comments we received throughout the course of the POS Project regarding the need for a standard risk classification methodology to be used in the Fund Facts. We think that the development of the Proposed Methodology would benefit both investors and the market participants by providing:

• a standard risk classification methodology across all conventional mutual funds for use in the Fund Facts and all ETFs for use in the proposed ETF Facts;{8}

• consistency and improved comparability between conventional mutual funds and/or ETFs; and

• enhance transparency by enabling third parties to independently verify the risk rating disclosure of a conventional mutual fund in the Fund Facts or an ETF in the ETF Facts.

We further think that the costs of complying with the Proposed Methodology will be minimal since most fund managers already use standard deviation to determine, in whole or in part, a conventional mutual fund's investment risk level on the scale prescribed in the Fund Facts. In addition, as risk disclosure changes in the Fund Facts or ETF Facts between renewal dates are expected to occur infrequently, the costs involved would be insignificant.

Overall, we think the potential benefits of improved comparability of the investment risk levels disclosed in the Fund Facts and ETF Facts for investors, as well as enhanced transparency to the market, are proportionate to the costs of complying with the Proposed Methodology.

Transition

Subject to the rule approval process, we anticipate publishing final rules aimed at implementing the Proposed Amendments in the Fall of 2016 (Publication Date). We anticipate the Proposed Amendments will be proclaimed into force three months after the Publication Date (In Force Date). After the In Force Date, the investment risk level of conventional mutual funds and exchange-traded mutual funds must be determined by using the Proposed Methodology for each filing of a Fund Facts or ETF Facts, and at least annually.

Local Matters

Annex G to this Notice is being published in any local jurisdiction that is making related changes to local securities legislation, including local notices or other policy instruments in that jurisdiction. It also includes any additional information that is relevant to that jurisdiction only.

Some jurisdictions may require amendments to local securities legislation, in order to implement the Proposed Amendments. If statutory amendments are necessary in a jurisdiction, these changes will be initiated and published by the local provincial or territorial government.

Unpublished Materials

In developing the Proposed Amendments, we have not relied on any significant unpublished study, report or other written materials.

Request for Comments

We welcome your comments on the Proposed Amendments. To allow for sufficient review, we are providing you with 90 days to comment.

We cannot keep submissions confidential because securities legislation in certain provinces requires publication of a summary of the written comments received during the comment period.

Deadline for Comments

Please submit your comments in writing on or before March 9, 2016. If you are not sending your comments by e-mail, please send a CD containing the submissions (in Microsoft Word format).

Where to Send Your Comments

Address your submission to all of the CSA as follows:

British Columbia Securities CommissionAlberta Securities CommissionFinancial and Consumers Affairs Authority of SaskatchewanThe Manitoba Securities CommissionOntario Securities CommissionAutorité des marchés financiersFinancial and Consumer Services Commission (New Brunswick)Office of the Superintendent of Securities, Prince Edward IslandNova Scotia Securities CommissionOffice of the Superintendent of Securities, Newfoundland and LabradorOffice of the Superintendent of Securities, Northwest TerritoriesOffice of the Yukon Superintendent of SecuritiesOffice of the Superintendent of Securities, Nunavut

Deliver your comments only to the addresses below. Your comments will be distributed to the other participating CSA members.

Contents of Annexes

The text of the Amendments is contained in the following annexes to this Notice and is available on the websites of members of the CSA:

Annex A

--

Summary of Public Comments on the 2013 Proposal

Annex B

--

Proposed Amendments to National Instrument 81-102 Investment Funds

Annex C

--

Proposed Amendments to National Instrument 81-101 Mutual Fund Prospectus Disclosure

Annex D

--

Proposed Changes to Companion Policy 81-101CP to National Instrument 81-101 Mutual Fund Prospectus Disclosure

Annex E

--

Proposed Amendments to National Instrument 41-101 General Prospectus Requirements

Annex F

--

Proposed Changes to Companion Policy 41-101CP to National Instrument 41-101 General Prospectus Requirements

Annex G

--

Local Matters

Questions

Please refer your questions to any of the following:

Me Chantal Leclerc, Project LeadSenior Policy AdvisorInvestment Funds BranchAutorité des marchés financiers514-395-0337, ext. 4463Me Marie-Claude Berger PaquinAnalystInvestment Funds BranchAutorité des marchés financiers514-395-0337, ext. 4479Wayne BridgemanDeputy Director,Corporate FinanceThe Manitoba Securities Commission204-945-4905Melody ChenSenior Legal Counsel,Corporate FinanceBritish Columbia Securities Commission604-899-6530George HungerfordSenior Legal CounselLegal Services, Corporate FinanceBritish Columbia Securities Commission604-899-6690Irene LeeSenior Legal CounselInvestment Funds andStructured Products BranchOntario Securities Commission416-593-3668Viraf NaniaSenior AccountantInvestment Funds andStructured Products BranchOntario Securities Commission416-593-8267Rajeeve ThakurLegal CounselCorporate FinanceAlberta Securities Commission403-355-9032Michael WongSecurities Analyst,Corporate FinanceBritish Columbia Securities Commission604-899-6852Dennis YanchusSenior Economist, Strategy and Operations -- Economic AnalysisOntario Securities Commission416-593-8095Abid ZamanAccountantInvestment Funds andStructured Products BranchOntario Securities Commission416-204-4955

{1} As published for comment on June 18, 2015 in "CSA Notice and Request for Comment: Mandating a Summary Disclosure Document for Exchange-Traded Mutual Funds and its Delivery -- Proposed Amendments to National Instrument 41-101 General Prospectus Requirements and to Companion Policy 41-101CP to National Instrument 41-101 General Prospectus Requirements and Related Consequential Amendments."

{2} See footnote 1.

{3} See footnote 1.

{4} Now the European Securities and Markets Authority (ESMA).

{5} Standard deviation measures how returns vary over time from the average return. It is a measure of volatility of investment returns, i.e., how spread out the returns are from their average, on average.

{6} Section 11.6 of National Instrument 31-103 Registration Requirements, Exemptions and Ongoing Registrant Obligations.

{7} See footnote 1.

{8} See footnote 1.

ANNEX A

SUMMARY OF PUBLIC COMMENTS and CSA RESPONSES ON CSA NOTICE 81-324 and REQUEST FOR COMMENT PROPOSED CSA MUTUAL FUND RISK CLASSIFICATION METHODOLOGY FOR USE IN FUND FACTS

|

Table of Contents |

|

|

|

|

|

PART |

TITLE |

|

|

|

|

Part I |

Background |

|

|

|

|

Part II |

Comments on the 2013 Proposal |

|

|

|

|

Part III |

Issues for comment |

|

|

|

|

Part IV |

Other proposals from commenters |

|

|

|

|

Part V |

List of commenters |

Part I -- Background

- - - - - - - - - - - - - - - - - - - -

Summary of Comments

On December 12, 2013, the Canadian Securities Administrators (the CSA or we) published CSA Notice 81-324 and Request for Comment Proposed CSA Mutual Fund Risk Classification Methodology for Use in Fund Facts (CSA Notice 81-324) which proposed a standardized risk classification methodology for use in the Fund Facts. The text of the CSA risk classification methodology (the 2013 Proposal) is contained in Annex A to CSA Notice 81-324.

The comment period expired on March 12, 2014. We received submissions from 56 commenters and the commenters are listed in Part V of this document. This document only contains a summary of the comments received on the 2013 Proposal and the CSA's responses. We received comments on disclosure items in the Fund Facts but we are not considering any additional disclosure items at this time. Comments received on the 2013 Proposal have informed the development of our current proposal (the Proposed Methodology). We wish to thank everyone who took the time to prepare and submit comment letters.

- - - - - - - - - - - - - - - - - - - -

Part II -- Comments on the 2013 Proposal

|

<<Issue>> |

<<Comments>> |

<<Responses>> |

|

|

||

|

General comments |

Many commenters provided broad support for the CSA's efforts in developing a standardized risk classification methodology, including the objectives and principles set out in the 2013 Proposal. |

We thank all commenters for their feedback. |

|

|

||

|

|

|

We are proceeding with the Proposed Methodology with proposed rule amendments aimed at implementing the Proposed Methodology for use by conventional mutual funds in the Fund Facts and exchange-traded mutual funds (ETFs, together with conventional mutual funds, mutual funds) in the proposed ETF Facts.{1} |

|

|

||

|

|

One commenter, The Investment Funds Institute of Canada (IFIC), acknowledged that although the risk classification methodology developed by IFIC (the IFIC Methodology) was developed only for IFIC's members, they supported making it publicly available for use by non-members as well. |

From our research, we know that the IFIC Methodology is the predominant risk classification methodology currently used by fund managers. Our Proposed Methodology was informed by the feedback we received on the 2013 Proposal. We note that the Proposed Methodology is consistent with the IFIC Methodology in many respects, including the use of standard deviation (SD) as a risk measure, a five-band risk scale, and the SD ranges for the risk bands. We believe this should minimize the changes in investment risk levels for funds resulting from the implementation of the Proposed Methodology. |

{1} See CSA Notice and Request for Comment: Mandating a Summary Disclosure Document for Exchange-Traded Mutual Funds and its Delivery as published on June 18, 2015.

Part III -- Issues for comment

|

<<Issue>> |

<<Comments>> |

<<Responses>> |

|

|

||

|

1. As a threshold question, should the CSA proceed with (i) mandating the 2013 Proposal or (ii) adopting the 2013 Proposal only as guidance for IFMs to identify the mutual fund's risk level on the prescribed scale in the Fund Facts? |

Several commenters emphasized that any risk classification methodology developed by the CSA should be mandated so that investors can readily compare funds knowing that the investment risk levels of mutual funds are determined using a standardized risk classification methodology. One commenter noted that this would assist investors in making informed investment decisions. |

The CSA have decided to move forward with a mandated standardized methodology. In addition to written comments received, the majority of experts we consulted with in Fall 2013 also recommended the use of a standardized risk classification methodology in order to level the playing field between mutual funds, and to eliminate arbitrage. Adopting a standardized risk classification methodology would achieve the objective of comparability across asset classes and mutual fund products. |

|

|

||

|

Are there other means of achieving the same objective than by mandating the 2013 Proposal, or by adopting it only as guidance? |

|

|

|

|

||

|

We request feedback from IFMs and dealers on what a reasonable transition period would be for this. |

One commenter believed that requiring the adoption of a more objective and uniformly applied metric such as SD will help reduce and eliminate "arbitrage" whereby some fund managers may determine the investment risk level by using subjective factors and giving a product a lower rating than it may otherwise warrant based on a more objective assessment. |

|

|

|

||

|

|

While supporting a risk classification methodology prescribed by the CSA, one commenter suggested that where the chosen standard is impractical to implement or when it would lead to meaningless or misleading results, exemption requests should be considered by the CSA. |

|

|

|

||

|

|

Several commenters also commented that it is beneficial for Canadians to have all mutual funds evaluated on a consistent standard. However, these commenters recommended that the CSA consider adopting the current IFIC Methodology as the new mandatory standard. This would accomplish the CSA goal of ensuring consistent determination of investment risk levels across all mutual funds and also have a limited impact on existing Canadian investors and the industry. This would enable a shorter transition period. |

As mentioned above, the 2013 Proposal has several features that are consistent with the IFIC Methodology, including the break points for the various risk bands. We expect that this will help reduce any transition period following the implementation of the Proposed Methodology. We note that the IFIC Methodology, as currently constructed, allows for significant use of discretion by fund managers and has not been consistently applied by fund managers in rating their mutual funds. |

|

|

||

|

|

Two commenters suggested that the IFIC Methodology is widely used by the vast majority of the industry and is easily understood by investors, and therefore, the IFIC Methodology should be adopted to minimize any impact on investors. |

|

|

|

||

|

|

Along the same lines, one commenter suggested that the CSA rule should mandate use of a single methodology which is managed by an industry group with appropriate knowledge and experience to meet the objectives (expanded to include investor interest) as set out in the CSA proposal. The commenter believed that management of guidance relating to the IFIC Methodology through IFIC's Fund Risk Classification Task Force could be expanded to include representatives from different industry segments, with the CSA as observers when the methodology itself is discussed annually. |

|

|

|

||

|

|

One commenter urged the CSA to consider the Committee of European Securities Regulators (CESR), now European Securities and Markets Authority (ESMA), risk classification methodology for adoption in Canada. |

In developing the 2013 Proposal, the CSA analyzed and considered both the IFIC and CESR methodologies. The 2013 Proposal has been amended based on the feedback received and, we believe, best fits the criteria and objectives as outlined in it. It should be noted that the European summary document and risk scale have significant differences compared to our summary documents. In our view, the Proposed Methodology best reflects the reality of our mutual fund market which allows for comparability across mutual funds. |

|

|

||

|

|

Several commenters believed that the CSA should adopt high level principle-based guidance with respect to risk classification rather than mandate the 2013 Proposal. |

The CSA believes that a standardized risk classification methodology is needed to enable investors to make meaningful comparison between mutual funds. We believe that a standardized risk classification methodology will benefit all mutual funds with greater transparency and consistency. It is our view that high-level principle-based guidance could not achieve either of these objectives, as it would allow room for potential manipulation. |

|

|

||

|

|

In one commenter's view, if the risk rating is not subject to fund manager discretion then it should only be guidance. |

|

|

|

||

|

|

One commenter did not recommend adopting the 2013 Proposal as guidance for fund managers, as it would co-exist with the currently used IFIC methodology, leading to non-comparability of information in the Fund Facts. |

|

|

|

||

|

2. We seek feedback on whether the 2013 Proposal could be used in similar documents to Fund Facts for other types of publicly-offered investment funds, particularly ETFs. |

Several commenters were of the view that the same risk classification methodology should apply to all investment funds to ensure a level-playing field for all products. |

We are proposing that the Proposed Methodology be used both for exchange-traded mutual funds and conventional mutual funds. |

|

|

||

|

For ETFs, what, if any, adjustments would we need to make to the 2013 Proposal? |

Some commenters asked how alternative funds, closed end funds, leveraged ETFs or structured products' risk rating would be determined. These commenters questioned that if these non-mutual fund products come out as high risk from a volatility perspective, would comparisons by retail investors be meaningful or misleading? These commenters question whether volatility alone is a sufficient measure of risk for these types of products. There may be high-risk mutual funds that are significantly less risky than a high-risk closed-end fund or alternative fund but this may not be apparent, if they are all bunched in the same risk category. Some commenters suggested that the limitations of volatility risk will likely become evident when trying to expand summary disclosure to other types of funds. |

We note that alternative funds, closed end funds and structured products are not currently required to produce a Fund Facts or an ETF Facts, and therefore, are not required to determine their investment risk level. Therefore, the Proposed Methodology will not apply to such products. Should the disclosure requirements for these non-mutual fund products change, the CSA would consider the applicability of the Proposed Methodology to such products. |

|

|

||

|

For instance should standard deviation be calculated with returns based on market price or net asset value per unit? |

|

|

|

|

||

|

|

Several commenters favoured using market price data rather than net asset value (NAV) in calculating SD for ETFs since it is more reflective of the returns investors are likely to realize. |

The CSA conducted research on this issue to assess whether there are significant differences in the investment risk level of a mutual fund if market values are used versus NAV. While a very small minority of ETFs provided a different risk rating by using market value versus NAV, we note that the larger issue the CSA encountered was consistent availability of market values for thinly traded ETFs or for the advisor series of ETFs. Given the lack of consistent market value data for ETFs, the CSA are proposing that NAV be used to determine investment risk level. |

|

|

||

|

|

Two commenters submitted that whether SD is best measured based on market price or NAV would be best determined by a focussed investigation. One of these commenters urged the CSA to include ETFs in the study before publishing any proposals. |

Using NAV to determine investment risk level also allows for consistency with performance reporting and continuous disclosure requirements for mutual funds. |

|

|

||

|

3. We seek feedback on whether you agree or disagree with our perspective of the benefits of having a standard methodology, as well as whether you agree or disagree with our perspective on the cost of implementing the 2013 Proposal. |

The vast majority of commenters who answered this question agreed with the CSA's perspective on the benefits of having a standard risk classification methodology as it will provide consistency and transparency of disclosure and improved comparability of different mutual funds. |

We agree that a standardized risk classification methodology will enhance transparency and ensure comparability between mutual funds. We have made a number of changes to the 2013 Proposal specifically in response to the comments received regarding the impact on dealers. We have retained the five-category risk scale currently used in the Fund Facts, used SD as the risk indicator and our proposed risk band break points are consistent with those used by the IFIC Methodology. We believe these changes to the 2013 Proposal will minimize the cost of implementation for both fund managers and dealers. |

|

|

||

|

|

Some commenters estimated that many fund managers will have a significantly high percentage of their mutual funds moving to a higher risk classification under the 2013 Proposal, resulting in significant impact for dealers and investors. |

|

|

|

||

|

|

Two commenters added that the cost to fund managers and dealers would be minimized if the IFIC Methodology is adopted since most firms already calculate and review the risk associated with their product in accordance with this methodology. |

|

|

|

||

|

|

A few commenters who agreed with the benefits of having a standardized risk classification methodology suggested that the cost incurred by fund managers is not expected to be significant if current risk categories and risk band breakpoints are not changed. This is because dealers would not have to amend their processes and systems technology to accommodate changes. Changes in the risk classification of funds, however, would require dealers to conduct client account reviews, re-paper client accounts and/or change client portfolio allocations. |

|

|

|

||

|

4. We do not currently propose to allow fund IFMs discretion to override the quantitative calculation for risk classification purposes. Do you agree with this approach? |

Several commenters agreed that fund managers should not be allowed to override the quantitative calculation for risk classification purposes. Two of these commenters suggested that if only a quantitative metric is used to determine the investment risk level, the CSA should allow fund managers discretion to move their risk classification higher only. |

After considering the comments received, the CSA recognize that circumstances could give rise to the need for consideration of qualitative factors in addition to the quantitative calculation in determining the investment risk levels of mutual funds. Therefore, the Proposed Methodology contemplates the use of discretion to classify a mutual fund at a higher investment risk level. |

|

|

||

|

Should we allow discretion for IFMs to move their risk classification higher only? |

|

|

|

|

||

|

|

A few commenters explained that not allowing the use of qualitative factors for the purposes of determining investment risk levels was advantageous as discretion can lead to misleading ratings and defeat the goal of comparability and transparency. One commenter added that if truly extraordinary circumstances prevail, some explanatory disclosure should be allowed. |

However, the CSA are of the view that there should be no discretion to classify a mutual fund into a lower investment risk level. We consider that a mutual fund should be classified, at a minimum, at the investment risk level determined by its SD. |

|

|

||

|

|

Several commenters were of the view that other types of risk, both measurable and non-measurable, may exist. The commenters believed fund managers must retain their discretionary power to classify an investment fund either higher or lower than the risk classification indicated by quantitative results. Doing so allows a fund manager to make full, true and plain disclosure of all material facts relating to the investment funds being offered. By removing discretion completely, the 2013 Proposal removes the responsibility of fund managers to consider other factors that could affect the risk of a fund, and thus reduces the responsibility to disclose all risks. One of the commenters added that the prospectus and Fund Facts impose civil liability so it is crucial that a fund manager is comfortable with the investment risk level assigned to a particular fund. Some commenters believed that a fund manager can document the reasons for deviating from the numerical SD calculation where they do so. |

|

|

|

||

|

|

One commenter supported the inclusion of a qualitative element which could be monitored by a third party, in conjunction with industry input and participation. |

|

|

|

||

|

|

Another commenter told us that it was important that fund managers be provided with discretion when determining the investment risk classification of funds in order to maintain consistency year over year. The commenter added that fund managers should be prepared to defend their use of discretion if it is questioned by the CSA. |

|

|

|

||

|

5. Keeping the criteria outlined in the introduction above in mind, would you recommend other risk indicators? |

Approximately two thirds of the commenters agreed with the use of SD as a comparable measure of risk for the purposes of a risk classification methodology. SD's simplicity, objectivity and relevance in measuring volatility risk are shared by the commenters. Its applicability to a large range of funds was also commended. |

The CSA propose to keep SD, which measures volatility of past returns of the mutual fund, as the risk indicator for the Proposal Methodology. We are of the view that given the available alternatives and the known data obstacles, SD is still the best general risk indicator and one that is useful as a first test to measure overall risk. Our analysis of data from the Canadian fund marketplace revealed that there were relatively few cases where alternative risk indicators signaled a higher risk rating than that indicated by SD. We also note that most risk indicators will tend to underestimate risk where the probability of event risk (i.e. unforeseen event) is high. |

|

|

||

|

If yes, please explain and supplement your recommendations with data/analysis wherever possible. |

|

|

|

|

||

|

|

While commenters generally supported the use of SD, some remained concerned with over-simplifying mutual fund risk to a single, quantitative measure. The commenters suggested that when asked about risk, many investors indicate their greatest concern is the risk of loss of capital, which is not captured by SD. |

|

|

|

||

|

|

|

Before the CSA decided on SD as its preferred risk indicator, we conducted a thorough study of 15 other indicators. The other indicators studied included, among others, risk/return indicators, (such as the Sharpe Ratio, the Information Ratio and the Sortino ratio), tail risk indicators (such as Value at Risk (VAR), CVAR) and performance indicators (such as worst period). Our study included an assessment of how well each of these indicators met our principles for the development of the Proposed Methodology. Further, we also assessed if any of these indicators added further value as a secondary indicator in addition to using SD as a primary indicator. |

|

|

||

|

|

|

To perform this analysis, we looked at data from mutual funds that were available in Canada from 1985 to 2013. We noted that these indicators tended to have significant correlation with SD. In other words, if VAR, as an example, indicated high risk for a particular fund, SD would have a similar higher risk indication. In only a small minority of instances (less than 2%) did SD tend to underestimate risk relative to another indicator such as VAR. Even in such instances, these funds tended to be small/mid cap equity and resource/precious metals equity funds, which already tend to be classified in the Medium to High or High risk category based on the SD calculation. We, therefore, concluded that SD did as good a job as any other indicator, and the additional complexity and regulatory burden associated with adding a secondary indicator was not justified. |

|

|

||

|

|

A few commenters opposed the use of SD as an indicator of risk disclosure in the Fund Facts. They felt that SD is not easily understood in practical terms by most retail investors. They wondered if retail investors will understand that a fund with a high SD does not necessarily mean that such a fund is worse than another with a low SD. |

Since the creation of the Fund Facts, SD has been widely used to determine the investment risk level of a mutual fund on the risk scale in the Fund Facts. While investors may not be able to understand the mathematical calculation of SD, there is a plain language description of volatility in the Fund Facts. The investment risk level, along with other key information in the Fund Facts, such as the suitability section will help investors make an informed investment decision. |

|

|

||

|

|

Several commenters believed that SD requires some knowledge of mathematical statistics to be employed effectively for informed decision making. Such approach is much too complex to be used by retail investors, no matter how well described in plain language. |

Further, in the Fund Facts, under the risk scale, there is a cross reference to the Risk section of the mutual fund's simplified prospectus for more information on risks. |

|

|

||

|

|

Another commenter was concerned that SD is an insufficient, inappropriate and not well-understood measure of risk. Additional descriptions of risk exist and are preferable as they propose a table/graph of worst-case and best-case historical return scenarios that can be used to demonstrate fund volatility. According to this commenter, the Fund Facts' disclosure of volatility is presented and used as though it gives an indication or assurance of future variability/risk. The commenter encouraged the CSA to do exhaustive cognitive and behavioural testing to determine what patterns of variation a risk-averse investor would view as risky before finalizing the statistical models, the classifications and the ranges that have been proposed. In the commenter's opinion, investors understand risk in terms of potential dollar losses in their portfolio more easily than percentage returns. In the commenter's experience most investors can understand graphs and tables far more readily than calculations such as SD. |

The CSA disagrees with the commenter. Past volatility is not presented in the Fund Facts as being an assurance of future variability. Under the section "How risky is it?" in the Fund Facts, it states "This rating is based on how much the fund's returns have changed from year to year. <<It doesn't tell you how volatile the fund will be in the future. The rating can change over time. A fund with a low risk rating can still lose money>>." |

|

|

||

|

|

|

Under the same section, there is a cross reference to the Risk section of the mutual fund's simplified prospectus for more information about the risk rating and specific risks that can affect the mutual fund's returns. |

|

|

||

|

|

According to one commenter, SD on its own does not tell us anything about the uncertainty of price movements (be it their size or their probability of occurring) or the uncertainty of events surrounding price movements, or whether it is a good or a bad risk to assume. Therefore relying on SD as the sole information point about risk does not inform the investor about the actual range and impact of outcomes that could affect them. |

|

|

|

||

|

|

Two commenters were of the view that looking at volatility risk alone can be misleading and lead to sub-optimal decisions for the investor. As a result, some risk/return metric disclosure should be added as a supplement to any type of risk disclosure. Metrics such as Sharpe ratio and Information ratio would provide additional clarity to how effectively fund managers use risk and how consistent their returns are. These commenters added that the Sharpe ratio and the Sortino ratio are far more meaningful as they measure risk adjusted returns. The Sharpe ratio allows an investor the ability to quantify an investment's risk relative to its investment performance in order to decide if a financial product is worth the risk. One of these commenters noted that the Sortino ratio is a more meaningful measure of investment risk than SD as the Sortino ratio is similar to the Sharpe ratio, but its denominator focuses solely on downside volatility, not overall volatility. It is only downside volatility that is relevant and unwanted. This is a serious flaw in the calculation of both SD and the Sharpe ratio as a measure of risk. The Sortino ratio is a more meaningful measure of investment risk than SD. |

Please see response above which describes the CSA's analysis in regard to consideration of other metrics. |

|

|

||

|

|

The commenter recommended that investment risk levels be measured based on portfolio holdings, thus reflecting the inherent risks. Should the CSA proceed with mandating a standardized risk classification methodology, the commenter strongly recommended that it be based on a blend of measures that includes Conditional Value at Risk (CVAR) and a holdings-based approach. The commenter believed that the use of the SD measure as the sole measure of risk does not serve the best interests of the investors. |

Please see response above which describes the CSA's analysis in regard to consideration of other metrics. |

|

|

||

|

6. We believe that standard deviation can be applied to a range of fund types (asset class exposures, fund structures, manager strategies, etc.). |

Several commenters agreed that a uniform measure should be applied across all investment funds. |

We thank commenters for their feedback. |

|

|

||

|

Keeping the criteria outlined in the introduction above in mind, would you recommend a different Volatility Risk measure for any specific fund products? |

Two commenters submitted that given the structured nature of target date funds, balanced funds and T-class series of securities, a different approach to articulating risk is required for these types of funds. |

|

|

|

||

|

Please supplement your recommendations with data/analysis wherever possible. |

In regard to target date funds, commenters indicated that one of the associated risks is a premature movement to a safe mode (a "triggering event") which happened in 2008 -- such a risk is not captured by SD. Further, life cycle funds are designed such that their risk level changes over time, so a backward looking risk measure may not be a suitable indicator of product risk as it may overstate the risk of the fund at a point in time. |

In order to address concerns relating to overstatement of investment risk levels for target date funds, we performed an analysis of the volatility profile of current target date funds. The analysis demonstrated that target date funds closer to their target date did indeed have lower SD, however, the difference in SD over the life cycle of target date funds was relatively small owing primarily to the inherent diversification attributes of products. Thus, we expect that many target date funds will remain in the same risk band over the course of their existence and those that do shift will not shift by more than one risk band, and even then very slowly. Therefore, the CSA did not propose a change to the Proposed Methodology since overstatement of risk for target date funds was not supported by the data studied. |

|

|

||

|

|

In regard to balanced funds, commenters noted that constant changing of asset mix can be a challenge in regard to risk classification. Similarly, some commenters pointed to tactical asset allocation funds as a challenge for the proposed risk classification methodology since the underlying statistical distribution is constantly changing for such funds. |

For balanced funds and T-series of securities, the 2013 Proposal allows for discretion to use a reference index as a proxy for missing information that best fits the risk profile of such funds. The reference index can be a single index or a blend of indices that best fits the risk profile, and therefore, should allow an index to be customized to the risk profile of the fund. |

|

|

||

|

|

Similarly, commenters also pointed to T-series of securities that return capital each month, suggesting that finding an appropriate index for the purposes of backfilling information may be difficult. Further, such mutual funds run the risk of disintegration if payouts are too steep, and such a risk is not captured by SD. |

The Proposed Methodology requires that the investment risk level of a mutual fund be determined by using the oldest series of the mutual fund, unless the oldest series has a different profile or materially different terms associated with it. As such, where appropriate, the investment risk level of currency hedged series of a mutual fund should be determined separately if it is materially different to the other series of the mutual fund. |

|

|

Commenters also suggested that currency hedged funds complicate return distribution profile and fund behavior/volatility, thus a different approach may be needed for currency hedged funds, such as a separate SD calculation for the hedged and unhedged series of a mutual fund. |

|

|

|

||

|

|

One commenter noted that ETFs and exempt funds by their nature are different products. The commenter supported investigating the possibility of using a different volatility risk measure for specific fund products. |

As noted above, we are proposing that the Proposed Methodology be used both for exchange-traded mutual funds and conventional mutual funds. |

|

|

||

|

|

One commenter agreed that a risk classification methodology that is based on SD of fund returns is a good measure of a fund's risk. However, fund managers should have the flexibility to supplement SD with other measures that may be more tailored to the specific fund. A good measure for a fixed income fund, for example, would be duration, which is a measure of sensitivity to interest rate risk, added this commenter. Another possible measure, for a fund that uses derivatives particularly, would be VAR. |

Please refer to our responses under question 35 in regard to applicability of other risk measures in addition to SD. |

|

|

||

|

7. We understand that it is industry practice (for IFMs and third party data providers) to use monthly returns to calculate standard deviation. Keeping the criteria outlined in the introduction above in mind, would you suggest that an alternative frequency be used? |

Commenters agreed that using a mutual fund's monthly returns is appropriate. Commenters added that monthly data is traditionally used to assess risk and return data in the mutual fund industry. |

Given the feedback from commenters, the CSA are keeping the monthly returns with reinvestment of all income and capital gains distributions for the Proposed Methodology. |

|

|

||

|

Please specifically state how a different frequency would improve fund risk disclosure and be of benefit to investors. |

|

|

|

|

||

|

Please supplement your recommendations with data/analysis wherever possible. |

|

|

|

|

||

|

8. Keeping the criteria outlined in the introduction above in mind, should we consider a different time period than the proposed 10 year period as the basis for risk rating disclosure? |

Several commenters agreed with the proposed 10 year period as the basis for risk rating disclosure. One commenter added that a 10 year period has the effect of attenuating sudden changes in financial markets and helps smooth out extreme fluctuations which are often temporary. |

After reviewing fund data for the Canadian fund marketplace, we are of the view that the use of ten-year performance returns is preferable to both shorter (3, 5, 7 years) and longer time periods (15, 20, 25 years) as it strikes a reasonable balance between indicator stability and data availability. |

|

|

||

|

Please explain your reasoning and supplement your recommendations with data/analysis wherever possible. |

|

|

|

|

||

|

|

Although one commenter supported the use of longer-term performance data to calculate SD, the commenter suggested that this be modified to 10 years or as far back as required to include at least one bear market for the mutual fund or its relevant benchmark. |

We also note that the CSA studied data of available mutual funds and various indices using varying time periods ranging from three, five, seven, ten and fifteen years for the calculation of the SD. We noted that three, five and seven year SD results caused frequent risk band changes for a number of funds resulting in significant costs for fund manufacturers as well as dealers. Compared to such time periods, a 10 year SD calculation was a more stable indicator of risk. We note that moving from a 10 year SD calculation to a 15 year SD calculation only provided minimally increased stability as a risk indicator, and any benefits from moving to a time period longer than 10 years would be offset by the costs of gathering data for a longer time period. We also note that a 10 year time period typically tends to catch at least one downturn in economic and financial markets. |

|

|

||

|

|

One commenter agreed with the proposed 10 year period as the basis for comparison of SD across mutual funds. However, the commenter was of the view that a 10-year period would be insufficient for measuring risk of loss. There are long periods of time where capital markets have delivered strong performance with limited downside. While a rolling 10-year measurement period will not significantly impact the SD calculation, it could significantly impact the worst and best returns. For risk of loss to be a stable indicator, it requires a static start date, with as long a time period as possible (for example, starting from 1960). |

|

|

|

||

|

|

Some commenters disagreed with the use of a 10 year time period for the purposes of the SD calculation. One commenter noted that the average lifespan of a mutual fund is less than 6 years, while studies indicate that the average holding period of a mutual fund is less than 5 years and shrinking. This indicates that a typical investor will not experience the smooth, consistent ride that a 10 year SD implies, but will experience the swings in volatility that occurs over a 5 year period. The commenter conceded that using the 10 year period will ensure that mutual funds are not frequently switching risk categories. |

In regard to comments about the average life of a mutual fund and the average holding period of a mutual fund, we note that the investment risk level is intended to capture the volatility risk of a particular mutual fund and a particular asset class rather than providing an assessment of the risk profile of an average mutual fund investor. |

|

|

||

|

|

One commenter felt that the use of a 3-year annualized SD model would decrease the ability of funds to obfuscate their risk rating and allow for better comparability across all mutual funds, as more funds would possess this complete return history. Another commenter suggested that the CSA should consider whether it is better to use a 7-year SD if this presents fewer incidences of needing to use a reference index as a proxy and will, therefore, be subject to less manipulation. |

|

|

|

||

|

|

One commenter thought that using a 10-year history to calculate the SD for an investment fund may result in an investment fund being classified as more volatile than it actually is if there are two volatile periods i.e. at the beginning and at the end of the 10 years. The commenter believed that using three-to-five-year historical data would be the appropriate timeframe as this represents the average time that an investor holds securities of an investment fund. |

|

|

|

||

|

|

Several commenters did not believe that a 10-year annualized SD provides any more information than the 3 or 5 year annualized SD presently prescribed under the IFIC methodology. These commenters recommended adopting 3 or 5 year annualized SD similar to the IFIC Methodology. |

|

|

|

||

|

|

To the best of another commenter's knowledge there is no research indicating that 10 years is a better indicator of a market cycle versus 5 years or 15 years, other than that the longer periods smooth results. |

|

|

|

||

|

|

One commenter noted that requiring the presentation of a 10 year measure of volatility (real or simulated) is contrary to the CFA Institute's Global Investment Performance Standards (GIPS). The commenter suggested that rather than selecting one risk category for a fund, the volatility of the fund be presented over time in graph format by showing, for each period, the annualized three year SD. This commenter recommended shortening the period to 5 years, similar to the CESR Guideline. |

We note that the purpose of the GIPS presentation is entirely different from the purposes of presentation of risk classification level in the Fund Facts or ETF Facts. GIPS performance presentation aims to ensure fair presentation of investment performance results of money managers, rather than an assessment of the risk level of their portfolios. |

|

|

||

|

9. Keeping the criteria outlined in the introduction above in mind, should we consider an alternative approach to the calculation by series/class? |

A few commenters agreed that a consistent approach should be applied across all series/class of a mutual fund. |

Our analysis concluded that the variance of the SD calculation is small across series/classes of securities of the same mutual fund. For this reason, and after considering the comments received, we are not requiring that the investment risk level be determined for each series/class of securities of a mutual fund, unless a series/class of securities possesses an attribute that could result in a different investment risk level than that of the mutual fund. In such instances, the investment risk level should be determined for that particular series/class of securities. An example of such an instance would be a currency hedged series/class of securities of a mutual fund which could have materially different performance returns relative to the other series of the mutual fund which may result in a different investment risk level. |

|

|

||

|

Please supplement your recommendations with data/analysis wherever possible. |

One commenter did not believe that it is necessary to apply the 2013 Proposal to individual series/classes of a mutual fund. Each series/class of a mutual fund has identical fund holdings and therefore bears equivalent levels of risk. While it is true that returns vary by series/class, differences in SD are slight to non-existent. |

|

|

|

||

|

|

Several commenters submitted that the fund manager should use the total returns of the "oldest" mutual fund series/classes as the basis for his/her volatility risk calculation across all the mutual fund series/classes having the same strategy as the volatility risk remains the same. Two of these commenters added that this should be the case unless an attribute of a particular fund series/class would result in a materially different level of volatility risk (e.g. currency hedging), in which case, the total returns of that particular mutual fund series/class must be used. |

|

|

|

||

|

|

One commenter told us that risk should be calculated and reported separately for different series of a mutual fund's units (for example, D and F class series) given that the greater the fees, the greater the risk of loss while SD does not change. |

|

|

|

||

|

10. Keeping the criteria outlined in the introduction above in mind, do you agree with the criteria we have proposed for the use of a reference index for funds that do not have sufficient historical performance data? |

A few commenters agreed with the use of a reference index in the absence of sufficient historical statistical information. One commenter not only agreed with the use of a reference index for the purpose of backfilling missing data but suggested that funds that have a 10 year history should provide data corresponding to a reference index similar to their funds. In so doing, investors could compare a fund's volatility with the volatility of its reference index. |

The CSA are aware that the majority of mutual funds do not have 10 years history required for the Proposed Methodology. To address this issue, we have proposed the use of a reference index as a proxy for the missing data. The Proposed Methodology sets out criteria for what constitutes an appropriate reference index to be used as a proxy for the purposes of backfilling missing data history. |

|

|

||

|

Are there any other factors we should take into account when selecting a reference index? |

|

|

|

|

||

|

Please supplement your recommendations with data/analysis wherever possible. |

|

|

|

|

||

|

|

One commenter was of the view that using a reference index is not an appropriate method of representing true expected volatility of any mutual fund and may lead to unintended consequences. When the performance of a reference index is compiled with the historical returns of a mutual fund, it does not allow investors to determine if the fund manager's active management style adds to the volatility of the fund or whether that is a function of its reference index. The commenter believed that permitting a fund manager to choose a reference index as a proxy will insert a measure of uncertainty and discretion into the calculation. In order to reduce some of the discretion, the commenter recommended that if use of a reference index as a proxy is permitted, fund managers should also be required to perform the calculation based only on the actual returns of the mutual funds and show that information alongside the reference index, and explain (if there is a difference) how the mutual fund would fit in a different risk band if the actual performance history and not using the reference index as a proxy for the missing returns over a 10 year period. |

The Proposed Methodology requires the selection of a reference index that reasonably approximates the volatility and risk profile of the mutual fund. The Proposed Methodology also sets out criteria for selecting and regularly monitoring the appropriateness of the reference index. We do not propose to add the suggested data points to the Fund Facts at this point as this is only likely to add confusion, in particular, for retail investors. |

|

|

||

|

|

Two commenters suggested that the use of a reference index is contrary to every other CSA publications, particularly CSA Staff Notice 31-325 Marketing Practices of Portfolio Managers issued July 2011 (a successor to OSC Staff Notice 33-729 Marketing Practices of Investment Counsel/Portfolio Managers issued November 2007). In both notices, the use of hypothetical or simulated performance data, especially for retail investors, is basically prohibited. Only actual returns are to be presented. It is also noted that under no circumstances are hypothetical and actual returns to be linked, which the 2013 Proposal specifically requires. The prohibition on hypothetical data is due to the various risks and inherent limitations in using such data, as outlined in the Notices. Consequently, the use of a reference index as a proxy for returns over a 10 year period as if they were achieved by the mutual fund and linking them to actual returns, is contrary to established CSA policy. The generation of a hypothetical or simulated risk profile, utilizing a linkage of theoretical and actual returns, is also prohibited by the CFA Institute GIPS. |

The CSA believe that the use of a reference index data in determining the investment risk level of a mutual fund is not contrary to previous CSA publications on the use of hypothetical or simulated performance data. The use of reference index data in the Proposed Methodology is limited to determining the investment risk level of a mutual fund which is disclosed in the Fund Facts or ETF Facts. The reference index is not used as a representation of a mutual fund's performance but rather it acts as a proxy for missing data in determining its investment risk classification using the Proposed Methodology. |

|

|

||

|

|

Two commenters asked that the CSA provide greater clarity around what can be used as a reference index, for instance whether fund managers may use blended indices and if so, whether such use must be disclosed in the mutual fund's prospectus. It should also be clarified in what circumstances, if any, a change in reference index from what was originally disclosed would constitute a material change. |

The Proposed Methodology allows for the use of blended indices and requires that if the reference index has changed since the last prospectus, the prospectus provides details of when and why the change was made. |

|

|

||

|

|

Several commenters suggested that the reference index be consistent with the broad-based market index chosen for the Management Report of Fund Performance (MRFP). Applying different criteria for the MRFPs and the fund's risk classification will create confusion for both investors and dealers added another commenter. |

The same index or indices used in the MRFP of a mutual fund can be used to determine its investment risk level if the index or indices reflect the risk profile of the fund and meets the criteria for an appropriate reference index as outlined in the Proposed Methodology. |

|

|

||

|

|

Two commenters agreed that fund managers should have the discretion to select an appropriate reference index to increase the information set of a fund to 10 years. These commenters would, therefore, extend this consideration to also allow using imputed data in situations where a fund's past returns are not representative of the fund's current attributes due to material and intentional changes to the fund. For example, if a mutual fund's securityholders vote to modify the fundamental investment objectives of a mutual fund, such that the returns of the fund would behave differently than it has previously, essentially making it a new mutual fund. One of these commenters also wanted to caution the CSA that determining an appropriate reference index may be difficult for mutual funds with volatility of returns that are different than any existing reference index. |

We agree with the comments made and have made some changes to the 2013 Proposal to address instances where there has been a fundamental change in the investment objectives or a reorganization of a mutual fund. |

|

|

||

|

|

One commenter noted that there is no perfect solution to choosing a reference index and that the investment objectives of some mutual funds are so flexible and unique that none of the widely available benchmarks capture the mutual fund's exposure or strategy. Two commenters were of the view that a mutual fund's returns may not be highly correlated to the index because of the mutual fund's active investment strategies The 2013 Proposal requires a reference index to meet each of the stated criteria which prove particularly difficult for innovative mutual funds where risk management is held out as a defining feature of the mandate, such as low volatility and target return funds. |

According to the criteria for a reference index set out in the Proposed Methodology, the returns of the reference index should be correlated to the returns of the mutual fund, rather than replicate the returns exactly. As such, we believe there are sufficient reference indices available that can serve as a proxy for the risk profile of actively managed funds. |

|

|

||

|

|

Another commenter proposed that the CSA should consider Canadian Investment Funds Standards Committee (CIFSC) category-based benchmarks as potential proxies because they are better proxies for the investor experience than market-based benchmarks. |

Fund managers have discretion in their selection of the reference index as long as the reference index appropriately reflects the risk profile of the fund's investment objectives and meets, among other things, the criteria outlined by the CSA in regard to what is an appropriate reference index. |

|

|

||

|

|

One commenter requested clarification on the conditions that the indices be "widely recognized" and "publicly available". On the criterion of "publicly available", the commenter noted that very few index publishers issue monthly data or make the SD of index returns available to the public free of charge. The commenter also noted that many fund types, such as sector funds, real estate funds, high yield funds and floating rate debt funds, would generally find the most suitable proxies among indices that are neither widely recognized nor whose data is publicly available. |

In response to comments, we have removed the requirement that the reference index be widely recognized and publicly available in all instances. |

|

|

||

|

|

Two commenters believed there may be some concerns surrounding the practice of the fund managers selecting their own reference indexes as fund managers may aim keep the risk rating of their fund at a certain level. In such instances, the fund manager could choose an index with the lowest possible investment risk level while abiding by the lax criteria put forth by the CSA. Having a third party, such as data providers or industry participants, select the reference index on behalf of the fund manager would eliminate the conflict of interest. One of these commenters also had concerns as to whether or not the CSA has the means to effectively monitor index selection to ensure the chosen benchmarks accurately reflect the potential volatility of a mutual fund. |

We believe that the requirement to disclose the chosen reference index in a mutual fund's prospectus allows for transparency. Where CSA staff have questions around the appropriateness of a reference index, the mutual fund may be the subject of a continuous disclosure review in this area. |

|

|

||

|

|

One commenter was of the view that certain fund of funds may not have the requisite 10 year history however, the underlying fund may have been in existence for a longer time period. In this case, using the returns of a reference index would not be a meaningful representation of a fund's risk level, rather preference should be given to the performance history of the underlying fund which may have been in existence for a longer time period. |

In instances where the underlying fund has a 10 year history, and the top fund's stated investment objectives and strategy is to "clone" that underlying fund, staff may consider allowing, through exemptive relief, the use of the underlying fund's volatility of returns for the purposes of determining the top fund's investment risk level. |

|

|

||

|

|

Two commenters believed that the consultation paper should have provided details of exactly how costless index returns are to be adjusted in order to link to actual after-fee fund returns to obtain 120 data points where actual data is less than 10 years. |

We do not propose that index data be adjusted for fees. We do not believe fees impact volatility of returns to a significant extent. |

|

|

||

|

11. Keeping the criteria outlined in the introduction above in mind, |

Several commenters told us that the 2013 Proposal's risk bands and associated risk categories will lead to a large number of mutual funds being re-classified into a higher investment risk level, without any associated change in the mutual fund's risk. According to two of these commenters, between 70% to 80% of their mutual funds would move upwards to a higher investment risk level under the 2013 Proposal. One of the commenters did not believe that it is necessary to have a "Very High" investment risk level as there are very few mutual funds which would be included in this band. A few commenters recommended that the CSA use the same number of risk bands and the same nomenclature as described in the IFIC Methodology to avoid investor confusion and industry disruption. |

In response to the concerns expressed by commenters about the change in the risk scale from 5 categories to 6 categories and the associated costs, the CSA are proposing to retain the current CSA five-band risk scale used in the Fund Facts to avoid unnecessary reclassification of mutual funds and suitability reassessments which may be triggered as a result. While our intention in proposing a six band risk scale was to improve the segregation of asset classes across risk bands, we acknowledge stakeholders concerns raised in this regard. |

|

|

||

|

i. Do you agree with the proposed number of risk bands, the risk band break-points, and nomenclature used for risk band categories? |

|