Sales Culture Concerns at Five of Canada’s Bank-Affiliated Dealers

Ontario Securities Commission

Canadian Investment Regulatory Organization

Executive Summary

Executive Summary

In November 2024, the Ontario Securities Commission (OSC) and the Canadian Investment Regulatory Organization (CIRO) announced a coordinated review of sales practices within five large Canadian bank-affiliated mutual fund dealers. This review was prompted by a public report of potential investor harm due to alleged high-pressure sales practices at Canadian bank branches.[1] To better understand the sales culture and environment within these branches, and identify and assess the scale of any potential issues, the OSC and CIRO conducted a survey of registered mutual fund dealing representatives (“representatives”)[2] working in a bank branch for one of the mutual fund dealers[3] affiliated with five of Canada’s banks – BMO, CIBC, RBC, Scotiabank, and TD. The survey explored the experiences and perceptions of these representatives, and sought to understand whether there are any recurring issues that could negatively impact retail investors.

Within the survey, representatives provided us with their views in four main areas:

- Sales Environment: how the existing sales environment, including compensation, incentives, and performance metrics, impacts the job-related behaviours of representatives.

- Sales Pressure: the extent to which representatives experience sales pressure in their role, and the potential impact on the products and services recommended to clients.

- Range of Products: representatives’ views on the range of mutual funds they are able to offer clients.

- Knowledge: the knowledge of representatives in specific areas, as well as the perceived knowledge of their peers.

A total of 2,863 representatives from all five bank-affiliated mutual fund dealers in Ontario completed the survey. This large sample demonstrates statistical alignment with the broader population on key characteristics, providing a strong basis for generalizing our findings across Ontario.

The results from this survey provide valuable insight into the environment within five of Canada's bank-affiliated mutual fund dealers. We observe that 25% of representatives across banks reported that clients have been recommended products or services that are not in their interests at least ‘sometimes’, which suggests that product recommendations may not always be in the interests of clients.

This issue may be tied to the sales environment, including compensation, incentives, and performance metrics. It may also be tied to the high degree of sales pressure that representatives reported experiencing. Our survey revealed widespread use of performance management tools or updates (e.g., sales scorecards). Scorecards are used by bank-affiliated mutual fund dealers to provide representatives with information on their individual performance, updated at regular intervals. Scorecards can include sales-related targets (e.g., product sales) and/or activity-based targets (e.g., client contact management), which can impact a representative’s compensation, performance assessment, and experiences of sales pressure. In completing our survey, representatives reported that scorecards not only increase pressure to meet sales targets, but also influence the products recommended to clients, posing a risk to the interests of retail investors. Given these survey results, the bank-affiliated mutual fund dealers should conduct an assessment of their sales environment, including compensation, incentives, and performance metrics, and sales pressure experienced by representatives, including through the use of performance management tools such as scorecards. Where any of the concerns noted in this report are identified, enhancements should be made to ensure that sales practices align with placing the clients’ interests first.

Regarding their views on the range of products, representatives generally expressed satisfaction with the current range of funds available to them but also indicated that a broader range that includes external mutual funds could be beneficial in offering clients more choices.

Our results also show that representatives may lack knowledge or otherwise fail to provide correct information in certain areas. Notably, one in three representatives reported that clients have been provided with incorrect information at least ‘sometimes’. Additionally, 23% of representatives were not able to identify the definition of Management Expense Ratio (MER), a foundational and important component of the mutual funds they sell which can materially influence clients’ investing decisions. However, representatives scored better when asked to identify the impact of MER on mutual fund performance (12% of representatives answered incorrectly). These results indicate that Canada’s bank-affiliated mutual fund dealers should assess their current training programs and make any required enhancements to ensure that clients are provided with accurate product information.

Taken together, the results of this survey highlight several areas of concern with respect to the sales culture and environment within five of Canada’s bank-affiliated mutual fund dealers. The five dealers should carefully consider what representatives have reported to identify where changes or enhancements may be needed to address the concerns outlined in this report.

Given the information provided to us through the survey data about the sales environment at the five bank-affiliated mutual fund dealers, including compensation, incentives and performance metrics, and experiences of sales pressure reported by mutual fund dealing representatives, we are continuing our work on this initiative. The next phase of the work will focus on obtaining and assessing information, including around the use of scorecards, directly from each of the five bank-affiliated mutual fund dealers related to specific concerns identified in the survey, and will also include meetings with key individuals and requests for data.

This next phase will enable us to obtain an understanding of the sales practices in place and how they may impact the behaviour of mutual fund dealing representatives, as well as any potential impacts to investors. We also want to understand the controls the dealers have in place to address any material conflicts of interest arising from the sales practices, including the compensation, incentives, and performance metrics, and experiences of sales pressure.

Once we have completed our review and analysis of the information from each of the five bank-affiliated mutual fund dealers, we will consider our regulatory tools available and determine whether further action is required to ensure ongoing compliance with securities laws.[4]

[2] Throughout this report, any use of “representatives” is intended to mean “mutual fund dealing representatives”. We use the shortened form to be more concise.

[3] The five bank-affiliated dealers are: BMO Investments Inc.; CIBC Securities Inc.; Royal Mutual Funds Inc.; Scotia Securities Inc.; and TD Investment Services Inc.

[4] Including compliance with conflicts of interest and suitability determination provisions in National Instrument 31-103 Registration Requirements, Exemptions and Ongoing Registrant Obligations and equivalent CIRO rules.

Introduction

Introduction

In November 2024, the OSC and CIRO announced a coordinated review of the sales practices at bank-affiliated mutual fund dealers. The review was initiated after a public report of potential investor harm due to alleged high-pressure sales practices within some Canadian bank branches.

As part of this review, the OSC and CIRO developed an initial phase of work to build an understanding of how representatives are experiencing the sales culture and environment within five Canadian bank-affiliated mutual fund dealers, and to identify and assess the scale of any potential issues. This initial phase of work focused on information gathering through a voluntary, anonymous survey sent to all mutual fund dealing representatives working in one of the bank branches of five of Canada’s bank-affiliated mutual fund dealers located in Ontario. The survey was designed to gain insight into the experiences and perceptions of these representatives and identify and assess the scale of any issues that could negatively impact retail investors.

In completing the survey, representatives provided their views in four main areas:

- Sales Environment: representatives were asked about their existing sales environment, including compensation, incentives and performance metrics, and its effect on motivating various job-related behaviours.

- Sales Pressure: a series of questions sought to identify any issues surrounding sales pressure experienced by representatives, including the degree to which representatives believe that clients are impacted.

- Range of Products: representatives were asked for their views on the range of mutual funds they are able to offer their clients (i.e., proprietary mutual funds), and on the possibility of having access to external mutual funds (i.e., third-party mutual funds).

- Knowledge: representatives were asked a set of questions about their knowledge in specific areas, as well as how they perceive the knowledge of their peers.

At various points in the survey, representatives were given the opportunity to provide brief written responses in open-text boxes. This allowed representatives to provide further insight into some of their responses to survey questions.

This report details the results of our survey. The report is structured as follows: we first provide an overview of the survey methodology, then detail the survey results, and conclude with key takeaways from this review.

Survey Overview

Survey Overview

The survey was developed by the OSC with input from CIRO in the fall of 2024. The OSC’s Research and Behavioural Insights Team played a key role in this project, providing expertise in behavioural science and leading the development of the survey methodology, data analysis, and interpretation.

The OSC invited registered mutual fund dealing representatives who currently work for a bank-affiliated mutual fund dealer in an Ontario branch of one of five large banks – BMO, CIBC, RBC, Scotiabank, and TD – to voluntarily participate. The survey was launched on November 26, 2024, and closed on December 13, 2024. In total, 2,863 representatives across all five bank-affiliated mutual fund dealers completed the survey.

Survey Distribution

Prior to releasing our survey, we communicated with each of the five bank-affiliated mutual fund dealers to notify them of our intention to survey their representatives and to request their cooperation. We sent representatives the initial invitation to complete the survey, followed by three reminder emails.

The survey was anonymous, meaning that each representative’s responses could not be linked back to them in any way.[5] Anonymity was necessary to increase the likelihood that representatives would feel comfortable expressing their honest views. The anonymous nature of the survey was communicated clearly to representatives in both the initial email and reminder emails.

The survey sample reflects the larger population in terms of the distribution of representatives across banks and Ontario regions, indicating that our sample is broadly representative of the larger population of mutual fund dealing representatives at each bank-affiliated mutual fund dealer. Our data are weighted to account for small differences between the sample and population. The sample's composition and meaningful size supports the generalizability of our survey results to the wider population of mutual fund dealing representatives.

[5] Our existing databases contain the work email addresses and bank of employment for all registered mutual fund dealing representatives. Although we used representatives’ work email addresses to distribute the survey, the survey dataset did not retain any email address data, thereby maintaining anonymity.

Results

Results

The results from our survey of mutual fund dealing representatives are detailed in this section. An overview of the key characteristics of our survey participants is followed by an exploration of the relationship between the sales environment, including compensation, incentives, and performance metrics, and job-related behaviours. We then discuss results related to sales pressure experienced by representatives, as well as the views of representatives with respect to the range of mutual funds they are able to offer their clients. We conclude this section with a discussion of representatives’ knowledge in specific areas.

The results described in this section reflect industry-wide trends that are applicable to all five bank-affiliated mutual fund dealers. Upon an in-depth analysis of our survey data, there were few significant differences among the five mutual fund dealers or the different regions where representatives are employed. Generally, there are more similarities than differences in the views and experiences of representatives across the five mutual fund dealers. Readers of this report can assume that the results and implications discussed are applicable across Ontario and all five of the bank-affiliated mutual fund dealers.

Table 1 provides an overview of the ‘average representative’ who completed our survey. On average, representatives hold one professional designation or credential (the required minimum) – commonly the CSC (Canadian Securities Course) or an equivalent. Representatives have six years of work experience, on average, and variable compensation (most commonly bonuses and profit-sharing plans) accounts for 10% of their total compensation. Representatives frequently offer products other than mutual funds – including the products identified in the table below.

Table 1: The Average Representative |

|---|

| One credential (Canadian Securities Course/Investment Funds in Canada/Canadian Investment Funds Course) |

| 6 years of work experience as a representative |

| 10% of total compensation is variable (e.g., bonuses, profit-sharing) |

| Frequently offers mortgages, lines of credit, credit cards, bank accounts, and GICs, in addition to mutual funds |

There are different roles that mutual fund dealing representatives can hold, which may be a function of credentials and/or work experience. For example, about 9% of representatives hold multiple or other credentials, most often the CFP (Certified Financial Planner). Those with multiple or other credentials more frequently offer planning-based services. Finally, most respondents have worked at their current dealer for anywhere from 2 to 14 years.

We now explore the sales environment, including compensation, incentives, and performance metrics for representatives working at one of the five bank-affiliated mutual fund dealers. Compensation, incentives, and performance metrics may vary based on roles and activities.

Monetary compensation typically comprises base pay (i.e., salary) and variable pay (most often in the form of performance-based bonuses and/or profit-sharing plans). The average representative (i.e. those with a CSC or equivalent credential) reports receiving 10% of their total compensation in variable pay; those on the higher end receive 20% in variable pay. A minority of representatives also indicated the use of non-monetary incentives to motivate performance, such as points or credit systems.

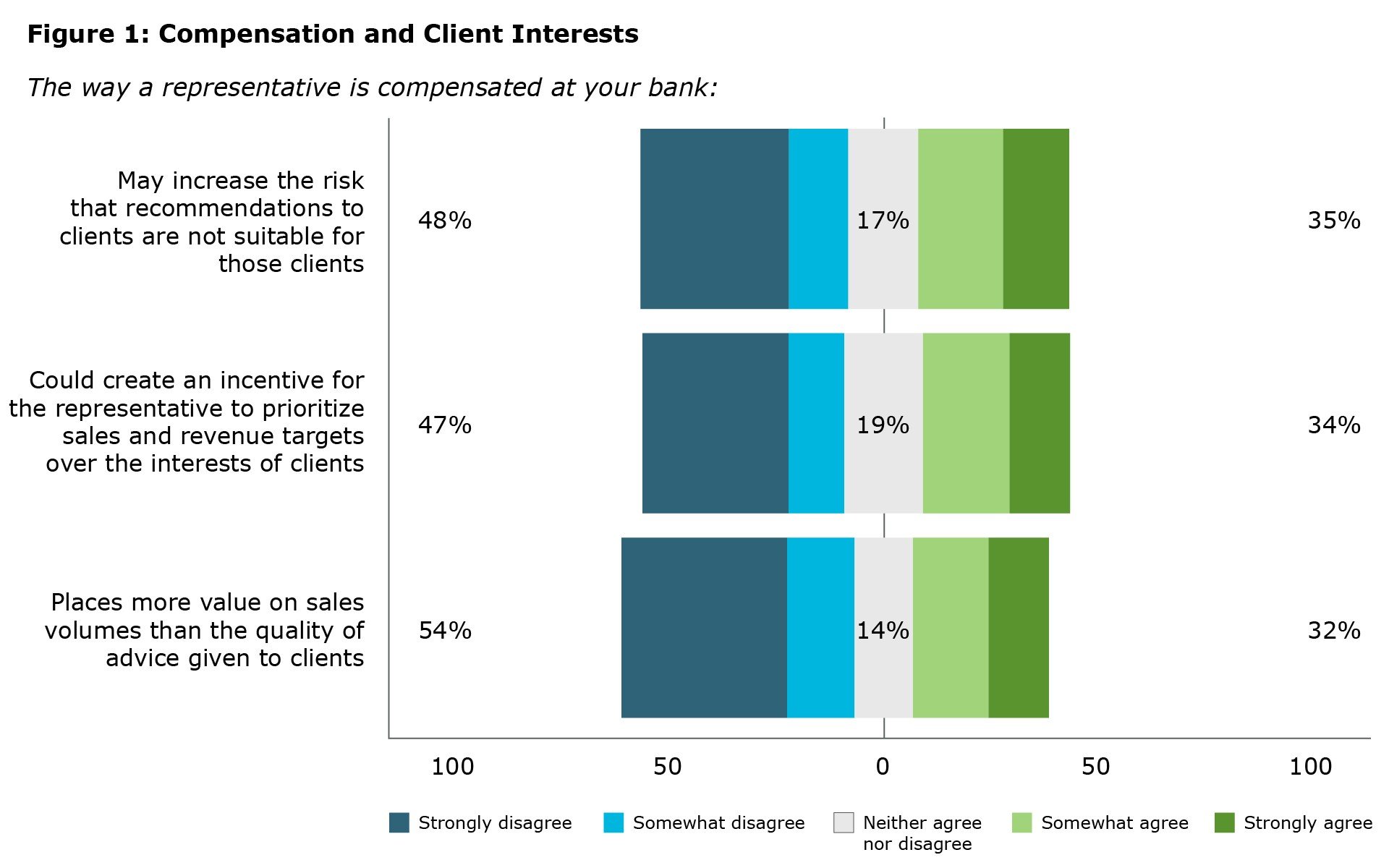

In their survey responses, representatives more often identified sales-related targets as the primary means to increase compensation, as compared to other factors like client feedback or referrals. 32% of representatives agree that the way representatives are compensated places more value on sales volume than the quality of advice given to clients (Figure 1). One representative’s response in an open-text box speaks to this prioritization of sales over financial planning:

“Our corporation does a great job in training and walking the line between suitability and profitability. That being said, we pay lip service to financial planning but someone who sells a huge mutual fund is viewed more favorably than someone who ran a complex financial plan and helped the client but in a more modest, financially ethical, and healthy way. This needs to change.”

Generally, about half of representatives (47%) disagree that the way they are compensated could create an incentive to prioritize sales goals over client interests (Figure 1). One representative illustrates this position through an open-text response:

“Our sales activities are heavily monitored from both a compliance and behavioral standpoint. The emphasis is on doing the right thing for the client and being able to prove we did the right thing for the client via documented planning and advice.”

However, about 1 in 3 representatives agree that the way they are compensated could create incentives for representatives to prioritize sales and revenue targets over client interests (Figure 1). In addition, 35% of representatives agree that the way they are compensated may increase the risk that recommendations made to clients are not suitable for those clients (Figure 1). In an open-text response, a representative speaks to the risk of prioritizing sales targets over client interests:

“There needs to be an overhaul in this industry that puts the clients' needs first above the bank’s targets and goals. There is a paradox in providing financial advice and tying compensation to how much you can sell. This comes from the top.”

Nearly all representatives in our survey reported that they are provided with information on their individual performance, updated at regular intervals. Representatives report that the performance information received can comprise sales-related targets (e.g., product sales) and/or activity-based targets (e.g., client contact management) and is provided through regular updates, using scorecards or other tools that set out the relevant performance metrics (these tools are referred to as scorecards in this report). These scorecards may also include comparisons on performance in meeting various targets, such as comparing branches to branches, individuals to their own past performance, or individuals to peers within their own branch or other branches.

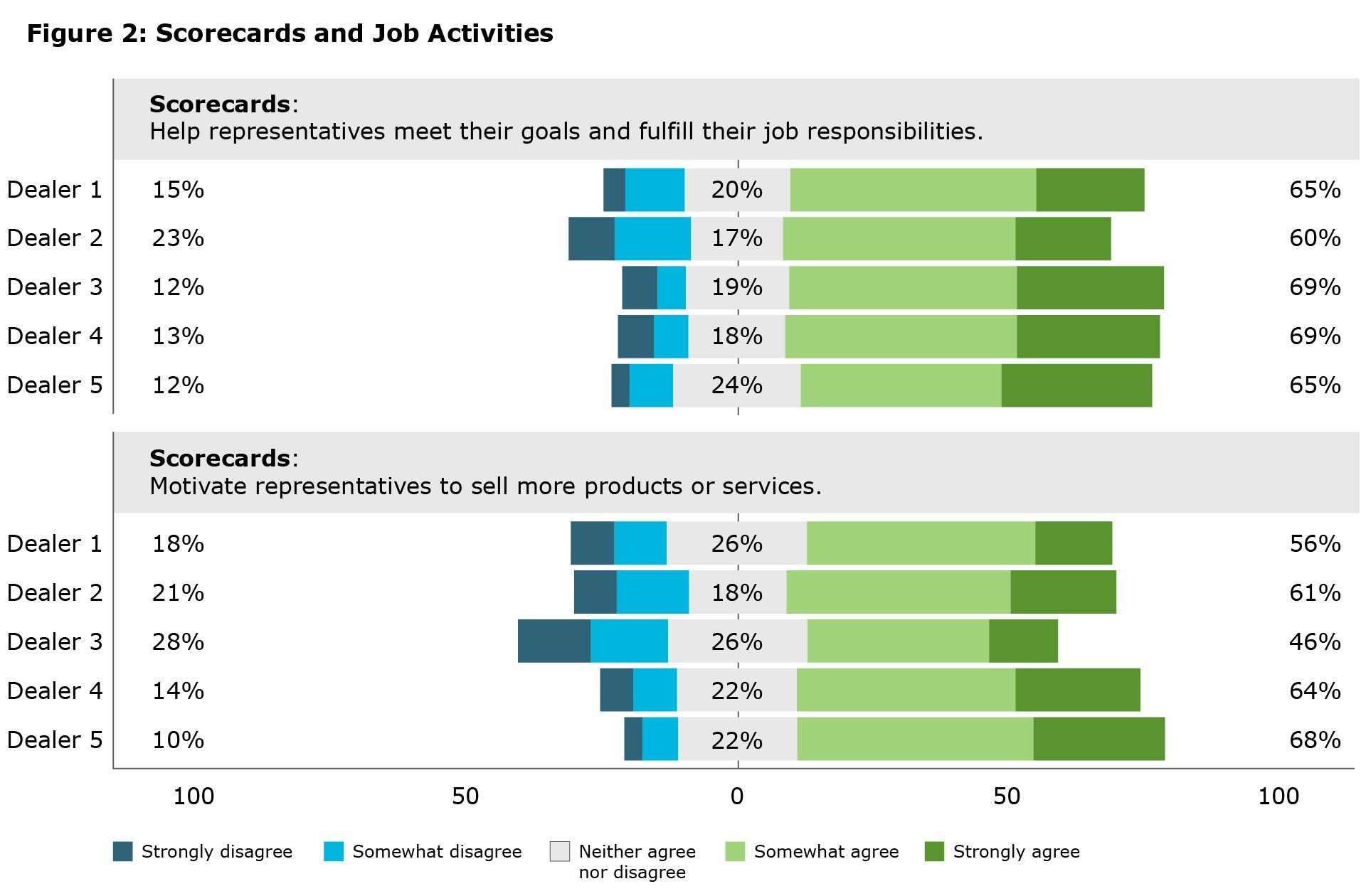

Most representatives agree that the performance metrics contained within scorecards, including targets, influence job behaviours. About 60% of representatives agree that performance updates help representatives meet their goals, fulfill their job responsibilities, and motivate them to sell more products and services (Figure 2). In the next section of this report, we will describe how representatives believe that performance updates provided through scorecards can contribute to sales pressure.

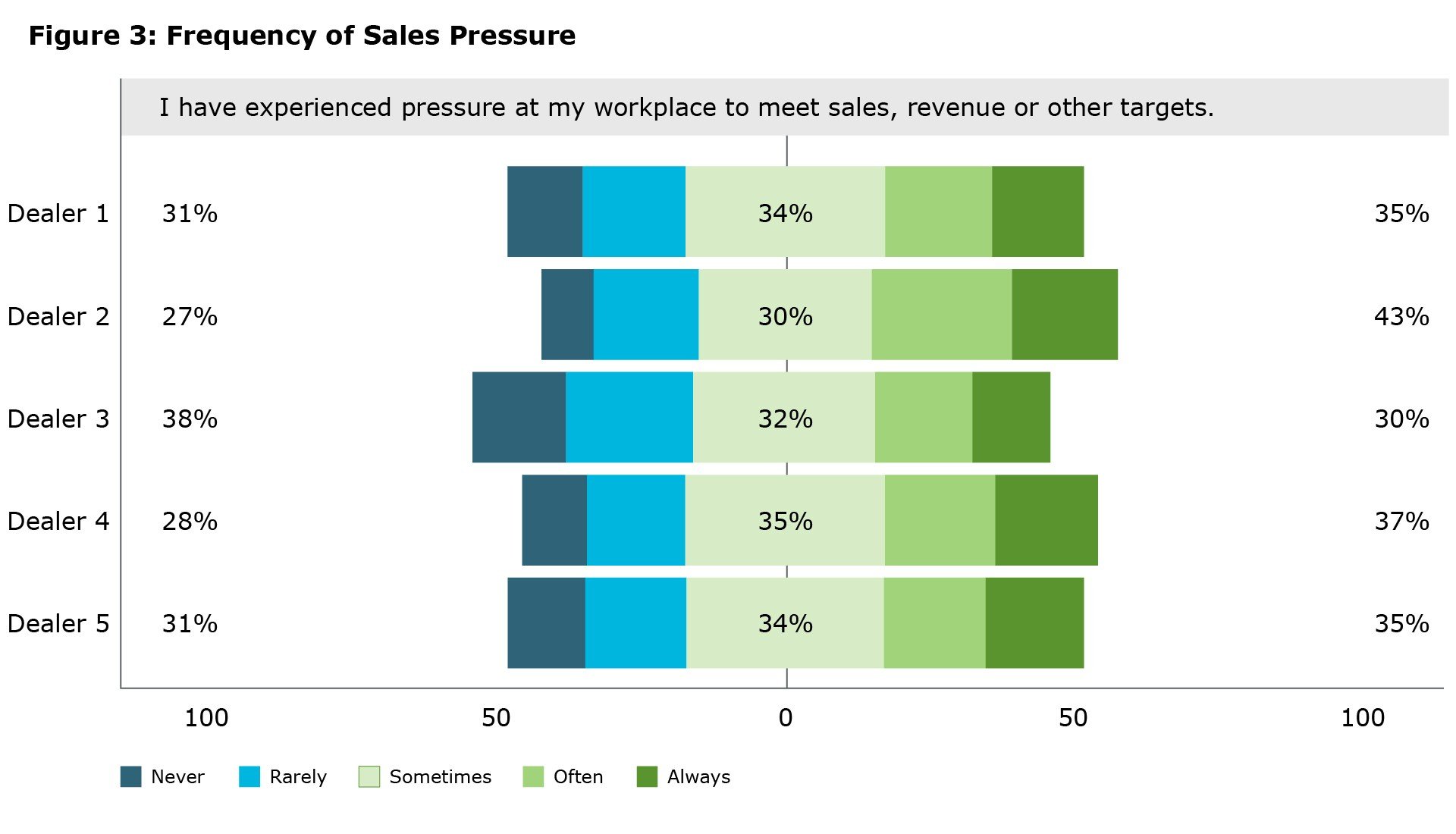

We now discuss survey results on the topic of sales pressure within the bank-affiliated mutual fund dealers. Representatives’ experiences of sales pressure are pervasive, with 68% of representatives experiencing sales pressure at least ‘sometimes’ and 35% experiencing pressure ‘often’ or ‘always’ (Figure 3).

One representative’s open-text response speaks about the sales pressure being experienced by many representatives:

“I feel pressured at work to make sales that aren’t always suitable for my client. This needs to change, as the practices in place are creating unease and anxiety for myself and clients.”

Conversely, a different representative describes how some representatives do not feel a sense of pressure to meet sales targets:

“[My bank-affiliated dealer] does a tremendous job in not focusing on just mutual fund sales. They want all staff to take a holistic approach to advising clients and ensure investment suitability and addressing client needs are at the heart of what we do.”

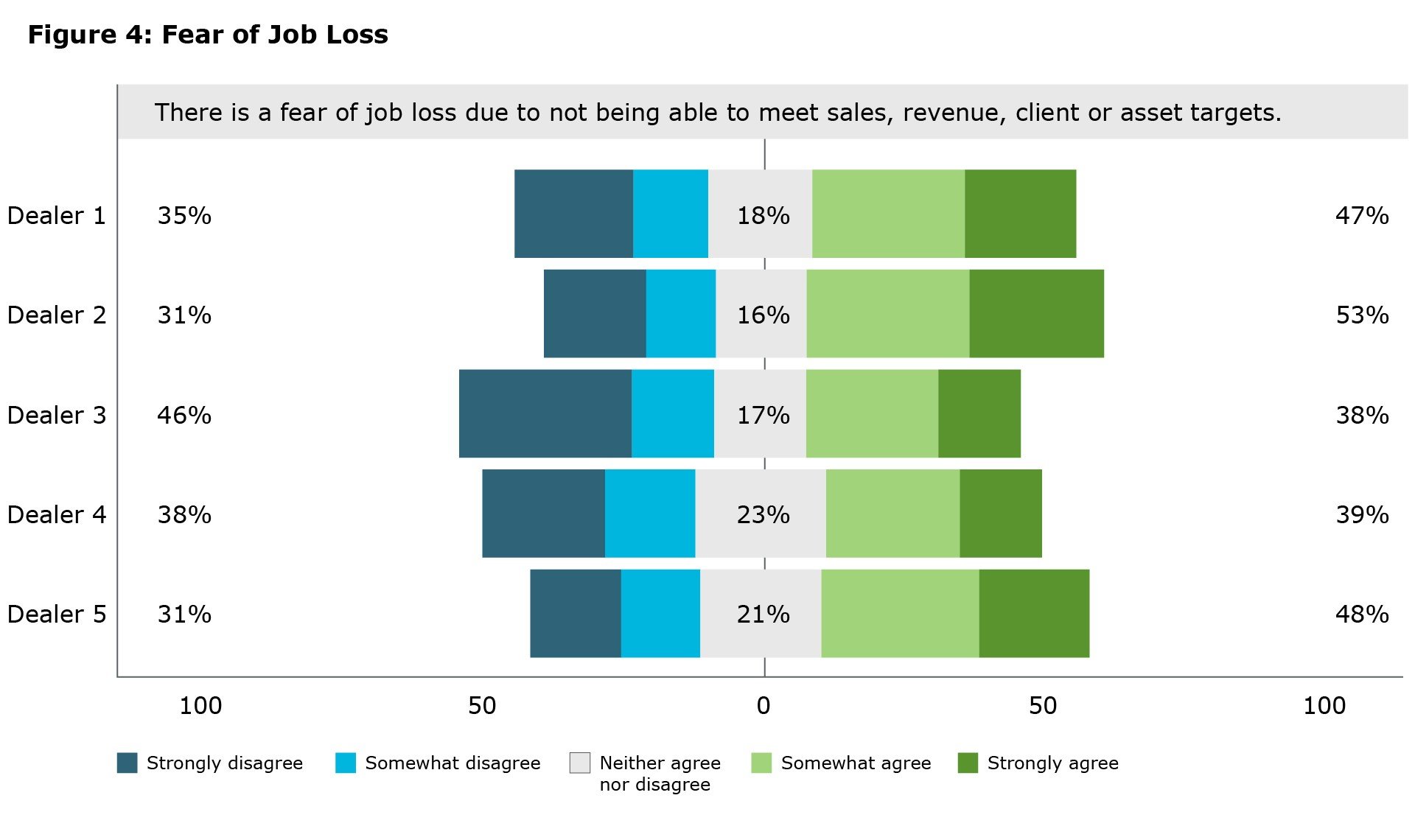

Representatives also reported that pressure to meet targets can create a sense of job insecurity. 44% of representatives agree that there is a fear of job loss due to not being able to meet sales, revenue, client, or asset targets (Figure 4), indicating that many representatives are operating in an environment with significant pressure.

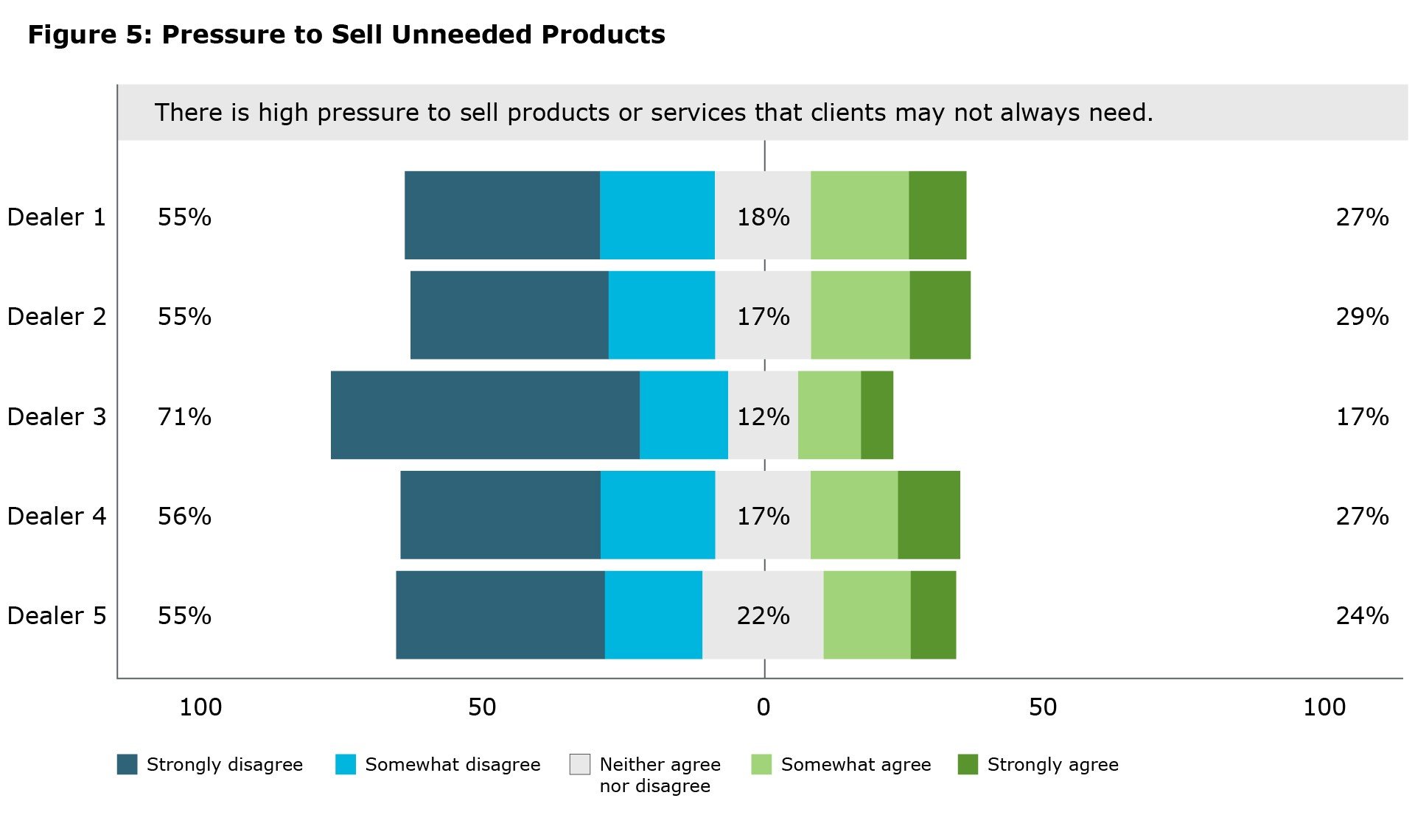

Representatives were also asked whether they agree that there is a high degree of pressure to sell products or services that clients may not always need. We found that 23% of representatives agree that there is high pressure to sell potentially unneeded products or services to clients, while 60% disagree with this sentiment (Figure 5). A sizable minority of representatives (23%) reporting that there is high pressure to sell products or services that clients may not always need is concerning.

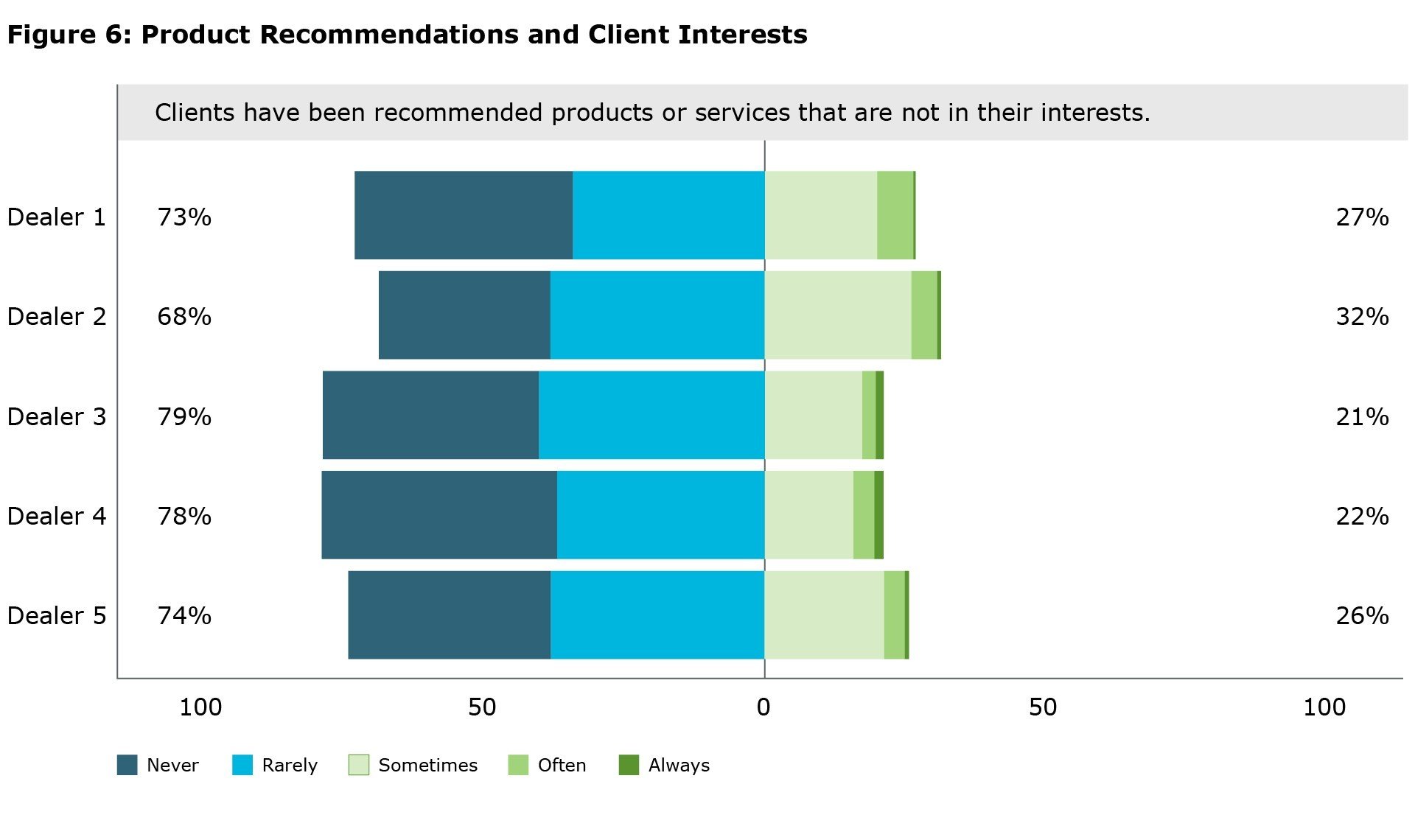

Our survey also assessed the extent to which sales pressure may influence the recommendations made to clients. We found that 25% of representatives indicated that clients have been recommended products or services that are not in their interests at least ‘sometimes’, while a small minority of 5% of all representatives surveyed said that this takes place ‘often’ or ‘always’ (Figure 6). One representative illustrates this point in an open-text comment:

“I think my workplace can do better at lowering risk and sales pressure. I have seen instances where a colleague has advised a client to purchase a mutual fund that is not adequate to their needs, or the client does not know the fund that they are purchasing. Although compliance is strict, there is no emphasis on the quality of the advice to the client. I feel more like a salesperson than an investment advisor.”

Additional analyses of our data showed a statistically significant association between experiences of sales pressure and reporting that clients have been recommended products or services that are not in their interests; representatives who reported experiencing higher levels of sales pressure were more likely to agree that clients have been recommended products or services that are not in their interests.

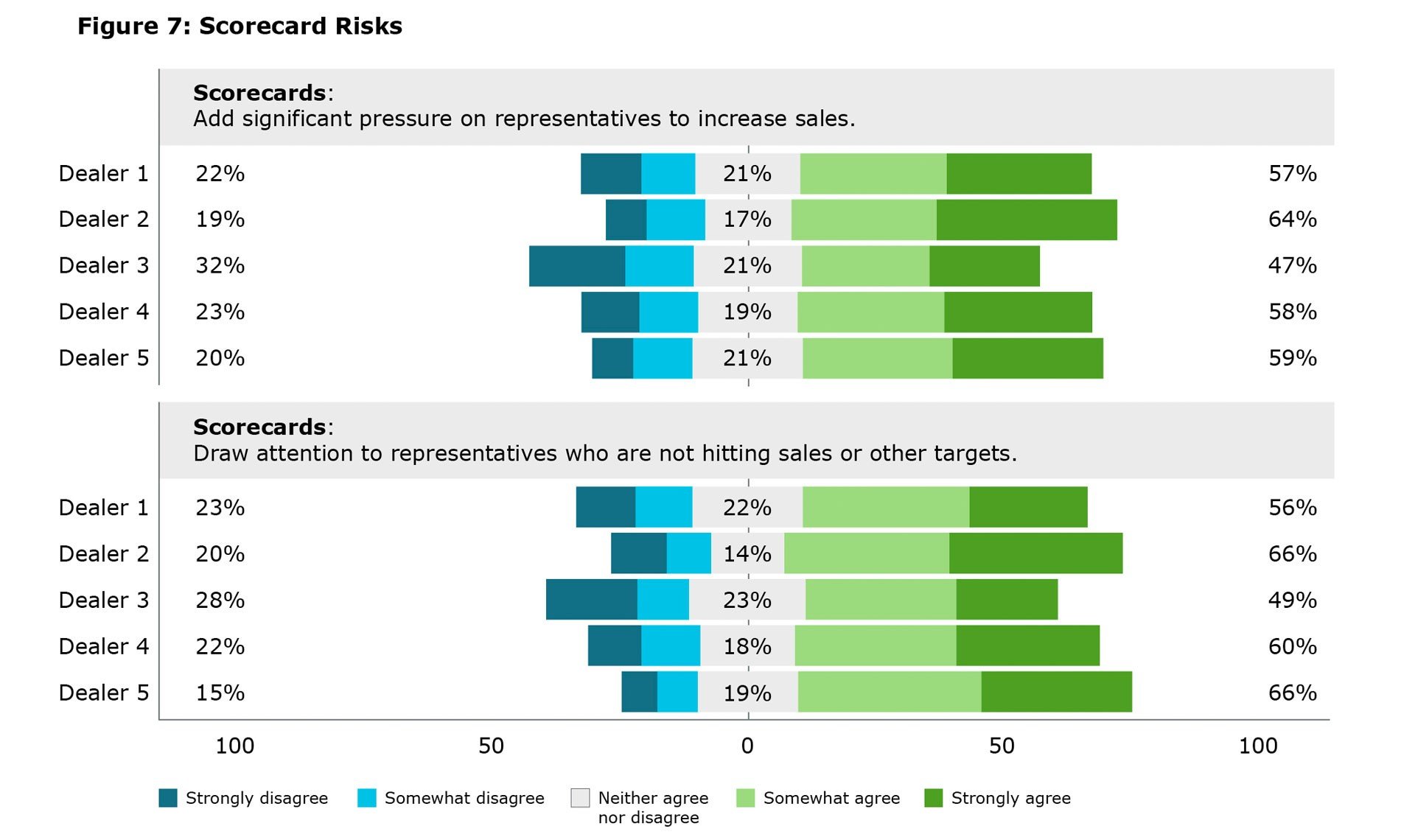

In the previous section of this report, we noted that representatives indicated that the use of scorecards motivates them to sell more products and fulfill their job duties. Here, we describe how scorecards play a strong role in increasing sales pressure among representatives. More than half of representatives (56%) agree that scorecards add significant pressure on them to increase sales, while a similar proportion (58%) agree that scorecards draw attention to the individual representatives who are not hitting sales or other targets (Figure 7). This pressure could increase if the targets contained within scorecards change frequently.

Relatedly, the majority of representatives we surveyed at each bank-affiliated mutual fund dealer report that they are exposed to peer-to-peer comparisons[6] of scorecards (i.e., when scorecards compare the performance of individual representatives with their peers). Peer-to-peer comparisons draw attention to underperforming representatives, and by doing so, may increase sales pressure. These comparisons sometimes occur in group settings that may highlight underperformers. One representative describes the pressure experienced through peer-to-peer comparisons in an open-text response:

“Names will be pointed out in periodic meetings and/or emails if we don't sell a specific type of product. In addition, when it comes to job promotion, the upper management is not only looking at the qualifications but also associates the promotion with how successful you are when ‘pushing’ the preferred products.”

Another representative speaks to scorecards adding significant pressure to increase sales volume in an open-text response:

“There are excessive daily pressures to meet and exceed sales targets. Representatives in the firm are ‘coached’ to [achieve] 150% of sales and referral targets. Legitimate fears of not achieving 150% of targets exist. The fact [that] representatives are compensated 110% on mutual funds and potentially 15% on GIC's creates a certain conflict of interest.”

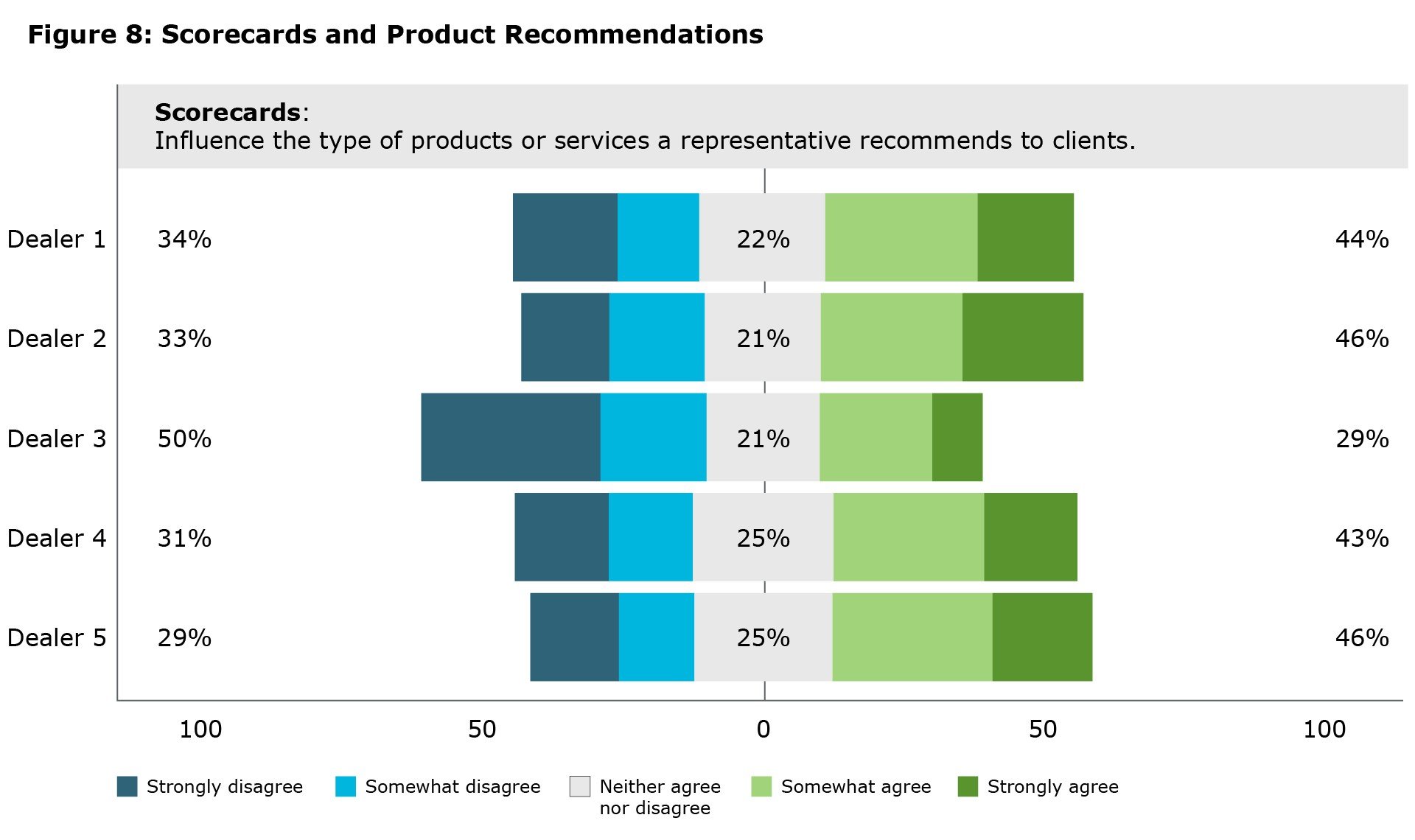

We note that our survey captures representatives’ perceived frequency of products being recommended that are not in clients’ interests but does not measure how frequently this may take place in practice. However, the survey results indicate that the sales environment and sales pressure experienced by representatives at the five bank-affiliated mutual fund dealers – including the use of scorecards – may increase the risk of representatives recommending products or services to clients that may not place clients’ interests first. We found that 40% of representatives agree that scorecards influence which products or services are recommended to clients. 37% of representatives disagree with this (Figure 8).

This suggests that, for some representatives, factors outside of the client’s investment needs and objectives, such as how a mutual fund dealer mandates goals and targets for representatives, can influence what products or services are recommended to clients. One representative describes how scorecards might incentivize representatives to recommend one product over another:

“While most sales representatives don't receive direct compensation from a mutual fund sale, a sale of a mutual fund is weighted much more heavily than the sale of a GIC on our scorecard, which then […] affects bonuses, promotions, etc. This can result in someone leaning more toward selling mutual funds, potentially to the detriment of the best interest of the customer.”

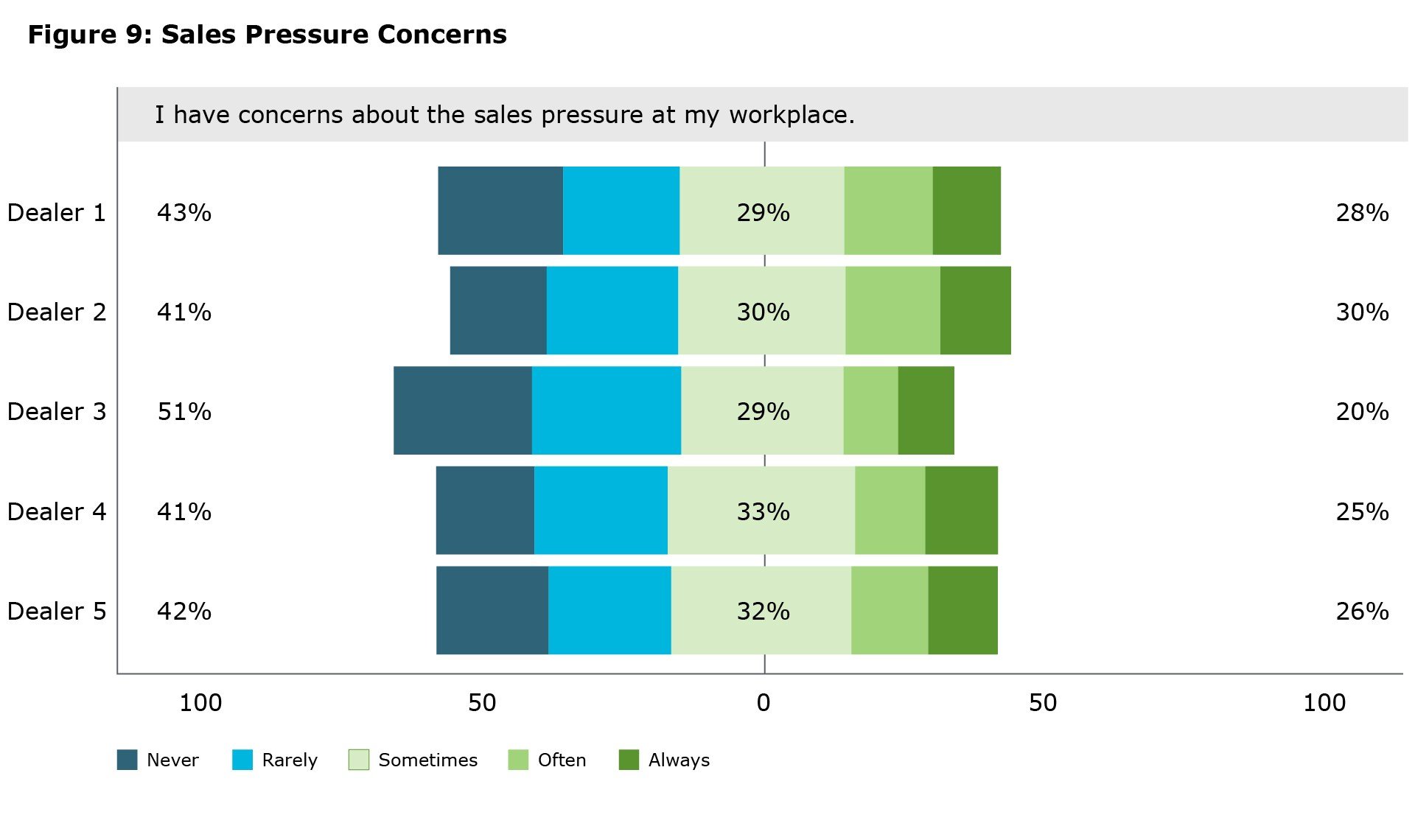

Our survey also included a set of questions to identify whether representatives have concerns related to sales pressure, as well as the frequency with which they voice these concerns within their firm. A majority of representatives (55%) reported having concerns related to sales pressure at least ‘sometimes’, while 25% reported having these concerns ‘often’ or ‘always’ (Figure 9). This indicates that the majority of representatives surveyed across all five bank-affiliated mutual fund dealers report experiencing concerns – to at least some extent – related to the environment in which they work.

About half (56%) of representatives report that their firm encourages them to raise sales pressure concerns at least ‘sometimes’. However, the other half (44%) of representatives say that they are encouraged to raise their concerns ‘rarely’ or ‘never’. This suggests that the five bank-affiliated mutual fund dealers may not be doing enough to create an environment where representatives feel confident to communicate sales pressure concerns in an open and safe manner, whether to enhance compliance and outcomes for their clients, for their own compensation or wellbeing, for a combination of these objectives, or otherwise.

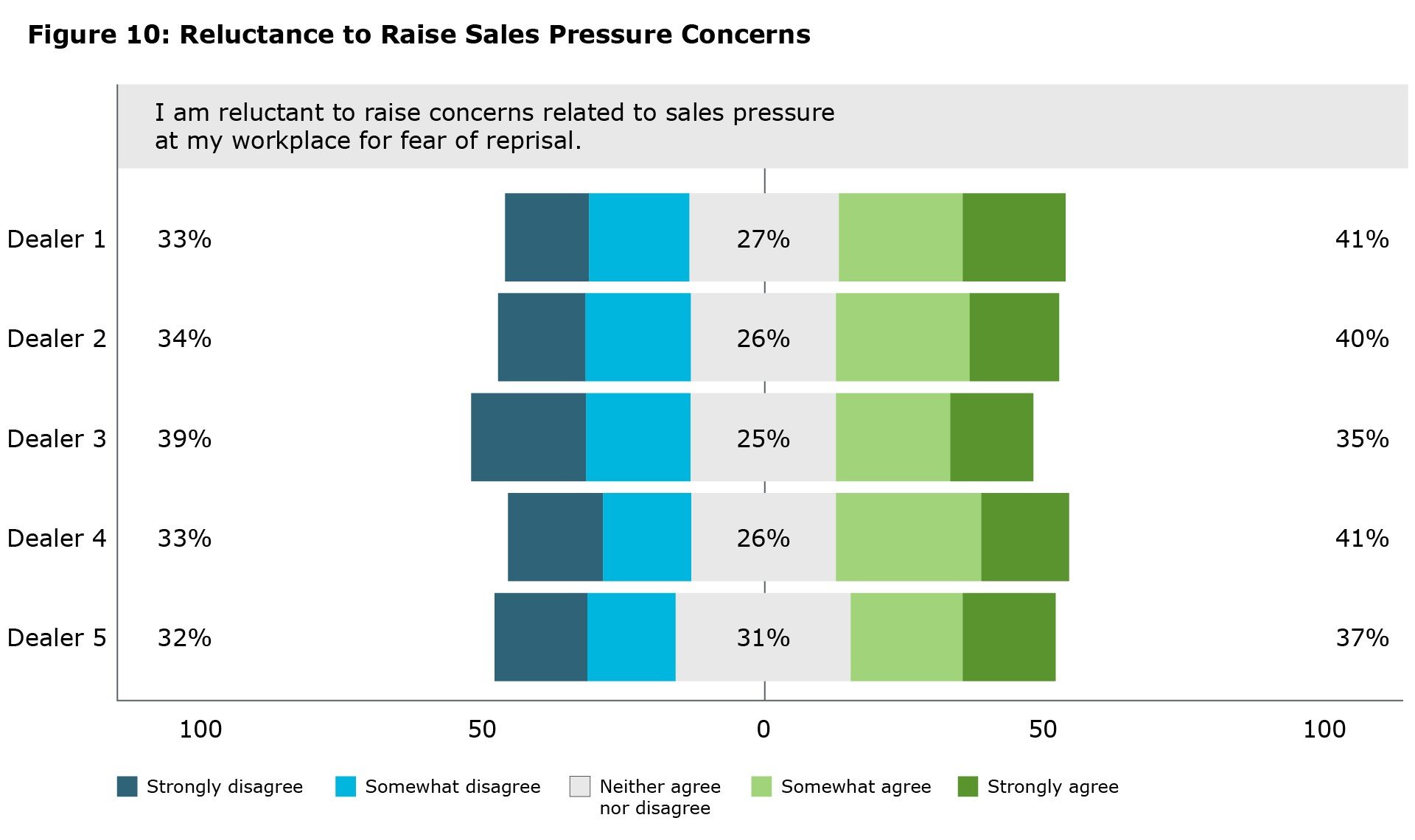

Although a majority of representatives surveyed have at least some sales pressure concerns related to their work environment, many representatives reported that they are reluctant to voice their concerns. Specifically, among those representatives who reported that they have concerns related to sales pressure at least ‘rarely’ (79% of all representatives), 38% indicated that they are reluctant to raise these concerns at their workplace due to fear of reprisal (Figure 10). These results indicate that for a substantial minority of representatives there may be a perception that their firms do not sufficiently foster a culture that is receptive to honest feedback related to sales pressure.

Among all representatives who indicated having at least some concerns related to sales pressure (79%)[7], 35% raised these concerns at their workplace (Table 2).

Table 2: Sales Pressure Concerns Expressed

| Dealer | % of those with concerns who expressed their concerns |

|---|---|

| All Dealers | 35% |

| Dealer 1 | 42% |

| Dealer 2 | 34% |

| Dealer 3 | 34% |

| Dealer 4 | 32% |

| Dealer 5 | 35% |

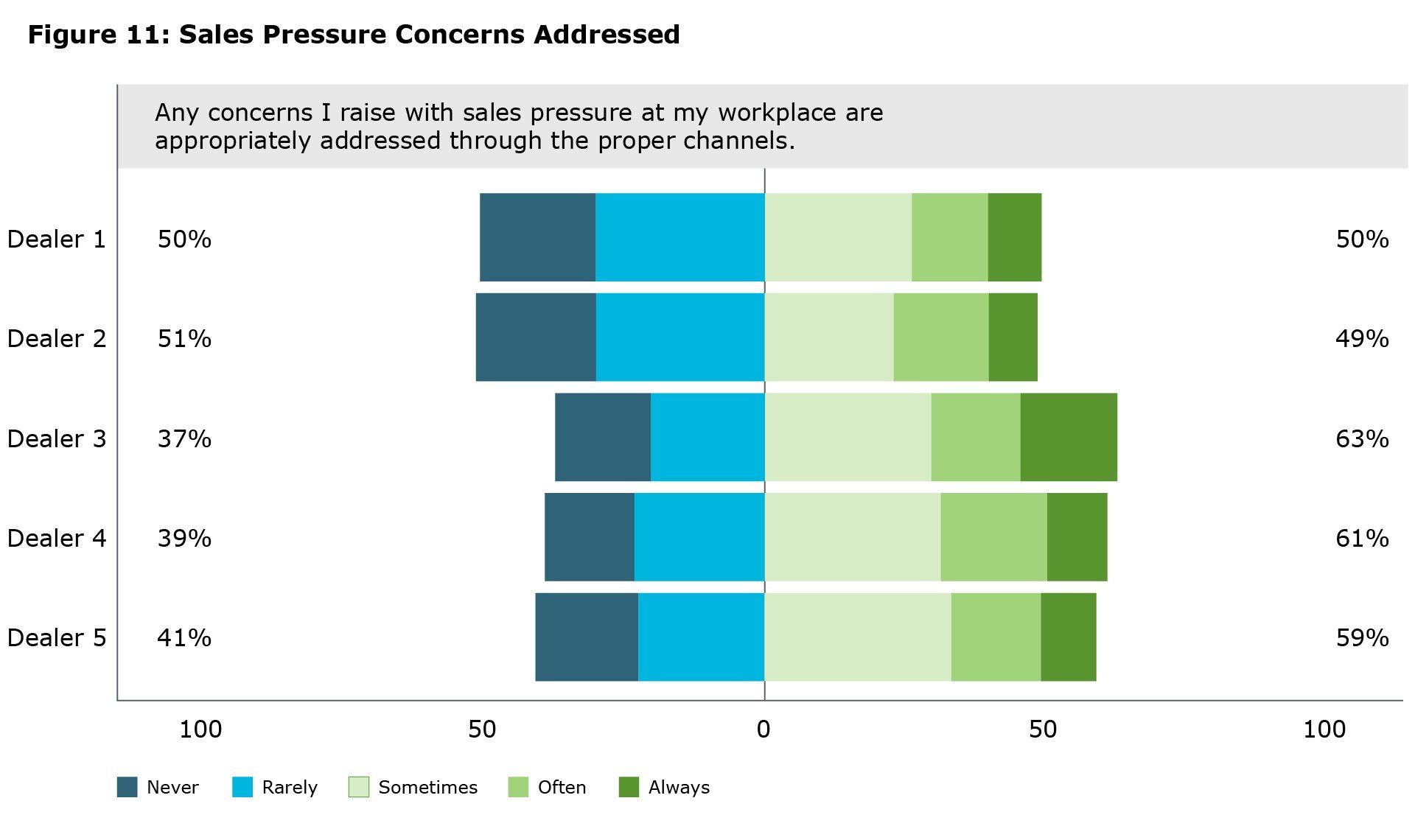

For those representatives who reported raising concerns related to sales pressure, 57% report that these concerns were appropriately addressed through the proper channels at least ‘sometimes’. A large minority of 43% indicate that their concerns were addressed ‘rarely’ or ‘never’ (Figure 11). This represents a sizable portion of representatives who took the initiative to voice concerns about their work environment but ultimately feel that these concerns were not adequately addressed by their firm.

Taken together, these results show that a majority of mutual fund dealing representatives working for one of the five bank-affiliated mutual fund dealers have at least some concerns related to sales pressure. Among this majority, a sizable minority reported that they are reluctant to raise these concerns for fear of negative repercussions; and among those who voiced their concerns, almost half feel that their firm has not done enough to address their concerns. These survey results should motivate the five bank-affiliated mutual fund dealers to examine sales pressure and its impact within their workplaces, and address the concerns expressed by their representatives.

[6] The majority of representatives from each dealer indicated that they experience peer-to-peer comparisons on scorecards (Dealer 1: 54%; Dealer 2: 81%; Dealer 3: 53%; Dealer 4: 65%; Dealer 5: 76%).

[7] This is the percentage of representatives who responded that they have concerns related to sales pressure at least ‘rarely’ or more frequently (i.e., ‘sometimes’, ‘often’, ‘always’).

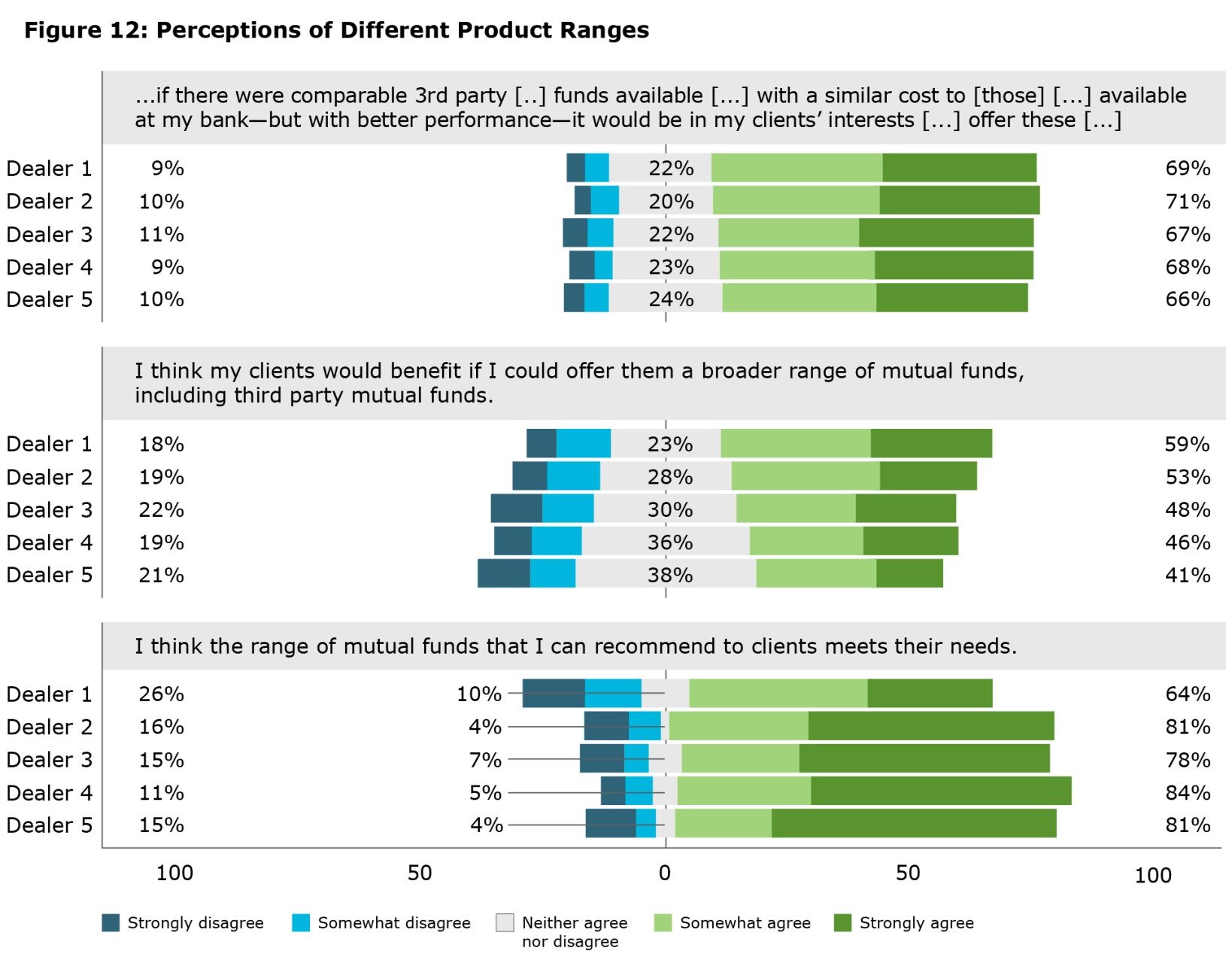

Representatives also provided their views on the range of mutual funds they are able to offer clients. The vast majority (94%)[8] of representatives report that they are only able to offer clients bank mutual funds (i.e., proprietary mutual funds) and are not able to offer external (i.e., third party) mutual funds.

Representatives were asked if they feel their existing range of mutual funds is sufficient in meeting their clients’ needs and if they think their clients would benefit if they were able to offer a broader range of mutual funds, including external (i.e., third party) mutual funds.

In terms of representatives’ overall sentiment about their range of products, there are positive views on both their current range, as well as on the idea of expanding their range to include external products. We found that 78% of representatives agree that their existing range meets the needs of their clients (Figure 12); however, almost half of representatives (48%) agree that clients would benefit if they could be offered a broader range of mutual funds, including external (i.e., third party) mutual funds.

Representatives were given the opportunity to provide an open-text response to offer more insight into their views on the range of products available to them. This allowed us to contextualize the results displayed in Figure 12 and identify some of the reasons why representatives feel the way they do. An analysis of the open text responses showed that representatives have a positive sentiment towards both their existing range of funds and the concept of having access to a broader range of funds, including external funds – which is in line with the responses to our survey questions described above.

In terms of positive sentiment towards the current range of products, we find that representatives commonly mention that the current range is sufficiently broad, and that representatives can refer clients to alternative channels within their bank-affiliated firms for any products they cannot offer themselves. Representatives who feel negatively about the current range frequently said that the existing range has limited choice.

With respect to external (i.e., third party) funds, representatives with a positive sentiment indicate that more options are better for clients, with some representatives going further to say that more options are essential to serving client needs. For those who expressed negative views towards external (i.e., third party) funds, they said that an expanded range of funds could create choice overload for clients and representatives, and that too many options could create confusion for clients. Some representatives also identified the need for additional training and Know Your Product (KYP) concerns as reasons for hesitation towards external (i.e., third party) funds. One representative illustrates this point in an open-text response:

"Being able to offer a broader range of mutual funds would require me to have in-depth knowledge of those third-party funds, and that would require me to spend more time researching and understanding those funds, and that would detract from the time I have available to meet with clients."

Overall, this combination of quantitative and qualitative data indicates an agreement among representatives that their current range of funds meets client needs, while also indicating that representatives see the benefit of a broader range of funds in terms of giving clients more choices.

[8] This combines the percentage of representatives who indicated that they do not sell third-party funds (86%) as well as those who indicated “do not know” when asked if they sell third-party funds (7%). Given the current offerings at the five bank-affiliated mutual fund dealers and/or other internal analyses of shelf range, it is likely that those who indicated “do not know” are not able to sell third-party funds.

The final section of our survey contained a set of questions designed to provide an indication of the knowledge of mutual fund dealing representatives in specific areas.

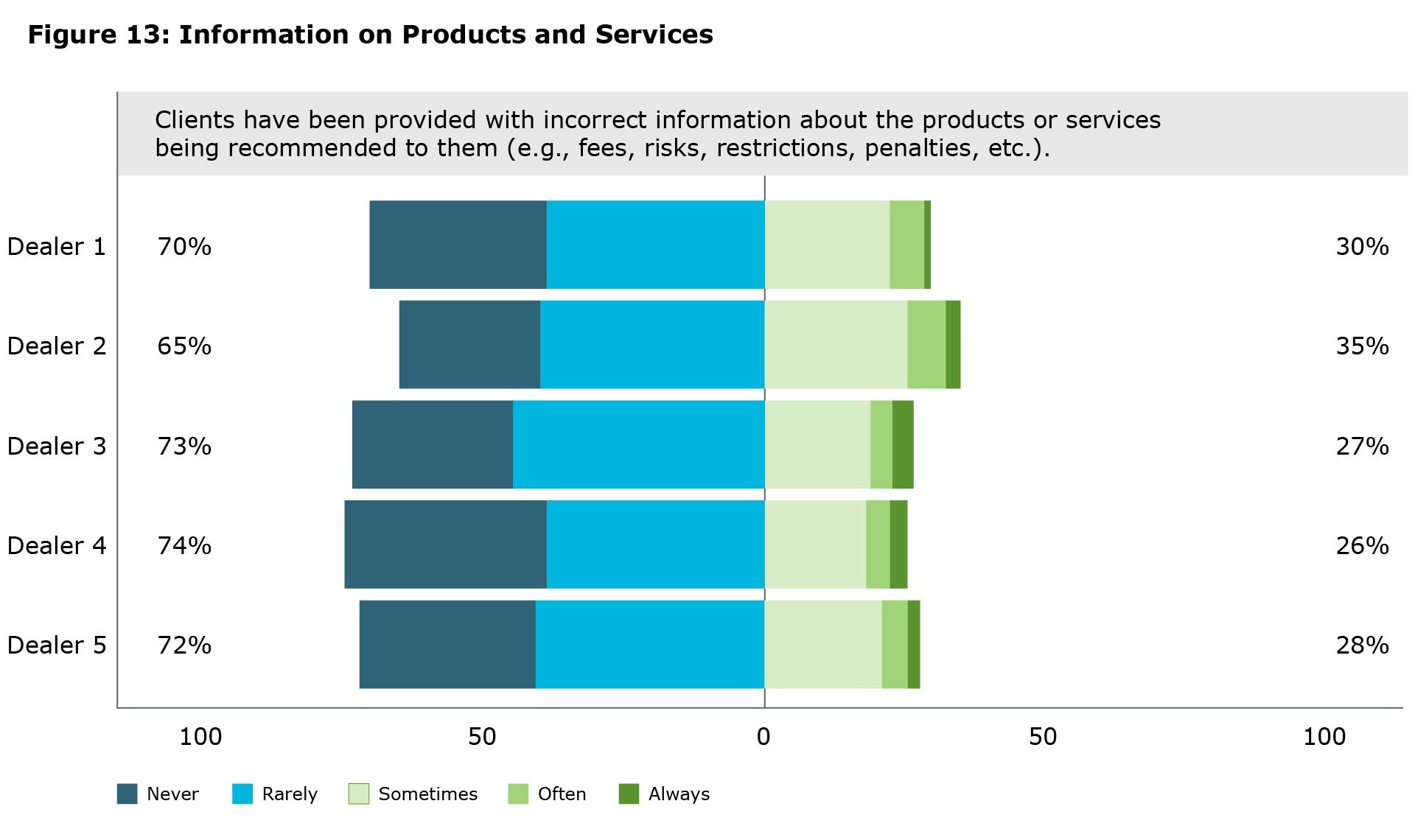

We first asked representatives a series of questions related to how knowledgeable they perceive their colleagues to be. Overall, we find that the majority of representatives (about 80%) believe that their peers are sufficiently knowledgeable on a variety of topics, ranging from registered plans to assessing client needs and understanding the fees associated with the funds they recommend. Although most representatives hold this perception, one third of representatives reported that clients have been provided with incorrect information about the products or services being recommended to them at least ‘sometimes’ (Figure 13). A representative speaks to this point in an open-text response:

“There needs to be more training for newly registered mutual fund representatives. I find they often don't even know how to put together a portfolio for a client based on their KYC [Know Your Client]. They don't know the proper investment sale process. They don't even know the list of mutual funds available for sale by the bank.”

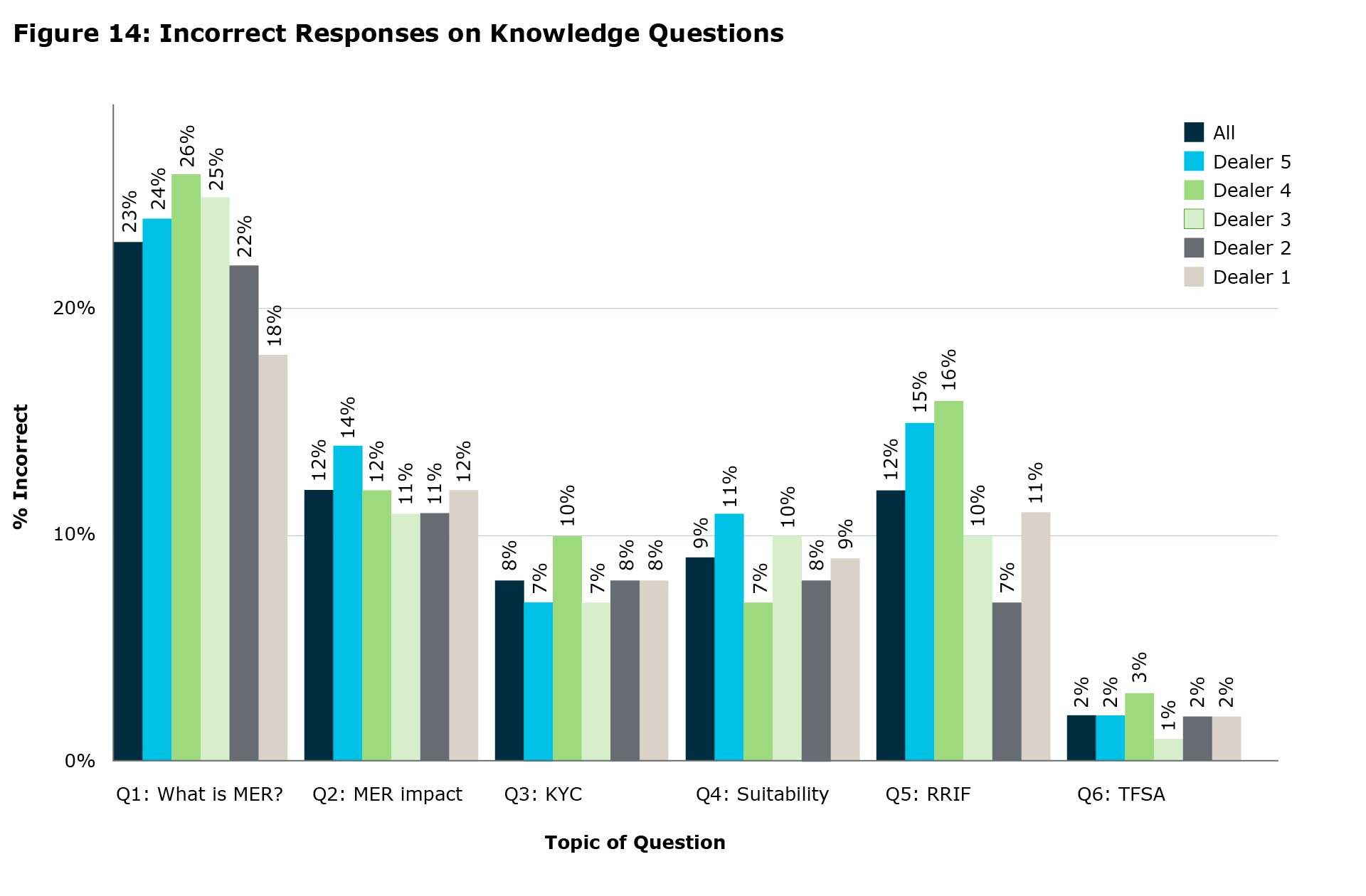

We concluded the survey by asking representatives six knowledge-based questions similar to those used in course examinations required for registration as a mutual fund dealing representative. The questions were on the meaning of Management Expense Ratio (MER), understanding the impact of MER, Know Your Client (KYC), Suitability, and understanding the features of registered accounts, such as Registered Retirement Savings Plans (RRSP), Registered Retirement Income Funds (RRIF) and Tax-free Savings Accounts (TFSA). While six questions do not provide a complete measure of a representative’s overall knowledge, the assessment was designed to identify whether there are specific areas where representatives may be lacking in knowledge.

Our results show that nearly all representatives ‘pass’ this assessment. More specifically, of the six questions asked, 86% of representatives correctly answered at least five, and 95% answered at least four correctly. Figure 14 illustrates the percentage of representatives who answered each of the six questions incorrectly.[9]

Although the large majority of representatives (83%) perceive their colleagues to be sufficiently knowledgeable on the topic of fees and expenses, we observed that some representatives answered the question about MER incorrectly. Specifically, 23% of representatives were unable to correctly identify the definition of a management expense ratio (MER), a foundational and important component of the products they are recommending to clients. However, representatives scored better on the second question which tested their ability to identify the impact of MER on mutual fund performance (12% of representatives answered this incorrectly). This indicates that although some representatives struggle to define MER, relatively more understand its impact on investor returns. Canada’s bank-affiliated mutual fund dealers should assess the current training provided to representatives and make any required enhancements so that clients are not provided with incorrect information, including around the fees and costs associated with mutual funds.

[9] The dark blue bar in Figure 14 is the overall average across all dealers, and the other bars represent the breakdown for each dealer.

Conclusion & Key Takeaways

Conclusion & Key Takeaways

This report provides insight on a range of topics from Ontario-based mutual fund dealing representatives working for one of Canada's five bank-affiliated mutual fund dealers. The primary focus of this survey was to gather information about mutual fund dealing representatives’ perspectives on their sales culture and environment and identify and assess the scale of any potential issues.

A key observation from this survey is that one in four representatives report that clients have been recommended products or services that are not in their interests. Our data suggests that this may be tied to several factors, such as the sales environment within the five bank-affiliated dealers (including compensation, incentives, and performance metrics used), a high degree of pressure to meet sales targets, and the frequent use of scorecards to track, compare, and emphasize those sales targets. Representatives reported that scorecards, in particular, not only exacerbate sales pressure, but could also influence the products or services recommended to clients. Collectively, these factors may pose risks that Canadian retail investors’ interests are not being sufficiently prioritized. Given these survey results, the bank-affiliated mutual fund dealers should conduct an assessment of their sales environment, including compensation, incentives, and performance metrics, and sales pressure experienced by representatives, including through the use of performance management tools such as scorecards. Where any of the concerns noted in this report are identified, enhancements should be made to ensure that sales practices align with placing the clients’ interests first.

Regarding the range of products available, representatives generally expressed satisfaction with the existing range of funds available to them, but also indicated that a broader range, including external (i.e., third party) funds, could be beneficial. However, any consideration of expanding the range of funds should address representatives’ perceived barriers, such as a lack of knowledge and potential training requirements for products that they are not currently permitted to offer.

Finally, our data highlight certain areas where representatives may lack knowledge, with one in three representatives reporting that clients have been provided incorrect information about the products or services recommended to them at least ‘sometimes’. Additionally, 23% of representatives were not able to identify the definition of Management Expense Ratio (MER) – a foundational and important component of the products representatives are selling. Although, relatively more representatives were able to correctly identify the impact of MER on mutual fund returns. These results indicate that Canada’s bank-affiliated mutual fund dealers should assess their current training programs and make any required enhancements to ensure that clients are provided with accurate product information.

Taken together, the results of this survey highlight several areas of concern with respect to the sales culture and environment within five bank-affiliated mutual fund dealers. The five dealers should carefully consider what representatives have reported to identify where changes or enhancements may be needed.

Given the information provided to us through the survey data about the sales environment at the five bank-affiliated mutual fund dealers, including compensation, incentives and performance metrics, and experiences of sales pressure reported by mutual fund dealing representatives, we are continuing our work on this initiative. The next phase of the work will focus on obtaining and assessing information, including around the use of scorecards, directly from each of the five bank-affiliated mutual fund dealers related to specific concerns identified in the survey, and will also include meetings with key individuals and requests for data.

This next phase will enable us to obtain an understanding of the sales practices in place and how they may impact the behaviour of mutual fund dealing representatives, as well as any potential impacts to investors. We also want to understand the controls the dealers have in place to address any material conflicts of interest arising from the sales practices, including the compensation, incentives, and performance metrics, and experiences of sales pressure.

Once we have completed our review and analysis of the information from each of the five bank-affiliated mutual fund dealers, we will consider our regulatory tools available and determine whether further action is required to ensure ongoing compliance with securities laws.[10]

[10] Including compliance with conflicts of interest and suitability determination provisions in National Instrument 31-103 Registration Requirements, Exemptions and Ongoing Registrant Obligations and equivalent CIRO rules.