Amendments to OSC Rule 13-502 Fees, OSC Rule 13-503 (Commodity Futures Act) Fees, Changes to their Companion Policies and Related Consequential Amendments and Changes

Amendments to OSC Rule 13-502 Fees, OSC Rule 13-503 (Commodity Futures Act) Fees, Changes to their Companion Policies and Related Consequential Amendments and Changes

Introduction

The Ontario Securities Commission (the OSC, the Commission or we) is

- repealing OSC Rule 13-502 Fees and replacing it with OSC Rule 13-502 Fees attached as Appendix A (the Main Fee Rule),

- repealing OSC Rule 13-503 (Commodity Futures Act) Fees and replacing it with OSC Rule 13-503 (Commodity Futures Act) Fees attached as Annex E (the CFA Fee Rule),

- replacing Companion Policy 13-502 Fees with Companion Policy 13-502 Fees attached as Annex C(the Main Fee CP),

- replacing Companion Policy 13-503 (Commodity Futures Act) Fees with Companion Policy 13-503 (Commodity Futures Act) Fees attached as Annex G (the CFA Fee CP), and

- publishing in final form related consequential amendments OSC Rule 11-501 Electronic Delivery of Documents to the Ontario Securities Commission and changes to Companion Policy 91-501CP Strip Bonds (the Consequential Amendments and Changes).

The repeal and replacement of the Main Fee Rule and the CFA Fee Rule are collectively referred to as the Amendments. The replacement of the Main Fee CP and the CFA Fee CP are collectively referred to as the CP Changes. The Amendments, the CP Changes, the Consequential Amendments and Changes are collectively referred to as the Materials. The Materials and their respective blacklines are in Annexes A to K of this Notice of Publication, with the text of the Consequential Amendments and Changes being in Annexes J and K of this Notice.

The Amendments reflect the increase in funding required to grow and mature our derivatives regulatory oversight program and support increasingly complex capital market activities and the OSC’s expanded mandate and structure, while considering burden reduction and fair allocation of costs across market segments. The Amendments establish a new fee for certain entities that enter into over-the-counter (OTC) derivatives transactions while reducing fees for certain existing fee payers to ensure that as specific sectors grow more than others, fees collected are proportionate to the cost of regulation across market segments. Furthermore, the Amendments are expected to generate efficiencies for most market participants and the OSC by eliminating a number of activity and late fees without compromising investor protection.

The Amendments:

- add new participation fees totaling $13.5 million for specific entities engaged in the trading of OTC derivatives, and

- reduce an estimated $5.6 million in annual fees for most existing payers by lowering participation fees and eliminating a number of activity and late fees.

The fee reductions are in addition to approximately $1.7 million of fee savings due to lower volumes of regulatory filings from policy-driven burden reduction initiatives, some of which have already been implemented and some that are planned over the next few years. Where applicable, these fee savings will be communicated as part of the implementation plan for these initiatives.

Background

The OSC is a self-funded agency that regulates Ontario’s capital markets. The OSC’s mandate is to protect investors from unfair, improper or fraudulent practices, to foster fair, efficient and competitive capital markets and confidence in the capital markets, to foster capital formation, and to contribute to the stability of the financial system and the reduction of systemic risk.

The fee structure is designed to recover the OSC's costs in delivering on its mandate. Fees are typically re-evaluated every three years based on the anticipated operating and capital costs to be incurred over the following period and infrequent cyclical investments that occur beyond a three-year cycle. The two main types of fees charged to market participants under the Main Fee Rule are participation fees and activity fees.

Participation fees are based on the cost of a broad range of regulatory services that cannot be practicably or easily attributed to individual activities or entities. Participation fees are intended to serve as a proxy for the market participants’ use of the Ontario capital markets. Participation fees are calculated differently for reporting issuers, registrant firms and certain unregistered capital market participants, specified regulated entities and designated rating organizations.

Activity fees are generally charged when a document of a designated class is filed with the Commission or a request for service has been made. The set fee is based on an estimate of the average direct cost of Commission resources (labour and materials) utilized in performing an activity. Activity fees are charged in connection with the following filings: prospectuses, registration applications, reports of exempt distribution, applications for discretionary relief and various other filings.

The guiding principles used by the OSC when evaluating potential fee changes are as follows:

- Recovery of regulatory costs

- Ease of administration

- Fair and proportionate fees

- Fee predictability

As part of the OSC’s periodic fee re-evaluation, market participants were informed in November 2020 that there would be no changes to the Main Fee Rule and the CFA Rule at that time, primarily as a result of uncertainty surrounding the Canadian capital markets during the early stages of the COVID-19 pandemic. The OSC implemented a cost reduction plan in fiscal year 2021 to address potential revenue implications from the COVID-19 pandemic, deferring a number of multi-year initiatives. Despite earlier market fragility concerns, Canadian equity markets have recovered from March 2020 declines and their continued growth to date has resulted in strong OSC revenues. Since the November 2020 notice, the OSC’s mandate was expanded and the complexity and levels of market activity requiring regulatory oversight have increased. The OSC has implemented significant structural changes as set out in the Ontario Government’s 2021 budget and in alignment with certain recommendations made by the Capital Markets Modernization Task Force, specifically to further separate the OSC Board from the Tribunal and separating OSC Chair and CEO roles. In addition, the OSC is aligning its operational capacity with growing market activity levels. We plan to draw down on cash to deliver multi-year initiatives, including a comprehensive derivatives regulatory oversight program and significant investments in technology modernization projects, some of which were previously slowed down or deferred.

When reviewing fee levels, the OSC considers the existing cash position, projected level of revenue and expenses, capital spending and the level of cash resources required to fund operations during market downturns. OSC revenues, particularly from participation fees, are impacted by capital market fluctuations. To this effect, the OSC’s existing cash position provides for an appropriate reserve, comprised of cash and reserve funds.

Summary of changes to the Proposed Amendments

On January 21, 2022, the OSC published proposed amendments to the Main Fee Rule and the CFA Fee Rule (the Proposed Amendments) for a 90-day comment period. Collectively, six comment letters were received on the Proposed Amendments. A list of those who submitted comments and a chart summarizing the comments received and responses to them are attached as Annex I to this Notice. Based on the feedback received in the comment letters and in order to reduce potential regulatory burden and improve clarity, the Commission has revised the Proposed Amendments.

The Amendments reflect our consideration of comments received on the Proposed Amendments. The following is a summary of key changes to the Proposed Amendments, which are also discussed in Annex I:

(a) Quarterly Notional Amount Determination

In response to comments, we have reduced the potential for regulatory burden by requiring derivatives participation fee payers to determine their average outstanding notional amounts on a quarterly basis, rather than on a daily basis as we had proposed.

(b) First Year of the Derivatives Participation Fee

To further reduce the potential for regulatory burden for the first derivatives participation fee payment due on August 29, 2023, we are providing derivatives participation fee payers with the option to calculate this payment based solely on their outstanding notional amount as at the end of the first derivatives fee year, rather than on an average quarterly basis.

(c) Drafting Changes

We have made drafting changes to improve clarity and address drafting comments from market participants.

(d) Late Fees for Investment Fund Families

We have extended the relief from late fees for investment fund families and affiliated registrants to the filing of Form 45-106F1 in subsection 40(2).

Substance and Purpose of the Materials

The Amendments are aimed at aligning fees to costs, reflective of the evolution of the regulatory landscape. This section provides information on fees required to support the maturing derivatives oversight framework while also summarizing fee reductions across different market segments. The OSC’s fee re-evaluation process encompasses an assessment of funding requirements to recover growing costs associated with delivering significant multi-year initiatives. Consequently, the fee reductions can only be offered with a successful introduction of the derivatives participation fee.

The OSC’s Oversight of the OTC derivatives market

The OSC established a Derivatives Branch in 2009 to implement the G20 Reforms following the 2008 financial crisis. The implementation of the G20 Reforms by the OSC resulted, among other things, in the creation of the following:

- a series of OTC derivatives specific rules (e.g., OSC 91-506 Derivatives: Product Determination, OSC 91-507 Trade Repositories and Derivatives Data Reporting, NI 94-101 Mandatory Central Counterparty Clearing of Derivatives, NI 94-102 Derivatives: Customer Clearing and Protection of Customer Collateral and Positions),

- proposed rules (NI 93-101 Derivatives: Business Conduct, NI 93-102: Derivatives: Registration),

- consultations (e.g., CSA Consultation Paper 92-401 Derivatives Trading Facilities and CSA Consultation Paper 95-401 Margin and Collateral Requirements for Non-Centrally Cleared Derivatives), and

- the development of a compliance oversight framework to ensure that the requirements set out in the rules that have already been implemented are being met.

The OSC’s oversight continues to evolve to adequately address the complexity and growth in the OTC derivatives sector. The aggregate notional amount of OTC derivatives transactions in Ontario continues to increase significantly annually. There is over $60 trillion of outstanding notional and over 3.7 million OTC derivative transactions outstanding, which the OSC monitors and analyzes for the purposes of achieving its mandate. The OSC receives approximately 10-12 million OTC derivatives trade reporting records per day, or approximately 2.4 billion records per year. Consequently, significant investments in both technology and staffing resources are necessary over the next few years to ensure the OSC is positioned to effectively ingest, manage, and analyze the vast quantity and complex nature of the OTC derivatives transaction data reported and to conduct appropriate oversight of derivatives market participants and address instances of non-compliance.

The OSC’s expanded systemic risk related mandate

The OSC’s mandate includes the monitoring of systemic risks in the capital markets.1 Systemic risk in the OTC derivatives market was a significant contributor to the 2008 financial crisis. Ontario’s OTC derivatives market is highly concentrated with the largest derivatives dealers representing the vast majority of the market.

Monitoring systemic risk involves not only monitoring the emergence of risks and financial system vulnerabilities that can threaten the stability of capital markets and have serious negative consequences to Ontario’s economy, but also identifying vulnerabilities such as access to liquidity, market fragmentation and trends in price formation that may impede efficient operation of the markets. We are continuing to evolve a framework for analyzing OTC derivatives data for systemic risk oversight , including the development of enhanced derivatives data capabilities and analytical tools to monitor and assess risk factors such as interconnectedness and concentration risk, as well as to detect market abuses such as manipulation and other unfair trading practices.

As part of the OSC’s mandate to contribute to the stability of the financial system and the reduction of systemic risk, we also work with other provincial, federal and global agencies to enhance the identification of financial system vulnerabilities and promote financial system resilience.

In order to achieve effective systemic risk oversight in relation to OTC derivatives, we require significant increases in staffing resources and technological capabilities for risk analysis.

Summary of the New OTC Derivatives Fee

Costs to monitor and regulate the OTC derivatives market are projected to increase significantly in the future as a result of the aforementioned future investments in both technology and people. Total annual costs are anticipated to be nearly $13.5 million by 2023, representing 9% of total projected OSC costs. These costs include direct costs and an allocation of indirect costs, such as premises, human resources, financial management, regulatory, advisory, and enforcement. The targeted fee is intended to recover $13.5 million of estimated annual costs from entities who engage in the trading of OTC derivatives.

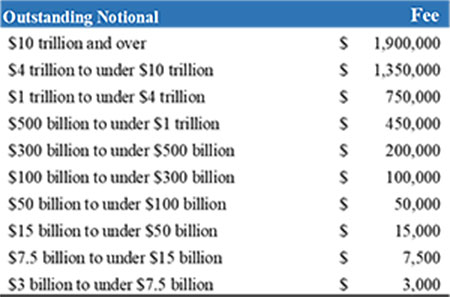

Consistent with a participation fee model charged to other market participants, we are proposing an annual participation fee comprised of a series of tiers based on a fee payer’s average quarterly outstanding notional of all transactions that are required to be reported under OSC Rule 91-507 over a one-year period. No fee is payable

- if a fee payer’s average outstanding notional is under $3 billion,

- by an entity that is not a reporting counterparty (as defined in OSC Rule 91-507), or

- by a recognized or exempt clearing agency.

The tiers and associated fees are as follows:

The OSC acknowledges that while these fees will increase regulatory costs for a select group of entities (namely, large financial institutions responsible for the vast majority of derivatives transactions occurring in Ontario), we believe these fees appropriately reflect the costs associated with oversight and monitoring of OTC derivatives activity in Ontario.

Summary of Fee Reductions and Fees Eliminated

As summarized below, the Amendments are expected to result in a targeted reduction in OSC participation, activity, and late fees of approximately $5.6 million (4.0%) from fiscal year 2021. These changes are further explained under “Detailed Listing of Fee Amendments”. The Materials also include changes to improve conciseness, simplicity and understandability. In addition, we outline below various changes where we are proposing to simplify, harmonize and reduce burden on market participants.

1) Participation Fee Reductions

We estimate $3.1 million in savings from fee rate reductions on participation fees, benefiting 98% of registrant firms and unregistered capital market participants and 88% of issuers. Issuers with a capitalization for the previous year below $1 billion are expected to see rate savings between 5% to 16% while registrant firms and unregistered capital market participants with specified Ontario revenues below $100 million are expected to see rate savings between 2% to 16%. The participation fee reduction is aimed at small and medium-sized businesses as part of our ongoing efforts to reduce regulatory burden, foster capital formation and competitive capital markets.

2) Fee reductions on exempt distribution filings under OSC Rule 45-501 Ontario Prospectus and Registration Exemptions and NI 45-106 Prospectus Exemptions

$1.8 million savings from reducing fees relating to exempt distribution filings under OSC Rule 45-501 Ontario Prospectus and Registration Exemptions and NI 45-106 Prospectus Exemptions. The rate reduction of 30% will reduce the fee to $350 from $500.

3) Elimination of certain activity and late fees

$0.7 million savings from the elimination of a number of activity fees and late fees. To streamline the fee rules, we have eliminated various activity fees that generate minimal volume and associated OSC regulatory work. In addition, we eliminated a fee that disincentivized shareholder activism, an activity that encourages accountability of public management and boards of directors. A number of document filings that attract possible late fees will be eliminated without compromising investor protection. Many of the eliminated late fees will also result in harmonization with other Canadian Securities Administrators (CSA) jurisdictions. These amendments also reflect permanently eliminating late fees on outside activities.

4) Simplify annual capital market participation fee calculation for registrant firms and unregistered capital market participants

We are simplifying the annual capital market participation fees calculation by using the most recent completed financial statements. This calculation will no longer require the use of estimates of specified Ontario revenues by any filers, or the subsequent filing of Form 13-502F5 (Adjustment of Fee for Registrant Firms and Unregistered Capital Markets Participants) or Form 13-503F2 (Adjustment of Fee Payments for Commodity Futures Act Registrant Firms) to provide for adjustments to estimates based upon actuals. Consequently, we have eliminated Forms 13-502F5 and 13-503F2.

Under the Amendments, capital markets participation fees will be calculated using a “designated financial year”. The definition of “designated financial year” will entail the use, in the case of registrants, of actual financial information based upon most recently audited financial statements.

In the case of unregistered capital markets participants that normally do not audit their financial statements, the definition of “designated financial year” will entail the use of available unaudited financial statements.

The Amendments will change the requirement and deadline for registrant firms to file between September 1st and November 1st based on actual financial statements. The previous deadline to file was December 1. The foregoing changes will reduce burden on market participants by reducing the amount of required form filings and are not intended to have a significant financial impact on fees.

5) Simplify and clarify annual capital market participation fee submission for Class 2 reporting issuers

As part of the simplification process, we are repealing section 2.5, Participation fee estimate for Class 2 reporting issuers, of the Main Fee Rule and the accompanying Form 13-502F2A (Adjustment of Fee Payment for Class 2 Reporting Issuers) and are eliminating the use of estimates. The method of calculating capitalization under section 2 of the Main Fee Rule, which is relevant for issuer participation fees, has also been clarified.

6) Relief for investment fund families and affiliates

The Main Fee Rule presently provides relief from the duplication of activity fees paid within investment fund families and by affiliated registrants. This relief is extended through the introduction of subsection 34(1) so that this relief applies to joint applications made by any applicants affiliated with each other. The same type of relief is also provided in section 10 of the CFA Rule.

7) Requests to the Commission

Minor adjustments to fees for the search of Commission public records and copies are implemented as per Rows M1 and M2 of Appendix F of the Main Fee Rule and Rows G1 and G2 of Appendix B of the CFA Rule.

8) Harmonization of Late Fee Calculations

We are harmonizing within our fee rules and other jurisdictions the basis for the calculation of late fees by using calendar days where it currently states business days.

Detailed Listing of Fee Amendments

|

Fee Reductions (section references are to the replaced Main Fee Rule) |

|

|

|

|

|

Stakeholders |

Description |

|

Registrant Firms, Unregistered Capital Markets Participants |

Reduce participation fees between 2% and 16% for firms with specified Ontario revenues up to $100 million (Main Fee Rule: Appendix C, CFA Rule: Appendix A) |

|

Issuers |

Reduce participation fees between 5% and 16% for issuers with capitalization up to $1 billion (Main Fee Rule: Appendix A/B) |

|

Issuers |

Reduce the activity fee from $500 to $350 for exempt distribution filings under OSC Rule 45-501 Ontario Prospectus and Registration Exemptions and NI 45-106 Prospectus Exemptions Report of Exempt Distribution (Main Fee Rule: Appendix F, Paragraph B) |

|

Specified Regulated Entities |

Reduce both the participation and activity fee to certain foreign clearing agencies providing services in Ontario, if they do not have a clearing member resident in Ontario. The Amendments will require such an exempt clearing agency with at least one customer resident in Ontario2 to pay an activity fee of $15,000 (instead of $83,000) and an annual participation fee of $7,500 (instead of $10,000). (Main Fee Rule: Appendix D, Row E1 & Appendix F, Row D5) |

|

Removal of Fees (section references are to the repealed Main Fee Rule) |

||

|

|

||

|

Stakeholders Affected |

Description |

|

|

Activity Fees |

||

|

Registrant Firms |

Remove the activity fee of $100 for a certified statement from the Commission/Director under section 139 of the OSA. (Main Fee Rule: Appendix C, Row M1) |

|

|

Investment Funds |

Remove the activity fee of $1,500 associated with Application for approval under s.213(3) of the Loan and Trust Corporations Act (Main Fee Rule: Appendix C, Row E7) |

|

|

Individuals |

Remove the activity fee of $30 for requests to the Commission for one’s individual registration form (Main Fee Rule: Appendix C, Row P3, CFA Rule, Appendix B, Row G3) |

|

|

Shareholders |

Remove the activity fee of $4,500 for filing an information circular by a person or company in connection with a solicitation that is not made by or on behalf of management (dissident proxy circular) (Main Fee Rule: Appendix C, Row J1) |

|

|

Issuers |

Remove the activity fee of $2,000 for a Notice of Exemption under paragraph 2.42(2)(a) of National Instrument 45-106 (Main Fee Rule: Appendix C, Row C1) |

|

|

Issuers |

Remove the activity fee for distribution of securities of an issuer under section 2.9 of (Offering memorandum) National Instrument 45-106 (Main Fee Rule: Appendix C, B2.1), now consolidated within Main Fee Rule: Appendix C, B2. |

|

|

Issuers |

Remove the activity fee of $500 for filing a prospecting syndicate agreement (Main Fee Rule: Appendix C, Row D1) |

|

|

Issuers |

Remove the activity fee of $3,800 for rights offering circular (Main Fee Rule: Appendix C, Row B3). |

|

|

Late Fees |

||

|

Issuers |

Remove various issuer late fees associated with late filing of participation fee documents (Main Fee Rule: Appendix D, Paragraph A. (g), (h),(i),(l)) |

|

|

Specified Regulated Entities |

Remove various late fees charged to specified regulated entities associated with the late filing of participation fee documents (Main Fee Rule: Appendix D, Paragraph A.(m),(n)) |

|

|

Registrant Firms |

Remove various registration related late fees (Main Fee Rule: Appendix D, Paragraph A. (c), (e), (k), Paragraph B. and corresponding provision in Appendix C of CFA Rule. |

|

|

Investment Fund Families and Affiliated Registrants |

Relief provided from late fees for investment fund families and affiliated registrants: Subsection 7A.3(3) and (4) of the Main Fee Rule. |

|

Purpose of the CP Changes

The CP Changes correspond to the Amendments. The purpose of the CP Changes is to clarify the Commission's view of the application of the Amendments.

Coming-into-Force

The Amendments and other required materials were delivered to the Minister of Finance on or about November 21, 2022. The Minister may approve or reject the Amendments or return them for further consideration. If the Minister approves the Amendments or does not take any further action the Amendments will come into force on April 3, 2023.

Content of Annexes

The following annexes form part of this Notice:

Annex A – Replacement OSC Rule 13-502 Fees

Annex C – Replacement Companion Policy 13-502 Fees

Annex E – Replacement OSC Rule 13-503 (Commodity Futures Act) Fees

Annex G – Replacement Companion Policy 13-503 (Commodity Futures Act) Fees

Annex I – Summary of Comments and OSC Responses

Annex K – Changes to Companion Policy 91-501CP Strip Bonds

Questions

Please refer your questions to:

|

Greg Toczylowski Benjamin Sing Matthew Au Liliana Ripandelli |

Roger Aguiar Anita Chung Alina Bazavan

|

1 Securities Act (Ontario), s. 1.1, as amended by the Stronger, Fairer Ontario Act (Budget Measures), 2017 (Ontario), Sch. 37, s. 2. IOSCO has referred to systemic risk as “the potential of any widespread adverse effect on the financial system and thereby on the wider economy” (Mitigating Systemic Risk A Role for Securities Regulators, IOSCO, February 2011 at https://www.iosco.org/library/pubdocs/pdf/IOSCOPD347.pdf).

2As defined in National Instrument 94-102 Derivatives: Customer Clearing and Protection of Customer Collateral and Positions