Notice and Request for Comment: Proposed Amendments to NI 31-103 Registration Requirements and Exemptions and to Companion Policy 31-103CP

Notice and Request for Comment: Proposed Amendments to NI 31-103 Registration Requirements and Exemptions and to Companion Policy 31-103CP

NOTICE AND REQUEST FOR COMMENT ON

PROPOSED AMENDMENTS TO

NATIONAL INSTRUMENT 31-103

REGISTRATION REQUIREMENTS AND EXEMPTIONS

AND TO

COMPANION POLICY 31-103CP

REGISTRATION REQUIREMENTS AND EXEMPTIONS

COST DISCLOSURE AND PERFORMANCE REPORTING

Introduction

The Canadian Securities Administrators (the CSA or we) are seeking comment on proposals to amend National Instrument 31-103 Registration Requirements and Exemptions (NI 31-103 or the Rule) and Companion Policy 31-103 CP Registration Requirements and Exemptions (the Companion Policy). We refer to the Rule and Companion Policy as the "Instrument".

NI 31-103 came into force on September 28, 2009 and introduced a new national registration regime that is harmonized, streamlined and modernized. We published amendments to the Instrument on April 15, 2011 which, subject to approvals, including ministerial approvals, will come into force on July 11, 2011{1}.

We are now proposing additional amendments in the context of the Client Relationship Model (CRM) Project, as described in this Notice, which, if adopted, would introduce performance reporting requirements and enhance existing cost disclosure requirements in the Rule.

The proposed amendments to the Rule are in Appendix A to this Notice. The proposed amendments are further to those in the amended Instrument published on April 15, 2011. A blackline version of the Rule, showing the proposed changes to the amended Rule is in Appendix B to this Notice. A blackline version of the Companion Policy, showing the proposed changes to the amended Companion Policy is in Appendix C to this Notice.

The comment period ends on September 23, 2011.

Background

The CSA, and the Investment Industry Regulatory Organization of Canada (IIROC) and the Mutual Fund Dealers Association of Canada (MFDA) (together referred to as the self-regulatory organizations or SROs), are working to develop requirements in a number of areas related to a client's relationship with a registrant. This initiative is referred to as the CRM Project. As part of this work, the CSA has already developed requirements relating to:

• relationship disclosure information delivered to clients at account opening

• comprehensive conflicts of interest requirements

These requirements were included in the Rule when it came into force.

The amendments outlined in this Notice relate to the remaining elements of CRM, specifically:

• disclosure of charges related to a client's account and securities transactions

• account performance reporting

Contents of this Notice

This Notice gives an overview of the proposed cost disclosure and performance reporting amendments to the Instrument. It is organized into the following sections:

1. Purpose of the proposed amendments and impact on investors

2. Investor research and industry consultations

3. Summary of the proposed amendments to the Instrument

A. Disclosure of charges

B. Performance reporting

4. Continuing work on what securities should be included in reporting

5. Transition

6. Impact on SRO members

7. Authority for the proposed amendments

8. Alternatives considered

9. Anticipated costs and benefits

10. Unpublished materials

11. Request for comments

12. Where to find more information

This Notice also contains the following appendices:

• Appendix A -- draft amending instrument to NI 31-103

• Appendix B - blackline version of proposed amendments to NI 31-103

• Appendix C - blackline version of proposed amendments to Companion Policy

1. Purpose of the proposed amendments and impact on investors

The purpose of the proposed amendments is to ensure that clients of all dealers and advisers (registrants), whether or not the registrant is a member of an SRO, receive clear and complete disclosure of all charges associated with the products and services they receive, and meaningful reporting on how their accounts perform.

We think that this is a significant investor protection initiative since we are of the view that investors want this type of information and should be entitled to receive it. Many investors do not understand, or are not aware of, all of the charges associated with their investment products and the services they receive. These charges are often buried in the cost of the product or in the prospectus, or are only mentioned briefly at the time of account opening.

The proposed amendments are intended to provide investors with key information about their account and product-related charges and the compensation received by registrants. This information would be provided at relevant times, such as at account opening, at the time a charge is incurred and on an annual basis.

Similarly, many investors do not receive any information about how their account is performing. If they do, the information is often complex and difficult to understand. We expect that providing investors with clear and meaningful account performance reporting will assist them in evaluating how well their account is doing and provide them with the opportunity to make more informed decisions about meeting their investment goals and objectives.

If adopted, the proposed amendments will result in investors receiving additional reporting from their registrant:

• a new annual summary of all account-related and product charges, and other compensation received by the registered firm

• the original cost of each security added to account statements

• annual account performance reporting

These reporting proposals are outlined in detail in section 3 of this Notice.

2. Investor research and industry consultations

To assist us in developing the proposed amendments, we sought feedback from investors to assess and evaluate their understanding and expectations relating to account charges and performance reporting. We also sought feedback from industry participants on current performance reporting practices, and the costs and benefits of providing additional disclosure in the areas of charges and performance reporting. We thank everyone who provided feedback during the research and consultation process. We also appreciate the input provided by the SROs during the development of the proposals.

Investor research

In July 2010, we surveyed approximately 2,000 investors to learn more about their understanding and expectations relating to charges and disclosure, and performance measures and reporting. The report on this survey, Report: Performance Reporting and Cost Disclosure, prepared by The Brondesbury Group is or will be available on the websites of CSA jurisdictions (see section 12 of this Notice, Where to find more information).

We learned from the investor survey that:

• most investors do not have the information they need to make an informed judgment about their account

• showing information in technical terms is often the same as not showing it at all because investors will tend to ignore complex data or terminology that they don't understand

• it cannot be assumed that investment and performance terms are well understood by investors

• regardless of the amount invested, information provided in a simple fashion is desired and understood by most investors

• more detailed reporting is of far greater interest to investors than more frequent reporting

The investor research provided us with useful information on the type of information investors want to receive from their dealers and advisers. The research also identified areas where investors need more guidance or disclosure. We considered all of this information in developing our proposals.

Industry consultations

We also conducted industry consultations with dealers and advisers to gain insight into current performance reporting practices, and to identify issues and concerns with providing performance information.

We learned that many registrants already provide some or all of the information required in the proposed amendments to their clients or certain groups of their clients. However, some raised concerns about the potential costs, time and resources that would be required to prepare performance information, especially if systems need to be modified.

In response to these concerns, we have provided for a phased introduction of the proposed new requirements. We believe that the potential benefits of the performance reporting proposals merit the incremental work that registrants would need to undertake to implement them.

Registrants also had concerns about the complexity of certain performance reporting information and whether clients would even comprehend or use this information. We have learned that investors want this type of information and can find it useful if it is communicated in a clear and understandable manner.

Document testing of a sample performance report

In conjunction with preparing the amendments to the Instrument, we developed a sample performance report that reflected the account performance reporting proposals. This document was tested on a one-on-one basis with investors, dealers and advisers to obtain reactions on its usefulness, clarity and overall appeal. The report Canadian Securities Administrators Performance Report Testing prepared by Allen Research Corporation is or will be available on the websites of CSA jurisdictions (see section 12 of this Notice, Where to find more information).

The research report indicates that the sample performance report was well received by the investors and registrants who participated in the testing. The investors described it as clearly written and offering them some information that they do not currently receive. Many of the investors preferred to have performance information presented using a combination of text and visual tools, such as tables, charts or graphs. Registrants also reacted positively to the sample performance report, but requested some modifications based on the types of clients or investment products that they deal with.

The research report recommends changes to the sample performance report based on the feedback received. After reviewing the research report, we made changes to clarify the information in the document and to better reflect the type of information that investors would find useful and meaningful. The revised sample performance report is included in proposed Appendix D of the Companion Policy.

While we do not intend to prescribe a form in the Rule for presenting performance information, we expect dealers and advisers to present this information in a clear and meaningful manner. This includes a requirement to use a combination of text and tables, charts or graphs. We encourage registrants that are already providing additional performance information to continue to do so.

Further research

In section 4 of this Notice, we discuss our plans for further research on clients' understanding and expectations with respect to account reporting.

3. Summary of the proposed amendments to the Instrument

The proposed amendments are intended to materially improve investor protection and would:

• enhance the current disclosure of charges in the Rule related to the operation of an account, and the making, holding and selling of investments

• enhance the current disclosure of the compensation received by a registered firm, particularly relating to charges such as trailing commissions and deferred sales charges, which are not always well understood by investors

• provide guidance in the Companion Policy on inappropriate switch transactions and the resulting compensation received by registrants, which may not be as transparent as other types of charges

• add a requirement to include information on the original cost of securities in the account statement

• add new account performance reporting requirements that would assist investors in determining how their account is performing

A. Disclosure of charges

We propose to enhance the requirements for the disclosure of charges at account opening for all accounts. We propose also to add new requirements for the ongoing disclosure of charges, both before accepting a client's order for a trade in an account where the registrant does not have discretionary authority (non-managed account), and annually for all types of accounts.

Relationship disclosure information

We are proposing in section 14.2 [relationship disclosure information] to replace the term costs with the term charges to avoid confusing the charges associated with the operation of an account or executing transactions with the actual purchase cost of a security.

We are also proposing some clarifications of the expectations for relationship disclosure information that is required to be provided under this section.

Pre-trade transaction charge disclosure

We propose requiring registered firms to provide specific disclosure of the charges a client with a non-managed account would have to pay when purchasing or selling a security prior to the registrant accepting the client's order.

Annual disclosure of charges

We propose requiring registered firms to provide each client with an annual summary of all charges incurred by the client and all the compensation received by the registered firm that relates to the client's account.

In addition, registrants would be required to disclose the nature and amount of compensation received from third parties, such as trailing commissions and referral fees, that were generated as a result of the client's account. Registrants would also have to disclose whether mutual fund holdings could be subject to a deferred sales charge.

Most investors do not currently receive personalized information on certain fees such as trailing commissions, deferred sales charges and referral fees and consequently, may have little understanding of these terms. We acknowledge that some information about these charges must be disclosed in the simplified prospectus for mutual funds. However, research indicates that many investors do not find the prospectus to be an accessible source of information. National Instrument 81-101 Mutual Fund Prospectus Disclosure contains the requirements to produce and file the Fund Facts document which was created in response to this concern, but it only contains disclosure on mutual fund charges. By providing clients with consolidated annual disclosure of all charges, the proposed requirements should assist in informing investors and raising awareness of how much their investments are actually costing them.

B. Performance reporting

Cost information

We propose requiring registrants to include original cost information for each security position in the account statement. This information should assist investors in assessing how well individual securities are performing by comparing their original cost to their current market value.

- - - - - - - - - - - - - - - - - - - -

Issue for comment

We have considered the option of permitting the use of tax cost (book value) as an alternative to original cost. We invite comments on the benefits and constraints of each approach to cost reporting, in particular as they relate to providing meaningful information to investors and their usefulness as a comparator to market value for assessing performance.

- - - - - - - - - - - - - - - - - - - -

We have also added guidance in the Companion Policy on the determination of market value.

- - - - - - - - - - - - - - - - - - - -

Issue for comment

Is the guidance provided on determining the market value of securities in section 14.14 [client statements] of the Companion Policy useful and sufficient? Please indicate if there is additional or different guidance needed. We are particularly interested in your comments on the guidance related to the valuation of exempt or illiquid securities where there are no quoted values available.

- - - - - - - - - - - - - - - - - - - -

Performance reports

We propose adding a new section 14.15 [performance reports] which would require firms to provide clients with account performance reporting on an annual basis. The content of the performance reports would be set out in a new section 14.16. This information would be provided as part of, or together with, the account statement.

- - - - - - - - - - - - - - - - - - - -

Issue for comment

We acknowledge that there are unique features to group plans offered by scholarship plan dealers (group scholarship plans). We invite comments on whether the proposed account performance reporting requirements should apply to accounts invested in group scholarship plans or what other types of performance reporting would be useful to clients of group scholarship plans in lieu of the proposals outlined in the Rule.

- - - - - - - - - - - - - - - - - - - -

The account performance reporting proposal includes the following components:

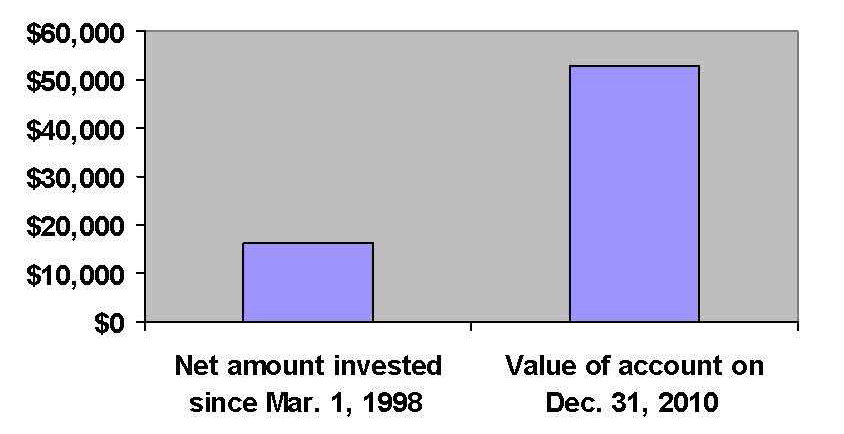

(a) Net amount invested

This is the actual dollars invested by the client and allows clients to assess how well the account has performed by comparing their investment to the market value of the account.

(b) Change in value

Clients would be provided with the change in the value of their account over the past 12- month period and also since the inception of the account. For example, the change in the value of the account since inception is the difference between actual dollars invested in the account and the market value of the account. It tells investors how much money they have actually made or lost in dollar terms.

Registered firms would be permitted to break out the change in value figure into more detail as described in the Companion Policy. However, the change in value would not be required to include realized capital gains and losses, unless the realized gains have been reinvested into the account. Clients should continue to receive this information separately for tax reporting purposes.

(c) Percentage returns

Dealers and advisers would be required to provide clients with annualized compound percentage returns of their account for specified time periods.

(d) Use of benchmarks

As part of the relationship disclosure information delivered to clients at account opening under section 14.2 [relationship disclosure information], registered firms would be required to provide each client with a general description of benchmarks, the factors that should be considered when using them and whether the firm offers any options for benchmark reporting to clients. This information is intended to make investors generally aware of benchmarks and their uses and limitations, and to ensure that investors are aware of any benchmark information that the firm makes available.

In addition, registered firms would be permitted to provide benchmark return information as part of their account performance reporting in circumstances where the firm and the client have agreed in writing to the use of benchmarks [proposed section 14.17 [benchmark information]].

We do not propose to require any further delivery of benchmark information in the Rule due to the mixed feedback we received during the document testing of the sample performance report. As part of that testing, we explored whether the use of three prescribed and broad based benchmarks would be useful to investors. While some investors understood and wanted this information, the research report indicated that the use of these benchmarks was not well understood by most of the investors. Further, many investors had difficulty comparing the benchmarks to their own account, or determining whether the benchmarks were relevant for comparison purposes.

We recognize that the use of benchmark information has its challenges. Guidance on the use of benchmarks that are meaningful and not misleading has been added to the Companion Policy. In general, a meaningful and relevant benchmark should assist an investor in measuring:

• the value added to an investor's account by a particular dealer or adviser in exchange for the fees paid by the investor

• the relative rewards and advantages of investing in the manner chosen as opposed to a passive alternative

• whether the investor's performance return goals are realistic compared to the market's returns

4. Continuing work on what securities should be included in reporting

In the June 25, 2010 Notice and request for comments on proposed amendments to NI 31-103, we sought feedback on eight questions related to what securities should be reported in account statements and related issues. We thank everyone who submitted comments.

We have not proposed any changes to section 14.14 [client statements] of the Rule in this publication related to this feedback.

Additional research

We have determined that more work needs to be done on these issues. We intend to:

• conduct further research with investors on their understanding and expectations about reporting on their security holdings

• consult further with industry participants to better understand the risks, benefits and constraints of reporting on clients' security holdings and the manner in which they could be disclosed, such as in the account statement or in another document. For example, in the context of securities sold by exempt market dealers, the type of reporting required may depend on whether the client's securities are held on the books of the registrant or the issuer

• revisit comments and feedback already received

After we have the benefit of this information, we may publish additional proposals for comment. In any event, we will communicate the outcome of this work.

5. Transition

Some registered dealers and advisers would require time to adjust their reporting practices in order to meet the requirements for disclosure of charges and performance reporting if the amendments are adopted. In addition, we recognize that certain information required to be reported under the proposed amendments is not currently available. Therefore, we have proposed the following transitional provisions:

• information will only be required to be reported on a go-forward basis so that firms will not be required to retrieve data for past periods unless it is already available

• a phased introduction period of two years following implementation of the amendments for most of the new requirements

6. Impact on SRO members

We worked with both SROs to harmonize the Instrument and SRO rules relating to disclosure of charges and performance reporting. To the extent that the SRO rules differ materially from the Rule if the amendments are adopted, each SRO will propose additional rule amendments to its cost disclosure and performance reporting requirements. These will be subject to final approval by applicable CSA members. Subject to approval, subsections 14.2(2) to (6) [relationship disclosure information] and sections 14.15 [performance reports], 14.16 [content of performance reports] and 14.17 [benchmark information] would not apply where the SROs have rules providing for substantially similar requirements.

On January 7, 2011, IIROC published for a third comment period proposed amendments to its Dealer Member Rules to implement the core principles of CRM (IIROC Notice 11-0005). The comment period ended on March 8, 2011, and the proposed amendments are currently under review.

The MFDA has also published its proposed amendments relating to CRM, which were approved by its members at its December 1, 2010 annual general meeting. The amendments will come into force subject to the prescribed transition periods.

7. Authority for the proposed amendments

In Ontario, the rule making authority for the proposed amendments is in the following paragraphs of subsection 143(1) of the Securities Act: 1, 1.1, 2, 3, 5, 7, 8, and 8.1.

8. Alternatives considered

We did not consider alternatives to the proposed amendments.

9. Anticipated costs and benefits

The anticipated investor protection benefits of the proposed amendments are discussed in section 1 of this Notice. We think the potential benefits to investors outweigh the costs to registered dealers and advisers of providing additional disclosure to their clients.

10. Unpublished materials

We have not relied on any significant unpublished study, report, or other written materials in preparing the proposed amendments.

11. Request for comments

We welcome your feedback on the proposed amendments. We need to continue our open dialogue with all stakeholders if we are to achieve our regulatory objectives while balancing the interests of investors and registrants.

All comments will be posted on the Ontario Securities Commission website at www.osc.gov.on.ca and on the Autorité des marchés financiers website at www.lautorite.qc.ca.

All comments will be made publicly available.

- - - - - - - - - - - - - - - - - - - -

We cannot keep submissions confidential because securities legislation in certain provinces requires publication of a summary of the written comments received during the comment period. Some of your personal information, such as your e-mail and residential or business address, may appear on the websites. It is important that you state on whose behalf you are making the submission.

- - - - - - - - - - - - - - - - - - - -

Thank you in advance for your comments.

Deadline for comments

Your comments must be submitted in writing by September 23, 2011.

Send your comments electronically in Word, Windows format.

Where to send your comments

Please address your comments to all CSA members, as follows:

Please send your comments only to the addresses below. Your comments will be forwarded to the remaining CSA member jurisdictions.

Questions

Please refer your questions to any of:

12. Where to find more information

The proposed amendments and the research reports are or will be available on websites of CSA members, including:

June 22, 2011

{1} After the amendments come into force, NI 31-103 will be re-named "Registration Requirements, Exemptions And Ongoing Registrant Obligations".

APPENDIX A

PROPOSED AMENDMENTS TO NATIONAL INSTRUMENT 31-103

REGISTRATION REQUIREMENTS AND EXEMPTIONS

- - - - - - - - - - - - - - - - - - - -

The proposed amendments in sections 3(g), 7, 8(a), 9(c), 10, 12, 13, 14 and 17 of the amending instrument below are proposed to come into force at dates later than the implementation date for the other proposed amendments. Please refer to section 18. This text box does not form part of the amending instrument.

- - - - - - - - - - - - - - - - - - - -

1. National Instrument 31-103 Registration Requirements and Exemptions is amended by this Instrument.

2. Section 1.1 is amended by

(a) adding the following after the definition of "Canadian Financial Institution":

"charges" include operating charges and transaction charges;

"compound percentage returns" means cumulative gains and losses over time expressed as a percentage;

(b) adding the following after the definition of "mutual fund dealer":

"net amount invested" means the sum of all contributions of cash or securities into an account, not including income generated by investments in the account if that income is reinvested, less all withdrawals of cash or securities out of the account, except charges paid out of the account;

"operating charges" means any amounts charged in respect of the operation of an investment account of a client, including service charges, administration fees, safekeeping fees, management fees, performance fees;

"original cost" means the total amount paid for a security, including any commissions or other charges related to purchasing the security; and

(c) adding the following after the definition of "subsidiary":

"transaction charges" means any amounts charged in respect of a purchase or sale of securities, including commissions, sales charges, transaction fees;

3. Subsection 14.2 (2) is amended

(a) in paragraph (b) by replacing "discussion that identifies" with "general description of" and by replacing "a client" with "the client";

(b) in paragraph (c) by adding "general" before "description";

(c) by replacing paragraph (f) with the following:

(f) disclosure of all operating charges the client may pay related to the account;

(d) by replacing paragraph (g) with the following:

(g) a general description of the types of transaction charges the client may pay;

(e) in paragraph (h) by adding "general" before "description", by replacing "the compensation" with "any compensation" and by adding "by any other party" before "in relation to";

(f) in paragraph (j) by adding "[dispute resolution service]" after "13.16" and replacing "registered firm's expense" with "firm's expense";

(g) in paragraph (l) by replacing "." with ";" at the end of the paragraph; and

(h) by adding the following after paragraph (l):

(m) a general description of investment performance benchmarks and the factors that should be considered by a client when comparing actual returns in the client's account to benchmark returns, and any options for benchmark information that are made available to clients by the registered firm.

4. Subsection 14.2(3) is amended:

(a) by deleting the words "to a client" after "must deliver"; and

(b) by adding ", paragraphs (2)(a), 2(c) to (k) and (2)(m) to the client in writing, and the information in paragraphs 2(b) and 2(l) either orally or in writing," after the words "subsection (1)".

5. Section 14.2 is amended by adding the following after subsection (3):

(3.1) Before a registered firm makes a recommendation to or accepts an instruction from a client to purchase or sell a security in an account other than a managed account, the firm must disclose to the client

(a) the charges the client will be required to pay in respect of the purchase or sale, and

(b) in the case of a purchase, any deferred charges that the client might be required to pay on the subsequent sale of the security, or any trailing commissions that the firm may receive in respect of the security.

6. Subsection 14.2(4) is amended by deleting "to" after "significant change" and adding "in respect of" before "information".

7. Section 14.2 is amended by adding the following after subsection (4):

(4.1) A registered firm must deliver the following information to a client every 12 months with or in the account statement that is accompanied by or includes the report containing the account performance information required under section14.15 [account performance reporting]:

(a) the registered firm's current operating charges which may be applicable to the account;

(b) the total amount of each type of operating charge related to the account paid by the client during the 12 month period covered by the account statement, and the aggregate amount of such charges;

(c) the total amount of each type of transaction charge related to securities in the account paid by the client during the 12 month period covered by the account statement, and the aggregate amount of such charges;

(d) if the price paid or received by the client in respect of purchases or sales of fixed income securities in the account during the 12 month period covered by the account statement included any dealer compensation, and the compensation was not disclosed to the client, the following notification or a notification substantially similar to the following:

"For some of the fixed income securities purchased or sold in your account during the period covered by this report, dealer charges were added to the price in the case of a purchase or deducted from the price in the case of a sale";

(e) the aggregate amount of any fees paid to the registered firm by any person or company in relation to the client during the 12 month period covered by the account statement;

(f) an identification of any securities in the account that may be subject to deferred sales charges;

(g) if the registered firm received trailing commissions on investment funds held by the client during the 12 month period covered by the account statement, the following notification or a notification substantially similar to the following:

"We received $ • in trailing commissions on the investment funds you held during the period.

Investment funds pay managers a fee for managing their funds. The managers pay us ongoing trailing commissions from that management fee for the service and advice we provide you. The amount of the trailing commissions depends on the sales charge option you chose when you purchased the fund. As is the case with any investment fund expense, trailing commissions affect you because they reduce the amount of the fund's return to you."

8. Subsection 14.12(1) is amended

(a) by adding the following after paragraph (b):

(b.1) in the case of a purchase of a fixed income security, the security's yield;

(b) in paragraph (c) by adding ", deferred sales charge" after "service charge";

(c) in paragraph (h) by replacing "registrant" with "registered dealer" wherever it occurs and by replacing "," with ";" at the end of the paragraph;and

(d) by adding the following after paragraph (h):

(i) if the price paid or received by the client in respect of the purchase or sale of a fixed income security included any dealer compensation, and the compensation is not otherwise disclosed to the client in the trade confirmation, the following notification or a notification substantially similar to the following:

(i) "Dealer charges were added to the price of this security" in the case of a purchase, or

(ii) "Dealer charges were deducted from the price of this security" in the case of a sale.

9. Section 14.14 is amended

(a) in subsections (4) and (5) by replacing "A statement" with "An account statement";

(b) by replacing paragraph (e) of subsection (5) with the following:

(e) the total market value of all securities and cash in the account.

(c) by adding the following after subsection (5):

(5.1) If a registered firm cannot determine the market value of a security, the firm must disclose that fact in the account statement and exclude the security from the calculation in paragraph 14.14(5)(e). and

(d) by adding the following before subsection (6):

(5.2) An account statement delivered under subsection (1), (2) or, (3) or (3.1) must include the following:

(a) for each security position opened in the account after [implementation date], the original cost of the position presented on either an average cost per unit or share basis, or on an aggregate basis, unless the security position was transferred from an account of another registered firm and the original cost of the transferred security position is not available or is known to be inaccurate, in which case the registered firm may

(i) use the market value of the security position as at the date of its transfer if that fact is disclosed to the client in the account statement, or

(ii) if the market value of the security position as at the date of its transfer cannot be determined, disclose that fact in the account statement;

(b) for each security position opened in the account before [implementation date], the original cost of the position presented on either an average cost per unit or share basis, or on an aggregate basis, unless original cost information is not available or is known to be inaccurate, in which case the registered firm may

(i) use the market value of the security position as at [implementation date] or an earlier date if the same date and value is used for all clients of the firm holding that security and that fact is disclosed to the client in the account statement, or

(ii) if the market value of the security position as of [implementation date] cannot be determined, disclose that fact in the account statement.

10. The following is added after section 14.14:

14.15 Performance reports

(1) A registered firm must deliver a report containing account performance information to a client every 12 months with or in an account statement.

(2) This section does not apply to an account that has existed for less than a 12 month period.

(3) This section does not apply if the client is a registered firm, a Canadian financial institution or a Schedule III bank.

(4) This section does not apply to an investment fund manager in respect of its activities as an investment fund manager.

(5) This section does not apply to a registered firm in respect of a permitted client if the permitted client has waived, in writing, the requirements under this section.

11. The following is added after section 14.15:

14.16 Content of performance reports

(1) The information delivered under section 14.15 must include all of the following:

(a) the net amount invested in the client's account or, if the account was opened before [implementation date] and the net amount invested up to [implementation date] is not available, the registered firm may use the market value of all securities and cash in the account as of [implementation date] plus the net amount invested since [implementation date] if the firm discloses in the performance report that it is using market value instead of net amount invested for the period prior to [implementation date];

(b) the total market value of all securities and cash in the account as at the end of the 12 month period preceding the date of the performance report;

(c) the change in value of the client's account during the 12 month period preceding the date of the performance report, calculated by subtracting the total of the market value of all securities and cash in the account at the beginning of the 12 month period plus the net amount invested in the account during the 12 month period, from the market value of all securities and cash in the account as of the end of the 12 month period;

(d) the change in value of the client's account since the account was opened, calculated by comparing the total market value of all securities and cash in the account as of the end of the 12 month period preceding the date of the performance report to

(i) the net amount invested in the account since the account was opened, or

(ii) if the account was opened before [implementation date] and the actual amount invested is not available, the market value of all securities and cash in the account as of [the implementation date] plus the net amount invested since [implementation date];

(e) a definition of "net amount invested" in the document where the information required under paragraphs (a) to (d) is presented;

(f) annualized compound percentage returns for the client's account calculated net of fees, using one of either a time-weighted or dollar-weighted method;

(g) notice of the calculation method used under paragraph (f) in the document where the information required in paragraph (f) is presented;

(h) a definition of "compound percentage returns" in the document where the information required in paragraph (f) is presented.

(2) The information delivered under section 14.15 must be presented using both text and tables, charts or graphs, and must be accompanied by notes in the performance report explaining

(a) the content of the performance report and how a client can use the information to assess the performance of the client's investments,

(b) the changing value of the client's investments as reflected in the information in the performance report.

(3) The information delivered for the purposes of paragraph 14.16(1)(f) must be provided for the following periods ending on the date of the report:

(a) the past year;

(b) the period since the account was opened if the account has been open for more than one year before the date of the report. If the account was opened before [implementation date] and the annualized compound percentage return for the period prior to [implementation date] is not available, the period since [implementation date].

12. Subsection 14.16(3) is replaced with:

(3) The information delivered for the purposes of paragraph 14.16(1)(f) must be provided for each of the following periods ending on the date of the report:

(a) the past year;

(b) the past three years;

(c) the period since the account was opened if the account has been open for more than one year before the date of the report. If the account was opened before [implementation date] and the annualized compound percentage return for the period prior to [implementation date] is not available, the period since [implementation date].

13. Subsection 14.16(3) is replaced with:

(3) The information delivered for the purposes of paragraph 14.16(1)(f) must be provided for each of the following periods ending on the date of the report:

(a) the past year;

(b) the past three years;

(c) the past five years;

(d) the period since the account was opened if the account has been open for more than one year before the date of the report. If the account was opened before [implementation date] and the annualized compound percentage return for the period prior to [implementation date] is not available, the period since [implementation date].

14. Subsection 14.16(3) is replaced with:

(3) The information delivered for the purposes of paragraph 14.16(1)(f) must be provided for each of the following periods ending on the date of the report:

(a) the past year;

(b) the past three years;

(c) the past five years;

(d) the past ten years;

(e) the period since the account was opened if the account has been open for more than one year before the date of the report. If the account was opened before [implementation date] and the annualized compound percentage return for the period prior to [implementation date] is not available, the period since [implementation date].

15. Section 14.16 is amended by adding the following subsection:

(4) If a registered firm delivers account performance information to a client for a period of less than one year, it must not do so on an annualized basis.

16. Section 14.16 is amended by adding the following subsections:

(5) If market value cannot be determined for a security position in the account, the security position must be assigned a value of zero in the calculation of the information delivered under section 14.15 and the reason for doing so must be disclosed to the client.

(6) If there are no security positions in the account for which market value can be determined, the registered firm is not required to deliver account performance information to the client.

(7) If the registered firm changes the calculation method used under paragraph 14.16(1)(f), it must, in the performance report where the change is first used, provide notice of the change and explain the reasons for it.

17. The following is added after section 14.16:

14.17 Benchmark Information - Before a registered firm delivers investment performance benchmark information to a client, it must set out the benchmarks it will provide in a written agreement between the registered firm and the client.

18.

(a) Subject to paragraph (b), this Instrument comes into force on * , 2011; and

(b) The provisions of this Instrument listed in column 1 of the following table come into force as set out in column 2 of the table:

1

2

Section(s)

Effective Date

3(h)

One year after the implementation date

7, 8(a), 9(c), 10, and 17

Two years after the implementation date

12

Three years after the implementation date

13

Five years after the implementation date

14

Ten years after the implementation date

APPENDIX B

BLACKLINE OF PROPOSED AMENDMENTS TO

NATIONAL INSTRUMENT 31-103 REGISTRATION REQUIREMENTS, EXEMPTIONS AND ONGOING REGISTRANT OBLIGATIONS

- - - - - - - - - - - - - - - - - - - -

This Appendix shows the proposed amendments to NI 31-103 against the relevant portions of the consolidation of NI 31-103 published on April 15, 2011.

- - - - - - - - - - - - - - - - - - - -

1.1 Definitions of terms used throughout this Instrument

....

"charges" include operating charges and transaction charges;

"compound percentage returns" means cumulative gains and losses over time expressed as a percentage;

"net amount invested" means the sum of all contributions of cash or securities into an account, not including income generated by investments in the account if that income is reinvested, less all withdrawals of cash or securities out of the account, except charges paid out of the account;

"operating charges" means any amounts charged in respect of the operation of an investment account of a client, including service charges, administration fees, safekeeping fees, management fees, performance fees;

"original cost" means the total amount paid for a security, including any commissions or other charges related to purchasing the security;

"transaction charges" means any amounts charged in respect of a purchase or sale of securities, including commissions, sales charges, transaction fees;

....

14.2 Relationship disclosure information

(1) A registered firm must deliver to a client all information that a reasonable investor would consider important about the client's relationship with the registrant.

(2) The information required to be delivered under subsection (1) includes all of the following:

(a) a description of the nature or type of the client's account;

(b) a

discussion that identifiesgeneral description of the products or services the registered firm offers toathe client;(c) a general description of the types of risks that a client should consider when making an investment decision;

(d) a description of the risks to a client of using borrowed money to finance a purchase of a security;

(e) a description of the conflicts of interest that the registered firm is required to disclose to a client under securities legislation;

(f) disclosure of all

costs to aoperating charges the clientfor the operation of anmay pay related to the account;(g) a general description of the

costs atypes of transaction charges the clientwill pay in making, holding and selling investmentsmay pay;(h) a general description of

theany compensation paid to the registered firm by any other party in relation to the different types of products that a client may purchase through the registered firm;(i) a description of the content and frequency of reporting for each account or portfolio of a client;

(j) if section 13.16 [dispute resolution service] applies to the registered firm, disclosure that independent dispute resolution or mediation services are available at the

registeredfirm's expense, to resolve any dispute that might arise between the client and the firm about any trading or advising activity of the firm or one of its representatives;(k) a statement that the registered firm has an obligation to assess whether a purchase or sale of a security is suitable for a client prior to executing the transaction or at any other time;

(l) the information a registered firm must collect about the client under section 13.2 [know your client];

(m) a general description of investment performance benchmarks and the factors that should be considered by a client when comparing actual returns in the client's account to benchmark returns, and any options for benchmark information that are made available to clients by the registered firm.

(3) A registered firm must deliver

to a clientthe information in subsection (1), paragraphs (2)(a), 2(c) to (k) and 2(m) to the client in writing, and the information in paragraphs (2)(b) and 2(l) either orally or in writing, before the firm first(a) purchases or sells a security for the client, or

(b) advises the client to purchase, sell or hold a security.

(3.1) Before a registered firm makes a recommendation to or accepts an instruction from a client to purchase or sell a security in an account other than a managed account, the firm must disclose to the client

(a) the charges the client will be required to pay in respect of the purchase or sale, and

(b) in the case of a purchase, any deferred charges that the client might be required to pay on the subsequent sale of the security, or any trailing commissions that the firm may receive in respect of the security.

(4) If there is a significant change

toin respect of the information delivered to a client under subsection (1), the registered firm must take reasonable steps to notify the client of the change in a timely manner and, if possible, before the firm next(a) purchases or sells a security for the client, or

(b) advises the client to purchase, sell or hold a security.

(4.1) A registered firm must deliver the following information to a client every 12 months with or in the account statement that is accompanied by or includes the report containing the account performance information required under section 14.15 [account performance reporting]:

(a) the registered firm's current operating charges which may be applicable to the account;

(b) the total amount of each type of operating charge related to the account paid by the client during the 12 month period covered by the account statement, and the aggregate amount of such charges;

(c) the total amount of each type of transaction charge related to securities in the account paid by the client during the 12 month period covered by the account statement, and the aggregate amount of such charges;

(d) if the price paid or received by the client in respect of purchases or sales of fixed income securities in the account during the 12 month period covered by the account statement included any dealer compensation, and the compensation was not disclosed to the client, the following notification or a notification substantially similar to the following:

"For some of the fixed income securities purchased or sold in your account during the period covered by this report, dealer charges were added to the price in the case of a purchase or deducted from the price in the case of a sale";

(e) the aggregate amount of any fees paid to the registered firm by any person or company in relation to the client during the 12 month period covered by the account statement;

(f) an identification of any securities in the account that may be subject to deferred sales charges;

(g) if the registered firm received trailing commissions on investment funds held by the client during the 12 month period covered by the account statement, the following notification or a notification substantially similar to the following:

"We received $ • in trailing commissions on the investment funds you held during the period.

Investment funds pay managers a fee for managing their funds. The managers pay us ongoing trailing commissions from that management fee for the service and advice we provide you. The amount of the trailing commissions depends on the sales charge option you chose when you purchased the fund. As is the case with any investment fund expense, trailing commissions affect you because they reduce the amount of the fund's return to you."

(5) This section does not apply if the client is a registered firm, a Canadian financial institution or a Schedule III bank.

(6) This section does not apply to a registrant in respect of a permitted client if

(a) the permitted client has waived, in writing, the requirements under this section, and

(b) the registrant does not act as an adviser in respect of a managed account of the permitted client.

....

14.12 Content and delivery of trade confirmation

(1) A registered dealer that has acted on behalf of a client in connection with a purchase or sale of a security must promptly deliver to the client or, if the client consents in writing, to a registered adviser acting for the client, a written confirmation of the transaction, setting out the following:

(a) the quantity and description of the security purchased or sold;

(b) the price per security paid or received by the client;

(b.1) in the case of a purchase of a fixed income security, the security's yield;

(c) the commission, sales charge, service charge, deferred sales charge and any other amount charged in respect of the transaction;

(d) whether the registered dealer acted as principal or agent;

(e) the date and the name of the marketplace, if any, on which the transaction took place, or if applicable, a statement that the transaction took place on more than one marketplace or over more than one day;

(f) the name of the dealing representative, if any, in the transaction;

(g) the settlement date of the transaction;

(h) if applicable, that the security is a security of the

registrantregistered dealer, a security of a related issuer of theregistrantregistered dealer or, if the transaction occurred during the security's distribution, a security of a connected issuer of the registered dealer.;(i) if the price paid or received by the client in respect of the purchase or sale of a fixed income security included any dealer compensation, and the compensation is not otherwise disclosed to the client in the trade confirmation, the following notification or a notification substantially similar to the following:

(i) "Dealer charges were added to the price of this security" in the case of a purchase, or

(ii) "Dealer charges were deducted from the price of this security" in the case of a sale.

....

14.14 Account statements

....

(4)

AAn account statement delivered under subsection (1), (2), (3),or (3.1) must include all of the following information for each transaction made for the client or security holder during the period covered by the statement:(a) the date of the transaction;

(b) the type of transaction;

(c) the name of the security;

(d) the number of securities;

(e) the price per security;

(f) the total value of the transaction.

(5)

AAn account statement delivered under subsection (1), (2), (3),or (3.1) must include all of the following information about the client's or security holder's account as at the end of the period for which the statement is made:(a) the name and quantity of each security in the account;

(b) the market value of each security in the account;

(c) the total market value of each security position in the account;

(d) any cash balance in the account;

(e) the total market value of all

cash andsecurities and cash in the account.(5.1) If a registered firm cannot determine the market value of a security, the firm must disclose that fact in the account statement and exclude the security from the calculation in paragraph 14.14(5)(e).

(5.2) An account statement delivered under subsection (1), (2) or, (3) or (3.1) must include the following:

(a) for each security position opened in the account after [implementation date], the original cost of the position presented on either an average cost per unit or share basis, or on an aggregate basis, unless the security position was transferred from an account of another registered firm and the original cost of the transferred security position is not available or is known to be inaccurate, in which case the registered firm may

(i) use the market value of the security position as at the date of its transfer if that fact is disclosed to the client in the account statement, or

(ii) if the market value of the security position as at the date of its transfer cannot be determined, disclose that fact in the account statement;

(b) for each security position opened in the account before [implementation date], the original cost of the position presented on either an average cost per unit or share basis, or on an aggregate basis, unless original cost information is not available or is known to be inaccurate, in which case the registered firm may

(i) use the market value of the security position as at [implementation date] or an earlier date if the same date and value is used for all clients of the firm holding that security and that fact is disclosed to the client in the account statement, or

(ii) if the market value of the security position as of [implementation date] cannot be determined, disclose that fact in the account statement.

....

14.15 Performance reports

(1) A registered firm must deliver a report containing account performance information to a client every 12 months with or in an account statement.

(2) This section does not apply to an account that has existed for less than a 12 month period.

(3) This section does not apply if the client is a registered firm, a Canadian financial institution or a Schedule III bank.

(4) This section does not apply to an investment fund manager in respect of its activities as an investment fund manager.

(5) This section does not apply to a registered firm in respect of a permitted client if the permitted client has waived, in writing, the requirements under this section.

14.16 Content of performance reports

(1) The information delivered under section 14.15 must include all of the following:

(a) the net amount invested in the client's account or, if the account was opened before [implementation date] and the net amount invested up to [implementation date] is not available, the registered firm may use the market value of all securities and cash in the account as of [implementation date] plus the net amount invested since [implementation date] if the firm discloses in the performance report that it is using market value instead of net amount invested for the period prior to [implementation date];

(b) the total market value of all securities and cash in the account as at the end of the 12 month period preceding the date of the performance report;

(c) the change in value of the client's account during the 12 month period preceding the date of the performance report, calculated by subtracting the total of the market value of all securities and cash in the account at the beginning of the 12 month period plus the net amount invested in the account during the 12 month period, from the market value of all securities and cash in the account as of the end of the 12 month period;

(d) the change in value of the client's account since the account was opened, calculated by comparing the total market value of all securities and cash in the account as of the end of the 12 month period preceding the date of the performance report to

(i) the net amount invested in the account since the account was opened, or

(ii) if the account was opened before [implementation date] and the actual amount invested is not available, the market value of all securities and cash in the account as of [the implementation date] plus the net amount invested since [implementation date];

(e) a definition of "net amount invested" in the document where the information required under paragraphs (a) to (d) is presented;

(f) annualized compound percentage returns for the client's account calculated net of fees, using one of either a time weighted or dollar weighted method;

(g) notice of the calculation method used under paragraph (f) in the document where the information required in paragraph (f) is presented;

(h) a definition of "compound percentage returns" in the document where the information required in paragraph (f) is presented.

(2) The information delivered under section 14.15 must be presented using both text and tables, charts or graphs, and must be accompanied by notes in the performance report explaining

(a) the content of the performance report and how a client can use the information to assess the performance of the client's investments,

(b) the changing value of the client's investments as reflected in the information in the performance report.

(3) The information delivered for the purposes of paragraph 14.16(1)(f) must be provided for each of the following periods ending on the date of the report:

(a) the past year;

(b) the past three years;

(c) the past five years;

(d) the past ten years;

(e) the period since the account was opened if the account has been open for more than one year before the date of the report. If the account was opened before [implementation date] and the annualized compound percentage return for the period prior to [implementation date] is not available, the period since [implementation date].

(4) If a registered firm delivers account performance information to a client for a period of less than one year, it must not do so on an annualized basis.

(5) If market value cannot be determined for a security position in the account, the security position must be assigned a value of zero in the calculation of the information delivered under subsection 14.15(1) and the reason for doing so must be disclosed to the client.

(6) If there are no security positions in the account for which market value can be determined, the registered firm is not required to deliver account performance information to the client.

(7) If the registered firm changes the calculation method used under paragraph 14.16(1)(f), it must, in the performance report where the change is first used, provide notice of the change and explain the reasons for it.

14.17 Benchmark Information

Before a registered firm delivers investment performance benchmark information to a client, it must set out the benchmarks it will provide in a written agreement between the registered firm and the client.

- - - - - - - - - - - - - - - - - - - -

Coming into force provisions, as provided in the proposed amending instrument in Appendix A:

(1) Except as otherwise provided in this part, these amendments come into force on [implementation date].

(2) Paragraph 14.2(2)(m) [deliver information about benchmarks] comes into force on [date that is one year after implementation date].

(3) Subsection 14.2(4.1) [deliver prescribed information about charges to a client every 12 months] comes into force on [date that is two years after implementation date].

(4) Paragraph 14.12(1)(b.1) [yield for fixed income securities] comes into force on [date that is two years after implementation date].

(5) Subsection 14.14(5.2) [original cost information] comes into force on [date that is two years after implementation date].

(6) Subsection 14.15[performance report] comes into force on [date that is two years after implementation date].

(7) Paragraph 14.16(3)(b) [compound percentage returns for past three years] comes into force on [date that is three years after implementation date].

(8) Paragraph 14.16(3)(c) [compound percentage returns for past five years] comes into force on [date that is five years after implementation date].

(9) Paragraph 14.16(3)(d) [compound percentage returns for past ten years] comes into force on [date that is ten years after implementation date].

(10) Subsection 14.17[written agreement for any benchmark information provided to the client] comes into force on [date that is two years after implementation date].

- - - - - - - - - - - - - - - - - - - -

APPENDIX C

PROPOSED AMENDMENTS TO COMPANION POLICY 31-103 CP

REGISTRATION REQUIREMENTS, EXEMPTIONS AND ONGOING REGISTRANT OBLIGATIONS

- - - - - - - - - - - - - - - - - - - -

The Canadian Securities Administrators are publishing changes to the Companion Policy for comment. The changes would come into effect on the implementation of the corresponding changes to the Rule.

This Appendix shows the proposed amendments to the Companion Policy against the relevant portions of the consolidation of the Companion Policy published on April 15, 2011.

- - - - - - - - - - - - - - - - - - - -

....

14.2 Relationship disclosure information

Content of relationship disclosure information

There is no prescribed form for the relationship disclosure information required under section 14.2. A registered firm may provide this information in a single document or in separate documents, which together give the client the prescribed information.

We expect, as part of the delivery obligation in subsection 14.2(3), that registered individuals spend sufficient time with clients as part of an in-person or telephone meeting to adequately explain the written documents that are delivered under subsection 14.2(2).

Disclosure of costsDisclosure of charges

The registered firm's compensation and the charges to a client will vary depending on the type of relationship with the client and the nature of the services and investment products offered.

At account opening, registered firms must provide clients with general information on the charges that the clients may incur and compensation the firms may receive as a result of their business relationship. A registered firm is not expected to provide information on all the types of accounts that it offers and the fees related to these accounts if this is not relevant to the client's situation. Charges include any amounts charged in respect of a transaction or the investment account of a client, such as

• Commissions

• sales charges

• service charges

• management fees

• transaction fees

• performance fees

• compensation received from third parties such as trailing commissions

While general information on the charges is appropriate at account opening, a firm must provide more specific information as to the nature and amount of the actual charges when it provides services or advises on a trade.

Under subsection 14.2(2) (g), registered firms must provide clients with a description of the costsoperating and transaction charges they will pay in making, holding and selling investments. We expect this description to include all costscharges a client may pay during the course of holding a particular investment. For example, forif a client will be investing in a mutual fundsecurity, the description should briefly explain each of the following and how they may affect the investment:

• the management expense ratio

• the sales charge

options available to the clientor deferred sales charge option available to the client and an explanation as to how such charges work. This means registered firms should advise clients that mutual funds sold on a deferred sales charge basis are subject to charges upon redemption that are applied on a declining rate scale over a specified period of years, until such time as the charges decrease to zero•

theany trailing commission• any short-term trading fees

• any fees related to the client changing or switching investments ("switch or change fees")

Another example relates to the rates charged on foreign exchange transactions which may be less transparent. The registrant's disclosure should specify whether the firm charges the client its cost or whether there is a mark-up component.

Registrants should advise clients whether their managed account is permitted to hold securities that pay third party compensation, and whether the fee paid by the client to the registrant will be affected by this. For example, the management fee paid by a client on the portion of a managed account related to mutual fund holdings may be lower than the overall fee on the rest of the portfolio.

Description of content and frequency of reporting

In order to comply with paragraph 14.2(2)(i), registered firms should describe to clients at account opening the following types of reporting that they will provide and the frequency of such reporting:

• client account statements

• trade confirmations for registered dealers

• annual charge and compensation disclosure

•

any switch or change feesperformance reporting

KYC information

Paragraph 14.2(2)(l) requires registrants to provide their clients with a copy of their KYC information at the time of account opening. We would expect registered firms to also provide a description to the client of the various terms which make up the KYC information, and describe how this information will be used in assessing the client's financial situation, investment objectives, investment knowledge, risk tolerance and in determining investment suitability. From this initial discussion, clients should better understand what their KYC information is being used for.

Disclosure at the time of a transaction

For non-managed accounts, subsection 14.2(3.1) requires disclosure to a client of charges specific to a transaction prior to the acceptance of a client's order. For the purchase of a mutual fund security on a deferred sales charge basis, we would expect this disclosure to also include that a charge may be triggered upon the redemption of the security, if it is sold within the time period that a deferred sales charge would be applicable. The actual amount of the deferred sales charge, if any, would need to be disclosed once the security is redeemed. This disclosure is not required to be in writing. Specific charges should be reported in writing on the trade confirmation as required in section 14.12.

Switch or change fees

We consider that providing clients with adequate disclosure of the charges at the time of a transaction will also help clients to be aware of the implications of proposed transactions and deter registered firms from transacting for the purpose of generating commissions. For example, changing a client's investment from a fund sold on a deferred sales charge basis when the charge period has lapsed to a similar fund sold on a sales charge basis would result in the client paying commissions that would otherwise have been avoided.

We are also of the view that a registered firm should not switch the client's investment in the same fund from units sold on a deferred sales charge basis when the charge period has lapsed to those sold on a sales charge basis in order to generate a higher amount of trailing commissions with no corresponding financial benefit to the client. These types of transactions are in our view inconsistent with a registrant's duty to act fairly, honestly and in good faith. Requiring sufficient disclosure of the charges the client may pay and the firm's compensation will provide investors with important information about their investments.

We would also expect all changes or switches to a client's investments to be accurately reported on trade confirmations by reporting each of the purchase and sale transactions making up the change or switch, as required in section 14.12, with a description of the associated charges.

Annual charge and compensation disclosure

Under paragraph 14.2(4.1)(a), registered firms must provide clients on an annual basis with their current account operating charges that are relevant to the type of account(s) held by the client. For example, these may include annual registered plan fees and any other charges associated with maintaining and using a registered account. We do not expect registered firms to provide clients with information on product-related charges since the range of products offered by a registrant may be quite broad and the types of products in a client's account may change over time.

Subsection 14.2(4.1) also requires registered firms to provide clients, on an annual basis, with information on the nature and dollar amount of each type of charge paid by the client during the 12 month period. This would include such charges as commissions, switch or change fees, performance fees and early redemption fees. Registered firms must also disclose the amount of trailing commissions they received related to the client's holdings and provide disclosure on the amount of any other type of compensation received by a third party, including a non-arm's length entity, such as referral fees, success fees on the completion of a transaction or finder's fees.

Registrants must also identify a client's investment fund holdings that may be subject to a deferred sales charge, regardless of whether or not a charge has been incurred.

Permitted clients

Under subsection 14.2(6), registrants do not have to provide relationship disclosure information to permitted clients if:

• the permitted client has waived the requirements in writing, and

• the registrant does not act as an adviser for a managed account of the permitted client

Promoting client participation

Registered firms should help their clients understand the registrant-client relationship. They should encourage clients to actively participate in the relationship and provide them with clear, relevant and timely information and communications.

In particular, registered firms should encourage clients to:

• Keep the firm up to date. Clients should provide full and accurate information to the firm and the registered individuals acting for the firm. Clients should promptly inform the firm of any change to information that could reasonably result in a change to the types of investments appropriate for them, such as a change to their income, investment objectives, risk tolerance, time horizon or net worth.

• Be informed. Clients should understand the potential risks and returns on investments. They should carefully review sales literature provided by the firm. Where appropriate, clients should consult professionals, such as a lawyer or an accountant, for legal or tax advice.

• Ask questions. Clients should ask questions and request information from the firm to resolve questions about their account, transactions or investments, or their relationship with the firm or a registered individual acting for the firm.

• Stay on top of their investments. Clients should pay for securities purchases by the settlement date. They should review all account documentation provided by the firm and regularly review portfolio holdings and performance.

....

14.12 Content and delivery of trade confirmation

Section 14.12 requires registered dealers to deliver trade confirmations. A dealer may enter into an outsourcing arrangement for the sending of trade confirmations to its clients. Like all outsourcing arrangements, the registrant is ultimately responsible for the function and must supervise the service provider. See Part 11 of this Companion Policy for more guidance on outsourcing.

Trades in fixed income securities

Under paragraph 14.12(1)(b.1), registered dealers must provide the yield of a fixed income security on trade confirmations. For non-callable fixed income securities, the yield to maturity would be appropriate, while for callable securities, the yield to call may be more useful.

....

14.14 Account statements

Account statements generally

Section 14.14 requires registered dealers and advisers to deliver statements to clients at least once every three months. There is no prescribed form for these statements but they must contain the information in subsections 14.14(4),(5) and (55.2). The types of transactions that must be disclosed in an account statement include any purchase, sale or transfer of securities, dividend or interest payment received or reinvested, any fee or charge, and any other account activity.

We expect all dealers and advisers to provide client account statements. For example, an exempt market dealer should provide an account statement that contains the information prescribed for all transactions the exempt market dealer has entered into or arranged on a client's behalf.

The requirement to produce and deliver an account statement may be outsourced. Portfolio managers frequently enter into outsourcing arrangements for the production and delivery of account statements. Third-party pricing providers may also be used to value securities for the purpose of account statements. Like all outsourcing arrangements, the registrant is ultimately responsible for the function and must supervise the service provider. See Part 11 of this Companion Policy for more guidance on outsourcing.

Market value of securities

Where possible, market value should be determined by reference to a quoted value on a recognized exchange or marketplace. If market value is not quoted on an exchange (e.g. bonds) market value may be determined by reference to quotes that are available through brokers. We recognize that it is not always possible to obtain a market value by these methods. In such cases, we will accept a valuation policy that is consistently applied and is based on measures considered reasonable in the industry, such as value at cost where there has been no material subsequent event (e.g. a market event or new capital raising by the issuer).

Under subsection 14.14(5.1), where a market value of a security cannot be determined, the registered firm must disclose this in the account statement and exclude the security from the calculation of the total market value in paragraph (e). If the registered firm can subsequently determine a market value for that security, the market value should be included in the account statement, accompanied at that time with adequate notes explaining that a market value is now determinable.

Once a market value is subsequently determinable for a security, registered firms may also need to add that value to the amount reported under paragraph 14.16(1)(a) (net amount invested) . This would be expected if the firm had previously assigned the security a value of zero in the calculation of net amount invested because it could not determine the security's market value, as required by subsection 14.16(5) This would reduce the risk of presenting a misleading improvement in the performance of the account by only adding the value of the security to the other calculations required under section 14.16. If the contributions used to purchase the security were already included in the calculation of net amount invested, the registered firm would not need to adjust that figure.