[repealed] Start up Crowdfunding Guide for Investors

[repealed] Start up Crowdfunding Guide for Investors

Crowdfunding is a process through which an individual or a business can raise small amounts of money from a large number of people, typically through the Internet. The objective is to raise sufficient funds in order to carry out a specific project. There are different types of crowdfunding, such as by donation, pre-selling of products, or securities crowdfunding. This guide discusses securities crowdfunding.

Securities crowdfunding

With securities crowdfunding, a business raises funds through the Internet by issuing securities (such as bonds or shares) to many people.

In Canada, all trading of securities is subject to legal obligations. For example, a business seeking to raise capital by issuing securities must file a prospectus with the securities regulator of their province or territory or have an exemption from the prospectus requirement under securities laws.

These obligations, however, can be costly for start-ups, small businesses and other issuers. The securities regulators in British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, Québec, New Brunswick and Nova Scotia (the participating jurisdictions) allow start-ups and small businesses to raise funds using securities crowdfunding without filing a prospectus or preparing financial statements. In this guide, we refer to this as the "start-up crowdfunding exemptions" or "start-up crowdfunding".

Top 3 things to do before investing in a start-up crowdfunding project:

#1 Know the process

#2 Do your homework

#3 Understand the risks

#1 -- Know the Process

How Start-up Crowdfunding Works

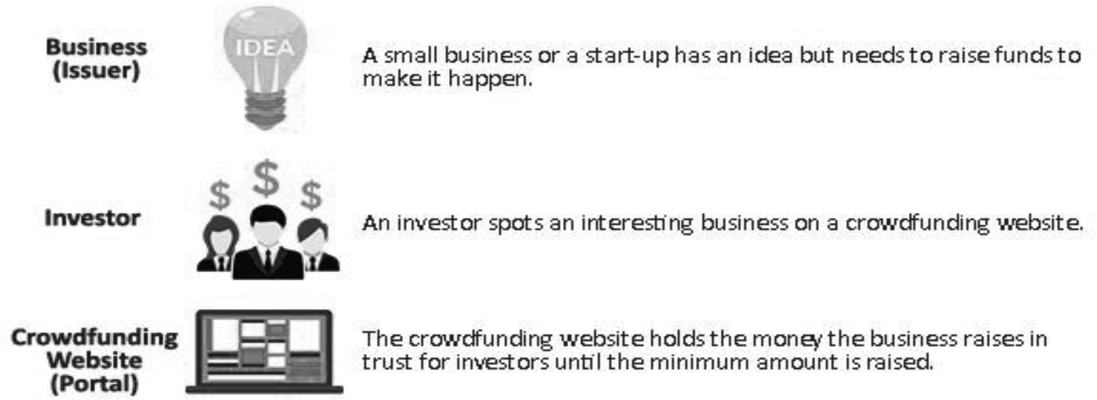

Start-ups and small businesses (issuers)

The business has an idea but needs to raise funds to make it happen. It must prepare an offering document that includes basic information about the business and the offering, how it will use the money and the risks in investing in the business. The business must state the minimum amount it needs to raise to accomplish its goal. The business must use a crowdfunding website called a funding portal to raise funds this way.

Investor (you)

You, the investor, spot an interesting business on a funding portal website. After reading the business' offering document and doing your homework, you may decide to invest up to the amount described in the "How Much Can I Invest?" section of this guide. Before you complete your investment, the funding portal will ask you to confirm that you understand the risks and have read and understood the business' offering document. You have 48 hours after your investment to change your mind and get your money back.

Crowdfunding website (funding portal)

The funding portal posts start-up crowdfunding projects on its website. The funding portal is responsible for:

• providing a risk warning form to potential investors;

• holding all investor funds in trust until the business raises the minimum funding target; and

• returning funds to investors, without deduction, if the business does not reach its minimum funding target or if the business withdraws the start-up crowdfunding campaign.

When you enter a funding portal website, you will see a pop-up notice telling you whether the funding portal is:

• operated by a registered dealer under Canadian securities legislation. Before you invest, these portals must determine if the investment is suitable for you; or

• not registered under Canadian securities legislation. These portals cannot give you advice. You must decide for yourself if the investment is right for you.

You will be asked to acknowledge that you have read this pop-up notice before entering the funding portal website.

You can check to see if the funding portal can do business in Ontario. You can do this by contacting the Ontario Securities Commission at (toll free) 1-877-785-1555 or by e-mail at [email protected].

#2 Do your homework

Before investing, you should:

• Read the start-up crowdfunding offering document posted on the funding portal. It contains basic information about the business' activities, its management, its financial condition, the amount it wants to raise, how the money raised will be used and the risks. The securities regulators have not reviewed or approved the offering document. It is your responsibility to understand the information in the offering document.

• Search the Internet for information on the business, its industry and the people operating its business. Check their background to see if they were ever disciplined for bad business practices. You can contact the business and the funding portal for further information.

• The business may also raise funds at the same time other than through start-up crowdfunding. Those investors may receive more or less information than what you are provided in the start-up crowdfunding offering document.

• You can ask the business about any previous successes or failures it may have had trying to raise funds in the past. The start-up offering document must disclose whether that business had any previous start-up crowdfunding distributions and whether they were successful or not. However, businesses are not required to report any failed or withdrawn offerings if they raised funds in another way.

• If the business gives you financial statements, you should know that those financial statements have not been provided to or reviewed by securities regulators and they are not part of the offering document. You should ask the business whether the financial statements have been audited and which accounting standards were used to prepare the financial statements. Do the financial statements include a balance sheet, income statement, statement of changes in financial position and detailed supporting notes?

• Consider their business plan. How is the business going to grow? How will it make money and within what period? Watch for unsupportable claims about the business' future success.

• Consider how you will receive a return on your investment. What type of securities is the business going to give you in exchange for your investment? The securities must be described in the offering document. If the business is offering debt securities, consider when the business intends to pay you back. If the business is offering equity securities, such as common shares, read the rights attached to these securities described in the offering document.

• Review all documents relating to your investment. There may be other rights and restrictions about the investment detailed in the business shareholder's agreement or other agreements.

• Think carefully about your risk tolerance and what you can afford to lose if the investment doesn't turn out as expected. Consider the cons as well as the pros.

• Ask the business any other questions you may have. The offering document will provide contact information for someone at the business who is able to answer your questions.

#3 Understand the risks

To make an informed decision, you must have a good understanding of the risks related to the start-up crowdfunding offering. These include:

• Securities of start-ups or small businesses are risky. Statistics show that a high percentage of start-ups and small businesses fail. You could lose the entire amount you paid for your investment.

• What is your risk tolerance? If your risk tolerance is low, an investment in a start-up or small business may not be suitable for you.

• What do you know about the individuals operating the business? Do they have the knowledge and experience required to manage it? Businesses are sometimes managed by inexperienced individuals. Find out more about the individuals operating the business before investing.

• Do you have the resources to be patient? If you think you will have to resell your securities in the short term, this type of investment may not be suitable for you. Securities purchased through start-up crowdfunding offerings are not publicly traded. You may have to wait indefinitely before reselling the securities or you may not be able to resell them at all.

• A great deal of information and analysis is available about public corporations. This is not the case for start-ups and small businesses. Unlike reporting issuers (such as companies listed on an exchange), start-ups and small businesses are not required to file audited financial statements or other periodic disclosure. You may receive much less information about the business before or after you invest.

• Once you have made the investment, the start-up or small business will not generally have any obligation to provide you with updates (such as an annual report). You will have to track your investment on your own.

If you are willing to take risks and invest in a start-up, you may want to consider investing in a business that operates in a sector you know well. You may be in a better position to assess its likelihood of success.

The start-up crowdfunding process -- an example

- - - - - - - - - - - - - - - - - - - -

Oliver has heard about start-up crowdfunding. He goes to ABC Funding Portal's website and sees a pop-up notice that says ABC Funding Portal is not registered. He checks the names of their management and does some research to see if they have ever been disciplined for bad business practices.

- - - - - - - - - - - - - - - - - - - -

- - - - - - - - - - - - - - - - - - - -

After satisfying himself about ABC Funding Portal, Oliver browses through the start-up crowdfunding projects listed on its website. He comes across Valerie's Maple Cola Company. Valerie wants to raise $75,000 to market and bottle soft drinks flavoured with maple syrup and other local products. Oliver thinks the investment looks interesting.

- - - - - - - - - - - - - - - - - - - -

- - - - - - - - - - - - - - - - - - - -

Oliver reads Valerie's Maple Cola Company's start-up crowdfunding offering document carefully, particularly the section that warns of the risks of this investment. Oliver does some additional research on Valerie's Maple Cola Company, Valerie herself as well as the rest of her management team, and the beverage manufacturing business.

- - - - - - - - - - - - - - - - - - - -

- - - - - - - - - - - - - - - - - - - -

Oliver decides he wants to invest $750 in Valerie's Maple Cola Company. He reviews the risk warning on ABC Funding Portal website. He confirms, by ticking a box, that he has read the offering document and understands the risks he is taking. He pays for the investment.

- - - - - - - - - - - - - - - - - - - -

- - - - - - - - - - - - - - - - - - - -

ABC Funding Portal holds Oliver's money in trust until Valerie raises at least $75,000. If Valerie doesn't raise her $75,000 target, ABC Funding Portal must return Oliver's money to him, without any deductions.

- - - - - - - - - - - - - - - - - - - -

- - - - - - - - - - - - - - - - - - - -

If Valerie successfully raises $75,000, she can proceed to complete the start-up crowdfunding offering. Oliver is now a shareholder of Valerie's Maple Cola Company. Upon completion of the offering, Oliver receives a confirmation setting out the number of the common shares he purchased and how much he paid.

- - - - - - - - - - - - - - - - - - - -

- - - - - - - - - - - - - - - - - - - -

There is no guarantee as to the future value of Oliver's investment. Oliver will have to hold onto these securities for an indefinite period or even be unable to resell them at all.

- - - - - - - - - - - - - - - - - - - -

Frequently asked questions about start-up crowdfunding

Where can I find start-up crowdfunding offerings?

You will find start-up crowdfunding offerings posted on the websites of funding portals. Before a funding portal can operate in any Canadian jurisdiction, it must meet certain conditions such as delivering mandatory documents to the securities regulatory authority in that jurisdiction. You can check with the OSC to see whether any particular funding portal is allowed to do business in Ontario by calling the phone number listed below under "Where can I get further information?"

Should I get investment advice?

You should use a registered portal if you want or need investment advice because they must determine whether an investment is suitable for you.

If you are viewing offerings on an unregistered funding portal, you will not receive investment advice; they are prohibited from telling you whether the securities you are subscribing for are a good investment. You must be prepared to make your own investment decision when investing through an unregistered funding portal. Unregistered portals are also prohibited from charging you a fee or commission for investing through their website.

When you enter a funding portal website, a pop-up notice will inform you whether or not the funding portal is operated by a registered dealer. To check if the funding portal is operated by a registered dealer, go to www.aretheyregistered.ca.

How much can I invest?

You can invest up to $1,500 in a start-up crowdfunding offering. However, this amount can be increased to $5,000 if all of the following apply:

• you live in British Columbia, Alberta, Saskatchewan or Ontario;

• you are interested in investing in a business with a head office in British Columbia, Alberta, Saskatchewan or Ontario;

• the start-up crowdfunding distribution is made through a registered dealer; and

• the dealer has determined that the investment is suitable for you.

What will I get in return for investing in a start-up crowdfunding project?

With securities crowdfunding, investors receive securities in exchange for their investment. This is different than other types of crowdfunding, where you may get a product. Start-up crowdfunding is restricted to particular types of securities: debt securities, such as bonds; equity securities, such as common shares or preference shares; limited partnership units; and convertible securities, such as warrants, that are convertible into either common shares or preference shares.

The offering document must describe the type of security you will receive in exchange for your investment.

What if I change my mind?

Once you have committed to purchasing securities:

• You may withdraw your investment within 48 hours of subscription if you no longer wish to invest; or

• If the business amends the offering document, you will also have the right to withdraw your investment within 48 hours of the funding portal notifying you that the offering document has been amended.

In either case, you must notify the funding portal that you wish to withdraw before the end of this 48-hour period. After receiving your notification, the funding portal will return your funds to you within 5 business days.

Where can I get further information?

For more information about the start-up crowdfunding exemptions in the participating jurisdictions, please refer to the following contact information:

British Columbia

British Columbia Securities Commission

Telephone: 604-899-6854 or 1-800-373-6393

E-mail: [email protected]

<<www.bcsc.bc.ca>>

Alberta

Alberta Securities Commission

Telephone: 403-355-4151

E-mail: [email protected]

Website: www.albertasecurities.com

Saskatchewan

Financial and Consumer Affairs Authority of Saskatchewan

Securities Division

Telephone: 306-787-5645

E-mail: [email protected]

www.fcaa.gov.sk.ca

Manitoba

The Manitoba Securities Commission

Toll free in Manitoba: 1-800-655-2548

E-mail: [email protected]

www.msc.gov.mb.ca

Ontario

Ontario Securities Commission

Toll free: 1-877-785-1555

E-mail: [email protected]

www.osc.ca

Québec

Autorité des marchés financiers

Direction du financement des sociétés

Toll free in Québec: 1-877-525-0337

E-mail: [email protected]

www.lautorite.qc.ca

New Brunswick

Financial and Consumer Services Commission

Toll free: 1-866-933-2222

E-mail: [email protected]

www.fcnb.ca

Nova Scotia

Nova Scotia Securities Commission

Toll free in Nova Scotia: 1-855-424-2499

E-mail: [email protected]

www.nssc.novascotia.ca

The information in this Guide is for educational purposes only and does not constitute legal advice.

If any information in this Guide is inconsistent with Ontario Instrument 45-506 Start-Up Crowdfunding Registration and Prospectus Exemptions (Interim Class Order), please follow the instrument and the related forms.

Published August 20, 2020.