CSA Staff Notice 52-329 Distribution Disclosures and Non-GAAP Financial Measures in the Real Estate Industry

CSA Staff Notice 52-329 Distribution Disclosures and Non-GAAP Financial Measures in the Real Estate Industry

CSA Staff Notice 52-329

Distribution Disclosures and Non-GAAP Financial Measures in the

Real Estate Industry

April 12, 2018

Executive Summary

Staff of the Canadian Securities Administrators (CSA staff or we) recently reviewed two important areas of disclosure for real estate investment trusts (REITs) and real estate operating companies (REOCs): distributions and non-GAAP financial measures. We reviewed distribution disclosures relative to National Policy 41-201 Income Trusts and Other Indirect Offerings (NP 41-201) and non-GAAP financial disclosures relative to CSA Staff Notice 52-306 (Revised) Non-GAAP Financial Measures (CSA SN 52-306). We sought to assess the quality and sufficiency of disclosure provided by real estate issuers relating to the sustainability of their distributions. For non-GAAP financial measures, we reviewed the following:

• adjustments made in arriving at non-GAAP financial measures,

• the prominence of non-GAAP financial measures, and

• the use and reconciliation of non-GAAP financial measures.

Given strong investor interest in this sector and the inherent pressure on issuers to pay distributions, the sustainability of distributions and the accompanying disclosures are important to investors.

The purpose of this notice is to share our review findings and to provide additional guidance for real estate issuers to disclose information that is more useful and transparent to investors.

1. Background and Disclosure Expectations

Distributions

REITs and many REOCs pay out the majority of their income in the form of distributions to their unitholders or shareholders. The opportunity to receive recurring distributions provides investors with an incentive to invest in real estate issuers, and distributions are an important component of the total return. Investors may compare distribution yields across issuers, and as a result, financial measures related to distributions provide important insights in analyzing both available returns and the variability of such returns. The industry uses a variety of financial measures of distributions, both GAAP and non-GAAP, to quantify the sustainability of distributions.

Distribution disclosures are outlined in NP 41-201{1}, and also captured in the disclosure requirements for liquidity under the MD&A form requirements (Form 51-102F1 Management's Discussion & Analysis).

Non-GAAP Financial Measures

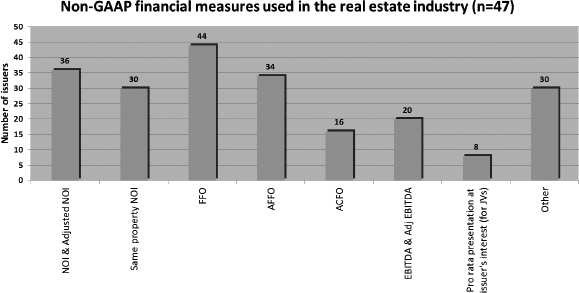

Real estate issuers use a variety of non-GAAP financial measures to explain their operating performance and/or cash flows. These measures include net operating income (NOI), earnings before interest, taxes, depreciation and amortization (EBITDA), funds from operations (FFO), adjusted funds from operations (AFFO), adjusted cash flow from operations (ACFO) and related distribution payout ratios.

The chart below outlines the frequency of non-GAAP financial measures used by the real estate issuers we reviewed:

Non-GAAP financial measures can provide investors with supplemental information about an issuer's financial position, financial performance or cash flows. However, investors must have sufficient information to understand what these measures represent, how they are calculated, and how they are useful to investors and management. Concerns arise when issuers present non-GAAP financial measures in a manner that is confusing or potentially misleading, such as when they are inadequately defined or when they obscure GAAP financial measures.

CSA SN 52-306 provides guidance to issuers that choose to disclose non-GAAP financial measures. Given the breadth and volume of non-GAAP financial measures used by issuers, we have recently renewed our focus in this area.

Given the prevalent use of non-GAAP financial measures in this sector, transparent disclosure of these measures is critical.

2. Our Review

We reviewed 47 REITs and REOCs{2} as part of this review. Our review excluded those issuers that did not use non-GAAP financial measures, did not pay distributions, or that had minimal market capitalizations.

We reviewed distribution disclosures and assessed the quality and sufficiency of disclosure provided about the sustainability of distributions. For non-GAAP financial measures, we assessed the disclosure with regard to the adjustments made, the prominence of these measures, and how they were used and reconciled by issuers.{3}

3. Findings

We sent comment letters to 72% of the issuers that we reviewed. Of the issuers that we reviewed, 6% were required to restate MD&A, and 62% agreed to enhance their disclosure prospectively.

Generally, REITs and REOCs provided adequate disclosure about their distributions, except when "excess distributions" were made and in those cases, many issuers did not disclose the sources of cash used to fund the excess.

- - - - - - - - - - - - - - - - - - - -

"EXCESS DISTRIBUTIONS"

Excess distributions occur when distributions declared (including distributions in connection with a distribution reinvestment plan) during a period exceed cash flows from operating activities (net of interest paid, even if the interest paid is classified as a financing activity in the statement of cash flows), creating a shortfall. As outlined in section 6.5.2 of NP 41-201, in determining cash flows from operating activities, the issuer should include borrowing costs.

- - - - - - - - - - - - - - - - - - - -

For non-GAAP financial measures, we found a lack of transparency about the various adjustments made in arriving at non-GAAP financial measures, particularly maintenance capital expenditures and working capital. We also noted instances where non-GAAP financial measures were presented with greater prominence than the most directly comparable measure specified, defined or determined under the issuer's GAAP. Lastly, we observed diversity in how non-GAAP financial measures, particularly AFFO, are used and reconciled by various real estate issuers. We are concerned that these issues have the potential to render non-GAAP financial measures not useful, confusing or misleading.

Part A sets out our findings with respect to "excess distributions" and the sustainability of distributions and Part B sets out our findings for non-GAAP financial measures.

Part A -- Distributions

3.1 "Excess distributions" and the sustainability of distributions

We generally found that REITs and REOCs provided adequate MD&A disclosure about their distributions. When "excess distributions" were made, issuers generally followed the guidance in NP 41-201, although some issuers did not compare and discuss their distributions in relation to cash flows from operating activities, as outlined in NP 41-201. Some issuers with "excess distributions" provided boilerplate disclosure, particularly about the sources of funding.

- - - - - - - - - - - - - - - - - - - -

DISCLOSURE GUIDANCE IN NP 41-201:

• Section 6.5.2 of NP 41-201

In situations where issuers are distributing cash in excess of cash flow from operating activities, disclosure should:

• quantify the "excess distributions" which were funded by sources other than operating activities,

• acknowledge that a return of capital has been provided, if applicable, and discuss the decision to provide distributions partly representing a return of capital,

• discuss the specific sources of the excess distributions, including debt or recent equity raise, and

• discuss the risk factors related to providing distributions in excess of cash flows from operating activities, including whether such distributions are expected to continue, and any impact on the sustainability of future distributions.

• Section 2.5 of NP 41-201

In situations where issuers are presenting a non-GAAP financial measure to describe the amount of net cash it has generated during the period which is available for distribution (this may include cash available for distribution, distributable cash, AFFO, ACFO or other) disclosure should:

• explain the purpose of the non-GAAP financial measure,

• reconcile the non-GAAP financial measure to the most comparable GAAP measure (cash flows from operating activities), and

• explain any changes in the composition of the non-GAAP financial measure.

- - - - - - - - - - - - - - - - - - - -

We found that 45% of real estate issuers had "excess distributions" in the interim reporting period. Of those issuers with "excess distributions", 68% quantified the amount of the excess relative to cash flows from operating activities.{4} Issuers generally provided disclosure of the reasons for the "excess distributions", and for most, this was due to seasonality in the interim period, the timing of certain payments or working capital fluctuations. The better quality disclosures provided entity-specific explanations for the particular items of working capital which led to the excess, such as leasing costs, taxes or transaction costs. We remind issuers that they should clearly quantify the amount of "excess distributions" relative to cash flows from operating activities in each reporting period.

Some issuers discussed that there was no "excess distributions" when the level of distributions was compared to ACFO or other non-GAAP financial measures. While this type of distribution analysis on a non-GAAP basis may be helpful, and provides insight into how management may view distribution sustainability, issuers should still quantify and explain "excess distributions" consistent with the guidance set out in NP 41-201, with equal or greater prominence.

We found that 67%{5} of the issuers did not disclose a description of the sources of cash used to fund the "excess distributions", or their description was boilerplate. Examples of boilerplate or vague disclosures include the following types of statements:

• These fluctuations could be funded from other sources such as credit facilities, or

• The issuer does not expect distributions to exceed operating cash flows on an annual basis.

When "excess distributions" exist in a period, issuers are reminded that it is not sufficient to simply state that they believe current distributions are sustainable.

The risk profile of an issuer that relies on sources other than operating cash flows to fund distributions, such as capital raising, debt financing or sale of properties, is inherently different than an issuer that funds distributions solely through operating cash flows. We expect the disclosure about distributions to address these risks.

Part B -- Non-GAAP Financial Measures

We identified a significant number of disclosures pertaining to non-GAAP financial measures{6} that did not conform to the guidance in CSA SN 52-306 or NP 41-201. These included:

• a lack of transparency and lack of disclosure about the adjustments made in arriving at non-GAAP financial measures such as AFFO,

• a lack of clarity in how management uses each individual non-GAAP financial measure,

• a failure to clearly identify the most directly comparable GAAP measure, and

• non-GAAP financial information being presented more prominently than the GAAP information

We are also concerned that some issuers might understate the cost to sustain and maintain their properties.

3.2 Non-GAAP adjustments: maintenance capital expenditures and working capital

For a non-GAAP financial measure to not be confusing or misleading, it is important that investors understand the adjustments being made as part of the reconciliation to the most directly comparable GAAP measure. Issuers should ensure all adjustments are sufficiently explained, including why and how the adjustment was determined. Our review noted many issuers that did not provide sufficient disclosure about the adjustments made in arriving at the AFFO, ACFO and other non-GAAP financial measures presented in the MD&A.

In determining each adjustment, issuers either use amounts presented in the financial statements, or an estimated amount. In situations where an adjustment is an estimate, issuers should provide additional disclosures about how the estimate was determined.

When non-GAAP financial measures are used to describe cash available for distribution, NP 41-201 outlines the relevant guidance about the non-GAAP financial measure and the adjustments and assumptions underlying the measure{7}.

Our review mainly focussed on adjustments related to maintenance capital expenditures and working capital. These two adjustments are often material and subject to significant management judgement. Furthermore, these adjustments can also have a direct impact on non-GAAP financial measures used to describe cash available for distribution (for example ACFO), including the related distribution payout ratios. Our review uncovered deficiencies in disclosures of these items, as detailed below.

Maintenance capital expenditures

The IFRS accounting treatment for capital expenditures (i.e. the requirement to capitalize or expense certain costs) does not address whether capital expenditures are for sustaining existing capacity or are for future growth (revenue-enhancing). To account for this, an adjustment for maintenance capital expenditure was made by most real estate issuers in reconciling certain non-GAAP financial measures. A maintenance capital spending adjustment (or "maintenance capex" adjustment, as it is commonly known) reflects the amount held back, and therefore not distributed, by the issuer to sustain and maintain their real estate properties in their current state. Any deterioration of a property resulting from not incurring sufficient maintenance capex would impact the property's ability to maintain the same level of revenues, and would ultimately impact distributions.

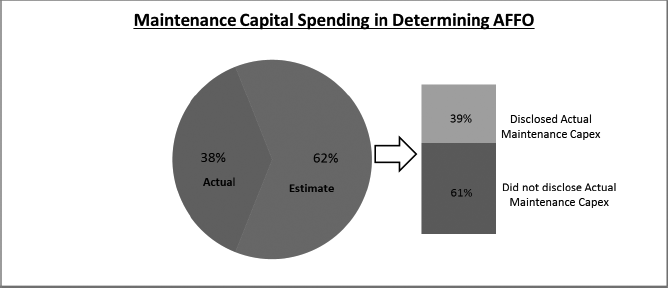

We observed that there is diversity in practice amongst real estate issuers in how the maintenance capital expenditures adjustment is determined and disclosed. The majority of issuers deducted an estimate of capital expenditures using an estimate or reserve, while 38% of real estate issuers deducted actual maintenance capital expenditures in calculating AFFO. Maintenance capital expenditures estimates were determined in a number of different ways: percentage of revenues or net operating income, certain dollar amounts per square foot, independent estimates, or forward-looking using forecast amounts{8}. Of the 62% of issuers who used an estimate in determining the capital expenditures adjustment for AFFO, only 39% disclosed a comparison to the actual maintenance capital expenditures, as shown in the chart below.

For many of the issuers using a maintenance capital expenditures reserve, the reserve was not well explained and it was often unclear from the disclosure how the reserve was determined. In order to provide investors with insight into how the reserve was determined by management, issuers should provide additional disclosure{9} in the MD&A including:

• the method by which management determined the reserve,

• why that method was chosen in determining the reserve and why that method is appropriate,

• how the reserve amount compares to actual maintance capital expenditures in the period and historically, and

• explanation of why management's estimate is more relevant than the actual.

The actual amount of maintenance capital expenditures incurred in a period may not be readily apparent from the issuer's financial statements, as the financial statements do not distinguish between maintenance and growth capital expenditures. Disclosing a comparison between the amount of the estimate used in the derivation of the non-GAAP financial measure and actual historical amounts would provide useful information, and give investors a better understanding of the issuer's business.

We acknowledge that, in some cases, an estimate of maintenance capital expenditures that is normalized or removes seasonality associated with the actual amount spent during a particular short term period may be more reflective of a sustainable amount. It is critical, however, that investors understand how the estimated amount was determined and why it is viewed by management as a more accurate or representative amount than the actual. Furthermore, where the maintenance capital expenditure estimate differs materially from the actual amount spent, there may be an impact on the sustainability of the issuer's distribution, which should be discussed.

Some issuers grouped together their estimate for maintenance capital expenditure with other amounts estimated by management, such as tenant inducements, tenant expenditures or leasing costs or incentives. This aggregation further obscures the amount of maintenance capital expenditure from investors, both the actual level and what management views as the appropriate normalized amount. We expect issuers to disaggregate this information in their disclosure in order to provide useful information on the capital expenditure requirements.

In the below example, the maintenance capital expenditure reserve has not been explained in sufficient detail for investors to be able to understand how it was determined (i.e. what percentage of net rental income was used), why this method was chosen or how the normalized amount compares to actual expenditures.

- - - - - - - - - - - - - - - - - - - -

Example #3.2(a) --Disclosure on maintenance capital expenditure reserve used in determining AFFO that did not meet CSA guidance

[1] The maintenance capital expenditure reserve represents the Trust's estimate of normalized maintenance capital and is based on a percentage of net rental income earned.

- - - - - - - - - - - - - - - - - - - -

The below example provides more useful information for users in assessing how management determined what a "normalized" amount is, and provides transparency to a key input which investors may use to assess the issuer's distribution payout ratio.

- - - - - - - - - - - - - - - - - - - -

Example #3.2(a) -- Enhanced disclosure on maintenance capital expenditure reserve

[1] In the calculation of AFFO the Trust makes an adjustment for the estimated amount of ongoing capital investment required to maintain the condition of its properties and current revenues. This reserve for normalized maintenance capital expenditure is estimated at 8% of net rental income earned. The 8% assumption is based on an average of historical results over the last 3 years as well as our forecast for the next fiscal year as approved by the Board of Trustees. This estimate will continue to be reassessed in future reporting periods. The table below compares the reserve amount with the actual maintenance capital expenditures over the last 3 fiscal years as well as the current and comparative period, and provides a discussion of the variances.

|

|

Q2 2017 |

Q2 2016 |

FY 2016 |

FY 2015 |

FY 2014 |

|

|

|||||

|

Reserve for normalized maintenance capital expenditure |

$2,750 |

$2,750 |

$10,000 |

$7,000 |

$12,000 |

|

|

|||||

|

Actual maintenance capital expenditure |

$3,000 |

$3,100 |

$10,000 |

$9,000 |

$11,000 |

Actual maintenance capital expenditure is typically higher in the second and third quarters because of the increased number of maintenance projects undertaken on our properties for suite renovations following suite turnover during the summer. In fiscal 2015, actual maintenance capital expenditure included costs related to property XYZ, which the Trust disposed of at the end of 2015, in the amount of $1,000.

- - - - - - - - - - - - - - - - - - - -

Working capital

Working capital adjustments are often made in determining non-GAAP financial measures used as measures of sustainable cash flow{10}. The intent of a working capital adjustment made by REITs and REOCs in this context is to eliminate fluctuations due to changes in receivables, payables and other working capital items that are not indicative of sustainable cash available for distribution. The amount of the working capital adjustment is subject to management's judgement and the appropriate amount depends on the nature of the business.

Issuers using non-GAAP financial measures other than ACFO as cash flow measures indicative of sustainable cash available for distributions should also be considering working capital adjustments.

A working capital adjustment should be accompanied by the disclosures outlined in section 2.7 of NP 41-201.{11}

We found that for a significant number (69%) of the issuers making a working capital adjustment, the adjustment was the same dollar amount as the change in non-cash working capital reported in the statement of cash flows. In the absence of clarifying disclosure, we questioned this adjustment, as it would appear unusual that the entire change in working capital from a prior period be considered to be inconsistent with sustainable cash flows.

We asked issuers to explain how they determined the working capital adjustment and the amounts that are not indicative of sustainable cash flows, and to explain the process undertaken by management in estimating the level of sustainable working capital.

Examples of working capital items that were adjusted include working capital changes related to: development, prepaid realty taxes and insurance, and accruals related to acquisitions and dispositions. As the nature of the working capital items requiring adjustment depend on the issuer's business, it is important to disclose the details of working capital adjustments to allow investors to better assess and evaluate the impact on sustainable cash flows.

The following example illustrates disclosure which met CSA guidance.

- - - - - - - - - - - - - - - - - - - -

Example #3.2(b) -- Working capital adjustment in ACFO

[1] In the calculation of ACFO the Trust makes an adjustment for certain working capital items that are not considered indicative of sustainable economic cash flow available for distribution. Examples include working capital changes relating to developments, prepaid realty taxes and insurance, interest payable and receivable, sales and other indirect taxes payable to or receivable from applicable governments, and transaction cost accruals relating to acquisitions and dispositions of investment properties.

ACFO continued to include the impact of fluctuations from normal operating working capital, such as changes to net rent receivable from tenants, trade accounts payable and accrued liabilities.

Management analyzes working capital quarterly through a detailed review of all of the working capital balances at the transactional level contained within each general ledger account. Significant individual transactions are reviewed based on management's experience and knowledge of the business, to identify those having seasonal fluctuations if related to sustainable operating cash flows or those transactions that are not related to sustaining operating cash flows.

The table below shows a breakdown of the adjustments for working capital changes used above in the calculation of ACFO:

Working capital changes not indicative of sustaining cash flows available for distributions:

Current Year

Prior Year

Taxes relating to XYZ Portfolio disposition in prior year

--

$120,000

Transaction cost accrual for dispositions/ acquisitions

7,000

15,000

Prepaid Realty taxes

34,000

50,000

Development project ABC

(10,000)

12,000

Total working capital adjustment for ACFO

31,000

197,000

- - - - - - - - - - - - - - - - - - - -

As the working capital adjustment is often material, and subject to significant management judgement, issuers should provide additional disclosure in order to provide transparency to investors.

Non-GAAP Adjustments -- Potential Impact

The table below illustrates the potential impact on ACFO and the ACFO payout ratio for a REIT under differing approaches to maintenance capital expenditures and working capital. It underscores the importance of clear disclosure for maintenance capital expenditure and working capital adjustments, as these amounts directly impact the distribution payout ratio.

- - - - - - - - - - - - - - - - - - - -

Example #3.2 (c) -- Sample ACFO Reconciliations for the six months ended June 30, 2017

|

|

Using actual maintenance capital expenditures and actual changes in working capital per the Financial Statements |

Using an estimate of maintenance capital expenditures and changes in sustainable working capital items |

Using actual maintenance capital expenditures and an estimate of sustainable working capital |

|

|

|||

|

Cash provided by operating activities |

$15,000 |

$15,000 |

$15,000 |

|

|

|||

|

Maintenance capital expenditure |

($5,000) |

($4,000) |

($5,000) |

|

|

|||

|

Changes in working capital |

$8,000 |

$8,800 |

$8,800 |

|

|

|||

|

Other adjustments |

$1,500 |

$1,500 |

$1,500 |

|

|

|||

|

ACFO |

$19,500 |

$21,300 |

$20,300 |

|

|

|||

|

Distributions |

$20,000 |

$20,000 |

$20,000 |

|

|

|||

|

ACFO Payout Ratio (distributions/ACFO) |

102.6% |

93.9% |

98.5% |

- - - - - - - - - - - - - - - - - - - -

3.3 Prominence of disclosures of non-GAAP financial measures

Joint Ventures in MD&A

Several real estate issuers use joint ventures to both own and operate real estate assets. Under IFRS 11 Joint Arrangements, joint ventures are a type of joint arrangement{12} in which the parties have rights to the net assets of the arrangement. Joint ventures are accounted for using the equity method of accounting in accordance with IAS 28 Investment in Associates.

We observed that issuers with joint ventures sometimes present a full set of non-GAAP financial statements in the form of a columnar reconciliation{13} within the MD&A that shows separately their pro-rata share of the interest in joint ventures (non-GAAP pro-rata financial statements). This presentation of a full set of non-GAAP financial statements within the MD&A effectively creates a non-GAAP financial measure for each financial statement line item. This presentation effectively unwinds the equity method of accounting required by IFRS 11.

We issued comments when issuers did not present the most directly comparable GAAP measures with equal or greater prominence to the non-GAAP financial measures. In many instances, in addition to the numerical presentation and reconciliation in the form of full non-GAAP pro-rata financial statements noted above, the narrative discussion in the MD&A about the issuer's performance, financial position, and liquidity that ensued was almost entirely focussed on the non-GAAP pro-rata financial results, with little to no discussion of the comparable GAAP metrics. In CSA staff's view, this extensive and pervasive use of non-GAAP financial measures at pro-rata interest makes it difficult for a reader to interpret the financial performance and financial condition relative to the GAAP financial statements. In these situations, where the discussion in the MD&A was pervasively based on non-GAAP metrics at pro-rata interest, without a GAAP discussion presented with equal or greater prominence, we requested issuers to restate prior periods' MD&As in order to provide greater prominence to GAAP measures.

We also issued comments relating to the naming of these non-GAAP financial measures. CSA SN 52-306 states that in order to ensure that a non-GAAP financial measure does not mislead investors, it should be named in a way that distinguishes it from GAAP items. In most instances, issuers presenting non-GAAP pro-rata financial statements did not explicitly name each line item (which is a non-GAAP financial measure) in a way that clearly distinguished it from the comparable GAAP measure. While these issuers did generally indicate elsewhere either narratively or in a footnote that the column of pro-rata numbers are not in accordance with GAAP, in CSA staff's view, the use of GAAP terms in the labelling of the individual line items is nonetheless misleading. This concern is compounded when the MD&A is focussed on the non-GAAP pro-rata financial statement line items which are labelled using the same terms as the GAAP financial statement line items.

Lastly, we required certain issuers to include clarifying disclosure in their MD&A that the issuer does not independently control the unconsolidated joint ventures, and that the presentation of pro-rata assets, liabilities, revenue, and expenses may not accurately depict the legal and economic implications of the issuer's interest in the joint ventures.

News Releases

We noted that several issuers gave more prominence to non-GAAP financial measures in news releases than the directly comparable GAAP measures. These news releases focussed heavily on describing the issuer's performance in terms of NOI, FFO, AFFO, and other non-GAAP financial measures without disclosing and discussing the most directly comparable GAAP measures.

We also remind issuers that CSA SN 52-306 applies to disclosures made on issuers' websites, investor presentations or other social media.{14}

3.4 Use of non-GAAP financial measures and reconciliations

Our review focussed on the use and reconciliation of AFFO and ACFO, however the observations may also apply to other non-GAAP financial measures.

AFFO

There continues to be diversity amongst real estate issuers in how AFFO is utilized, with some using it as an earnings measure (35%), and others using it as a cash flow measure (21%), or both (44%). We noted that the MD&A disclosure about the purpose and use of AFFO was often boilerplate.

For greater clarity, the purpose and the use of AFFO (and any other non-GAAP financial measure) is an important factor in considering whether it should be reconciled to net income or cash flows from operating activities, or other GAAP measures. Issuers' disclosures should clearly explain why management calculates and uses AFFO, and the reconciliation provided should be consistent with this intended use. For example, where AFFO (or another non-GAAP financial measure) is discussed primarily as a performance measure used to explain the cash generated by the issuer, its distribution-paying capacity, or the sustainability of distributions, the most directly comparable GAAP measure would be cash flow from operating activities. In determining the most directly comparable GAAP measure, an issuer may also consider the nature, number and materiality of the adjusting items.

An issuer should also consider the most appropriate label for its non-GAAP financial measures. Labeling a measure as AFFO is misleading if the measure excludes normal, recurring operating expenses necessary to operate the issuer's business because "from operations" is included in the acronym "AFFO".

Use of non-GAAP financial measures other than AFFO

Our review noted that issuers are also using a variety of other non-GAAP financial measures such as NOI, adjusted funds available for distribution, normalized FFO, operating FFO, normalized AFFO, ACFO or free cash flow. Issuers should provide appropriate accompanying disclosure with these measures as set out in CSA SN 52-306.

Issuers should also carefully consider the number of non-GAAP financial measures used to "tell their story" in the MD&A, and avoid using multiple non-GAAP financial measures for seemingly the same purpose.

4. Conclusion and Next Steps

The findings of our review indicate that the quality and completeness of disclosure pertaining to non-GAAP financial measures and distributions in the real estate industry need improvement. We remind issuers to review the guidance set out in NP 41-201 and CSA SN 52-306. We also remind issuers to provide appropriate disclosures when they are distributing more cash than they are generating from their operations, and when they are discussing their operating and cash flow performance with non-GAAP financial measures.

We will continue to assess these areas in our continuous disclosure and prospectus reviews. We will also monitor certain issuers to ensure commitments to prospective changes and enhancements requested have been made.

Questions

Please refer your questions to any of the following:

{1} Although the primary focus of NP 41-201 is income trusts, the principles can apply more generally to issuers that offer securities which entitle holders of those securities to the net cash flow generated by the issuer's business or its properties. The policy rationale therefore applies to REITs and REOCs given their stated objectives to provide shareholders with stable dividends or distributions. Section 2.5 of NP 41-201 refers to "distributable cash", a term which is no longer widely used in the industry. However, section 2.1 of the policy clarifies that the disclosures that should be provided about distributable cash extend to any other non-GAAP financial measure that a REIT or REOC may use to describe the amount of net cash it has generated during the period which is available for distribution (and therefore includes adjusted funds from operations or adjusted cash flow from operations, or any other non-GAAP financial measure of cash flows).

{2} This included the interim and annual filings, as well as the news releases of these issuers.

{3} We are aware of the existence of industry guidance relating to FFO, AFFO and ACFO. Our review was focussed solely on compliance with securities obligations.

{4} For the 2016 annual period, 19% of real estate issuers reviewed had "excess distributions", and of those with "excess distributions", 67% quantified the amount of the excess relative to cash flows from operating activities.

{5} For the 2016 annual period, 44%.

{6} Non-GAAP financial measures are generally found in the MD&A, news releases and investor presentations on issuers' websites.

{7} Section 2.7 of NP 41-201.

{8} We remind issuers that forward-looking information is subject to the requirements in Part 4A of National Instrument 51-102 Continuous Disclosure Obligations (NI 51-102).

{9} Refer to section 2.7 of NP 41-201.

{10} In our review, working capital adjustments were primarily made in reconciling cash flows from operating activities to ACFO.

{11} The working capital adjustment should be supported by a detailed discussion of the nature of the adjustment, a description of the underlying assumptions used in preparing each element, including how those assumptions are supported, and a discussion of the specific risks and uncertainties that may affect the assumption.

{12} IFRS 11 defines a joint arrangement as an arrangement of which two or more parties have joint control.

{13} For example, a columnar reconciliation of this type may show the issuer's statement of income as presented in the financial statements, an additional column with amounts related to equity accounted investees for each financial statement line item, and then a total column for each financial statement line item, which is often labelled "Proportionate Share" or "At Issuer's interest".

{14} Disclosures of non-GAAP financial measures made through social media are also covered by CSA SN 52-306. Refer to CSA Staff Notice 51-348 Staff's Review of Social Media Used by Reporting Issuers, for additional details.