CSA Staff Notice 51-341 - Continuous Disclosure Review Program Activities for the Fiscal Year Ended March 31, 2014

CSA Staff Notice 51-341 - Continuous Disclosure Review Program Activities for the Fiscal Year Ended March 31, 2014

CSA Staff Notice 51-341

Continuous Disclosure Review Program Activities

for the fiscal year ended March 31, 2014

July 17, 2014

Introduction

This notice contains the results of the reviews conducted by the Canadian Securities Administrators (CSA) within the scope of their Continuous Disclosure (CD) Review Program. This program was established to review the compliance of the CD documents of reporting issuers{1} (issuers) to ensure they are reliable and accurate. The CSA seek to ensure that Canadian investors receive high quality disclosure from issuers.

In this notice, we summarize the results of the CD Review Program for the fiscal year ended March 31, 2014 (fiscal 2014). To raise awareness about the importance of filing compliant CD documents, we also discuss certain areas where common deficiencies were noted and provide examples to help issuers address these deficiencies in the following appendices:

• Appendix A -- Financial Statement Deficiencies

• Appendix B -- Management's Discussion and Analysis (MD&A) Deficiencies

• Appendix C -- Other Regulatory Disclosure Deficiencies

For further details on the CD Review Program, see CSA Staff Notice 51-312 (revised) Harmonized Continuous Disclosure Review Program.

Results for Fiscal 2014

CD Activity Levels

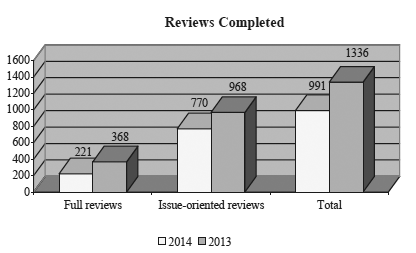

During fiscal 2014, a total of 991 reviews (221 full reviews and 770 issue oriented reviews (IOR)) were conducted. This is a 26% decrease from the 1,336 CD reviews (368 full reviews and 968 IORs) completed during fiscal 2013.

The decrease in the number of reviews can be primarily attributed to a change in our review focus. A higher number of IORs were conducted in fiscal 2013, where the main objective was to monitor quality of disclosure, observe trends and conduct research. In fiscal 2014, we focused on obtaining more substantive outcomes, as evidenced by the review outcomes chart below. We applied both qualitative and quantitative criteria in determining the level of review and type of review required. Some jurisdictions have also devoted additional resources to communicating results and findings to the public by issuing local staff notices and reports, where applicable, and holding education and outreach seminars to help issuers better understand their CD obligations.

CD Outcomes for Fiscal 2014

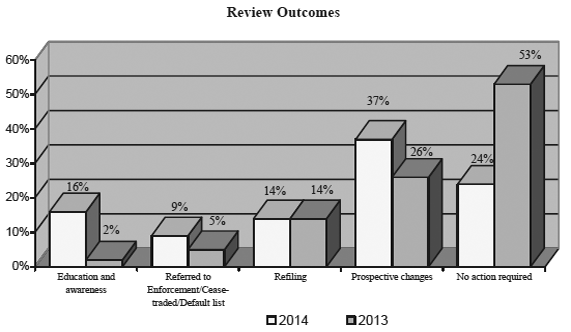

In fiscal 2014, 76% of our review outcomes required issuers to take action to improve their disclosure or resulted in the issuer being referred to enforcement, ceased traded or placed on the default list, compared to 47% in fiscal 2013.

Review Outcomes

We classified the outcomes of the full reviews and IORs into five categories as described in Appendix D. Some CD reviews generated more than one category of outcome. For example, an issuer may have been required to refile certain documents and also make certain changes on a prospective basis.

Although the number of reviews conducted in fiscal 2014 decreased, the total number of review outcomes resulting from our reviews has remained fairly consistent with fiscal 2013. These results reflect our focused approach on obtaining more substantive outcomes. As noted in the review outcomes chart above, the significant changes were a decrease in the "No action required" category offset by increases in the "Prospective changes" and "Referred to Enforcement/Cease traded/Default list" categories. There was also a significant increase in the "Education and awareness" category and a consistent number of outcomes in the "Refiling" category.

For fiscal 2014, the largest review outcome was in the "Prospective changes" category. If material deficiencies or errors are identified, we generally expect issuers to correct them by restating and refiling the related CD documents. However, when enhancements are required as a result of deficiencies identified, we request that amendments be made when the issuer next files its CD documents.

Some of the observed deficiencies requiring prospective changes and/or refiling, included:

• financial statement measurement and disclosure, which may include going concern, accounting policies, critical judgements, sources of estimation uncertainty and fair value measurement;

• MD&A compliance with Form 51-102F1 of National Instrument 51-102, Continuous Disclosure Obligations (Form 51-102F1), which may include non-GAAP measures, forward looking information, discussion of operations, liquidity, related party transactions, etc.;

• executive compensation disclosure compliance with Form 51-102F6 Statement of Executive Compensation, particularly the compensation discussion and analysis; and

• business acquisition reports in compliance with Part 8 of National Instrument 51-102 Continuous Disclosure Obligations (NI 51-102).

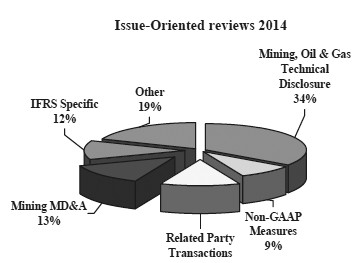

Issue-Oriented Reviews

An IOR focuses on a specific accounting, legal or regulatory issue. IORs may focus on emerging issues, implementation of recent rules or when we want to narrow the scope of our review and focus on specific issues. In fiscal 2014, a total of 78% of all CD reviews were IORs (fiscal 2013 -- 72%). The following are some of the IORs conducted by one or more jurisdictions:

The "Other" category includes reviews of:

• Social Media

• Business Acquisition Reports

• Certifications

• Operating Segments

• Timely Disclosure

• Management Information Circular

The "Other" category of IORs noted above is not an exhaustive list. We may undertake an IOR for various other subject matters during the year. Refer to the Appendices for some common deficiencies identified as a result of our IORs.

Full Reviews

A full review is broad in scope and covers many types of disclosure. A full review covers the selected issuer's most recent annual and interim financial reports and MD&A filed before the start of the review. For all other CD disclosure documents, the review covers a period of approximately 12 to 15 months. In certain cases, the scope of the review may be extended in order to cover prior periods. The issuer's CD documents are monitored until the review is completed. A full review also includes an issuer's technical disclosure (e.g. technical reports for oil and gas and mining issuers), annual information form (AIF), annual report, information circulars, news releases, material change reports, business acquisition reports, corporate websites, certifying officers' certifications and material contracts.

In fiscal 2014, a total of 22% of the reviews were full reviews (fiscal 2013 -- 28%).

Common Deficiencies Identified

Our full reviews and IORs focus on identifying material deficiencies and potential areas for disclosure enhancements. To help issuers better understand their CD obligations, we have provided guidance and examples of common deficiencies in the following appendices:

Appendix A: Financial Statement Deficiencies

1. Disclosure of Interests in Other Entities

2. Revenue Recognition

3. Impairment of Assets

Appendix B: Management's Discussion and Analysis (MD&A) Deficiencies

1. Non-GAAP Measures

2. Forward Looking Information

3. Additional Disclosure for Venture Issuers Without Significant Revenue

Appendix C: Other Regulatory Disclosure Deficiencies

1. Mineral Projects

2. Executive Compensation

3. Filing of News Releases and Material Change Reports (MCRs)

This is not an exhaustive list of disclosure deficiencies noted in our reviews. We remind issuers that their CD record must comply with all relevant securities legislation and lengthy disclosure does not necessarily result in full compliance. The examples in the appendices do not include all requirements that could apply to a particular issuer's situation and are only provided for illustrative purposes.

Results by Jurisdiction

All jurisdictions participate in the CD review program and some local jurisdictions may publish staff notices and reports summarizing the results of the CD reviews conducted in their jurisdictions. Refer to the individual regulator's website for copies of these notices and reports:

• www.bcsc.bc.ca

• www.albertasecurities.com

• www.osc.gov.on.ca

• www.lautorite.qc.ca

{1} In this notice "issuers" means those reporting issuers contemplated in National Instrument 51-102 Continuous Disclosure Obligations.

APPENDIX A

FINANCIAL STATEMENT DEFICIENCIES

This Appendix provides some examples of deficient disclosure contrasted against more robust entity-specific disclosure for three areas of IFRS requirements. Many issuers could improve compliance in these areas.

1. Disclosure of Interests in Other Entities

IFRS 10 Consolidated Financial Statements (IFRS 10), IFRS 11 Joint Arrangements (IFRS 11) and IFRS 12 Disclosure of Interests in Other Entities (IFRS 12) came into effect for annual periods beginning on or after January 1, 2013. IFRS 10 and IFRS 11 changed the definition of control and joint control as well as the classification of, and in some cases the accounting for, joint arrangements. IFRS 12 resulted in additional disclosure requirements for all entities with subsidiaries, joint arrangements, associates and structured entities.

For the majority of issuers, the adoption of these standards did not have a material impact on comprehensive income and the statement of financial position. For those issuers where adoption of the standards led to significant changes, such as from joint control to control, we observed many examples of insufficient disclosure in the financial statements to explain the basis for the change. In these instances, it was not apparent what factor(s) when considered in the context of the new standards led to the changes, such as the underlying structure, the agreements in place and/or the relevant activities. In many of these circumstances, we noted that the issuer only disclosed what the change was and how it was accounted for, but did not explain the significant judgements and assumptions made in arriving at management's conclusion.

The following is an example of good disclosure of the significant judgements and assumptions made where the issuer changed their assessment from joint control to control (Paragraphs 7(a) and (b) of IFRS 12). In this instance, while the issuer had lengthy disclosure, all information presented appeared relevant. For ease of presentation, we have provided only a summary of the key disclosure.

- - - - - - - - - - - - - - - - - - - -

Example of Entity-Specific Disclosure

Critical Accounting Estimates and Judgements

The Company owns 85% of Entity B, with the remaining 15% owned by a third party. Under the shareholder agreement, majority shareholder approval (greater than 50%) is required for certain items such as commissioning feasibility studies and approving projects based on these studies, signing new operating agreements and voting on expansion activities that do not represent activities outside of the core business.

However, other items require the unanimous approval of all shareholders, such as entering into new credit financing, approval of operating and capital budgets and expansion outside of the ordinary course of business.

Under IAS 27 and IAS 31{1}, the Company determined that it did not have control as it did not have the power to govern the financial and operating policies so as to benefit from the activities based on the items which required unanimous approval.

On adoption of IFRS 10, the Company assessed the power to direct the relevant activities of Entity B. The Company assessed that the relevant activities of Entity B were only those requiring majority approval under the shareholder agreement.

In assessing the relevant activities, management used significant judgement to determine that the ability to unilaterally undertake feasibility studies and acting on these studies, as well as signing new operating agreements, meant that the Company, in addition to being exposed to variable returns through their 85% interest, had the ability to use its power to affect the potential returns from Entity B, and therefore these relevant activities supported the determination that the Company now controlled Entity B.

Furthermore, as Entity B does not currently have or intend to have external debt, and does not plan to undertake any projects outside of the ordinary course of business, these were not deemed to be relevant activities.

- - - - - - - - - - - - - - - - - - - -

The above example is specific to the facts of one issuer, and issuers are reminded that the disclosure should clearly discuss all relevant factors and significant judgements made by the issuer.

2. Revenue Recognition

IAS 18 Revenue (IAS 18) defines revenue as income that arises in the course of ordinary activities of an entity, and sets out a framework for recognizing revenue. One of the key determinations that needs to be made when recording revenue, is whether the issuer is acting as principal or agent. When an agency relationship exists an issuer collects amounts on behalf of a third party rather than on their own behalf. Therefore, in agency relationships the issuer can only recognize the fee, commission or mark-up that will be paid to the issuer as revenue.

The determination as to whether the issuer is acting as principal or agent is based on the specific facts and circumstances of the transactions, and the role of each party to the arrangements. Whether revenue is generated from the sale of goods, the rendering of services or the receipt of interest, royalties or dividends will also need to be factored into the assessment, and the specific conditions to recognize revenue in these circumstances are outlined in IAS 18, paragraphs 14, 20 and 29, respectively. Examples have been noted whereby an issuer recognized revenue as either principal or agent but their disclosure documents (e.g. financial statements, MD&A, AIF) contradicted or did not support the accounting treatment. We expect issuers to provide sufficient disclosure of their accounting policies and judgements applied in determining those policies.

In the following example, the issuer recognized the revenue as principal.

Example of Deficient Disclosure

Significant Accounting Policies

The sub-contract revenue is recognized when the service has been performed, the related costs are incurred, the revenue can be reliably measured and when collectability is reasonably assured. There are no post-service obligations.

- - - - - - - - - - - - - - - - - - - -

For the above example, the only additional disclosure in the MD&A was that sub-contracting revenues are generated by sub-contractors who own and operate their own vehicles, suggesting an agency relationship.

Based on this limited and potentially conflicting disclosure, we questioned the issuer's rationale for recognizing the revenue as principal. In particular, the issuer did not provide:

• entity-specific disclosure in the policy note;

• discussion of the significant judgements, if any, that management has made in the process of applying the issuer's accounting policies (paragraph 122 of IAS 1 Presentation of Financial Statements); and

• disclosure of the factors that were assessed in the determination of recognizing revenue on a gross basis as principal (paragraph 122 of IAS 1 Presentation of Financial Statements). Indicators that suggest the issuer is acting as principal include if the issuer (paragraph 21 of IAS 18 Illustrative Examples):

• has the primary responsibility for providing the goods or services to the customer;

• assumes the risk of inventory before or after the customer order, during shipping or on return;

• has latitude in establishing prices either directly or indirectly; and

• assumes the credit risk on the receivable due from the customer.

Example of Entity-Specific Disclosure

Significant Accounting Policies

The Company evaluates whether it is appropriate to record the gross amount of its revenues and related costs by considering a number of factors, including, among other things, whether the Company is the primary obligor under the arrangement and has latitude in establishing prices. Sub-contract revenue is derived from lease operators providing services to customers operating under the Company banner. Management has reviewed the primary indicators of the lease operator transactions such as:

• The sub-contractor provides the service to the customer operating on behalf of the Company;

• The Company has control over who performs the service;

• The Company is responsible for all billing and collecting of revenues;

• The Company is responsible for setting all rates; and

• The lease operator receives a set percentage of lease operator revenues generated.

Taking all of the above into consideration, management has made the judgement that the Company is the primary obligor in these transactions and has sole latitude in establishing prices. Accordingly, revenue is recorded on a gross basis, excluding any taxes, when the service has been performed, the related costs are incurred, the revenues can be reliably measured and when collectability is reasonably assured.

- - - - - - - - - - - - - - - - - - - -

3. Impairment of Assets

In accordance with paragraph 130 of IAS 36 Impairment of Assets (IAS 36), an issuer must disclose information about the events and circumstances that led to the recognition or reversal of an impairment loss, and the amount of impairment loss recognized or reversed during the period. An issuer must disclose whether the recoverable amount of the asset (cash-generating unit) is its fair value less costs of disposal or its value in use. For level 2 and level 3 fair value measurements, if the recoverable amount is fair value less costs of disposal, an issuer must disclose the valuation technique used to measure fair value less costs of disposal. If recoverable amount is value in use, an issuer must disclose the discount rate(s) used in the current estimate and previous estimate (if any) of value in use. Some issuers did not disclose all the information required by paragraph 130 of IAS 36.

- - - - - - - - - - - - - - - - - - - -

Example of Deficient Disclosure

The recoverable amount of the Company's cash generating unit A (CGU A), which includes oil and natural gas assets, is determined at each reporting period end, or where facts and circumstances provide impairment indicators. During the year ended December 31, 2013, the Company performed an impairment test on CGU A and identified that the carrying amount of CGU A of approximately $140 million exceeded its recoverable amount of approximately $85 million, and accordingly recognized an impairment expense of approximately $55 million. The impairment test was conducted by management based on information provided by an independent reserves evaluator.

- - - - - - - - - - - - - - - - - - - -

In the above example, the issuer did not disclose:

• the events and circumstances that led to the recognition of the impairment loss (paragraph 130(a) of IAS 36);

• whether the recoverable amount of the assets is its fair value less costs of disposal or its value in use (paragraph 130(e) of IAS 36);

• if the recoverable amount is fair value less costs of disposal, how fair value is determined, and the valuation technique used to measure fair value less costs of disposal (paragraph 130(f) of IAS 36); and

• if the recoverable amount is value in use, the discount rate(s) used in the current estimate and previous estimate (if any) of value in use (paragraph 130(g) of IAS 36).

- - - - - - - - - - - - - - - - - - - -

Example of Entity-Specific Disclosure

During the year ended December 31, 2013, the Company performed an impairment test on its cash generating unit A (CGU A), which includes oil and natural gas assets. The Company determined that the carrying amount of CGU A of approximately $140 million exceeded its recoverable amount of approximately $85 million due to a decline in estimated reserve volumes, and accordingly recognized an impairment expense of approximately $55 million.

The recoverable amount of CGU A was based on the higher of value in use and fair value less costs of disposal. The fair value measurement of CGU A is categorized within level 3 of the fair value hierarchy. The estimate of the fair value less costs of disposal was determined using forecasted cash flows based on proved plus probable reserves, forecasted commodity prices, and an after-tax discount rate of 5% which represents the Company's weighted average cost of capital and which includes estimates for risk-free interest rates, market value of the Company's equity, market return on equity and share volatility. The key input estimates used to determine cash flows from oil and gas reserves, which are subject to significant changes, include: reserves at the time of reserve estimation, forward oil and natural gas prices, and the discount rate. See table below for the values of these input estimates (table not provided in this illustrative example).

- - - - - - - - - - - - - - - - - - - -

{1} IAS 27 Separate Financial Statements and IAS 31 Interests in Joint Ventures. IAS 31 was superseded by IFRS 11 and IFRS 12 with effect from annual periods beginning on or after 1 January 2013.

APPENDIX B

MANAGEMENT'S DISCUSSION AND ANALYSIS DEFICIENCIES

As in prior years, deficiencies were also noted in the MD&A disclosure. As stated in Part 1(a) of Form 51-102F1, the MD&A should include balanced discussions of the issuer's financial performance and financial condition, including, without limitation, such considerations as liquidity and capital resources. The MD&A should help current and prospective investors to understand what the financial statements show and do not show. It should also discuss material information that may not be fully reflected in the financial statements.

In fiscal 2014, we identified three areas of the MD&A where deficient disclosure was noted: 1) non-GAAP measures; 2) forward looking information; and 3) additional disclosure for venture issuers without significant revenue. For each area, we have provided examples of deficient disclosure contrasted against more robust entity-specific disclosure.

1. Non-GAAP Measures

CSA Staff Notice 52-306 (Revised) Non-GAAP Financial Measures and Additional GAAP Measures (SN 52-306) provides issuers with guidance on non-GAAP financial measures and additional GAAP measures. A non-GAAP financial measure is a numerical measure of an issuer's historical or future financial performance, financial position or cash flows that does not meet one or more of the criteria of an issuer's GAAP for presentation in financial statements, and that either:

i. excludes amounts that are included in the most directly comparable measure calculated and presented in accordance with the issuer's GAAP, or

ii. includes amounts that are excluded from the most directly comparable measure calculated and presented in accordance with the issuer's GAAP.

Non-GAAP financial measures are often found in public documents, such as the MD&A, news releases, prospectus filings, corporate websites and marketing materials. Earnings before interest, taxes, depreciation and amortization (EBITDA) is a commonly used non-GAAP financial measure. We note that while EBITDA is generally a non-GAAP measure presented outside the financial statements, in some cases it may be an additional GAAP measure if it is presented in the financial statements (e.g. as a subtotal in the statement of comprehensive income).

Based on our reviews, we noted that the composition of EBITDA is often inconsistent with this commonly understood meaning. We noted that additional adjustments are often made to EBITDA to make the metric look more positive. When additional adjustments are included in the EBITDA calculation, the measure could be seen as potentially misleading or confusing to investors.

In the following example, adjustments for impairment, restructuring and foreign exchange charges have been made to EBITDA, which makes the non-GAAP measure potentially misleading, as it is unlikely to be comparable to similar measures presented by other issuers.

|

Example of Deficient Disclosure |

||

|

|

||

|

|

2013 |

2012 |

|

|

||

|

Net earnings |

3,453 |

2,768 |

|

|

||

|

Interest expense |

335 |

326 |

|

|

||

|

Current and deferred taxes |

522 |

468 |

|

|

||

|

Depreciation and amortization |

45 |

48 |

|

|

||

|

Impairment charges |

350 |

520 |

|

|

||

|

Restructuring charges |

240 |

120 |

|

|

||

|

Foreign exchange loss |

85 |

65 |

|

|

||

|

EBITDA |

5,030 |

4,315 |

The following example illustrates better and more transparent disclosure where the impairment, restructuring and foreign exchange charges are not included as part of the EBITDA calculation, rather applied to EBITDA to arrive at Adjusted EBITDA.

|

Example of Entity-Specific Disclosure |

||

|

|

||

|

|

2013 |

2012 |

|

|

||

|

Net earnings |

$3,453 |

$2,768 |

|

|

||

|

Interest expense |

335 |

326 |

|

|

||

|

Current and deferred taxes |

522 |

468 |

|

|

||

|

Depreciation and amortization |

45 |

48 |

|

|

||

|

EBITDA |

4,355 |

3,610 |

|

|

||

|

Impairment charges |

350 |

520 |

|

|

||

|

Restructuring charges |

240 |

120 |

|

|

||

|

Foreign exchange loss |

85 |

65 |

|

|

||

|

Adjusted EBITDA |

5,030 |

4,315 |

In addition to the table above, in order to ensure the disclosure is not misleading, the issuer should include all material disclosures set out in SN 52-306.

2. Forward Looking Information

Section 4A.3 of NI 51-102 states that a reporting issuer that discloses material forward-looking information (FLI) must include disclosure that:

a) identifies the FLI as such;

b) cautions users of FLI that actual results may vary from the FLI and identifies material risk factors that could cause actual results to differ materially from the FLI;

c) states the material factors or assumption used to develop FLI; and

d) describes the reporting issuer's policy for updating FLI if it includes procedures in addition to those described in subsection 5.8(2) of NI 51-102.

FLI is a key area of interest for investors. Most issuers include some FLI in a continuous disclosure document, a news release or on their website. When prepared properly, FLI can be used to enhance transparency and increase an investor's understanding of a reporting issuer's business and future prospects.

Our reviews identified four common areas where improvement is needed:

• clear identification of FLI;

• disclosure of material factors or assumptions used to develop FLI;

• updating previously disclosed FLI; and

• comparison of actual results to the future oriented financial information or financial outlook previously disclosed.

The most significant area of required improvement is disclosure of the material factors or assumptions used to develop FLI. Material factors and assumptions should be disclosed and should be reasonable, supportable, entity specific, and tied to FLI. Reporting issuers continue to provide general boilerplate disclosure that does not adequately describe the key assumptions used and how primary risks may impact future performance.

- - - - - - - - - - - - - - - - - - - -

Example of Deficient Disclosure

In fiscal 2013, the Company anticipates that total sales will increase by 5.0% to 6.0%.

- - - - - - - - - - - - - - - - - - - -

The following entity-specific disclosure example includes detailed factors and assumptions specific to the issuer's business. This is an example of clear disclosure which will assist an investor in understanding the issuer's business.

- - - - - - - - - - - - - - - - - - - -

Example of Entity-Specific Disclosure

The following represents forward-looking information and users are cautioned that actual results may vary. In fiscal 2013, the Company expects total sales to increase by 5.0% to 6.0%. This expectation is based on same-store sales growth of between 3.0% and 4.0% and the introduction of new brands to our centre stores. It is expected that new brands will contribute to the increase in sales and will be offset by increased competition from U.S. retailers. A key performance indicator for the Company includes retail sales per square foot. This target assumes an average sale per square foot of $45. An increase of 25 basis points in interest rates may cause the sales target to decrease by 1.0 % to 2.0%.

- - - - - - - - - - - - - - - - - - - -

3. Additional Disclosure for Venture Issuers Without Significant Revenue

Section 5.3 of NI 51-102 and Item 1.15 of Form 51-102F1, require a venture issuer that has not had significant revenue from operations in either of its last two financial years, to disclose in its MD&A, on a comparative basis, a breakdown of material components of:

a) exploration and evaluation (E&E) assets or expenditures;

b) expensed research and development costs;

c) intangible assets arising from development;

d) general and administration expenses; and

e) any material costs, whether expensed or recognized as assets, not referred to in paragraphs (a) through (d);

and if the venture issuer's business primarily involves mining exploration and development, the analysis of E&E assets or expenditures must be presented on a property-by-property basis.

We often find disclosure, as presented in the example below, where the issuer presents its exploration expenditures on a property-by-property basis without giving a breakdown by material components. This disclosure does not allow an investor to understand where and how the money was spent.

|

Example of Deficient Disclosure |

|||

|

|

|||

|

|

Property A |

Property B |

Total |

|

|

|||

|

Balance, as at December 31, 2011 |

$3,000,000 |

$1,000,000 |

$4,000,000 |

|

|

|||

|

Additions |

1,812,910 |

175,620 |

1,988,530 |

|

|

|||

|

Balance, as at December 31, 2012 |

4,812,910 |

1,175,620 |

5,988,530 |

|

|

|||

|

Additions |

775,220 |

469,840 |

1,245,060 |

|

|

|||

|

Balance, as at December 31, 2013 |

5,588,130 |

1,645,460 |

7,233,590 |

In the following entity-specific example, the issuer has disclosed its E&E expenditures by material components and has provided the information for both of its material properties. The example assumes that the issuer's accounting policy is to expense E&E expenditures, however we would expect similar disclosure, along with a reconciliation of opening and closing balances if the issuer capitalized the amounts. In addition to such presentation, we would expect relevant qualitative discussion.

|

Example of Entity-Specific Disclosure |

||||||

|

|

||||||

|

|

Property A |

Property B |

Total |

Total |

||

|

|

||||||

|

|

December 31, 2013 |

December 31, 2012 |

December 31, 2013 |

December 31, 2012 |

December 31, 2013 |

December 31, 2012 |

|

|

||||||

|

Exploration Expenditures |

|

|

|

|

|

|

|

|

||||||

|

Assays and geochemistry |

$41,050 |

$145,730 |

$27,390 |

- |

$68,440 |

$145,730 |

|

|

||||||

|

Camp costs |

25,550 |

57,400 |

5,410 |

- |

30,960 |

57,400 |

|

|

||||||

|

Consulting |

15,490 |

6,400 |

7,650 |

28,880 |

23,140 |

35,280 |

|

|

||||||

|

Drilling |

466,820 |

1,248,500 |

330,390 |

- |

797,210 |

1,248,500 |

|

|

||||||

|

Geology |

38,690 |

19,400 |

17,420 |

- |

56,110 |

19,400 |

|

|

||||||

|

Geophysics |

25,990 |

42,200 |

- |

92,480 |

25,990 |

134,680 |

|

|

||||||

|

Travel and lodging |

77,260 |

124,880 |

36,120 |

21,660 |

113,380 |

146,540 |

|

|

||||||

|

Salaries and labour |

84,370 |

168,400 |

45,460 |

32,600 |

129,830 |

201,000 |

|

|

||||||

|

Total exploration expenditures |

775,220 |

1,812,910 |

469,840 |

175,620 |

1,245,060 |

1,988,530 |

|

Cumulative E&E since inception |

$5,588,130 |

$4,812,910 |

$1,645,460 |

$1,175,620 |

$7,233,590 |

$5,988,530 |

APPENDIX C

OTHER REGULATORY DISCLOSURE DEFICIENCIES

CSA Staff assess issuer compliance with securities laws. Our objective is to promote clear and informative disclosure that will allow investors to make informed investment decisions. Some of the areas where compliance issues persist include disclosure or filings related to: 1) mineral projects; 2) executive compensation; and 3) news releases and material change reports.

1. Mineral Projects

Issuers engaged in mineral exploration and mining activities have to comply with the requirements set out in National Instrument 43-101 Standards of Disclosure for Mineral Projects (NI 43-101) which includes Form 43-101F1 Technical Report (Form 43-101F1). Common deficiencies noted in complying with Form 43-101F1 include the following:

• lack of clearly disclosing how "reasonable prospects for economic extraction" were established for projects with mineral resource estimates, including the key assumptions, parameters and methods;

• insufficient discussion of any potential social or community related requirements and plans for advanced properties and the status of any negotiations or agreements with local communities;

• failure to provide the required context and justification for capital and operating cost estimates for advanced properties;

• inadequate information related to economic analysis information for advanced properties, particularly disclosing only pre-tax cash flows or only up-side sensitivity analysis;

• lack of disclosure related to project-specific risks and uncertainties that could reasonably be expected to affect the reliability or confidence in the information presented;

• incomplete disclosure of the "key findings" about the mineral property in the summary section; and

• missing statements required under section 8.1(2) of NI 43-101 in the qualified person's certificate.

Given the significance of the mining sector in Canadian capital markets, compliance with NI 43-101 and Form 43-101F1 for issuers with mineral projects is critical.

2. Executive Compensation

Issuers must provide, in accordance with Form 51-102F6 Statement of Executive Compensation of NI 51-102 (Form 51-102F6) a Compensation Discussion and Analysis (CD&A) that describes and explains all significant elements of compensation awarded to, earned by, paid to, or payable to named executive officers (NEO).

A number of issuers that were reviewed did not include sufficient explanation in their CD&A as to how each element of compensation is tied to each NEO's performance. In many cases, the CD&A did not fully describe how executive compensation decisions were made. This was of particular concern with regard to performance goals and similar conditions.

We remind issuers that subsection 2.1(4) of Form 51-102F6 requires that if applicable, performance goals or similar conditions that are based on objective, identifiable measures, such as the company's share price or earnings per share, be disclosed. When an issuer discloses the grant of a bonus to an NEO, the issuer also has to explain in the CD&A that it granted the bonus because the performance goals were met and explicitly link this discussion with its NEO's compensation, as reported in the summary compensation table. If the payment of a bonus ultimately remained at the discretion of the board of directors, this fact should also be included in the CD&A to place the quantification of the objective measures in context.

We also remind issuers that, if they disclose performance goals that are non-GAAP financial measures, for example EBITDA, they have to explain how the issuer calculates these performance goals and similar conditions from its financial statements.

3. Filing of News Releases and Material Change Reports (MCRs)

In accordance with National Policy 51-201 Disclosure Standards, news releases and announcements of material changes should be factual and balanced. In particular, an issuer's disclosure should contain enough detail to enable the media and investors to understand the substance and importance of the change it is disclosing. Issuers should avoid including unnecessary details, exaggerated reports or promotional commentary. Over the past fiscal year, we have seen many issuers filing news releases and/or MCRs when the timing of the release may be inappropriate and/or the content of the report is inadequate.

For example, if the issuer is changing the focus of their business to a different industry, the issuer should consider whether they have done sufficient due diligence prior to deciding whether they should file a news release and/or issue a MCR. This may include, but is not limited to, obtaining the appropriate licenses and/or meeting regulations, determining whether the issuer has sufficient capital or other resources to implement the changes, etc. The issuer would then need to consider the level of disclosure to be included in the news release and MCR, which should include, among other things, information about the time and resources required for the change in business as well as the barriers and obligations involved in realizing the change.

We also continue to see issuers who either do not file their news releases and/or MCRs or fail to do so on a timely basis in accordance with Part 7 of NI 51-102. We have also noted several issuers are inconsistent with their filings of news releases and/or MCRs. The following are some examples of these types of situations:

• Announcement of directors and officers appointments or resignations. We note issuers file news releases and/or MCRs announcing new appointments but do not file similar announcements of resignations. We have also observed several instances where issuers' disclosure of the appointments/resignations of directors and officers is buried within lengthy news releases, often after positive earnings and production activity.

• Breach and/or waiver of financial covenants. We note issuers do not file news releases and/or MCRs for a breach and/or waiver of financial covenant in a timely manner. In several instances we have observed issuers that have breached and/or received a waiver but wait until the filing of their next interim or annual filings before this information is disseminated.

We will continue to monitor these types of filings going forward.

APPENDIX D

CATEGORIES OF OUTCOMES

Referred to Enforcement/Cease-Traded/Default List

If the issuer has critical CD deficiencies, we may add the issuer to our default list, issue a cease trade order and/or refer the issuer to enforcement.

Refiling

The issuer must amend and refile certain CD documents.

Prospective Changes

The issuer is informed that certain changes or enhancements are required in its next filing as a result of deficiencies identified.

Education and Awareness

The issuer receives a proactive letter alerting it to certain disclosure enhancements that should be considered in its next filing or when staff of local jurisdictions publish staff notices and reports on a variety of continuous disclosure subject matters reflecting best practices and expectations.

No Action Required

The issuer does not need to make any changes or additional filings. The issuer could have been selected in order to monitor overall quality disclosure of a specific topic, observe trends and conduct research.

Questions -- Please refer your questions to any of the following: